China’s GDP: The Costs of Omertà

This note explains the reasons for the awkward code of silence within official policy debates in discussing problems with China’s GDP estimates, and the costs of this silence both for China and the rest of the world.

China’s GDP data have been far too smooth to be realistic over the past four years, and the available benign explanations for the data are unpersuasive. This note explains the reasons for the awkward code of silence within official policy debates in discussing problems with the most common measure of China’s economy, and the costs of this silence both for China and the rest of the world.

A funny thing happened over the past winter and spring. China’s economy moved from a point approaching crisis to a modest cyclical recovery. But China’s economic data didn’t move. GDP growth was 6.4% year-on-year in Q4 2018. Then the economy posted 6.4% y/y GDP growth in Q1 2019, and only slowed to 6.2% in Q2 2019. Over the past sixteen quarters, China’s headline GDP has only varied by 0.8 percentage points in total, within the range of 6.2% and 7.0%.

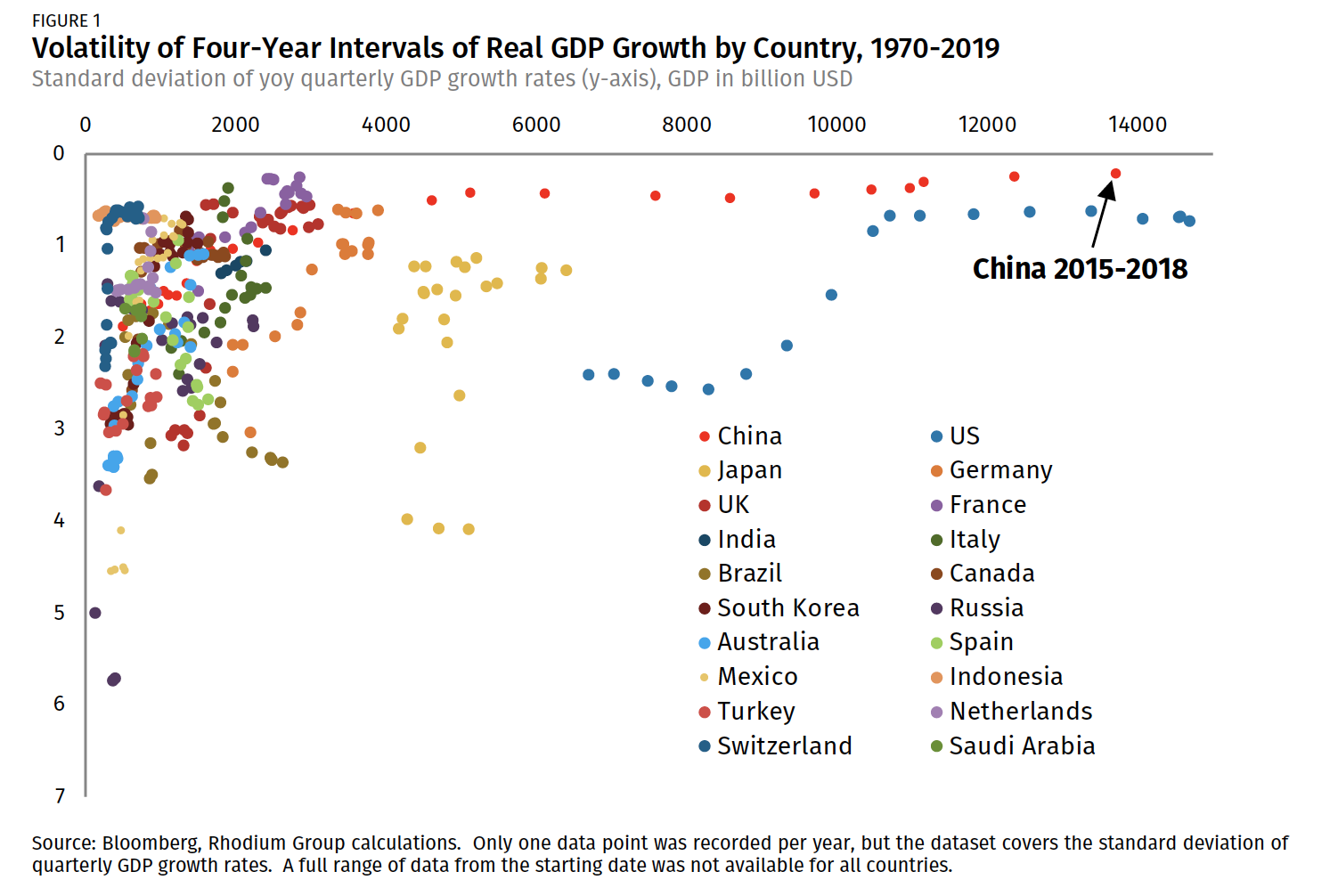

If that sounds unusually smooth, it is. There is no other country that we could find that had a similarly stable record of economic performance over four years, as far back as we could find quarterly economic data, for the top 20 economies in the world. China’s GDP data have varied less than any other large economy’s, and given that smaller emerging economies are usually far more volatile, China’s GDP data over the past four years likely exhibited lower volatility than in any other country. As Figure 1 indicates, China’s reported real GDP growth rates are a significant outlier, by any standard.

