Ain’t No Duty High Enough

EU duties on Chinese EV imports are unlikely to be high enough to slow market share gains for Chinese automakers, forcing Brussels to consider other tools to protect the continent’s car industry.

The European Commission is likely to impose countervailing duties on imports of electric vehicles (EV) from China in the coming months to head off the risk of subsidized cars damaging Europe’s auto industry. We expect the Commission to impose duties in the 15-30% range. But even if the duties come in at the higher end of this range, some China-based producers will still be able to generate comfortable profit margins on the cars they export to Europe because of the substantial cost advantages they enjoy. Duties in the 40-50% range—arguably even higher for vertically integrated manufacturers like BYD—would probably be necessary to make the European market unattractive for Chinese EV exporters. As countervailing duties at this level are unlikely, policymakers in Brussels may decide to turn to non-traditional tools to shield the European auto industry, including restrictions based on environmental or national security-related factors.

The EU’s anti-subsidy probe

In the biggest EU trade case against China ever, the Commission initiated an anti-subsidy investigation into EV imports from China in October 2023. Should it determine that China-based producers have benefited from subsidies in ways that harm EU-based manufacturers, it could place provisional countervailing duties on China-origin EV imports anytime from now until July 3, and final duties by early November. In March 2024, the Commission asked European customs authorities to track imports of EVs from China, a signal that it could impose provisional duties in the near future.

The EV probe stands out for several reasons. First, the Commission initiated the investigation ex officio, without a formal complaint from industry, which is a rarity in such cases. Second, there is a divide within Europe’s car industry—which accounts for 7% of the EU’s GDP and 8.5% of its manufacturing employment—on the desirability of the probe. German carmakers, which are heavily reliant on the Chinese market, oppose it out of fear that Beijing could retaliate against them, while French counterparts, which are far less exposed to China, support it. Third, the probe is based on the threat that cheap EV imports from China could cause damage to European manufacturers in the future, rather than an assessment that this damage is already taking place. Finally, the probe is perhaps the most political case of its kind in recent memory. Commission President Ursula von der Leyen chose to announce it in her annual state of the union speech last September. And the Commission has focused its investigation on three China-based carmakers—BYD, Geely, and SAIC—rather than western carmakers like Tesla, which exports more EVs from China to the EU than any other producer.

