A Climate-friendly Gas Tax Swap?

With the long term solvency of the Highway Trust Fund still in doubt, this note explores the impact of replacing the current federal gasoline tax with an economy-wide tax on carbon dioxide emissions.

The primary source of federal funding for highway and public transit maintenance and improvement is the federal excise tax on gasoline and diesel. These taxes, which have remained unchanged since 1993, deliver 22% less revenue in inflation-adjusted terms now than they did two decades ago. This trend is projected to accelerate as declining real tax rates are compounded by declining gasoline demand. While the bipartisan infrastructure framework currently being debated in Congress would help cover federal surface transportation spending, the long-term solvency of the Highway Trust Fund remains in doubt. In this note, we explore the impact of replacing the current federal gasoline tax with an economy-wide tax on carbon dioxide emissions. If set at a level that would result in no net change in retail gasoline prices, but inflation-adjusted over time, such a carbon tax would generate an additional $477 billion over the next ten years while reducing carbon dioxide emissions by roughly 300 million metric tons. That would provide more than enough revenue to shore up the Highway Trust Fund and cover any increase in household energy costs through a dividend or programmatic spending. If the carbon tax rate increased faster than inflation, it would deliver both greater emission reductions and more revenue.

The dim outlook for federal gas tax revenue

Since 1956, the primary source of federal funding for surface transportation (highways and public transit systems) maintenance and improvement has been the Highway Trust Fund. The primary source of funding for the Highway Trust Fund is the federal excise tax on gasoline and diesel sales. These taxes, currently set at 18.4 and 24.4 cents per gallon respectively, have remained fixed in nominal terms since 1993. In addition, after decades of growth, US gasoline demand peaked in 2007, on the eve of the Great Recession, and had still not fully recovered in 2019 on the eve of the COVID-19 pandemic. Flat demand growth combined with declining real tax rates resulted in a 27% decline in federal gasoline tax revenue between 1999 and 2019 after adjusting for inflation, from $35 billion to $25.6 billion in 2020 dollars. Real diesel tax revenue declined by a more modest 10% during the same period, from $13.1 billion to $11.8 billion.

While gasoline demand is recovering from a severe pandemic-driven decline in 2020, it is unlikely to return to previous peak levels. Improved efficiency in internal combustion engine vehicles and growing market share for electric vehicles will deliver sustained reductions in US gasoline demand in the years ahead, even with no change in federal or state policy. For example, in their 2021 Annual Energy Outlook, the Energy Information Administration (EIA) projects US gasoline demand for transportation will fall from 9 million barrels per day in 2019 to 7.7 million barrels per day by 2030. If the federal gasoline tax remains unchanged, annual revenue will decline from $25.6 billion to $17.8 billion in real 2020 dollars over the same period. Rhodium Group modeling projects an even steeper decline under current policy if lithium-ion battery prices fall as fast as Bloomberg New Energy Finance and other analysts project.

Even with a more optimistic outlook for federal gas tax revenue than the one cited above, the Congressional Budget Office still projects that the Highway Trust Fund will run a $178 billion loss between 2022 and 2031 in real 2020 dollars. [1] The recently announced Bipartisan Infrastructure Framework would address much of that gap over the next 5-8 years, provided Congress and the White House can agree on revenue sources. But the long-term fate of the Highway Trust Fund remains threatened by the structural decline in federal gasoline tax revenue.

The impact of replacing the gasoline tax with a carbon tax

A carbon tax is not on the list of revenue sources the White House or Congress are currently considering as part of either the Bipartisan Infrastructure Framework or the remainder of the American Jobs Plan or American Family Plan that the White House and congressional Democrats are looking to pass through budget reconciliation. But there continues to be pockets of support for carbon tax legislation in both the House and Senate. Two recent examples of this are the Energy Innovation and Carbon Dividend Act (H.R.2307), which has 77 co-sponsors in the House, and the Save Our Future Act (S.2085), which has eight co-sponsors in the Senate.

Given this continued interest, we modeled the impact of replacing the gasoline tax with an economy-wide carbon tax as a revenue source for federal surface transportation funding. For this modeling we used RHG-NEMS, a version of the National Energy Modeling System created by the EIA as modified and maintained by Rhodium Group. As our baseline, we used the current policy scenario detailed in this report, which relies on our Taking Stock 2020 V-shaped macroeconomic recovery scenario, coupled with the latest low technology cost assumptions from National Renewable Energy Laboratory.

We started with a carbon tax that would have the same impact on retail gasoline prices as the current federal gasoline tax—roughly $18 per ton of CO2—taking effect in 2023. As opposed to the current gasoline tax, however, we index this to inflation. This is a considerably lower carbon tax rate than proposed in S.2085, which starts at $54 a ton, but a little higher than the $15 a ton starting price in H.R.2307.

