Chinese Participation in US Infrastructure

A new report co-authored for the US Chamber of Commerce assesses the opportunities for Chinese participation in the coming $8 trillion US infrastructure modernization.

The United States is poised to undertake the most significant expansion and modernization of its infrastructure since the 1950s. Unlike previous infrastructure booms, this new period is taking place in the context of significant pressure on public budgets and a dramatically changed global economy that boasts new players in global trade and investment. Rhodium Group was one of the lead contributors to a new report by the US Chamber of Commerce that assesses the opportunities for China, the largest of these new players, to participate in US infrastructure build-out. This note summarizes the key figures and findings from this report.

Capital funding needs for US infrastructure over the next two decades are massive: We project $8 trillion in capital investment demand to keep US energy, transport, and water infrastructure alone in a state of good repair from now until 2030.

Great opportunities for foreign participation: With dwindling public funding sources, the need to expand private funding means there is significant opportunity for foreign investors to participate in US infrastructure build-out.

A good match for Chinese firms, but commercial and political hurdles exist: US infrastructure offers attractive opportunities for Chinese investors and suppliers. However, there are several commercial and political hurdles specific to Chinese participation which make some modes of investment and participation more realistic than others.

The full text version of the report is available for download from the US Chamber of Commerce.

Massive Capital funding needs for US infrastructure

The US is approaching a period of massive infrastructure build-out, and quantifying the economic opportunity is a first step towards assessing the possibilities for private participation. In the forthcoming report, we project required capital investment needs in US energy, transport, and drinking water and wastewater infrastructure (water-related infrastructure) for the years 2013 through 2030.

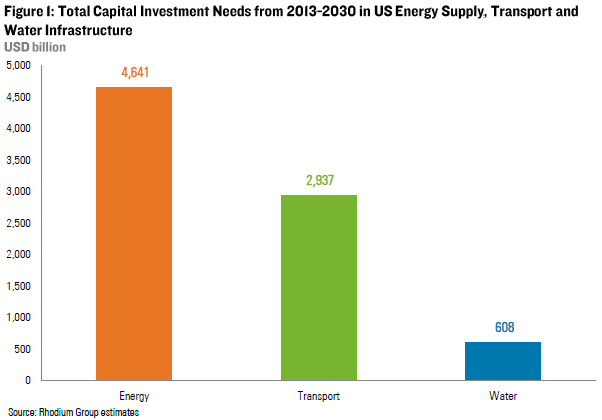

At a minimum, we estimate that more than $8 trillion in new investment will be needed in these three sectors over the 18 year outlook period—totaling some $455 billion per year. In all cases we project required investment using conservative assumptions, so a much higher amount of investment will likely be necessary. Investment in energy infrastructure accounts for 57% of the total projected need, followed by 36% for transport and 7% for water-related infrastructure (Figure 1).

A Good Match for Chinese Interests and Capabilities

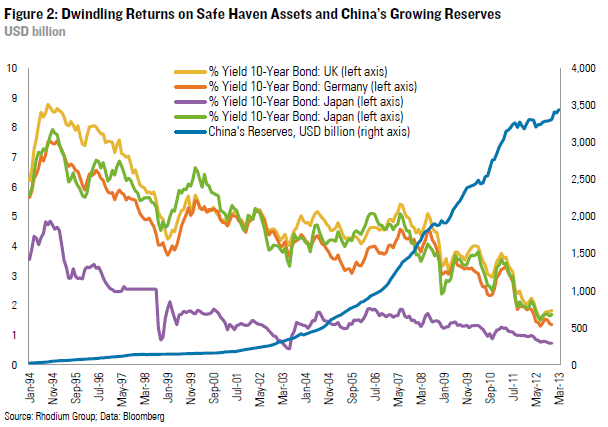

There is significant opportunity for foreign investors to participate in US infrastructure build-out. Given China’s external portfolio and the growing capabilities of Chinese firms in infrastructure-related activities, it will be a particularly interesting opportunity for Chinese investors and suppliers. The most straightforward way for Chinese firms to participate in US infrastructure build-out is via financial investment – providing capital either via debt or equity investments. Such investments would help China in its goal to diversify its global portfolio in terms of both geographies and asset classes. Currently, Chinese institutional investors and firms have large and growing capital pools, but their balance sheets show a high degree of “home bias”—that is, almost all of their investments are in the domestic economy. Greater uncertainty about domestic growth in China has increased awareness of the risks of maintaining domestically concentrated portfolios and the benefits of global diversification. At the same time, the returns for low-risk investments have fallen precipitously across the globe in light of quantitative easing and a flight to safe haven assets since the financial crisis (Figure 2).

