The New Complexity of Chinese Outbound Investment

Alternative data points suggest that the growth of China’s outbound investment in 2014 was much less spectacular than official data suggest.

After aggressive policy liberalization that effectively lifts approval requirements for most overseas deals, outbound foreign direct investment (OFDI) by Chinese firms is projected to reach a new record high of $120 billion this year. However, the recent liberalization of capital controls has also further complicated the task of accurately recording such outflows. Alternative data points suggest that the growth of China’s outbound investment in 2014 was much less spectacular than official data suggest.

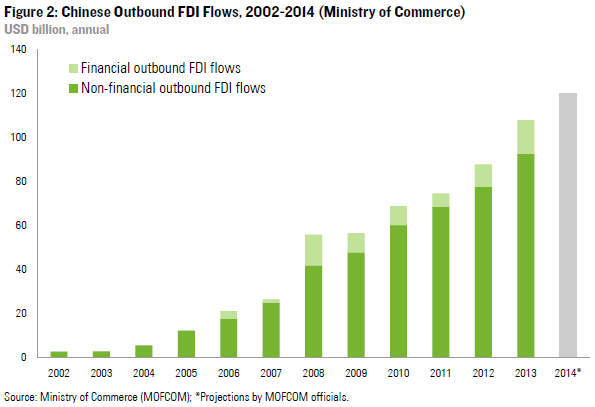

A decade of steady growth: Official data from China’s Ministry of Commerce (MOFCOM) show that outbound FDI by Chinese firms is on track for a projected $120 billion in 2014, bolstered by recent reforms that significantly cut approval requirements for investors.

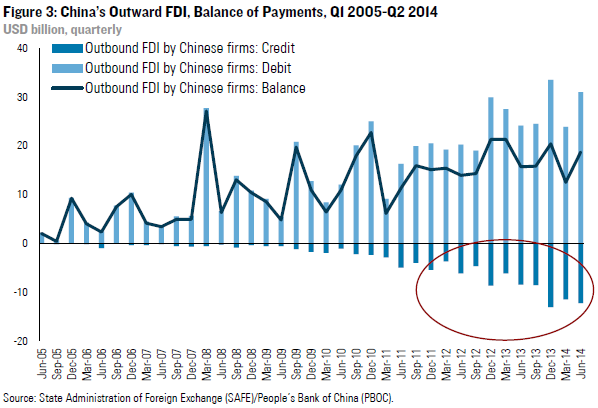

Greater two-way traffic: However, MOFCOM’s data largely ignores reverse flows from overseas subsidiaries back to Chinese parent firms, which have jumped in past 2 years because of greater freedom to move money both ways and a tighter credit environment in China. Taking a net perspective as presented in central bank data, outbound FDI this year was significantly lower than MOFCOM figures suggest.

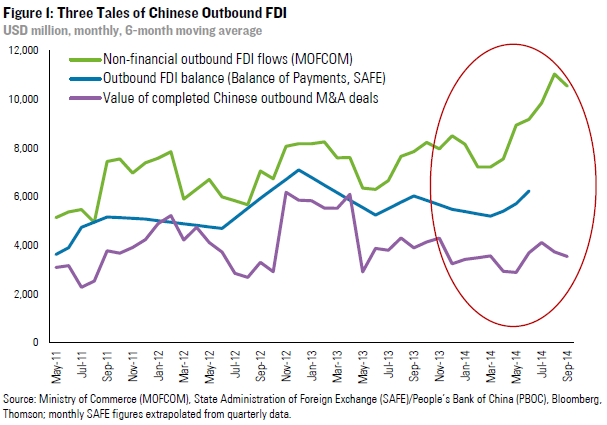

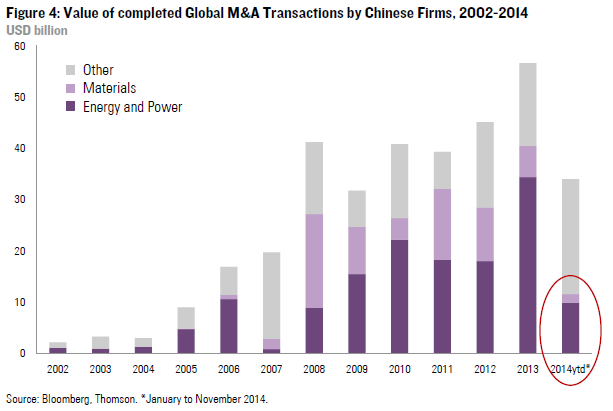

A new hole in the wall: Official statistics showing strong OFDI growth in 2014 are also in contrast with a significant drop in global M&A deals by Chinese firms, ending a long-standing correlation between OFDI and global deal-making. The coincidence with more liberal policies suggest that at least a portion of recent OFDI growth can be attributed to portfolio and other short-term investment flows disguised as direct investment.

