Chinese FDI in the United States: Q2 2014 Update

China’s economic reform program is beginning to impact the country’s global investment profile, with the changes also felt in the United States. Interest in US assets continues to be strong, but the industry focus is shifting towards real estate, advanced services and manufacturing. This note reviews the patterns, key transactions, and political developments in the China-US investment relationship in Q2 2014.

The momentum for Chinese investment in America remains strong: Chinese companies spent $2.1 billion in the second quarter on investments in the US, and more than $10 billion worth of deals are currently pending. Notable is the recent increase in greenfield investments and growing average capital expenditures for such projects.

Real estate, advanced services and manufacturing are big winners: Investment in US real estate continues to boom as investors and developers are looking for risk diversification and new opportunities abroad. Economic reforms are also changing price structures for Chinese manufacturers, incentivizing greater investment in overseas R&D facilities, brands and local manufacturing capacity.

The much debated Ralls decision will not lower the national security bar: A recent ruling by a US court in favor of Chinese-owned Ralls Corporation was hailed as an historic victory by many in China, but it will not change the level of national security scrutiny Chinese firms face when acquiring assets in the US. It is however a powerful reminder to Chinese executives that their property rights in the US are protected by independent courts.

Trends and Patterns

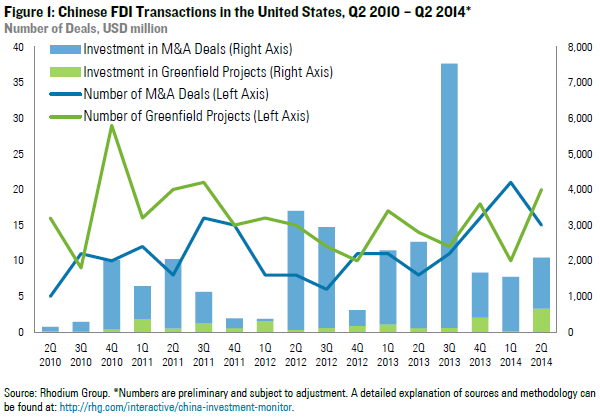

In Q2 2014, Chinese firms spent $2.1 billion on 35 direct investment transactions. The total investment value for H1 2014 is at a slightly lower level than the first six months of last year, but with a very strong pipeline for the second half: Pending acquisitions and announced greenfield projects amount to more than $10 billion.

After a temporary slump in 2012, the number of greenfield projects has grown significantly and we counted 20 new establishments in Q2 2014 with a combined investment of more than $600 million. Moreover, the nature of greenfield projects are shifting from small trade-facilitating offices to projects with larger capital expenditure in advanced manufacturing (see next section). Chinese firms also continue to ramp up investments in greenfield R&D facilities, for example WuXi PharmaTech’s new cell therapy facility, Baidu’s new R&D center in Silicon Valley, or Gloria Pharmaceuticals’ joint R&D initiative with Cumberland. We also see greater activity in travel and financial services (see next section) and entertainment (China Movie Media Group or Mili Pictures).

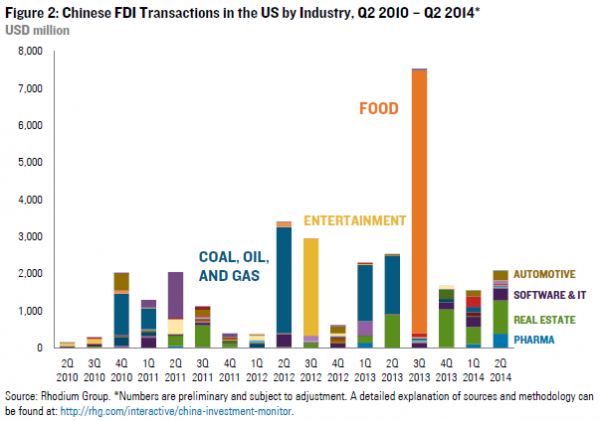

Acquisitions still account for the majority of total investment value ($1.4 billion), but we see a shift away from extractive resource plays towards real estate and strategic assets in manufacturing and services. After a spending spree by the big Chinese state-owned enterprises in US unconventional oil and gas plays in 2013 (including CNOOC, Sinopec and Sinochem), activity in the upstream segment has cooled markedly in recent quarters while greenfield investments in midstream (methanol plants, see below) and downstream markets (ENN’s LNG fueling stations) are trending up.

