Chinese FDI in Europe: 2022 Update

Greenfield investments in EV battery plants cushioned a drop in Chinese FDI in Europe to a decade low, a new report from Rhodium Group and MERICS shows

Building on a long-standing collaboration between Rhodium Group and MERICS, this report summarizes China’s investment footprint in the EU-27 and the UK in 2022, analyzing the shifting patterns in China’s FDI, as well as policy developments in Europe and China. Key findings and a link to the full report are below:

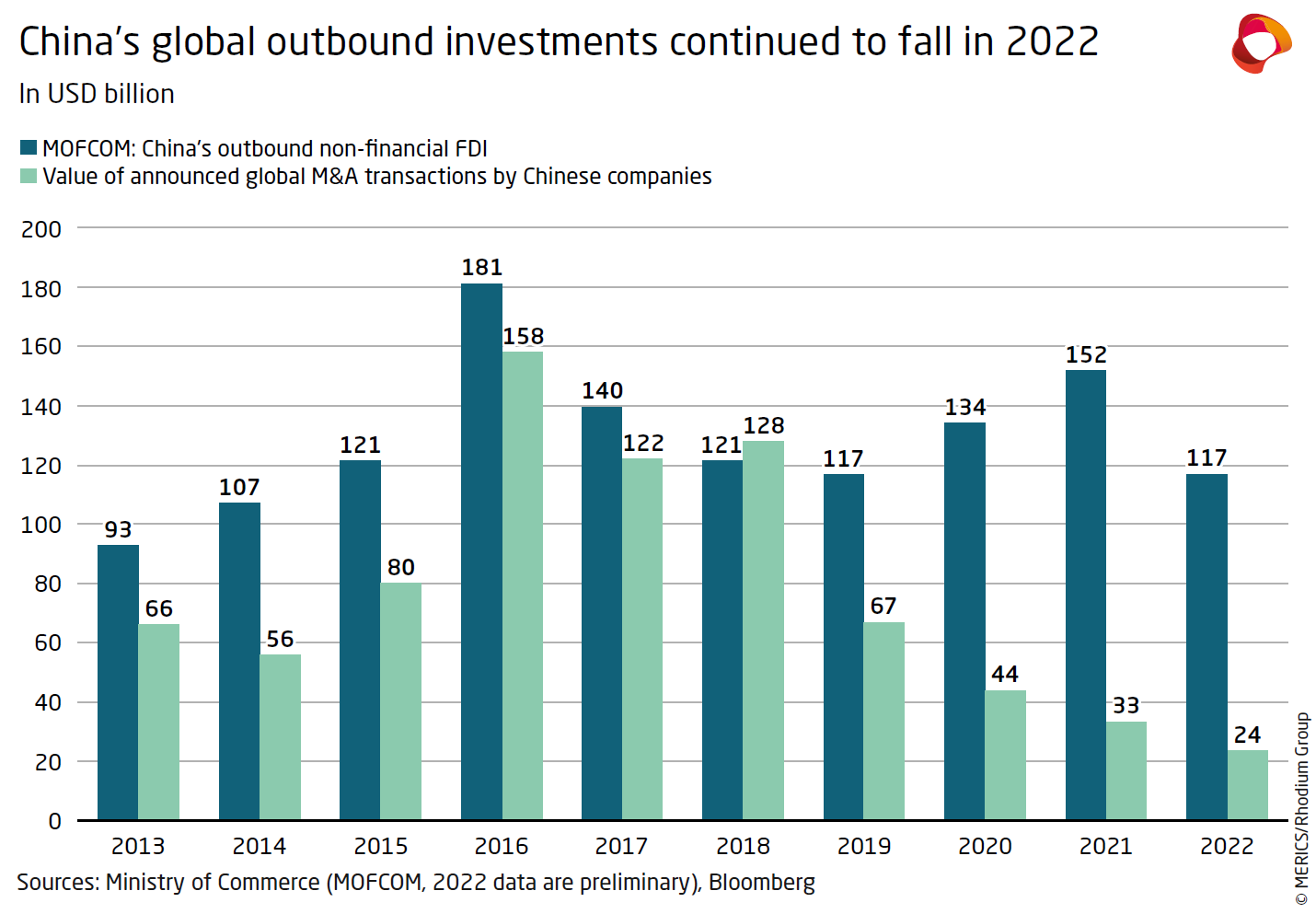

China’s global outbound investment falls to an 8-year low: In line with the global decline in cross-border investment, Chinese outbound foreign direct investment (FDI) fell by 23 percent in 2022 compared to 2021, to USD 117 billion (EUR 111 billion). China’s outbound mergers and acquisitions (M&A) activity also dropped, falling 21 percent from 2021 levels to a total of EUR 22 billion. A range of external and internal factors—from China’s zero-Covid policies to rising global risks following Russia’s invasion of Ukraine—created strong headwinds for Chinese investors.