A Decade of Steady Growth

The most commonly cited figures for Chinese outbound FDI are those compiled by China’s Ministry of Commerce, which releases monthly data on outward investment by Chinese firms in non-financial sectors (which is then combined with financial sector OFDI data to calculate annual numbers). MOFCOM data shows steady growth of outbound FDI for the last decade, with an average annual growth rate of almost 50% (Figure 2). For 2014, MOFCOM’s figures show strong performance thus far, with outflows of $82 billion from January-October, up 18% year-on-year. Growth was reported to be particularly strong in the third quarter. MOFCOM officials predict a new record high of $120 billion for the full year of 2014, putting outbound FDI on track to surpass inbound flows very soon.

This optimistic read is bolstered by recent political reforms that significantly reduced approval requirements and bureaucratic red tape for Chinese firms investing overseas. In December last year the State Council ordered the abolition of many existing restrictions and approval requirements for outward FDI, which resulted in more liberal policies by the two main regulators, the National Development and Reform Commission (NDRC) and the Ministry of Commerce, implemented over the course of the first 10 months of this year. Effectively, Chinese firms now only need to register with those two regulators if they invest less than $1 billion in low-risk economies.

Greater Two-Way Traffic

One important development that MOFCOM’s dataset does not factor in, however, is the growing importance of two-way flows through the OFDI channel. Recent liberalization policies have not only made it easier for firms to bring money out of the country, but they have given corporate treasurers more freedom to move funds between a PRC parent company and offshore subsidiaries both ways. MOFCOM data captures most outflows, but it does not properly account for reverse flows back into China through the OFDI channel, such as proceeds from divestitures or intra-company lending and transfers.

An alternative dataset on Chinese outbound FDI collected by the State Administration of Foreign Exchange (SAFE), which compiles China’s Balance of Payments (BOP) statistics, shows that such reverse flows have become very significant in the past 1.5 years, as firms are reacting to tighter liquidity conditions in China and arbitrage opportunities. In the first six months of 2014 alone, such reverse flows under the OFDI channel amounted to nearly $24 billion, almost twice as much as in H1 2013 (Figure 3). Taking into account this “net” perspective, the growth of Chinese outbound FDI is much less spectacular than MOFCOM’s recent monthly figures suggest – in fact, the net OFDI data records a 16% drop in outbound FDI for the first six months of 2014 compared to the same period in 2013.

A New Hole in the Wall

One other important observation that is important to put official OFDI figures in perspective is the breakdown of the traditional correlation between recorded OFDI flows and the value of completed global M&A deals by Chinese firms. If smoothened out for volatility, OFDI and global deal-making have been tracking fairly closely for most of the past five years, but this relationship has broken down since mid-2013 (Figure 1). The gap has grown particularly large in 2014, as global M&A activity by state-owned firms in energy and commodities has declined dramatically, and the growth of private sector outbound M&A has not been fast enough to make up for the disappearance of megadeals in the extractive sector (Figure 4).

Though there are commercial factors that help explain this recent “de-coupling” of OFDI flows and global M&A deals (for example, the growing importance of greenfield FDI projects and intra-company transfers to finance existing operations), the coincidence in timing with policy liberalization suggest that at least part of this discrepancy can be explained by funds leaving through the OFDI channel that do not end up in FDI projects. Recent reforms have dramatically reduced approval requirements for moving money offshore through the OFDI channel, effectively punching a big hole in China’s system of capital controls. While difficult to quantify, we believe that the outflow of portfolio investment and other short-term funds disguised as OFDI is at least partially responsible for the strong growth of outbound investment in recent months.

Key Takeaways

The growth of China’s outbound FDI in recent years is a secular trend that presents huge opportunities for host economies, and the recent relaxation of administrative controls will help sustain an elevated level of overseas investments in coming years. However, as we show in this note, the story of Chinese outbound FDI is a lot more complex than the most commonly used official dataset suggests. MOFCOM data offers a good perspective on recorded gross outflows, but it is missing important trends such as the stagnant or even declining level of net outbound FDI, the changing industry composition of Chinese investment, the growth of fundraising activities by Chinese overseas subsidiaries (and related liabilities), and the implications for a more liberal OFDI policy regime for the effectiveness of China’s system of capital controls. An approach that carefully considers both official data and available proxies is necessary to properly capture and assess the implications for business strategy and policy planning resulting from China’s growing global investment footprint.