How China’s Overcapacity Holds Back Emerging Economies

Unless Beijing implements serious demand reforms, developing nations will be crowded out of manufacturing by Chinese overcapacity, leaving them dependent and without export opportunities.

Since 2019, weak domestic demand and expanding industrial capacity have combined to balloon China’s manufacturing trade surplus. While growing Chinese exports benefit developing countries to some extent by providing inputs for their local industries, they also contribute to China’s rising market power, creating new vulnerabilities for the developing world. It has long been assumed that China’s rise up the value chain would create a growing market for labor-intensive manufactured goods from other emerging markets. These hopes will be dashed if Beijing cannot restart the engines of its own domestic growth and absorb more of what it currently exports. Unless Beijing implements serious demand reforms, developing nations will be crowded out of manufacturing by Chinese overcapacity, leaving them dependent and without export opportunities.

Riding the wave

The past four years of COVID-19 have obscured developments in China’s trade with the world. Now that the air is clearing, we can start to discern the magnitude of the pandemic’s impact on China’s economy. The combination of weak domestic demand and expanding industrial capacity increased China’s manufacturing trade surplus by $775 billion between 2019 and 2023—more than Belgium’s entire GDP.1

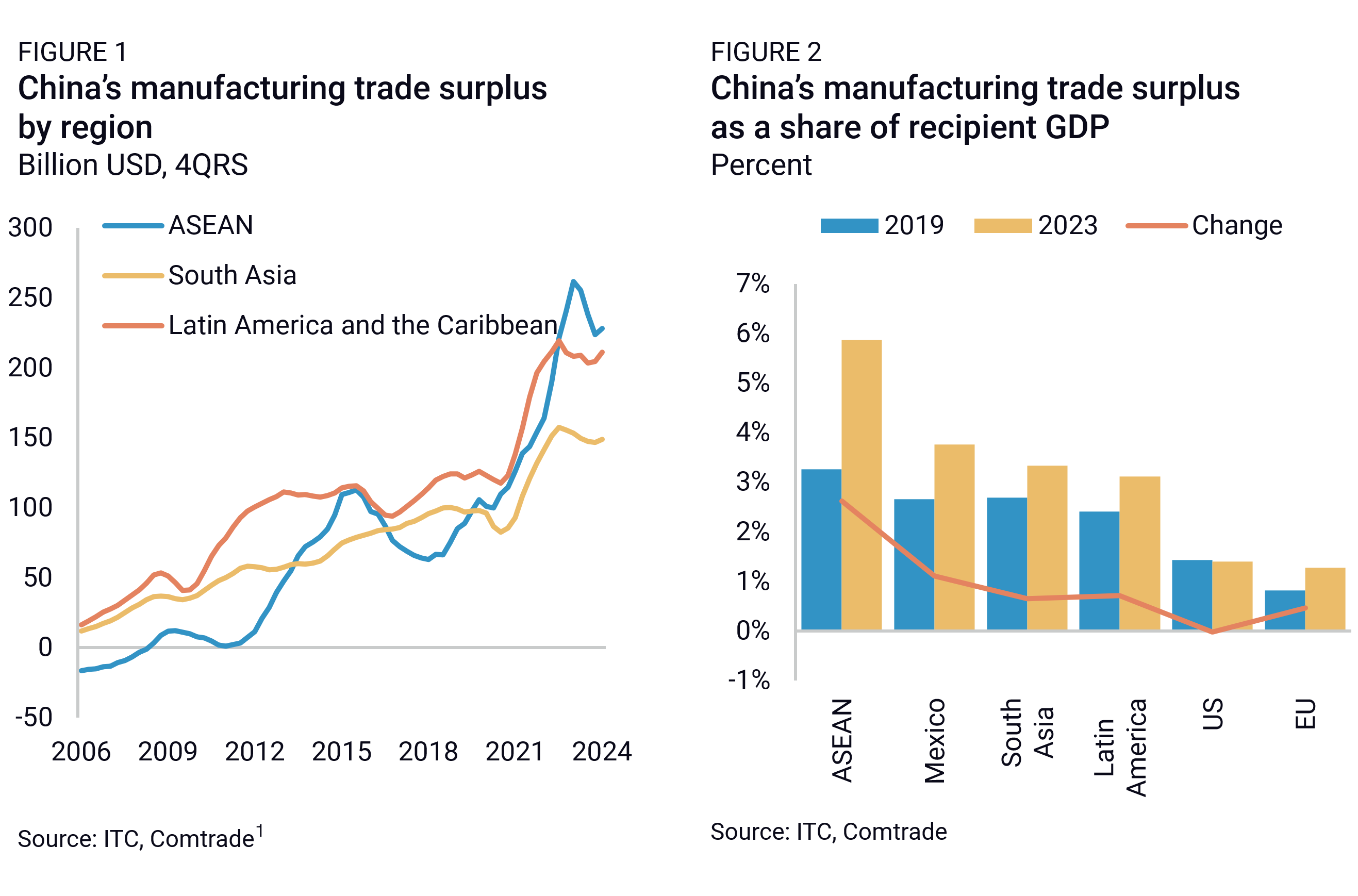

This growth has been across the board, but emerging and developing economies experienced particularly substantial increases (Figure 1). For example, China’s manufacturing trade surplus with ASEAN more than doubled between 2019 and 2023, rising from 3% to 6% of the region’s GDP (Figure 2). The surplus with Mexico reached 3.8% of Mexico’s GDP in 2023, up from 2.7% in 2019. In comparison, China’s surplus with the EU as a share of the EU’s GDP increased by 0.5 percentage points, and its surplus with the United States remained flat as a share of US GDP.