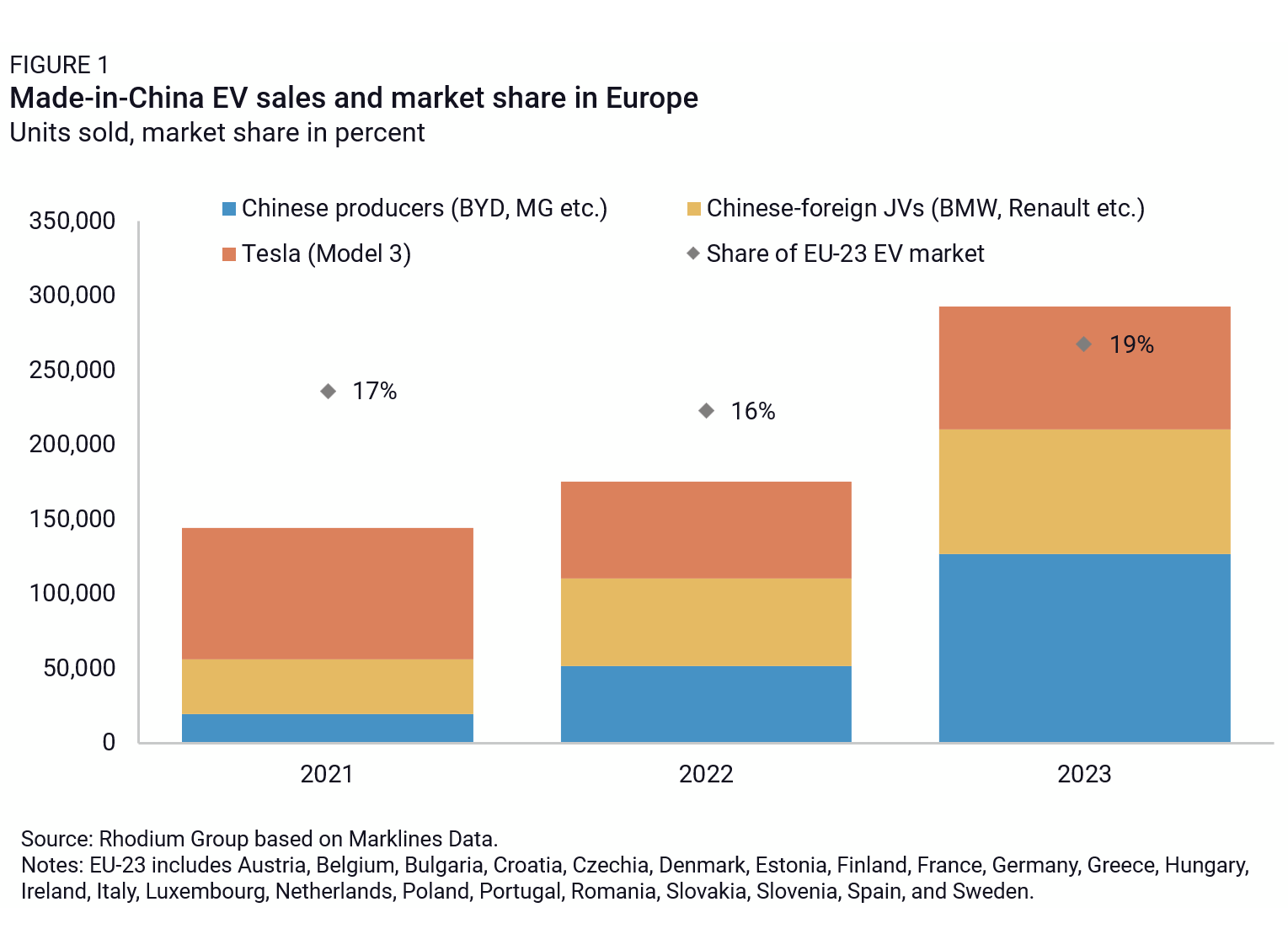

EU imports of EVs from China ballooned from $1.6 billion in 2020 to $11.5 billion in 2023, accounting for 37% of all EV imports in the bloc. While the market share of China-produced EV models in the European market has only increased slightly to 19%, the share of Chinese and Chinese-owned brands has increased substantially in the last two years. This suggests that Chinese companies are gaining momentum in the European market. BYD has said that it is aiming to secure a 5% share of EV sales in Europe by 2026 and to be among the top five automotive companies in Europe in the medium term.

Based on an analysis of previous instances of countervailing duties (CVDs) imposed by the EU on Chinese imports and on conversations with experts, we expect the Commission to consider duties on Chinese EVs in the 15-30% range. This is based on the following factors:

- The average of the highest duty level imposed in previous anti-subsidy cases against China stands at 24.4% (see Figure 2). In rare instances, CVDs have been as high as 40-50%, however these were concentrated on industries with a high degree of direct state-ownership, such as steel, and focused on non-cooperating Chinese entities. In contrast, the EV sector is primarily privately owned in China.

- The three companies (BYD, Geely, and SAIC) that the Commission has chosen to focus on in its investigation have signaled their willingness to cooperate. This means that they are providing information to the Commission. For non-cooperating firms the Commission estimates duties based on public information, which in the past has resulted in higher duties.

The Commission will calculate individual duties for BYD, Geely, and SAIC, while other exporters such as Tesla will receive a duty based on the weighted average of the duties imposed on the Chinese brands that the Commission deems to have cooperated. Theoretically, the Commission could also opt to impose other remedies, for instance a minimum import price or fixed price, but given the highly complex nature of modern EVs, this is an unlikely and unpractical prospect.

