Chinese FDI in the United States: Q2 2013 Update

Last week, China and the United States agreed to enter negotiations on a bilateral investment agreement (BIT). China’s readiness to negotiate an agreement that encompass all industries and all stages of investment comes on the back of fast-growing Chinese outbound investment. In the United States, Chinese FDI has soared from virtually zero to $6.7 billion last year. In the first six months of 2013, Chinese firms spent almost $5 billion on M&A and greenfield projects in the US, with another $10 billion worth of deals announced or pending. This note discusses the most important economic and political developments in the US-China investment relationship in Q2 2013.

Strongest H1 ever recorded and a lot more to come: After a strong first quarter, Chinese investors spent another $2.5 billion on FDI transactions in the US in Q2. Completed transactions in the first six months of 2013 total $4.7 billion, the strongest first half ever recorded. More than $10 billion worth of deals are currently pending.

Economic rebalancing drives outward investment: Recently closed and announced transactions show that firms are gearing up for a new growth model in China, with growing interest in consumer goods, healthcare, and technology assets.

Institutional deficiencies become more apparent: At the same time, recent deals highlight some specific hurdles for Chinese firms when entering developed economies that are rooted in the domestic institutional environment, for example burdensome capital controls or a different level of IPR protection.

Trends and Patterns

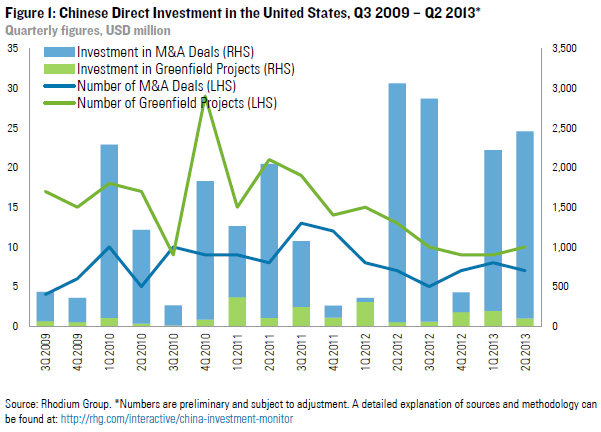

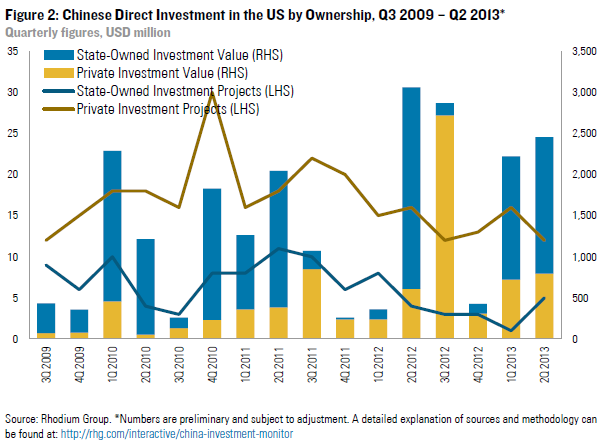

In Q2 2013, Chinese firms spent $2.46 billion on seven acquisitions and ten greenfield projects in the United States (Figure 1). Completed transactions in the first six months of 2013 total $4.7 billion, which makes it the strongest first half ever recorded. Following a trend from previous quarters, private investment continued to be strong in Q2, accounting for more than one third of the total investment value (Figure 2). The number of jobs provided by majority Chinese-owned firms in the US grew to more than 33,000.

With two closed transactions in Q2, unconventional oil and gas continues to be a key driver of Chinese investment in America. In May, Pioneer Natural Resources sold a 40% stake in its West Texas Wolfcamp Shale to Sinochem Group for $522 million in cash and assumption of $1.2 billion of future drilling and facilities costs. In June, Chesapeake completed a sale of a 50% undivided interest in its Mississippi Lime field in northern Oklahoma for $1.02 billion. As evidenced by these deals, Chinese partners now seem comfortable with increasing their stakes from previously 20-30% to up to 50%.

Real estate is another big driver of Chinese investment in the United States. The Vanke-Tishman venture in San Francisco, closed in Q1, broke ground this June. In May, the family of Chinese billionaire Zhang Xin purchased a 20% stake in New York’s GM building. And in June, the Port of Oakland closed escrow with Beijing-based Zarsion Group and Signature Development Group on a $1.5 billion real estate development project. Non-real estate firms also continue to purchase commercial real estate to support their expansion. Such deals include China Construction’s $71 million purchase of a four-story, 320,274-square-footoffice building in Morristown, New Jersey.