One can ask serious people about this problem of China’s “smoothed” economic data. Arguments about the quality of China’s GDP data are as old as the late 1990s at least, when Thomas Rawski realistically pointed out that there was a much sharper drop in China’s electricity output than GDP during the years following the Asian financial crisis.[1] And there used to be a legitimate argument about the extent of the smoothing, with some analysts claiming that China reduced reported GDP growth rates when conditions are good, and also boosted them slightly when conditions were bad. Others claimed that distorted local government data submissions had influenced nationally reported data to overstate overall growth rates, notably Chen, Chen, Hsieh and Song in a paper earlier this year.[2]

We are heavily invested in this debate ourselves, having taken a deep dive into China’s statistical methods in our report Broken Abacus in 2015.[3] We noted the numerous controversies involved in Chinese GDP reporting at the time, including the problems of the uncertain transition from production to income accounting at the local level, the problems of enterprise versus establishment reporting that can contribute to double-counting and the overlapping responsibilities between central and local authorities in statistical reporting.[4] But the stubborn fact is that since the publication of Broken Abacus in 2015, the GDP data simply has not moved, despite ample evidence of significant shifts within the Chinese economy during this four-year period, primarily from official Chinese output statistics themselves.

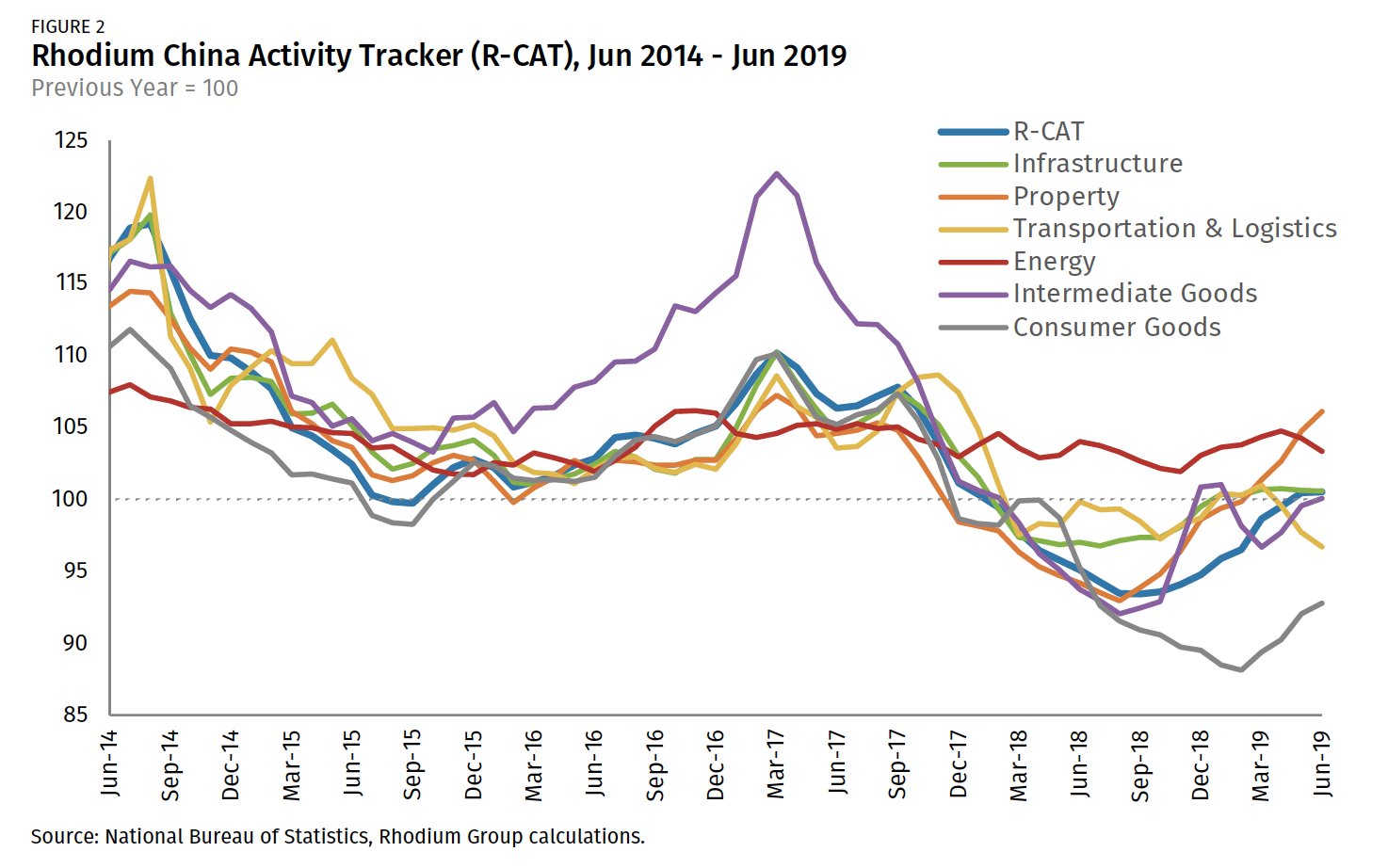

The best arguments typically on offer right now to explain the smoothing of GDP data point to the fact that perhaps policy-makers’ “manipulation” or management of the economy itself has improved, rather than manipulation or smoothing of the GDP data. However, raw output data (reflected in our Rhodium China Activity Tracker, which is a weighted average of official industrial output statistics) show a much more cyclical pattern than revealed in headline data (Figure 2). This rising cyclicality in recent output data does not suggest more precise economic management.

