Overcapacity at the Gate

China's policy plans will compound the growing imbalance between domestic supply and demand, setting China on course for a trade confrontation with the rest of the world.

China’s National People’s Congress (NPC) concluded in March 2024 with an explicit focus on industrial policy favoring high-technology industries, and very little fiscal support for household consumption. This policy mix will compound the growing imbalance between domestic supply and demand. Systemic bias toward supporting producers rather than households or consumers allows Chinese firms to ramp up production despite low margins, without the fear of bankruptcy that constrains firms in market economies.

So far, policymakers in Brussels and other advanced economies have mostly fretted over excess capacity in clean technology sectors, including electric vehicles, solar modules, and wind turbines, which have already seen supply-demand imbalances in China for years. However, indications of rapid production expansion across many more sectors have emerged since 2021, as Beijing sought to boost growth with supply-side policies during and after the pandemic. The situation underscores a systemic problem, not confined to specific sectors, which will set China on course for a trade confrontation with the rest of the world.

Saturation point

The simplest and most widely accepted definition of overcapacity is when factories’ production capacity is under-utilized. While temporary overcapacity can be harmless and a normal part of market cycles, it becomes a problem when it is sustained through government intervention. Structural overcapacity happens when companies maintain or grow their unused capacity without worrying about making a profit (or a loss), often due to a lack of economic pressure to operate efficiently, like a hard budget constraint.

China has a long history of structural overcapacity. Its last severe episode happened in 2014-2016, a few years after the government launched a massive stimulus package in response to the 2008-09 global financial crisis. The program, centered on infrastructure and property construction, triggered significant capacity build-up in a range of associated industries. In 2014, as demand for property and infrastructure construction weakened, overcapacity became evident in heavy industry products such as steel and aluminum.

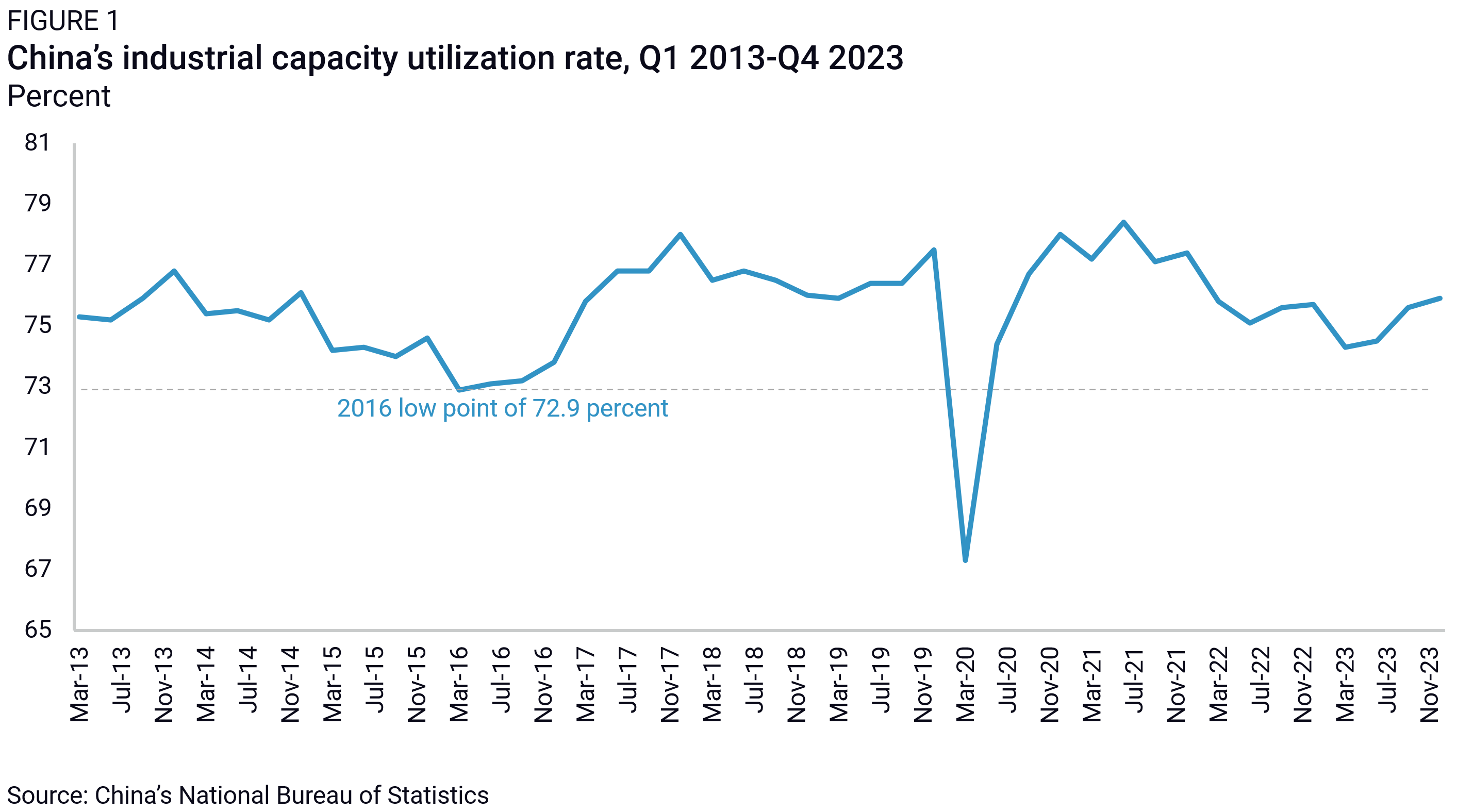

After years of retreat, anecdotal evidence is mounting that overcapacity is back in China. This is clear in emerging sectors such as clean technology. Capacity utilization rates for silicon wafers have dropped from 78 percent in 2019 to 57 percent in 2022. China’s production of lithium-ion batteries reached 1.9 times the volume of domestically installed batteries in 2022. But beyond these higher-profile cases, overcapacity now affects the industrial sector as a whole. In early 2023, aggregate capacity utilization dropped below 75% for the first time since the worst point of China’s last overcapacity cycle in 2016 (Figure 1), with a slight rebound since.1