Price analysis of China-based exporters

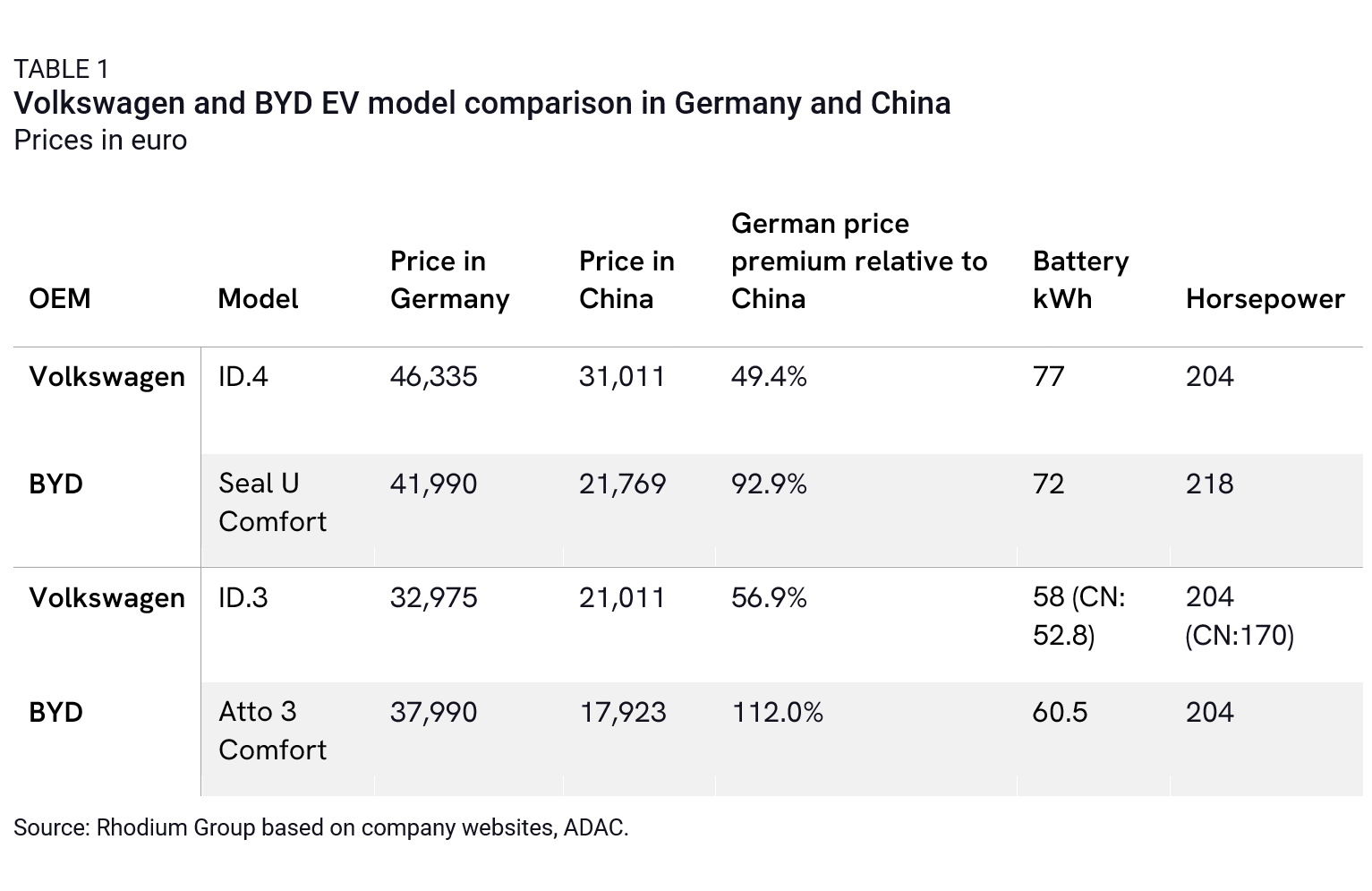

Currently, the electric vehicle markets in Europe and China are characterized by major price discrepancies which have encouraged producers to export their cars from China to Europe. Intense competition in a saturated Chinese market has led to a price war there and forced manufacturers to boost efficiencies in the pursuit of ever-lower production costs. Volkswagen’s ID.4 model, for example, sells for nearly 50% more in Europe than it does in China. For Chinese producers like BYD, the price gulf is even larger, as they try to compensate for the profit squeeze in China by charging higher prices for their products in the EU. But with exports picking up, some of these price differences are likely to erode over time. Increasingly, Chinese and foreign manufacturers are taking advantage of China’s cheaper labor and energy prices, its more developed battery ecosystem and government subsidies to produce in China for the European and third markets.