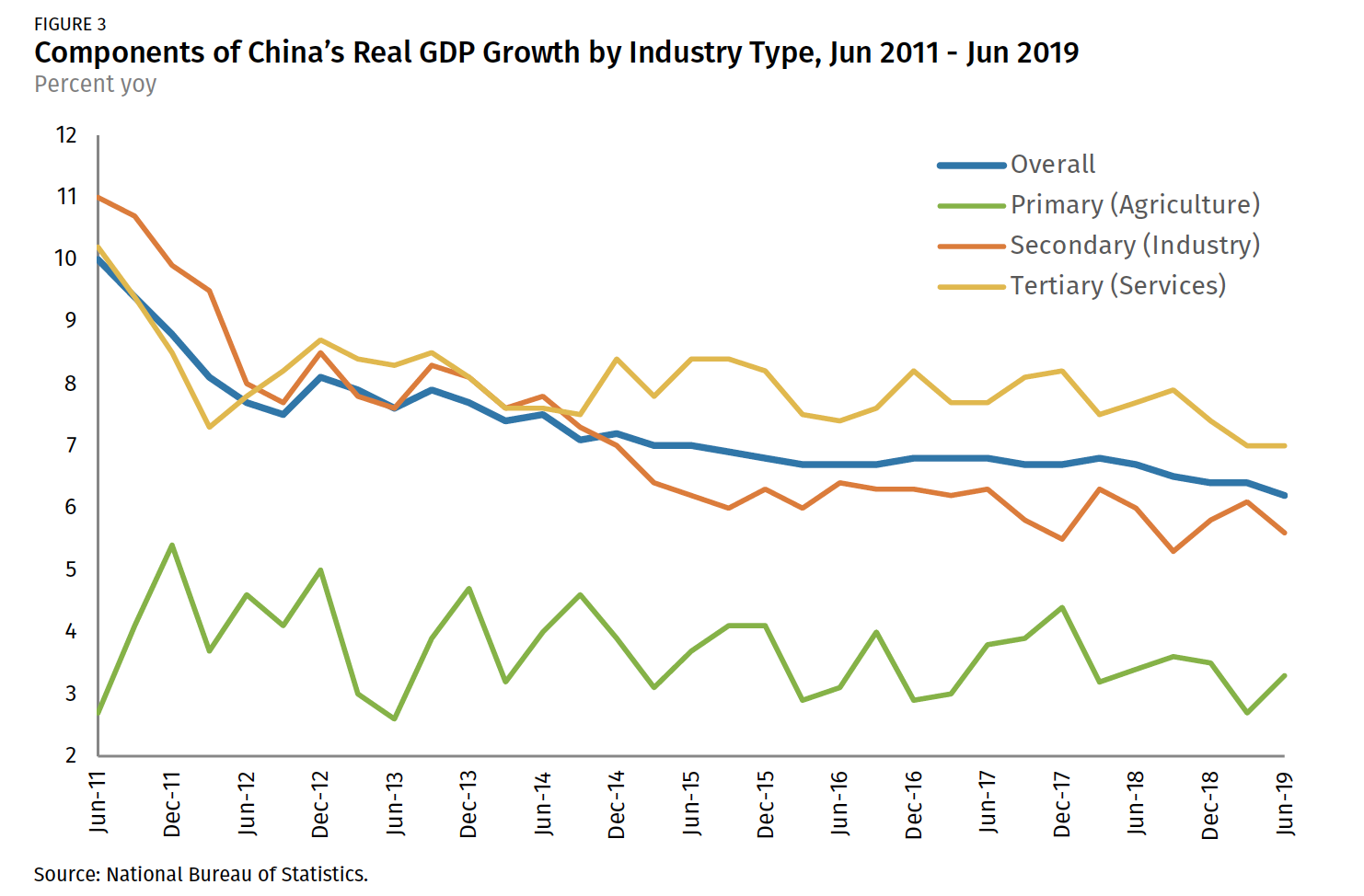

It can also be argued plausibly that as China becomes a services-driven economy, then growth should become less cyclical as incomes rise, and therefore GDP growth should be smoother over time. The problem with this argument in China’s context is that the services sector (tertiary sector production) is actually the more volatile component of officially reported GDP, particularly in the last four years (Figure 3). Agriculture (primary industry) only contributes a small portion of China’s official GDP. Looking at the data over the past four years, there is also a reasonable argument that services are actually being used as the instrument by which headline data are being smoothed, to offset some of the volatility in industry and construction.

There is no longer a readily available or plausible technical argument to explain the smoothing of China’s GDP data, and discrepancies can no longer be easily explained via debates about the importance of central government adjustments versus local government reporting. Given that most raw Chinese industrial output data series slowed sharply in 2015 and again in 2018, it is far more likely that data smoothing was conducted to overstate China’s GDP growth over the past four years rather than to understate it. The extent of that overstatement is vitally important to the global economy, given that China is the second-largest economy in the world.

The public debate should now shift toward a more realistic argument about how significant or meaningful the distortions in China’s GDP might be, and what implications those should have for our understanding of China’s economy and the global economy.

The Politics of China’s Inevitability

More interestingly, the reasons for these distortions in China’s GDP growth are well-acknowledged: economic performance is a key element of the legitimacy of the Chinese Communist Party, and stable data showing strong growth rates imply that China is growing more powerful, while any disruptions to the economy have been marginal. The cynicism about these political elements of China’s economic data runs deep, particularly within China itself. It is not an exaggeration to say that in almost two decades of professional experience in this field we have never met a Chinese official who professed privately to actually believe the GDP data (some did argue that while flawed, it was roughly accurate). All of them understood it was an element of political messaging, for various audiences.