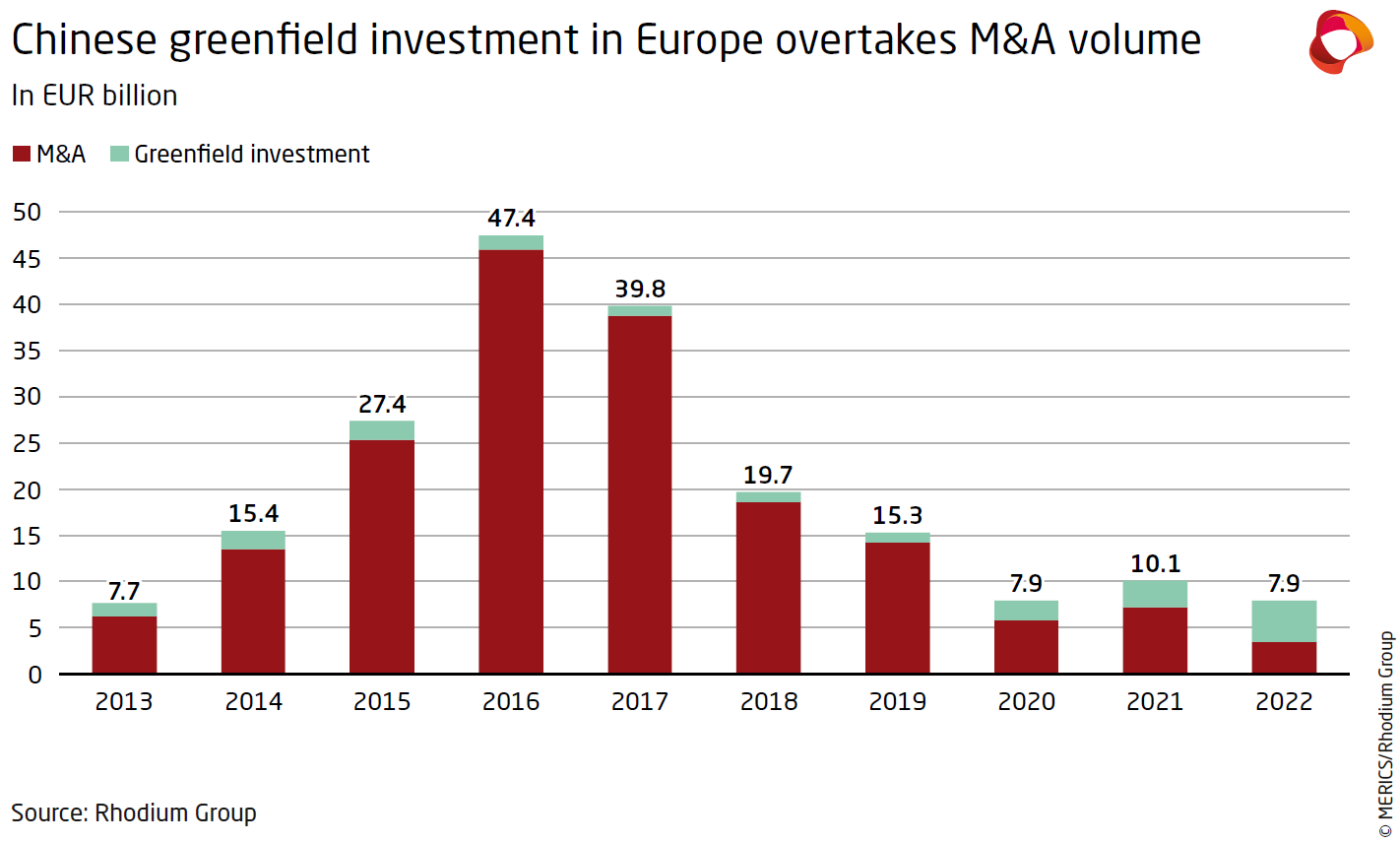

Chinese investment in Europe (EU-27+UK) continues its multi-year decline: Chinese FDI in Europe reached a decade low of just EUR 7.9 billion in 2022, down 22 percent compared to 2021. The drop takes Chinese investment back to its 2013 level. A lack of Chinese M&A activity was the prime reason for the fall. Only one transaction—Tencent’s purchase of British video game developer Sumo Digital—exceeded one billion euros.

