Report

Clean Investment Monitor: Q1 2024 Update

Clean energy and transportation investment in the United States continued its record-setting growth in Q1 of 2024, reaching a new high of $71 billion.

The Biden administration’s recent decision to raise tariffs on imports of electric vehicles and batteries from China raises the question of how the levels of projected domestic EV and battery manufacturing capacity compare to projected demand.

The Biden administration’s recent decision to raise tariffs on imports of electric vehicles (EVs) and batteries from China, and more, raises the question of how the levels of projected domestic EV and battery manufacturing capacity compare to projected demand, as well as demand pathways consistent with US climate change commitments under the Paris Agreement.

In this report, we provide insight into this question by comparing announced domestic EV and battery manufacturing capacity from the Clean Investment Monitor database with EV and battery demand projections from Rhodium Group’s 2023 Taking Stock Report. We find that if all announced and under-construction battery manufacturing facilities come online as scheduled and produce at expected volumes, the US will produce more battery cells and modules than what domestic demand will consume by 2030. If EV demand comes in at the lower end of the Rhodium projections (or falls short of those projections), we would expect battery manufacturers to slow the pace of construction or production ramp-ups of currently announced facilities.

In terms of EV manufacturing, the facilities that are operating, under construction, and announced would produce more than projected demand by 2027 if they come online as expected, but would fall short of projected demand by 2030. If demand continues to track Rhodium’s Taking Stock projections and the IRA incentives for EV purchases remain in place, we would expect companies to announce additional domestic production capacity in the next several years, given the average production timelines for new EV manufacturing facilities and the ability of manufacturers to relatively quickly repurpose internal combustion engine vehicle manufacturing to produce EVs, provided they can source batteries.

This month, the Biden administration announced that the US Trade Representative will be increasing tariffs on imports from China of a range of clean energy and transportation technologies under Section 301 of the Trade Act of 1974. This includes tariffs on imports of electric vehicles, batteries, battery components, and critical minerals. Starting this year, tariffs on electric vehicles imported from China will rise from 25% to 100%. Tariffs on imports of lithium-ion batteries for EVs will rise from 7.5% to 25%.

China is not the only potential foreign supplier of EVs and batteries to the US market. Americans are already purchasing imported EVs from Europe, Korea, and Japan and imported batteries from China, Korea, Japan, Europe and Mexico. But the increase in Section 301 tariffs has raised questions around the role that domestic EV and battery manufacturing will play in meeting domestic demand. To help answer these questions, we compare EV and battery demand projections from Rhodium Group’s 2023 Taking Stock Report projections to EV and battery manufacturing capacity projections from the Clean Investment Monitor (CIM) database developed by Rhodium Group and the MIT Center for Energy and Environmental Policy Research (CEEPR).

Every year, Rhodium Group provides energy and emissions projections for the US under current policy through its Taking Stock report. In the most recent Taking Stock report, published in summer 2023, Rhodium’s “Current Policy” projections included both the Inflation Reduction Act (IRA) and the Infrastructure Investment and Jobs Act (IIJA), as well as other major federal and state policy adopted as of early summer 2023. The Current Policy projections included three underlying scenarios—low emissions, mid emissions, and high emissions—driven by uncertainty in economic growth, oil and gas prices, and renewable energy and battery costs. Across these Current Policy scenarios, Rhodium projected a reduction in net GHG emissions in the US of 29-42% below 2005 levels by 2030.

The 2023 Taking Stock report also included a set of “Joint Action” scenarios that capture additional prospective federal and state policy action sufficient to reduce emissions to 41-52% below 2005 levels by 2030, a range that includes the US commitment of 50-52% emissions reductions by 2030 under the Paris Agreement. Relevant to EV sales, additional policies in the Joint Action scenarios included new federal GHG standards for light-duty vehicles that are a little more aggressive than the rule recently finalized by EPA, as well as an increase in the level of ambition of state ZEV standards and low-carbon fuel standards by those states that already have them in place.

