A Turning Point for US Climate Progress: Assessing the Climate and Clean Energy Provisions in the Inflation Reduction Act

The Inflation Reduction Act is the single largest action ever taken by Congress and the US government to combat climate change. We provide a detailed assessment of the key energy and emissions impacts of the legislation.

On August 12th, the US House of Representatives passed the Inflation Reduction Act (IRA) after the Senate did the same five days before. The climate change and clean energy investments are the single largest component in the package, out of the many issues that the IRA addresses. When President Biden signs it, the IRA will be the single largest action ever taken by Congress and the US government to combat climate change.

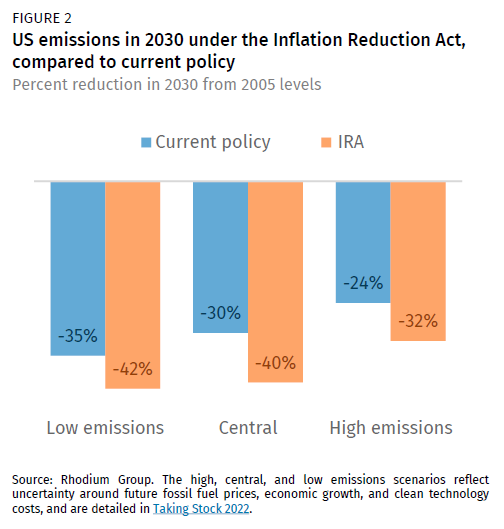

In this report, we provide a detailed assessment of the key energy and greenhouse gas (GHG) emissions impacts of this historic legislation. The IRA is a game changer for US decarbonization. We find that the package as a whole drives US net GHG emissions down to 32-42% below 2005 levels in 2030, compared to 24-35% without it. The long-term, robust incentives and programs provide a decade of policy certainty for the clean energy industry to scale up across all corners of the US energy system to levels that the US has never seen before. The IRA also targets incentives toward emerging clean technologies that have seen little support to date. These incentives help reduce the green premium on clean fuels, clean hydrogen, carbon capture, direct air capture, and other technologies, potentially creating the market conditions to expand these nascent industries to the level needed to maintain momentum on decarbonization into the 2030s and beyond.

We also find that the IRA cuts household energy costs by up to an additional $112 per household on average in 2030 than without it, cuts electric power conventional air pollutants by up to 82% compared to 2021, and scales clean generation to supply as much as 81% of all electricity in 2030. The IRA represents major progress by Congress, and at the same time more action will be needed for the US to meet its 2030 target of reducing emissions by 50-52% below 2005 levels. With the IRA enshrined as law, all eyes will be on federal agencies and states, as well as Congress, to pursue additional actions to close the emissions gap.

A first for Congress: passing major climate legislation

Congress has had climate change on its radar since the first major hearings on the topic in 1988. Now, with the passage of the IRA 34 years later, Congress has taken decisive action. Though the intervening years have seen plenty of false starts on legislation to tackle emissions, acting late is certainly better than never. The package of new grant and loan programs, tax credits and emissions fees touches nearly every corner of the US economy and will make meaningful progress toward decarbonizing the US energy system for the next decade and beyond. While the overall size of the package is trimmed down compared to the Build Back Better Act (BBBA) passed by the House in November, the emissions reduction components are still robust and effective.

In this report, we provide a comprehensive assessment of the emissions and energy system impacts of the IRA, building on our preliminary assessment published on July 28. To conduct this analysis, we used RHG-NEMS, a version of the Energy Information Administration’s (EIA) National Energy Modeling System modified by Rhodium Group. We model the impacts of the IRA using the three core emissions scenarios—high, central, and low—from our newly updated baselines for 2030 US emissions under current policy in Taking Stock 2022. We compare projected emissions from Taking Stock with the projected emissions trajectories we estimate under the IRA and calculate the emissions impacts of the IRA as the difference between the two policy environments for each emissions pathway. For more information on our methodology and analytical approach, see the technical appendix of Taking Stock 2022.