Several deals illustrate that Chinese firms are increasingly using US investments to gear up for a new growth model in China and related business opportunities and cost pressures. In May, a Chinese venture capital firm bought a 22% stake in VTL Associates, the parent company of RevenueShares, a specialty provider of revenue-weighted Exchange Traded Funds (ETF), in a bid to prepare for growth of similar products in a more liberal Chinese financial market. Chinese manufacturers continue to utilize US inbound acquisitions to upgrade technology and to access clients for advanced products, for example San’an’s $22 million acquisition of LED technology firm Luminus Devices in June (see below). Finally, rising Chinese labor costs and the move towards higher value-added products is also accelerating the localization of manufacturing operations. The latest example of this trend is a new $45 million facility in Missouri by auto supplier Yanfeng.

Key Transactions

Sinovel’s US Exit: National Champion, Global Disaster

On July 1, China’s largest wind-turbine manufacturer Sinovel announced it will shut down its US operations and exit the American market. The rise and fall of Sinovel illustrates the difficulties Chinese firms face in transitioning from protected national champions to globally competitive multinationals, and particularly highlights some of the legal risks Chinese firms face when going abroad.

Founded in 2005, Sinovel thrived on the back of Chinese policies to boost home-grown clean energy producers and to end the dominance of foreign suppliers in the Chinese wind power market. Sinovel’s market share grew to more than 11%, with annual revenues exceeding RMB 20 billion by 2010. The firm aimed at replicating this success story overseas, vowing to become a global player with presence in major markets including the US, Europe, Canada, Turkey, and Brazil, by 2015. However, Sinovel’s ambitions to develop into a global wind power champion ended in disaster. Rampant overcapacity and a slowdown of domestic expansion led to a dramatic decline in revenues at home. In overseas markets, Sinovel had to realize that its model of hyper growth was not replicable given the intense competition and the lack of political support it had enjoyed at home. Over the past year Sinovel was forced to shut down 8 of its 10 global units, leaving only its Spain and Turkey subsidiaries operational.

Legal problems related to intellectual property rights violations have dealt the final blow to Sinovel’s global ambitions. In June, the US government filed charges against the firm on counts of “conspiracy to commit trade secret theft, theft of trade secrets, and wire fraud” for stealing technology from its former supplier American Semiconductor (AMSC). Sinovel’s indictment illustrates that non-compliance with international business norms could prove a substantial barrier to future overseas expansion of Chinese firms, particularly in developed economies with independent legal systems. In the case of Sinovel, the firm had little to fear from a politicized Chinese court system (AMSC tried to sue Sinovel in China without success, despite a strong case), but the move abroad exposed the firm and their executives to the jurisdiction of US courts. Similar sins from the past could prove a major liability for Chinese firms’ expansion in such markets.

Sanan-Luminus: Chinese Buyers as Exit Option for US Tech Investors

On June 4th, Chinese LED component manufacturer Sanan Optoelectronics announced that its US subsidiary Lightera had acquired Luminus for $22 million. The transaction shows that Chinese buyers have become an important option for US investors looking for an exit strategy from their investments, in particular for investments in ailing technology firms.

Luminus Devices was launched 11 years ago as a startup that aimed at revolutionizing LED technology using proprietary technology in TV illumination. It accumulated $150 million in venture capital funding from firms such as Braemar Energy Ventures, CMEA Ventures, and Paladin Capital Group. However, Luminus’ initial products failed to successfully commercialize when competing with flat-screen LCDs. Even switching focus to general LED lighting to exploit the firm’s Supersize LED technology brought only limited success, partly due to the dropping price of regular LED. With net profits of only $3.2 million in 2012, the start-up fell short of investors’ expectations.

While Luminus could not meet the expectations of its US investors, it still provides great value for its new owner Sanan, which has been hoping to jump-start its LED manufacturing operations and to compete in high-end global markets. Through the merger, Sanan will gain access to Luminus’ key intellectual property (94 patents and patents-pending in the US) and to an established supply network, including clients such as LG, Acer, and Philips. Other recent examples in which ailing US technology firms have attracted Chinese buyers are A123 Systems, Evergreen Solar, and MiaSole.

Policy Developments

The biggest news in the US-China investment relationship is the announcement following the Strategic and Economic Dialogue meetings in Washington that both countries agreed to take the BIT talks to the next stage. While still not a breakthrough, this is a positive signal amid persistent tensions around espionage and calls by US lawmakers to broaden investment reviews to include economic security criteria.

United States: BIT Negotiations amid Fresh Calls for Economic Security Screening

The announcement that China agreed to BIT negotiations without preconditions and covering all industries and stages of investment provided much needed positive news amid a heated public debate in the US about Chinese investment. After the outrage about alleged Chinese cyber espionage, the announced takeover of US pork producer Smithfield by China’s largest pork processor Shuanghui International triggered a fresh debate in the US over the sufficiency of the current investment review framework. Lawmakers and local politicians wrote letters voicing concerns about the deal and some members of the Senate Agriculture Committee called for an expansion of reviews to include “economic security”.