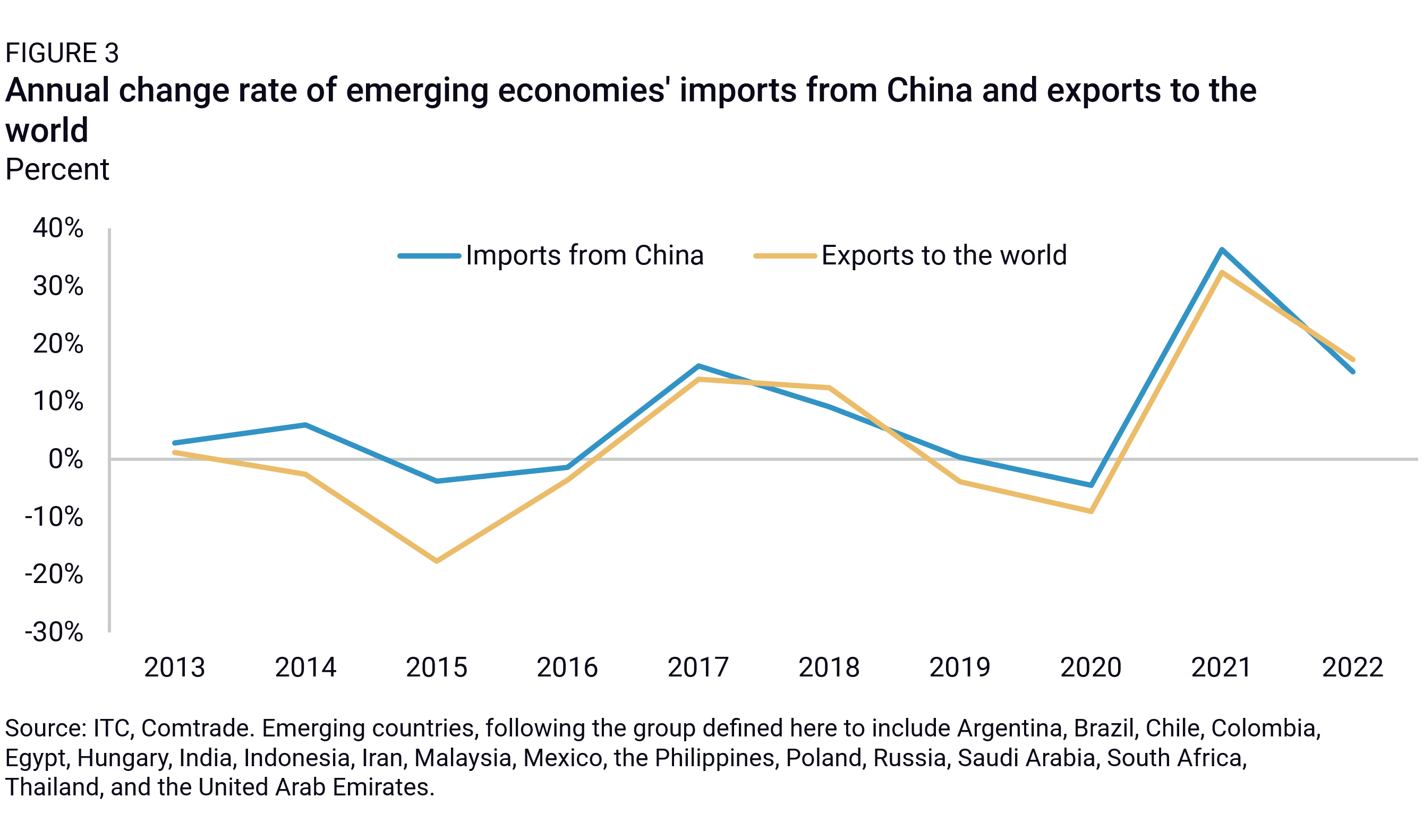

Developing countries import all kinds of goods from China, but the largest-growing category is intermediate inputs. This suggests that the rise in Chinese imports may have been fueling the industrial growth of some of these countries. Developing countries registered higher demand for their goods in recent years, due both to pandemic-related purchases and G7 de-risking efforts. Firms looking to diversify and avoid rising tariffs have relocated part of their activities outside of China. In that process, they have imported significantly more inputs from China, before processing them and re-exporting them worldwide.