We first assess the IRA’s impact from an economy-wide vantage point. From there, we consider key impacts in the three largest emitting sectors in the US: electric power, industry, and transportation. We then zero in on the implications of the IRA for a few critical emerging clean technologies and look at its effect in other sectors. Finally, we quantify the IRA’s impact on consumer costs and energy security and conclude with a look to the future.

The IRA cuts emissions across the economy

The IRA contains an array of programs, tax credits, and fees that, in combination, drive a step change in decarbonization of the US economy by the end of the decade. These provisions lower the cost of commercial clean technologies like wind and solar, electric vehicles, and building efficiency, enabling them to become more competitive with incumbent fossil fuel technologies and driving a shift towards cleaner energy. Tax credits and other programs for manufacturing of clean technologies expand production capacity and help to enable accelerated deployment.

Provisions of the IRA also modify fossil fuel leasing on federal lands, including requiring lease sales and changing royalty rates, but we find almost no emissions impacts from the combined impact of these provisions, relative to the benefits of the clean energy provisions.

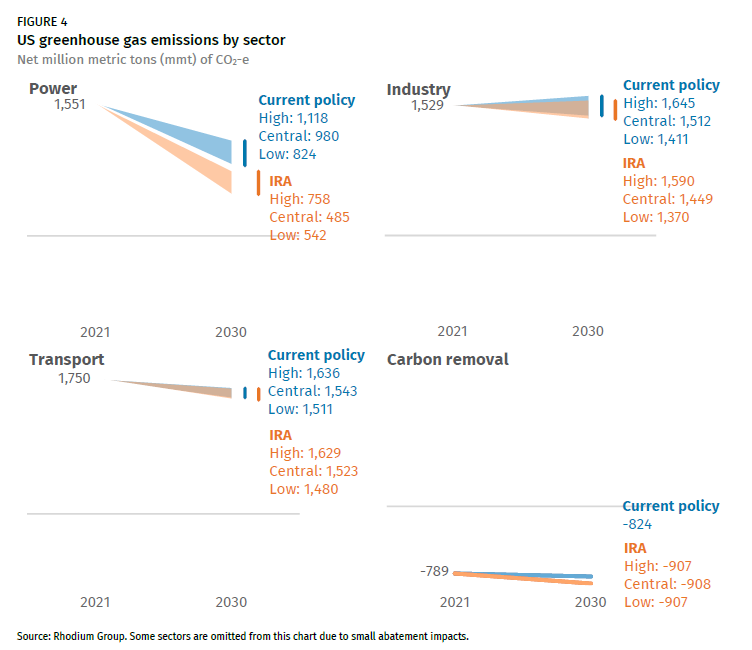

The net result of all the provisions in the IRA is that US net GHG emissions decline to 32-42% below 2005 levels in 2030. That’s up to 10 percentage points more than under current policy without the IRA, in which we project emissions of 24-35% below 2005 levels in the same year (Figure 1). The range reflects uncertainty around economic growth, clean technology costs, and fossil fuel prices across our high, central, and low emissions scenarios detailed in Taking Stock 2022. In the high emissions case, which features cheap fossil fuels and more expensive clean technologies plus faster economic growth, we find that the IRA can accelerate emissions reductions to a 32% cut below 2005 levels in 2030, compared to 24% without it (Figure 2). On the flip side, in the low emissions case, with expensive fossil fuels and cheap clean technologies, the IRA can drive even larger reductions, from 35% below 2005 levels without it to 42% below 2005 levels with it. In the central emissions case, the IRA accelerates emissions reductions to 40% below 2005 levels in 2030, compared to 30% without it.

This is a huge step forward towards the US climate target of 50-52% below 2005 levels in 2030, though clearly more action is needed. No single action on its own will be enough to meet the target. Still the IRA changes the game, not just with the deep emissions reductions it generates but also by cutting the cost of additional action by the executive branch and states, which could put the 2030 target within reach.