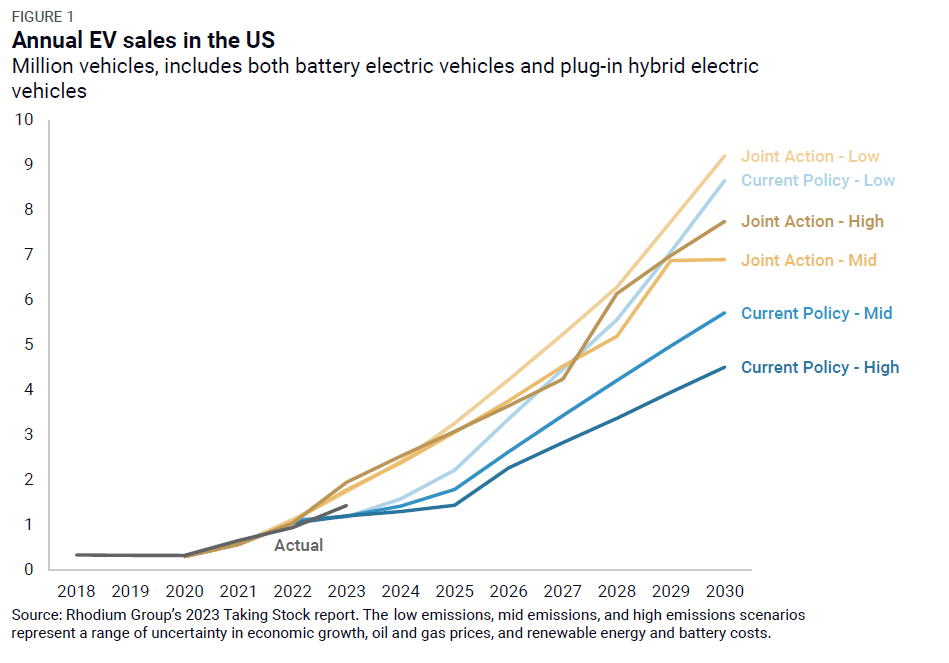

Actual full-year EV sales in 2023 (both battery electric vehicles and plug-in hybrid electric vehicles, and including everything from passenger cars and light trucks to freight trucks, buses, and other medium- and heavy-duty vehicles) came in at 1.43 million vehicles. This exceeded Rhodium’s Current Policy scenario projections of 1.19-1.21 million, but came in slightly below Rhodium’s Joint Action scenarios of 1.75 to 1.96 million vehicles (Figure 1). By 2030, EV sales grow to 4.6 to 9.0 million in Rhodium’s Current Policy scenarios and 7.2 to 9.6 million in the Joint Action scenarios.

Based on vehicle characteristics in the Rhodium Group projections, we estimate that battery electric vehicles and plug-in hybrid electric vehicles sold in the US will require between 360 to 838 gigawatt hours (GWh) of batteries in 2030 in the Current Policy scenarios and 647 to 899 GWh in the Joint Action scenarios.

The EV and battery manufacturing supply chain has grown substantially in the wake of the Infrastructure Implementation and Jobs Act (IIJA) and Inflation Reduction Act, with annual investment increasing by 184% between 2021 and 2023.

The Clean Investment Monitor is currently tracking 75 EV manufacturing facilities in the United States that are either operating, under construction, or have been announced (with a specific location and construction timeline) since 2018. This includes plants making cars and light trucks, as well as those making medium and heavy-duty buses and trucks, and includes both battery electric vehicles and plug-in hybrid electric vehicles. Additionally, there are about 100 facilities in the CIM database manufacturing battery cells and/or modules that are either operating, under construction, or have been announced. There are additional facilities producing electrode active materials and critical minerals that are not included in this count. The share of projected EV-related demand for critical minerals and electrode active materials likely to come from operating, under construction, and announced domestic facilities is an important question, which we will explore in a future report.

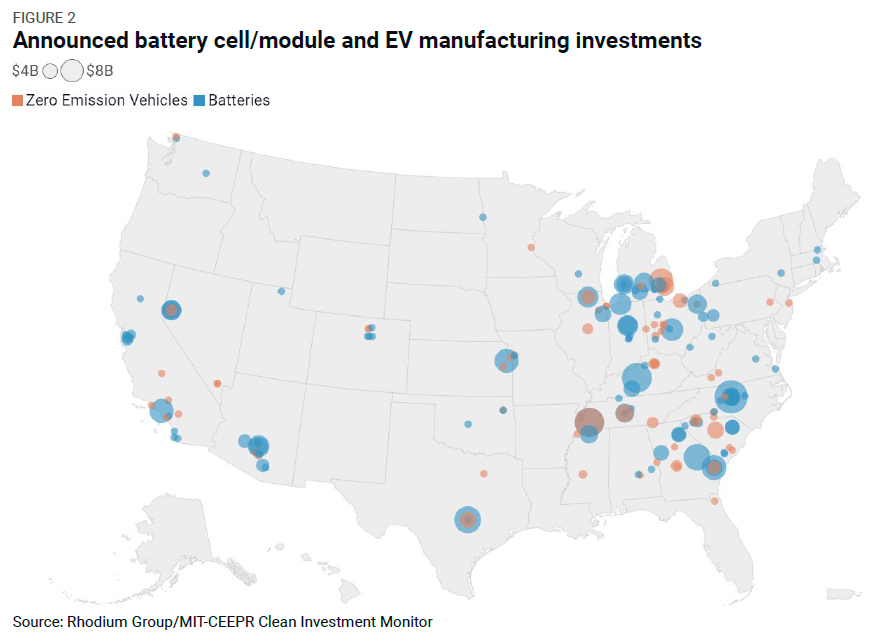

Since 2018, companies have announced $166 billion in investment in these facilities, with $128 billion in battery cell/module manufacturing and $38 billion in EV manufacturing (Figure 2). Of that, $79 billion has already been invested, with $55 billion in battery cells/modules manufacturing and $24 billion in EV manufacturing.