GDP data around the world are messy and frequently subject to revisions, and GDP itself is a debatable measure of economic performance within any economy. One can easily discuss the controversies over India’s national accounts data revisions in 2015, for example. What is different in China is that these discussions about the accuracy of economic data are seemingly viewed internally as an attack on the legitimacy of the Communist Party, at least based on the way Chinese officials respond to alternative data series. China’s bureaucracy consequently cannot abide alternative measurements of China’s economy or even individual data series such as the level of fiscal spending, because they suggest an alternative political message from that broadcast by China’s Party leadership. A China that is growing at a much slower rate is not a China that is rising inevitably in global stature and influence.

One of the factors often cited to explain high and stable levels of announced GDP growth is a target Communist Party leaders reportedly announced in 2010, to achieve a doubling of GDP and household income by 2020 in order to mark China’s emergence as a “moderately prosperous society in all respects.” Others have cited the importance of the date 2021 for such a benchmark, since that would be the 100th anniversary of the founding of the Chinese Communist Party and one of the Party’s “centenary goals.”[5] The true relevance of these longer-term targets in actually guiding economic decision-making remains unclear; they were not mentioned in the report of the 19th Party Congress in 2017, for example, which is meant to establish key priorities for the Party leadership. But what is clear is that the targets themselves are explicitly political, and not grounded in an economic calculus of China’s potential growth or the financial system’s capacity to sustain growth at a certain level. If these longer-term Party-created targets require rates of GDP growth over 6 percent, then it is political factors that are likely pushing reported GDP growth rates higher.