Greenfield investment overtakes M&A for the first time since 2008: Driven by electric vehicle battery factories, Chinese greenfield investment in Europe increased by 53 percent, exceeding M&A flows for the first time since 2008.

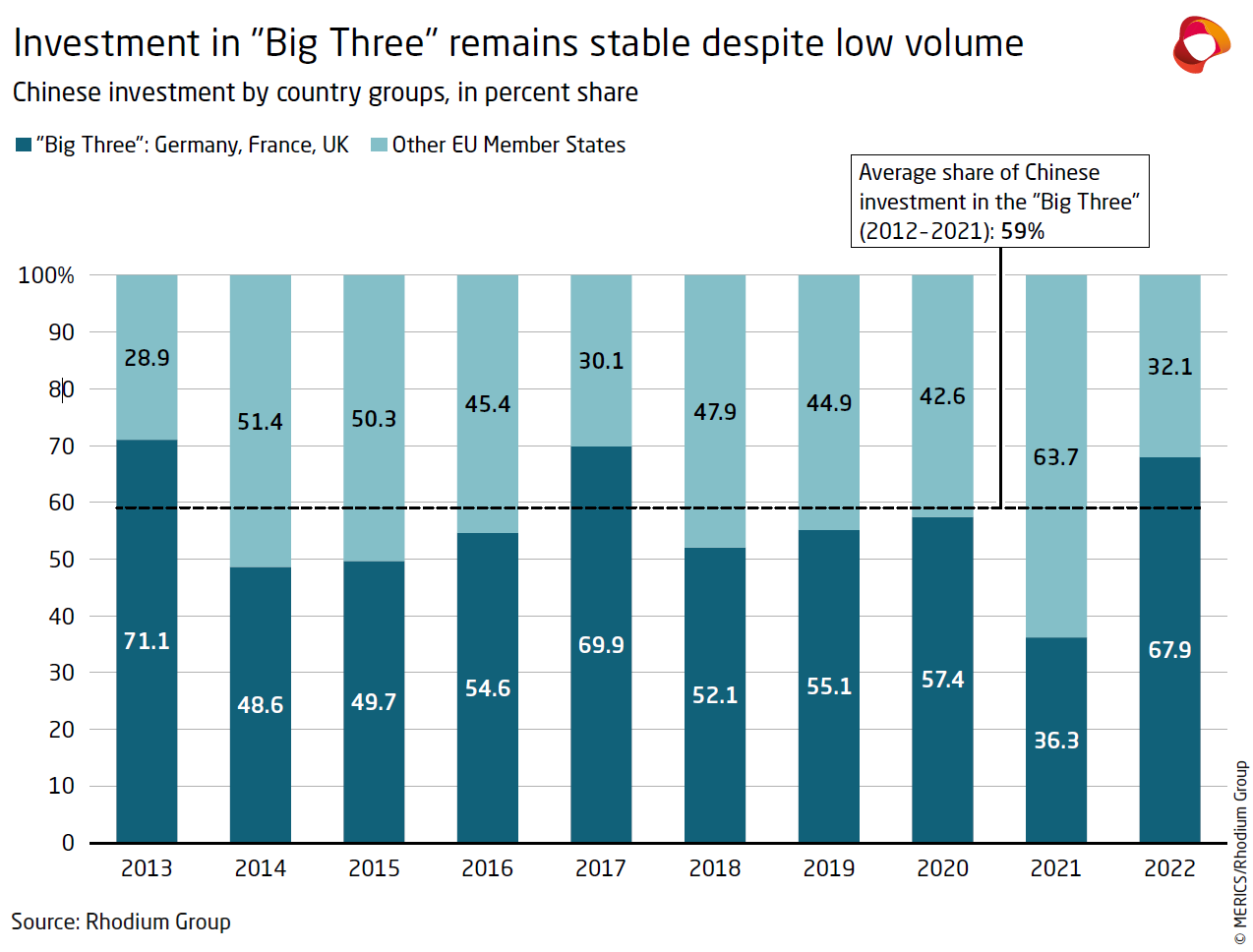

Investment concentrates heavily on the “Big Three” and Hungary: 88 percent of investment flowed to just four countries, the “Big Three” European economies (the UK, France and Germany) and Hungary. All four received major greenfield investments by Chinese battery makers, as well as most of the year’s M&A activity.

