Chinese FDI in the United States: Q1 2014 Update

After spending more than $14 billion on US acquisitions and greenfield projects last year, Chinese companies announced more than $8 billion worth of deals in the first quarter of 2014. This note reviews the patterns, key transactions and political developments in the China-US investment relationship in Q1 2014.

A solid start in 2014: In the first three months of the year, Chinese firms spent $1.36 billion on 26 FDI transactions in the US. The number of acquisitions reached an all-time quarterly high. The industries attracting the most investment were healthcare, real estate and information technology.

Strong pipeline for the rest of the year: More than $8 billion worth of deals are currently pending, including two large-scale M&A transactions in IT equipment worth more than $5 billion, and two big greenfield projects with a combined capital investment of almost $3 billion.

New realities put China under pressure to accelerate market opening: The recent surge in Chinese outbound FDI puts increasing pressure on China to level the playing field for foreign firms in China. Expectations are that China will offer a significantly trimmed down “negative list” of sectors restricted to foreign investment for a US-China bilateral investment treaty.

TRENDS AND PATTERNS

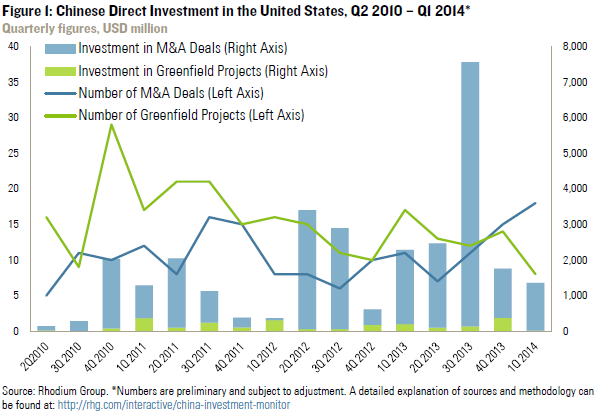

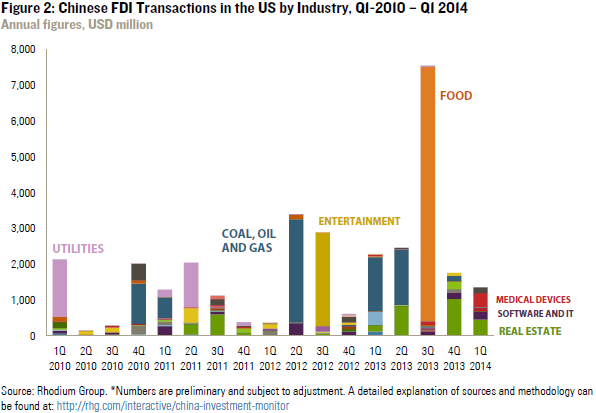

In Q1 2014, Chinese firms spent $1.36 billion on eighteen acquisitions and eight greenfield projects in the United States (Figure 1). That number of acquisitions is the highest quarterly figure on record. The biggest transaction was MicroPort Scientific’s acquisition of Wright Medical Group’s OrthoRecon business. Other completed M&A transactions include Wanxiang’s purchase of the assets of bankrupt Fisker Automotive, a stake by Alibaba in TangoMe, and the takeover of Plaza Construction by China Construction America. Figure 2 provides an overview of industry trends by quarter. A detailed breakdown of all deals in Q1 2014 and previous quarters by industry, geography, ownership and entry mode can be found on Rhodium Group’s China Investment Monitor.

KEY TRANSACTIONS

Keer Group in South Carolina: Chinese Cotton Yarn Made in America

In December 2013, Chinese cotton yarn producer Keer Group announced a $218 million investment in a new greenfield production facility in South Carolina. The project broke ground in early 2014 and is expected to create 500 local jobs. The decision to move production to America illustrates the changing cost structures in China, which offers opportunities for the US to win back some manufacturing activity from China. In the case of Keer Group, it was mostly the pricing of cotton that made the move to the US attractive. Raw cotton is about 30% cheaper in the US because of Chinese price controls. Other factors were utility costs in South Carolina, which are about half of what they are in China, and lower prices of land, which have soared in China in recent years.

