China 30/60: Tracking the Financing of China’s Green Transition

In a new workstream, Rhodium Group will be providing regular updates and analysis on the state of China’s green financing, domestically and abroad.

As China’s economy enters a period of prolonged slowing, regulators will be tackling difficult reforms that may have significant impacts on the financing of decarbonization. In a new workstream, Rhodium Group will be providing regular updates and analysis on the state of China’s green financing, domestically and abroad.

At the moment all eyes are on China’s leadership as President Xi Jinping and his newly appointed Politburo host the “Two Sessions.” In this inaugural note, we dive into some key takeaways on the state of China’s green financing, including China’s 2022 climate performance, the political representation of climate change and clean technology, and how the People’s Bank of China (PBoC) continues to support decarbonization investment.

China falling behind on energy intensity targets, sets none for 2023

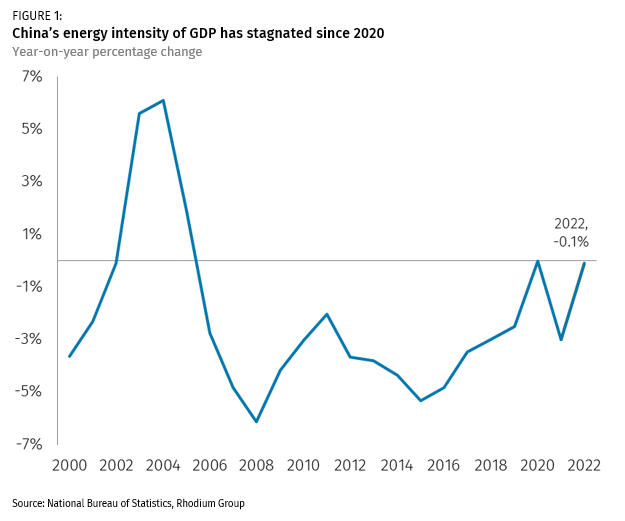

On March 5, outgoing premier Li Keqiang delivered the Government Work Report (GWR) at the National People’s Congress. It reported that on performance over the past five years (2018-2022), China’s GDP grew at an annual average rate of 5.2% while the energy intensity of GDP decreased 8.1%, and carbon dioxide (CO2) intensity of GDP fell by 14.1%. This assumes at face value China’s reported 2022 performance of a 0.1% year-on-year (y/y) decrease in energy intensity and a 0.8% y/y decrease in CO2 intensity of GDP, with GDP growth at 3% y/y. There remain some questions about the accuracy of reported energy consumption data for 2022.

The accuracy of energy and emissions data is important in assessing China’s performance against its own near-term and long-term climate targets. China had previously set a target of a 13.5% reduction in the energy intensity of GDP and an 18% reduction in energy sector CO2 intensity for the 14th five-year plan period (2021-25). This is aligned with its longer-term goal of achieving over 65% emissions intensity of GDP by 2030 from a 2005 baseline. Energy intensity improvements in China have stagnated since 2020 (Figure 1).

Unsurprisingly, China has reduced the importance of energy intensity in measuring climate performance. The GWR has set a target of around 5% growth in GDP for 2023, but like 2022, set no energy intensity reduction target. “Continuing the transition to green development” remains one of the top eight priorities for Beijing in 2023, but without energy intensity targets, local governments may not necessarily prioritize reducing energy consumption and carbon emissions as they try to stimulate economic growth. For instance, historically during major political meetings like the “Two Sessions,” local regulators would take steps to control heavy industry, traffic, and other sources of air pollution in order to ensure blue skies in Beijing. However, this year, the “Two Sessions” were marked by a noticeable return of bad air quality.

Clean tech representation at “Two Sessions” rises as internet companies fall

The annual “Two Sessions,” currently taking place, is when both the National People’s Congress (NPC) and the Chinese People’s Political Consultative Conference (CPPCC) hold meetings at the same time. This year’s Two Sessions is also the first of the new five-year term of the Chinese Communist Party (CCP), meaning there is a new group of delegates for the NPC and CPPCC. The NPC is the CCP’s legislative body, and the CPPCC is an advisory body. Both have members drawn from various sectors of Chinese society, including government officials, social organizations, ethnic minority groups, and private individuals like academics, business executives, and celebrities.

Notably, for the first time in 30 years, the CPPCC has added a new working group on “Energy and Resources” (环境资源界). It is one of 34 working groups and one of the largest groups with 85 members. About 20% of the members are from energy and chemical companies, mostly power generation, oil and gas, and mining state-owned enterprises (SOEs). This group does not include delegates from clean tech companies in the private sector, who are represented elsewhere.

Another notable difference this year is the relative prominence of representation in the NPC and CPPCC of clean tech industries versus internet platform companies. In the last NPC and CPPCC term (2018–2023), many notable internet platform company executives were appointed as delegates, including Pony Ma (Tencent), Li Yanhong (Baidu), Liu Qiangdong (JD Group) and Wang Xiaochuan (Sohu). Notably fewer corporate leaders from China’s largest internet platform companies were appointed delegates in this term.

In contrast, we count at least 27 delegates representing private companies in the clean tech and energy industries, up from 21 in 2018. Significant ones include Li Liangbin, president of Ganfeng Lithium, and Zhong Baoshen, president of LONGi Group, both members of the NPC, and Li Shufu, founder of Geely Auto and Zeng Yuqun, founder of CATL, both members of the CPPCC.

