Far From Normal: An Augmented Assessment of China’s State Support

Compared to other countries, China’s approach to industrial policy has been characterized by broader and more entrenched market distortions, deeply systemic rather than targeted, and with a far greater distortive effect on global trade.

About this paper

Far From Normal is a Rhodium Group occasional paper written to share views and elicit discussion. The analysis consolidates years of piecemeal work by the authors on China’s economic system and its international interactions, both in design and in practice. The work is self-funded and self-initiated: Our sole objective is to promote better policy and commercial deliberation, both in China and abroad.

In addition to our own research and scholarship, the authors have drawn upon extensive work by other professionals both at Rhodium Group and other organizations, especially those working on financial system dynamics. We have benefited from ample feedback from numerous outside experts in the fields of international trade, investment, the WTO and other organizations, and China.

We welcome correspondence to discuss this work.

Executive summary

In recent years, many countries—including major market economies—have ramped up support for their domestic industries, embracing industrial policy in ways that were once considered at odds with the rules-based trading system. However, these newly enthusiastic industrial policies remain fundamentally different from those pursued by Beijing over the past decades. China’s approach has been characterized by broader and more entrenched market distortions, deeply systemic rather than targeted, and with a far greater distortive effect on global trade.

China uses a broader range of state-support mechanisms than most countries.

- China uses instruments and practices in a much broader way than other countries, distorting market competition and providing advantages to domestic firms. The state’s pervasive and systemic participation in China’s economy also happens on a larger scale than in other countries.

- While not all of these instruments and practices are countervailable subsidies under the WTO’s Agreement on Subsidies and Countervailing Measures (SCM), they have large distortive effects due to their widespread use in China.

China’s use of “conventional” market-support mechanisms is more intense.

- Many of the state support tools China uses are also broadly used elsewhere. These include direct grants to companies, tax incentives, and below-market access to finance, equity, land, energy, and other intermediate inputs (we call these “conventional” support tools).

- Estimates vary, but existing research overwhelmingly indicates that the scale of China’s state support through these conventional instruments widely exceeds international practice.

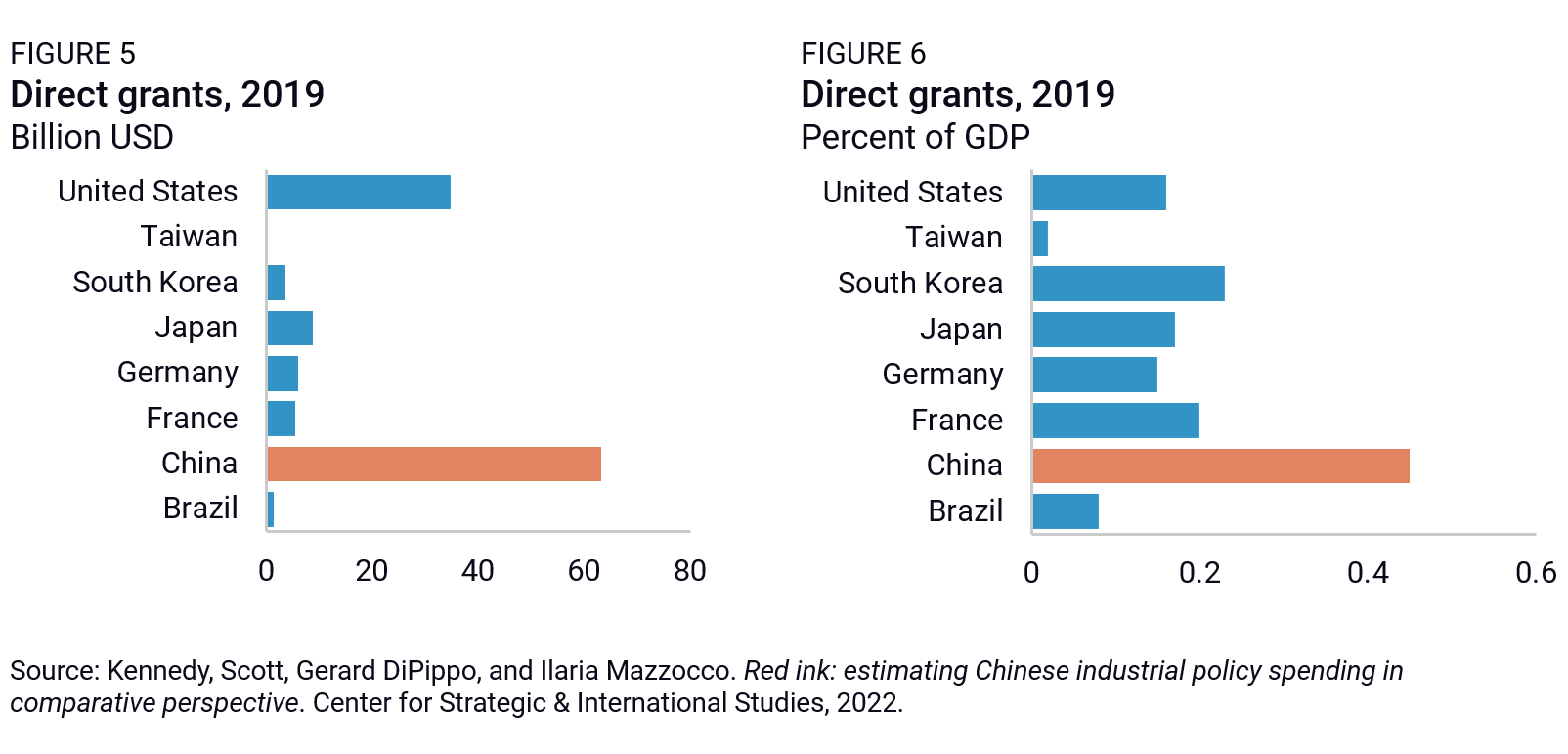

- China spends more through direct grants and tax benefits than any other major economy, both in absolute amounts and as a share of GDP. While direct grants have increased at about the same pace as GDP growth over the past decade, tax benefits have grown faster.

- China’s government also supports an unusually wide swath of sectors and firms. This is because it uses these support mechanisms not only as an instrument of strategic industrial policy, but also for more quotidian purposes like boosting economic growth or maintaining employment and social stability. For example, research shows that more than 98% of A-share listed companies in China received subsidies in 2020.

- Since its entry into the WTO, China has rolled back many of its grant and tax incentive policies that were evidently non-WTO-compliant. However, our and others’ research suggests that some of China’s current practices remain effectively discriminatory and hence might be considered actionable subsidies under the WTO framework.

- China’s practices are also difficult to track. Local governments play a key role in disbursing grants and tax incentives and China is unwilling to share details about them.

- China’s use of below-market borrowing and equity is much more pervasive than in other economies. This is largely because of the significant weight of state ownership in China’s banking system and widespread state investment in companies.

- The provision of below-market inputs is the most difficult area to examine due to the lack of available data. While there is no evidence that China uses more widespread subsidization through below-market energy than its global peers, there is a systematic bias toward low industrial land prices that benefits the entire industrial sector. Research also shows that state-owned companies are routinely asked to provide below-market intermediate inputs to firms in key sectors.

Persistent systemic distortions in China’s economy also generate some of the same effects as subsidies and other “conventional” state support tools.

- Many Chinese firms operate with the assumption of implicit guarantees from the government. This has led to an expansive and politicized financial sector that allocates credit to strategic sectors without the same regard for economic fundamentals as in more market-driven economies. The politically-driven deployment of these vast financial resources gives Chinese—and, to a lesser extent, some foreign—companies easy access to finance and soft budget constraints, creating effects akin to more conventional subsidies.

- Local governments also build production infrastructure and real estate in industrial parks, which are then provided at discounted prices to companies. This has some of the same effects as a subsidy—enhancing corporate profitability and competitive advantage—but without direct financial handouts.

- Regulation and market access is selectively enforced to the benefit of politically favored companies, often local firms, but also foreign firms that align with Beijing’s strategic interests. This helps them scale rapidly and become globally competitive when they otherwise might not have been.

- Lastly, China exercises control over commercial actors through state-owned companies, Party cells, and “golden shares” in private companies. It can steer firms’ behavior, coordinate competition, and encourage excessive market power, which benefits state-backed companies and strategic domestic industries.

Investigations under the WTO SCM framework are hindered by the pervasiveness and opacity of China’s state support and the diversity of actors involved.

- China’s state support toolbox is extensive, including financial, regulatory, and political tools, creating a self-reinforcing system that generates significant market distortions. These distortions affect whole value chains, which are more difficult to capture in CVD investigations that typically only focus on one sector.

- State-induced market distortions in China are not only the result of interventions from the government and state-owned enterprises. They include a much wider set of actors—private companies that feel pressured (even without explicit requests) to align with Beijing’s objectives, private investors who are incentivized to follow high-level policy guidance, universities and researchers who are encouraged to follow state priorities in their research agendas, courts that take government goals into consideration in their rulings, and media that amplifies government messages. Interventions from these actors are more difficult (though not impossible) to capture in an SCM framework that only considers interventions from entities that possess, exercise, or are vested with governmental authority.

- These market distortions don’t come solely from explicit national policies or directives from the top. There are built-in incentives for various actors, particularly at the local level, to support local producers. These incentives are a by-product of the inherent structure of the local economy and fiscal system. The lack of clear documentation of state support practices makes the system opaque, and difficult to address under a SCM framework that requires thorough evidence of the alleged subsidy. Yet they also contribute to deep distortions in global markets.

- The scale and systemic nature of China’s state-driven industrial policies have fueled a growing mismatch between Chinese manufacturing supply and global demand, contributing to China’s worsening overcapacity problem. This imbalance is not just a domestic issue—it has far-reaching consequences for global trade, as surplus production floods international markets, undercutting competitors, disrupting industrial ecosystems, and heightening trade tensions with major economies.

Current legal tools to address subsidies may need to be updated

- Recent CVD cases, such as the EU Commission’s investigation on imports of new battery electric vehicles from China, have featured innovative ways to overcome the opaque nature of the Chinese system. For example, the Commission established the existence of a normative framework that applied to all financial institutions in China, whether private or state-owned, and justified their treatment as entrusted and directed by the Chinese government. More creative use of the WTO’s SCM rules could follow.

- The more systemic aspects of China’s state support system require policymakers to take a new look at global tools to address non-market policies and practices, with a view to adapt, expand, and potentially innovate from current rules to make it easier to address these distortions. A rules-based system remains the best way forward, but it needs to integrate new realities to remain relevant and efficient.

- Current legal tools are not fully sufficient to address the scale and systemic nature of China’s market distortions, despite efforts by some economies to push the boundaries of existing trade rules through more creative enforcement. As global trade tensions intensify and the US increasingly turns away from the WTO system, policymakers face the dual challenge of protecting their economies from China’s market distortions while trying to uphold the integrity of the rules-based trading order. Ultimately, the long-term relevance of the multilateral trading system depends on its ability to adapt and address the full spectrum of trade and market distortions that undermine fair competition.

Introduction

Over most of the post-1978 period, and especially as it prepared to join the WTO, China made admirable progress toward marketization. It reduced trade and investment barriers, improved intellectual property rights regimes, removed price controls, and improved laws governing customs, product quality, and commodity inspections. It also boldly reformed its tax, corporate, and price systems. At the turn of the century, it shook up its state-owned firms at the cost of millions of jobs. Altogether, its regulators revised over 10,000 rules to align with international standards.