And it is this political element of China’s GDP data that has introduced an awkward omertà or code of silence in discussing these issues concerning China’s official statistics frankly, particularly for global policy-makers and international financial institutions. International financial institutions such as the International Monetary Fund or the World Bank need active Chinese cooperation and signoffs on key reports and initiatives. Awareness that any dispute over China’s official data series would escalate quickly and might jeopardize that cooperation with China’s bureaucracy is probably enough to prevent any official from raising these issues publicly.

In addition, other governments encouraging China to reform its economy similarly have little interest in downplaying China’s current pace of GDP growth. In trying to convince China’s leaders of the necessity of reform, it is easier to do so when emphasizing China’s strength rather than its weakness. A weaker and more volatile Chinese economy may induce additional caution in reform initiatives from Beijing (although the counterfactual also has little evidence in support at this point, which our China Dashboard demonstrates).

The Costs to China

But this omertà of refusing to acknowledge the problems of China’s GDP data has real economic costs, and it is past time that these consequences were discussed more openly. Most of the costs of smoothing GDP data are borne by China itself.

It goes without saying that bad data can produce bad decision-making. Based on our work in Broken Abacus and our experience researching the Chinese economy for decades, we are highly skeptical that there is a hidden “second set of books” or an alternative data series for China’s overall economic growth that is only available internally. Certainly there are some data series and separate reports where the leadership has access, but are not released publicly. But generally, the official macroeconomic data presented publicly are also used by China’s leaders to guide the economy.

Therefore, an internally communicated impression of a smooth economic trajectory can lead to policy mistakes. Stimulative or accommodative monetary and fiscal policies could be left in place too long, without obvious evidence materializing that these policies are boosting output significantly. Similarly, the perception of stability can cause leaders to hold off from supporting the economy even when downside risks are building. China has arguably made both of these mistakes over the past decade and may be in the process of repeating the latter at present, given the pressures facing China’s economy from the US-China trade dispute and the slowdown in credit growth resulting from Baoshang Bank’s seizure and resulting interbank market tensions.