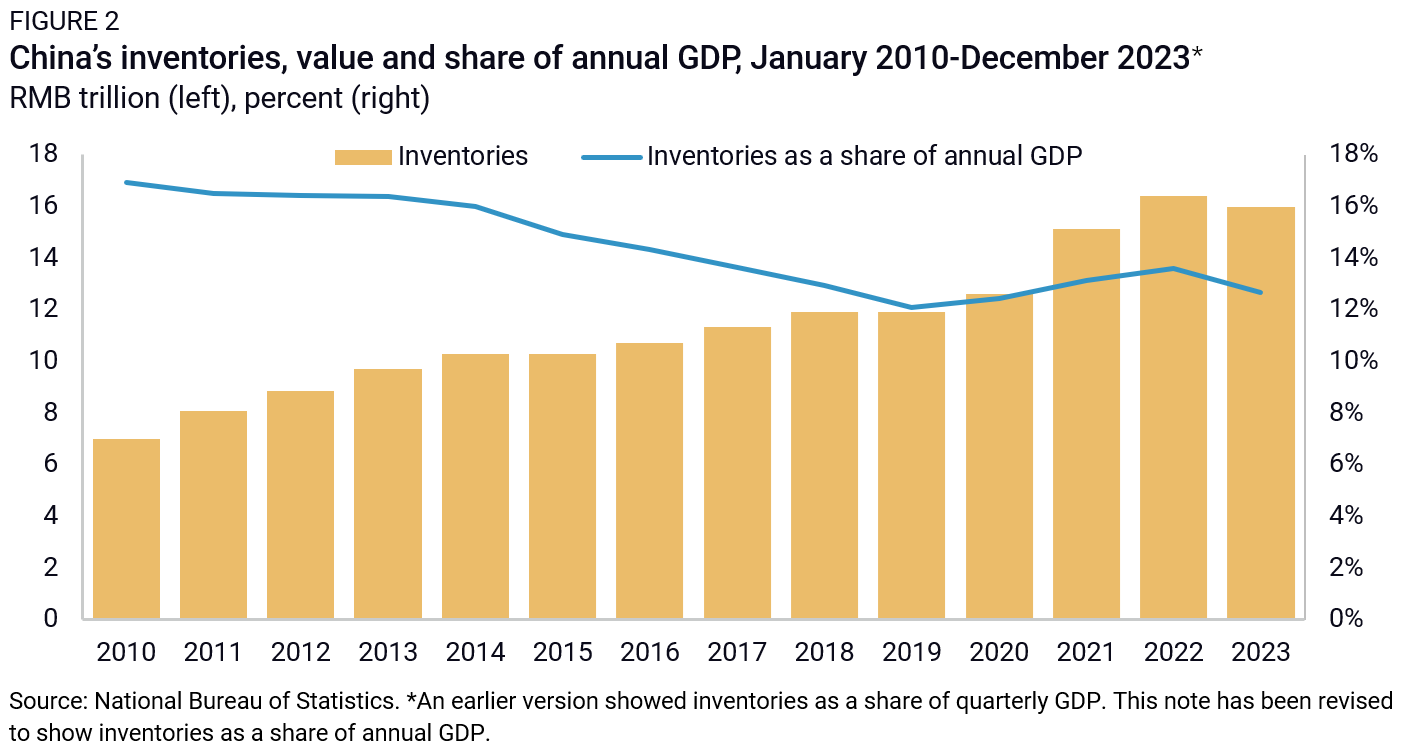

In addition to low overall capacity utilization, Chinese firms seem to have been suffering from over-production. Inventories reached their highest absolute levels since the beginning of the data series 13 years ago. After years of decline relative to GDP, they grew again from 12% in 2019 right before the pandemic, to 14% in 2022 (Figure 2). The trend is improving slightly, but the pattern of the past few years means that for many firms in China, even when operating below capacity, their production does not find consumers.

