Rebalancing the Clean Power Plan

EPA’s Clean Power Plan (CPP) guidelines for regulating CO2 emissions from existing power plants establish statewide emission rate goals for fossil fuel-fired power plants. EPA’s “building block” approach to setting these goals is based on recent industry and policy trends in the power sector. One trend, the replacement of old fossil steam generation with new natural gas combined-cycle (NGCC) power plants was notably absent from EPA’s calculations. In this note, we explore how EPA could incorporate new NGCCs into the CPP, what it could mean for emission reductions, natural gas prices, and the distribution of burden on states.

EPA can incorporate new NGCCs into CPP goals: EPA set state goals based on Best System of Emission Reduction (BSER) determinations. The foundation of the BSER rests on electric power sector trends and best practices in state policy. We observe that recent trends demonstrate that fossil-steam capacity can be replaced in a reasonable and cost-effective way with new fossil base load capacity such as NGCCs. We provide one plausible approach EPA could use to incorporate this trend into its final CPP goal calculations expected late this summer.

New NGCCs can rebalance EPA’s proposed CPP emission rate reduction requirements: When generation from new NGCCs is incorporated into CPP goals, the distribution of emission rate goals across states becomes more even. Keeping all other goal components identical to the EPA proposal, generation from new NGCCs would increase requirements for the most carbon intensive states while most other states would see little to no change in their goals.

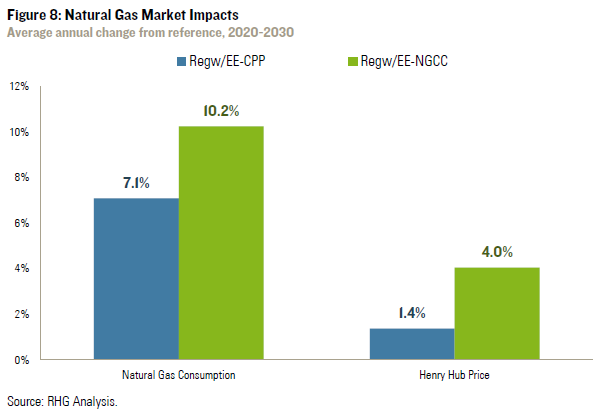

New NGCCs can raise CPP ambition with modest impacts on natural gas prices: Conservatively incorporating NGCC replacement capacity trends into CPP goals yields nearly 140 million metric tons of additional abatement on average between 2020 and 2030. By 2030, this represents a cut in power sector CO2 emissions of 35% below 2005 levels by 2030. This additional abatement largely comes from greater coal to gas switching. This shift in dispatch results in modest impacts on wholesale natural gas prices of 4% on average from 2020-2030 compared to 1.4% under the CPP as proposed.

EPA CAN INCORPORATE NEW NGCCS INTO CPP GOALS

EPA’s CPP proposal calculates state emission rate goals using four now familiar building blocks: 1) heat rate improvements at coal steam plants, 2) increasing existing NGCC generation to displace fossil steam generation, 3) increasing and preserving zero emitting generation to displace fossil generation and, 4) energy savings through demand-side energy efficiency programs. All four of the building blocks were selected because EPA determined they meet the requirements of BSER under the Clean Air Act (CAA). In other words these measures are widely available and are already deployed in several states, they can deliver substantial emission reductions, they encourage technology development, and their costs are reasonable. EPA cited engineering studies, industry trends, and state adoption of clean energy policies in making its determination.

EPA contemplated inclusion of generation from new NGCCs in its CPP proposal, but argued that new NGCCs built solely due to the CPP would probably be costlier than Important disclosures www.rhg.com can be found in the Appendix

shifting generation to existing NGCCs. The agency cited additional capital costs for plants and associated infrastructure. Additionally, they expressed concern over the sensitivity of natural gas prices due to a substantial increase in demand from the combination of ramped up generation at existing NGCCs plus a build out of new NGCCs. Meanwhile, EPA acknowledged that several gigawatts of new NGCCs are likely to be built under business as usual to replace existing fossil capacity. While it still did not count any generation from this expected new NGCC capacity in its BSER determination, the agency did request public comment on the issue. EPA revisited the topic in response to initial comments on the CPP proposal in its October 2014

Notice of Data Availability (NODA). Several comments pointed out that the four building blocks ended up asking little of coal intensive states with little or no existing NGCCs, while states with a lot of both coal and NGCCs had much higher burdens. EPA again asked for comment on if and how new NGCCs should be considered in its goal calculations as it moves to finalize the CPP.