Consider the trading profile of major emerging economies over the past few years. Increasing overall exports roughly track with these countries’ imports from China, highlighting the close integration of their industry with Chinese supply chains and the importance of those inputs to the countries’ manufacturing exports (Figure 3). This dynamic is particularly evident in ASEAN, which has become highly integrated with Chinese value chains over the past decade and, as of 2020, imported roughly three times more intermediate manufacturing inputs than final manufactured goods from China.2

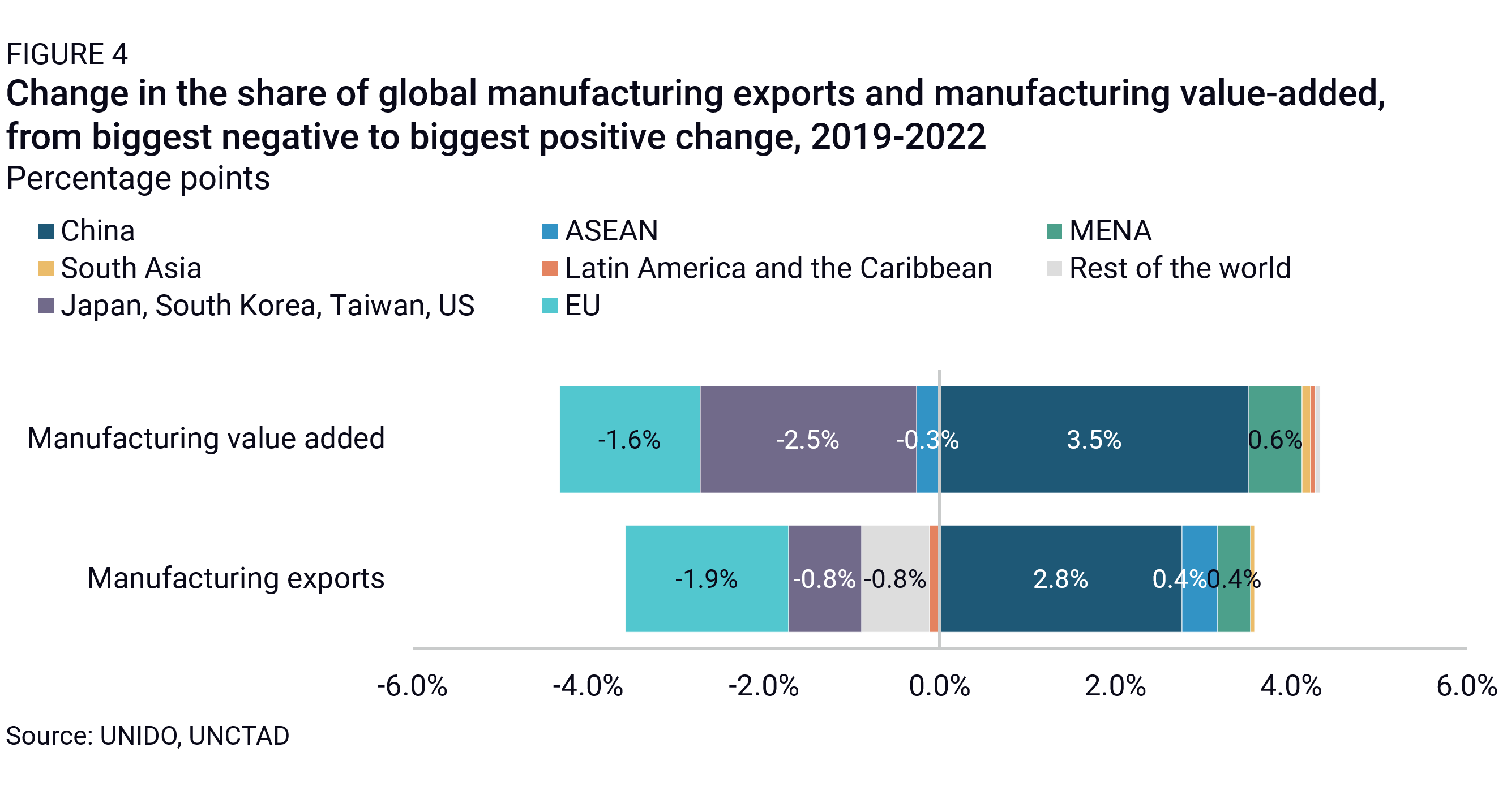

Importantly, developing countries3 do not appear to have lost export market share to China over the last decade. Instead, their share of global exports expanded slightly, from 19.8% in 2019 to 20.4% in 2022. In comparison, China’s rising manufacturing export strength seems to have affected advanced economies most drastically—these countries collectively lost 2.7 percentage points of global export market share between 2019 and 2022 (Figure 4). At first glance, this is not necessarily a bad prospect for developing nations. China appears to be enabling heightened competitiveness for emerging economy exports at the expense of the wealthiest nations.

A risky path

Despite some benefits, rising Chinese exports have also sharply increased Chinese companies’ market power. This makes developing countries vulnerable to monopolistic practices such as withholding supply or colluding to raise prices, as well as to market disruptions, pandemic-like external shocks, and potential economic coercion.

Given China’s longstanding dominance in goods trade, these risks are not novel. As China has cemented its status as the global hub for intermediate manufacturing, many countries have become strongly dependent on Chinese suppliers. What is new, though, is that the mismatch between domestic supply and demand in China has widened in the past few years, driving Chinese companies to seek additional markets overseas.