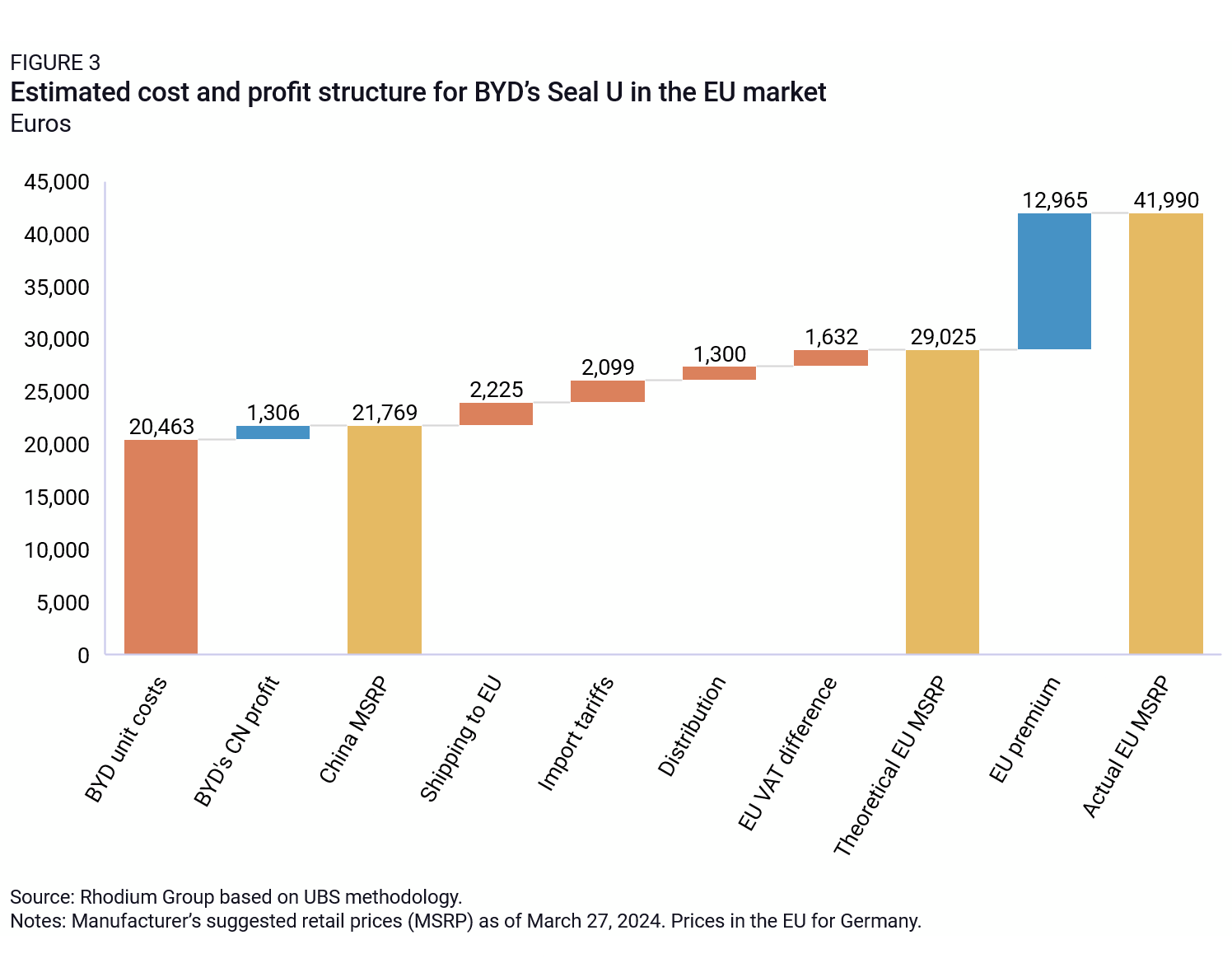

Should the EU impose countervailing duties on Chinese EV imports, it would seriously affect incentives for China-based producers to export to Europe. Our price analysis reveals that exports to the EU by China-based producers are very profitable. BYD makes around €14,300 in profit on each SEAL U model sold in the EU, compared to €1,300 on units sold in China. This means that BYD earns €13,000 more on every Seal U model sold in the EU (the “EU premium”). Our analysis is based on the suggested retail prices (MSRPs) of the various manufacturers in China and Germany, and calculates profits after shipping, tariffs, distribution and VAT.

It should be noted that BYD’s relatively low sales numbers in Europe suggest that the prices it is charging in the European market may be too high, especially in light of the fact that it is still a relatively unknown brand. With such a high EU premium, however, the company has ample space to adjust pricing.

In order to substantially reduce the incentive for BYD to export models like the SEAL U to the EU, duties would need to be set at a level that erases the €13,000 premium that the company currently enjoys in Europe. This would bring profit margins in the EU in line with those that BYD enjoys in China. In reality, this is not the goal of the anti-subsidy investigation. It is not meant to render EVs produced in China and sold on the EU market unprofitable, but rather determine whether China’s export competitiveness is based on subsidies. Even if duties were set at a high enough level to erase the EU premium, BYD might decide that exporting to Europe makes sense, given slowing demand and competitive pressures in the Chinese market. One cannot dismiss the possibility that Chinese EV producers would be willing to forgo profits in the short-term and sell at a loss in order to gain market share in the world’s second biggest EV market.