A focus on recent trends

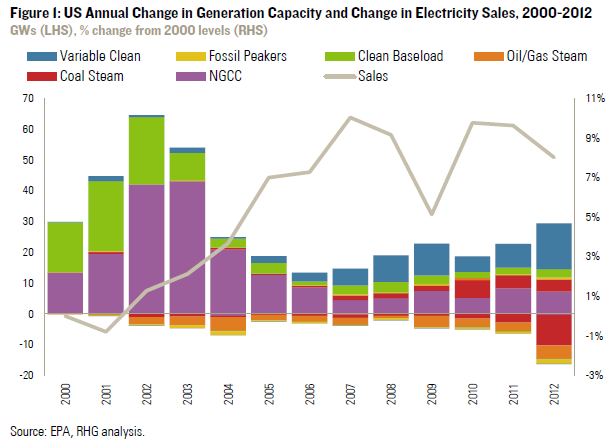

One approach EPA could use to incorporate generation from new NGCCs into the CPP goals is to look at recent industry trends in replacing fossil base load generating capacity. Basing BSER determinations on observed changes in the power sector increases their defensibility and prevents EPA from going too far afield in its search for reasonable and cost effective abatement opportunities. Figure 1 shows US generating capacity additions and retirements over the past 12 years. In the early 2000s there was a surge of NGCC and peaking unit additions in response to relatively cheap gas prices and a surge in electric demand. Meanwhile there were relatively few retirements. The later part of the decade saw demand flatten out on average while variable clean resources such as wind and solar took off in response to state policies and declining costs. From 2008-2012, annual NGCC additions peaked at 8GWs – far from the 40 GW years of 2002 and 2003. In the same period fossil capacity retirements ramped up – setting a record of 14.5 GWs in 2012 – as old, inefficient units reached the end of their useful lives.