Progress in the three biggest emitting sectors

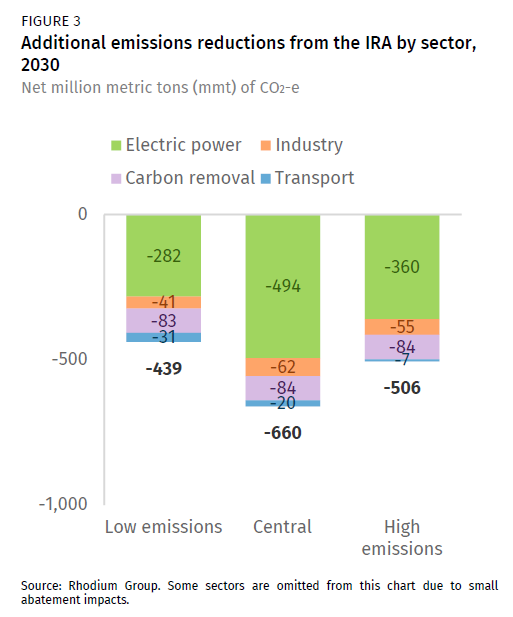

All told, the IRA cuts emissions and increases carbon removal by an additional 439-660 million metric tons in 2030 beyond what’s projected without the IRA (Figure 3). On the high end, that’s equal to zeroing out all current emissions from California and Florida combined. Put another way, the IRA helps close as much as 51% of the gap between the US emissions trajectory without the bill and the US’s 2030 climate target.

Our preliminary estimate of the impacts of the IRA found a 31-44% reduction over 2005 levels attributable to the policies. Our revised estimate finds a narrower band of emissions impacts of 32-42%, as we’ve honed our modeling to reflect more of the nuance of the bill language. The biggest drivers of the difference from our preliminary estimate are a more refined representation of the EV tax credits; more granular characterization of the transition from the current electric sector tax regime, as extended by the IRA, to the new clean electricity credits; and interactive effects of increased federal fossil royalty rates driving gas prices slightly higher in the low emissions case, leading to more coal generation and higher emissions relative to our preliminary assessment (though still substantially lower than without the IRA).

Looking across sectors, the biggest emission reductions by far occur in the electric power sector, followed by carbon removal (due to forest and soil practices, direct air capture and other actions), industry (including emissions from fossil fuel production), and transportation (Figure 4). The investments that drive these emission reductions will create new economic opportunities across the country and shift the US closer to a decarbonized energy system.

Record-level clean generation in the electric power sector

The suite of long-term, full-value, flexible clean energy tax credits and other programs in the IRA focus on the “4 Rs” of electric generation decarbonization:

- Reinvigorate new clean capacity additions: production and investment tax credits (PTC and ITC)

- Retain existing clean capacity: zero-emitting nuclear PTC

- Retire fossil capacity: US Department of Agriculture (USDA) investments in rural electric cooperatives (coops) and Department of Energy (DOE) loan programs

- Retrofit remaining fossil capacity: section 45Q carbon capture tax credit

Critically, the IRA includes direct pay and transferability provisions that make it easier to monetize the tax credits by decoupling them from a finite pool of tax equity dollars. Without these provisions, there would be a real risk that developers face financing bottlenecks as deployment expands, stifling the impact of incentives. Now, under the IRA, a broader set of players in the electric power industry can use tax credits and pour investment into achieving an increasingly cleaner electric grid. The manufacturing tax credits and other programs in the IRA will help expand domestic production capacity to support accelerated clean energy deployment across the US. New DOE and USDA programs can support rural electric coops and other owners of coal plants to retrofit or install new clean technologies to achieve CO2 and criteria pollutant reductions.

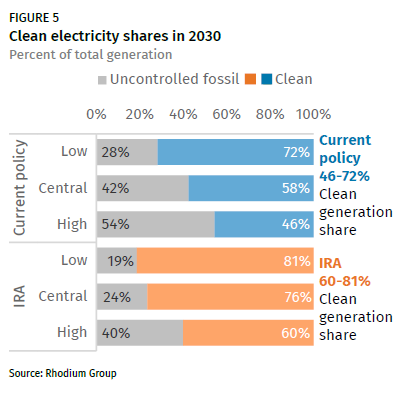

All of these measures taken together drive clean generation to the highest levels the US has seen in the modern era. Clean generation as a share of total electric generation rises from roughly 40% in 2021 to 60-81% in 2030 due to the IRA, compared to 46-72% without it (Figure 5). The IRA puts the US in a strong position to meet the President’s goal of 100% clean generation in 2035. These shares are achieved by preventing 10-20 GW of nuclear from retiring through 2030 and increasing the annual average capacity additions of renewables to 35-77 GW per year through 2030—more than double per year in the low and central emissions cases than the record set in 2021.