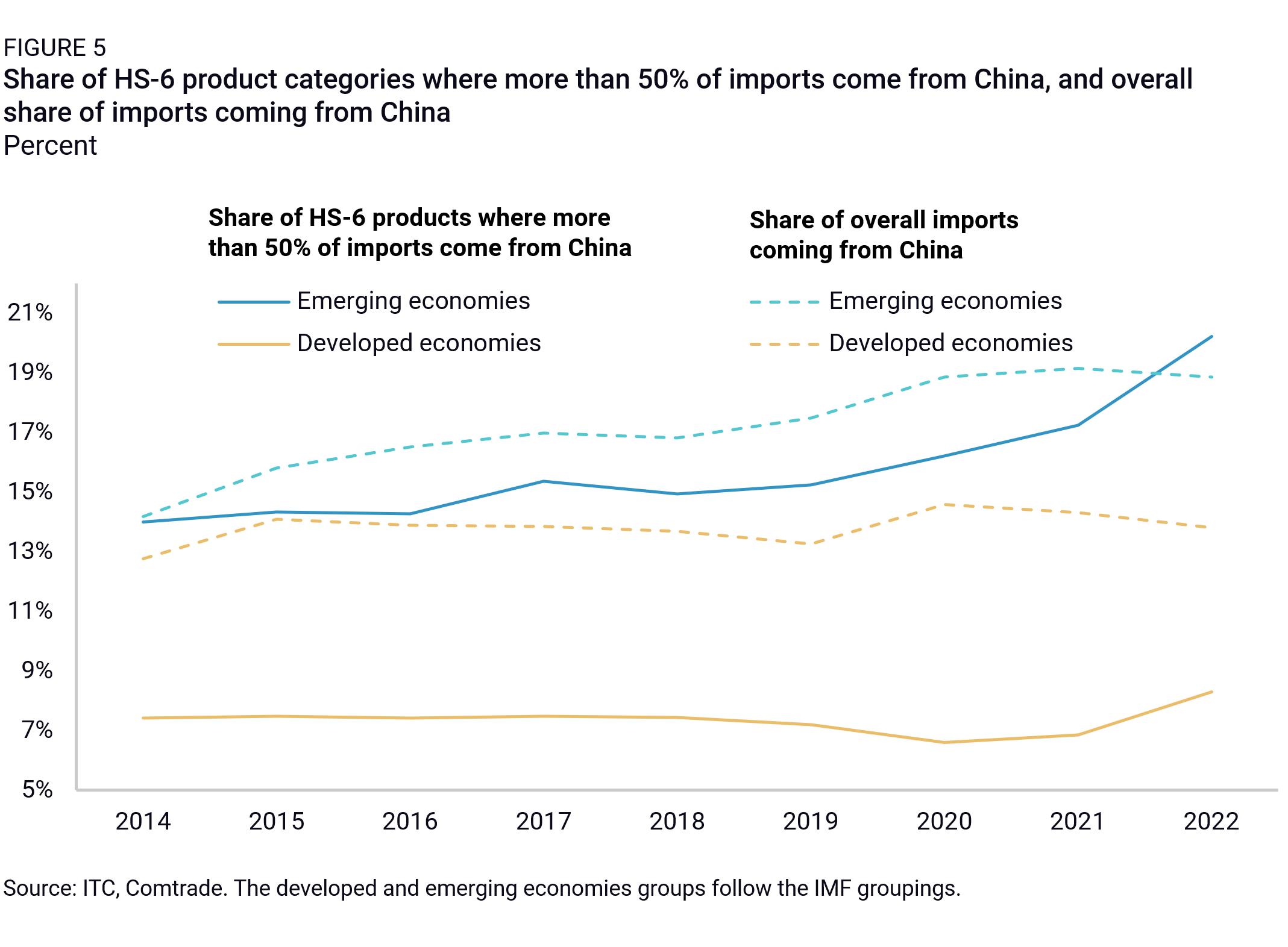

This has led to a marked increase in the share of imports coming from China, for both developed and emerging countries (roughly one percentage point between 2019 and 2022). However, the overall import value hides an even greater reliance on China for specific products, particularly in emerging markets.

Consider the number of products where countries rely on China for more than half of their imports. Using that definition, emerging economies were reliant on China for 20% of all product categories in 2022, up from 15% in 2019 (Figure 5). Together, the product categories where emerging markets are reliant on China represent a significant portion of their import value: 12% in 2022, against 10% in 2019.

They include inputs such as critical raw materials, chemicals, and electronic components used in the value chains of several strategic industries. In other words, when sourcing inputs for production, firms in developing countries are increasingly left with few options outside of Chinese suppliers. Developed economies’ reliance on China is lower and has increased less dramatically. The number of product categories where China makes up more than 50% of imports only rose by one percentage point in the same period, from 7% to 8%.

These statistics put China in a historically unique position in the global economy. China’s share of global exports has variously been surpassed by at least one other major exporter (such as the US, Japan, or the EU) over the last few decades, but no other country has had the same level of global dominance across product categories since the early 1970s. Moreover, achieving that level of dominance is more significant now than in prior decades, when trade represented a much lower share of global goods production and consumption. For comparison, the global trade-to-GDP ratio in 1970 was around 25%. By 2022, that had risen to 63%.