Greater investment in the property sector is making up for the decline in oil and gas M&A. In Q2 Chinese investors spent more than $600 million on commercial real estate projects in the US, including Greenland Group and Forest City’s joint-development project in Brooklyn, Genzon Group’s acquisition of an office building in downtown San Francisco, and Wanxiang Real Estate’s investment in an office tower in Chicago. One important observation is that Chinese firms are not restricting themselves to just passive financial investments, but are increasingly taking more active roles in developing property (see China Construction America’s 99 Hudson in Jersey City, Greenland’s Metropolis project in Los Angeles, and Xin Development’s Oosten building in Brooklyn).

The remaining M&A deals are focused on acquiring strategic assets including technology, brands, and know-how. Examples from Q2 are Shenzhen Hepalink Pharmaceutical’s takeover of Scientific Protein Laboratories or Shanghai Moons’ Electric’s acquisition of Applied Motion Products.

Key Transactions

More Chinese Manufacturing FDI for the US: Shandong Tranlin Paper

On June 18, Shandong Tranlin Paper Co. announced investments worth up to $2 billion in a manufacturing plant in Virginia, the largest Chinese greenfield investment project in the United States to date. Using proprietary technology, the plant will utilize agricultural field waste such as wheat straw and corn stalks to produce straw paper, and convert byproducts of the paper manufacturing process into fertilizer. Shandong Tranlin’s factory is the latest example of growing Chinese manufacturing FDI in the US.

With a focus on labor-intensive products and competitive cost structures at home, Chinese firms had little incentive in the past to invest in US manufacturing except to avoid punitive tariffs and other trade barriers. This first wave of manufacturing projects motivated by tariff-jumping have now opened or begun construction (like Tianjin Pipe’s steel pipe plant in Texas and Golden Dragon’s precision copper tubing manufacturing facility in Alabama).

In the past 2-3 years, the mix of manufacturing investments has become more diverse due to changing commercial realities in the Chinese marketplace, which – together with greater political freedom for firms to make overseas investments – has dramatically changed the rationale for overseas manufacturing investments for some Chinese firms. The primary motives are access to technology and know-how in advanced manufacturing (for example, A123 Systems in Massachusetts, Cirrus Aviation in Minnesota, and Nexteer Automotivein Michigan), and proximity to partners and consumers (Sany in Georgia and Lenovo in North Carolina), but also increasingly a gradual normalization of manufacturing input costs due to economic maturation and structural reforms.

In order to rationalize its economic structure, China is gradually removing price controls, subsidies, and other distortions to market-based prices. This is fundamentally changing the cost for input factors such as such as land, natural resources, electricity, and environmental protection. Firms that are already feeling the pressure from these changes, or that are anticipating these new realities, have a strong incentive to streamline their global value chains and outsource production of such goods to markets with a natural comparative advantage. In the case of Tranlin Paper, Virginia provides ample agriculture waste and demand for fertilizers and paper products, as well as lower electricity and land price compared to China. Other projects with similar considerations include Keer Group’s $218 million cotton yarn production facility in South Carolina, a new facility for recycled polyester staple fiber products by JN Fibers ($45 million), a $230 million production facility for Fuyao Glass in Ohio, a manufacturing plant by Taizhou Fuling Plastic in Pennsylvania ($21 million), and methanol plants by Northwest Innovation Works in Washington and Oregon ($1 billion each) and Yuhuang Chemical in Louisiana ($1.85 billion).

Hospitality, Transportation, and Finance: Serving the Chinese Consumer Abroad

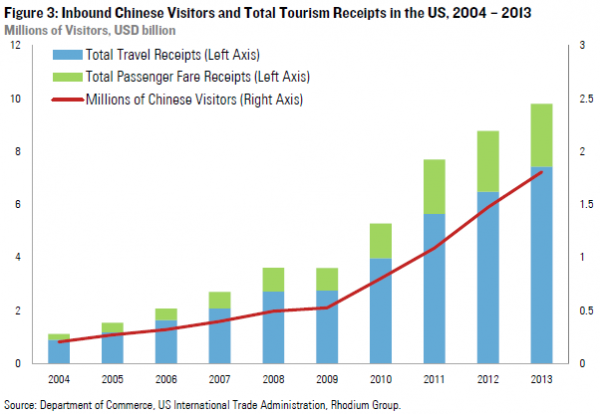

One new trend we observe is that Chinese service providers are ramping up US investments to better serve Chinese citizens traveling to or residing in America. That includes investments in hospitality (Dalian Wanda’s investment in a Chicago hotel complex and the acquisition of the Sheraton Gateway Los Angeles Hotel), air transportation (new US routes by Hainan Airlines and China Southern Airlines), ground transportation (limousine services by Yongche.com and Hainan Airlines) and financial services (new branches by Bank of China and China Merchants Bank).