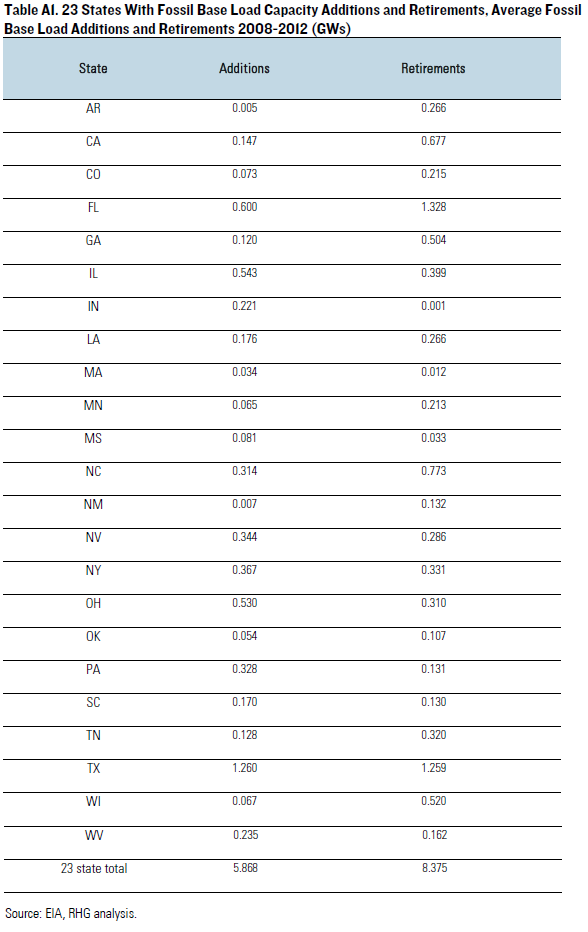

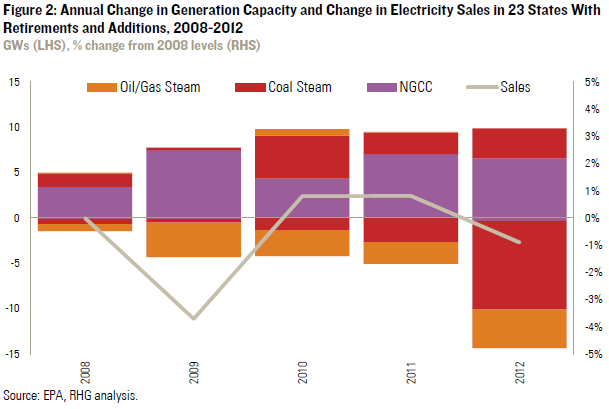

Figure 2 takes a closer look at the recent trend in capacity retirements by focusing on changes to fossil base load capacity in the 23 states that experienced both additions and retirements from 2008 through 2012 (for a list of states in this group along with capacity data, see the technical appendix at the end of this note). This five year period is relevant, as demand was flat and significant environmental regulations on fossil plants, such as the Mercury and Air Toxics Standards, were yet to be finalized and can’t be cited as a major driver of retirements. The 23 states are relevant because they represented 96% of total US retirements in the period and consist of a diverse set of states, both geographically and by power market structure. Restructured power market states such as Illinois, Massachusetts, and Texas, as well as vertically integrated states like Georgia, Nevada, and Florida are included in this group. It’s clear that when fossil base load capacity gets retired, new fossil capacity that plays a similar base load role on the grid tends to take its place. With flat power demand in this period, new capacity couldn’t have been built solely on speculation that demand might pick up in the future. It’s far more likely that new plants were built to replace retired capacity.

While NGCCs dominated capacity additions, coal steam capacity also was added. The latter option isn’t available now that EPA’s proposed standards for new fossil plants prohibits new coal units not equipped with partial carbon capture and storage. This recent trend in states experiencing nearly all of the nation’s fossil retirements demonstrates a low cost way to replace fossil steam base load capacity. EPA could take this trend into account and incorporate it into its final CPP BSER determination in late summer of this year.

Incorporating new NGCCs into EPA goals

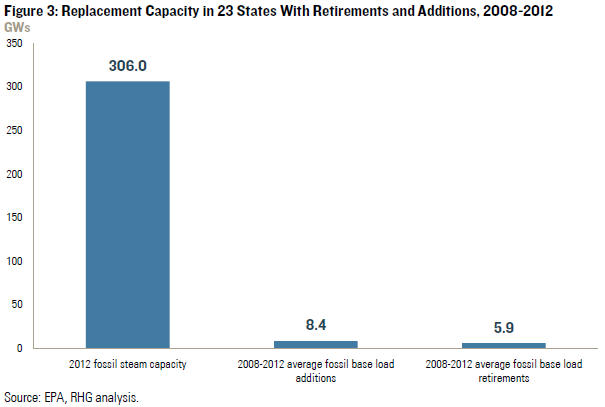

To incorporate generation from new NGCCs into its BSER determination and state goal calculations, EPA needs to have a benchmark for best practice base load capacity replacement that can be applied to each states’ generation fleet. Figure 3 summarizes the trends in the group of 23 states mentioned above. In 2012, the base year for EPA’s goal calculation, these states were home to 306 GWs of fossil steam capacity. Between 2008 and 2012 just over 8 GWs of new fossil base load capacity was added each year, while just under 6 GWs of capacity was retired. EPA could conservatively estimate that best practice in the utility industry for capacity replacement is retirement of 1.9% (5.8GWs/306GWs) of a state’s fossil steam capacity annually. EPA might assume that

capacity could be replaced one for one with new NGCCs within a state, again reflecting industry trends and recognizing the limits imposed by EPA’s proposed power plant New Source Performance Standards (NSPS). EPA could then assume that new NGCC replacement capacity runs at 70% capacity factor and that all new NGCC generation displaces fossil steam generation consistent with its current building block two assumptions. Other factors EPA could consider as part of this approach include a state’s access to adequate natural gas pipeline capacity, the timing required to build new infrastructure, and overall abatement cost relative to other building blocks.

For example, if a state has 10 GWs of coal capacity, EPA could assume that 190 MW of that capacity could be retired and replaced with the same amount of new NGCC capacity each year. At a 70% capacity factor the new capacity would displace 1,168,272 MWHs of coal generation as part of building block calculation. The exercise would be repeated in each goal calculation year with an additional 1.9% of new NGCC’s added to the equation, unless there is no more fossil steam generation left to displace.

