Vanishing Act: The Shrinking Footprint of Chinese Companies in the US

The US is experiencing a post-pandemic boom in FDI, but Chinese companies are notably missing from the party.

The United States is experiencing a post-pandemic boom in foreign direct investment (FDI), driven by the resilience of the US economy as well as new industrial policies that incentivize US manufacturing investment such as the CHIPS Act and the Inflation Reduction Act (IRA). Chinese companies are notably missing from the party. This note uses a proprietary Rhodium dataset as well as new US government data to analyze latest patterns of China’s FDI in the US. The findings are:

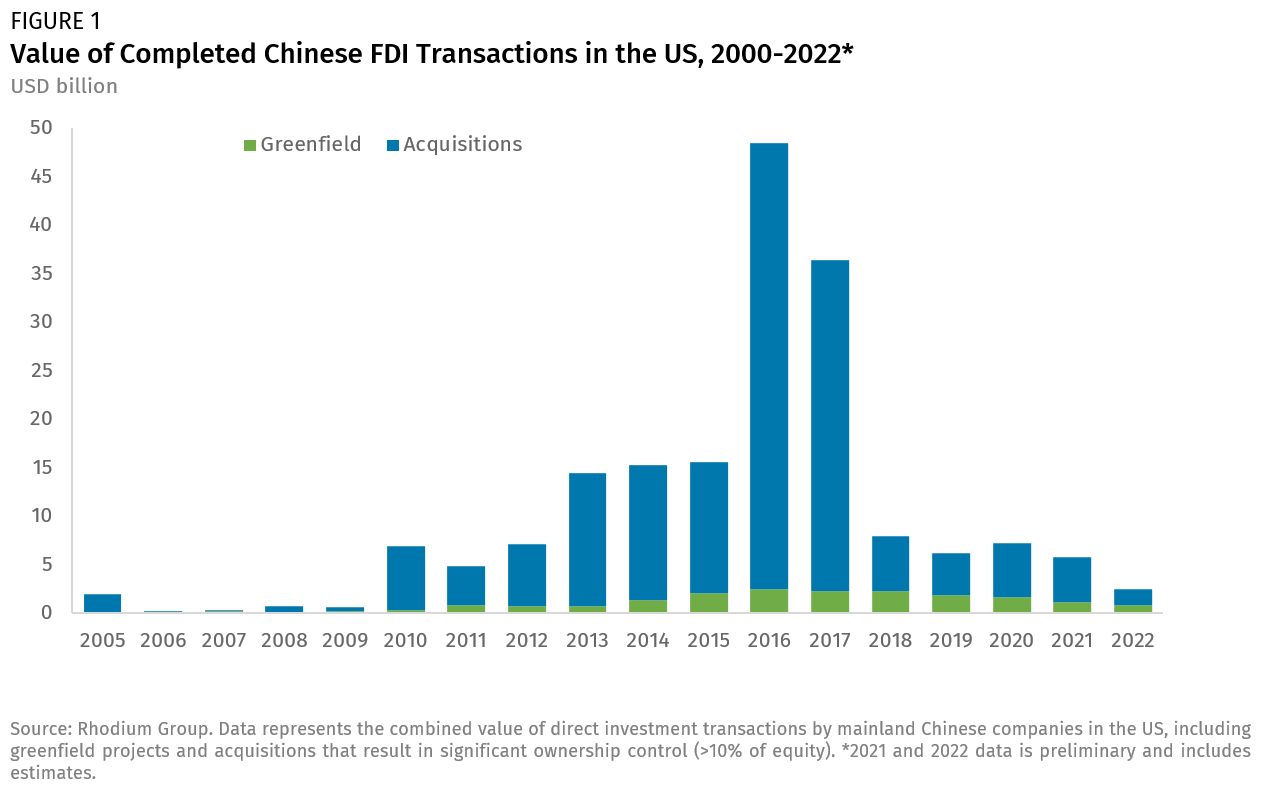

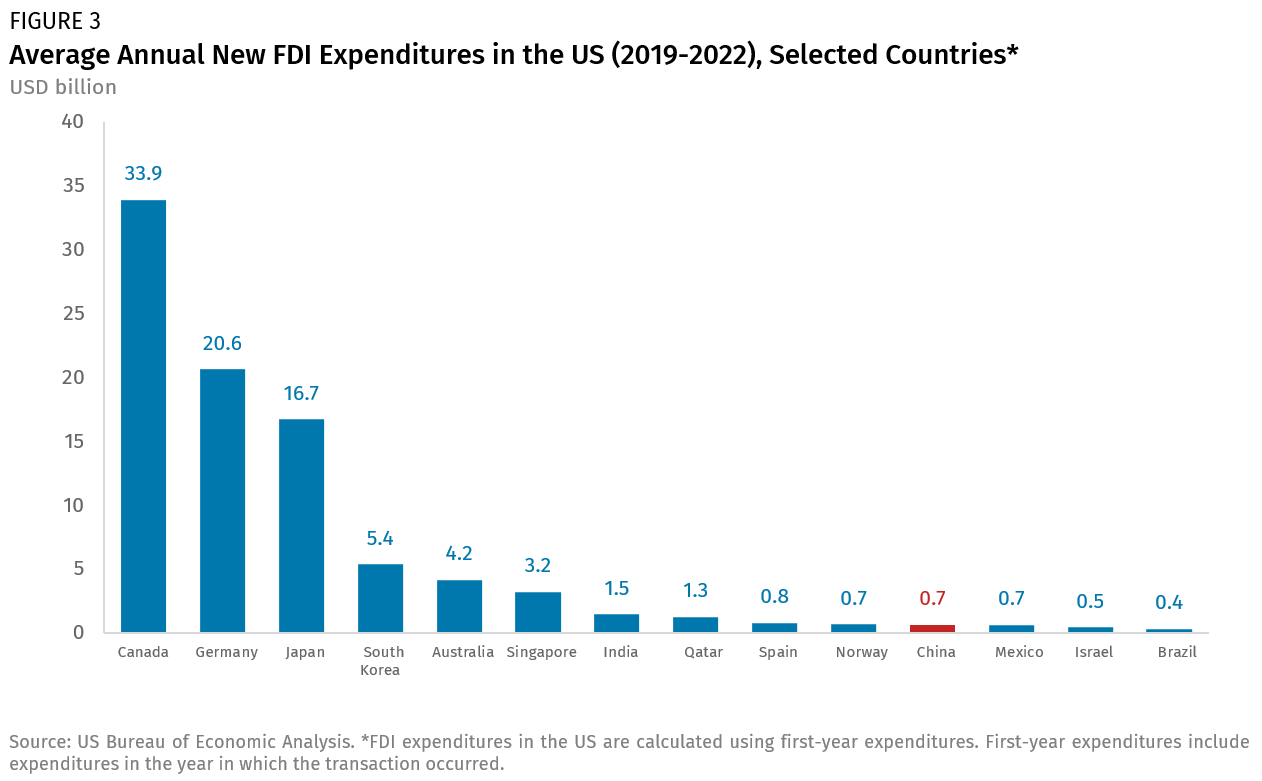

- New investment has slowed to a trickle: Both official and alternative data show a sustained slowdown of Chinese FDI in the US since 2017. Annual investment has dropped from $46 billion in 2016 to less than $5 billion in 2022. In the past seven years, China has gone from one of the top five US investors to a second-tier player surpassed by countries such as Qatar, Spain, and Norway.

- The US footprint of Chinese firms is shrinking: Not only has investment slowed, but assets, revenues, and employment at Chinese companies in the US have all declined in recent years. The retrenchment is more severe and prolonged than the temporary slowdown in business that other multinational corporations (MNCs) experienced during the pandemic, suggesting that the retreat of Chinese companies from the US market was driven by restrictive economic policies fueling US-China economic decoupling over the past five years.

- Declining local job creation is further undermining political support for US-China economic engagement: As the prospects of Chinese firms serving as major local employers in the US dwindle, fewer local officials and businesses are willing to stand up against more restrictive US economic and national security policies towards China.

