Nukes in the Crosshairs: Can the Clean Power Plan Save the Day?

The proliferation of renewables and persistently low natural gas prices have been pushing down coal generator margins for years. The results to date have been an unprecedented wave of plant retirements and lower CO2 emissions. These dynamics are having a similar impact on the largest source of zero emitting generation in the US, the nuclear fleet. Entergy Corporation announced last week that it will retire its Fitzpatrick nuclear plant in upstate New York. The news marks Entergy’s third nuclear plant retirement announcement in as many years. Meanwhile, states are on the hook to achieve substantial power sector CO2 reductions under EPA’s Clean Power Plan (CPP). If retired nuclear plants are replaced with new Natural Gas Combined Cycle (NGCC) units, the resulting emissions may cancel out CPP CO2 reductions. In this note we take a look at what’s driving nuclear retirements, as well as the intersection between the CPP and the US nuclear fleet.

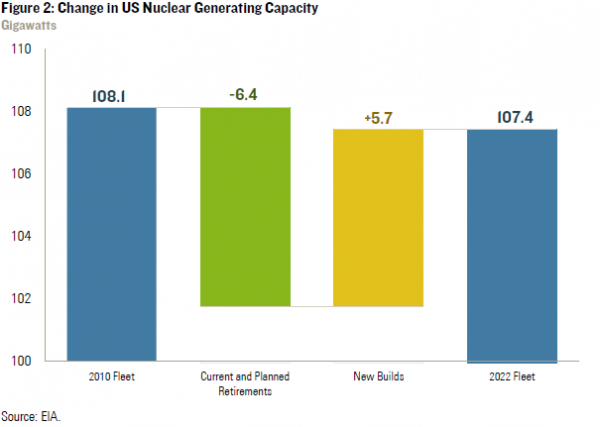

Nuclear is the largest source of zero-emitting power, but that’s changing: Nuclear power has consistently provided nearly 20% of US power since 2005. That’s more than all other zero-emitting generation combined. Still, nuclear retirements due to a variety of market and regulatory factors will shrink the fleet by 6% between 2010 and 2020. Assuming no additional retirements, new plants under construction will get the nuclear fleet close to 2010 capacity levels by 2022.

A wave of nuclear retirements could cancel out up to half of CPP CO2 reductions: The same factors that have pushed 6% of the fleet to retire aren’t going away any time soon. If more nuclear plants retire, CO2 emissions from replacement NGCC generation could wipe out some or all of the emission reductions associated with the CPP in the 13 states where nuclear plants have the most exposure to market factors. This is especially the case if new NGCCs aren’t covered under CPP state implementation plans (SIPs).

State CPP decisions could prop up or knock down troubled nukes: Different SIP designs will help or hurt the prospects for existing nuclear plants. A rate-based SIP could exacerbate current market factors, such as low wholesale electricity prices, that have been dogging nuclear plants of late. A mass-based SIP on only existing fossil sources leaves new NGCCs free to emit unrestricted in the event that nuclear units retire. A mass-based SIP on both new and existing sources provides the greatest potential boost to existing nuclear units, but on its own may not completely counter the full breadth of factors currently putting pressure on the fleet.

Nuclear is the largest source of zero-emitting power, but that’s changing

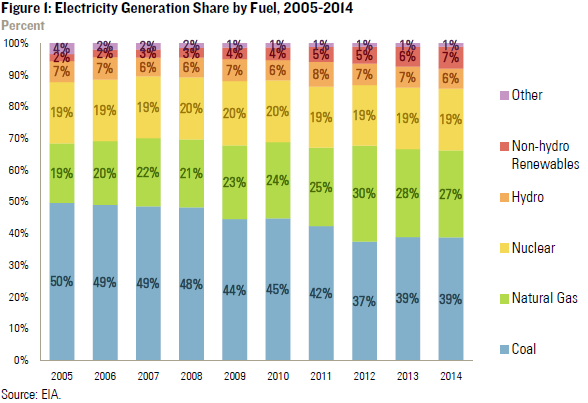

Nuclear power has been a consistent source of zero-emitting generation for decades. Figure 1 shows the breakout of US generation by fuel since 2005. The US nuclear fleet, at just over 100 gigawatts of capacity, provides reliable baseload power representing 19% of US generation in 2014. That’s larger than the share of all other zero-emitting resources (primarily hydro, wind, and solar) combined. While wind and solar continue to make gains, nuclear stands to maintain its role as the leading source of zero emitting generation—though the future is looking increasingly shaky.