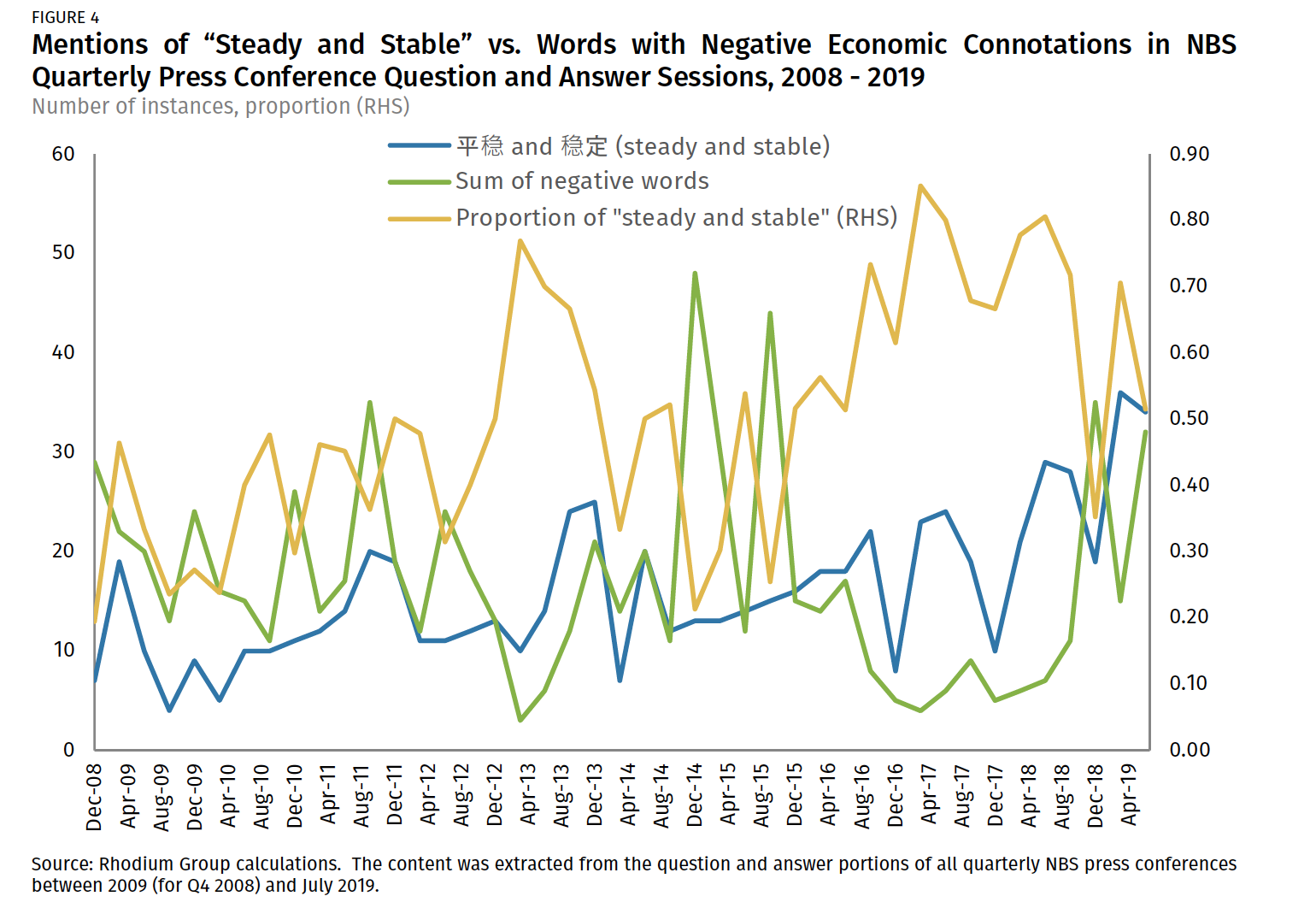

It can be argued that Chinese officials themselves understand how to read more minor adjustments within the headline data and attribute greater significance to a more limited degree of volatility, and that may be true. But China’s most recent four years, in which GDP growth has varied by only 0.8 percentage points, also saw limited volatility in other official headline output indicators, such as industrial value-added (IVA) or fixed asset investment. Chinese authorities clearly saw greater volatility in economic conditions over that interval. As the following analysis of official rhetoric within quarterly National Bureau of Statistics press conferences in Figure 4 shows, officials certainly discussed the economy in very different terms throughout the past four years. But this begs the question of what actual data was driving those assessments, and how accurate those data series were.

One can also argue that stability in headline GDP data has been an obstacle to more significant structural economic reforms. After all, if nothing is broken, what is the urgency of wrenching structural changes? More significant reforms to place economies on the path to more sustainable growth are often the product of economic crisis or a sharp slowdown. The perception of stability reduces the perception of the necessity of reform itself and the political power of reformers and technocrats, which causes the imbalances at the heart of China’s economy—exports over domestic demand, investment over consumption, continued debt growth—to swell and create larger problems in the future.

In addition, the perception of China’s inevitability cuts both ways for China’s leadership. Steady growth projections may look attractive when presented to intra-Party audiences and to the Chinese public. But they also clearly inspire concern from countries more worried about the potential consequences of China’s rise, which can lead to more aggressive efforts to “decouple” China from the rest of the world or increase the political costs of engagement with China. China likes to label this the “China threat” theory, but for those voices already casting a skeptical eye in China’s direction, straight-line GDP projections do not help to dissuade them. It is an open question whether or not more volatile and realistic GDP data would change these policy debates over the medium term, but more uncertainty in projections of China’s economy would probably drive a wider range of potential contingencies in policy planning in the Western world. If China wants to change its external perceptions, changing its economic data may be a good place to start.

The Costs to the World

The most obvious cost to the rest of the world in dealing with distortions in China’s GDP data occurs in making realistic projections of global growth and China’s impact on the global economy. This is the key dilemma for policy-makers within countries that are China’s trading partners. Put simply, according to IMF data, China has been responsible for around 39% of global GDP growth between 2010 and 2018, and around two-thirds of the growth in emerging markets over that time. The total growth in China’s economy has almost matched the total growth in all advanced economies over the same timeframe. If China’s data has been distorted meaningfully, then the growth of the global economy and growth of all emerging markets relative to developed markets has also been distorted.

For the rest of the world, a smoothed picture of China’s GDP leads to a search for alternative indicators of growth. But there is no consensus alternative measure of China’s economy as a whole, outside of the data produced by the NBS itself. However, there is a mountain of evidence that suggests that China’s economy is far more volatile and pro-cyclical than headline GDP or IVA data indicate. A recent Financial Times article discussing China’s GDP data made the case simply, “China’s quarterly gross domestic product growth numbers are closely monitored for clues to the direction of the Chinese economy, but they are rarely taken at face value because many believe the practice of giving officials targets skews the results.”[6] This creates challenges for policy-makers and investors who see the impact of rapid changes in lower-level Chinese data components—steel output, iron ore imports, semiconductor prices, auto sales—reverberate within their own domestic economies and impact asset prices.

