Spread Thin: China’s Science and Technology Spending in an Economic Slowdown

China's economic slowdown will likely force Beijing to channel S&T funding toward a narrower core of national security-relevant companies and priorities.

In recent years, G7 countries have ramped up trade and investment controls to contain the growth of China’s dual-use high-tech sectors and to limit spillovers of China’s muscular industrial policy to their industries. Faced with growing geopolitical headwinds, the Chinese government has doubled down on its ambition to become a more self-reliant global technological powerhouse. “Scientific and technological innovation has become the main battlefield of the international strategic game,” said Xi Jinping in a speech on May 28, 2021, “and the competition around the commanding heights of science and technology is unprecedentedly fierce.”

But slowing economic growth in China could rein in Beijing’s ambitions to become an innovation powerhouse in isolation. History suggests that slowing economic growth tends to negatively affect innovation funding and capacity. The trend could be even more acute in China, where local governments, which play an outsized role in science and technology (S&T) funding, find themselves under intense fiscal pressure.

In this note, we provide a detailed picture of the main funding sources for China’s innovation ecosystem and assess how each could be affected by slower growth and a tighter fiscal environment in China. Scarcer resources will likely force the government to channel funding more strategically toward a narrower core of national security-relevant technologies and companies. Overall lower S&T spending will not necessarily impede China’s ability to develop as a global leader in these strategic sectors. It could, however, slow China’s development of a well-rounded innovation ecosystem—the kind that facilitates spillovers between technologies, fosters the emergence of next-generation innovation, and keeps talent and resources mobilized, even in less critical fields.