However reforms have stalled in recent years. Despite ambitious promises of market-centered reforms in 2013, China has not delivered on enough to assuage trade partner concerns. Market outcomes in China and their impacts abroad are still distorted by many state-related factors. Beijing has made perfectly clear that it asserts control over the economy, including its lifeblood, the financial system.

China is now starting to feel the limits of its decade-long, investment-led, and industrial policy-fueled growth model. Rising imbalances in its economy—including persistent overcapacity, a growing manufacturing trade surplus, and deflationary pressures—are not only creating domestic vulnerabilities but also distorting global trade and challenging industrial ecosystems abroad.

This has created tensions with other trading nations, with some US policymakers even calling for the withdrawal of China’s permanent normal trade relations status. At the same time, the global trade environment itself has shifted significantly. Many countries—including the US and the EU—have ramped up support for their domestic industries, embracing industrial policy and local industry protection on a scale that the GATT and later the WTO were meant to prevent. The US, once the leading proponent of a rules-based global trade system, has turned away from WTO rules, opting for unilateral trade actions and bypassing multilateral dispute settlement.

This leaves policymakers worldwide grappling with the dual challenge of protecting their economies from China’s market distortions while navigating escalating trade tensions—and, for many, trying to preserve the integrity of the rules-based trading order amid these pressures. In the longer term, if and when the global trade system eventually stabilizes, the question of how to reset or update the rules to make them more sustainable and fit for purpose will become unavoidable.

At the heart of this debate will be China. Beijing does not explicitly challenge the WTO and, in fact, officially positions itself as a defender of the multilateral trade system. However, its market distortions are more systemic, more widespread, and—because it accounts for a third of global manufacturing—more consequential than those of any other major economy. The scale of China’s state support is simply not the same.

A fact-based assessment of China’s policies and practices is therefore critical to inform current debates. This paper provides as comprehensive an accounting as possible of China’s state support by cataloging subsidies and subsidy-like measures. It documents the scope and scale of Chinese state support that qualifies as countervailable subsidies. It also highlights the difficulties in using them in CVD investigations due to partial data, opaque practices, and the multiplicity of actors involved.

Beyond traditional tools, this paper also focuses on non-conventional forms of state support beyond the scope of the WTO rules. These forms of state support distort the Chinese and global playing fields in a similar way to subsidies, generally to the near-term benefit of China-made products, contributing to China’s expanding dominance in global manufacturing.

To better discipline these distortions, some economies have already started to push the boundaries of existing rules. For example, the EU’s CVD investigation into imports of China-made battery electric vehicles has used existing trade tools in a more creative and expansive way. A growing number of cases brought under the WTO, as well as new trade instruments like the EU’s Foreign Subsidies Regulation, suggest a trend toward more aggressive enforcement within existing legal frameworks. But despite these adjustments, there are serious concerns about the ability of current legal instruments to effectively counter the scale and complexity of China’s state-driven economic model.

Ultimately, however, the long-term relevance of the rules-based global trading system depends on its ability to address the full spectrum of trade and market distortions that undermine fair competition. Failing to do so risks a fragmentation of the global economic order, with the proliferation of mini-lateral frameworks, sectoral trade agreements, and an erosion of multilateral norms. Over time, this could weaken the guardrails that prevent national security or environmental justifications from overtaking normal trading relations, further accelerating the shift toward a more fragmented, unpredictable, and politicized trade environment.

Actionable subsidies under the WTO system

Today’s rules-based international trading system, with the WTO at its heart, are founded on the principle that international trade should be conducted fairly, with minimal distortions caused by government intervention or support. In particular, the Agreement on Subsidies and Countervailing Measures (SCM Agreement), signed in 1994 by 128 countries including China, provides a framework to address specific types of subsidies that are actionable or prohibited—and enables members to take action when these subsidies cause material injury to domestic industries.

The SCM Agreement was deliberately designed to focus on specific types of distortions, particularly those involving financial contributions by a government or a government-entrusted body. It only applies to subsidies related to trade in goods, leaving aside trade in services, and foreign direct investment. Other subsidy-like distortive measures can be challenged under other WTO rules, such as the Trade-Related Investment Measures (TRIMs) Agreement, but these rules typically require members to initiate disputes through the WTO’s dispute settlement mechanism. This process can be time-consuming, uncertain, and costly – and has been effectively stalled due to the vacancy of the WTO Appellate Body since December 2019, which blocks major avenues for legal recourse.

The WTO SCM Agreement’s definition of subsidies contains three basic elements: (1) a financial contribution (2) by a government or any public body within the territory of a Member (3) which confers a benefit. All of these elements must be satisfied in order for a subsidy to exist.

- Financial contribution means: a direct transfer of funds (e.g., a grant, loan, or infusion of equity); a potential transfer of funds or liabilities (e.g., a loan guarantee); foregone government revenue (e.g., a tax credit); or the purchase of goods, or the provision of goods or services (other than general infrastructure).1

- To determine that an entity is a public body, the entity should “possess, exercise, or be vested with governmental authority.” The Appellate Body, however, stipulated that measures may still be attributed to a government if the entity is a private entity “entrusted or directed” by a government or by a public body.2

- Benefit: government provision of equity capital, loans, goods and services, shall not be considered as conferring a benefit, unless the decision can be regarded as inconsistent with the usual investment practice.

Further, only some subsidies are countervailable under the SCM Agreement. Some subsidies are prohibited under the rules, including export performance subsidies and local content requirement subsidies. But beyond those, a member state can only take countervailable actions against a subsidy if it is specific, meaning it needs to have been specifically provided to an enterprise or industry or group of enterprises or industries. The underlying principle is that a subsidy that distorts the allocation of resources within an economy should be subject to discipline. Where a subsidy is widely available within an economy, such a distortion in the allocation of resources is presumed not to occur.

The member state must also show adverse effects of the subsidy. These include (1) injury to the domestic industry of another Member, (2) nullification or impairment of benefits accruing directly or indirectly to other Members under GATT 1994, or (3) serious prejudice. This last category includes total ad valorem subsidization of a product over 5%, subsidies covering operating losses sustained by an industry or an enterprise, or if the effect of the subsidy creates a significant price undercutting.

A taxonomy of China’s state support mechanisms

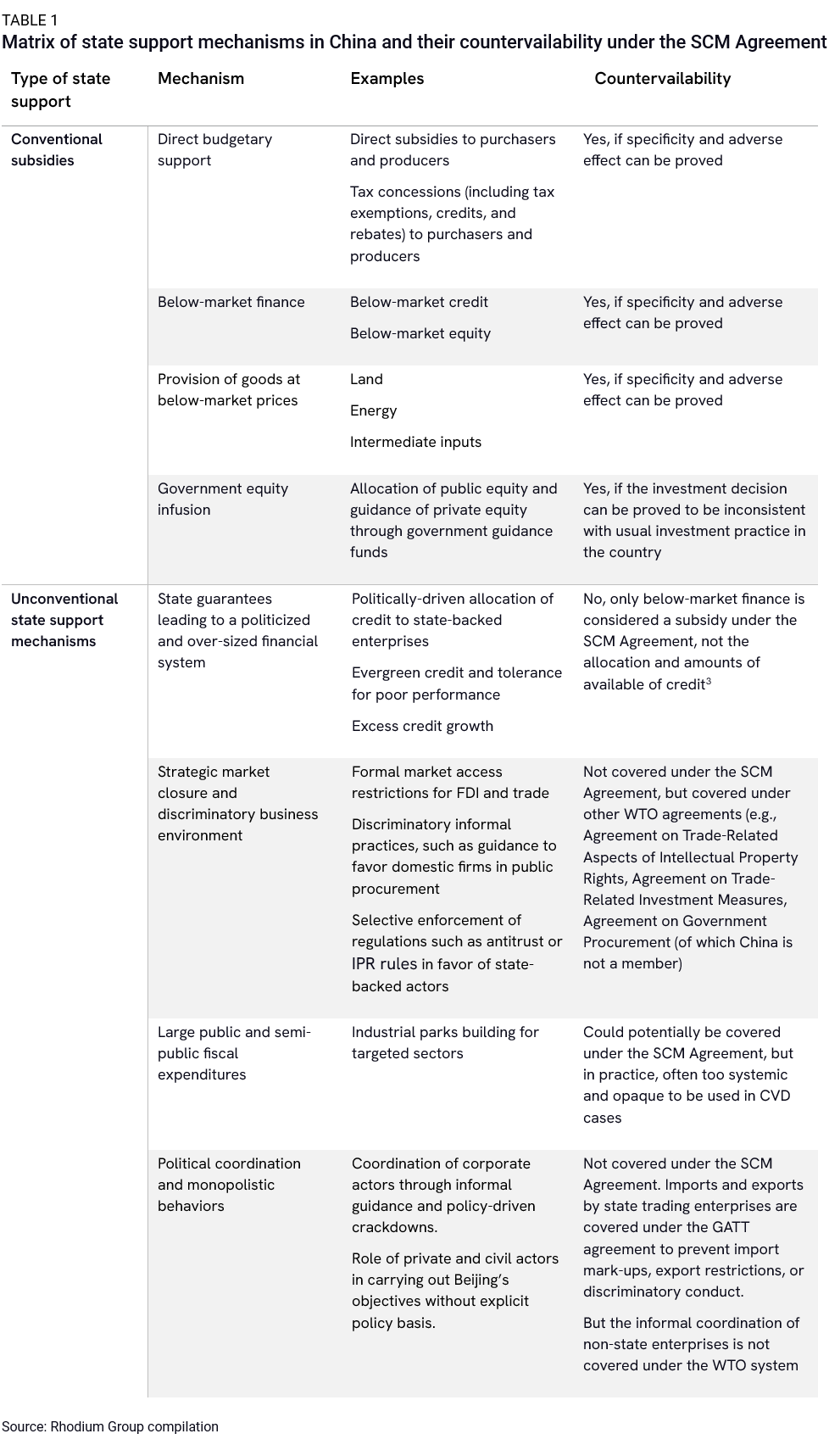

The Chinese government uses a wide range of instruments to intervene in the economy and steer industrial outcomes (Table 1). Many of them are conventional subsidies that are widely used in other countries and largely fall under the SCM Agreement. Other mechanisms, like the pervasive moral hazard that runs throughout China’s economy and results in large amounts of credit flowing to state-backed enterprises, are not typically considered subsidies but have subsidy-like effects of distorting the economy and altering industrial outcomes.

Most of these unconventional state support mechanisms are not easily addressed within the WTO system, in part because they are systemic, pervasive, and cannot easily be identified as benefiting certain sectors or companies in particular. In particularly, they pose challenges under the WTO’s SCM Agreement because they do not amount to a financial contribution by a public body—but rather by corporate actors (banks, investors, other firms) or by consumers (market restrictions leading to higher prices). Nonetheless, they have large distortive effects, particularly due to the large scale of their use in the Chinese economy.

In the next sections, we define and contextualize each instrument, provide an estimate of their scale in China’s economy where available, and discuss their countervailability in the China context.

Conventional state support mechanisms

Conventional state support mechanisms are subsidies that are broadly used in and outside of China and are well-researched. They include budgetary support (through direct grants, tax rebates, and other mechanisms), below-market finance (borrowing and equity), and inputs provided at below-market prices.