The output data that China’s statistical bureau produces, across a wide variety of indicators, show a much higher degree of cyclicality than GDP. As we wrote in Broken Abacus, the NBS itself claims to supplement its own survey work with a measure of over 400 volume-based indicators, because at that scale, volume data could not vary too much from GDP growth over a short period of time.[7] This is essentially the logic we used ourselves in constructing our alternative indicator of China’s industrial output, the Rhodium China Activity Tracker (R-CAT, in Figure 2). The R-CAT is designed to essentially provide a reading on China’s industrial output across a wide range of volume-based indicators, with heavier weights for the more volatile components and those that are less correlated with China’s headline data. As a result, the R-CAT amplifies the resulting volatility of a weighted average of 103 different output indicators, but even with no underlying adjustments, a simple weighted average is still far more volatile than headline GDP or official measures of industrial value-added.

Most importantly, however, the R-CAT has shown a wide range of outcomes over the past four years, from 0-1% industrial output growth in the summer of 2015 to 10-11% growth in Q1 2017, dropping sharply to an outright 6-7% decline in the middle of 2018 amidst China’s deleveraging campaign, which dramatically cut corporate credit growth, industrial output, and investment.

The R-CAT is merely our preferred measure of China’s industrial output, and there are others available in the marketplace. But the fact that no one can agree upon the essential shape of China’s economic cycles naturally leads to difficulties in policy-making, particularly for emerging market central banks and China’s trading partners. Many of these central banks have used the IMF’s economic forecasts in the past in order to make their own projections of inflationary or deflationary forces emerging from China. As a result, when China slows more than headline data would imply, inflation measures weaken and emerging market central banks are often forced to quickly cut interest rates. We have seen this phenomenon in both the last Chinese slowdown in 2014-2015 and the current cycle.

Many central banks are adjusting their own metrics, based on our own conversations; some have downplayed GDP growth from China significantly in favor of more granular indicators that are meaningful within their domestic economies, such as steel or coal demand, or semiconductor exports, for example. But the broader consequence of China’s smoothed GDP data is that it introduces a broader range of uncertainty into the assessment of economic conditions in the rest of the world. This is already a monumental task, and uncertainty over the signals emerging from the world’s second-largest economy only complicates it further. For example, if China decided to be more realistic tomorrow and publish growth rates below 6%, markets would certainly react, financial conditions in global markets would change, and global policy-makers may be forced to consider policy adjustments to the lower potential trajectory of China’s growth in the future, at least as it would be reported. And if global growth has truly been weaker than reported in recent years, there is a reasonable case that the rest of the world should have responded sooner or altered strategies for economic stimulus.

The Linkage Between Credibility and Financial Stability

Fundamentally, the most important consequence of China’s management of its GDP data is a continued deterioration in China’s credibility—in domestic and international financial markets, in international policy circles, and even among the media and the general public. If China’s economy continues to report stable growth rates above 6%, then it is a reasonable assumption that China will become the largest economy in the world—on paper—sometime around the end of the next decade. But should those growth rates never vary at all on a gradual glide path lower, it is just as plausible that no one will take China’s claim to be the world’s largest economy seriously, or at the least will attach a high degree of skepticism to that claim.

As we argued in Credit and Credibility, the credibility of China’s leadership to provide macroeconomic and financial stability has been the most important defense against financial crisis so far, despite the rising credit risks within China’s economy.[8] The Baoshang Bank seizure and the corresponding creation of counterparty solvency risk highlights the rising importance of Beijing’s overall level of credibility. As government guarantees on bank solvency were removed, markets scrambled to reprice these risks, and banks started transacting with a smaller pool of counterparties that were considered safe.

As financial risks in China continue to mount, Beijing’s credibility is more important than ever in managing those risks. Messages that the state still has both the capacity and the will to address financial contagion need to be believed by markets for the containment of risks to be effective, as risks spread from the more peripheral segments of the financial system to larger institutions.

And if China’s GDP is believed to be overreported, then China’s debt burden will consequently be perceived as higher as a proportion of the economy and less sustainable over time. Banking system assets are already 310.5% of China’s 2018 GDP. If GDP is overstated by even 10% then this metric would be closer to 345%, and annual interest payments on credit would approach 16-17% of GDP. Should markets discount China’s GDP data, they will also be less willing to deploy capital within the Chinese financial system over time, because of the belief that more credit risks will materialize despite strong rates of reported economic growth. A more realistic accounting of GDP, immediately, is therefore much safer for Beijing in the long term rather than risking markets making their own assessments that may be inaccurate, but still harmful to policy-makers’ attempts to stabilize the economy.