The impact of China’s economic slowdown on S&T funding sources

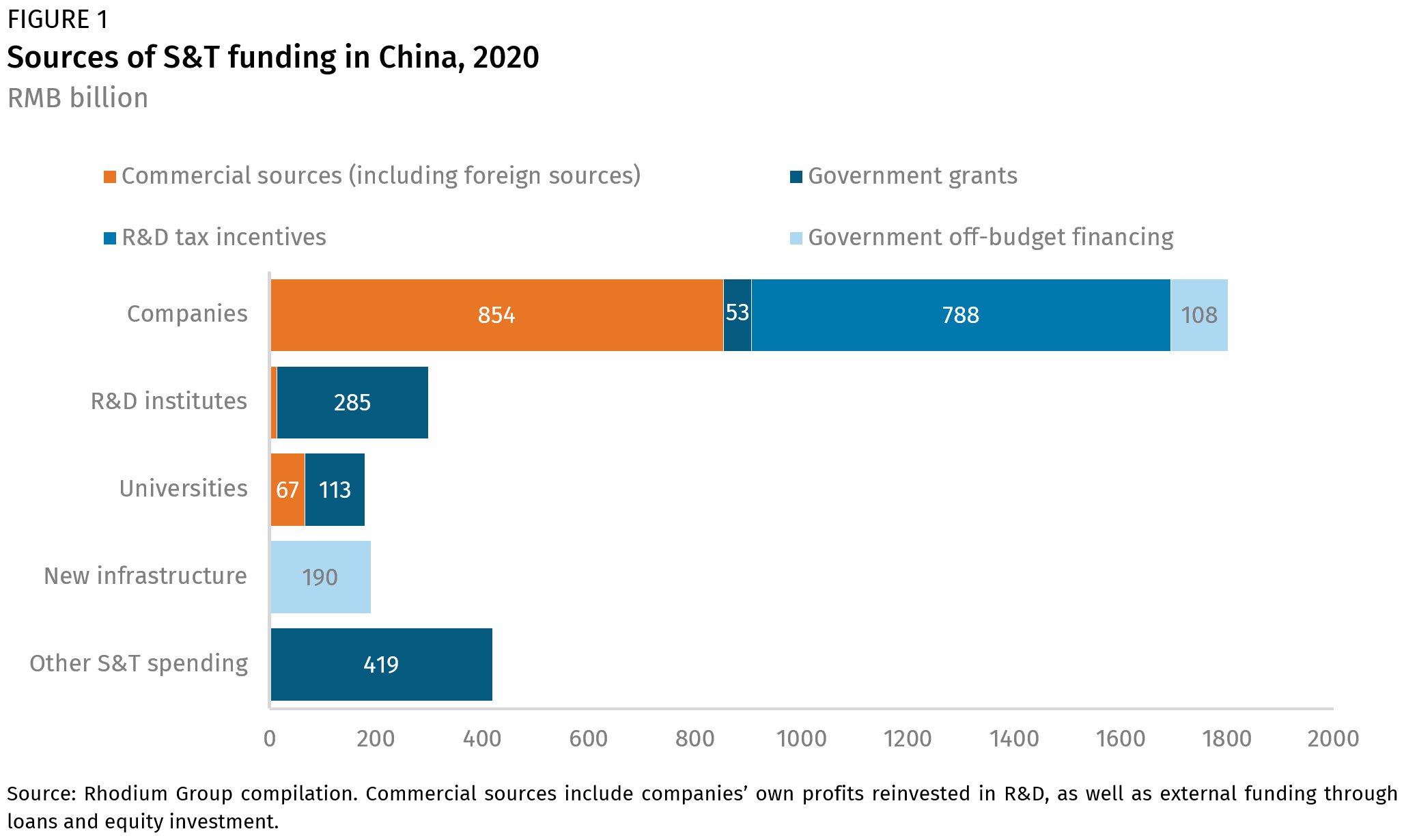

As elsewhere in the world, funding for China’s innovation ecosystem comes from a variety of commercial and public sources and flows to a wide range of public and private S&T actors. In contrast to other large and technologically advanced economies, however, government-related sources play a dominant role in China, representing around 60% of all financing flowing into the country’s S&T ecosystem (see Figure 1).1

Because government-related funding underwrites so much of China’s S&T system financing, weakening fiscal conditions pose a high risk of disruption. Local governments, many of which are facing fiscal crunches, were responsible for about two-thirds of total government S&T spending in 2022. Other sources of funding for S&T, including commercial financing channels from reinvested profits to equity and loans, will also face pressure from slowing economic growth.

Funding to universities and research institutes

China’s universities and R&D institutes are most directly at risk from the country’s slowing economy and local government fiscal woes. These institutions play a crucial role in China’s innovation ecosystem, accounting for 85% of China’s basic research spending, and are largely supported through government funding. In 2022, they received an estimated RMB 438 billion (USD 65.1 billion) of budgetary spending for R&D activities, representing about 70% of their overall S&T budget, a 34% increase from 2018. Spending is mostly—and increasingly—shouldered by local governments, which accounted for 68% of government support to universities and research institutes in 2022.