The largest absolute emissions abatement and lowest total power sector emissions occur in the central emissions scenario, which combines central clean technology costs and central fossil fuel prices. In this case, the IRA policy provisions drive large-scale deployment of clean generation, drive down coal generation, and limit the growth of natural gas generation. By contrast, in the low emissions case, natural gas prices are high enough in 2030 to allow relatively more coal generation to remain competitive, though generation from coal plants is still lower than without the IRA and relative to today.

All of this clean energy drives deep reductions in emissions of both GHGs and conventional pollutants. In 2030, electric power CO2 emissions are 69-80% below 2005 levels, which represents a meaningful departure from the 54-66% below 2005 levels that occur under current policy.

Electric power plant emissions of harmful air pollutants like sulfur dioxide (SO2) and oxides of nitrogen (NOx) that exacerbate asthma attacks and cause premature deaths also decline dramatically thanks to the IRA. Without the IRA, SO2 (Figure 6) and NOx (Figure 7) are on track to decline by 39-63% and 51-55% below 2021 levels in 2030 respectively. The shift to clean energy driven by the IRA cuts SO2 emissions down to 59-82% below 2021 levels and NOx to 61-66% below 2021 levels. These cuts will provide important relief to the communities nearby and downwind of major power plants.

Industrial emissions turn the corner

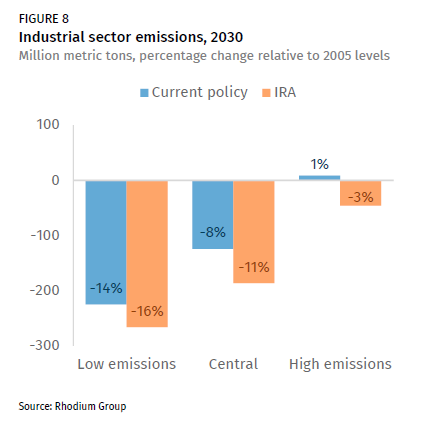

Without the IRA, industrial emissions decrease by 14% and 8% in our low and central emissions scenario and increase by 1% in our high scenario relative to 2005 levels. In Taking Stock 2022, we projected that industry would become the largest-emitting sector by the early 2030s, so progress in this sector is important for meeting the 2030 target and achieving long-term decarbonization. With the IRA, industrial emissions decrease by 3%, 11%, and 16% in 2030 relative to 2005 in the high, central, and low emissions cases, respectively (Figure 8).