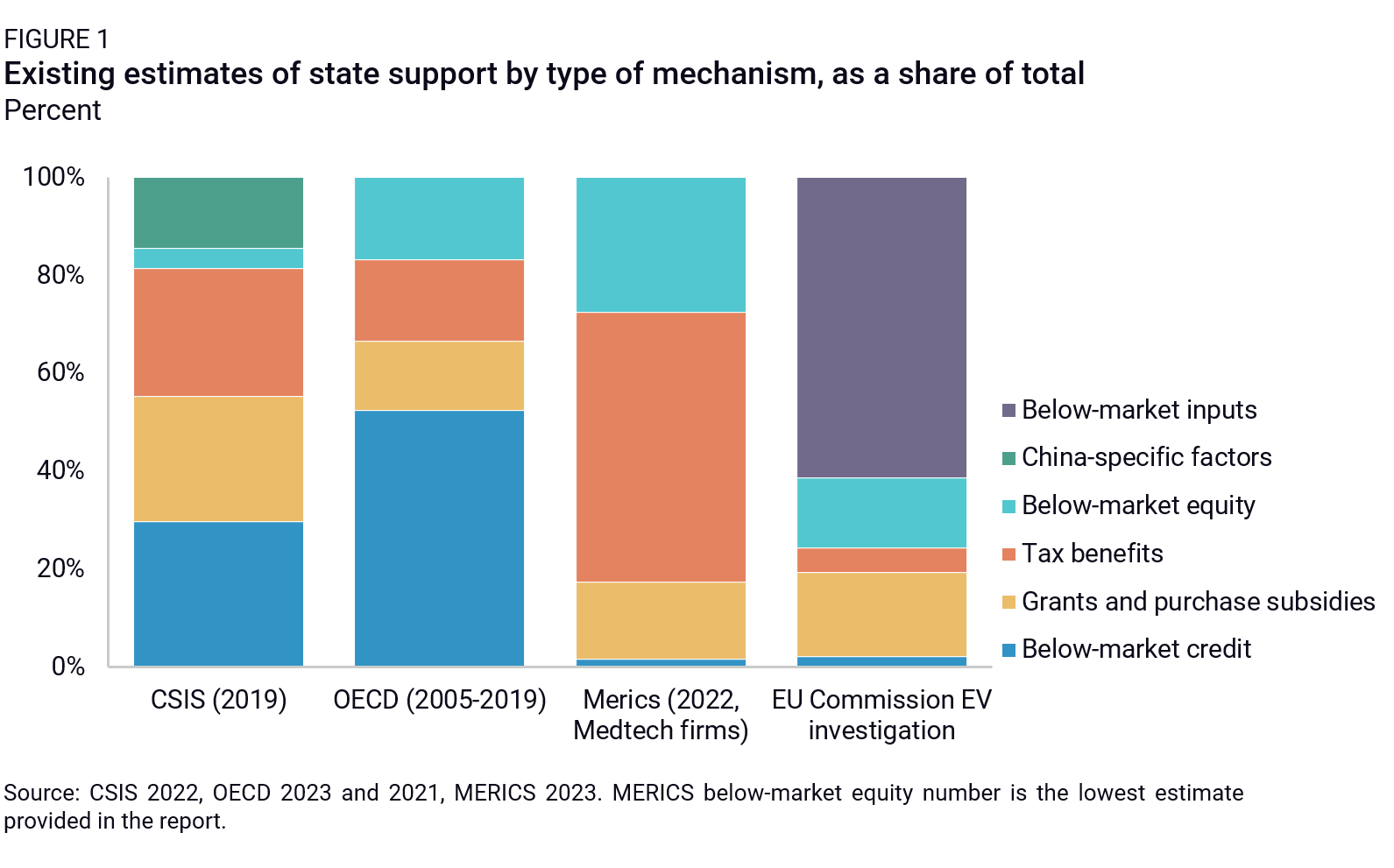

Estimates of China’s use of each of these instruments vary (Figure 1),3 but all point to a significant scale. OECD research covering firms in 13 sectors between 2005 and 2019 estimates that Chinese state support spending amounted to 4.5% of the revenues of Chinese firms covered (against 0.69% in OECD countries) with more than half being below-market borrowing.4 More recent OECD reports on the wind and solar value chains5 and the automotive industry6 also found that Chinese firms generally receive larger subsidies relative to their revenue than firms based in OECD countries. CSIS research found China’s industrial policy spending to be $248 billion in 2019, or 1.73% of China’s GDP.7 A MERICS study from 2023 on the medtech sector in China estimated that between 2017 and 2022, state support was equivalent to at least 5.3% of company revenue on average, with more than half through tax benefits.8 The EU Commission’s implementing regulation of 3 July 2024, imposing a provisional countervailing duty on imports of new battery electric vehicles, found that direct grants, below-market inputs, as well as non-loan types of financing, were the three largest channels of state support.

Budgetary support

China’s budgetary support takes two main forms: direct transfers of funds (such as research grants, operating grants, and other cash transfers) and foregone tax revenue (including preferential tax rates, tax credits and rebates, whether they are for investment, R&D, or other purposes).9 China also uses other forms of budgetary support, such as underpricing government goods and services, but they are more difficult to track.10

Direct grants

Definition: Direct grants are financial contributions provided by governments or other organizations to businesses without the expectation of repayment. They can be operational (provided to cover day-to-day expenses and operational costs of the company) or non-operational (for purposes outside of regular operational expenses, often linked to specific projects or investments). From a corporate accounting perspective, direct grants can either be counted as income or deducted from the cost of capital expenditure.

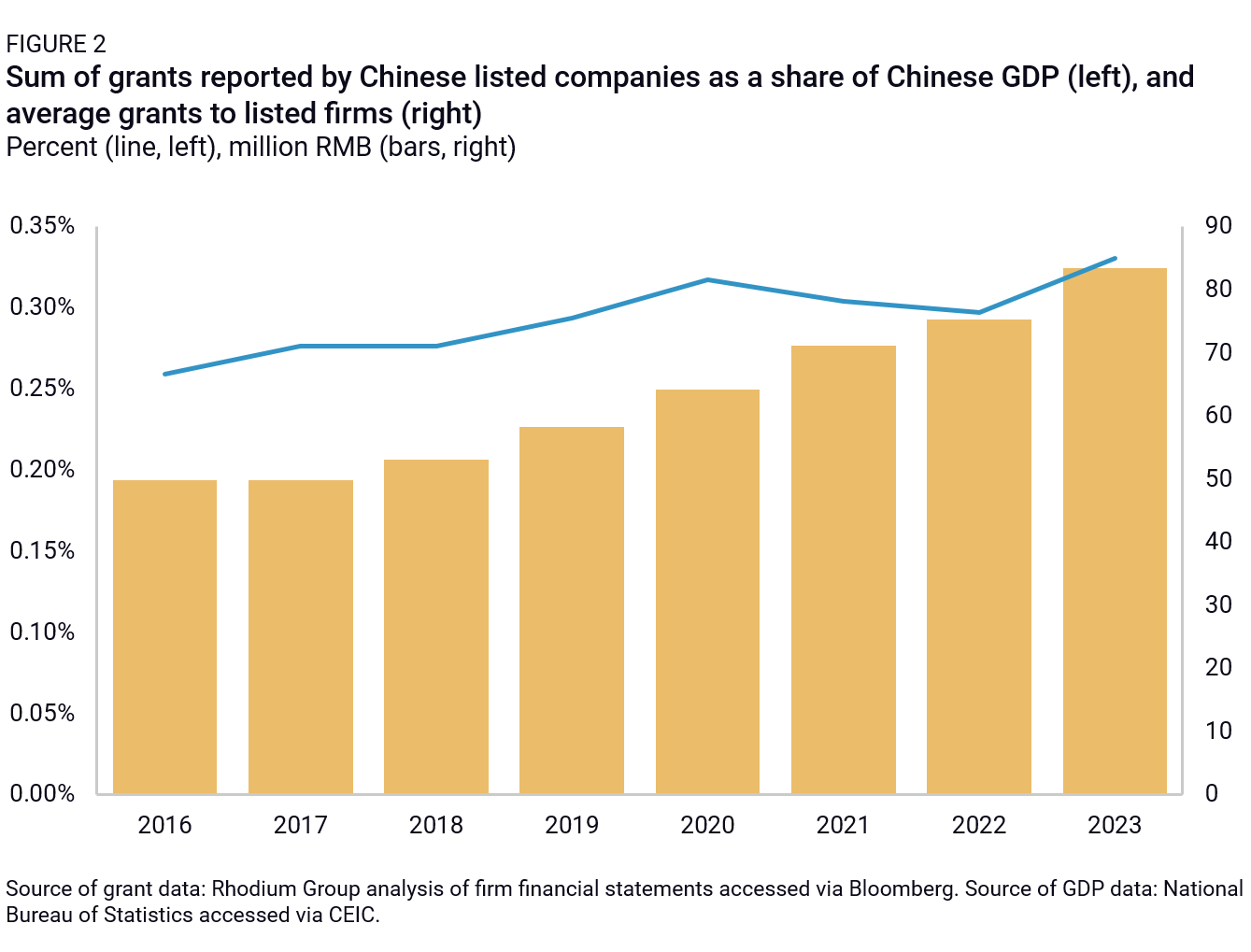

Amounts and evolution: Over the past decade, direct grants to Chinese listed companies have grown at a relatively rapid pace, particularly since 2016—though they have stagnated as a share China’s GDP (Figure 2). The average amount of grants received by listed companies in China increased by 67% between 2016 and 2023, while China’s GDP officially increased by 70% over the same period.