Local government budgetary funding is likely to come under increasing pressure in the coming years. Local government revenues have been consistently falling as a share of GDP, from about 12% in 2015 to 9% in 2022. Tax revenues, which fund 70% of local governments’ general budgets, have also fallen in absolute terms in 2020 and 2022 due to tax breaks given during the pandemic, as well as smaller corporate income tax and value-added tax revenues from a slowing business sector. On top of all this, many local governments are facing increasingly heavy debt repayment burdens, accumulated before and during the pandemic.

Despite falling revenues, local governments are being asked to spend more across a range of policy priorities, especially as an aging population retires at an accelerating pace and demands more of public healthcare and social systems. This is already affecting direct government spending for S&T, which increased more slowly than spending for health and social security in the past decade, according to official budgets. With evidence mounting that even basic spending obligations are coming under stress in certain localities, and with anecdotal reports of late or missed payments for transportation and health workers, it is becoming clear that the growth of local budgetary S&T spending will also be constrained.

Reduced S&T spending ability will put China’s 3,000 provincial-level universities, plus local government-funded research institutes, laboratories, and research projects particularly at risk. The effects of a local government fiscal crunch will not be equal across provinces. About half of China’s direct local government S&T funding comes from five wealthy provinces that generally have more stable finances. But even they are not immune to fiscal constraints. In 2022, the average general budget revenues of these provinces declined by 4%, compared with 8% on average for all provinces.