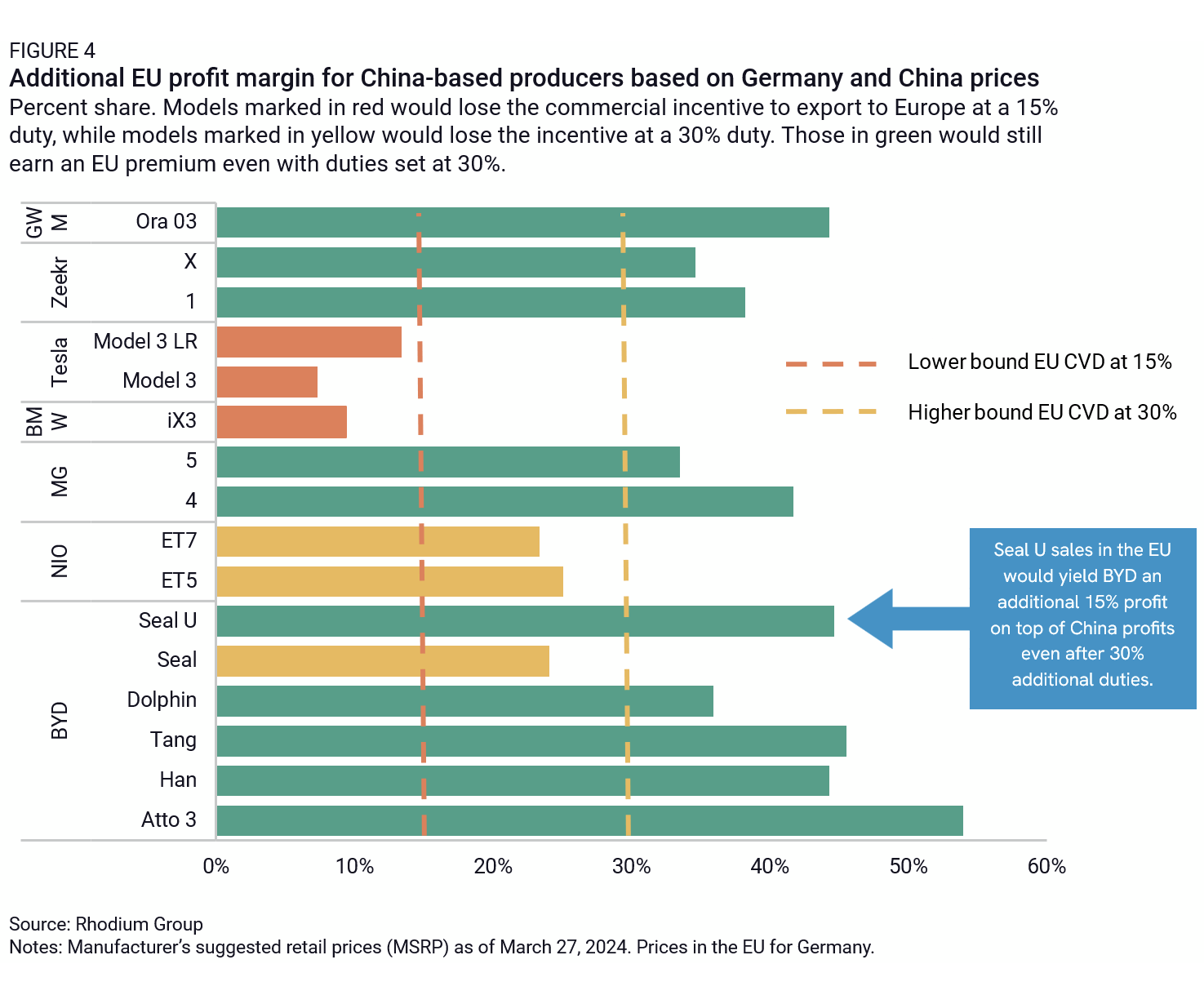

A 30% duty imposed on BYD for the Seal U would fall far short of leveling the playing field between the EU and China as far as the company’s profits on the car are concerned. According to our calculations, a 30% duty would still leave the company with a 15% (€4,700) EU premium in relation to its China profits, meaning that exports to Europe would remain highly attractive. Moreover, duties at this level would provide BYD with space to lower its prices in order to gain market share in Europe. Our analysis of several other models sold in China and Germany indicates that even after a 30% duty, many Chinese EV models would still enjoy a strong EU profit premium (see Figure 4).

In short, much steeper duties of around 45%, or even 55% for fiercely competitive producers like BYD, would probably be necessary in order to render exports to the European market unappealing on commercial grounds.

Duties at the 15-30% level could, however, wipe out the business model for foreign players like BMW or Tesla, which are using China as a base for exporting to Europe. For BMW’s iX3 SUV, for example, the EU premium (after accounting for related costs such as shipping) is only 9%, meaning that if duties are above 9%, the company would make less money on sales in Europe than in China. This also means that duties set at the higher end of our range could undermine plans by companies such as BMW, Honda and Volkswagen to expand the use of China as an export hub for the EU market going forward.

The price gap between foreign and Chinese producers is likely due to two main factors: Chinese producers receive more subsidies than foreign producers, although both benefit from Chinese government support, and Chinese companies are more vertically integrated and can procure products at lower prices than their foreign competitors.

Chinese producers will likely need to export

While duties would make exporting to the EU less attractive, several factors suggest that China’s EV export push will continue to gain momentum in the coming years:

Slowing growth and tighter profit margins at home: While China’s new energy vehicle (NEV) market has expanded rapidly, with sales surging by 97% in 2022 and 38% in 2023, growth is expected to decelerate significantly due to the higher base and China’s economic slowdown. Cui Dongshu, the Secretary General of China’s passenger vehicle association, forecasts that NEV sales growth will drop to 22% in 2024. Moreover, intense competition has led to a price war, resulting in profit margins in the auto sector plummeting from 8.7% in 2015 to 4.3% in 2023. Both of these trends are making exports much more appealing to China-based producers.