For the Party, appointing private-sector executives to the NPC and CPPCC signals openness to support private enterprises and a recognition of their importance to China’s economy. The increasing share of delegates from clean tech companies implies more political importance attached to green industries and supply chains in China’s overall industrial policy design. However, at a time when private Chinese clean tech companies are under scrutiny for their connections to the CCP, their growing political representation in government also weighs on external perceptions of their independence.

Key economic leadership reappointed, PBOC extends decarbonization lending support for another year

In a surprising announcement, Finance Minister Liu Kun and PBOC Governor Yi Gang were both reappointed, even though they are not currently members or alternate members of the CCP’s Central Committee, a break from tradition that has only happened once before, with the reappointment of ex-PBOC governor Zhou Xiaochuan in 2013. The reappointment of these key officials signals a need for continuity in economic policy, navigating a gradual exit from financial stresses worsened by three years of pandemic policy.

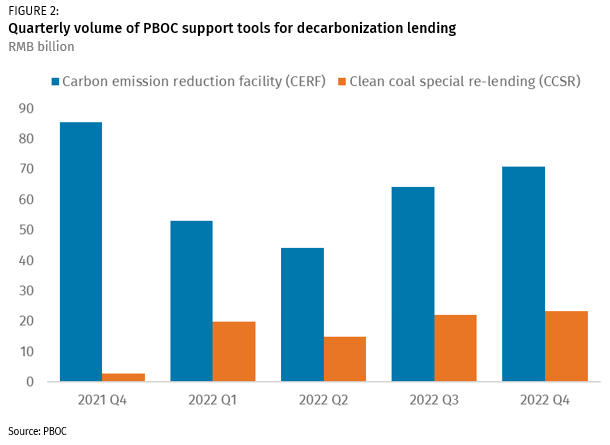

For the green transition, currently Beijing’s plan is to keep in place monetary tools through the central bank (PBOC) that encourages investment in decarbonization. The PBOC has 15 structural monetary tools in place dedicated to providing discounted lending to strategic segments, including agriculture, innovation, logistics, pension, carbon reduction, clean coal, and small private businesses. Introduced in November 2021, the carbon emission reduction facility (CERF) and the clean coal special re-lending (CCSR) were specifically designed to incentivize investment in four green industries: renewables, environmental protection and energy conservation, low-carbon technologies, and clean coal.[1] The CERF does not have a hard quota, while the CCSR has a total quota of RMB 300 billion (initial quota of RMB 200 billion). In January, the PBOC extended the CERF to 2024 and the CCSR to 2023.

The CERF was limited to 21 state-owned national banks when it was introduced in November 2021. The PBOC has since expanded the list to include smaller local banks and some foreign banks, including Deutsche Bank and Société Générale. We calculated that as of Q3 2022, China’s six largest state-owned commercial banks[2] received at least 85% of CERF funds. The CCSR lending facility continues to be limited to state-owned national banks only.

The Chinese government admitted that many companies face challenges in clean coal utilization. Coal power companies have been losing money due to high fuel costs. Thus, market demand for the CCSR funds has been lukewarm compared to the CERF. As of year-end 2022, eligible clean coal projects received loans totaling RMB 82 billion, only 27% of the full quota (Figure 2). Given the facility uptake rate, the RMB 300 billion quota is unlikely to be exhausted before the lending facility expires at the end of 2023.

On the other hand, RMB 310 billion of CERF loans have been deployed as of the end of 2022. Our survey of Q3 2022 reports from the six largest state-owned commercial banks revealed that renewable energy projects accounted for over 95 percent of their portion of CERF lending, totaling RMB 337 billion. China’s renewable energy market has seen record growth over the last two years. China added 223GW of new wind and solar generation capacity since 2020, although notably nearly half of this capacity was commissioned before the CERF was established. Assuming most of the lending facility was used to finance new projects and not refinance existing projects, this indicates significantly more growth in China’s renewable power is to come.

The PBOC provides 60% of the loan principal to financial institutions for qualified CERF projects and 100% for the CCSR projects at an interest rate of 1.75%. Finance institutions then reloan to companies at roughly the loan prime rate of the same term. The average borrowing rate of CERF recipients from the six commercial banks was 4% as of Q3 2022, just 0.3 percentage points lower than the weighted average interest rate of all new loans issued, according to the PBOC’s data. But the average interest rate for small and medium-sized (SME) companies’ new borrowing is 5.35% nationally as of H1 2022. The CERF could be much more attractive for SME businesses; however, the majority of renewable energy developments are by SOEs, so it remains to be seen if the CERF mechanism has actually reduced borrowing costs for green energy projects or opened more support for SMEs and private companies.

Overall commercial banks’ disclosure of CCSR loan details is nonexistent, and their disclosure of CERF loans remains inadequate to determine their efficacy. For CERF loans, the PBOC initially required banks to disclose project details and third-party-verified emission reduction benefits. However, currently, the major commercial banks only disclose quarterly aggregated data on the number of projects, total loan amount, average interest rates, and emission reductions at the aggregate (rather than project) level without evidence of third-party verification. While CERF’s interest rates seem attractive, without more transparent and granular data, it’s hard to determine if the CERF and CCSR mechanisms have truly opened doors for SMEs and private companies to access lower cost borrowing for green projects.

[1] “Clean coal” refers to technologies that lower emission from coal-fired power generation, coal chemicals, coal-fired furnaces, civilian coal use, coalbed methane use, and coal waste utilization per the National Energy Administration http://www.nea.gov.cn/2017-10/13/c_136677423.htm

[2] The six banks are Bank of China, Industrial and Commercial Bank of China, China Construction Bank, Agricultural Bank of China, Bank of Communications, Postal Savings Bank of China