- The retreat of Chinese firms from the US illustrates risks of fragmentation and political misalignment: Chinese FDI has remained more resilient in other markets, reflecting a lower degree of regulatory and political scrutiny. The divergence of Chinese FDI trajectories across the OECD—especially in high-growth sectors like electric vehicles—illustrates the risks of fragmented global value chains as well as misalignment of policy priorities between the US and important allied nations.

Boom and Bust: The Slowdown of Chinese FDI Since 2017

Chinese FDI in the US experienced a period of rapid growth after 2014, but has been on a downward trajectory since 2017. Investment was a trickle up until the mid-2000s but increased steadily after the global financial crisis in 2008 and 2009 as Chinese firms weathered the storm relatively well and sought opportunities abroad. After Beijing loosened restrictions on outward FDI in 2014, large M&A transactions drove Chinese FDI in the US up to a record $46 billion in 2016. A re-tightening of capital controls and crackdown on highly leveraged private investors by Beijing led to a sharp drop in China’s global outward FDI. This was felt in the US in 2017 and following years, especially in real estate, entertainment, and other industries scrutinized by the Chinese government.

At the same time, US policy and politics started to impact Chinese investors, especially in sectors where Beijing still allowed and supported outbound FDI, such as the acquisition of technology assets in line with national development priorities. US policymakers started to shut Chinese companies out of certain markets for national security reasons, for example banning the use of Chinese telecommunications equipment. The US screening process for inbound acquisitions was tightened further with the enactment of FIRRMA in 2018, and the political environment for Chinese companies became more hostile overall amid the Trump administration’s confrontational stance toward economic engagement with China. By 2019, Chinese FDI had slowed to a trickle of less than $10 billion per year.