For Chinese investors, financial investments in infrastructure projects in advanced economies offer relatively safe returns and a longer-term investment horizon. Investments in capital-intensive infrastructure projects also have the advantage of allowing for the passive investment of large amounts of money without the need for constant managerial supervision. This provides a particularly attractive opportunity for cash-rich Chinese funds that are looking to “go out” and invest abroad. Chinese money managers and sovereign investors are known to already have significant equity and debt holdings in mature markets, but because there are no disclosure requirements for smaller stakes, it is impossible to provide an accurate snapshot of current exposure to infrastructure-related positions. However, bigger stakes usually are disclosed, and these have increased substantially in recent years. For example, in 2012, the China Investment Corporation (CIC), one of China’s sovereign wealth funds, purchased an 8.68% stake in British water utility Thames Water and a 10% stake in Heathrow Airport Holdings, the firm that owns London’s Heathrow Airport, for $726 million.

The US infrastructure sector also offers opportunities for Chinese firms as providers of infrastructure goods and services. Owing to the past 30 years of China’s infrastructure boom, many Chinese firms now have significant economies of scale which, when combined with low labor costs, enable them to offer construction materials at globally competitive prices. China’s infrastructure boom and educational priorities also have grown the size, capabilities, and experience of the country’s engineering corps. Chinese firms have thus become increasingly competitive in the market for such infrastructure-related services such as civil engineering, construction services, contract management services, and operations and maintenance or life-cycle management services.

Existing political and commercial hurdles

While Chinese participation in US infrastructure is a good commercial fit, several hurdles and specific firm-level disadvantages limit the opportunities. These limitations are rooted in the lack of experience of Chinese firms beyond borders and political and regulatory realities on both sides.

With regard to policy and politics, Chinese investors will have to deal with US national security concerns and adverse reactions to foreign ownership. While the United States has a longstanding policy of openness to foreign investment, certain proposed transactions that result in Chinese ownership of existing infrastructure projects or businesses may face scrutiny from CFIUS or political opposition. On the Chinese side, a rigorous outbound investment approval process and state conditions on outbound investment (e.g. state owned investors or banks conditioning investments on other state owned firms obtaining service or supply contracts) can stand in the way of greater participation in US infrastructure. Foreign direct investment (FDI) typically requires separate approvals from the National Development and Reform Commission, the Ministry of Commerce, and the State Administration of Foreign Exchange, and relevant industry regulators. For financial investments, Chinese investors need to have a specific government mandate for overseas investment or to obtain a quota under the Qualified Domestic Institutional Investors Program (QFII).

For Chinese providers of goods and services, certain commercial and operational challenges also diminish the prospects of participation in US projects. First, as a result of several high-profile cases of defective Chinese products in recent years, US buyers have exhibited growing concerns over the safety and quality of Chinese-sourced products. For infrastructure in particular, it is critical that parts and components are safe, of high-quality, and durable. Second, although Chinese construction service providers have operated successfully in developing economies, lack of experience operating within foreign and often complex regulatory environments in developed economies and managing labor relations are primary commercial impediments.

Outlook

Although extensive opportunities for Chinese participation in US infrastructure exist, there are lots of hurdles to overcome. In the short term, passive financial investment – as the largest and most straightforward target with manageable commercial and political challenges – is the most easily embraced form of potential participation, particularly in projects with US partners and low national security sensitivity.

Chinese participation through export of goods and services is already growing, but long-term success will depend on two factors. First, Chinese firms need to expand their US presence via foreign direct investment and build local operations with US workers and ties with local economies. Second, China needs to converge with international legal norms and practices to alleviate concerns and meet certain regulatory requirements for the provision of goods or services by foreign parties to public work projects. Reforms that create more certainty with regard to legal remedies and greater transparency would help to create trust in Chinese products and services abroad. In addition, China needs to make efforts to join relevant global governance rules and frameworks. For example, certain procurements by US government agencies are limited to products from a list of designated countries, including parties to the WTO Agreement on Government Procurement (GPA). Successfully completing China’s accession to the GPA would be a requirement for Chinese firms to access those projects.