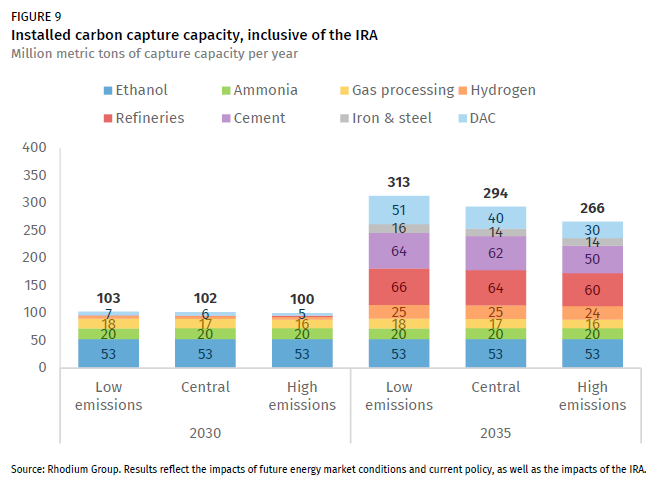

There are two main reasons for the IRA-driven decline. First, the enhancements to the section 45Q carbon capture tax credit drive meaningful additional deployment of carbon capture. Without the IRA, we project 74 million metric tons of carbon capture and direct air capture (DAC) capacity will be retrofitted on existing facilities or installed by 2030. With the IRA we project a 35-40% increase, to 100-103 million metric tons of carbon capture and DAC (Figure 9). This additional capacity helps drive down industrial sector CO2 emissions. Importantly, the IRA continues to incentivize further carbon capture and DAC deployment after 2030, as the 45Q provision includes a commence construction deadline of 2032. By 2035, we project that that provision can help to more than double installed carbon capture and DAC capacity from 2030 levels, to 266-313 million metric tons of installed capacity. The longer duration and larger size of the credit also help drive carbon capture retrofits in harder-to-abate corners of industry, including in refineries, cement plants, and iron and steel facilities. The bill also provides an important level of foundational support for DAC deployment, helping to scale a new and necessary clean energy technology.

The other factor behind the decline in industrial emissions in the IRA is a decline in oil and gas production and transmission emissions, which we include as part of industrial sector emissions in our calculations. The clean technology provisions in the IRA lead to small reductions (<1%) in petroleum consumption and larger reductions of 3-10% in natural gas consumption across the economy. The much-discussed fossil fuel provisions of the IRA do not lead to meaningful increases in domestic production of oil and gas, which we discuss in greater detail below. All else equal, less production equates to lower production and transmission emissions. In addition, the IRA institutes a methane fee on emissions from production and transmission above a certain volumetric threshold, driving down oil and gas emissions further still.

Taken together, the policies start to bend the industrial emissions curve in the right direction, but much more needs to be done to drive the levels of decarbonization that will be required from industry. Fortunately, the bill makes an important down payment in that regard in the form of domestic manufacturing conversion grants, additional funding for the DOE Loan Programs Office, an advanced industrial facilities deployment program, and a suite of other provisions to help the industrial sector demonstrate and deploy new technologies.

Diversifying transportation sector energy consumption

Transportation has been the highest-emitting sector in the US since surpassing power sector emissions in 2016. Due to long vehicle stock turnover cycles, it will take decades to fully decarbonize the transportation sector, even with aggressive clean technology deployment. The array of tax credits for clean light, medium and heavy-duty vehicles (LDV, MDV, HDV) in the IRA accelerate the adoption of clean vehicles across the sector.