The carbon tax in both S.2085 and H.R.2307 rises over time in inflation-adjusted terms, by 6% a year and $10 a year respectively. Therefore, in addition to our fixed $18 per ton scenario, we assessed the impact of a carbon tax that starts at the same level—$18 per ton—but rises at $6 per year after inflation—a rate of escalation somewhere between S.2085 and H.R.2307. Finally, we modeled the same rising carbon tax scenario combined with the power sector and electric vehicle tax incentives in the Clean Energy for America Act (S.1298), which passed the Senate Finance Committee at the end of May.

Revenue Impacts

We estimate that if the federal government replaced the current gasoline tax (but not the diesel tax) in 2023 with an economy-wide carbon tax fixed at $18 per ton in inflation-adjusted terms, the US Treasury would collect $668 billion over the 2022-2031 budget window (in real 2020 USD), a net increase of $477 billion relative to keeping the current gasoline tax in place. [2] That would more than cover the $178 billion projected shortfall in the Highway Trust Fund over the same period of time, with $300 billion left over for other purposes.

If the carbon tax were to increase by $6 a year (after adjusting for inflation), net revenue collection would nearly triple, to $1.24 trillion between 2022 and 2031. After covering the projected Highway Trust Fund deficit, there would still be $1.06 trillion in available revenue. According to recent analysis from the Joint Committee on Taxation, the clean electricity and electric vehicle tax incentives in S.1298 would cost $187 billion between 2022 and 2031 in 2020 dollars. [3] Funding that, in addition to the Highway Trust Fund deficit, with revenue from an $18 per ton carbon tax that rises at $6 a year would still leave an $873 billion surplus.

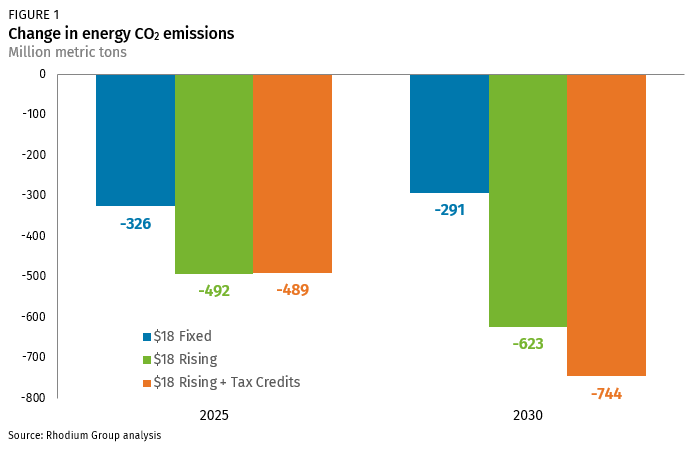

CO2 emissions

Unsurprisingly, an economy-wide carbon tax is far more effective at reducing CO2 emissions than a gasoline tax. Replacing the current gasoline tax with a fixed $18 per ton carbon tax would reduce US energy-related CO2 emissions by 326 million metric tons in 2025 and 291 million metric tons in 2030 relative to current policy (Figure 1). That brings overall energy-related CO2 emissions to 28% and 30% below 2005 levels in 2030 respectively. Increasing the carbon tax by $6 a year significantly improves its environmental effectiveness, boosting energy-related CO2 reductions to 492 million metric tons in 2025 and 623 million metric tons in 2030 (to 31% and 35% below 2005 levels respectively). If some of the revenue is used to fund the clean electricity and electric vehicle provisions in S.1298, energy-related CO2 emissions will fall to 37% below 2005 levels by 2030.

Energy costs

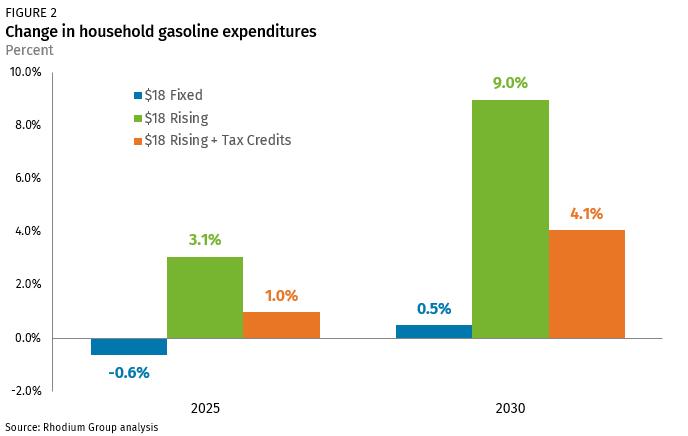

Swapping out the current federal gas tax with a fixed $18 per ton economy-wide carbon tax would, by design, have no immediate impact on retail gasoline prices in the US or overall household gasoline expenditures (Figure 2). If the carbon tax rose by $6 a year, household gasoline expenditures would increase by 3.1% in 2025 and 9% in 2030 relative to current policy. The electric vehicle tax credits included in S.1298 would cut the increase in household gasoline expenditures under a rising carbon tax by more than half by incentivizing more Americans to switch from internal combustion engines to electric vehicles.