In recent years, headwinds have only increased. The outbreak of the COVID pandemic weighed on FDI globally in 2020, further dragging down China’s outbound investment. While global FDI flows rebounded in 2021, Chinese investors remained stuck at home due to Beijing’s zero-COVID policy. US national and economic security policies also continued to weigh on the prospects of Chinese companies. The Biden administration further expanded export controls and sanctions against Chinese companies and recently expanded investment screening to outbound capital flows. Most importantly, Congress enacted powerful new industrial policies that incentivize large capital expenditures into US manufacturing, but explicitly forbid or restrict the participation of Chinese investors, most notably the CHIPS Act and the Inflation Reduction Act (IRA). As a result, Chinese FDI in the US remained lackluster through 2022 and 2023.

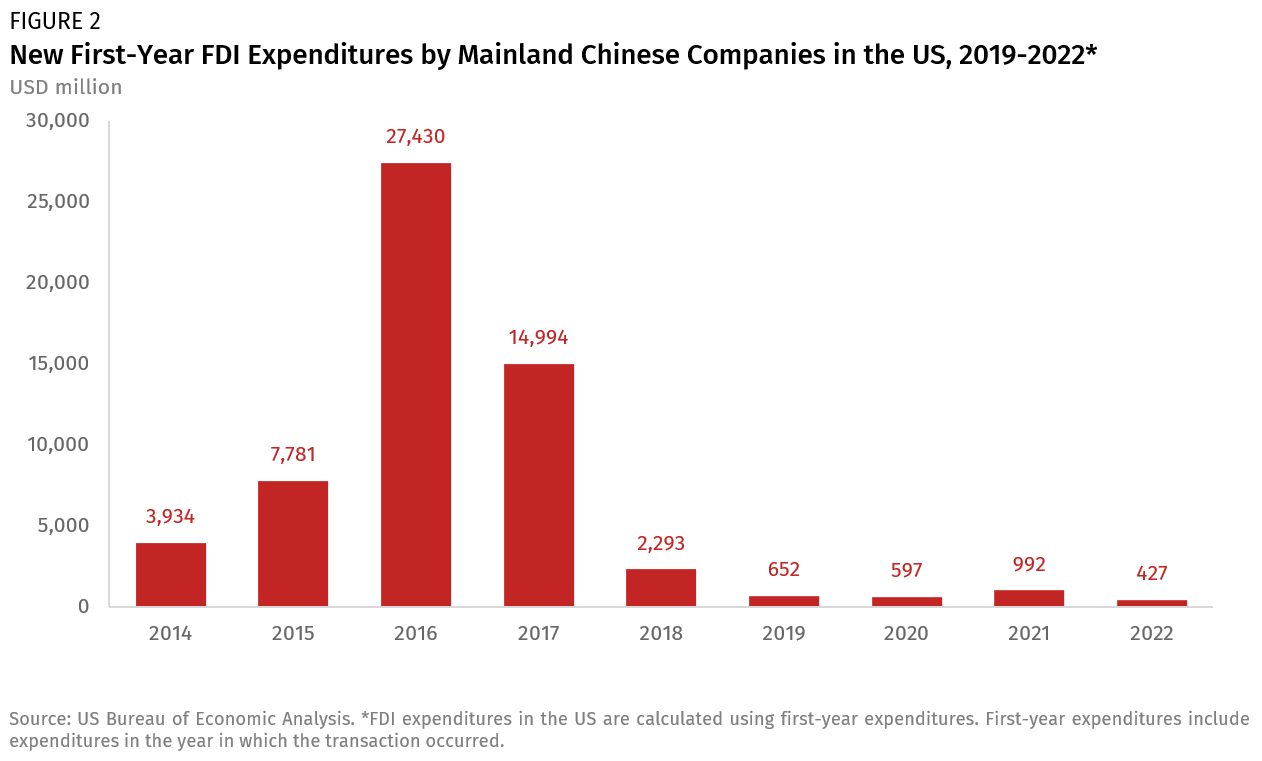

The latest data from the Bureau of Economic Analysis (BEA) on new foreign direct investment in the US, which uses company surveys to calculate firms’ new FDI expenditures, confirms this trajectory. First year FDI expenditures of Chinese firms grew rapidly 2014-2016 but then peaked and slowed dramatically in following years. Since 2019, annual investment has dropped below the billion-dollar mark and 2022 shows the lowest level of new FDI in at least a decade (Figure 2). Over the past four years (2019-2022), new Chinese FDI in the US has averaged only $667 million, which is dwarfed by the expenditures of other major economies and significantly below the investments by MNCs from smaller Asian or European economies such as Singapore, South Korea, or Spain (Figure 3).

A Shrinking Footprint: US Operations of Chinese Firms

Not only is new investment slowing dramatically, but there is increasing evidence that the operational footprint of Chinese firms in the US has been shrinking in recent years. The BEA recently published their latest batch of data on the operations of MNCs in the US, which is collected through mandatory surveys and includes a variety of data that illustrate the struggles of Chinese firms in the US market.