Higher incomes, local pollution, and streamlined visa policies in the US have contributed to a growing physical presence of Chinese citizens in the US. Education continues to be a major draw (with now more than 235,000 Mainland Chinese students studying in the US), but the most recent trend is the fast growth of tourism from China. The number of Chinese visitors quadrupled from just half a million to almost two million within less than five years (Figure 3) and it is expected to soar to over four million by 2018. Total spending by Chinese visitors in the US has reached nearly $10 billion in 2013, doubling from just three years ago, making Chinese visitors the biggest per trip spenders among the top ten source countries for US tourism. Chinese firms are now investing in the US to get a share of this fast-growing pie.

Policy Developments

The US and China continued to make progress in their BIT negotiations and established a timeline to finish the text by year-end, entering negotiations about negative lists in early next year. A court decision hailed as victory for a Chinese firm against the Obama administration may marginally improve the transparency of the US investment review process but is unlikely to have a major impact on short-term deal flow.

United States: Progress on BIT and possible changes to CFIUS process

During their 6th Strategic and Economic Dialogue (S&ED) in early July, the US and China announced their intent to complete negotiations on the text of a US-China Bilateral Investment Treaty (BIT) by the end of 2014, and commence negotiation of a negative list in early 2015. For the first time, the official S&ED Fact Sheet includes language that China commits to shift from an approval to a registration regime in sectors outside of the negative list, a step which may help to level the playing field for foreign-owned companies in China (see below for an update on those reforms).

The most debated news was an unexpected ruling by the US Court of Appeals for the District of Columbia Circuit, which found that the Obama administration denied Chinese-owned Ralls Corporation its constitutional right to due process when it blocked an investment in US wind farm assets on national security grounds in 2012 (see our earlier assessment for background). Although it was hailed as “big victory” by parent firm Sany and the Chinese media, the decision is unlikely to significantly change the situation for Chinese companies trying to enter the US market.

Most importantly, the court does not question the authority of the President or the Committee on Foreign Investment in the United States (CFIUS) to block foreign investment on national security grounds. Thus, the ruling will not change the degree of scrutiny that Chinese and other foreign firms face when they acquire assets in America deemed as potentially sensitive (for example, dual-use technology, telecommunications infrastructure, and certain assets with proximity to military operations).

However, the court’s decision emphasizes that foreign firms have the right to “due process” and that CFIUS violated those rights in the way they dealt with Ralls Corporation. If the ruling is upheld (the US government can appeal the decision and send it to the Supreme Court), it could marginally improve the transparency of the CFIUS process by giving foreign firms and their lawyers more information and more channels to engage with government officials. The exact parameters of a sufficient “due process” still have to be defined, but the court argued that affected parties should be notified if the president intends to block their transaction, that they should be given access to non-classified evidence on which this decision is based, and that they should be given the opportunity to respond and rebut this evidence. CFIUS lawyers have specifically welcomed the establishment of an official feedback channel, which may help firms better explain the purpose of their business, and avoid misunderstandings and misinterpretations of certain transactions.

Beyond the actual impact on the CFIUS process, the court decision also sends an important psychological signal: that the US foreign investment regime is based on the rule of law and that businesses can rely on independent courts to defend their property rights irrespective of the nationality of their owners. This in turn will help strengthen the attractiveness of the US as an investment location. It is a particularly important signal to private firms in China that highlights the institutional advantages of the US marketplace. For example, Sany executives have expressed amazement that one can sue the President of the United States of America without facing harassment or immediate detention, noting that “filing the lawsuit has been a great experience to the Chinese and other people around the world – as to how the rule of law can provide the freedom for one to protect one’s rights against one’s own government in the courtroom on an equal footing.”

In short, the court’s decision will not have a notable impact on Chinese investment in the US in the near-term, as it does not change the role or authority of CFIUS in assessing Chinese acquisitions. However, the Ralls case will help to optimize the CFIUS process and help to defy existing misperceptions in China about the institutional environment in the United States, which should be a net positive for the expansion of Chinese businesses in America in the long run.

China: Inward FDI reforms continue, but fall short of expectations

China continues to gradually reform its regulations for inbound and outbound investment. The general direction is toward more openness, but at a slower pace than hoped and with important caveats.