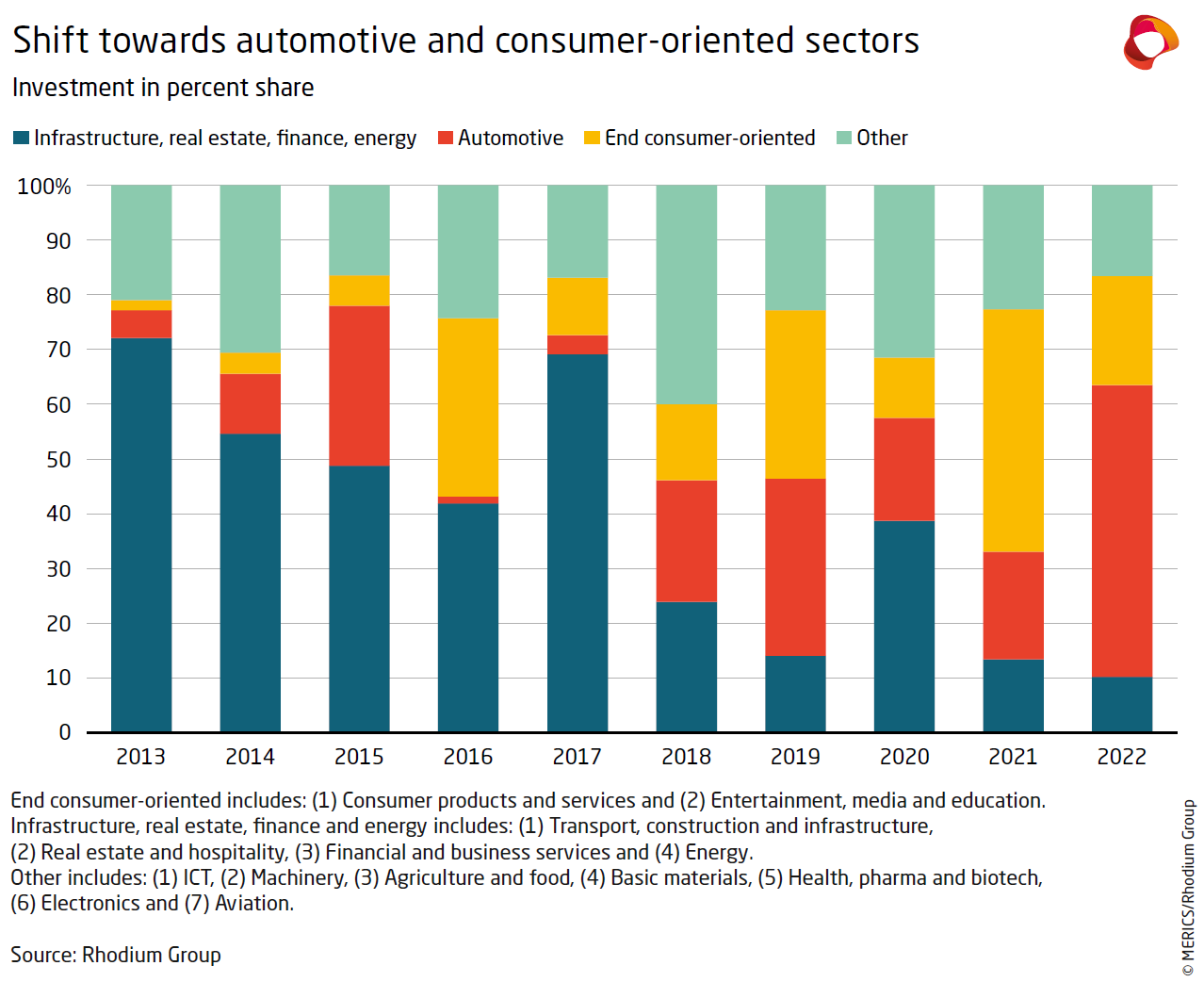

Consumer products and automotive remain the top sectors: As in 2021, consumer products—again driven by a single large acquisition—and automotive remained the two top sectors. Three quarters of total Chinese investment flowed into these two sectors.