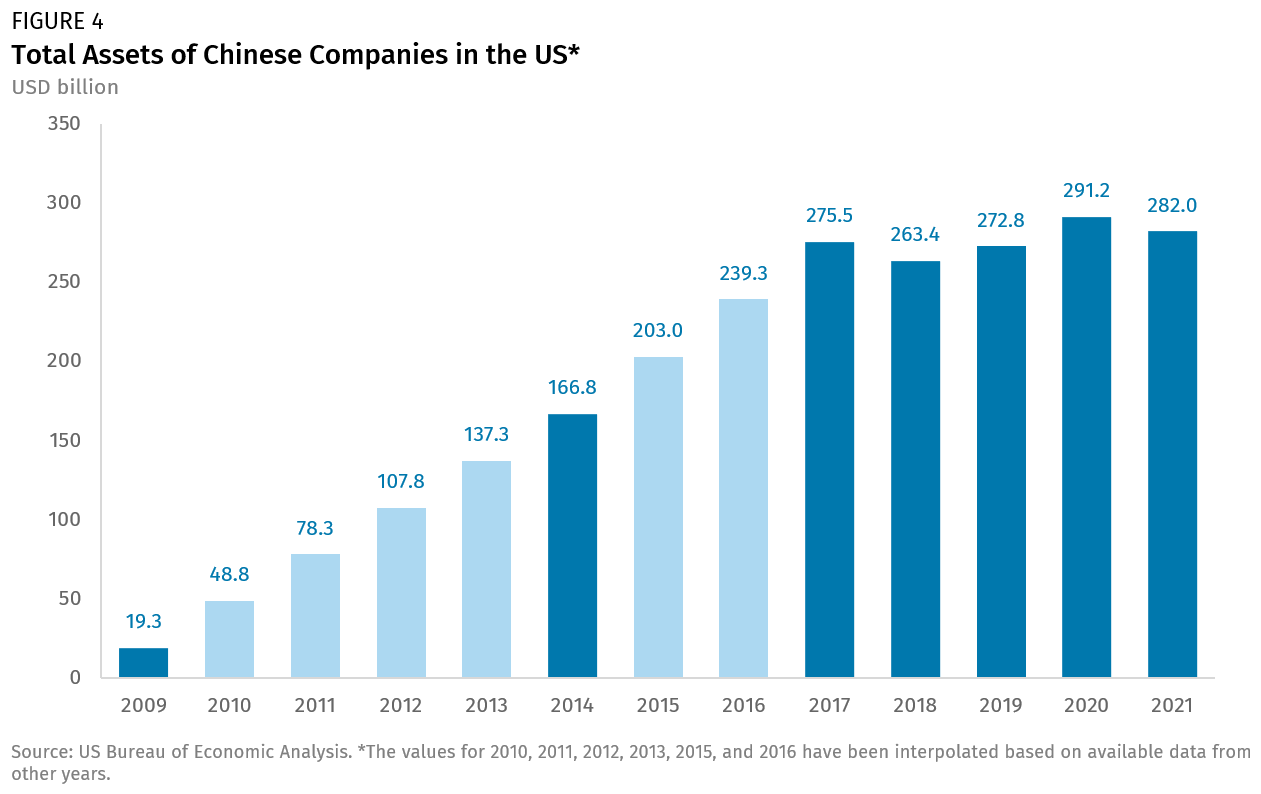

The assets of Chinese companies in the US grew rapidly from $19.3 billion in 2009 to $275.5 billion in 2017. Since then, the asset base of Chinese companies in the US has plateaued, suggesting that additional investment flows since then have been offset by divestitures or write-offs. As of 2021, the BEA survey puts Chinese firms’ asset base in the US at $282 billion. That is almost four times higher than ten years ago, but roughly at the same level as in 2017. China only accounts for 1.5% of the total asset base of multinational companies in the US—a meager number for the US’s largest trading partner.