On the outbound side, SAFE released new rules on capital flow to offshore Special Purpose Vehicles (SPVs). SAFE now allows citizens and enterprises to convert foreign exchange to establish or finance offshore SPV’s after registration with SAFE. The administration also lifted the 180 day income and dividends repatriation requirement for offshore SPV’s. This should generally be a net positive for outbound FDI, but the actual impact remains to be seen.

At the same time, greater efforts to crack down on corruption and illicit overseas assets provide some downside risks to certain capital outflows. President Xi’s campaign to address corruption is reaching the country’s state-owned enterprises (SOEs), and the recent arrest of a PetroChina executive tied to investments in Canada shows that investigations increasingly extend to overseas operations. This may impact the strategy and risk appetite of SOEs for overseas deals. Similarly, a recent campaign by state broadcaster CCTV against Chinese banks and official rhetoric to intensify the crackdown on corrupt officials abroad could signal greater caution for the overseas investment activities of wealthy individuals.

China is also tightening regulations to create more transparency with regard to firms’ and individuals’ overseas assets for tax purposes. Beginning September this year all Chinese firms must report information regarding their overseas assets to the State Administration of Taxation in greater detail and more frequently. China also agreed to comply with the US Foreign Account Tax Compliance Act (FATCA) and has agreed to join the G20 initiative to create a framework for the automatic exchange of tax information. These developments could have an impact on outbound financial flows, as China will likely demand better information on the overseas assets of Chinese citizens, particularly in developed economies such as the US, Canada, and Australia.

As we have mentioned before, eliminating barriers to FDI is becoming increasingly important to convince foreign partners to keep their borders open to Chinese investors. China has released several important policies in Q2 in that respect.

First, on July 1 the Shanghai government released the second version of the negative list of restricted sectors for the new Shanghai Free Trade Zone. The list is considered progress compared to the initial list, effectively eliminating 14 items from the previous version and relaxing restrictions on an additional 19 items. Although a step in the right direction, the list is still a long way from foreign expectations of a more dramatic reduction in investment barriers. China is allowing several special zones to explore more aggressive proposals of negative lists in search of a national list: Fujian province’s Pingtan district released a negative list on June 3 and Shenzhen’s Qianhai district released a negative list on June 24. These developments indicate that China is experimenting at the local level to make progress on a national negative list. However, there is no clarity about the scope and timeline for a nationwide list at this point.

Second, in line with the promise to move to a registration approach for inward FDI, the National Development and Reform Commission (NDRC) released new Foreign Investment Projects Approval and Registration Administrative Measures in May which removed the approval requirement for investments on the list of encouraged industries, effective from June 17. This is a positive step with regard to implementation of a modern FDI regime, but the short-term impact on investors is limited. For one, the approval relaxation only concerns projects that were already on the encouraged list within China’s Catalog for the Guidance of Foreign Investment Industries. More importantly, the NDRC continues to have de facto control over FDI projects as it retains the right to refuse registration to any investment, and companies are prohibited from proceeding with the investment prior to registration – in other words, China’s central economic planner ultimately retains control on all inward FDI transactions despite the announced switch to a “registration” system (and the same is true for new outbound investment rules, which were released in Q1).

With regards to global merger control, China approved a total of 68 transactions in Q2 2014, imposed conditions on two global deals and blocked one transaction in the shipping industry. On April 8, MOFCOM approved the acquisition of Nokia Corporation by Microsoft Corporation under the condition that Microsoft and Nokia honor certain commitments regarding their standard-essential and non-essential patents. On April 30, the acquisition of AZ Electronic Materials by Merck was approved under the condition that the two companies do not engage in tie-in sales and Merck license its liquid crystal patents on non-exclusive, commercially reasonable, and non-discriminatory terms. On June 17, MOFCOM blocked the merger of Maersk, MSC, and CMA CGM. This was only the second time that MOFCOM has blocked a transaction since China’s Anti-monopoly Law came into effect in 2008.

Outlook

Several large acquisitions are currently pending: Lenovo’s acquisitions of IBM’s x86 server business ($2.3 billion) and Motorola ($2.91 billion) are waiting for CFIUS approval; Dalian Wanda has proposed a Chicago waterfront real estate project (up to $900 million) and Fosun has announced investment in Studio 8 (estimated $200 million); Johnson Controls is divesting its interiors unit in a joint venture with Yanfeng Automotive Trim (up to $5 billion), which will create the world’s largest automotive interiors supplier. Several announced greenfield projects that are in early stages could bring significant investment to the US, including Shandong Tranlin’s Virginia plant (up to $2 billion) and methanol production facilities by Yuhuang Chemical (up to $1.85 billion) and Northwest Innovation Works (up to $3 billion).