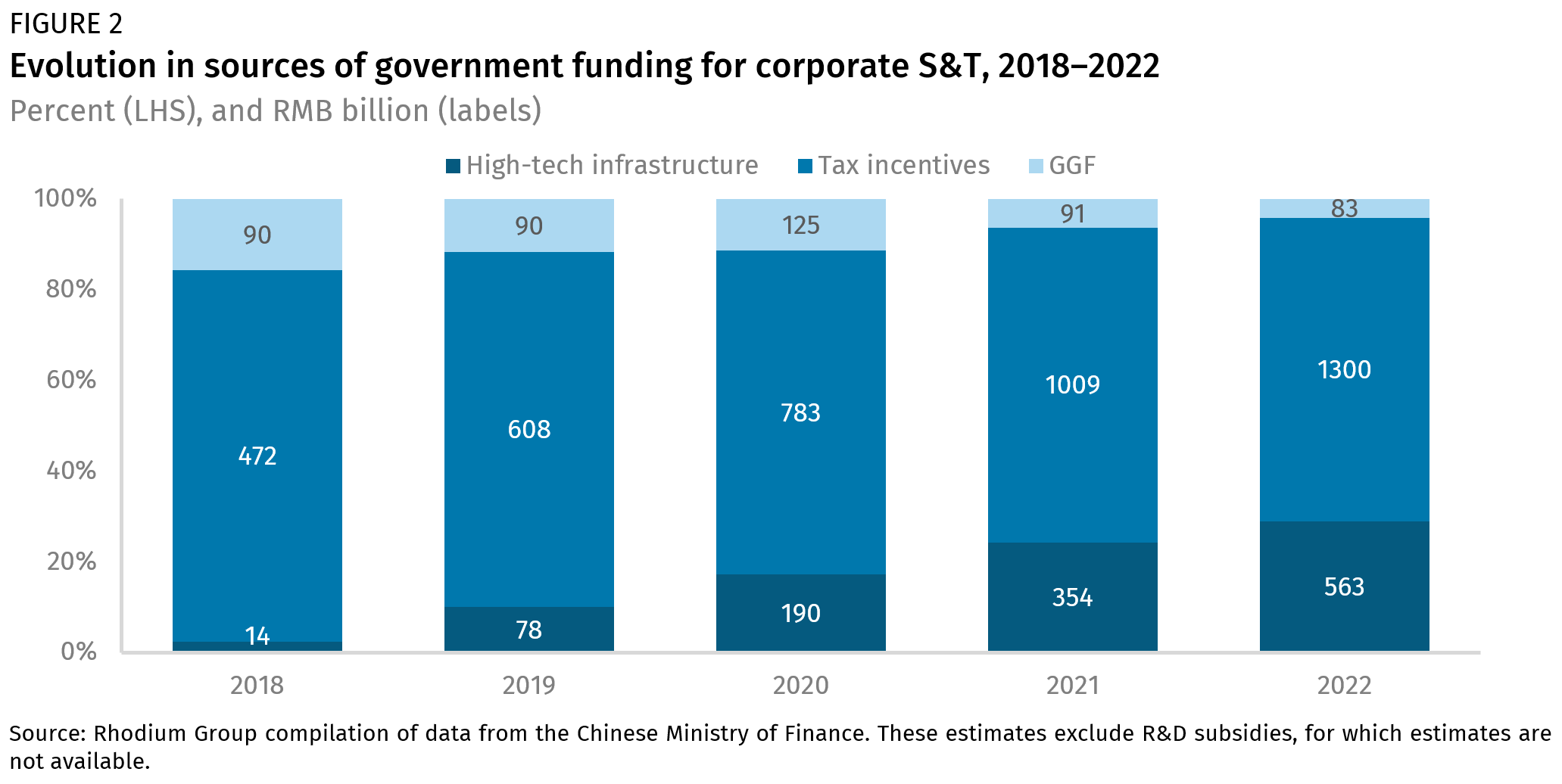

Government funding to encourage corporate R&D

Over the past decade, China’s government has also ramped up its support to corporate R&D through subsidies and tax incentives, as well as through indirect instruments such as equity financing and high-tech infrastructure (Figure 2). All sources of funding have grown quickly, but tax rebates alone registered a whopping average annual growth rate of 28.8% between 2018 and 2022—becoming the single largest source of government funding for corporate R&D at RMB 1.3 trillion (USD 193.3 billion) in 2022.2