Another question EPA raised in its CPP proposal was how should it account for generation and emissions from new NGCCs regulated under NSPS (not the CPP) in its goal calculations? We believe the most defensible approach requires subtracting the displaced fossil steam generation and emissions from the denominator and numerator, respectively, in a state’s goal. Meanwhile, the generation and emissions from new NGCCs would not be added into the denominator and numerator, respectively, of the emission rate calculation, since new NGCCs are not subject to CPP regulation. EPA could add a fraction of the generation from new NGCCs to the denominator as an incentive, based on the amount a new NGCC’s emission rate is below the final emission rate established under EPA’s NSPS.

NEW NGCCS CAN REBALANCE CPP EMISSION RATE REDUCTION REQUIREMENTS

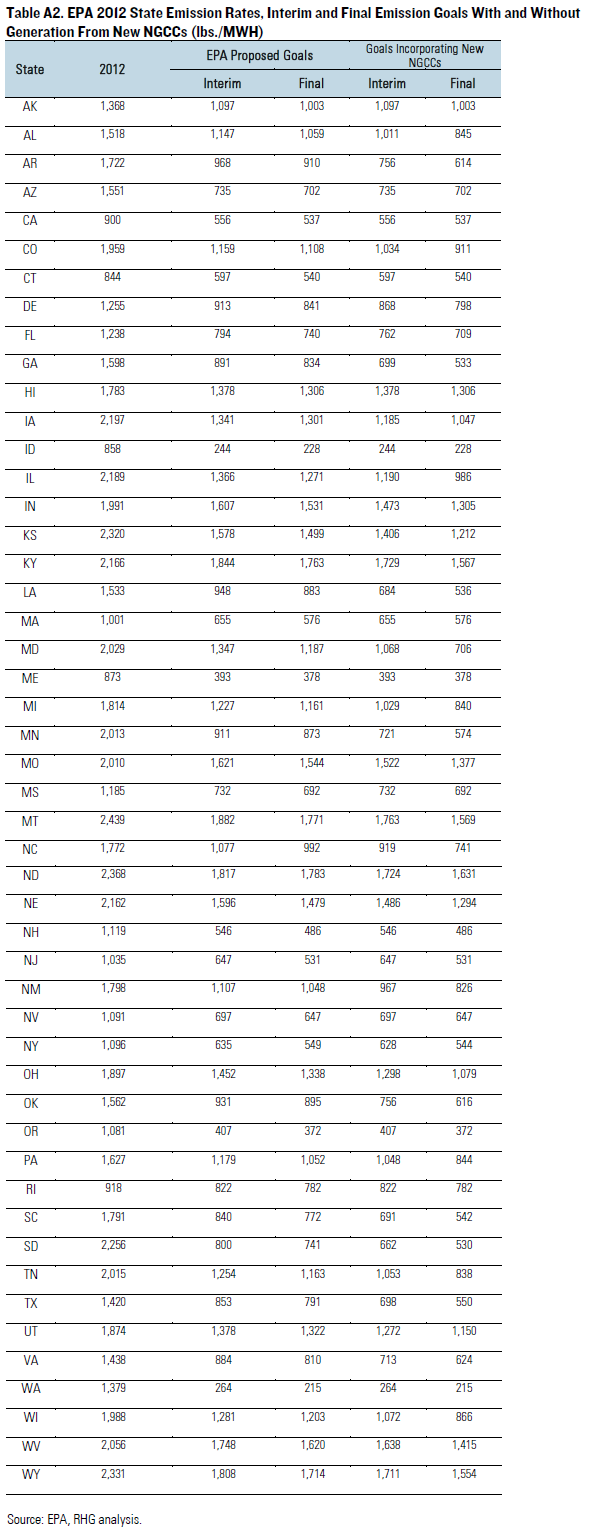

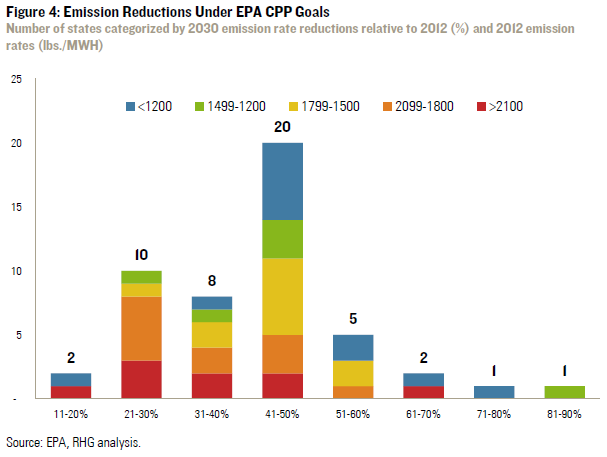

Under EPA’s proposal the most carbon intensive states generally aren’t prescribed stringent emission rate goals relative to the rest of the country. This is largely due to these states having very few, if any, existing NGCCs that could be used to displace coal generation under building block two. Another factor is that most coal heavy states are big electricity exporters, which diminishes the impact of in-state demand side efficiency on state emission rate goals under building block four. Figure 4 shows the distribution of 2030 state goals based on EPA’s proposal, with states categorized by their 2012 carbon intensity. In the graph there are more red and orange bars (the most carbon insensitive categories) on the left hand side, with relatively small reductions in emission rates compared to 2012.

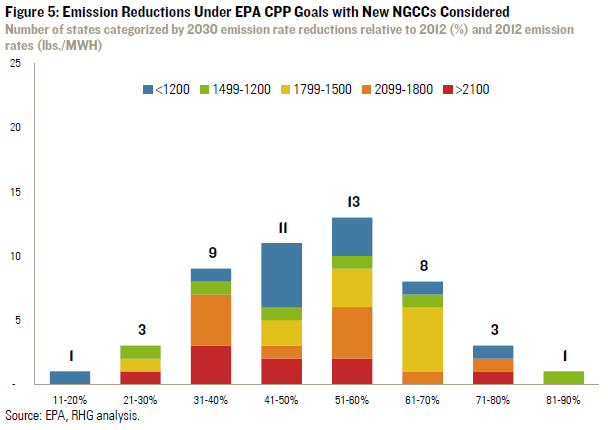

Figure 5 shows the impact of incorporating generation from new NGCCs into the equation by applying the approach described above to all states except Hawaii (which doesn’t have any natural gas infrastructure). 1.9% of a state’s fossil steam capacity is assumed to be replaced with new NGCCs each year, displacing fossil steam emissions and generation in the goal calculation. 13% of new NGCC generation is added to the denominator, reflecting the average emission rate performance of new NGCCs relative to EPA’s proposed NSPS standard. All other goal calculation components are the same as in EPA’s proposal (a table comparing EPA goals and our recalculated goals incorporating generation from new NGCCs can be found in the technical appendix at the end of this note).

