Two-Way Street – US-China Investment Trends – 2021 Update

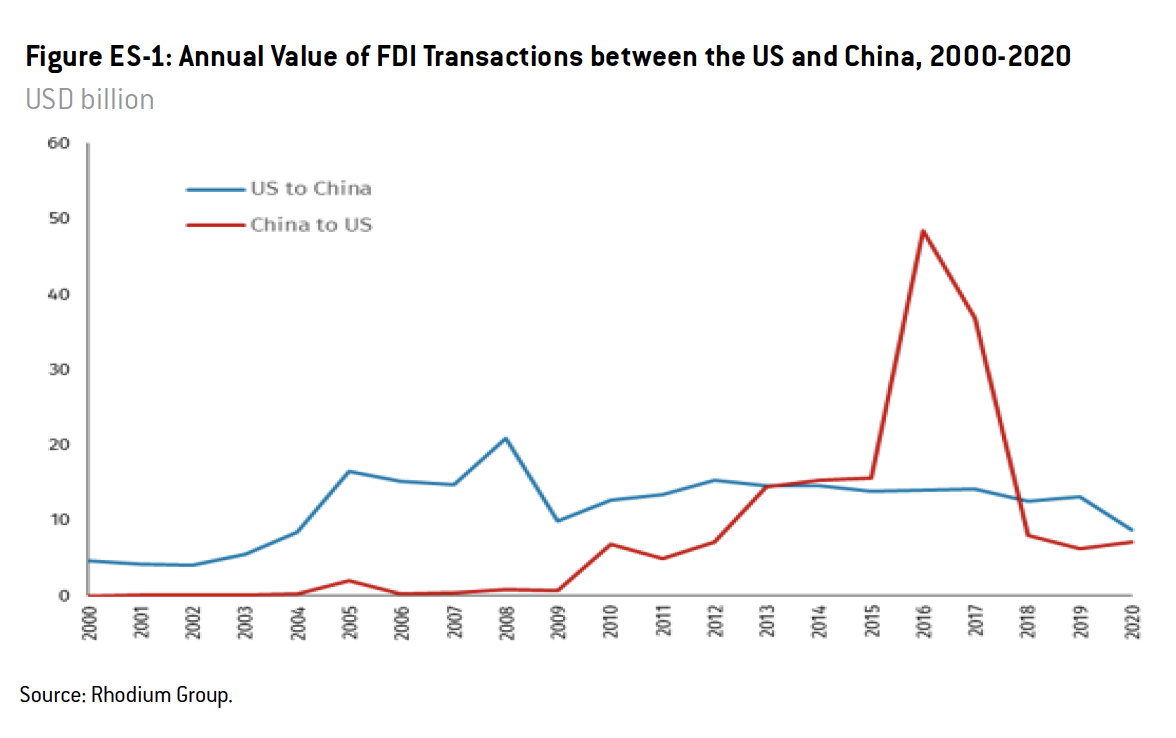

Two-way FDI between the US and China fell to $15.9 billion in 2020, its lowest level in over a decade, amid pandemic-related disruptions and rising US-China tensions.

The US-China Investment Project tracks and analyzes investment flows between the world’s two largest economies. This report summarizes key developments in 2020, an unusually volatile year due to the COVID-19 pandemic, and analyzes the outlook for 2021 as the world slowly emerges from this period of crisis and a new US administration settles in. The key findings of the report are:

Foreign direct investment (FDI) between the US and China fell to $15.9 billion in 2020 amid pandemic related disruptions and rising tensions in the US-China relationship. This was the lowest level for two-way flows since 2009.

Completed Chinese FDI in the United States reached $7.2 billion in 2020, a slight increase from $6.3 billion in 2019. This was driven by a handful of large acquisitions, including Tencent’s purchase of a share in Universal Music Group and Harbin Pharmaceutical Group’s acquisition of GNC Holdings. M&A transaction volumes remained low, and acquisitions were mostly confined to consumer-oriented sectors. Greenfield investments did not see a meaningful uptick.

US FDI in China dropped to $8.7 billion in 2020, a fall of roughly a third from the previous year, and the lowest level since 2004. Greenfield investment was disrupted by the pandemic in the first half of the year but picked up strongly in the second half as China’s economy stabilized and COVID-19 related restrictions eased. Compared to previous years, US investors launched fewer significant greenfield projects. The slowdown in acquisitions was more acute, with only a handful of medium-sized takeovers in consumer products and financial services.