Yet, like direct S&T support to universities and research institutes, tax incentives mostly come out of local governments’ pockets. They therefore hinge on localities’ ability to maintain or grow tax revenues—a harder task amid a slowing economy. Because tax incentives represent more than half of corporate R&D spending, the effect of a funding slowdown could be stark. Earlier-stage companies in emerging and less-profitable fields, like robotics or fuel cells, are comparatively more reliant on government funding for their R&D activities, putting them more at risk.

Local fiscal constraints could also put a brake on newer, indirect sources of government funding for S&T, like semi-fiscal spending for “new infrastructure” projects that support high-tech sectors such as AI and clean technologies. According to Rhodium’s partial database of “new infrastructure” projects, this funding grew by a factor of 40 between 2018 and 2022, to reach RMB 563 trillion (USD 83.7 billion).3 Alternative sources of S&T funding also include government guidance funds (GGFs) that leverage state equity investment to funnel private funds into innovative companies. By single transaction amounts, these investments are fairly small, but they indicate government priorities—a helpful signal for private investors in China’s heavily politicized economy. Altogether, they represented no less than RMB 83 billion (USD 12.3 billion) in funding to high-tech Chinese companies in 2022.

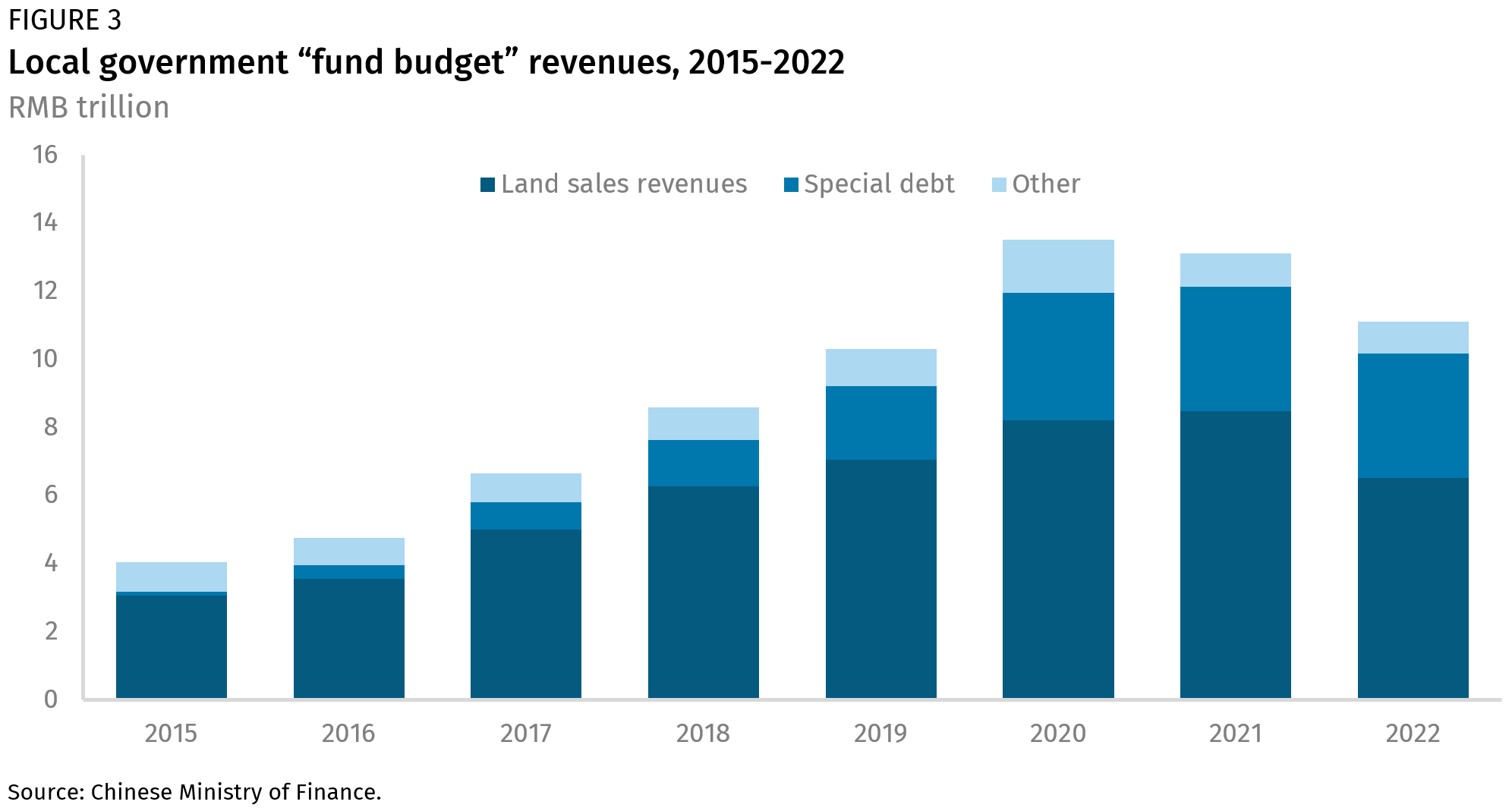

“New infrastructure” and GGFs are financed by local governments through a special government “fund budget” (Figure 3). These budgets are dependent on land revenues and debt, which made them less constrained than budgetary funding in the past. But the stability of their revenue sources is now in question. Between 2021 and 2022, land sales revenues have fallen by 23%, while unsustainable levels of debts and rising interest payments constrain local governments’ ability to use more debt to finance new projects. Even in rich provinces like Guangdong and Jiangsu, associated interest payments as a share of public revenues grew by 30% and 25% between 2015 and 2021, accounting for 5.4% and 7.3% of revenues, respectively.

These constraints will impact investment levels in high-tech zones and facilities, as well as equity in innovative companies. As Beijing strives to rebalance local governments’ investment toward new growth drivers, high-tech infrastructure could prove slightly more resilient overall.