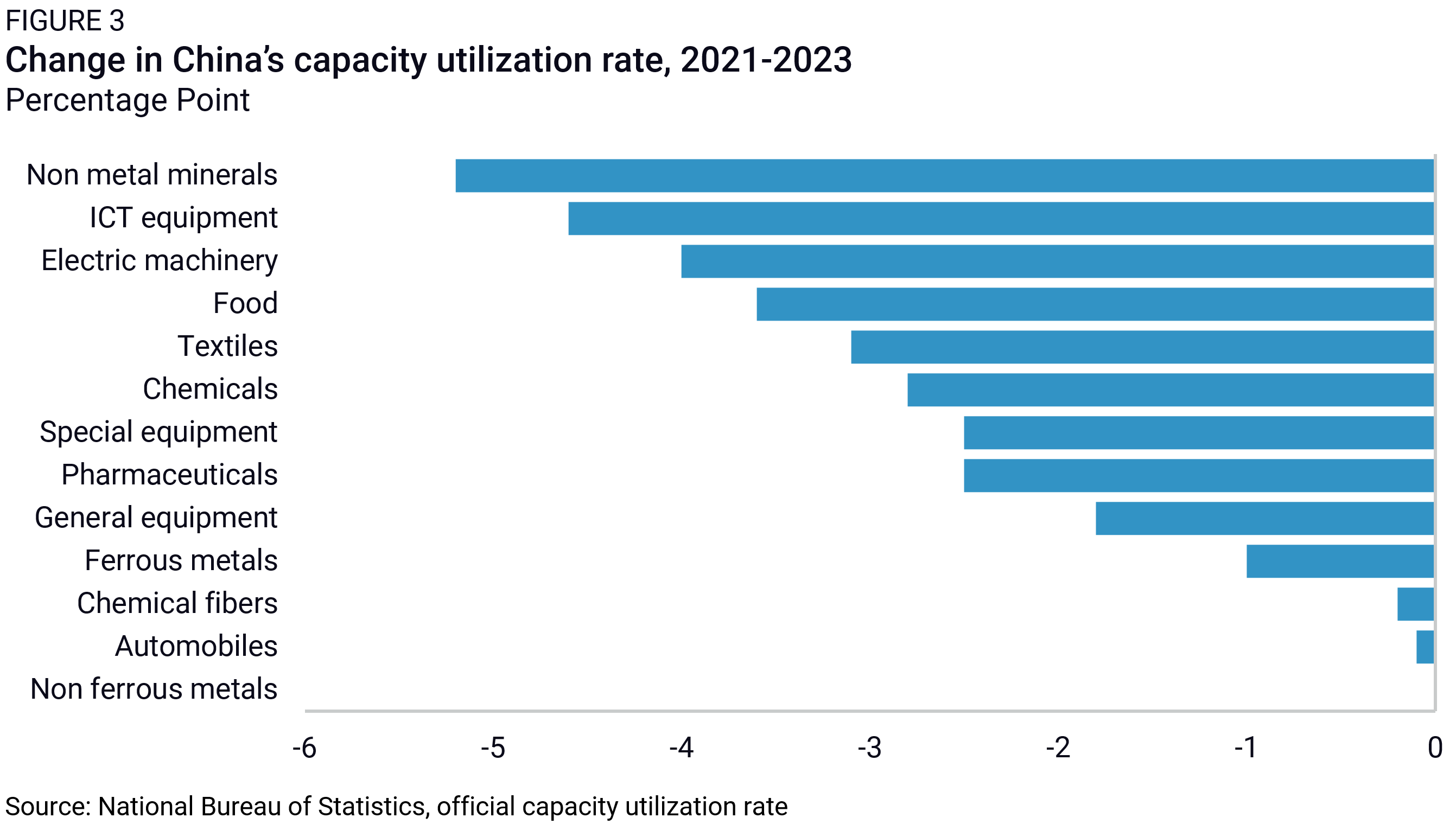

The problem is widespread—capacity utilization rates in China have declined over the past couple of years in every surveyed manufacturing sector except non-ferrous metals (Figure 3). Products linked to the property sector, such as plastics and non-metal minerals, are experiencing severe overcapacity because of weak demand in their downstream markets. But many other sectors are seeing declining capacity utilization, too, from machinery to food, textiles, chemicals, and pharmaceuticals.

Growing imbalances

The under-utilization of production capacity in China is concerning in its own right for foreign policymakers and businesses. It incentivizes firms to lower their prices in search of a market for their excess capacity. In the past, this has led to global over-supply, price declines, weak profitability, bankruptcies, and job losses.

But the drop in capacity utilization rates observed in the past few years is only one aspect of a more profound phenomenon that should draw equal concern for policymakers in Brussels and other economies—China’s growing domestic production surplus. Chinese companies, across a wide range of sectors, now produce far more than domestic consumption can absorb. This domestic surplus can produce low factory utilization rates. But it can also find its way into foreign markets, creating a growing trade surplus and, at times, global redundancies that threaten industrial ecosystems in other countries.

Those imbalances are not new, but they have reached unprecedented levels since the pandemic. In 2020, as COVID hit the global economy, China launched a stimulus program to boost industrial companies, with little support for household consumption. Beijing rolled out substantial tax credits, production subsidies, and interest rate cuts to keep struggling companies afloat and workers employed. When economic growth continued to disappoint in 2023, Beijing’s policy support kept the emphasis on producers, as their bias against “welfarism” kept policymakers from stimulating consumption.

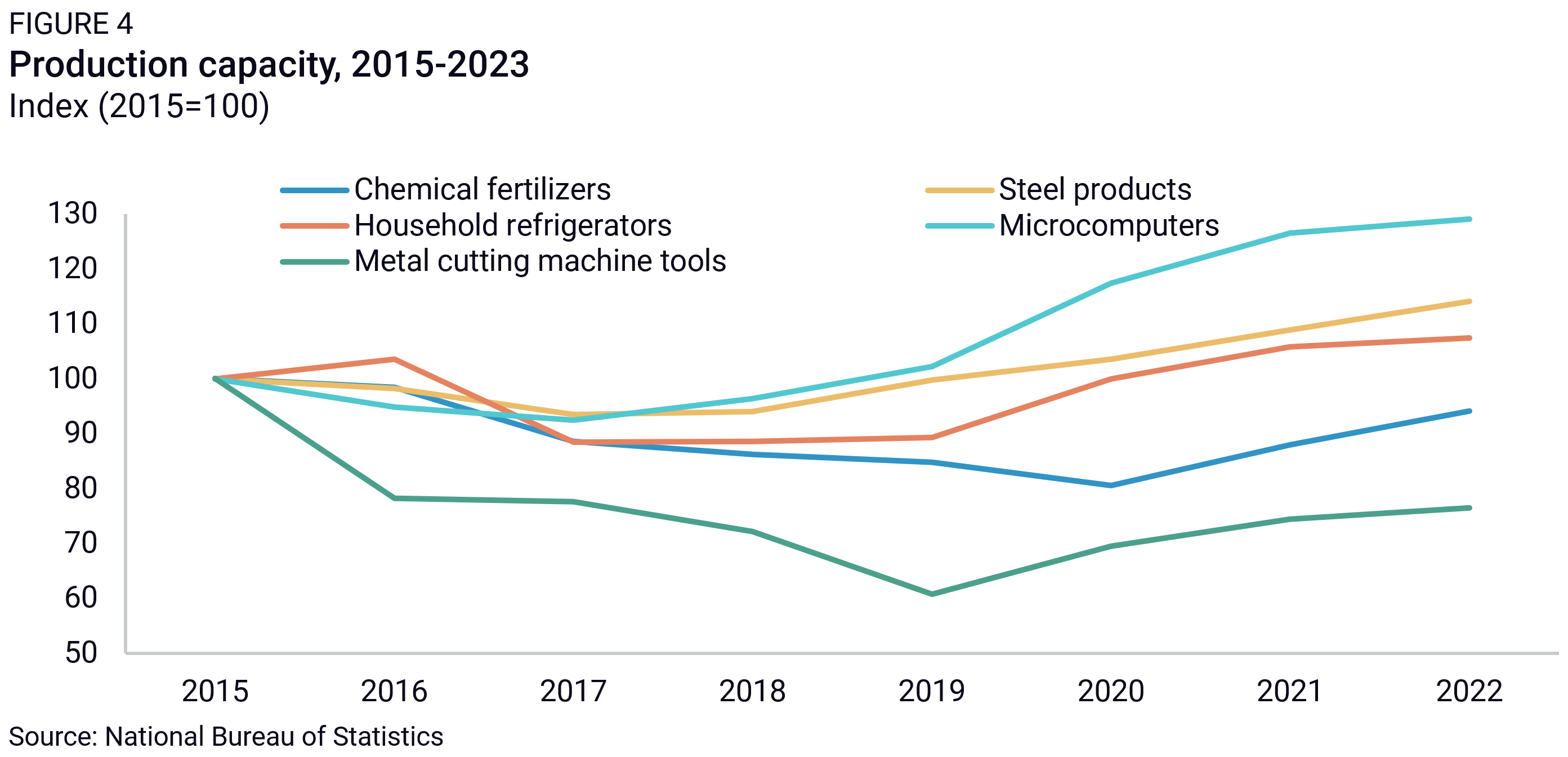

China’s growing support for its companies resulted in rapidly growing production capacity across many industrial sectors. From 2016 to 2020, investment and production capacity growth was concentrated in strategic sectors linked to the Made in China 2025 strategy, such as advanced electronics, particularly chips, and clean technology sectors. In other areas of the economy, the focus was instead on reducing capacity in the supply-side structural reform campaign from 2015 to 2019. However, this changed in 2020, with renewed growth across all manufacturing sectors, including non-strategic ones like steel products, household refrigerators, fertilizers, microcomputers, and machine tools (Figure 4).