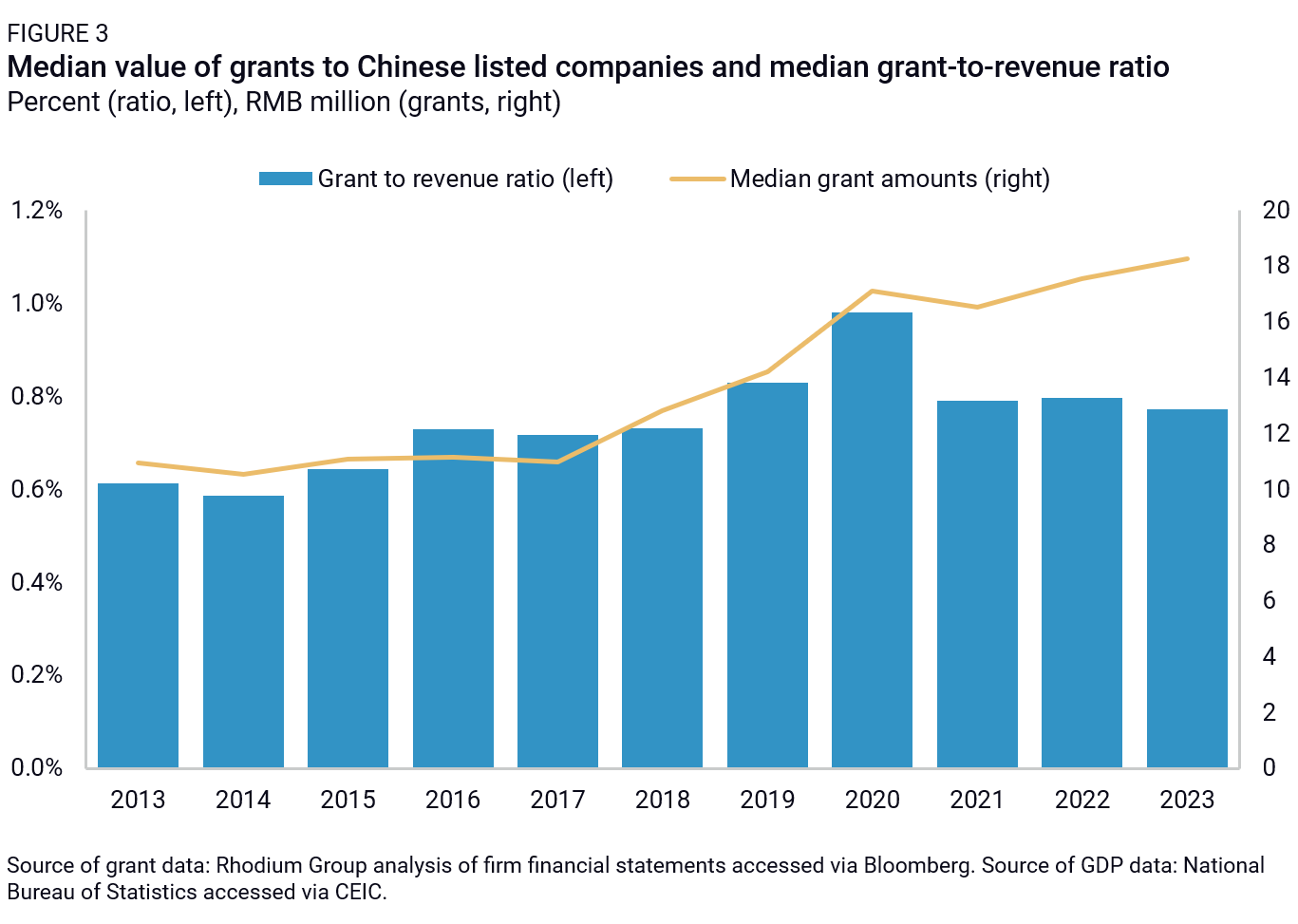

Moreover, the median amount of subsidies received, as well as the median grants-to-revenue ratio, has stagnated since 2020, an indication that more funding is concentrated in larger companies (Figure 3). This stagnation may be due to growing fiscal constraints, particularly for local governments that are responsible for funding the majority of direct grants. However, direct subsidies to certain sectors, like the electric vehicles industry, have grown much faster in the past few years.

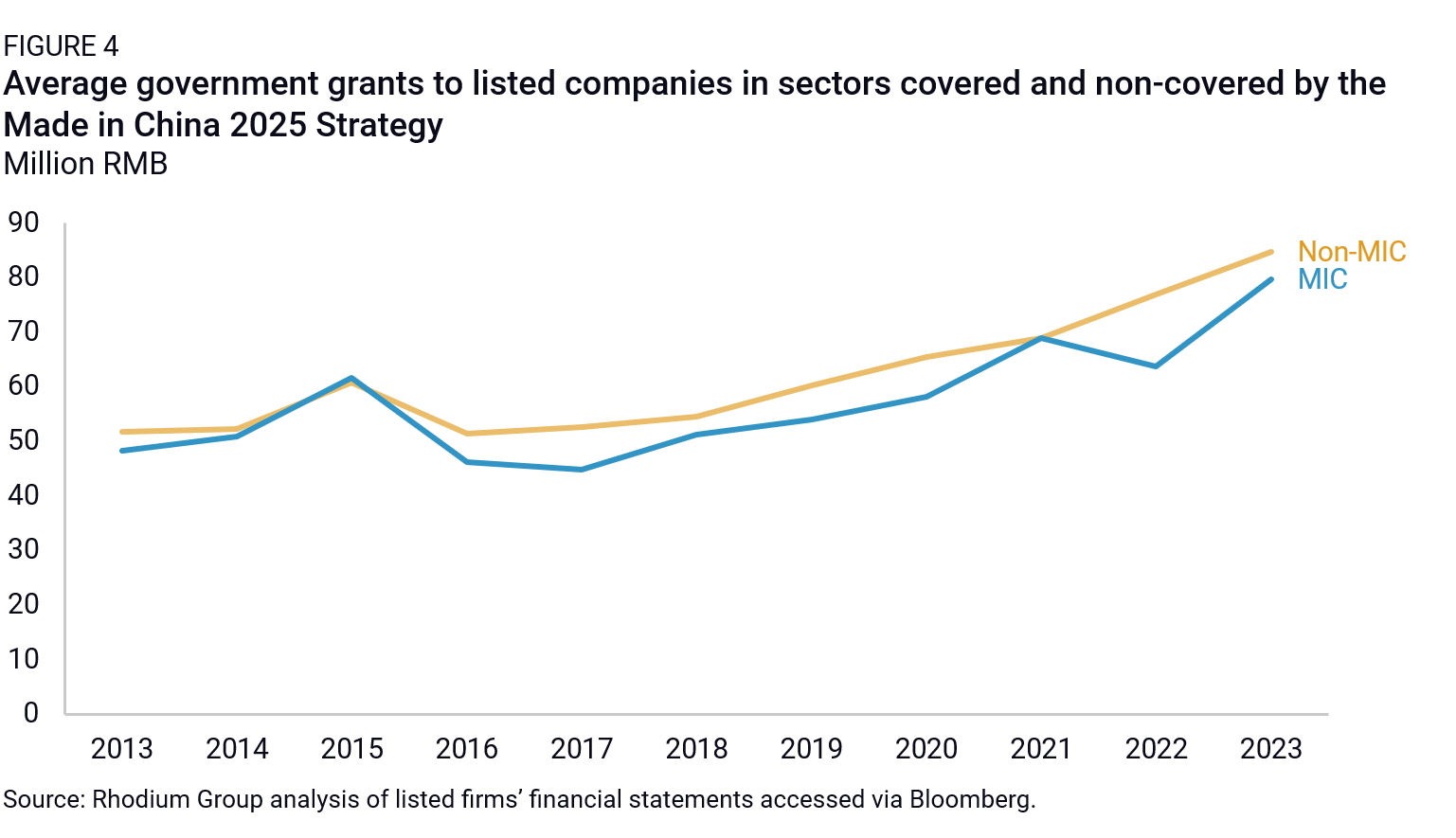

Disbursed amounts tend to match China’s announced industrial policy priorities, but also often reflect broader objectives of economic and social stability.11 In recent years, companies in strategic sectors targeted by the Made in China 2025 strategy have seen comparable levels of support as other companies (Figure 4). This points to two non-exclusive realities: China’s industrial policy priorities tend to span a wide range of sectors, and economic and social stability objectives also drive state support—especially since the COVID-19 outbreak.

Virtually all large, listed Chinese firms receive government subsidies in one way or another. Since 2007, the proportion of subsidized companies in all Chinese A-share companies has remained above 70%, growing to more than 90% after 2010, and as much as 98.58% in 2020.12 Moreover, data from listed companies shows that, when controlling for size, listed SOEs receive less direct grants than private peers.

Data is harder to collect for non-listed companies, but OECD reports have pointed out subsidies to non-listed SOEs such as COMAC, AVIC, or Baowu are much larger than those to most listed companies in their sectors. The OECD reports also showed that Chinese SEOs are larger recipients of subsidies than other China-based firms.13

The analysis is also limited by inconsistent financial reporting by Chinese firms and frequent changes to disclosure rules on what qualifies as a subsidy, making it harder to track and compare subsidy data over time.14

International comparison: Direct grants are not specific to China, but the amounts disbursed in China through direct grants have been found to vastly exceed those in other OECD economies. According to the CSIS Red Ink report from 2022, Chinese direct grants, both in absolute terms and as a share of GDP, vastly exceed amounts in other surveyed countries (Figures 5 and 6).15

Countervailability: The Chinese government provides various kinds of grants to different types of enterprises (Table 2). The most commonly used forms of direct subsidies are R&D and industrial upgrading grants, which together account for more than half of all amounts disbursed since 2003.16 Both are seemingly horizontal and non-sector-specific. However, in practice, they often target certain sectors and technologies that the government wants to promote.

Some grant schemes even discriminate against foreign players, like the subsidies for electric vehicles. Between 2015 and 2019, EV carmakers had to use batteries from a catalog of recommended domestic suppliers to obtain state subsidies.17 Beyond the battery sector, foreign firms in all industries report that subsidy provisions widely discriminate against them. A vast majority of respondents to the European Chamber of Commerce’s Business Confidence Survey in 2021, for example, reported being aware of subsidies offered to Chinese firms that foreign firms could not access.

However, certain grants are also allocated to foreign firms that align with Beijing’s strategic objectives. In the EV industry, foreign carmakers have received significant state support for their China operations to encourage them to shift production and export capacity from Europe to China. The EU Commission’s investigation on imports of battery electric vehicles, for example, found Tesla to have received substantial direct grants from the Chinese government.

In practice, direct grants have often been used in countervailing cases. A study of 45 CVD orders imposed by the US Department of Commerce on China between 2008 and June 2017 shows that grants were one of the most common forms of state support mentioned in cases regarding subsidies granted by Chinese local governments.18

In practice, direct grants have often been used in countervailing cases. A study of 45 CVD orders imposed by the US Department of Commerce on China between 2008 and June 2017 shows that grants were one of the most common forms of state support mentioned in cases regarding subsidies granted by Chinese local governments.18

However, the dense tangle of local governments handing subsidies to companies—often without clear policies—makes it difficult to prove that they are countervailable. For example, of the grants disclosed by Chinese rolling stock firm CRRC in 2022, only 3% were issued by the central government and 3% by provincial governments, the rest being sub-provincial governments. This makes subsidization particularly opaque and difficult to address within the WTO’s SCM Agreement framework.