Commercial sources

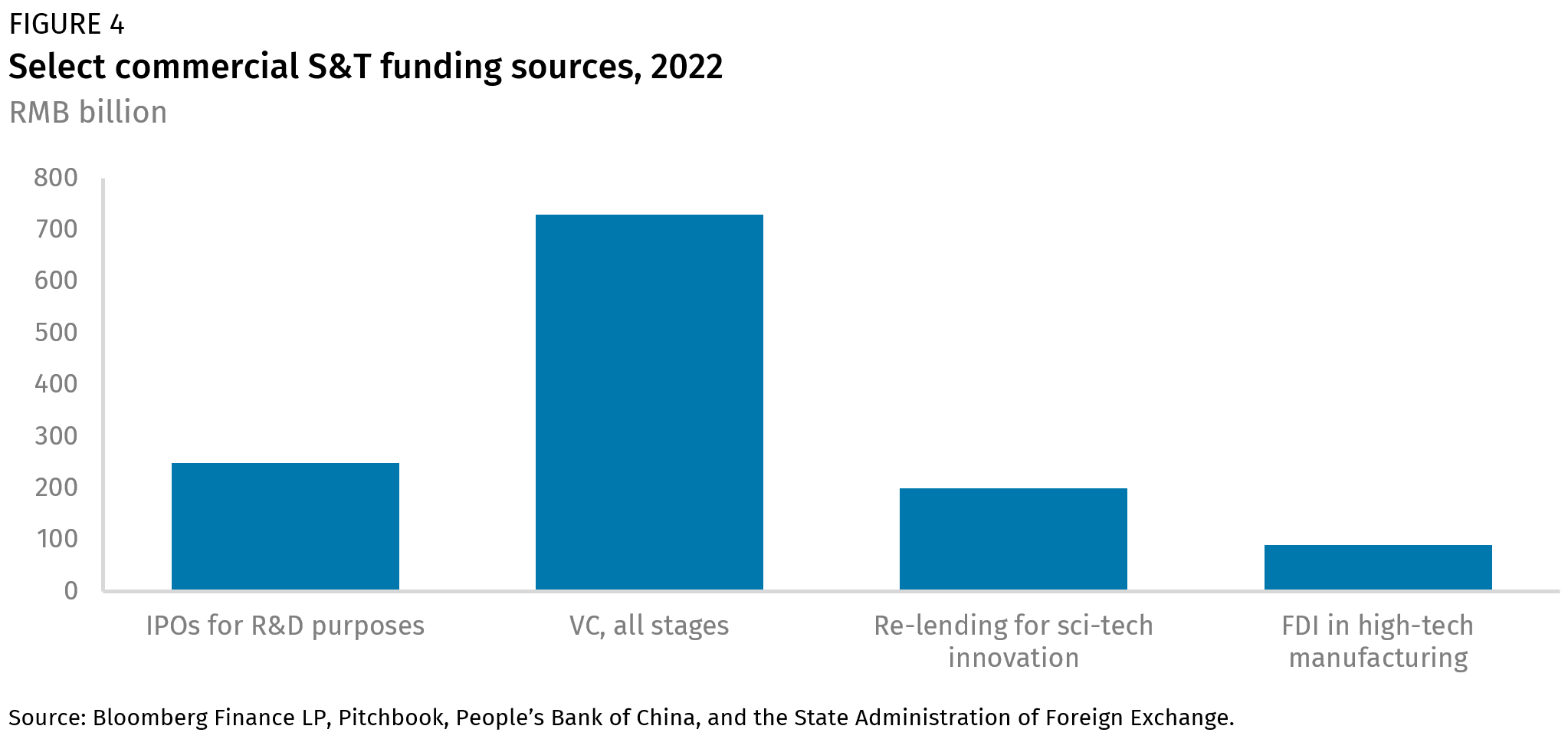

Finally, China’s economic weakness should also impact the commercial sources that constitute the other ~45% of corporate R&D funding in China. Most commercial funding comes from corporate profit reinvestment.4 But for firms that do not break even, venture capital (VC) and private equity (PE) financing are also available as crucial sources of financing. Finally, companies often raise R&D funding through IPO financing, and preferential or commercial loans, which are broadly available to innovative firms in China’s politically-driven banking system (Figure 4).

Coming on top of recent crackdowns on tech firms, China’s economic slowdown is affecting corporate profits, especially in major S&T verticals exposed to weak consumer spending—including major innovative firms in the AI field, such as Alibaba, Tencent, Kuaishou, and Xiaomi. The revenue of enterprises focusing on information services (including news information, search, social networking, games, and music videos) fell by 2.5% y/y in H1 2023. And China’s largest internet companies reported reducing their R&D spending by 6.8% y/y in the same period. China’s tech sector, more broadly, has experienced massive layoffs, hiring freezes, and systematic pay cuts over the past two years, directly affecting its R&D staff and capacity. Beyond just a short-term slump, growing uncertainty could discourage companies from spending on ambitious, shoot-for-the-moon projects and other critical exploratory research.

The slowdown is also affecting equity financing channels, which have become a crucial source of funding for China’s start-ups. China’s VC funding was cut in half (-48%) in 2022 compared to 2021 and was down another 17% y/y in H1 2023—with direct negative effects on early-stage funding and VC-dependent industries like biotech. The trend is not limited to just China: the past few years have seen a global downturn in VC funding. But it will nevertheless deprive Chinese start-ups of an important source of funding and know-how and knowledge transfer. According to Pitchbook data, VC transactions with foreign participation fell from 21% to only 10% of total transactions between 2021 and 2023. Inbound foreign direct investment (FDI)—which has been an important channel for bringing foreign capital, know-how, and technology to China—also turned negative for the first time in Q3 2023, according to data from SAFE.

Finally, though loans are not a typical source of R&D financing in advanced economies, they play an important role in China given the policy-oriented nature of the country’s financial system. Banks are incentivized to hand out loans targeting innovation activities—16% of technologically innovative firms in China used bank loans in 2020 to finance their R&D, according to the SAFE report cited above.