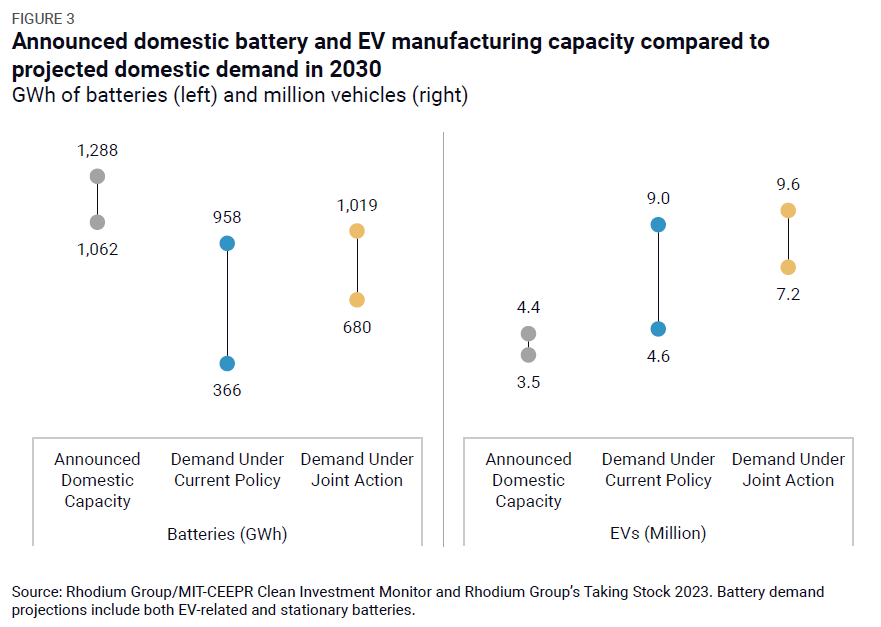

If all of these battery facilities meet their currently estimated construction timelines, by 2030 they will have nameplate capacity of 1,062 to 1,288 GWh of cells and modules. Generally manufacturing facilities run a little below nameplate capacity so actual potential production would likely be 80-90% that amount. If all EV facilities meet their currently estimated construction timelines they will have the capacity to produce between 3.5 to 4.4 million vehicles by 2030. In the case of both batteries and electric vehicles, most currently announced facilities are expected to come online by 2028, so there is room for additional expansion in production capacity by 2030 if market and policy conditions justify doing so. Likewise, currently announced projects could be delayed or put on hold if EV demand growth slows considerably.

Stacking these manufacturing projections up against projected demand, we find that if current investment plans stay on track, domestic supply will be larger than US battery and EV demand through 2030. For batteries, currently operating, under construction, or announced cell and module manufacturing facilities in the US would have more capacity by 2030 than projected EV-related demand across Rhodium’s Current Policy and Joint Action scenarios (Figure 3).

EVs are, of course, not the only large battery cell and module consumer. Stationary batteries used for storage on the electrical grid are a growing source of demand for cells and modules. Last year, there was 27 GWh of utility-scale and distributed battery storage capacity added to the grid in the US. Rhodium projects up to 120 GWh a year of stationary storage additions by 2030 in its Current Policy scenarios, and a similar amount in its Joint Action scenarios. Under these projections, announced domestic battery manufacturing capacity capable of meeting both EV and stationary storage demand, even if factories operate at a 80-90% of nameplate capacity. If EV demand growth slows considerably and looks set to come in at the lower end of Rhodium’s projected range (or miss it entirely), we would expect manufacturers to slow the pace of construction of currently announced battery cell and module facilities, slow the pace of production ramp-up at those facilities, or cancel some plans entirely.

Announced EV manufacturing capacity would likely produce more than projected domestic capacity through 2027, but not through 2030 by which time annual EV sales reach up to 9 million in Rhodium’s Current Policy scenarios, and 9.6 million in its Joint Action scenarios, compared to announced manufacturing capacity of up to 4.4 million vehicles (Figure 3).

Given the average production timelines for new EV manufacturing facilities, as well as the ability of manufacturers to relatively quickly repurpose internal combustion engine vehicle manufacturing to produce EVs, provided they can source batteries, we would expect companies to announce additional domestic production capacity in the next several years if demand continues to track along Rhodium’s projections and the IRA incentives for EV purchases remain in place.

Other important variables to watch are on the demand side. While EV sales exceeded Rhodium projections in 2023, EV sales growth slowed down in the first quarter of the last year. EV registrations fell to 352,000 in Q1 2024, down 9% from the 385,000 ZEVs registered in Q4 2023. Moving forward, the critical questions will be whether domestic manufacturers can offer a wide enough selection of EVs at attractive enough price points, and whether the public and private sector can build out charging infrastructure quickly enough, to keep EV demand growth on track.

Report

Clean energy and transportation investment in the United States continued its record-setting growth in Q1 of 2024, reaching a new high of $71 billion.

Report

Clean energy and transportation investment in the US set another record in Q4 of 2023, reaching $67 billion—a 40% increase from Q4 in 2022.