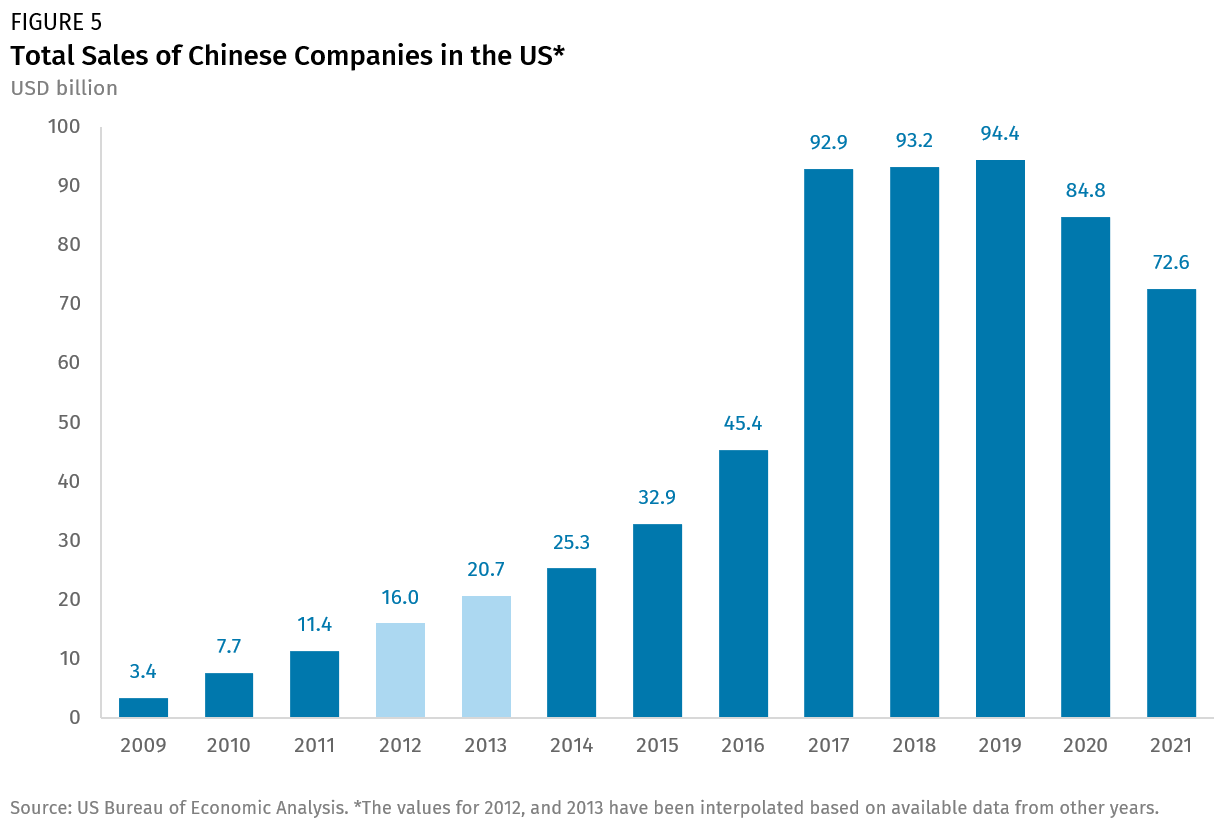

Another data point that illustrates the challenges of Chinese firms in the US market is declining revenues. Sales of Chinese MNCs in the US rose quickly from $3.4 billion in 2009 to just over $90 billion in 2017. Revenues then stagnated from 2017 to 2019 and contracted in 2020 and 2021. The 2020 drop can at least partially be attributed to pandemic-related market volatility, but the revenue of Chinese firms does not show the post-pandemic rebound in sales in 2021 seen for the broader set of MNCs operating in the US.