And more importantly, the credibility of China’s claims to maintain unprecedented stability in growth rates will weaken over time as long as there is no structural reform of China’s economy, with a significant reallocation of capital away from state-owned enterprises and toward the more productive private sector. This will necessarily involve short-term pain and a slowdown in output as the costs of past malinvestment are absorbed. As we discussed in Chapter 1 of Credit and Credibility, China’s potential growth is clearly slowing—the labor force is already declining, and additional growth from capital formation can only contribute 3-4% of annual GDP growth at most.[9] The rest must come from rising productivity, including the productivity of the financial system, and that shift will not occur overnight. The longer that China continues to report stable GDP growth rates, pledges of structural reform will become less and less believable.

Another related issue to the smoothness of China’s GDP growth is whether China is ultimately regarded by global financial markets as a large emerging market economy, or a developed economy. Emerging economies typically see more volatility in economic performance than developed markets. This is a particularly important question given China’s recent inclusion into global bond indices. In an emerging market economy, a sudden slowdown in growth is likely a reason to grow concerned about financial stability: capital outflows may result, bond yields will rise, and currencies are likely to weaken. Balance of payments pressures are likely to result.

In developed economies, however, a slowdown in growth is likely more positive for bond prices, as there is less concern about the instability created by capital outflows. Longer-term bond yields may fall in these circumstances, and investors’ assumptions will generally gravitate toward the slowdown becoming more controlled. Stable GDP growth rates may help China attract foreign inflows in the short term as the economy slows, similar to developed economies, but if those statistics are less credible, China may suddenly appear more like a large emerging market once again.

Stability in published economic performance is not credible evidence of stability in economic management. The concern for China in the coming years is that continued projections of stability will result in a lost decade of economic growth when the consequences of an unreformed economy become readily apparent to all.

A Way Out: Reshaping an Uncertain Past

We would offer Chinese policy-makers a modest proposal to address some of these threats to credibility in published GDP growth rates: change the past, for the sake of the future.

Specifically, we would suggest the NBS make a highly public announcement of a revision of GDP levels and growth rates from 2014 to 2018, reducing GDP growth rates in 2014 and 2015, revising 2016 and 2017 rates slightly higher, and reducing the 2018 growth rate and producing a correspondingly lower level of nominal GDP. This is roughly in line with the pattern of China’s official output statistics, as summarized in the R-CAT.

The logic of such a revision would be to bring China’s level of reported economic volatility more in line with other economies, and to increase the credibility of each subsequent GDP release. Localities have already revised down 2014 and 2015 output growth rates themselves, and the sum of these revisions already totals around 2-3% of 2014 GDP. Such a data revision needs to be realistic. But more importantly, anything else besides the current growth rates will look more realistic, and will enhance Beijing’s credibility.

A more volatile growth trajectory in the past can also help policy-makers to downplay the significance of GDP targeting in the future, if it has been shown that China has already missed these targets in the recent past, without economic or social calamity. And demonstrating that the economy has slowed sharply in an unreformed state can reinvigorate debates about the importance of structural reform.

For those who would argue the costs of this adjustment are too high, because they jeopardize other Party-driven goals such as a doubling of key indicators by 2020 or the perception of China’s economic inevitability, we can only reply that the costs of continuing on the current unrealistic path and trying to enforce a global omertà in discussing these problems in China’s GDP data are much, much higher.

Notes

[1] Thomas Rawski, “What is Happening to China’s GDP Statistics?” China Economic Review, vol. 12, no. 4 (2001): 347-354.

[2] Chen et al., “A Forensic Examination of China’s National Accounts,” Brookings Papers on Economic Activity, March 7, 2019. https://www.brookings.edu/bpea-articles/a-forensic-examination-of-chinas-national-accounts/.

[3] Dan Rosen and Bao Beibei, Broken Abacus? A More Accurate Gauge of China’s Economy (Washington: Center for Strategic and International Studies, September 2015).

[4] Rosen and Bao, Chapter 2.

[5] See, for example, Shannon Tiezzi, “Why 2020 is a Make-or-Break Year for China,” The Diplomat, 13 February 2015, https://thediplomat.com/2015/02/why-2020-is-a-make-or-break-year-for-china/.

[6] Lucy Hornby, “China locked into investment-led growth by GDP targets,” Financial Times, 22 July 2019.

[7] Rosen and Bao, p. 62.

[8] Logan Wright and Daniel Rosen, Credit and Credibility: Risks to China’s Economic Resilience (Washington: Center for Strategic and International Studies, October 2018, Chapter 6.

[9] Wright and Rosen, Chapter 1.