The investment illustrates how changing cost structures in China and more freedom for private firms to streamline their value chains across borders opens new opportunities for the US to attract private manufacturing FDI from China. There are no indications of a massive “re-shoring” trend that would move manufacturing activity from China to the US, as firms are moving labor-intensive production to other Asian economies or Mexico (as TCL’s recent investment in a TV production facility in Tijuana demonstrates) before coming to the US. However, in industries where firms are looking for human capital, better access to input materials, proximity to consumers or avoidance of trade barriers, the US is becoming an increasingly attractive location for new Chinese manufacturing operations.

Other recent examples of Chinese manufacturing greenfield projects include a new facility by JN Fibers to produce polyester staple fibers (also in South Carolina) and new operations by floor manufacturer Zayuan and furniture producer Liaoyang Ningfeng in Virginia. At the end of May, Golden Dragon will open its $100 million copper tubing plant in Alabama. Chinese investors are also exploring opportunities arising from the recent boom in unconventional oil and gas. For example, two-large scale methanol plants in the Northwest, which together would cost about $3 billion and ship methanol to an industrial park in China’s Northeast.

Microport Medical – Wright OrthoRecon: Getting Ready for China’s Aging Society

In January, Chinese medical device company Microport closed its $290 million acquisition of Wright Medical’s OrthoRecon business, which it announced in June 2013. Microport sees the acquisition of Wright’s OrthoRecon business, which consists of hip and knee implant products, as a key pillar for the expansion of its orthopedics business in the fast-growing Chinese market and globally.

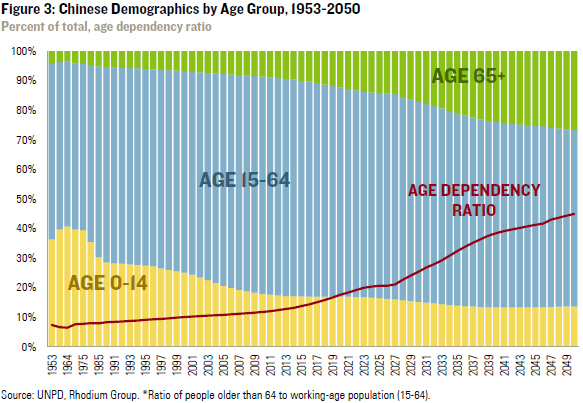

Chinese acquisitions in the US healthcare and pharmaceutical sectors have trended up in the past 18 months as companies aim at increasing their long-term competitiveness through overseas M&A. While some Chinese firms are eying the US and other international markets, their main goal is to become more competitive in the domestic Chinese market. China’s healthcare market is growing fast and the demographic outlook hints at plenty of opportunities in the coming two decades (Figure 3). Other recent transactions include Mindray’s acquisitions of Datascope and Zonare, BGI’s acquisition of Complete Genomics, and Fosun’s investment in Saladax Biomedical.

POLICY DEVELOPMENTS

The US and China are making progress with negotiations of a bilateral investment treaty, but the path forward will depend on China’s readiness to offer a substantially reduced list of sectors restricted to foreign investment. The market reforms announced at the Third Plenum last year, the new Shanghai Free Trade Zone and the recent opening up of the insurance sector to foreign investment are positive signals. Meanwhile, China has continued to gradually reform and improve its outward FDI policy regime by allowing greater flexibility in foreign exchange transactions and cutting down the role of industrial policy planners in outbound FDI approvals.

United States: Seeking Greater Symmetry in Market Access through a BIT

Talks between the US and China about a bilateral investment treaty (BIT) have recently entered a critical phase, with the latest round of negotiations held in March. Presidents Obama and Xi personally set these talks on a faster track last summer, and major progress could be announced when they meet again in Beijing at APEC later this year.