Tax concessions

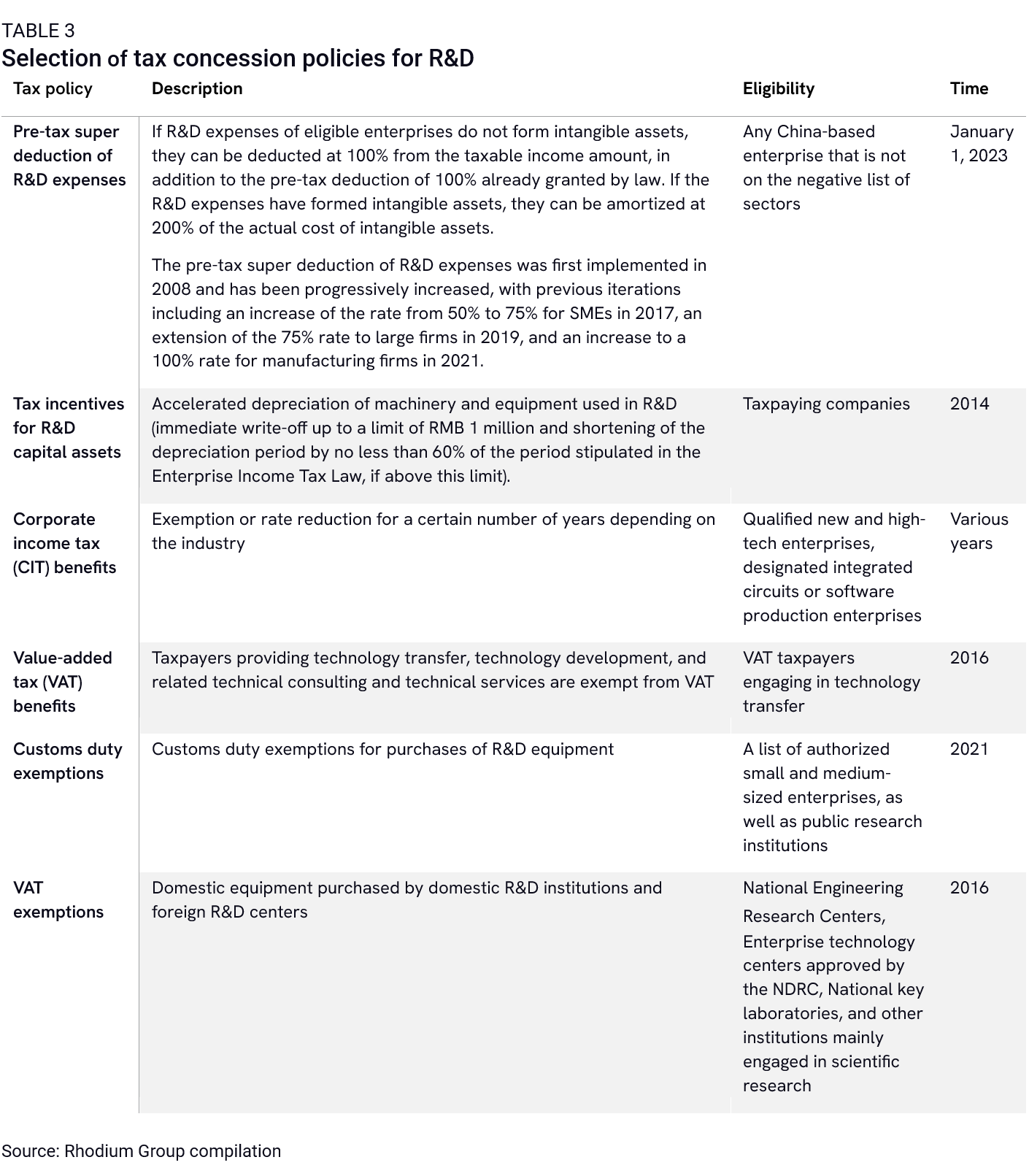

Definition: Tax concessions are a widely used form of support in China. They include preferential tax rates for certain industries, broad-based tax deductions for R&D, and the exemption or reduction of corporate income tax for selected industries (Table 3).

Amounts and evolution: China’s use of tax concessions has greatly expanded over the past decade and is a crucial part of China’s state support system, given its centrality in China’s S&T funding effort, as well as a tool to promote the emergence and growth of start-ups in strategic industries like medical technologies or biotech. China’s Bureau of Taxation reported that R&D tax incentives alone amounted to RMB 1.3 billion in 2022 and grew by an average of 28.5 percent every year between 2018 and 2022.19 In R&D-intensive and strategic sectors, they account for a large part of conventional government support. According to a 2023 MERICS study on the medtech industry, tax concessions were the single largest channel of subsidies in 2022, above direct grants and below-market finance.

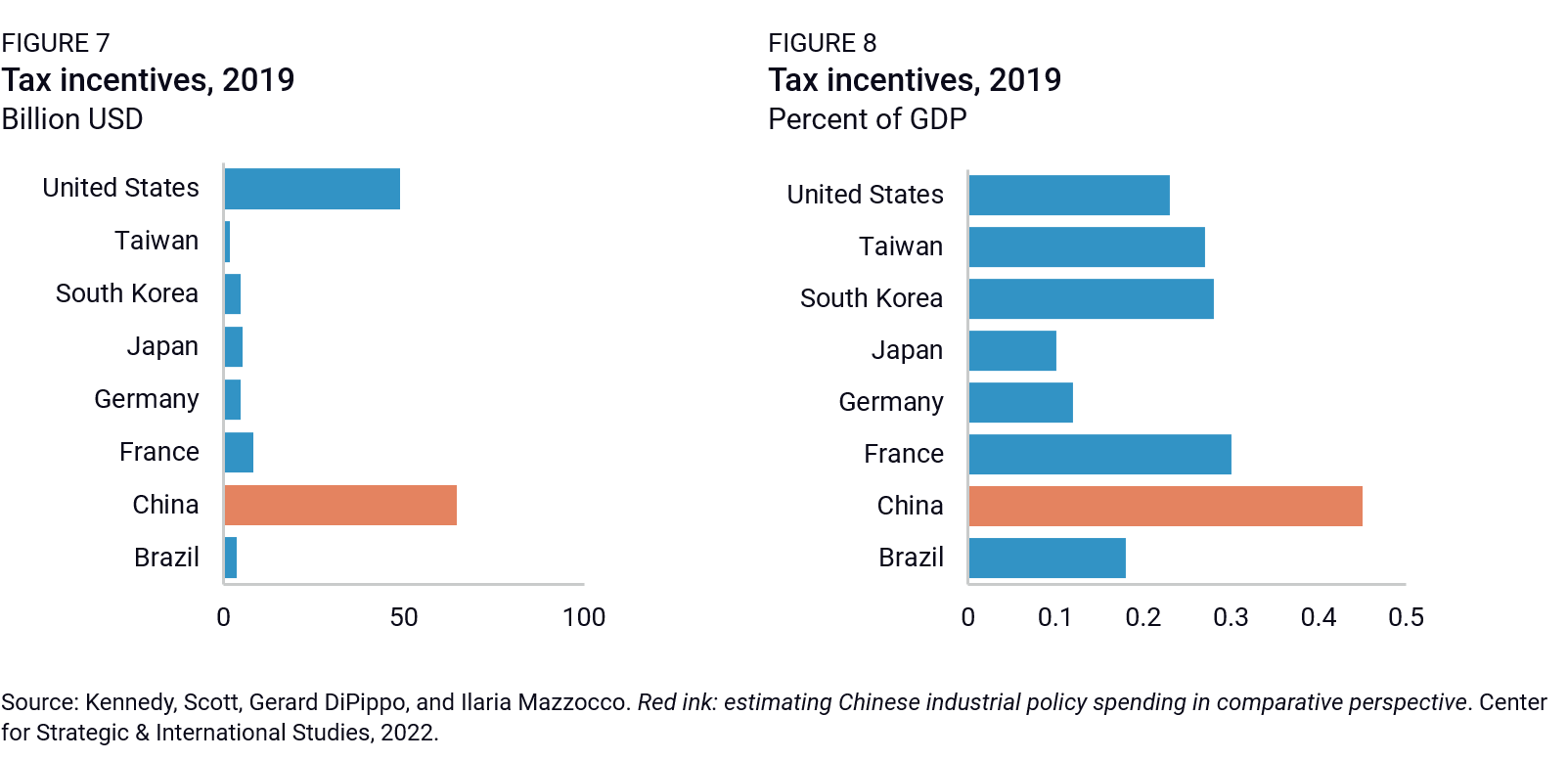

International comparison: Tax concessions are not specific to China but, just as with grants, the scale in China exceeds that seen in other economies, both in absolute terms and as a share of GDP (Figures 7 and 8). A study by the OECD found that firms based in China were the largest recipients of tax concessions as a share of their revenue as well: 0.75% of annual revenue, against 0.32% for OECD-based firms, 0.28% for India-based firms, and 0.47% for firms based in other jurisdictions covered.20 These numbers may even overestimate how much OECD countries give out as tax concessions since they report amounts disclosed by firms, many of which are multinationals and receive their tax concessions from countries other than their headquarters country.

Countervailability: China’s use of banned tax incentives has been vastly reduced over the past two decades. Among all the countervailing investigations against China in the early years following its entry to the WTO, the main complaints were against China’s tax incentives, such as specific tax reductions and exemptions or specific tax preferences related to exports or imports.21 Subsequently, China canceled all its official export-oriented tax incentives.

However, certain tax incentives are still likely to constitute actionable subsidies under the SCM Agreement in the WTO, such as the corporate income tax reduction for high and new technology enterprises, whose list is stipulated in the Measures for Administration of Accreditation of High-Tech Enterprises (also named Circular 32) from 2016. In that circular, eight fields are recognized as high and new tech fields: 1) electronic information, 2) biology and new medicine, 3) aerospace, 4) new materials, 5) high-tech services, 6) new energy and energy saving, 7) resources and environment, and 8) advanced manufacturing and automation.22 The European Commission, in its 2024 EV investigation, estimated that this tax concession scheme was countervailable as it explicitly limits access to a subsidy to certain sectors. It also found other schemes countervailable, such as the preferential pre-tax deduction of research and development expenses, and the accelerated depreciation of equipment used by high-tech enterprises.

Below-market finance

Below-market finance includes below-market borrowings and equity. It can be defined as the provision of loans or equity finance at more favorable terms than the market would otherwise provide. This includes practices such as lower interest rates, longer repayment periods, and lower returns on equity. While China is not unique in using this type of subsidy, it uses below-market finance at a much larger scale than other countries.

Below market borrowing (loans and bonds)

Definition: Below-market borrowing can occur when a government directs financial institutions to provide finance on preferential terms, or when the government provides an explicit or implicit guarantee, reducing the firms’ ultimate borrowing costs by reducing repayment risk. These government guarantees do not always need to be explicit but can also simply reflect the market anticipation of government support—i.e., an implicit government guarantee that increases access to financing and lowers interest rates to below-market rates.