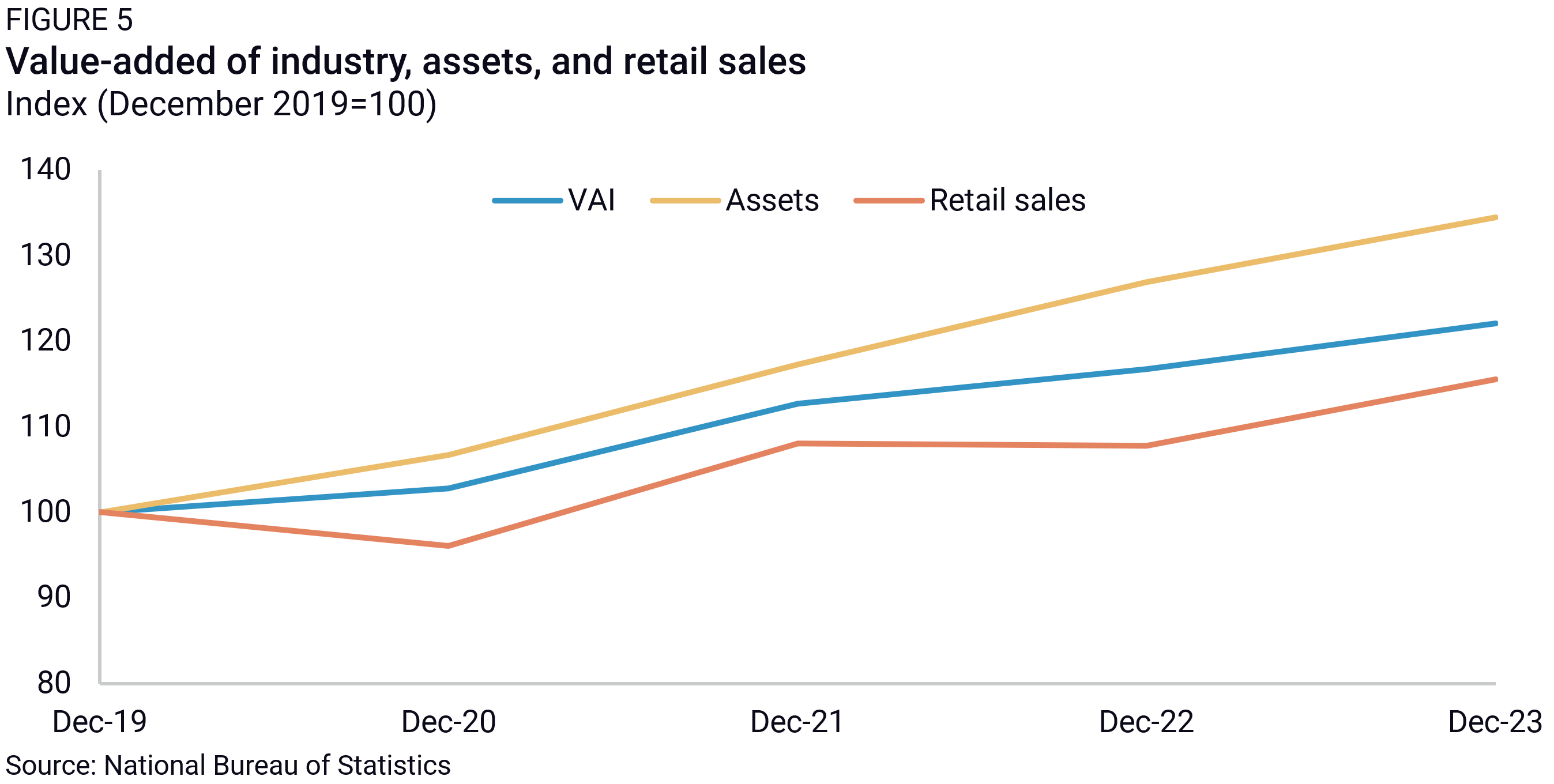

This capacity build-up was supply-driven, and most often not matched by equivalent domestic demand. With little support from the government, household consumption labored under strict zero-COVID restrictions and failed to pick up enough in 2023 to deliver a consumption-led recovery. The property market downturn played a role, dampening demand for a wide range of goods, from machinery to plastics and furniture. As a result, consumption did not grow nearly as fast as industrial production and investment (Figure 5).

Déjà vu with a twist

Current growing overcapacity and domestic surplus is similar to previous occurrences, but it differs in three important ways. The first is timing. The previous wave of overcapacity and domestic surplus hit China six whole years after the 2008 investment boom because domestic demand was strong enough to absorb the capacity expansion until 2014. This time around, China’s investment boom immediately hit a wall because of the weakness of domestic demand.