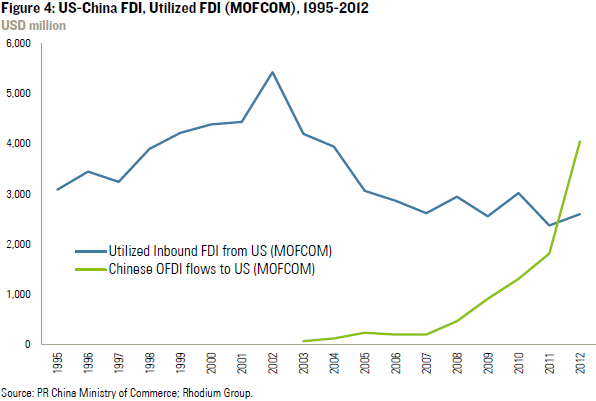

Among the questions that are currently being negotiated, one stands out in particular: China’s readiness to accelerate the liberalization of its inward FDI regime and level the playing field for foreign firms in China. Easing restrictions for foreign investors in China has long been a priority of US officials and the business community, but the recent surge in Chinese FDI in America has changed the political dynamics and put pressure on China to accelerate this process. Even China’s own official statistics now confirm what alternative indicators have suggested for some time: that Chinese investment in the US has not only grown rapidly, but it now exceeds flows in the other direction (Figure 4).

Outright reciprocity in FDI openness is not what the US is or should be asking for, but as Chinese companies now compete head-to-head with local firms in the US market, indulgence toward this developing economy behavior is fading. China needs to take more aggressive steps to avoid a political backlash against Chinese FDI in the US and elsewhere. For the US-China BIT negotiations, this means that China is expected to offer a “negative list” of sectors prohibited for foreign investment that is significantly shorter than the existing list of restricted and prohibited industries or the current negative list for the Shanghai FTZ.

With regard to national security screenings, there were few relevant developments in the first quarter. In March, the Committee on Foreign Investment in the United States (CFIUS) approved the acquisition of Plaza Construction by China Construction America. Lenovo’s two announced US deals (Motorola Mobility and IBM’s x86 server business) both require approval from CFIUS before they can be closed later this year. In February, CFIUS agreed to a proposed divesture plan for a Chinese investment in a Nevada-based mining company it had opposed in 2013 due to national security concerns (probably its proximity to the Fallon Naval Air Station). Meanwhile, Ralls Corporation, which is affiliated with Sany, continued its legal battle with CFIUS by appealing a decision dismissing its claims for due process after the President blocked its investment in an Oregon wind farm in 2012. Claims that the NSA breached networks of Huawei have added more fuel to the fire on bilateral frictions over investment and market access in telecommunications equipment.

With regard to regulatory compliance after market entry, two developments were important in Q1 2014. First, BYD settled one of its three labor disputes in California by paying $1,900 in fines. The settlement came just in time for the roll-out of BYD’s first electric buses assembled in Lancaster County. BYD now employs 60 people in its production facility and aims to add another 100 by the end of 2014. The case illustrates the difficulties for Chinese firms adjusting to local US labor laws and regulations when making the move to the US, particularly in highly-regulated states like California. The second important regulatory development was a lawsuit by the Attorney General of Oklahoma against a Chinese supplier of valves (Neway Valve) to remedy allegedly unfair competitive advantages from IPR theft. It shows that state-level competition laws could become an additional instrument for US firms to address unfair competitive advantages for Chinese firms operating in the US, particularly in cases where existing federal instruments, such as punitive tariffs or trade secret legislation (see the Sinovel case), are not effective.

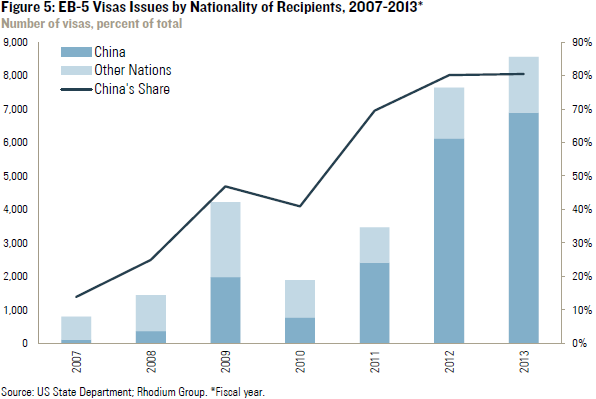

Finally, new statistics by the US State Department illustrate that the run by Chinese investors on EB-5 investor visas continued in the fiscal year 2013. The number of visas issued to Chinese citizens reached an all-time high of 6,895, up from less than 2,500 just two years ago (Figure 5). Chinese now account for 80% of total EB-5 visas issued, up from just 14% in 2007. A similar investor visa scheme created in Australia in 2012 also predominantly attracts Chinese citizens, with 91% of their applicants from Mainland China. Meanwhile, Canada recently announced it would abandon its permanent residency program for wealthy foreigners after finding it provided relatively little economic benefit. More than 70% of the 65,000 pending applications came from Mainland China.