Last week’s announcement of the Fitzpatrick plant closure as well as Entergy’s announcement last month that it will shut down its Pilgrim plant in Massachusetts aren’t just a flash in the pan. Over the past five years, five nuclear units totaling 4.3 gigawatts of capacity have been shuttered. One additional unit is slated to close by the end of the decade. Together with Pilgrim and Fitzpatrick, current and planned nuclear capacity retirements this decade total 6.4 gigawatts. Nuclear retirements aren’t unprecedented—they happen from time to time. The last wave occurred in the late 1990s as a handful of the very first commercial nuclear reactors reached the end of their useful lives. What’s different this time around is what’s driving these retirements: instead of reaching the end of their lifespan, recent and planned retirements represent plants with operating licenses lasting well into the 2020s.

Almost the same combination of market and regulatory factors driving coal retirements in the US are putting the squeeze on the nuclear fleet. These factors include:

- Low natural gas prices: Persistently low natural gas prices increase competition from NGCCs units for providing baseload power—the same baseload power that has been traditionally supplied by nuclear and coal generators. NGCCs are often on the margin in wholesale markets, playing a key role in setting power prices. As gas prices have come down so have wholesale prices, putting a squeeze on coal and nuclear plant margins.

- Competition from subsidized generation: State Renewable Portfolio Standards (RPSs) and the Federal Production Tax Credit (PTC) have spurred the growth of renewable power. Renewable generators only get these subsidies if they sell power to the grid. This sets up an odd incentive in competitive markets where renewables sometimes bid below their operating costs to insure that they get called on to generate power and receive RPS and PTC credits. This pulls down wholesale prices further, sometimes to the point where prices go negative. In turn, nuclear and coal plant profits get squeezed.

- Low electric demand growth: The great recession and energy efficiency policies have pushed demand growth to historically low levels. Lower demand for electricity reduces the need for generation.

- Low wholesale electricity and capacity prices: The sum of the factors above equals relatively low wholesale electricity prices. Sometimes prices are so low that nuclear plant revenues from electricity sales don’t cover costs. In regions where capacity markets exist, market rules sometimes undervalue highly reliable units (such as nuclear units) which also lowers nuclear plant revenues.

- Increasing costs: As plants get older, increases in operation and maintenance cost are inevitable. Meanwhile, post-Fukushima safety rules—and in some cases environmental regulations (such as cooling tower requirements)—are forcing plant owners to decide whether it is sensible to make new large capital investments or simply shut down.

- Unexpected wear and tear: In a few cases (such as San Onofre and Crystal River), unexpected and/or accelerated degradation of key plant components have forced owners to retire plants due to insurmountable repair costs.

Current and planned nuclear retirements, while sizable, come at a time when the US is building the first new reactors in decades. Tennessee, Georgia, and South Carolina are all slated to add new nuclear capacity by 2022. Figure 2 shows the total US nuclear fleet before and after retirements and new builds. Assuming no additional units are shutdown, the US fleet will be roughly the same size in 2022 as it was in 2010.

A wave of nuclear retirements could cancel out half of CPP CO2 reductions

The same factors that have knocked out Fitzpatrick and Pilgrim (and Vermont Yankee and Kewaunee in Wisconsin before them) are still in play. There’s no end in sight to low wholesale power prices absent a highly unlikely surge in demand and/or natural gas prices. Meanwhile, states and grid operators have been exploring regulatory changes that could help shore up nuclear plants in competitive markets. For example, regional grid operator PJM has revamped its capacity market to better value reliable baseload generation. These changes appear to have been enough for Exelon to delay decisions on the closure of a few nuclear plants it owns in Illinois. Still, if another wave of nuclear plant retirements occurs, what will it mean for states as they work to meet CO2 emission reduction targets under the CPP?