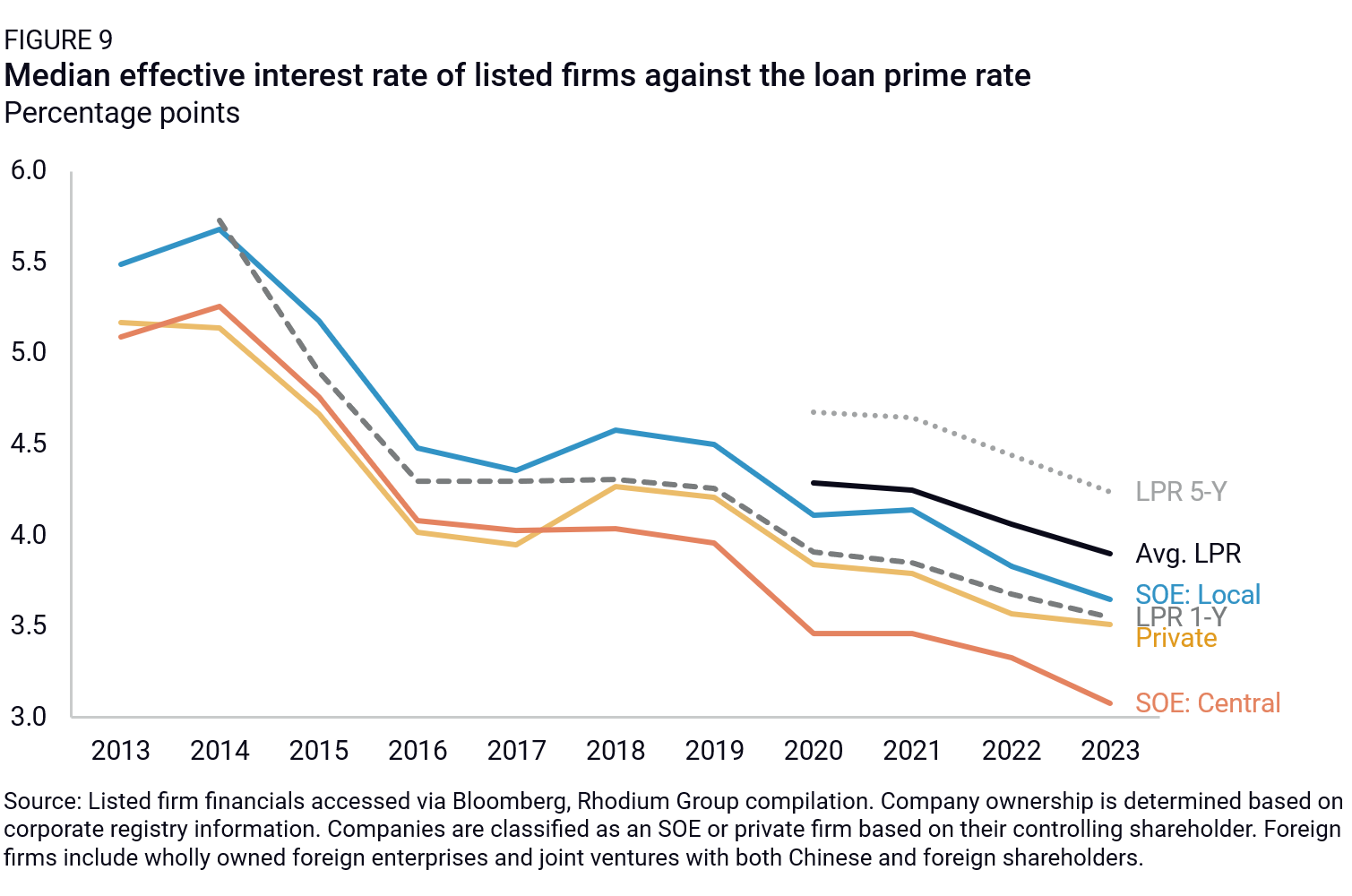

Globally, below-market borrowing tends to be concentrated in heavy industry sectors that have high debt-to-asset ratios. As a share of firm revenues, OECD research showed that aluminum, cement, glass and ceramics, and solar PV panels were the most affected sectors.23 But in China, SOEs and strategic sectors targeted by industrial policy goals often enjoy lower interest rates. Within a sample of all listed companies in China, central SOEs have lower effective interest rate on debt than private companies since 2018 (Figure 9). They also enjoy interest rates that are systematically below the loan prime rate (LPR), a benchmark monthly calculated by the People’s Bank of China that reflects the rates commercial banks offer to their best customers.

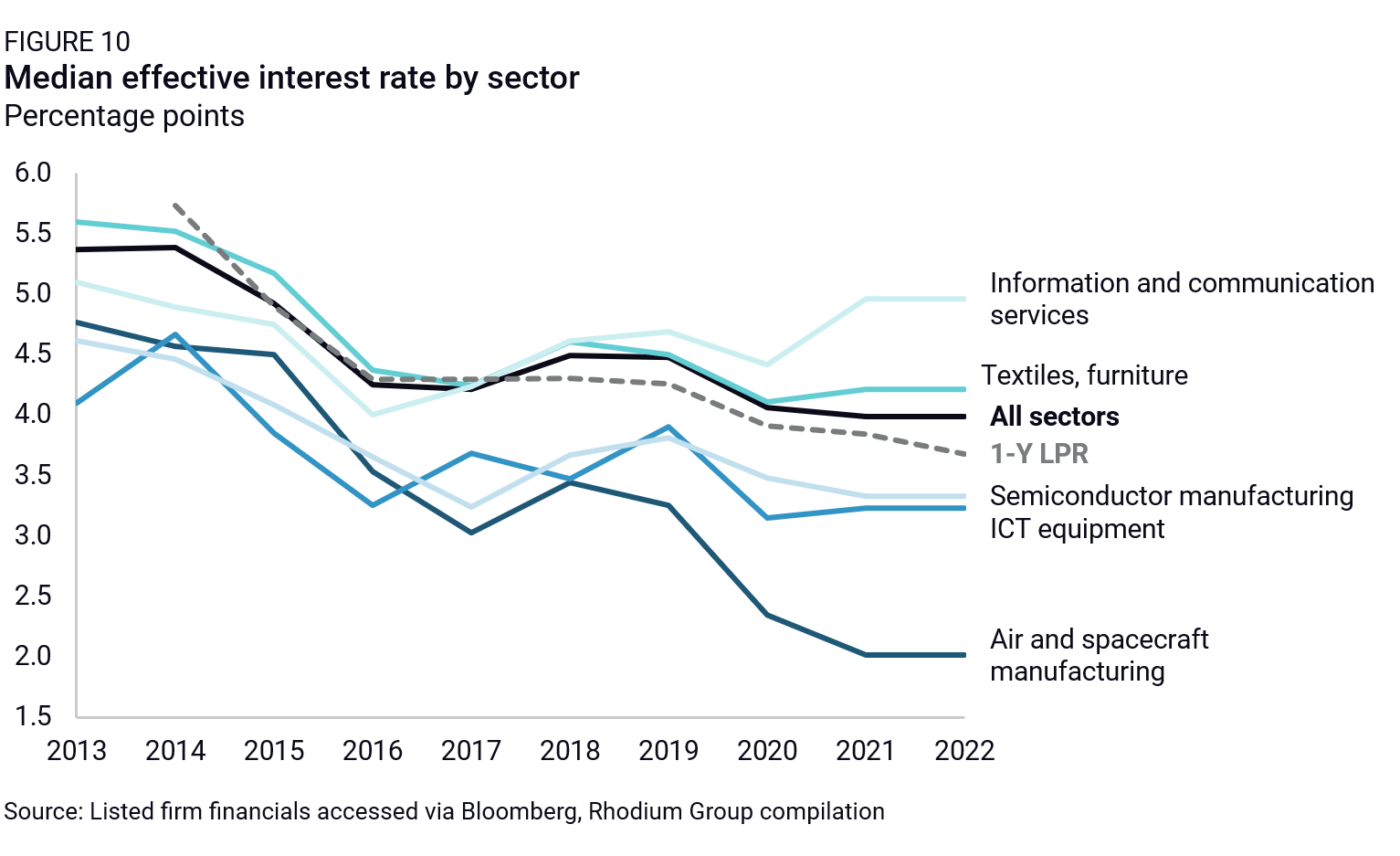

Certain sectors, typically those considered strategic in China’s industrial policy, also enjoy much lower average interest rates than other sectors, consistently lower than the benchmark LPR. That said, this rate is also affected by many other factors, including company size and industry (Figure 10).

International comparison: Below-market borrowing is not specific to China. For example, Germany’s federal government guarantees SME loans, resulting in below-market interest rates. Many governments’ policy responses to COVID-19 have included job-retention schemes, increased unemployment benefits, and loan guarantees for businesses. Many central banks have also ramped up their outright purchases of corporate bonds to support liquidity in credit markets. This includes, for example, the US Federal Reserve’s Primary and Secondary Market Corporate Credit Facilities, as well as the Main Street Lending Program, which supported lending for businesses in the US before all three programs lapsed in January 2021.

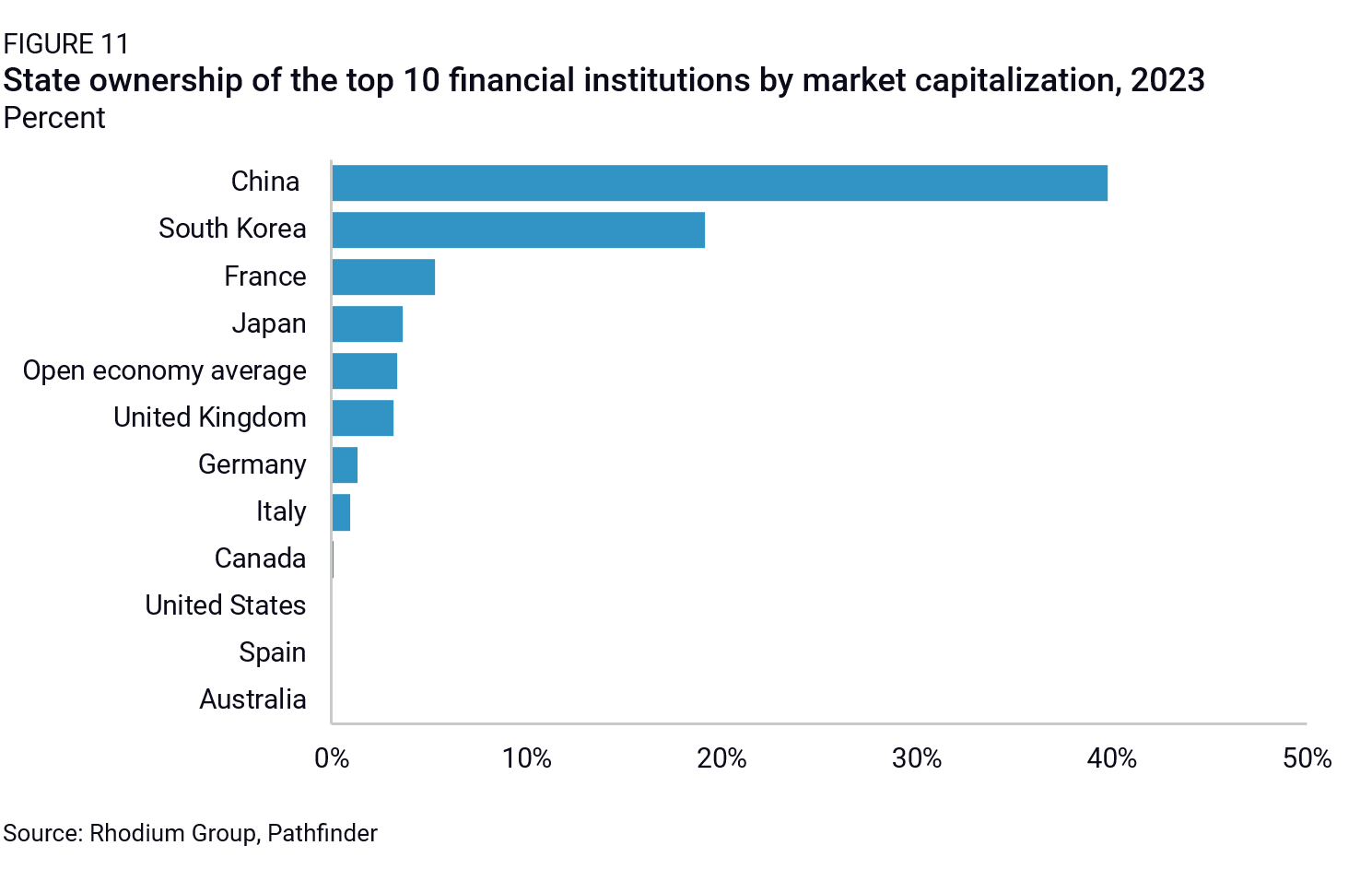

However, below-market borrowing in China is more pervasive. This is, in part, because its bank system is much more state-dominated than in most other countries (Figure 11). As 2024 OECD research has shown, the six largest state-owned commercial banks (the “Big Six,” including Agricultural Bank of China, Bank of China, Bank of Communications, China Construction Bank, Industrial and Commercial Bank of China and the Postal Savings Bank of China) held, as of end-2023, 41.7% of all commercial bank assets in China. The Chinese government, through the Ministry of Finance, Central Huijin Investment (a state-owned investment company), and other state-owned companies, remains the majority shareholder in these six institutions. Chinese authorities also retain a controlling stake in joint-stock commercial banks even when they are not majority-owned by the government.