China: Fewer Bureaucratic Hurdles for Cross-Border Business

China continues to gradually reform its outbound FDI regime. In December 2013, the State Council announced new rules that curtail the power of the National Development and Reform Commission (NDRC) in the OFDI approval process. Starting May 8, NDRC approval will only be needed for large-scale deals over $1 billion and transactions in sensitive industries and countries. While it is still uncertain how the latter is defined, cutting down the role of the NDRC in the bureaucratic approval system is an important step towards a more open and market-based OFDI environment. As China’s industrial policy behemoth, the NDRC has, in the past, actively interfered with overseas deals that did not fit its industrial policy agenda and excluded or imposed conditions on firms it did not consider fit for going abroad.

A less political and bureaucratic OFDI environment will help Chinese companies to become more serious contesters in competitive M&A bidding processes in non-extractive sectors, and it will lower the premium for political risk they have to pay for assets. Perhaps more importantly, reducing the influence of the NDRC in OFDI approvals will also help to reduce foreign fears about politically driven investments. The involvement of NDRC and other state agencies fuels foreign anxiety about non-commercial investment motives, even in the case of privately owned Chinese firms. Limiting the state’s role in firms’ investment decision making is the best way of addressing these fears.

In addition to new OFDI approval rules, China’s forex regulator, the State Administration of Foreign Exchange (SAFE), announced several measures to simplify cross-border operations of Chinese companies. In January, SAFE announced new rules to allow firms to lend to their offshore units without a new layer of approvals and documentation, as long as the loan is not more than 30% of the onshore firm’s equity. In April, SAFE announced it would give domestic and foreign firms with at least $100 million of FX income, solid risk controls, and no prior FX rule violations greater freedom in moving capital in and out of China. Separate rules by the central bank give firms registered in the Shanghai Free Trade Zone more freedom in FDI-related FX flows.

While regulatory barriers for cross-border business transactions are gradually declining, Lenovo’s takeover of IBM’s x86 server business has shown that the politics of outbound FDI got more complicated due to the emergence of a new stakeholder: Chinese workers. More than 1,000 workers reportedly went on strike to protest against lower wages and insufficient severance packages related to Lenovo’s acquisition. Similar strikes have impacted global M&A transactions in the past (most recently the merger between US firm Cooper Tire and India’s Apollo Tyres), but this is the first time that domestic worker protests have impacted a Chinese outbound deal. Looking forward, a stronger worker lobby could particularly affect overseas investments that are perceived to lead to loss of domestic jobs.

With regard to inbound FDI liberalization, the biggest news was the relaxation of M&A rules in the Chinese insurance industry. In March, the China Insurance Regulatory Commission’s (CIRC) abandoned rules that prohibited insurers from buying a stake in more than one peer that competes in the same market segment. It also extended these rules to foreign firms, which allowed the Starr Group to take control of Dazhong Insurance, marking the first foreign takeover of a state-backed general insurer. China is reportedly also considering the relaxation of investment caps in the auto sectors, which triggered substantial backlash from the domestic auto lobby.

With regard to global merger control, China’s Ministry of Commerce approved a total of 42 transactions in Q1 2014 , only one of which was conditionally approved. The acquisition of Life Technologies Corporation by Thermo Fisher Scientific was approved under the conditions that Thermo Fisher divest its global cell culture and gene modulation businesses, sell its 51% stake in China’s Lanzhou National Hyclone Bioengineering and cut prices on two key products sold in China.

OUTLOOK

Several deals have already closed in the beginning of Q2, including a strategic stake in US broker BTIG by China’s biggest brokerage, Citic Securities. Several major transactions are currently waiting for regulatory approval, including Lenovo’s acquisition of Motorola Mobility from Google ($2.91 billion), Lenovo’s takeover of IBM’s x86 server business ($2.3 billion), and Goldleaf Jewelry’s announced $665 million purchase of oil and gas producer ERG Resources. We are also waiting for progress on some of the announced real estate deals, including Shanghai Greenland Group’s participation in the development of the $5 billion Atlantic Yards project in New York.