China’s dominance over so many product categories creates, first and foremost, a risk of economic coercion, where the government restrains access to crucial inputs for political leverage. Examples already exist, from rare earth exports to Japan in 2010 to more recent export controls on solar panels and other technologies and reported denied access to solar equipment in India.

Monopolistic practices are another risk. In countries where firms compete with each other in overseas export markets, the impact of single-country monopolies is limited. But compared to other leading trading nations throughout history, the Chinese state is heavily interventionist, managing competition between its domestic firms and their external trade relations. State-owned enterprises accounted for half of China’s top 100 listed firm market capitalization in 2023 and 70% of listed companies declared that they hosted Communist Party cells within the firm as of 2022. This means that the Chinese government can encourage companies to partner together, merge and consolidate, coordinate to gain market shares, raise prices, restrict access to products where they already have substantial market power, or favor domestic firms in their suppliers and client networks. As a result, China’s dominant position across so many product categories considerably limits the space for new entrants to emerge as new manufacturing powers.

Such a strong dominance in export markets also means that developing countries are vulnerable to changes within the domestic environment in China. Weakening domestic demand, combined with export-facilitating policies in products where China is the world’s dominant manufacturer, can cause prices to collapse globally and drive other national producers out of business. Consider the steel industry, where China accounts for more than half of global production. China’s property sector woes since 2021 caused vast overcapacity and led to a collapse in global prices, which now puts significant pressure on producers in India, Vietnam, Brazil, and other countries. China’s steel product exports are surging again—by 27% so far in 2024—after 35% growth last year.

The road not taken

The weakness in Chinese demand for imported goods is another concern. Over the past two decades, China’s move up the global value chain was expected to create massive demand for low value-added manufactured goods. This underpinned expectations of industrial development in emerging economies. That assumption is now undermined by China’s weak domestic demand and the growing gap between its manufacturing exports and imports. This gap is by far the largest in the world, and almost an order of magnitude larger than that of the worst years of trade imbalances in Germany, Japan, and South Korea.