First, about half the nuclear fleet is owned by vertically integrated utilities located in rate-regulated states. The owners of these units usually cover plant costs through rate cases with their state Public Utilities Commissions (PUCs), shielding them from low gas prices and subsidized renewables. Barring unforeseen large capital requirements from unexpected wear and tear, the rate-regulated half of the nuclear fleet will almost certainly continue to run within the limits of their operating licenses. The other half of the nuclear fleet is owned by independent power providers operating in deregulated states where market forces rule. Indeed, Fitzpatrick and Pilgrim are both located in deregulated states.

When a nuclear plant retires, additional baseload generation is needed to replace it. In nearly every corner of the US that means ramping up or building new NGCCs. For every nuclear plant that retires, CO2 emissions will almost certainly increase. Meanwhile, the CPP places requirements on existing fossil generators only. This allows new NGCCs not subject to CPP constraints to fill the nuclear retirement void, undermining the environmental integrity of President Obama’s flagship climate policy. If states opt to comply with the CPP through mass-based caps on both new and existing fossil generators then nuclear retirements may not results in increased emissions. Instead, meeting those caps will become much more challenging.

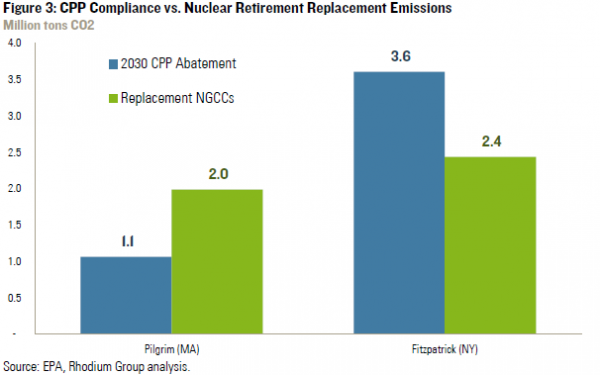

Figure 3 compares Massachusetts’ and New York’s 2030 projected CO2 reductions from the CPP to our estimates of emissions from replacement NGCC generation associated with the retirement of the Pilgrim and Fitzpatrick plants. While Massachusetts has a relatively modest CPP goal, the retirement of the Pilgrim plant makes the goal twice as hard to meet. Meanwhile, emissions from replacement generation for Fitzpatrick are roughly 2/3 the projected 2030 abatement for New York. Both states are parties to the Regional Greenhouse Gas Initiative (RGGI) and presumably will use the regional cap-and-trade platform covering both existing and new sources as their CPP compliance vehicle. The regional trading within RGGI means that the added pressure from nuclear retirements will be spread among participating states, making CPP compliance more challenging for all states in the program.

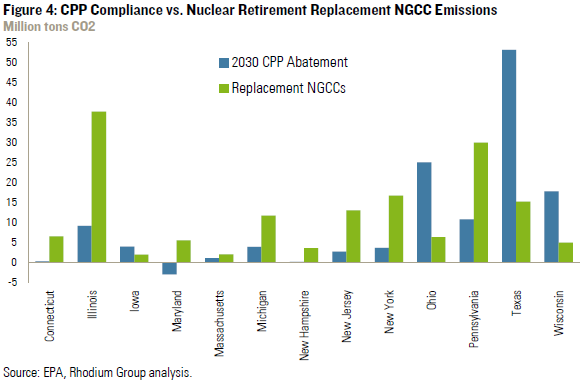

What might happen in other states? Figure 4 compares projected 2030 CPP abatement and our estimates of emissions from replacement NGCC generation, assuming market dynamics in deregulated states force the retirement of all nuclear units in those states by 2030. While this is almost certainly a worst case scenario, it highlights the important relationship between maintaining zero emitting generation and meeting CO2 reduction goals. For example, if Illinois achieves its projected CPP abatement of 9.1 million tons in 2030, those gains could be wiped out by a factor of four if new NGCCs are built to replace the generation provided by the state’s nuclear fleet. The same holds true for New York and New Jersey. In Pennsylvania, projected 2030 abatement could be canceled out by a factor of three. Nationwide, 40%—or 155 of the 375 million tons of EPA’s projected 2030 CPP abatement—could evaporate due to nuclear retirements in deregulated states.