In June, CFIUS effectively blocked another Chinese mining investment in the US on national security grounds. Procon Resources, an affiliate of China National Machinery Industry Corporation, was forced to divest its investment in Lincoln Mining Corporation, which owns facilities that are close to the Naval Air Station Fallon. It follows similar decisions in the past related to geographic proximity of assets to defense installations, for example Northwest Nonferrous-Firstgold, TCIC-Emcore, Far East Golden Resources -Nevada Gold. Meanwhile, the US District Court of Columbia continues to review a case that could help to define the role and procedures of CFIUS. In February, the court rejected a case brought by Sany-affiliate Ralls Corporation which claimed that a Presidential order to divest its investment in a US wind farm project was unconstitutional. The court stated that it has no jurisdiction to review the President’s decision to block foreign investments based on the Exon-Florio Amendment. However, the judge allowed Ralls to proceed with claims that the divesture requirements were unconstitutional because they were not done through due process of law. A decision is expected to take several months.

Finally, a notable change in the US regulatory framework was a new set of rules released by the FCC (Federal Communications Commission) on April 18 for foreign investment in wireless networks, one of the few areas where foreign ownership is restricted by law and needs approval from regulators beyond CFIUS and antitrust. FCC streamlined its policies for reviewing foreign ownership in common carrier wireless licenses and certain aeronautical radio licenses. The new rules eliminate the distinction between WTO and non-WTO country investors, and no longer require identification of foreign investors that hold less than 5% voting interest (10% in certain cases). In addition, the new rules permit parties to obtain prior approvals for specific foreign investors to increase their equity or voting interest beyond the level specified in the initial petition. They also permit FCC grants of foreign ownership stake to be applied to affiliates and subsidiaries, new foreign investors, and new geographic areas or services under specified circumstances.

China: Economic Reforms and Investment Policy

As others have stressed, the short term impacts of China’s agreement to enter serious BIT conversations with the US will be negligible and it will take years to reach a conclusion. At the same time, this step is significant in the medium term in the context of ongoing efforts to modernize the economy and liberalize China’s capital account. It signals that China is ready to give up its current approval-based FDI regime in favor of a modern FDI regime with pre-establishment rights restricted only by national security reviews, antitrust concerns and potentially a negative industry list.

Such a change in investment policy would be in line with a broader push for capital account liberalization, the pace of which has accelerated in the past year with several new policies announced in Q2: In May, the State Administration of Foreign Exchange (SAFE) further streamlined China’s foreign exchange regime by abolishing more than 20 restrictions and registration requirements. In June, the People’s Bank of China (PBOC) reportedly approved plans for a new pilot scheme that allows individuals to make financial investments overseas (QDII2). At the end of June, China’s State Council announced that it was considering turning Shanghai into a new type of free trade zone to experiment with financial and capital account liberalization.

In the near term, China’s reaction to Edward Snowden’s revelations of the US government’s PRISM program will be a major test for the US-China investment and broader bilateral relationship. The Snowden affair has added a new angle to the exclusion of Huawei and other Chinese telecommunications equipment suppliers from US markets on national security grounds. The PRISM revelations combined with US treatment of Chinese telecom equipment firms could lead to serious retaliation for US and other foreign tech firms in China. Cisco and seven other major US tech firms have been identified by Chinese state media as “guardian warriors” that have “seamlessly penetrated” China; calls to weed out foreign equipment in Chinese IT infrastructure are also increasing (see our recent note).

The second quarter was also a busy time for China’s antitrust regulators with regard to global merger control. The Ministry of Commerce (MOFCOM) approved a total of 56 transactions in Q2, and imposed conditional approvals on two cases. The Glencore/Xstrata merger was conditionally approved in Q2 after several delays; MOFCOM ordered Glencore to divest its Las Bambas copper mine, and to provide long-term contract offers of copper, zinc, and lead concentrate products to the Chinese market on specified terms. The merger between Japanese trader Marubeni and US grain supplier Gavilon was approved under the condition that both parties set up two independent legal entities for exporting and selling soybeans in the Chinese market.

Outlook

Several previously announced and rumored deals have fallen apart in Q2, including the takeover of Fisker by Geely and a purchase of IBM’s x86 server business assets by Lenovo for up to $5 billion. However, a slew of new investments were announced over the past 3 months, among them Shuanghui International’s $4.7 billion takeover of pork producer Smithfield, Mindray’s acquisition of Zonare Medical Systems ($102 million), MicroPort’s acquisition of Wright Medical Group’s OrthoRecon business, and a new $1 billion luxury hotel project in New York by Wanda, the new owner of AMC theatres. Together with the $4.2 billion stake of a Chinese consortium in AIG’s aviation leasing unit International Lease Finance Corp. (ILFC), which is back on track after the investor group missed a deadline for a payment in May, the pipeline of pending Chinese acquisitions in the United States amounted to more than $10 billion as of July 2013.