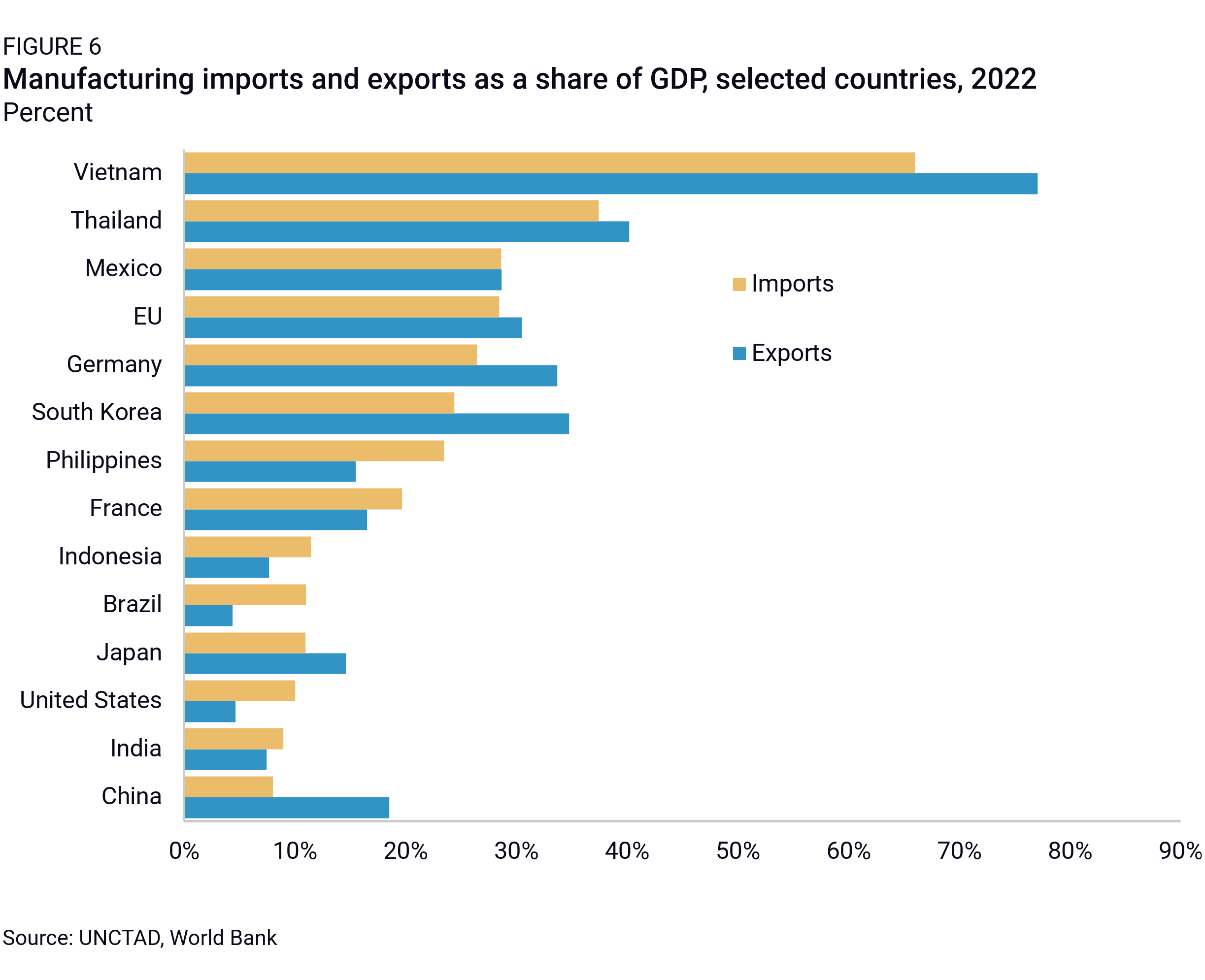

More than export competitiveness, weak Chinese imports explain this imbalance. Given the size of its economy, China is not exceptional in its large volume of manufacturing exports, but China has seen lower import volumes of manufactured goods than all other large economies in the world (Figure 6). Much of that imbalance can be explained by the small contribution of China’s household consumption to economic growth, which is the result of Beijing’s systematic policy support for producers and weak fiscal support for consumers. China’s domestic demand for imported manufacturing goods has been weak for years but was somewhat obscured by China’s reliance on imports related to the processing trade for re-export, and commodities imports. Both of the latter categories are now under pressure, particularly because of the slowdown in construction activity.

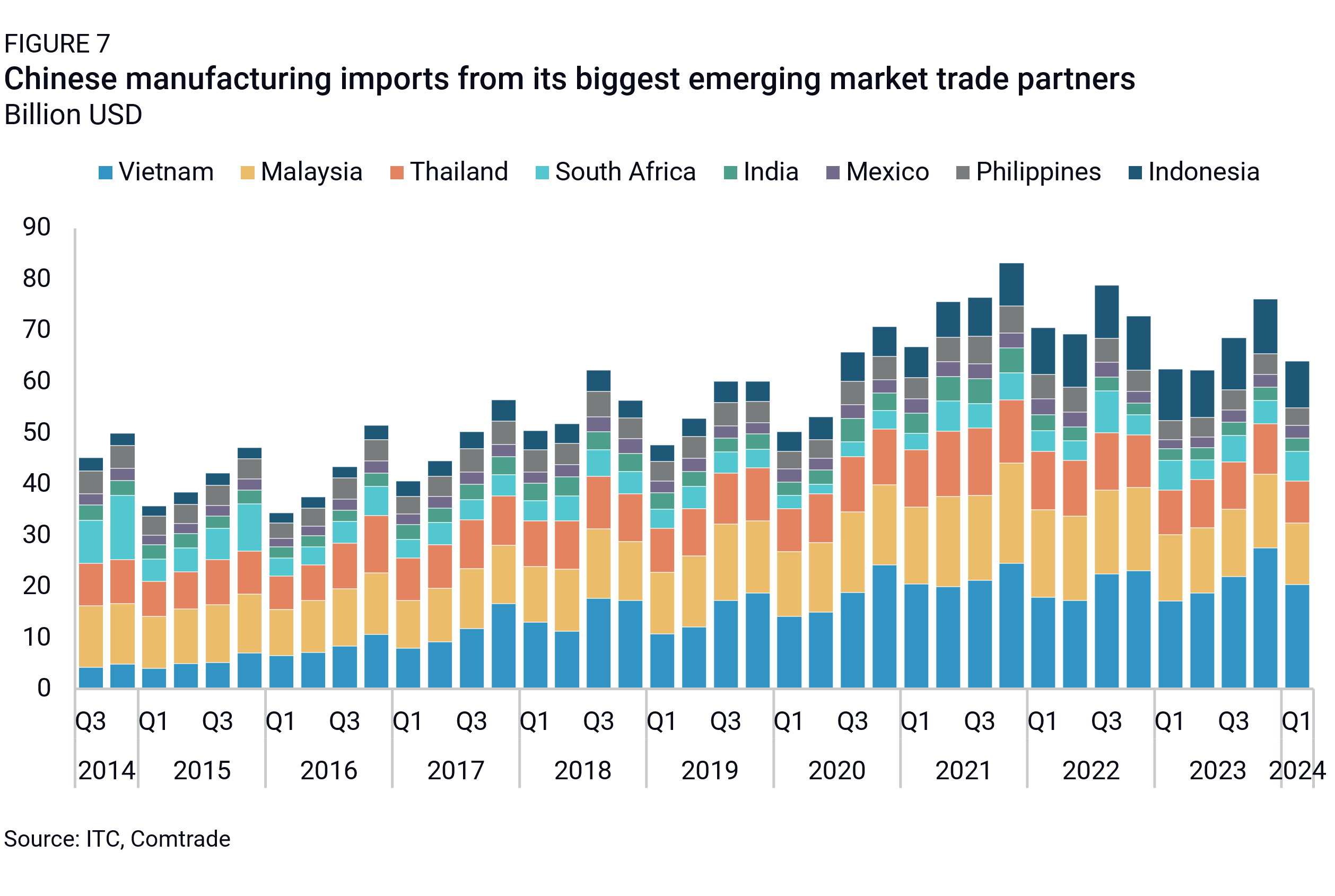

Since 2019, China’s manufacturing imports from emerging economies, already weak relative to the size of its economy, have plateaued in absolute terms for countries like Vietnam, or outright declined in the case of Malaysia and Thailand (Figure 7). Put differently, if China had increased its manufacturing imports as much as its exports since 2019, it would have created an additional $363 billion in import demand in 2022, or the equivalent of 11% of total manufacturing exports from developing countries. If it simply imported manufactured goods as much as it exported them in 2022, the additional demand would be equivalent to 54% of developing countries’ total manufacturing exports.