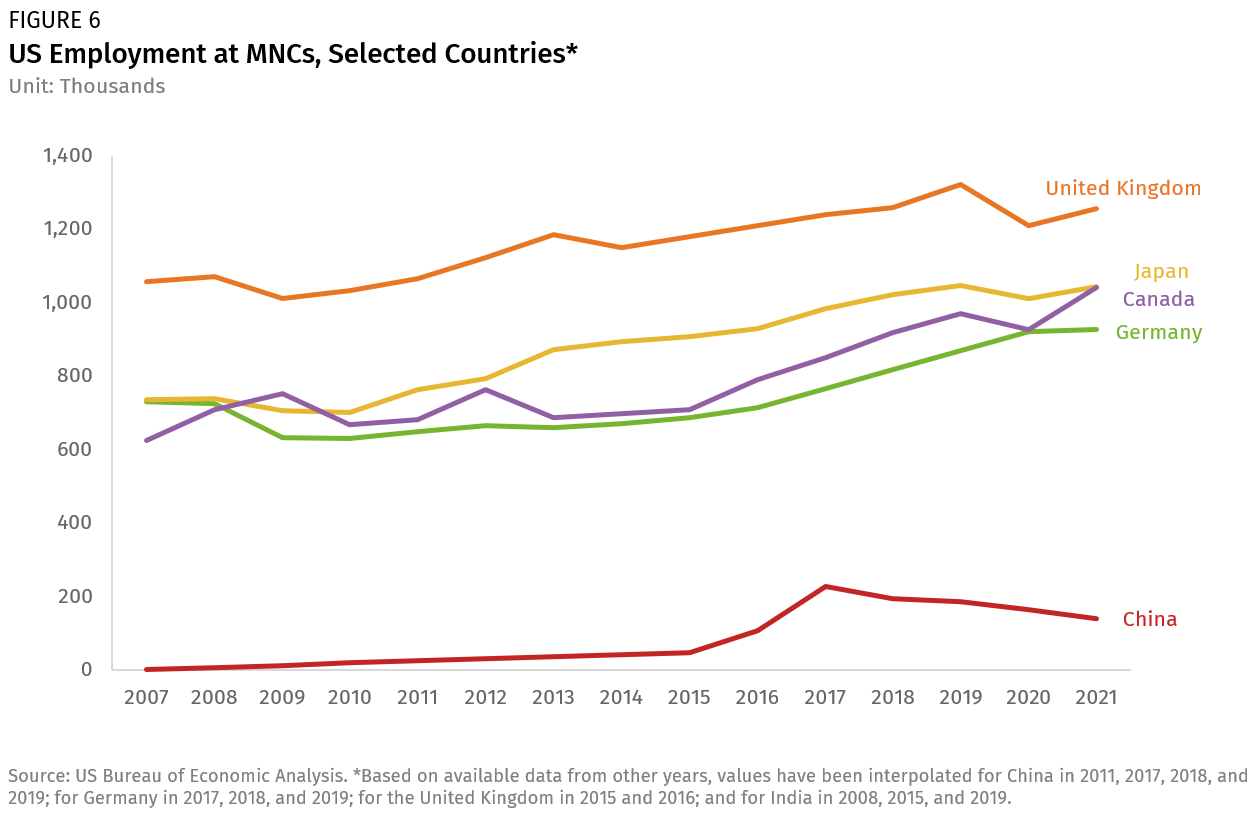

A particularly important trend is the decline of employment at Chinese companies in the US. Employment at Chinese firms in the US had surged from next to nothing in 2007 to more than 229,000 in 2017. Since then, employment at Chinese companies in the US has fallen back to only 140,000. That compares to about a million American workers employed by MNCs from other major export nations such as Germany (929,000) or Japan (1,045,000). Chinese firms today provide fewer jobs locally in the US than Swedish companies and only slightly more than firms from Italy or Australia (Figure 6).

Implications for US China Policy: Less Ballast for Engagement

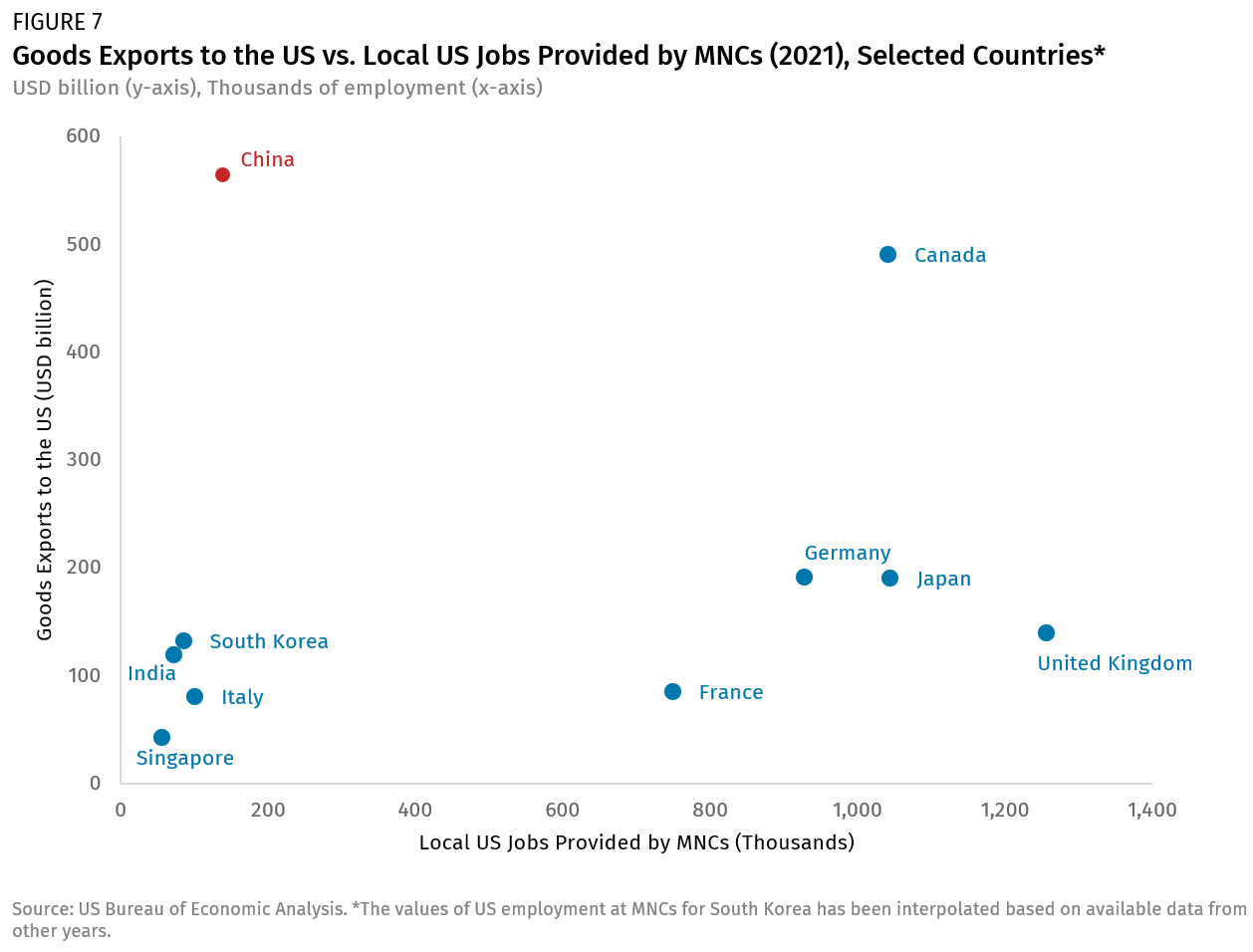

While the physical presence of Chinese companies in the US economy as investors and employers has shrunk since 2017, Chinese exports to the US have continued to grow to a record $564 billion in 2022. China remains a massive outlier in that it predominantly serves the US market through exports and has not followed other major trading partners in building out a significant local presence through FDI in local manufacturing and service operations (Figure 7).

