Chinese FDI in Europe – 2020 Update

Chinese FDI in Europe slumped 45 percent to a 10-year low of 6.5 billion euros in 2020 amid pandemic-related restrictions, Chinese capital controls and higher regulatory hurdles in the EU

This report, from Rhodium Group and MERICS, summarizes China’s investment footprint in the EU-27 and the United Kingdom (UK) in 2020, analysing the fallout from the pandemic as well as policy developments in Europe and China. Below are the main findings and a link to the full report:

China’s global outbound investment hit a 13-year low in 2020: Concerns that the Covid-19 global pandemic slump might trigger another round of Chinese distressed asset-buying proved unfounded. Instead, China’s global outbound M&A activity dropped to a 13-year low, as completed merger and acquisition (M&A) transactions totaled just EUR 25 billion, down 45 percent from 2019.

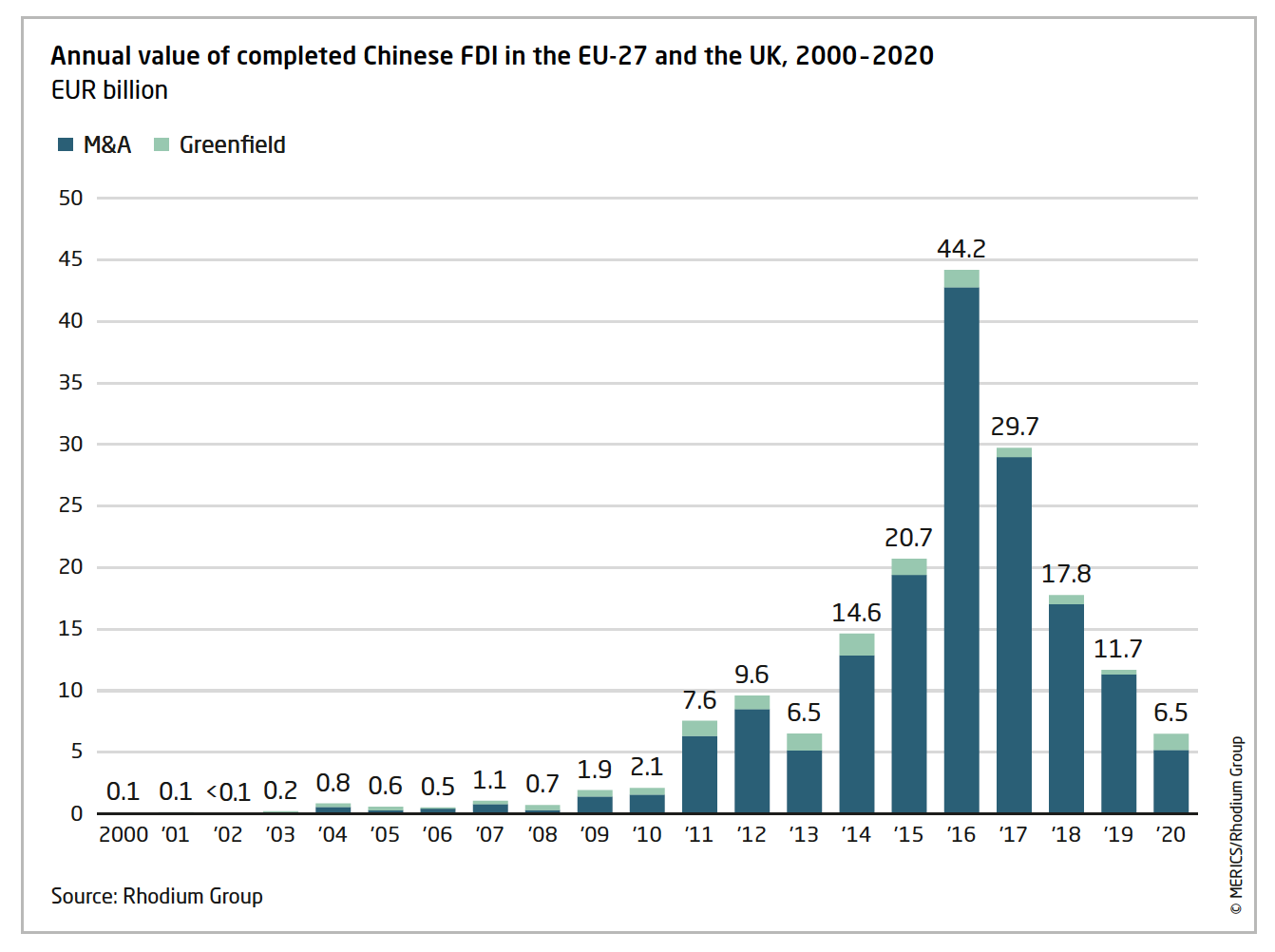

China’s FDI in Europe continued to fall, to a 10-year low: Shrinking M&A activity meant the EU-27 and the United Kingdom saw a 45 percent decline in completed Chinese foreign direct investment (FDI) last year, down to EUR 6.5 billion from EUR 11.7 billion in 2019, taking investment in Europe to a 10-year low. However, greenfield Chinese investment reached its highest level since 2016 at nearly EUR 1.3 billion.

The “Big-3” reclaimed their top spot, Poland emerged as a key recipient: More than half of total Chinese investment in Europe went to the “Big Three” economies – Germany, the UK and France. However, the UK saw Chinese investment plummet by 77 percent. Poland rose to become the second most popular destination, though inflows of EUR 815 million were largely concentrated on one acquisition.