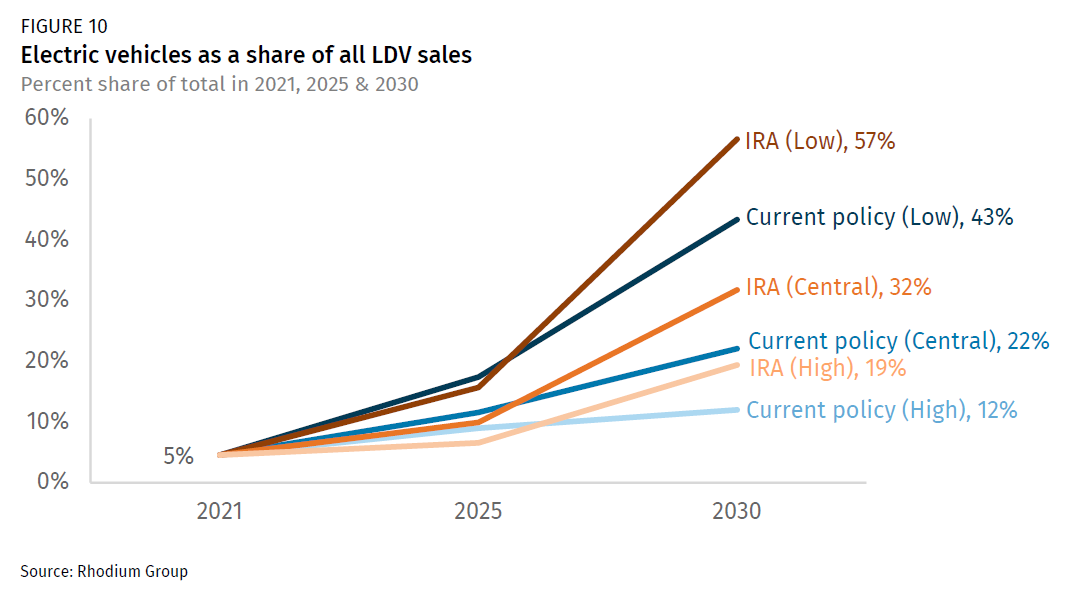

The new structure of the 30D electric vehicle (EV) tax credit limits its impacts in the near term, as manufacturers race to meet critical mineral and battery component sourcing requirements. This limits the amount of total LDV EVs on the road in 2030 relative to a policy without these requirements, reducing its emissions impact over this decade. Despite that, by 2030 the IRA increases the share that electric vehicles comprise of all LDV sales to 19-57%, up from 12-43% without it (Figure 10). In addition, these requirements and other investments made as part of the IRA can help stand up a meaningful EV supply chain domestically and in close partner countries.

The IRA also provides tax credits for used clean vehicles, improving access to this important clean technology for buyers for whom a new vehicle is out of financial reach. On the MDV and HDV front, the IRA provides a tax credit for the purchase of clean trucks. It also includes a number of grant programs and other fiscal incentives to drive clean vehicle deployment and reduce conventional air pollutants. In total, these provisions drive total transportation emissions down to 18-26% below 2005 levels in 2030, compared with an 18-24% reduction without the IRA.

More to do in carbon removal, agriculture, and buildings

Though we project some emissions abatement in the carbon removal and buildings sectors relative to current policy due to the IRA, in general, these impacts are small compared to the scale of decarbonization needed in these sectors, and continued work on all fronts will be necessary to drive down these emissions.

We find that a suite of provisions in the IRA can increase technological and natural carbon removal. For our accounting purposes, both direct air capture facilities and ethanol facilities retrofitted with carbon capture, which we discuss above, are accounted for as carbon removal. In addition, the agriculture title of the IRA includes agricultural conservation investments, non-federal reforestation projects, and state and private forestry conservation programs, which together increase the ability of natural and working lands to act as carbon sinks.

In the buildings sector, the bill makes important investments in decarbonizing buildings via retrofit and high-efficiency electric home rebates. The Greenhouse Gas Reduction Fund in the IRA may also help reduce emissions from buildings, though we don’t know enough yet about how the program would be implemented to model its effects. The bill also modifies the current tax credit for the adoption of energy efficiency appliances, but the effect is largely to incentivize the installation of more efficient gas appliances, locking in long-lived fossil-consuming assets rather than driving needed progress in electrification. The new energy efficient home credit also helps drive some improvements in new home shell efficiency. But in total, these reductions are modest compared to the rest of the bill. More action, actually focused on decarbonization and not just energy efficiency, is necessary in the buildings sector.

Cutting the green premium for emerging clean technologies

The IRA doesn’t just incentivize the commercial-scale clean technologies like solar and wind available today. It also builds on the investments in the Infrastructure Investment and Jobs Act to cut the cost of deploying a host of emerging clean technologies such as carbon capture and DAC covered above as well as clean fuels, clean hydrogen, advanced nuclear, and other cutting-edge solutions. It does so through new deployment tax credits that reduce the “green premium,” which is the added cost of clean technologies relative to fossil incumbents. The more diverse the set of emerging clean technologies that get to commercial scale, the more opportunities there will be for large, low-cost emissions reductions in the long-term. In other words, the investments in emerging clean technologies in the IRA make achieving net-zero emissions by mid-century more feasible and more affordable.

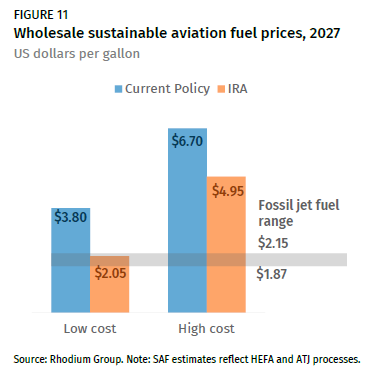

We find that these new tax credits can make clean fuels competitive with conventional fossil fuel options in this decade. For example, the new sustainable aviation fuel (SAF) credit in the IRA provides up to $1.75/ gallon of SAF produced with very low life-cycle GHG emissions. SAF is a critical technology for decarbonizing long-haul aviation where few other clean technologies are available. There are multiple ways to make SAFs, and they all have different associated costs. We considered low and high cost production pathways that can qualify for the maximum credit value and find that, at least in the low case, SAF could match projected fossil jet fuel prices in 2027, the last year the credit is available (Figure 11).