The shrinking prospects of significant local job creation by Chinese firms have arguably further tilted the scale toward more restrictive economic policies toward China. Local policymakers and US companies have fewer incentives to spend their political capital on pushing back against policies in Washington that are increasingly shaped by national and economic security considerations.

Global Implications: The Fragmentation of China’s Outbound FDI

From a global perspective, the withdrawal of Chinese firms from the US economy illustrates the risk of an increasingly fragmented global economy, particularly in high-tech sectors with national and economic security relevance such as clean tech, telecommunications equipment, or semiconductors.

While the slowdown in China’s outbound FDI after 2017 is primarily a result of Chinese policies, the decline of Chinese FDI in the US has been deeper and more sustained than in other advanced economies, in part due to more restrictive US policies. In addition to investment screening by CFIUS, US policymakers have expanded their toolbox to explicitly or implicitly restrict market access and local R&D activities of Chinese firms through supply chain security policies, sanctions lists, export controls, and industrial policy provisions. Other countries have tightened their investment review processes but have not matched the US in other areas, contributing to a growing divergence in Chinese outbound FDI patterns.

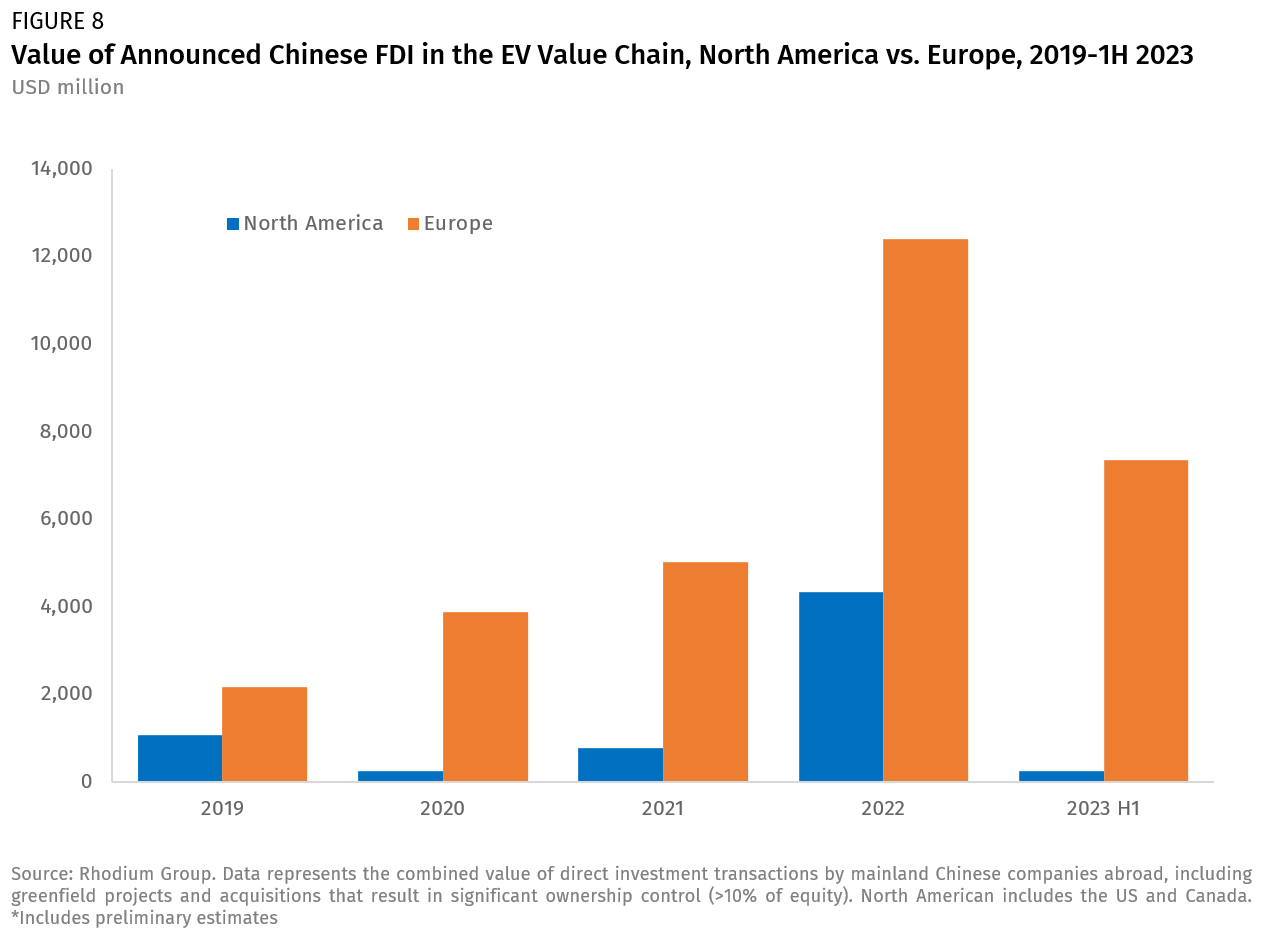

One illustrative example is the electric vehicle industry. While overall Chinese outbound investment has declined, Chinese companies have invested billions of dollars in the past five years across the global electric vehicle value chain, from critical minerals mining to battery manufacturing and research and development operations. The US has experienced a boom of foreign investment in the electric vehicle industry driven by the IRA, but the role of Chinese investors has been limited due to provisions that exclude Chinese investors from certain government subsidies.