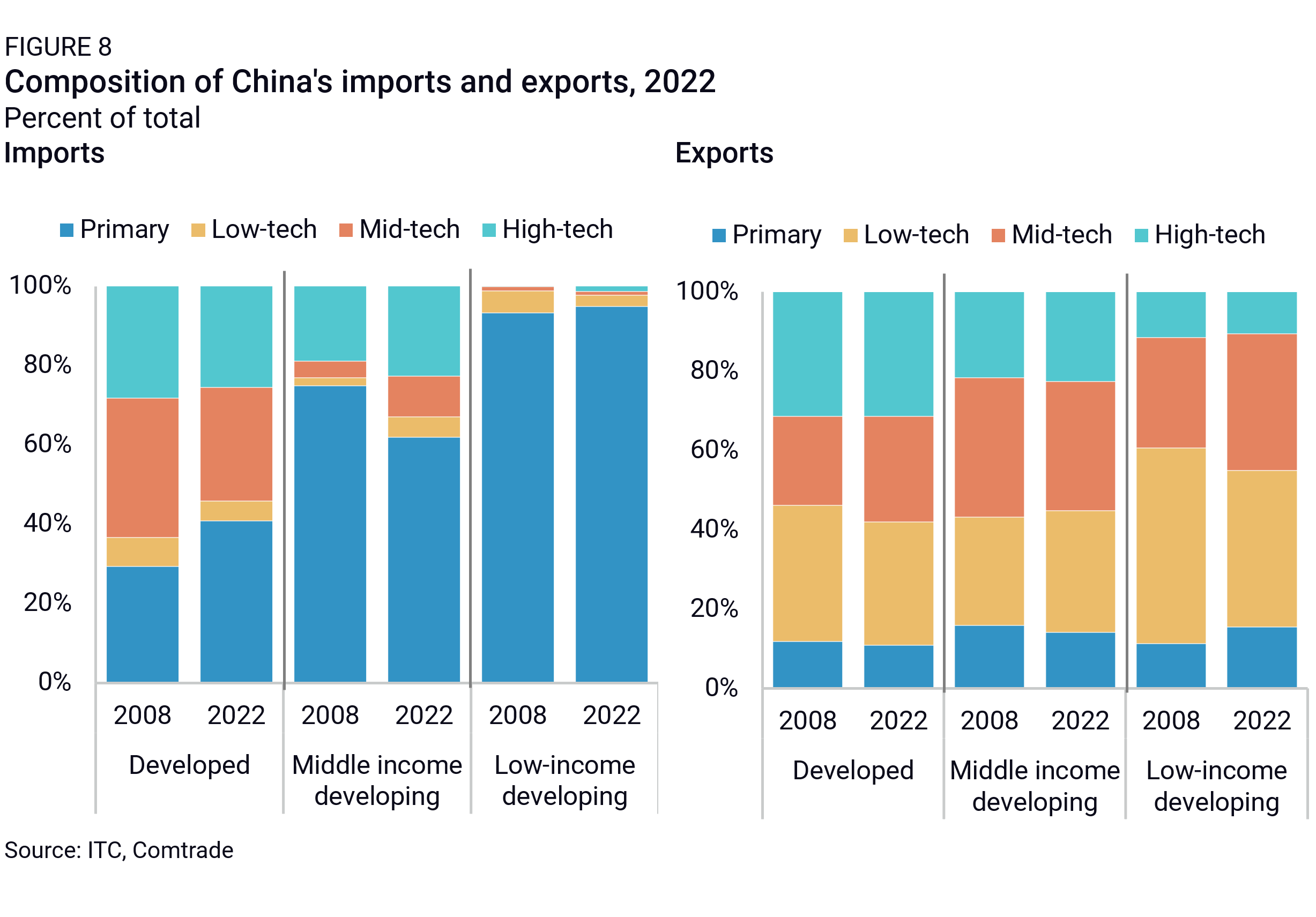

The weakness of China’s imports also has a bigger impact on emerging economies than developed ones. While China still needs to import high-tech products from rich industrialized economies, it imports very few low-tech goods, where developing countries would have a comparative advantage.

This is largely a result of deliberate policy interventions, which have intensified in recent years. While the central government has long emphasized developing high-tech industries, local governments sought to sustain low-end manufacturing companies through subsidies and other types of state support, because they are a vital source of local employment. Despite their efforts, labor-intensive sectors have started to move to other countries with a cheaper labor force in the past decade, and the share of manufacturing in China’s employment was on a downward slope until 2021.

