China’s Global Outbound M&A in 2014

With more than $50 billion worth of completed deals, Chinese firms continued to be an important driver of global mergers and acquisitions (M&A) activity in 2014.

With more than $50 billion worth of completed deals, Chinese firms continued to be an important driver of global mergers and acquisitions (M&A) activity in 2014. However, anticipation of a different growth model and more liberal outward investment policies have affected Chinese buying behavior and deal structures. This note reviews China’s global outbound M&A activity over the past 12 months, focusing on five trends that are most relevant for intermediaries and policymakers.

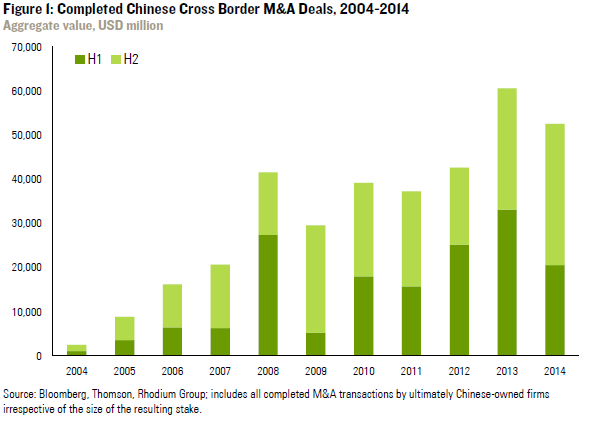

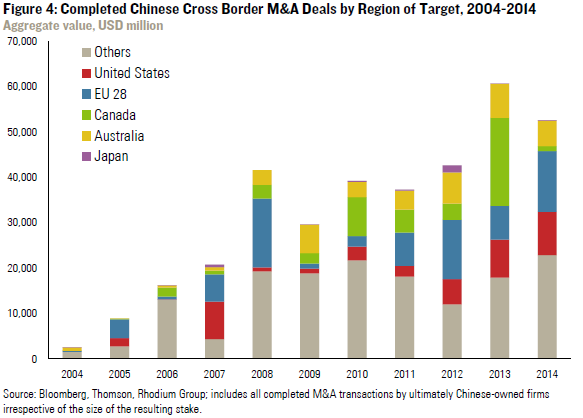

1. Global M&A spending by Chinese firms dips for the first time since 2011: While global M&A activity reached new post-crisis heights in 2014, completed cross border acquisitions by Chinese companies only came to $53 billion, a 13% drop compared to last year. That said, Chinese spending on global acquisitions was still above the average of the past five years, and activity picked up markedly in the second half of the year.

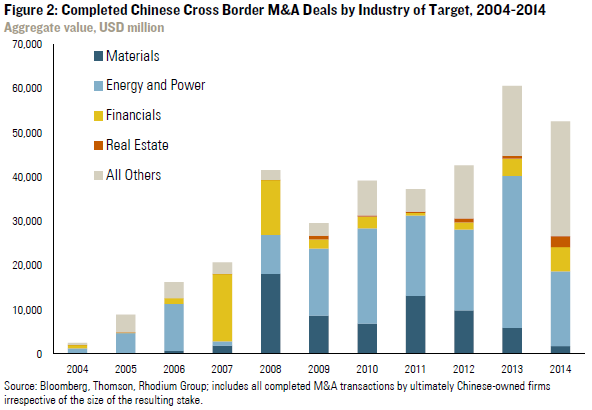

2. Energy and materials acquisitions drop sharply, but greater appetite for technology, brands, financials, and real estate: The major reason for lower total spending last year was a sharp drop in natural resource asset buying. Energy and materials deals were a major factor driving Chinese outbound M&A growth over the past decade, with an average of $30 billion spent each year between 2008 and 2013. In 2014, Chinese spending on extractive industry assets tumbled to just $19 billion, as an anti-corruption campaign and anticipation of a less resource-intensive growth model dampened firms’ risk appetite. Spending on financial services, real estate, technology, and brands grew fast, but not fast enough to make up for the resources slump.

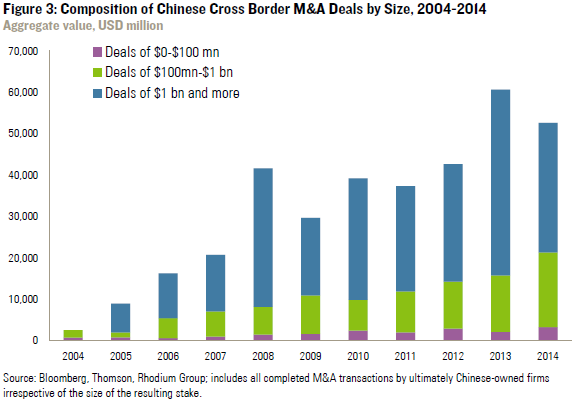

3. Small and middle market deals catch up with mega mergers: The drop in extractive deals and greater interest in non-resource assets also affected the average size of Chinese outbound M&A transactions. The dominance of mega deals is eroding, while small and middle market deals are becoming a major driver of growth. In 2014, small and medium sized transactions accounted for almost 40% of total outbound M&A spending by Chinese firms.

4. Chinese buyers continue to favor advanced economy assets, but Canada and Japan underperform: Since 2012, the majority of Chinese M&A activity is targeting advanced economies, a trend which continued in 2014. Spending on European assets surged to new record levels; the United States attracted high levels of Chinese capital for the third year in a row; and Australia maintained high levels of Chinese investment, as activity shifted from metals to agriculture, food, and real estate. Chinese M&A in Canada collapsed due both to lower interest in extractive assets and greater political scrutiny for investment by state-owned enterprises. Japan continues to be an outlier among OECD economies by attracting very little Chinese capital, mirroring its overall poor performance in attracting foreign investment.

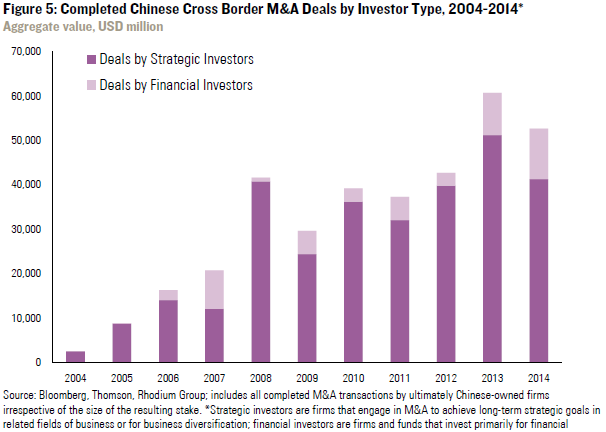

5. Financial investors from China are entering the global stage: While the growth of outbound M&A by private Chinese firms in recent years is well documented, 2014 particularly highlights the rise of financial players in Chinese outbound M&A. Previously restricted to sovereign entities with special mandates (such as China Investment Corporation), more mature industry structures and fewer restrictions have boosted global investments by private equity firms, financial conglomerates, insurance firms, and other financial players including both state-controlled entities (SAFE Investment Corporation and China Merchants Banks) as well as private firms (like Fosun, Hony, Ping An, and Anbang). In 2014, financial investors accounted for 22% of total outbound M&A value, twice as much as the average of previous five years.