Looking ahead, however, Chinese banks will likely be required to shoulder much of the cost associated with local government debt restructuring processes, which will reduce their profits and ability to extend credit to the rest of the economy. Cases of high-tech companies defaulting might also deter banks and investors from lending to innovative firms.

Ultimately, the willingness of Chinese financial institutions to continue lending to S&T players will depend on deeper government moves to raise incentives to redirect credit towards more innovative parts of the economy. But this would require Beijing to overturn implicit guarantees for local government, LGFV, and SOE borrowing by letting a series of state-linked actors default—a move not yet in the cards.

Instead, in the context of an economic slowdown, SOEs could attract a growing share of innovation funding going forward, as they are the most trusted actors in an increasingly government-controlled innovation ecosystem. This could incentivize low-quality, low-efficiency innovation. Though SOEs have increased their R&D spending faster than their private peers in the past few years, they produce on average far fewer higher-quality international patents.

Pathways out of the S&T funding crunch

To maintain high levels of S&T financing—a core priority for Beijing—in a context of slowing growth and rising fiscal constraints, the central government could decide to take a number of measures:

- It could choose to take bold reform steps to increase fiscal revenues, including a series of fiscal reforms that would see a greater redistribution of VAT revenues to local governments, and a long-debated property tax. China’s leaders are familiar with these solutions, but have faced strong resistance for years and seem unlikely to be implemented in the short term.

- The government could increase central-to-local fiscal transfers and make more of them conditional upon S&T funding. As of 2023, a mere 0.06% of central-to-local transfer funds were formally tied to S&T. Filling in for local governments’ S&T contribution would however require significant new fund allocation from the central level, as well as an expansion of China’s central budget deficit. But much like local governments, Beijing is also facing hard choices between different funding priorities, and under financial constraints, it could well decide to prioritize securing social, economic, and financial stability.

- The government could try to backfill government S&T funding sources with commercial ones. This is an easier and likelier move, and arguably already underway. Last year, the government launched a “scientific and technological innovation re-lending quota,” aimed at unlocking RMB 200 billion (USD 29.7 billion) and RMB 400 billion (USD 56.6 billion) in S&T funding for innovative firms in 2022 and 2023, respectively. The government is also increasingly encouraging financial markets to align with technological priorities. In November 2022, then-CSRC chairman Yi Huiman said that capital markets exist to “help implement national strategies regarding technological self-reliance and the development of modern industries.” As of March 2023, 20% of firms listed on the ChiNext stock exchange, 43% on the STAR market, and 40% on the Beijing stock exchange were “little giants,” government-sponsored high-tech manufacturing companies. By continuing to send strong political signals that strategic industries need to be prioritized, Beijing might eventually channel greater bank lending and equity support to priority sectors, and even convince entrepreneurs to focus their energies on state-defined S&T priorities.

- The government could also increase its use of non-financial tools in support of innovative firms and key S&T actors. China’s innovative national champions and little giants already have access to a range of non-financial benefits that give them a competitive advantage against non-strategic, often foreign, companies. These include favorable legal and regulatory treatment, preferential licensing or public procurement access, informal guidance to state-linked actors to favor Chinese firms and products, market access barriers to foreign competitors, or state actors providing low-price input to key S&T players. In the context of greater financial and fiscal constraints, these non-financial tools might become even more pervasive.

- Finally, the government could decide to concentrate its scarcer resources on a few sectors and actors deemed most critical for China’s long-term national security. There are indications that such re-prioritization is happening. In universities, social science research is being deprioritized to concentrate resources on hard sciences. Sectors like semiconductors, and firms like Huawei, have already received increasing government support, including through redirecting procurement of SOEs to favor local champions. While the total amount of GGF investment has decreased in the past two years, in September 2023, the government launched the largest-ever semiconductor fund under the China Integrated Circuit Industry Investment Fund, with a target of RMB 300 billion (USD 40 billion) and a focus on chip manufacturing equipment. But narrowing down the focus of China’s innovation funding will not be easy. Amid increasing derisking and diversification efforts, the government might need to manage a widening range of chokepoints, from agricultural machinery to advanced robotics and software.