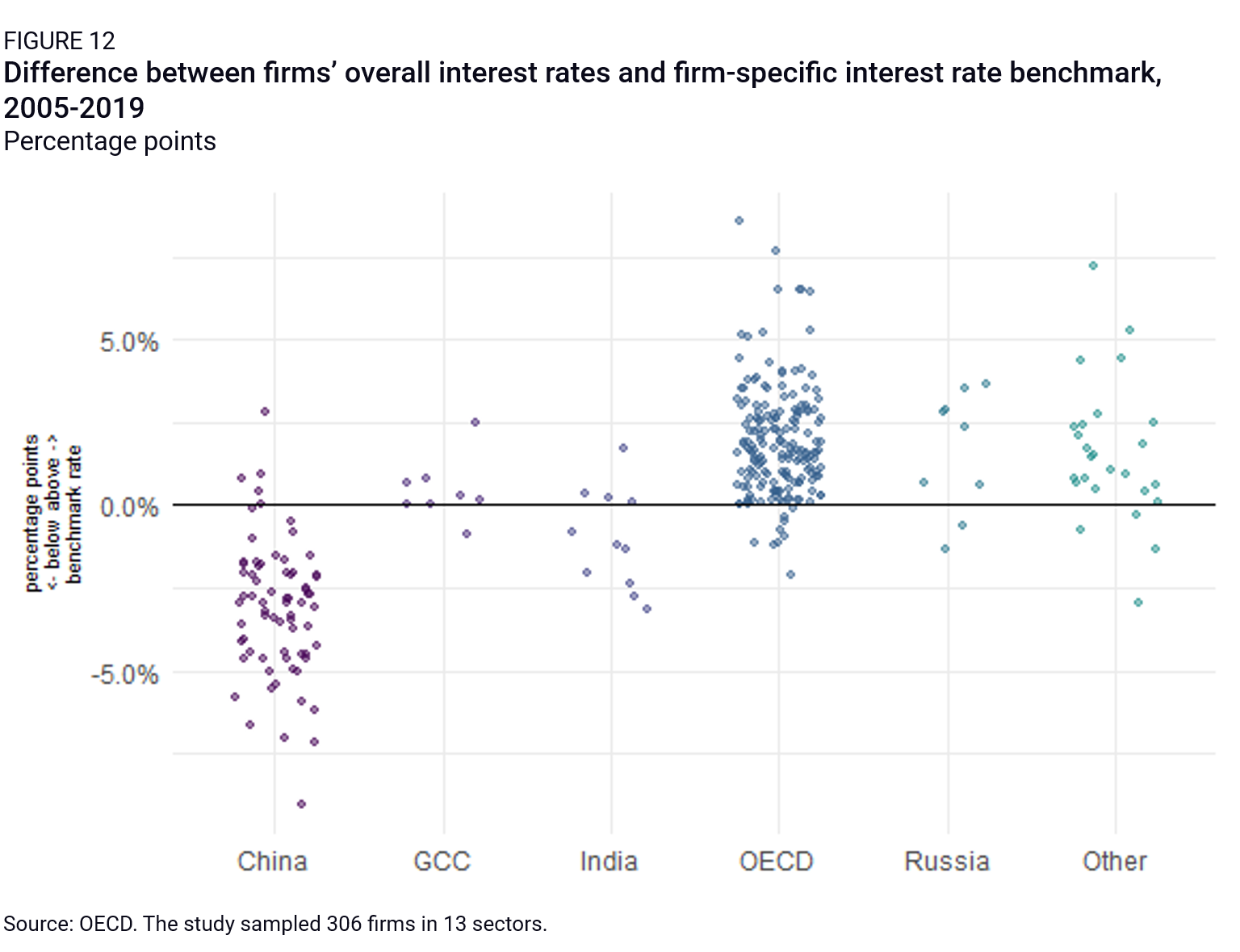

As a result, existing measures of below-market borrowings show that China provides much more below-market borrowings than the OECD average as well as other countries like India and Russia (Figure 12).

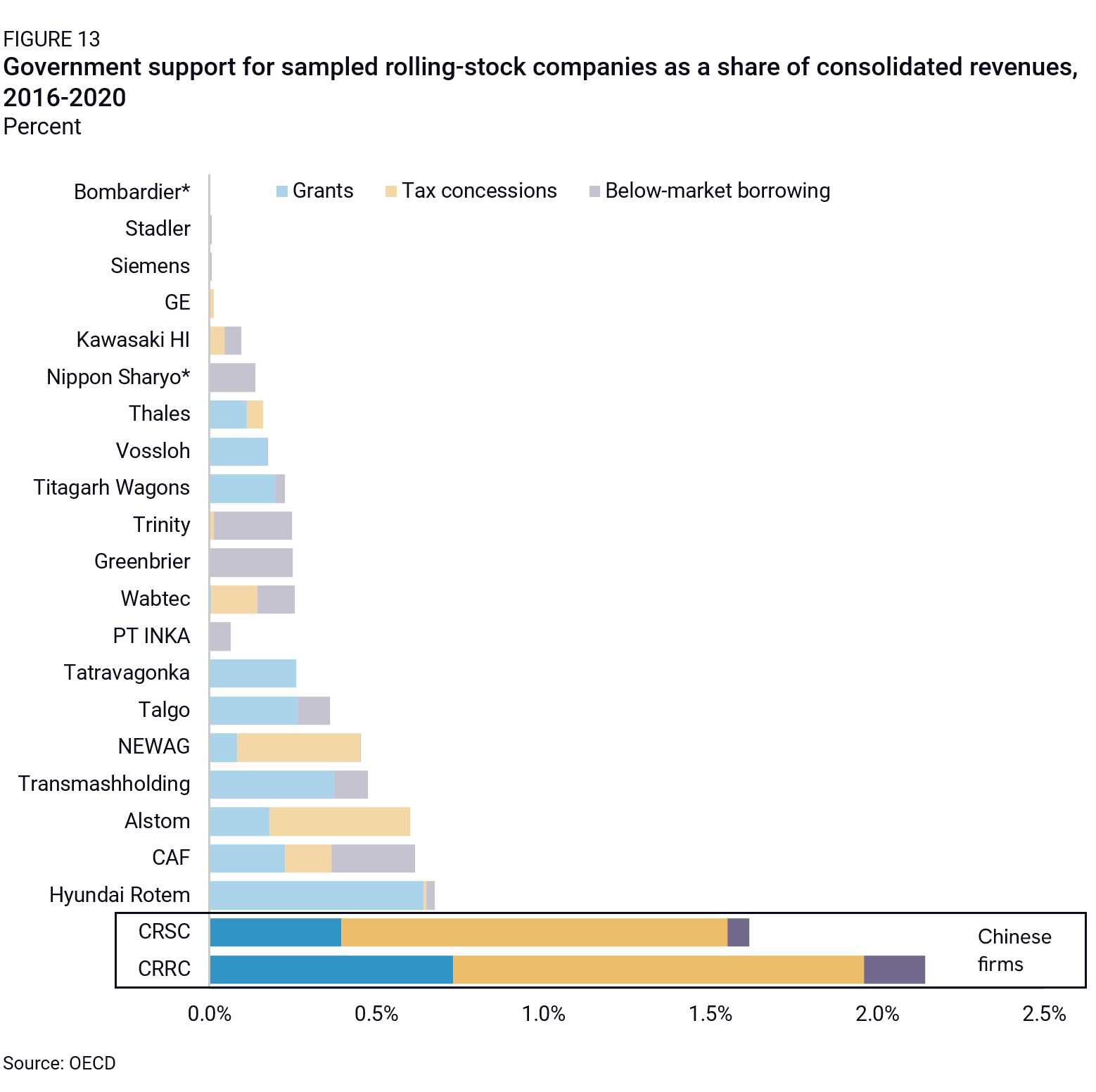

In a range of sectors, Chinese firms have also benefited from much larger amounts of below-market borrowing than their global peers. An OECD study focusing on the rolling stock industry found that China’s state-owned rolling stock manufacturer CRRC alone obtained almost 60% of all the below-market borrowings identified in a sample of 22 firms during the period 2016-2020, while it only had a 24.3% global market share in the rolling stock sector (Figure 13).24 Below-market borrowings were nonetheless found to be much smaller than tax concessions and direct grants for that company. In other sectors, OECD research found that below-market borrowing had a much larger role in overall state support. For example, it estimated that the Chinese aluminum company SPIC received more than half of its government support through below-market borrowing over the period 2013-2017.

Countervailability: Below-market borrowing in China has often been used in CVD investigations. A study on forty-five CVD orders imposed by the US Department of Commerce (USDOC) on China between 2008 and June 2017 shows that preferential loans provided by state-owned commercial banks such as the Big Six, and policy banks, such as the Export-Import Bank of China, are often used in investigations.

However, including below-market borrowing in CVD investigations can be difficult. For one, state-owned banks do not always qualify as a public body (interpreted by the WTO Appellate Body in past cases as “an entity that possesses, exercises, or is vested with governmental authority”). State ownership of banks itself is sometimes difficult to prove in China, where government stakes are indirect and ownership structures often opaque. Still, considering companies as state actors is not impossible, and many subsidy investigations by the US and Europe in recent years have done so. A 2019 WTO Appellate Body report further found that the US’s identification of certain SOEs as public bodies was not inconsistent with Article 1.1 of the SCM Agreement.25

Another hurdle is determining the market benchmark to assess whether a loan was provided at a below-market rate. Because below-market borrowing is so prevalent in China, local market benchmarks are often heavily distorted and unreliable. Nonetheless, this challenge is not insurmountable. The US and the EU justify using out-of-country benchmarks in CVD investigations by pointing to significant distortions in the Chinese economy—through China’s designation as a non-market economy in the US and via a case-by-case assessment of distortions in the EU. This approach has already been partly applied in investigations such as the European Commission’s recent case on subsidies for electric vehicles, where an international credit risk premium was used to determine whether financing terms deviated from market norms.

Overall, however, the widespread use and implicit nature of government guarantees, as well as the lack of clear policy underpinning these practices, generally raises the bar when trying to prove the specificity of the distortion to certain sectors or companies and makes investigations into Chinese subsidies more challenging.26

Below market equity

Definition: Below-market equity happens when investors are willing to accept lower returns on equity than they would under normal market conditions.27 Investors can be government agencies, state-owned financial institutions, or other financial institutions that are influenced by the state.