Stark differences in the value of announced Chinese FDI in the EV industry in Europe and North America illustrate these diverging trajectories. Since 2019, Chinese companies have announced investments exceeding $30 billion across Europe, including large manufacturing facilities like Envision AESC’s in France and the UK, as well as CATL’s in Hungary. Over the same period, Chinese FDI in North America totaled less than $7 billion (Figure 8). Among the small number of investments announced in the US, several large-scale Chinese battery plants—like the $2 billion facility by Gotion in Michigan—have triggered a political and regulatory backlash.

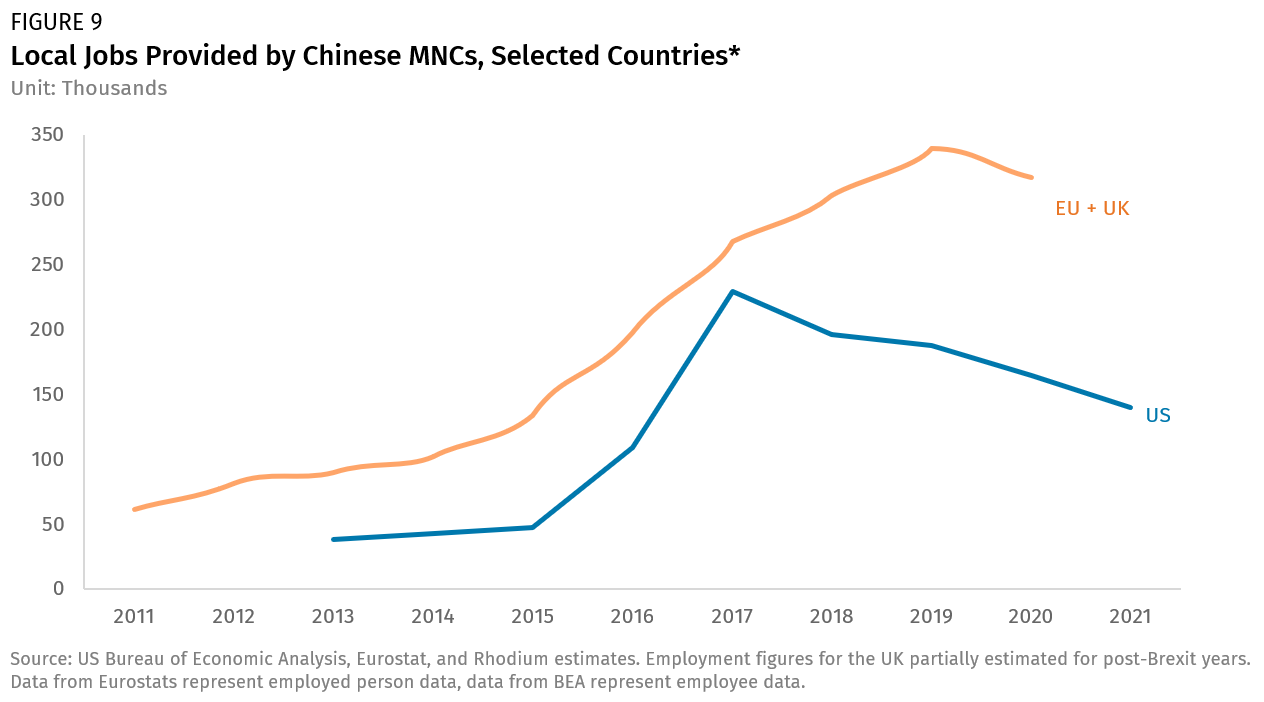

If this divergence persists, it could become a source of transatlantic tension, particularly if Europe’s embrace of Chinese green technology suppliers gives its home-grown manufacturers a leg up on US rivals that do not have access to the same critical inputs. Ultimately, this is also about jobs. Over the past five years we have observed a stark divergence between Europe and the United States when it comes to local job creation by Chinese firms: In 2017, Chinese companies employed roughly the same number of workers in Europe and the US (between 200,000 to 250,000). Today, more than 300,000 Europeans are employed by Chinese companies, while the number of US workers with Chinese employers has dropped to less than 140,000 (Figure 9).

At a time when the US and Europe (not to mention other G7 countries like Japan, the UK, and Canada) are ramping up efforts to coordinate their policies toward China, differences in their embrace of Chinese FDI could, in the long run, undermine this push. It will be especially important to monitor whether the US and its allies converge around a common approach to Chinese greenfield investment in high-growth, job-creating industries.