We find an even more encouraging story with regard to clean hydrogen. Clean hydrogen is sometimes referred to as the “Swiss Army Knife of decarbonization” because it can be used in so many applications across the energy system. Clean hydrogen can be made in a variety of ways including by using natural gas steam methane reformation equipped with carbon capture (“blue” hydrogen) or by splitting water via electrolysis using zero-emitting electricity (“green” hydrogen).

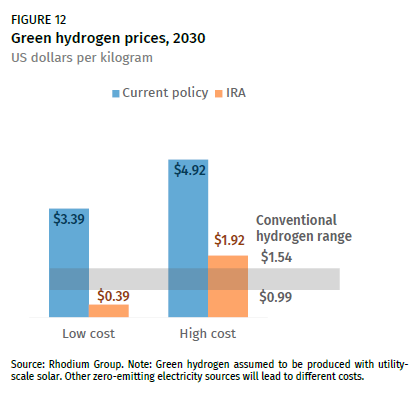

The new clean hydrogen production tax credit in the IRA supports both blue, green and other production pathways, providing higher credit values for lower lifecycle GHG emissions. The maximum credit is $3/kg for the cleanest processes. It is likely that the credit will shrink or eliminate the green premium for a variety of clean hydrogen options. Looking at green hydrogen produced with solar energy through high and low technology cost assumptions, we find that in 2030 the fuel will cost $3.39-$4.92 per kilogram to produce without the IRA (Figure 12). The IRA credit more than eliminates the green premium for clean hydrogen assuming low technology costs and shrinks it to just 40 cents per kilogram using the high technology cost assumptions. With this credit, clean hydrogen will be primed for takeoff through the 2020s.

Cutting costs and bolstering security

Beyond the large emissions impacts and other energy system benefits we’ve discussed, the IRA also has other effects across the economy, chief among them decreasing household energy costs and improving energy security.

Costs go down for consumers

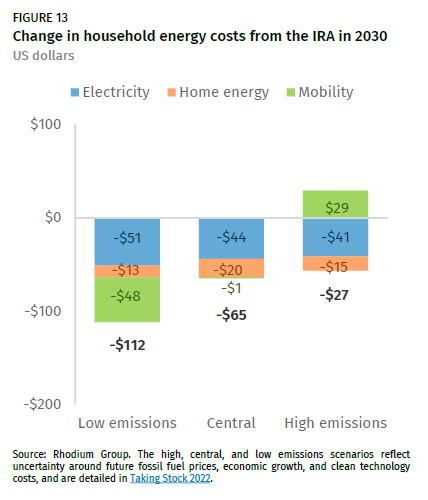

The IRA lives up to its name by reducing the costs that consumers pay for electricity, other residential fuels, and transportation fuels by $27-$112 relative to without it in 2030 (Figure 13). The bill accomplishes this by driving some consumers to adopt electric vehicles, heat pumps, and other electrified and/or more efficient technologies that can help reduce their demand for fuels while meeting the same level of demand for energy services. But it doesn’t just help consumers who are able to go electric—by reducing overall demand for fossil fuels, the bill also drives down their costs for everyone by helping to reduce the price consumers pay for electricity, gasoline, diesel, and home heating fuels. In addition to the savings from the IRA described above, current policy and improving energy market conditions drive further decreases in household energy costs over the next decade. All together, we estimate household energy costs will decrease by between $717 and $1,146 in 2030, relative to 2021 levels.