But since 2021, China’s high-level economic strategy has shifted emphasis toward retaining low-tech manufacturing jobs and production. The 14th Five-Year Plan issued in March 2021 called for maintaining manufacturing’s share of China’s GDP. This was a reversal from the previous plan, which called for increasing the proportion of the service industry. As Xi Jinping remarked in 2023, China must “insist on promoting the transformation and upgrading of traditional industries and cannot regard them as ‘low-end industries’ to simply abandon.” Many provincial five-year plans followed suit, outlining quantified targets for the share of manufacturing in the local economy. As a result, deliberate policy interventions to retain low-end manufacturing have multiplied, with visible consequences on manufacturing jobs and production. The result is that China provides fewer opportunities as an export market for emerging countries while competing head-on with them in the low-tech and mid-tech space (Figure 8).

Reactions to rising imbalances

What could change this pattern of trade? Stronger household consumption in China, as well as rebalancing the economy away from low value-add activities toward services and high-tech manufacturing would create more opportunities for developing countries. However, this is unlikely in the absence of substantial structural reform. So far, China’s government has not shown any signs that it is willing to change course. For example, China’s March 2024 National People’s Congress set an explicit focus on industrial policy favoring high-technology industries, with very little fiscal policy support for household consumption or plans to address the vast social inequalities and the lack of a social security net that dampens household consumption.

Reactions from emerging economies to protect their industries and encourage domestic production are more likely. These may not be through official trade defense instruments, in part due to the fear of retaliation, but also because of the cost and efforts required to conduct formal investigations. In fact, there has been no significant rise in the use of CVD and anti-dumping investigations in the past three years, either from developed or developing economies (Figure 9).

But developing economies have raised informal barriers to trade with China over the past few years (Figure 10). Many of these interventions are in the form of import tariffs and quotas, as well as local content incentives. Brazil enacted import quotas, a 25% import tax on steel products, and a subsidy scheme tied to local content requirements in 2024. India also launched a local content-driven subsidy program this year.

Overall, however, trade restrictions and other localization policies are likely to be weaker in emerging and developing economies than those imposed by the United States, Europe, and Japan, if only because developing economies are more dependent on China and more vulnerable to potential retaliation. The countries that were able to most productively use Chinese intermediate inputs to expand their own manufacturing operations and gain market shares in developed economies will also likely prefer to maintain that access to Chinese value chains.

Domestic demand in China is still weak and advanced economies are pursuing policies to relocate manufacturing outside of China and close markets off to Chinese imports. This may push Chinese companies to invest more in emerging markets. China’s outbound manufacturing FDI, which had been historically very low, started rising in 2023, particularly in ASEAN, but also in Eastern Europe, the Middle East, and Latin America. Announced Chinese manufacturing investment deals in Mexico, Vietnam, and Thailand roughly quadrupled in 2023 compared to 2022. This could provide emerging economies with a crucial source of capital and know-how and help them grow their own industry.

As a result, many ASEAN countries are courting Chinese investment while growing their exports to G7 countries. Thailand, in the hope of becoming a growing car manufacturing hub, has strived to attract Chinese electric vehicle investments. Vietnam increased its economic cooperation with China to attract investments, including in semiconductors. Brazil and Turkey have raised barriers to imports of Chinese EVs, but enacted measures to attract Chinese FDI in the sector.

It is unclear how Beijing will react. Some policymakers in China are listening to those calls. People’s Bank of China adviser Huang Yiping recently called for China to provide capital and technology to developing nations so they can build their own renewable energy industries. But the Chinese government also has an incentive to keep manufacturing jobs onshore at a time of weak economic growth and rising unemployment. Any major support for outbound FDI is therefore unlikely.

Another significant variable is likely to be how China manages the exchange rate in response to trade restrictions. China could try to respond to Western tariffs and trade defenses by letting the currency depreciate, creating incentives for a further rise in its exports.

Growing Chinese exports and investments in emerging economies could also run counter to G7 de-risking efforts. The US strategy so far has been to incentivize and pressure third countries to shun Chinese involvement in strategic supply chains. The EU, while more welcoming of Chinese investments, could also become wary of superficial diversification that hides a growing indirect dependence on Chinese inputs. In all major advanced economies, de-risking efforts have also entailed significant domestic investment, and populations are often reluctant to open up to more trade with developing economies.

This means that the global south may not find as many opportunities to expand their exports to advanced economies in the coming years, particularly in strategic sectors where they are tied to Chinese investment and inputs. Overall, without significant domestic policy changes within China or significant new restrictions on trade, developing economies are likely to run larger trade deficits with China, while becoming more dependent upon Chinese inputs.

Footnotes

Manufacturing goods are defined following the World Bank’s definition: Commodities in SITC sections 5 (chemicals), 6 (basic manufactures), 7 (machinery and transport equipment), and 8 (miscellaneous manufactured goods), excluding division 68 (non-ferrous metals), to which we re-added the manufactured product categories within division 68. South Asia includes Afghanistan, Bangladesh, Bhutan, India, the Maldives, Nepal, Pakistan, and Sri Lanka.

According to the latest release of TiVA data, OECD.

We use the IMF definition of developing countries. See https://www.imf.org/en/Publications/WEO/weo-database/2023/April/groups-and-aggregates.