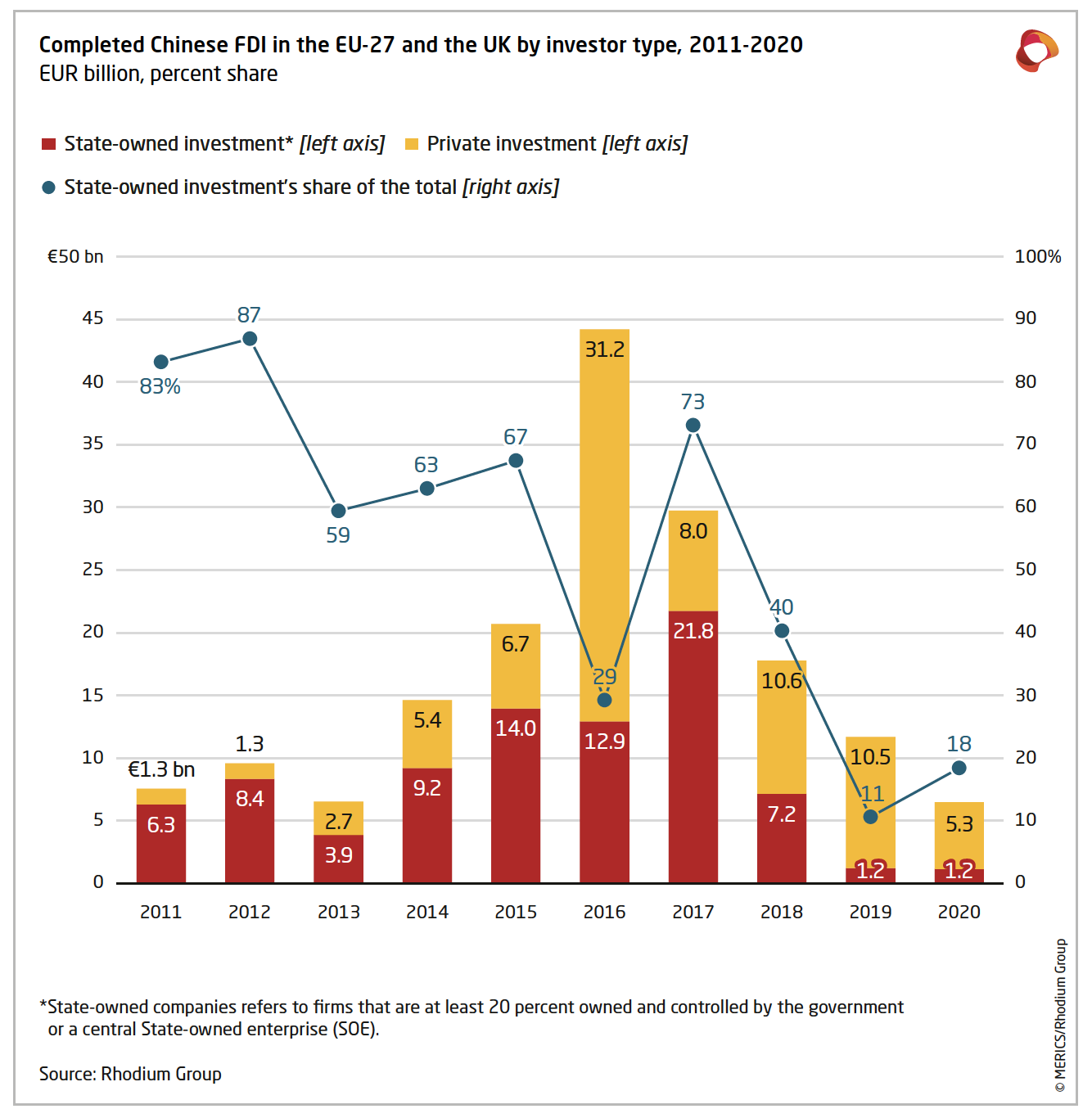

China’s state-owned enterprises (SOEs) took a higher share in a quiet market: SOEs were responsible for 18 percent of total Chinese FDI to Europe, higher than 11 percent 2019 but still significantly below historical averages. Their investment stayed relatively stable in absolute terms, however, concentrating in energy, infrastructure and basic materials. Private sector investment dropped by almost 50 percent.

Chinese investment was spread more evenly across sectors: Small- and mid- size transactions dominated in 2020, with no major billion-dollar acquisitions as in 2019. As a result, Chinese investment was spread more evenly across sectors. Infrastructure, ICT and electronics were the top three sectors, attracting 51 percent of the total.

Chinese FDI faces greater scrutiny by EU member states: The Covid-19 crisis prompted the EU to issue guidelines stepping up scrutiny of FDI in Europe’s critical assets. 14 EU member states, including Italy, France, Poland and Hungary, have updated their FDI screening mechanisms last year. Member states have also moved to block several acquisitions by Chinese firms.

Headwinds to Chinese investment in Europe will grow in 2021: Chinese FDI activity into Europe continued to fall in the first quarter of 2021 and has remained weak elsewhere, even as global M&A activity has recovered and surged to a 10- year high of EUR 1.08 trillion. Europe remains an attractive investment location. However, continued disruption from Covid-19, high barriers to outward capital flows in China and rising regulatory barriers to foreign investment in Europe have all contributed to low levels of Chinese investments. Deteriorating EU-China relations will create additional headwinds for Chinese investors going forward.