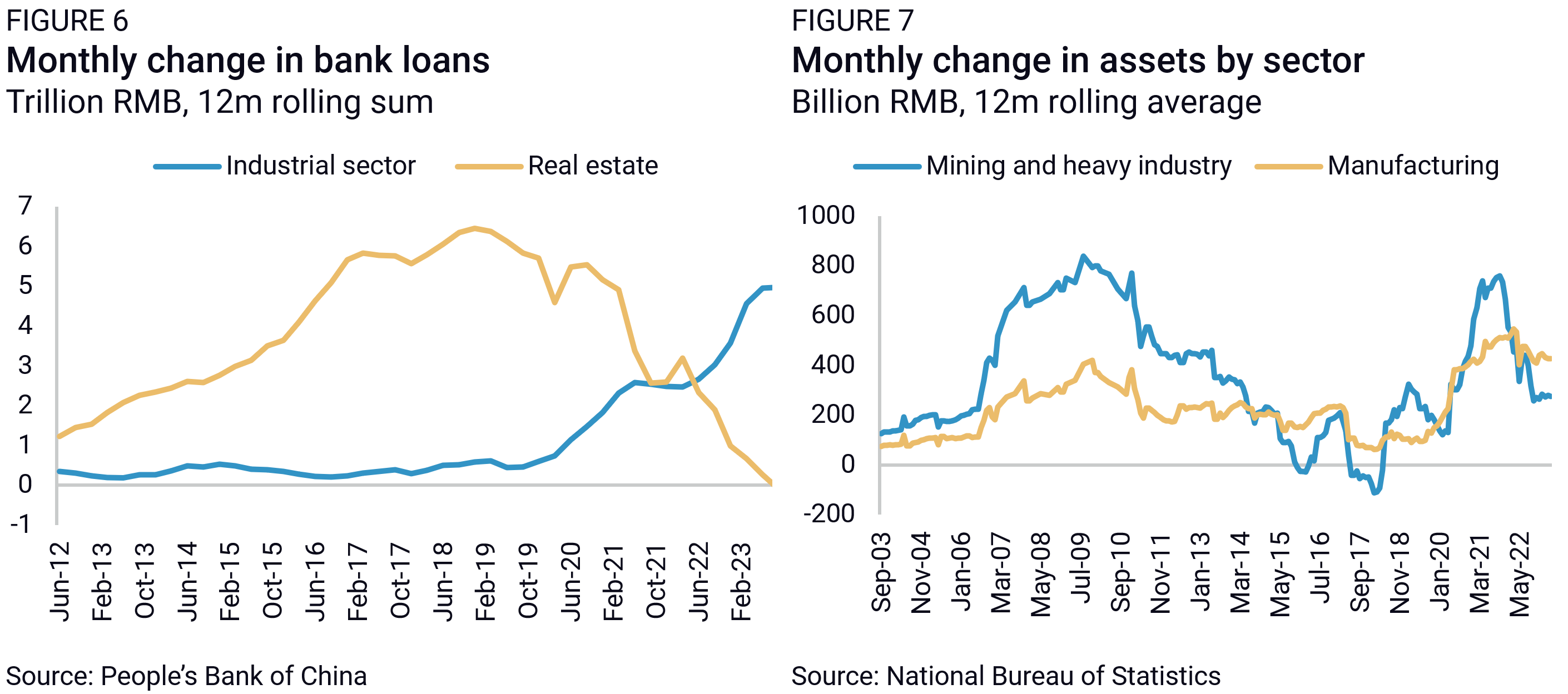

The second difference is the list of affected sectors. China’s 2008 stimulus focused on construction, infrastructure, heavy industry, and mining. In recent years, however, support for infrastructure and construction was derailed by China’s acute property crisis starting in the second half of 2021. Distress in the property sector diverted credit to other industrial sectors (Figure 6)—with the effect of concentrating China’s recent investment boom in manufacturing (Figure 7).