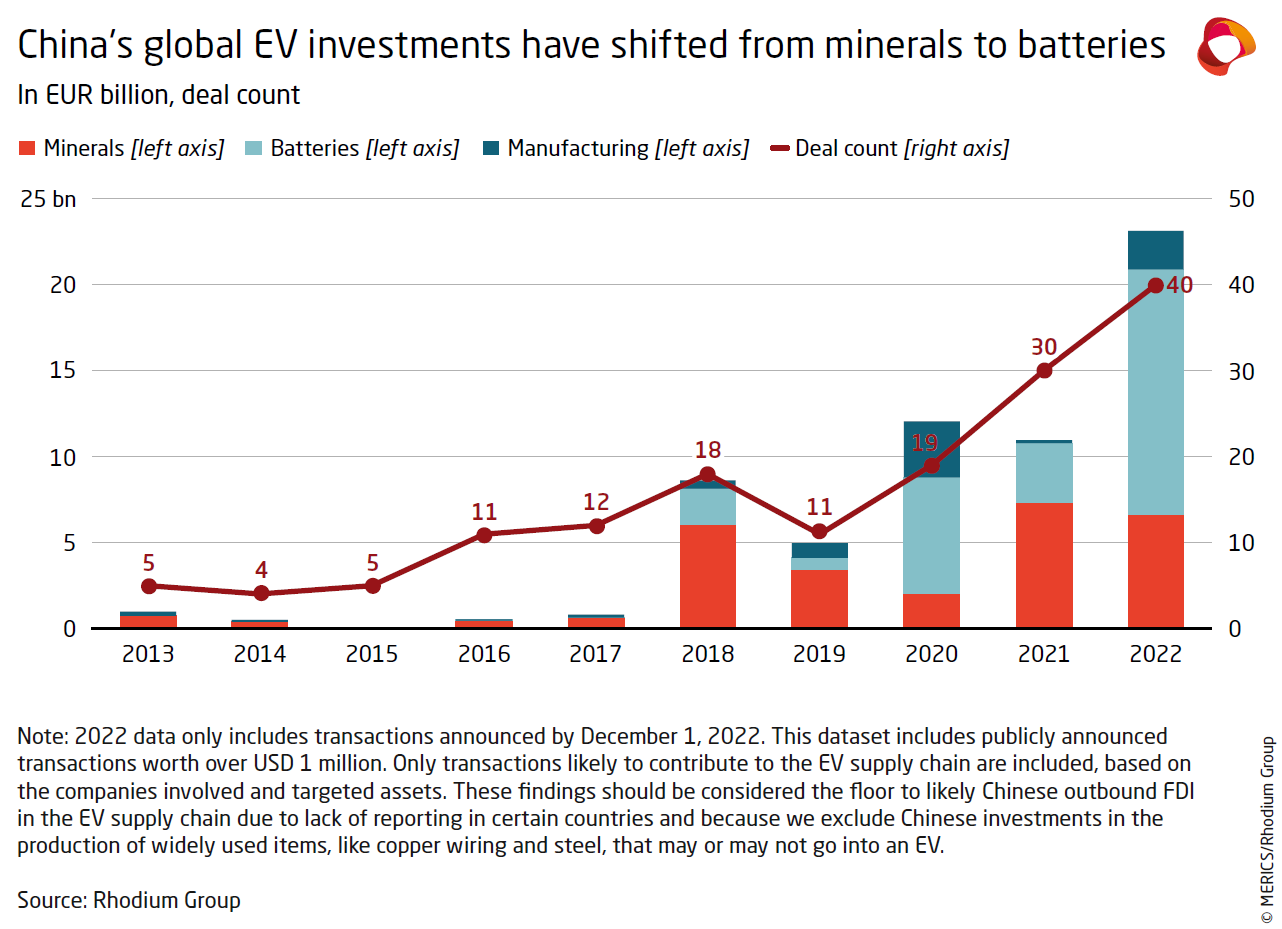

Europe has become a key part of China’s global electric vehicle expansion: Battery investments are now the mainstay of Chinese investment in Europe. Further greenfield expansion in Europe in up- and down-stream segments of electric vehicle (EV) value chains, including vehicle production, are being considered by Chinese firms.