Less reliance on imported fossil fuels, improving energy security

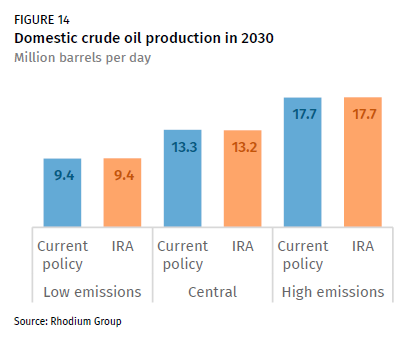

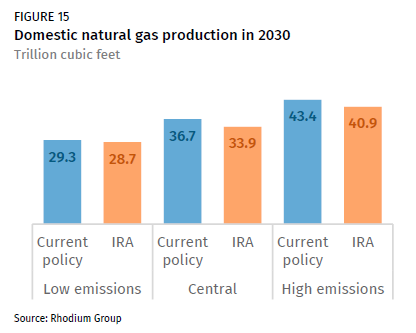

We incorporate the IRA’s new leasing requirements and royalty reforms into our estimates of the impacts of the bill. We do not make exogenous assumptions around the impacts of these provisions; instead, the model finds the most economical way to meet demand for energy. As we mention in the discussion on industrial emissions, the clean energy provisions in the IRA drive down demand for petroleum and even more so for natural gas. Domestic production and imports respond accordingly, even though more federal land is available for exploration. In 2030, crude production is effectively flat (Figure 14) when comparing the IRA with current policy, and gas production declines by 2-7% (Figure 15) with the IRA compared to current policy.

As a sensitivity, we also tested the impacts of the IRA relative to a current policy scenario in which no new offshore exploration could occur until 2026. Compared to a future with this more restrictive leasing policy than is currently on the books, the IRA would increase domestic crude production by 0.1-0.2%, effectively flat, and decrease domestic gas production by 1-5%.

In addition to impacting domestic production, fossil fuel demand also drives trade dynamics. The IRA reduces net imports of crude oil by 1-6% and net pipeline imports of natural gas by 9-11%. The liquified natural gas trade remains unchanged with and without the IRA, as the price differential between US production plus transportation costs versus global gas markets isn’t sufficient to drive further LNG export capacity expansion beyond what happens under current policy.

So much achieved, so much more to do

The IRA is a historic step forward in the US’s efforts to rapidly decarbonize in the next decade and beyond. It lays a strong foundation for rapid clean energy deployment and the scale-up of emerging clean technologies, and it cuts conventional pollutants, household energy costs, and the US’s reliance on imported energy. The provisions in the IRA drive meaningful reductions in US greenhouse gas emissions, and at the same time, the IRA alone will not get the US on track to meeting its 2030 climate target of cutting emissions in half. However, it does lower the costs associated with additional action by the executive branch and subnational actors, which can help close the gap to the 2030 target.

All eyes will now be on EPA, DOE and other federal agencies as well as states to push the next wave of policies that build on the IRA and get US emissions down to 50-52% below 2005 levels in 2030. The biggest ticket policies to keep an eye on in the near term are the finalization of EPA’s proposed oil and gas methane regulations, how EPA proposes to regulate CO2 emissions from new and existing power plants, and if EPA and the National Highway Traffic Safety Administration (NHTSA) ramp up ambition in the next round of light-duty vehicle standards.

Congress may also be of further help. A range of policies that were previously part of the Build Back Better Act and other past climate legislation didn’t make the cut for the IRA, including some areas where there’s been recent bipartisan agreement like electric power transmission, CO2 pipelines, and building energy efficiency. The permitting reform bill currently under development is widely expected to contain provisions to accelerate the construction of some fossil fuel infrastructure, which has the potential to push emissions in the wrong direction. But it could also be a vehicle to address some of these and other issues relating to roadblocks to clean deployment of clean energy and associated infrastructure. The 2023 Farm Bill could be an important vehicle for more investments in rural decarbonization and carbon removal on natural and working lands. We look forward to assessing options and impacts across all of these fronts in this new era where the US finally has momentum on the road to long-term decarbonization.

This nonpartisan, independent research was conducted with support from Bloomberg Philanthropies, the William and Flora Hewlett Foundation, and the Heising-Simons Foundation. The results presented in this report reflect the views of the authors and not necessarily those of supporting organizations.