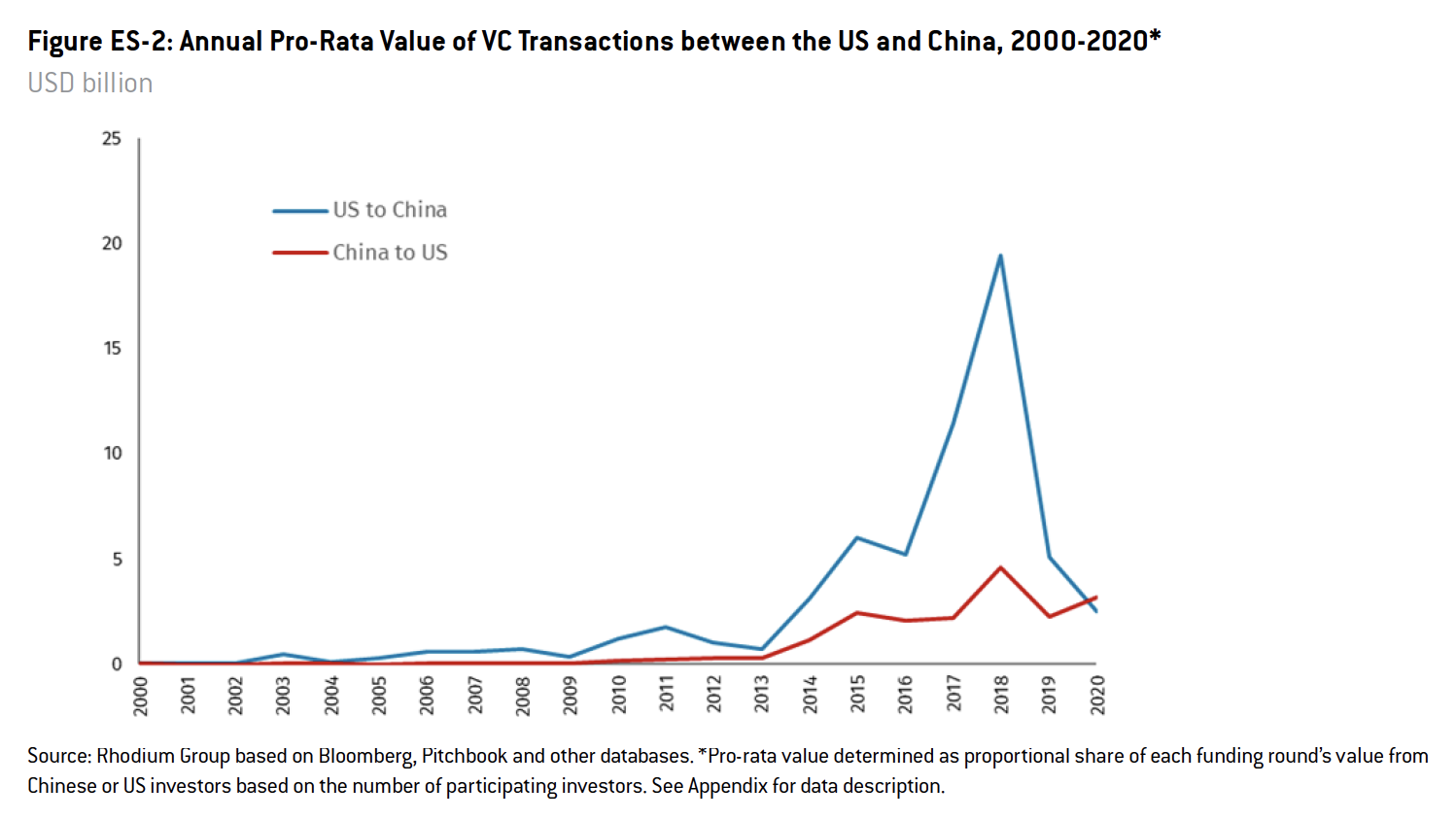

Two-way venture capital (VC) investments also declined slightly in terms of both total value and number of funding rounds. Chinese VC in the US increased slightly and exceeded flows in the other direction for the first time ever, but only marginally so. In contrast, US VC in China dropped to the lowest level in five years.

Chinese venture capital investment in the US increased to $3.2 billion in 2020, from $2.3 billion in 2019, despite stricter regulatory scrutiny tied to Chinese venture investors participated in 249 unique funding rounds for US startups, which was lower than the previous year (305). But investment totals were larger due to several later stage transactions with high valuations. More than half of all transactions (132) occurred in the Health, Pharmaceuticals and Biotechnology sector, followed by Financial and Business Services (43) and Information and Communications Technology (26).

US to China venture capital deals dropped in terms of value and deal count. In 2020 there were 247 unique funding rounds, down from last year’s total of 306. Total investment value dropped more sharply to $2.5 billion, just half of last year’s total and a fraction of the almost $20 billion recorded in 2018. Financial and Business Services and Health, Pharmaceuticals and Biotech were the most common targets for US VC investors, with 54 and 52 transactions each. Consumer Products and Services deals fell from 52 to 31.

The post-pandemic recovery could lead to a rebound in two-way flows but policy developments in Washington and Beijing are a wild card.

In China, the balance that leaders strike between domestic financial stability and openness to the outside world will shape the investment landscape. Throughout the pandemic, Beijing prioritized stability, refusing to loosen restrictions on outbound investment by private companies despite a massive trade surplus and upward pressure on its currency. On the inflow side, the outlook hinges on whether Beijing delivers on its promises to level the playing field for foreign firms and how its “dual circulation” strategy and industrial policy push to replace foreign technology suppliers with domestic firms progresses. A more challenging environment for traditional FDI could also encourage foreign investors in certain sectors to seek greater exposure to Chinese assets through portfolio investment.

In the United States, the Biden administration has signaled that it will maintain key elements of the restrictive policies deployed in past year. But a change in style, that seeks to restore confidence in due process, transparency and non-discriminatory openness to foreign investment, seems likely. A shift away from aggressive decoupling rhetoric could also help instill confidence. Among the key questions are how US officials will implement and enforce new rules for foreign investment reviews (FIRRMA) and export controls (ECRA). Supply chain safety rules, next generation antitrust policies, and new initiatives to protect personal data could all have a profound effect on Chinese companies and investors.

Aside from national policies, broader geopolitical dynamics will likely shape the environment for bilateral investment. The arrival of a new US administration that is prioritizing cooperation with allies could lead to more coordinated action among advanced economies in areas like investment screening, export controls and human rights. If such convergence brings more transparency and predictability around national security-related concerns, then it could support US-China investment in non-sensitive areas. But greater market economy convergence could also trigger a broader rethink that incentivizes US and Chinese investors to shift their focus.

Click here for the full report