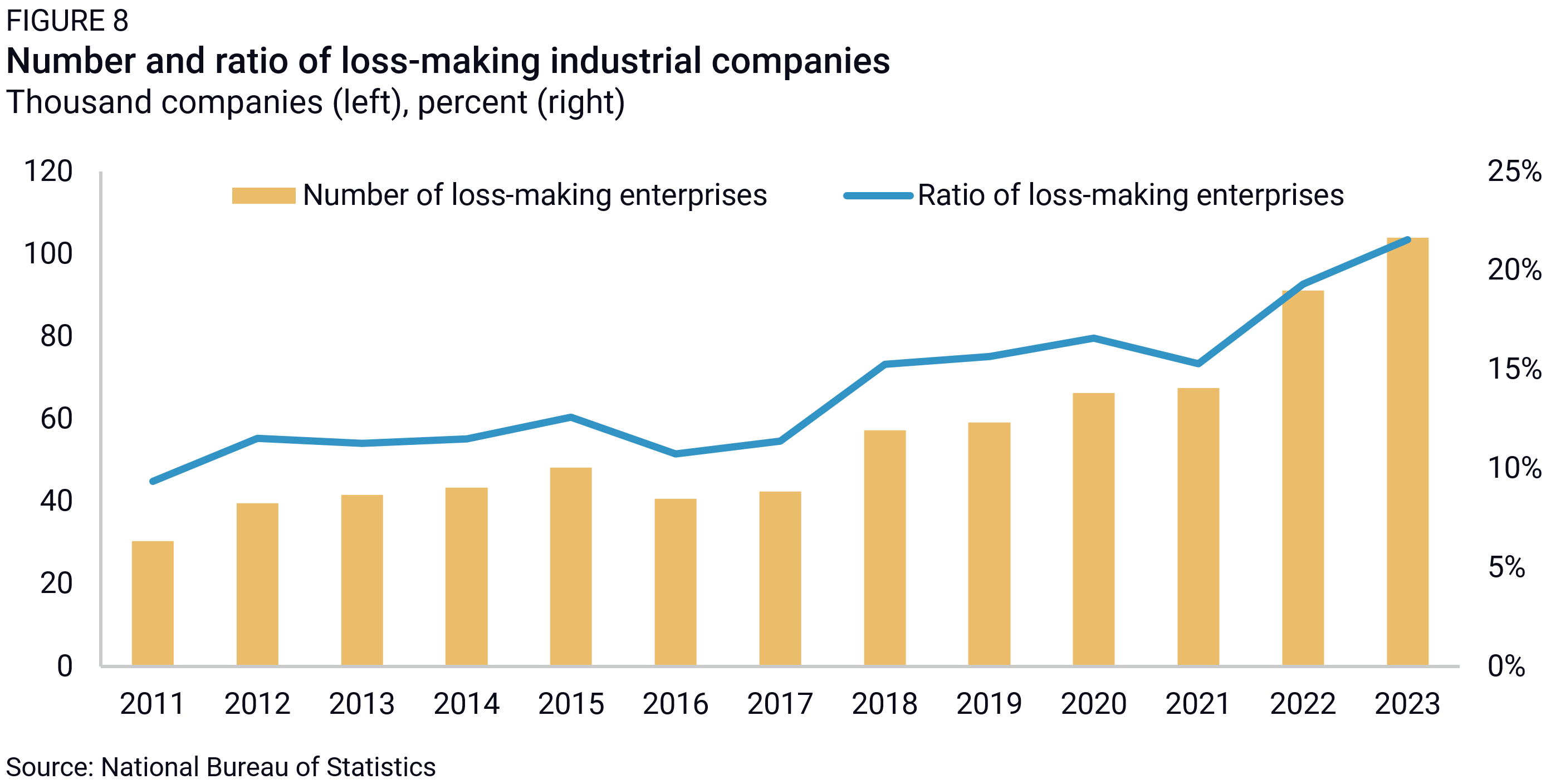

One last difference is how much support central and local governments have given failing enterprises with little consideration of profit and efficiency. In addition to generous credit and tax support measures, struggling companies were granted credit forbearances during COVID to help them face liquidity crunches and operational disruptions. Government support and prevention of market exit boosted the number of loss-making companies (Figure 8). In a crowded environment, with loose budget constraints, firms lowered prices and accepted razor-thin margins to retain market share. Perversely, it also pushed them to build additional capacity in hopes of offsetting lower margins with higher volumes, and because they knew from prior episodes that if authorities ultimately forced a market consolidation, survival would be determined based on scale, not financial health.

Trade spillovers: Bracing for impact

Because China’s previous cycles of policy-driven capacity expansion severely affected global markets—especially in steel and aluminum, but also in promising sunrise industries like solar panels—advanced economies are watching with intense concern and evaluating response options. In 2023, the number of EVs exported from China was already 7 times greater than in 2019 and 1.7 times greater year-on-year. China’s exports of solar cells in 2023 were five times larger than in 2018, and 40% above 2022 levels. These surges are potentially devastating to market-constrained producers in advanced economies.

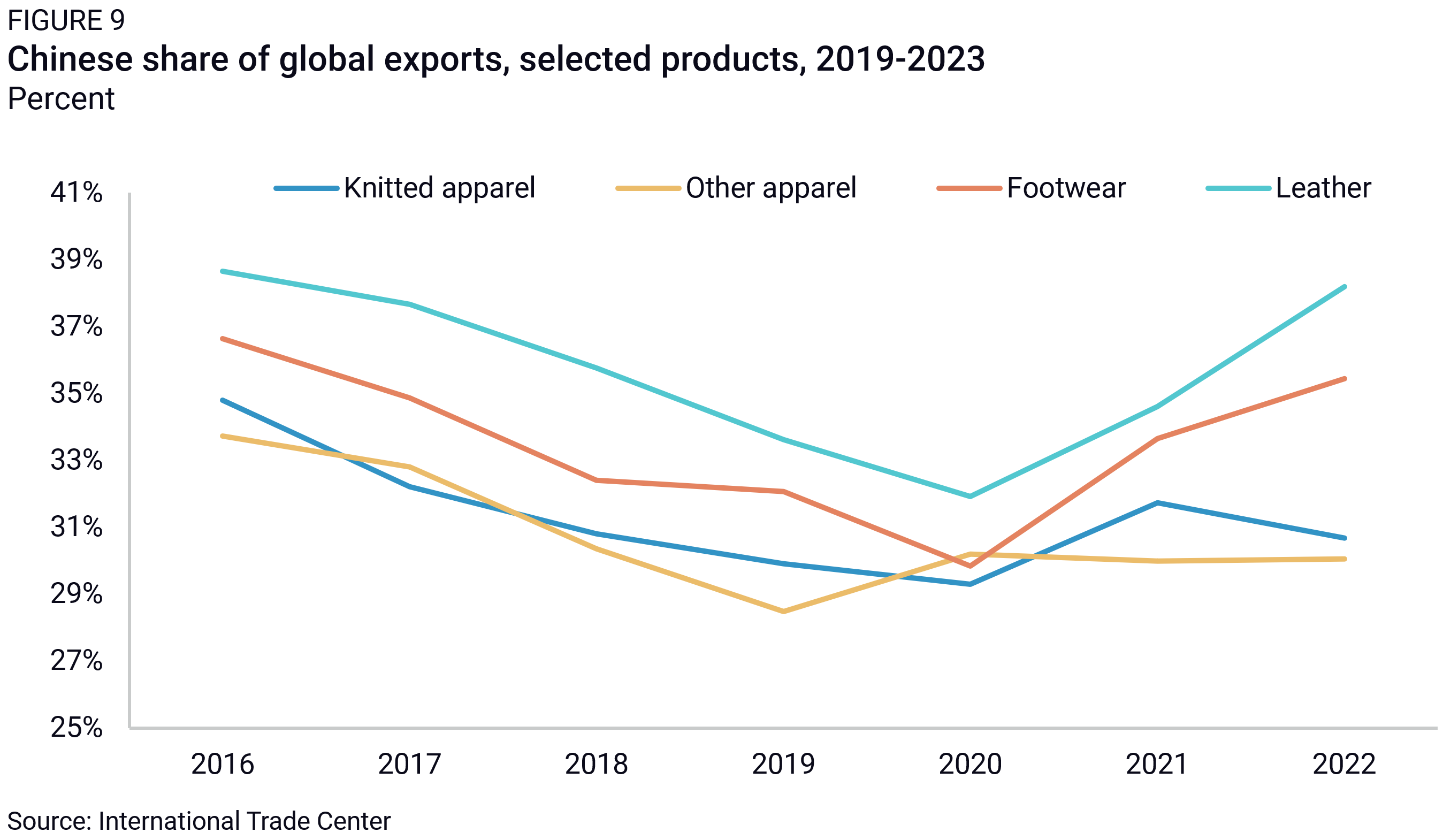

The growing mismatch between fast-paced capacity expansion and slow-growing domestic demand in China will have trade impacts beyond green technology sectors too. China’s share of global trade expanded by 1.5 percentage points in 2020, arguably in the context of global supply chain disruptions that put China at a global advantage. But, importantly, that share did not come down as COVID-19 restrictions retreated everywhere. In select sectors, Chinese firms have been gaining significant global export shares in the past four years. In the electronic machinery sector, for example, China’s share of global exports grew more than 5 percentage points between 2019 and 2022 in 18 of 46 HS-4 product categories. In 2016-2019, that was the case for only 7 out of 46 categories. In lower-technology sectors such as textiles and furniture, China has also been re-gaining market shares it had lost in previous years due to diversification of production and relocation to lower-cost destinations (Figure 9).