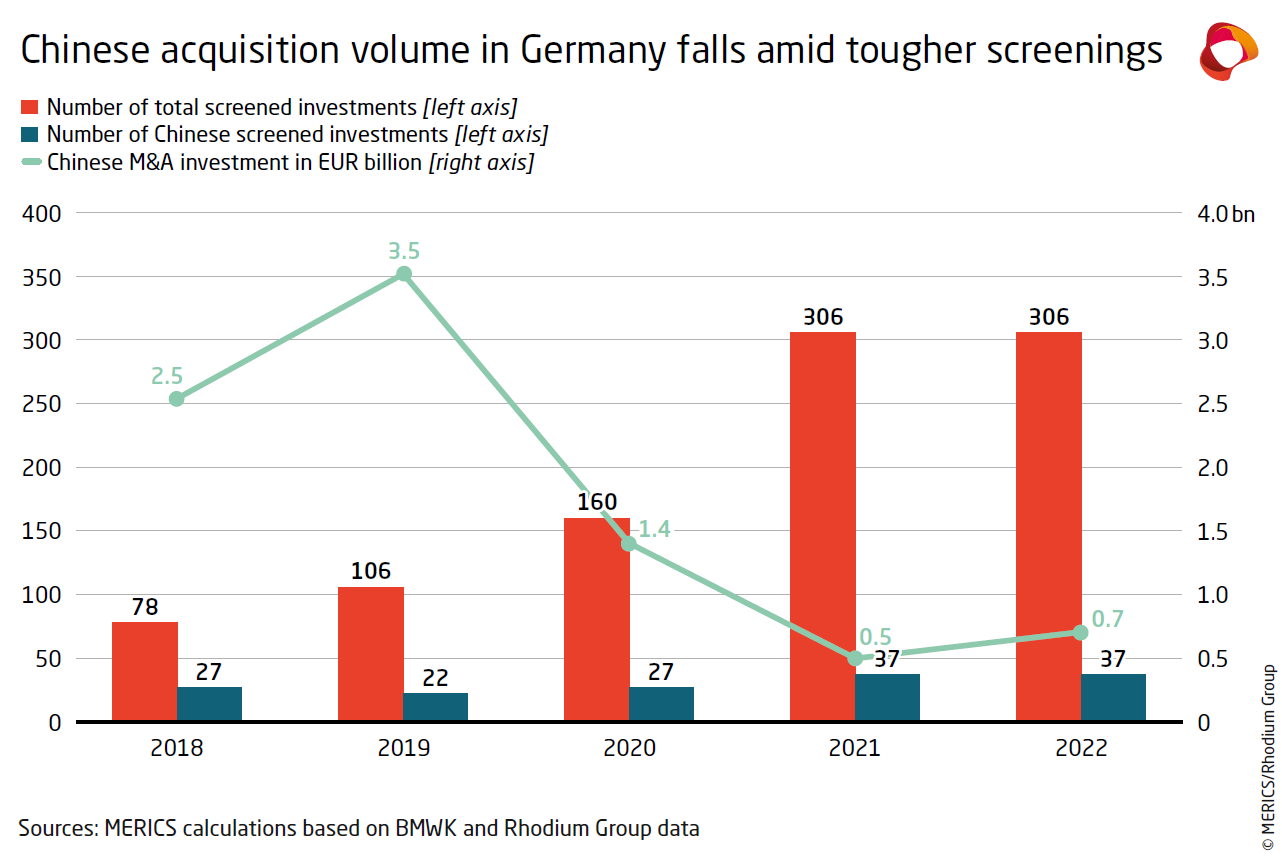

European governments increase scrutiny of Chinese investment: They continue to tighten investment screening measures, impacting Chinese acquisitions of strategic assets such as European semiconductor companies and critical infrastructure.

A strong rebound in 2023 is unlikely, but investment could recover slightly: The end of China’s zero-Covid policy could boost Chinese outbound investment in 2023, but China’s fragile economic situation and geopolitical pressures make a rebound to mid-2010 investment levels unlikely.