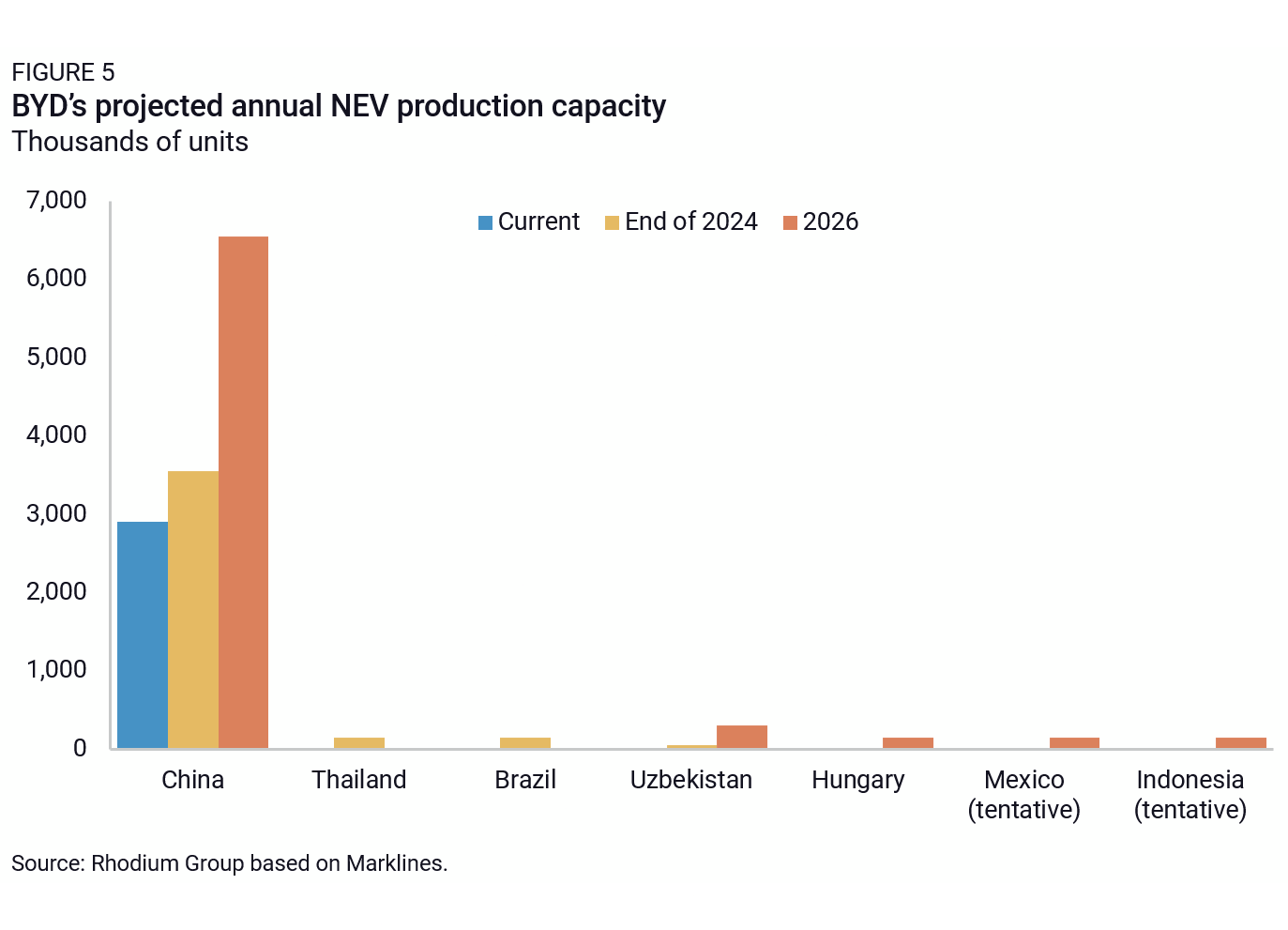

New production capacity coming online: Bolstered by robust profits and government backing, Chinese EV manufacturers have made substantial investments in new production facilities. This additional capacity will hit the market soon. BYD’s new plants illustrate this: By 2026, BYD’s production capacity in China will reach 6.55 million EVs up from 2.9 million at the end of 2023. To fully utilize all this capacity BYD would need to more than double its domestic EV sales—a challenging feat given the anticipated slowdown in China’s overall EV sales. Even to maintain capacity utilization at 80%, BYD would need to increase domestic sales by 81% by 2026.