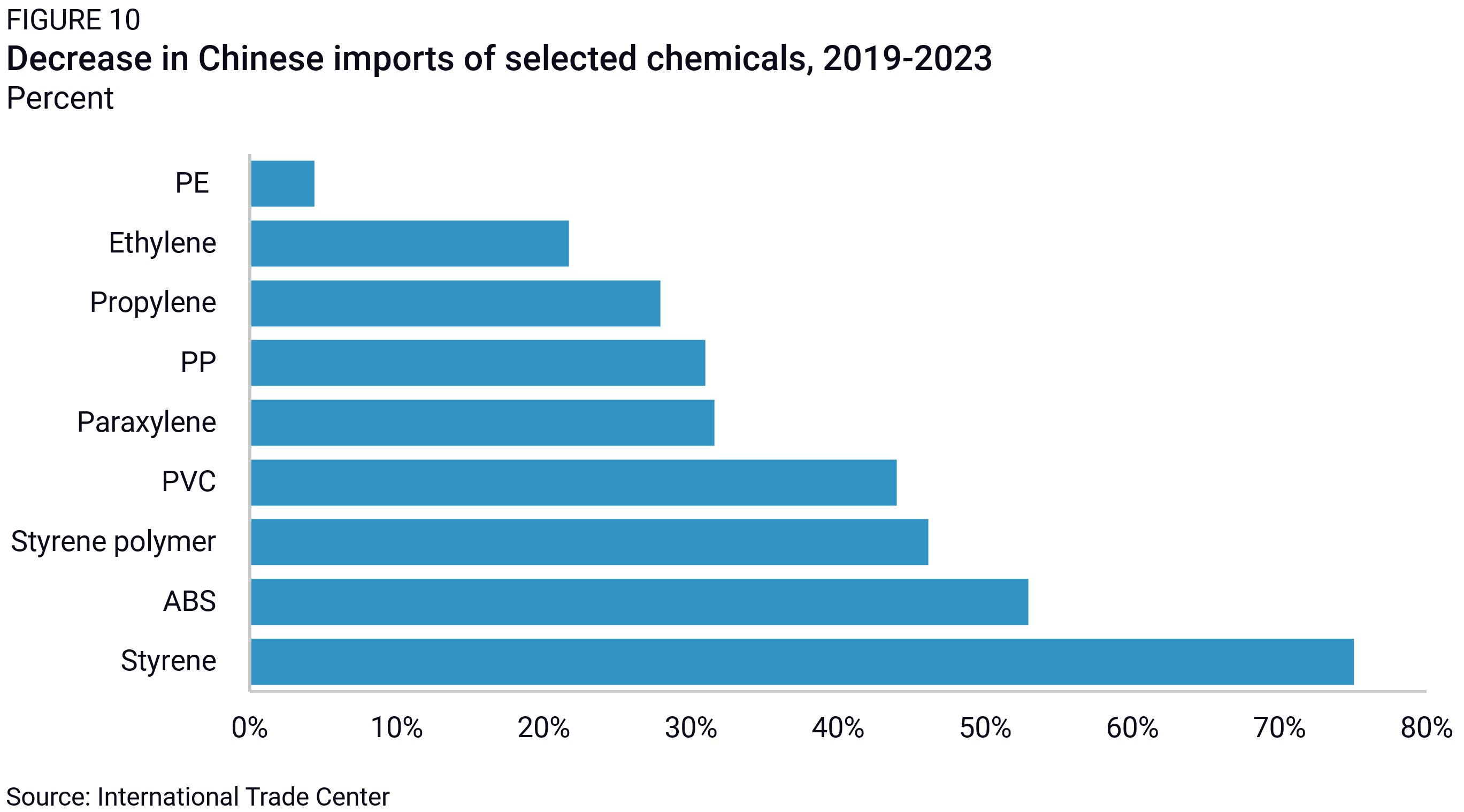

Export gains are not the only spillover channel for China’s rapidly growing production capacity. In sectors where China used to be a net importer, such as the petrochemical sector, the combination of domestic production capacity increase and weak demand in China resulted in sometimes drastic declines in Chinese imports, affecting firms in Europe and the United States (Figure 10).

Low prices are not the only factor behind Chinese firms’ ability to export their growing capacity abroad. Competitiveness is another one. By lowering firms’ costs, allowing them to scale up, and increasing their ability to improve products as they “learned by doing,” state support made some Chinese companies fiercely competitive in global markets. The electric vehicle sector is a case in point. The top Chinese exporters of EVs, BYD and SAIC, are not the most affected by overcapacity—they are close to working at full capacity. Still, these carmakers were able to leverage the supportive environment of the past four years to become more efficient and more technologically competitive than their rivals. Facing low profit margins in China today, and intense competition, they are uniquely equipped and motivated to capture growth and profits outside of China.

The effects of this new wave of policy-driven capacity expansion in China are not yet all visible. In certain industries, the timeline from investment to production can stretch over years, meaning that funds allocated in 2021-2022 might only begin to materialize into market-ready products or services several years later, with a delayed impact on Chinese and global markets.