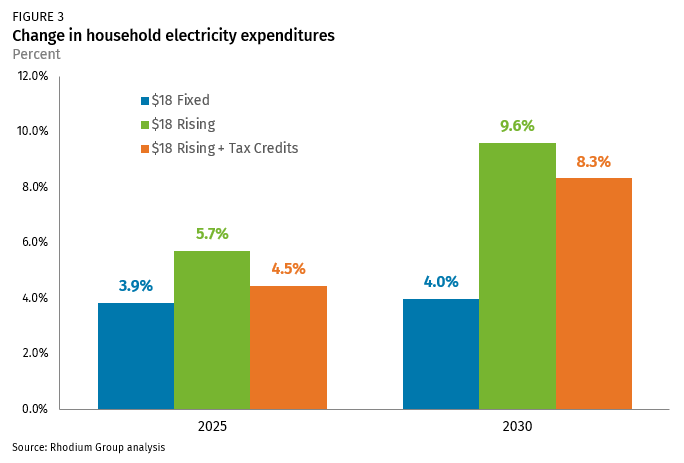

Household electricity expenditures increase modestly under all three carbon tax scenarios, from 4% in 2030 under a fixed $18 a ton tax to 9.6% under a tax that rises by $6 per ton a year (Figure 3). The tax credits in S.1298 would reduce household electricity costs, even as they shift more Americans into electric vehicles, by cutting the cost of renewable electricity.

Net effect for American households

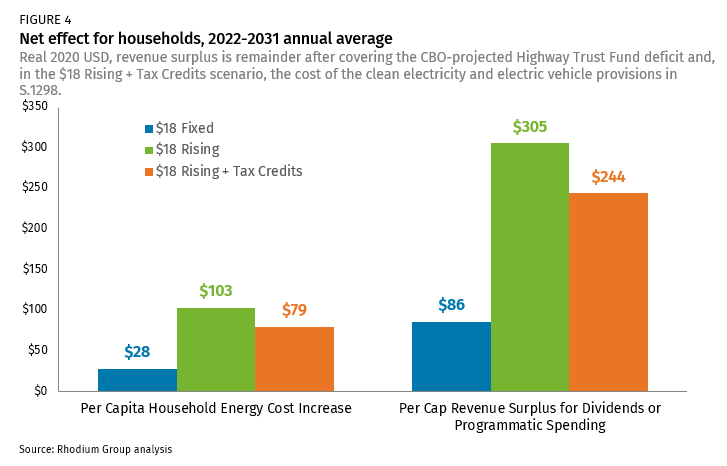

Replacing the current gasoline tax with a carbon tax would not only shore up the Highway Trust Fund but would provide substantial additional revenue for other purposes—all while delivering significant CO2 emission reductions. A gas tax-carbon tax swap would, however, increase overall energy costs (electricity, gasoline and other fuels) for American households—by $28 per person annually on average between 2022 and 2031 if the carbon tax is fixed at $18 per ton, or $103 per person if it rises by $6 per year (Figure 4). Using some of the revenue to fund the clean electricity and electric vehicle provisions in S.1298 would cut the increase in energy costs by 23% and deliver additional carbon emission reductions. The surplus revenue generated by the carbon tax after paying for the Highway Trust Fund shortfall would, however, be three times more on a per capita basis than the increase in household energy costs. That revenue surplus could be returned to households in the form of rebates to cover both the increase in household energy costs and the potential increase in the price of non-energy goods, or it could be used to fund programs that address other potential impacts of the carbon tax (like economic development support for coal-producing communities), or a combination of both.

[1] CBO projections are in nominal dollars. We converted these to real 2020 dollars using the CBO’s GDP Price Index published in July 2021.

[2] For budget scoring purposes, the Joint Committee on Taxation and Congressional Budget Office would likely apply a 20-25% “hair cut” to carbon tax revenue estimates to account for a reduction in other tax revenue as a result of the effects of the carbon tax. That “hair cut” is not included in the revenue estimates provided in this analysis.

[3] JCT projections are in nominal dollars. We converted these to real 2020 dollars using the CBO’s GDP Price Index published in July 2021.

This nonpartisan, independent research was conducted with support from the Linden Trust for Conservation. The results presented in this report reflect the views of the authors and not necessarily those of the supporting organization.