Implications for China’s innovation ecosystem

While China’s total S&T spending might still grow in the coming years—especially if it takes some of the steps outlined above—it will most likely be at a much slower pace than over the past decade. This will put Beijing in a difficult spot. China’s research spending as a share of GDP (2.43% in 2021) is still well behind top innovators such as the United States (3.46%), Japan (3.30%), South Korea (4.93%), or Germany (3.13%)—and its basic research spending as a share of GDP is less than a third of that of South Korea and the United States.

If the government manages to concentrate scarcer resources on a narrower pool of firms and technologies, however, its technological prowess in these sectors could well continue to grow. Beyond semiconductors, technological chokepoints that create national security vulnerabilities and disruptive future technologies crucial to the long-term race for technological primacy are likely to be prioritized. The 2023 Government Work Report listed AI, quantum computing, integrated circuits, high-end chips, operating systems, industrial software, and fundamental hardware and software as core strategic sectors. These sectors will likely continue to receive significant government funding, even under the conditions of an economic slowdown.

But basic research will be hard to expand without a rapid growth in government budgetary support. And focusing resources on a limited set of government-picked technologies and firms runs the risk that China’s wider innovation ecosystem will suffer. Innovation is rarely linear and predictable—it often happens through spillovers between different technological areas and interactions between a wide variety of actors. Though the Chinese government has been successful in encouraging key technologies like renewable energy that are powering a major change in today’s global economy, it may not be as successful in selecting the technologies of the future.

The human factor is also key to innovation. So far, the government has failed to create the skills and employment rebalancing it had hoped for. In the past year, the pressure to ramp up research activities despite scarcer resources has resulted in per capita funding for researchers falling by RMB 5,000 (USD 743.5) compared to 2021. Faced with a shortage in funding, universities in China also raised student fees across the board in 2022—by more than 50% in some instances—making it more difficult for a generation of Chinese scholars to access quality education. The dampening study and employment prospects, salary stagnation, and worsening in working conditions that result from the economic downturn may also affect the productivity and entrepreneurial drive of a whole generation of innovators.

Footnotes

1. To compile these estimates, we added together a wide range of direct and indirect funding data. Data for direct government and corporate funding comes from the China Science and Technology Statistics Data Book, 2021, from the Ministry of Science and Technology, China’s Bureau of Taxation, and proprietary dataset of Special Revenue Bonds and Government Guidance Funds. Government funding includes the central, provincial, and sub-provincial levels. High-tech infrastructure is estimated by extrapolating from the eight provinces in Rhodium’s proprietary database on Special-Revenue Bond funding with a similar high-tech infrastructure-to-total special revenue bonds ratio. Amounts disbursed in 2020 by the eight provinces in our database are calculated by dividing the total project amounts by the number of years the projects will run, including all projects with a running period that include 2020. R&D tax incentives are estimated using the Bureau of Taxation’s reported amount of RMB 1.3 billion (USD 193 million) in 2022 and their reported average annual growth of 28.5% every year between 2018 and 2022. Note that our finding contradicts official numbers that claim that government-based funding for S&T is closer to 20% of total, grossly under-estimating indirect funding and tax incentives for innovation. Our GGF funding estimate assumes 35 % of total investment going to high-tech companies.

2. We take a broad approach to scoping out tax incentives meant to encourage innovation, which includes various kinds of tax incentives for start-ups and small businesses based on reports by China’s Bureau of Taxation. Within those tax incentives, the R&D “super reduction” scheme resulted in a total tax savings of RMB 333.3 billion for Chinese companies in 2021. Although there is no consistent data available to estimate the scope of R&D subsidies, the amounts at stake are likely much smaller. For example, a CSIS report mentions USD 9.4 billion (RMB 64.9 billion) in R&D subsidies in 2019. See Gerard DiPippo, et al., “Red ink: Estimating Chinese industrial policy spending in comparative perspective,” Center for Strategic & International Studies (CSIS, May 2022).

3. Rhodium data covers the eight largest issuers of special revenue bonds, the financial vehicles most often used by local governments to fund these investments.

4. A 2020 report from the State Administration of Foreign Experts Affairs (SAFEA) found that 87.2% of technologically innovative firms relied on revenues to fund their S&T activities.