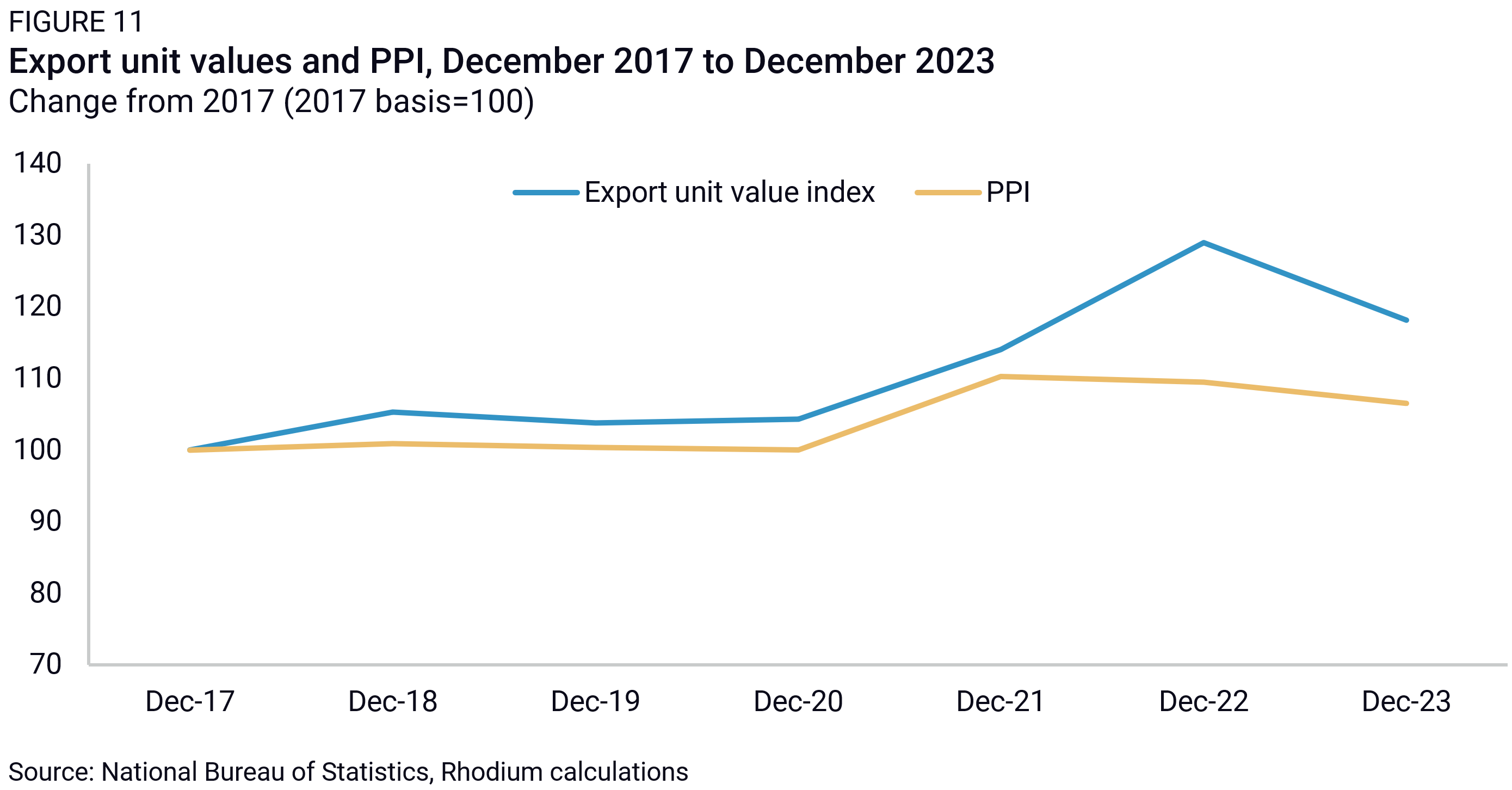

What’s more, although overcapacity created strong deflationary pressure within China, it has not yet impacted global prices to the same extent (Figure 11). In fact, China’s export prices were up in most sectors in 2023 compared to 2021, and the prices of imports from China rose more quickly than the prices of imports from other extra-EU countries in 2021-2022, before decelerating in 2023.

This is because many Chinese firms are still using overseas markets to make up for lower prices, margins, or even losses on the China market. But this China-world price discrepancy also means that Chinese firms could lower their export prices further in the future to gain market access, weed out competitors, or make up for new tariff barriers in the EU or the US.

Outlook

In the last two quarters of 2023, China’s capacity utilization rates have picked up, reaching 75.9%—a level similar to 2018-2019. However, China’s capacity expansion in manufacturing sectors will likely stay elevated in the long run, creating episodes of overcapacity and further effects on global trade.

In previous overcapacity cycles, cheap Chinese exports contributed to rising trade tensions and a series of anti-dumping investigations, such as the EU investigations on Chinese steel in 2016. Overcapacity also hurt Chinese companies’ profits and came with unsustainable debt growth. Reducing overcapacity thus became a priority for the Chinese government in 2016.

This time around, the Chinese government is also expressing awareness of the issue. The Government Work Report in March 2024, for example, mentioned strengthening “investment guidance for key sectors to prevent overcapacity, poor quality, and redundant development.” However, the solutions adopted will likely center on retiring obsolete capacity and letting the most uncompetitive companies shut down while continuing to support capacity expansion, innovation, and exports in others.

This policy mix is part of a broader economic strategy that emphasizes manufacturing and exports as key growth drivers. Beijing has made clear in recent years that it wants to prevent China from de-industrializing, including in low-tech industries that would otherwise naturally migrate to lower labor-cost countries. Since the 14th Five-Year Plan in 2021, Beijing has vowed to stabilize the share of the manufacturing sector in GDP—a reversal of a decade-long trend. Several key local governments have since announced quantified objectives for their share of manufacturing in the economy.

Beijing is also desperately looking to rebalance the economy away from the infrastructure and property sectors and toward new growth drivers. Yet in the absence of a clear strategy to prop up consumption, this means supporting the manufacturing industry—particularly in emerging sectors such as renewable energy and electric vehicles—as a core engine of growth. China’s March 2024 NPC meeting set an explicit focus on industrial policy favoring high-technology industries, with very little fiscal policy support for household consumption. This policy mix will only compound the trade impacts of China’s growing state-supported industrial capacity.

This sets China, the EU, and the US on a dangerous course of trade confrontation in 2024, with a high probability of trade defense action cases. The systemic nature of China’s trade surplus and market distortions, not confined to specific sectors, may also motivate larger actions. Strong measures such as revoking the Permanent Normal Trade Relations status or introducing a new tariff column for China are already on the radar of US politicians during an election year. But China’s growing manufacturing surplus is not only a problem for the US and the EU. In fact, China’s trade surplus with G7 countries grew by a third between 2019 and 2023 while it more than tripled with developing economies, setting a daunting barrier as they try to nurture their own industrial sectors. The spillovers of China’s domestic imbalances are already compelling a response from a broader set of countries, including Brazil, India, Mexico, and South Africa. If China’s imbalances continue, this emerging market pushback will also likely intensify.

Footnotes

This is an aggregate number across sectors. Different industries may have different optimal capacity utilization rates. For example, in the semiconductor industry, a CUR of 80 percent is typically understood to be the optimal full utilization rate of a fab and a lower rate indicates overcapacity. In the automotive sector, a rate of 70 to 80 percent is generally considered healthy.