When generation from new NGCCs are considered, carbon intensive states would have to achieve greater emission rate reductions than in the current proposal, while most other states would see little or no change to their goals. Goals that incorporate generation from new NGCCs also produce a more even distribution of reduction

requirements across states. It’s important to remember that including new NGCCs in CPP goals doesn’t require any state to build new gas capacity it just adjusts the stringency of the goals to reflect the emission reduction potential of that particular option.

NEW NGCCS CAN RAISE CPP AMBITION WITH MODEST IMPACTS ON NATURAL GAS PRICES

When generation from new NGCCs are incorporated into state goals, the increased stringency in carbon intensive states doesn’t just rebalance the distribution of state emission rate target, it increases the aggregate ambition of the CPP. To understand the emissions and natural gas market implications of incorporating new NGCCs into CPP goal calculations, we revisit our comprehensive analysis of the CPP, Remaking American Power, conducted in partnership with the Center for Strategic and International Studies (CSIS). In that report we used the RHG-NEMS model to assess the energy market impacts of a variety of CPP scenarios. The Regional W/EE (Regw/EE-CPP) scenario in that report captured the impact of the CPP if states (or 22 NEMS regions in the analysis) each implement the rule using tradable performance standards (TPS) set to achieve EPA’s proposed goals, without any interstate cooperation and all states crediting energy efficiency measures to the same level as EPA considered under building block 4 four. We compare that scenario with one where the EPA goals are modified to incorporate generation from new NGCCs (Regw/EE-NGCC). The regional W/EE scenario was chosen for this comparison because it most closely reflects the implementation of state-specific emission rate goals using all four building blocks without making any presumption about state cooperation. For a full discussion of our assumptions and analytical approach please refer to our Remaking American Power report.