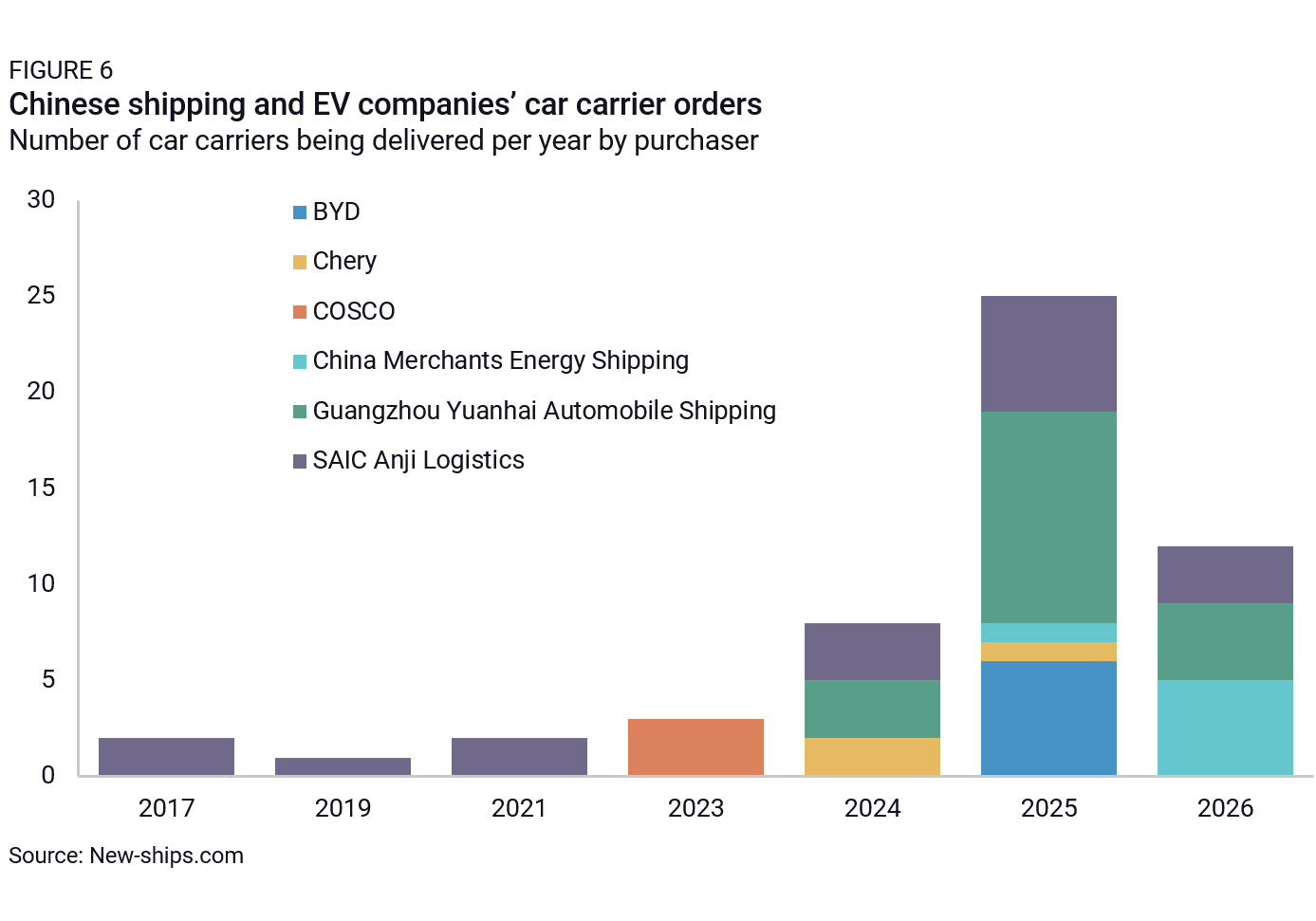

New shipping capacity coming online: China’s EV exports have been hindered by a scarcity of affordable car shipping vessels. In 2023, charter prices for such carriers skyrocketed by 700% compared to 2019, exacerbated by Houthi attacks in the Red Sea, further straining shipping capacity and inflating costs. However, Chinese carmakers and shipping companies have responded by placing orders for numerous new ships. Based on these orders, they will have capacity to ship an estimated 560,000 cars annually to Europe in 2025, based on six trips a year (in 2023 the EU imported 472,000 EVs from China). Capacity could surge to as much as 1.7 million cars in 2026. In the unlikely case that all ships were used for transporting cars to Europe, the volumes exported from China would likely be enough to capture 50% of the EU’s EV market. Notably, the decision to purchase rather than rent car-carrying ships underscores the long-term goal of Chinese EV producers to export large quantities of cars.

Lack of other attractive export markets: The EU, the world’s second biggest EV market, is likely to remain the primary destination for China-made EVs. With its plans for a de facto ban on internal combustion engine (ICE) vehicles from 2035, and various support mechanisms in place, the EU presents a highly attractive market—especially compared to the US, which already has high tariffs on Chinese EVs in place and is planning further measures to restrict Chinese carmakers. Exports to other markets will be challenging for other reasons: either they are smaller, lag behind in EV adoption or will be served by local production, often because of local content requirements (ASEAN, Brazil, India and Mexico).

Ambitious targets for the European market: BYD has set an ambitious goal to capture a 5% market share in Europe even before its Hungary plant commences operations in 2026. This would entail selling approximately 130,000 EVs in Europe in 2025, a massive increase from the 16,000 sold in 2023. Looking ahead to 2030, the company aims to account for 10% of Europe’s EV market, corresponding to an estimated 920,000 vehicles, with a portion produced in its Hungary plant and the majority likely imported from China. These targets are consistent with those communicated by Shenzhen’s municipal government, where BYD is headquartered. The city wants to increase NEV exports from 71,000 in 2023 (January to November) to 400,000 in 2024 and to 600,000 in 2025. It released a 24-point plan to achieve these goals in November 2023. Similarly, SAIC-owned MG, having sold nearly 232,000 vehicles in Europe last year, plans to sell more than 300,000 cars this year.

EU officials might consider additional tools

If duties fail to slow Chinese exporters, at a time when China continues to incentivize firms to export, the Commission may feel the need to explore alternative measures. Competition Commissioner Margrethe Vestager floated this idea in a speech at Princeton University in April, calling for the introduction of “trustworthiness” criteria at G7 level based on factors like environmental footprint, labor rights, cybersecurity, and data security. A range of options are on the table:

Cybersecurity: The EU could attempt to tighten cybersecurity requirements to restrict market access for Chinese EV producers. Similar to the 5G Toolbox it published in January 2020, the EU could establish policy guidelines for member states that designate Chinese EVs as a cybersecurity risk due to the integration of cameras and sensors in cars and Beijing’s close oversight of China-based producers. Although most EVs will be privately purchased, member states could also decide to include “trustworthiness” criteria in public tender documents.

This approach would, however, face numerous obstacles, as the uneven implementation of the 5G Toolbox illustrates. National security remains primarily a member state prerogative, and convincing all members that Chinese EVs pose a national security risk will be challenging, particularly as some fear retaliation against their own products in China. A fragmented solution that restricts Chinese EVs in some countries but not others, would be problematic given the Schengen Zone’s open borders. Unlike 5G, where the costs to replace untrusted equipment would be shouldered by telecommunications operators, cybersecurity-related restrictions on connected vehicles would directly affect consumers.

Moreover, the notion that cybersecurity measures would serve as a panacea is tempered by the availability of Chinese smartphones in the EU, which arguably pose a greater risk but enjoy substantial market share with Xiaomi and Huawei ranking as the third and fourth biggest smartphone brands in 2023. While some member states, such as Belgium and Lithuania, have expressed cybersecurity-related concerns about Chinese phones, others disagree. With the automotive industry, the economic stakes are considerably higher.