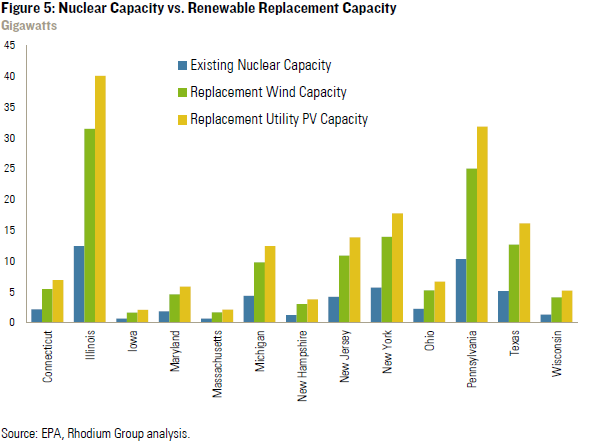

Could renewables fill in the gaps left by retired nuclear plants to avoid any adverse emissions outcomes? Perhaps, but it will take significant amounts of new renewable capacity to do so. Figure 5 shows how many gigawatts of wind or utility scale solar PV would be required to replace nuclear retirements in each state, assuming national average capacity factors. This is probably an underestimate for states that aren’t very windy or sunny such as Connecticut and Maryland. A state like Iowa with its world class wind resources and small nuclear fleet should be able to easily cover the gap. However, a state like Pennsylvania would have to expand its current wind capacity by a factor of 20 or expand its utility solar capacity by nearly a factor of 800 to fill in for its nuclear units. A renewables buildout of this scale would also require substantial transmission and grid upgrades. And there may still be increases in emissions if natural gas units are used to help balance all of this new variable renewable generation with load and meet reserve margins.

State CPP decisions could prop up or knock down troubled Nukes

While CO2 regulations can’t counter all of the factors driving nuclear retirements discussed above, they can certainly help or hurt the situation depending on implementation. Under the Clean Air Act, states decide how to design standards to meet EPA’s CPP requirements. Under the CPP there are three primary SIP compliance options that EPA says would undergo a streamlined approval process. A rate-based SIP, a mass-based SIP covering existing sources, and a mass-based SIP covering existing and new sources (including new NGCCs). Each option would influence the existing nuclear fleet in different ways.

Under a rate-based SIP, existing fossil generators would need to meet an average emission rate goal across the state’s power plant fleet. New renewables and new nuclear plants can generate and sell credits to help fossil plants meet the goal. Existing nuclear units can’t generate credits and in turn don’t get any new revenue under a rate-based SIP. But existing nuclear isn’t held harmless. New nuclear and renewables (and to a lesser extent existing NGCCs) do get new revenue from the sale of compliance credits and in turn can lower their bids into the power market—the same dynamic currently driven by the PTC and state RPSs. This could put further downward pressure on wholesale electric prices and increase retirement pressures on deregulated nuclear plants. Meanwhile, new NGCCs aren’t covered by the program, and are not restricted from generating power and emitting CO2.

A mass-based SIP on existing units establishes a cap-and-trade system and a price on carbon for existing fossil generators. Any generation outside the cap—such as existing and new renewables and nuclear as well as new NGCCs—get a benefit, since they don’t have to pay the carbon price. Generally, a price on carbon increases the bid price for all covered units and in turn increases wholesale power prices. This could provide a boost for troubled nuclear plants depending on how high carbon prices go. Still, with new NGCCs not subject to the cap any nuclear retirements would likely be met with an increase in CO2 emissions.

Finally, a mass-based SIP covering existing and new fossil generators establishes a cap-and-trade program and carbon price on all CO2 emitting power plants, including new NGCCs. The upside for wholesale prices and nuclear plant revenues should be larger than under an existing-sources-only cap, all else equal, because new NGCCs would also increase their bid prices to incorporate the carbon price. Furthermore, with new NGCCs under the cap there would be a limit on how much they could emit as they fill in behind any nuclear plants that still might retire. In the end, this all adds up to higher wholesale power prices and an upside for nuclear plant margins. Still, it’s the magnitude of the carbon price and its influence on wholesale power prices that matters most and it’s not a panacea for nuclear’s woes. The fact that both Pilgrim and Fitzpatrick are going to retire even as they operate under the RGGI CO2 cap-and-trade program with a $6/short ton (as of the September auction) price on carbon is a case in point. As states move forward in designing and implementing their CPP SIPs, how their decisions impact the nuclear fleet will be a critical issue.