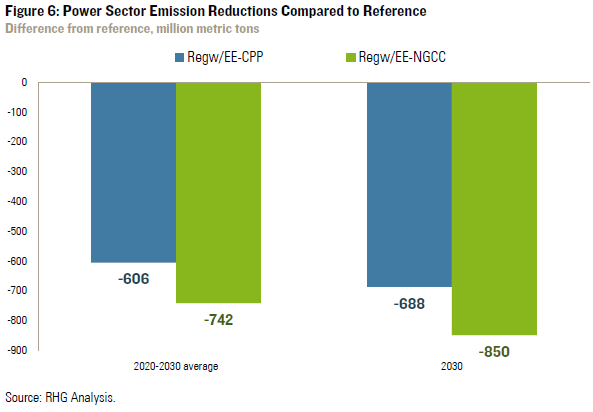

Figure 6 shows the emission reductions achieved compared to a reference case keyed to EIA’s Annual Energy Outlook 2014. Over the 2020-2030 CPP compliance period, new NGCC adjusted goals achieve nearly 140 million metric tons per year more emission reductions on average compared to EPA’s proposal. This amounts to a 31% reduction in emissions from reference on average compared to a 25% cut without generation from new NGCCs considered. In 2030 NGCC adjusted goals could allow the CPP to achieve reductions of 850 million metric tons (34%) compared to reference, 160 million tons more than EPA’s proposal (28%). In comparison to 2005 emission levels, by 2030 new NGCC goals could achieve a 35% reduction in emissions compared to 31% for the CPP as proposed.

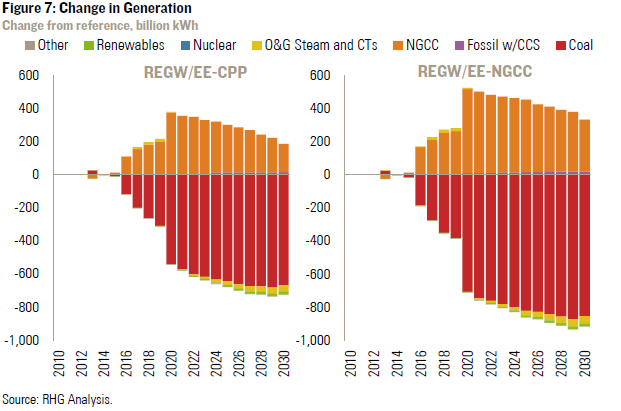

Just as we found in our work with CSIS, shifts from coal to natural gas generation represent the least cost pathway towards compliance with the CPP, even with more ambitious goals reflecting generation from new NGCCs. Figure 7 shows the change in generation compared to the reference case for the two scenarios. When generation from new NGCCs are included in state goals, NGCC generation increases on average by 140 billion kWh a year compared to the CPP as proposed and in turn displaces more coal generation.

This surge in natural gas generation has a small impact on the natural gas market, thanks to deep, low-cost supplies of natural gas from the shale boom. Figure 8 shows the change in gas consumption and Henry Hub spot prices under the two CPP scenarios. Under our new NGCC scenario, natural gas consumption increases by 10% or 8 billion cubic feet (bcf) per day on average compared to the reference case between 2020 and 2030. This increase in demand results in a 4% increase in Henry Hub natural gas prices or 21 cents/mmbtu (in 2012 dollars). Under the CPP proposal gas consumption increases by 7% or 5.5 bcf/day, resulting in an increase in prices of 1.4% or 7 cents/mmbtu. These results should reassure EPA that consideration of generation from new NGCCs in its BSER determination will not make building block two abatement costs prohibitively high.

While EPA is fully expected to revise the CPP when the rule goes final, it remains to be seen how they will incorporate feedback on treatment of generation from new NGCCs. With substantial abatement potential and small impacts on natural gas markets, incorporating generation from new NGCC’s appears to be a feasible way to increase ambition and rebalance the distribution of state goals at reasonable costs.

TECHNICAL APPENDIX