Conditioning EV purchasing subsidies: Many European member states offer purchasing incentives to spur the adoption of electric vehicles. Member states could follow the lead of France and tweak regulations to restrict Chinese-made EVs based on sustainability criteria. This would place Chinese EVs at a severe competitive disadvantage. However, member states would have to act fast as most subsidy schemes are already on their way to being phased out. Additionally, if countries use environmental standards to penalize Chinese exporters as France is doing, Chinese companies could limit the damage by decarbonizing their production.

Forced labor regulation: A new EU measure banning products made with forced labor could be used to restrict the import of Made in China EVs. A recent report by Human Rights Watch found that many big OEMs including BYD, Tesla and Volkswagen could be procuring aluminum produced with forced labor. US authorities recently impounded cars produced by Volkswagen Group over allegations that they violated the Uyghur Forced Labor Prevention Act. The long lead time that is foreseen for implementation of the EU’s forced labor ban illustrates the limits of using this tool as a near- or medium-term solution for restricting imports.

Reviewing subsidies in procurement and investments: The EU’s new foreign subsidy regulation facilitates the review of large procurement contracts exceeding €250 million. However, it’s unlikely that many EV contracts will surpass this threshold. For instance, BYD secured a contract in December to supply 640 EVs for Austria’s federal government, likely for around €20 million considering MSRPs. Still, the use of EU funds, like REPowerEU, to support BYD in Hungary has prompted concerns that could lead to policy adjustments going forward.

Scaling back Europe’s EV ambitions: In 2022, the EU effectively instituted an internal combustion engine ban by implementing progressively stricter fleet emission targets, compelling manufacturers to elevate the proportion of EVs or incur penalties. Nonetheless, confronted with the considerable expenses associated with the EV transition and the surge in Chinese competition, certain segments of the European automotive industry and conservative parties across Europe have voiced opposition to the target. A review of the 2035 target, slated for 2026, presents an opportunity to recalibrate objectives, potentially buying ICE-focused European incumbents time and curbing the competitiveness of Chinese EV producers.

A more drastic review of WTO rules: In her Princeton speech in April 2024, Vestager voiced the view that the EU needs a more comprehensive approach to tackling Chinese distortions. One such way would be to raise tariffs on China across the board. This is highly unlikely for now, but could gain momentum if the US moves first. The Select Committee on China in the House of Representatives has called for the removal of Permanent Normal Trade Relations status for China, which would increase tariffs for Chinese goods across the board.

What to watch

We expect the Commission to place provisional duties on Chinese EV imports by early July. Going ahead we are also watching for:

Member state pushback: Before the imposition of final duties (by early November 2024) EU member states could try to block the EU’s case in the Trade Defence Instruments Committee. This would require a qualified majority of member states to vote against duties, something that has never been achieved before in an EU anti-subsidy investigation. German politicians and carmakers have signaled that they do not support the case. France, on the other hand, has made clear that it sees the need for EU action. Whether Berlin would risk a fight over the EV case is unclear. But we have seen Germany’s divided coalition government stand in the way of EU measures that were well advanced in recent months, notably refusing to support sustainability due diligence legislation.

Chinese retaliation: In January 2024, China launched an anti-dumping probe into brandy imports from the EU. The move was widely seen as a retaliatory move aimed at France, which was a vocal supporter of the EU’s trade case against Chinese EV imports. Should the EU impose duties, China is likely to do the same on brandy imports. It could also take other steps, for example responding in kind against EU automakers, tightening the regulatory screws on other European companies with a presence in China, or restricting the supply of critical minerals to Europe’s fledgling battery sector. Beijing, which is keen to avoid a tit-for-tat trade conflict with Europe that could further impeded its access to the European market, may wait until final duties are imposed before responding.

Following up with an anti-dumping probe: The EU chose to launch an anti-subsidy investigation into EVs rather than opt for an anti-dumping probe, which would have allowed it to impose higher tariffs. The decision to go down this path was likely driven by the fact that anti-dumping cases have a higher burden of proof and because Chinese producers have not priced their products extremely cheaply in Europe. Should Chinese EV exporters absorb the countervailing duties and subsequently lower their prices to gain market share in the EU, the Commission could follow up with an anti-dumping case at some point in the future.

Chinese EV sales figures in Europe: In recent months, Chinese EV exports to the EU have declined against a backdrop of high shipping costs, policy uncertainty, and major changes to EV purchasing subsidies in France and Germany. A continued decline in Chinese EV sales could reduce the political momentum for additional policy measures beyond the EV duties that are expected before the summer. A renewed surge of Chinese EV exports, by contrast, would increase the likelihood that new tools, including the measures floated by Vestager in her April speech, would be considered.

Chinese EV investment: In contrast to the US, the EU has remained open to Chinese investments in the EV sector. In December 2023, BYD announced plans to build a factory in Hungary. In April 2024, Chery signed a JV deal with Spanish EV Motors to produce cars in Catalonia. Were more Chinese brands to announce plans to invest in local production facilities in Europe, this could alleviate pressures in the bilateral trade relationship. It is also possible, however, that Chinese brands could come under scrutiny if they are producing cars that undercut European rivals. This could trigger cases under the EU’s Foreign Subsidies Regulation. Chinese brands could also face a backlash within Europe if their production facilities remain concentrated in China-friendly countries like Hungary, the country that has attracted the majority of EV-related investments by Chinese firms so far.