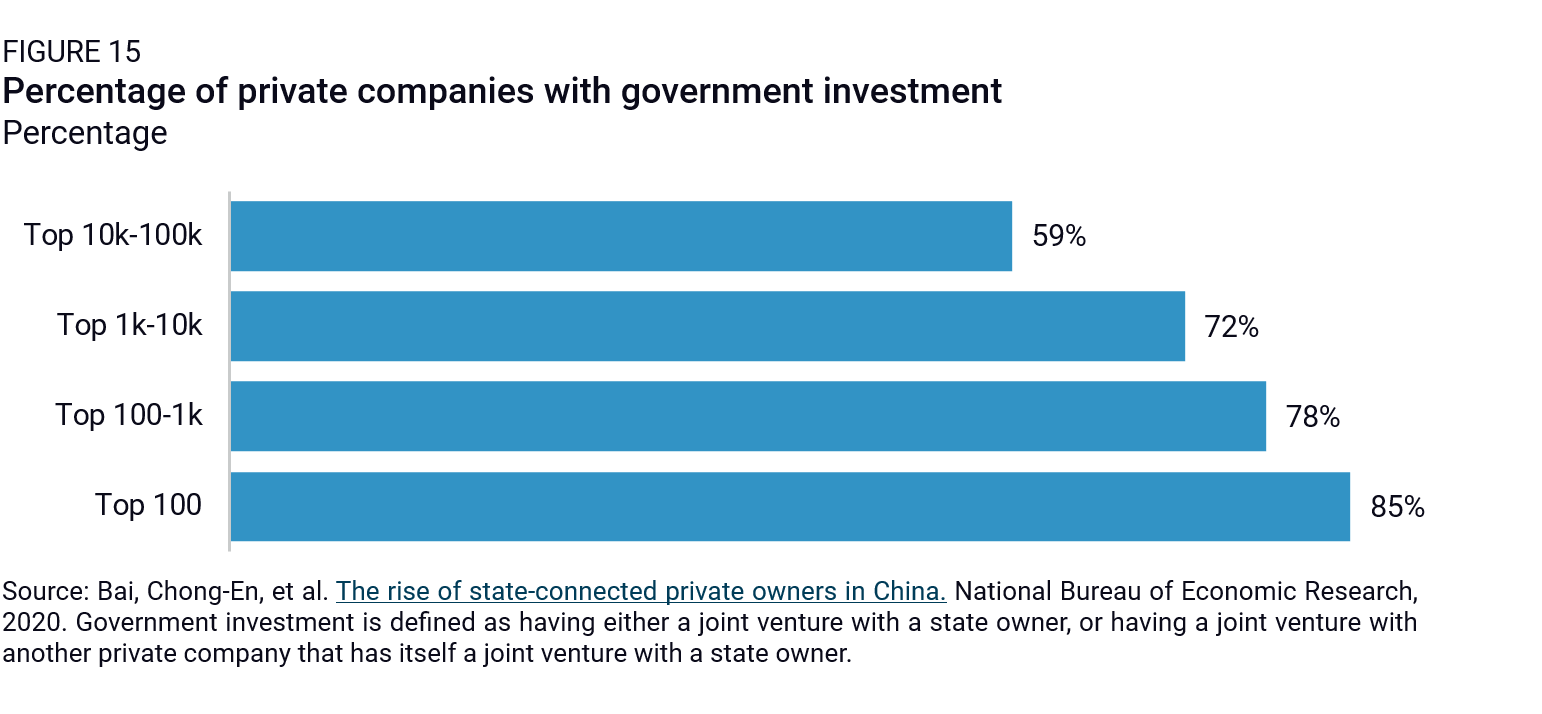

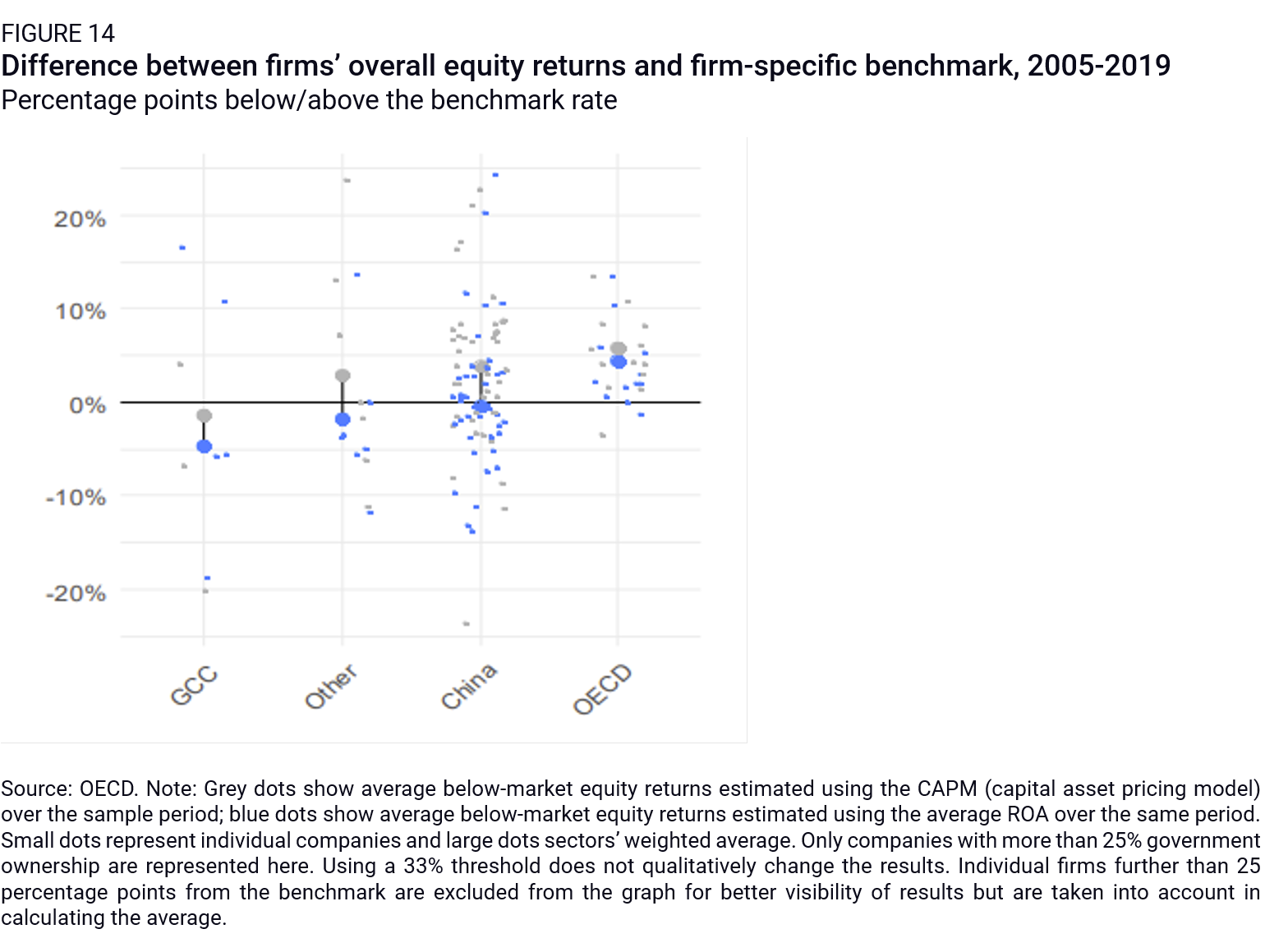

International comparison: According to OECD research, on average, government-invested Chinese companies receive similar amounts of below-market equity as their OECD peers, but far more companies are covered (Figure 14).

However, far more firms in China are state-invested, and far more investors are state-controlled, so the total amount of below-market equity in China is likely far greater than in other countries (Figure 15).

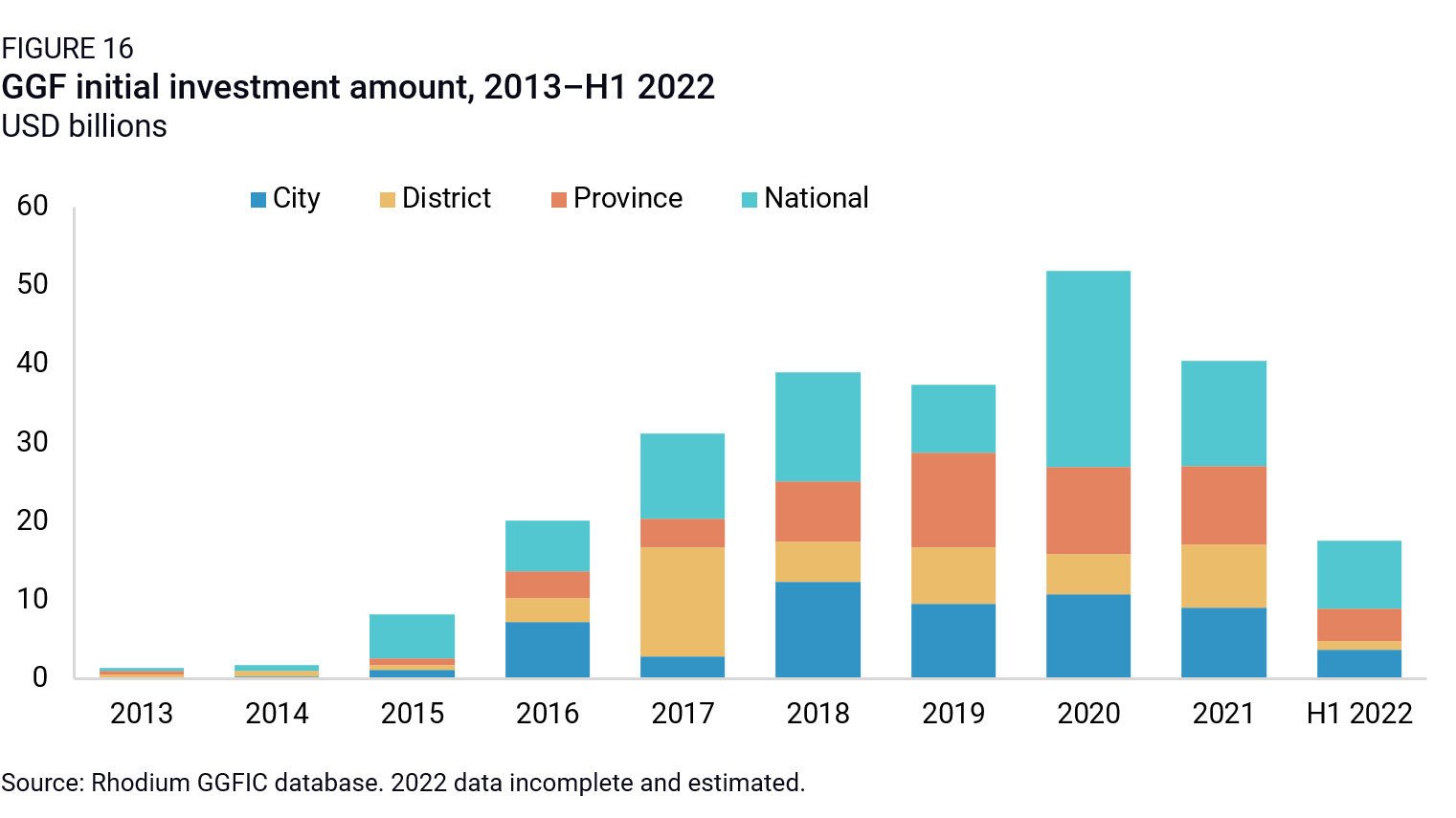

The large number of state-invested firms, in particular, has grown with the development of government guidance funds (GGFs). First rolled out in 2005, GGFs have become a key tool for China’s industrial policy, investing growing amounts until 2020 (Figure 16). They are government-established funds, funded from various sources, including general fiscal budgets, government-managed fund budgets (whose revenues are mainly land sales proceeds), or SOE operation budgets, but the exact source of funding is often not explicitly disclosed. The government usually helps establish a parent fund, which typically does not directly engage in venture capital business but invests as a limited partner in several sub-funds established in cooperation with private capital. The now-infamous China National Integrated Circuit Industry Investment Fund, set up in 2014, is one such example. In the first phase, it raised $19.5 billion to invest in China’s domestic semiconductor capabilities, followed by $28.7 billion in the second phase in 2019 and $47.5 billion in the third phase in 2024. Although new GGF establishment peaked in 2015–2017, they remain a staple of state support, with more than 150 new funds being created annually over the past six years.

Even when they do not provide capital at below-market costs, GGFs can create subsidy-like effects for targeted companies, first because of the sheer availability of capital that they deploy for state-backed actors and second because of their signaling effect that steers the allocation of private resources.

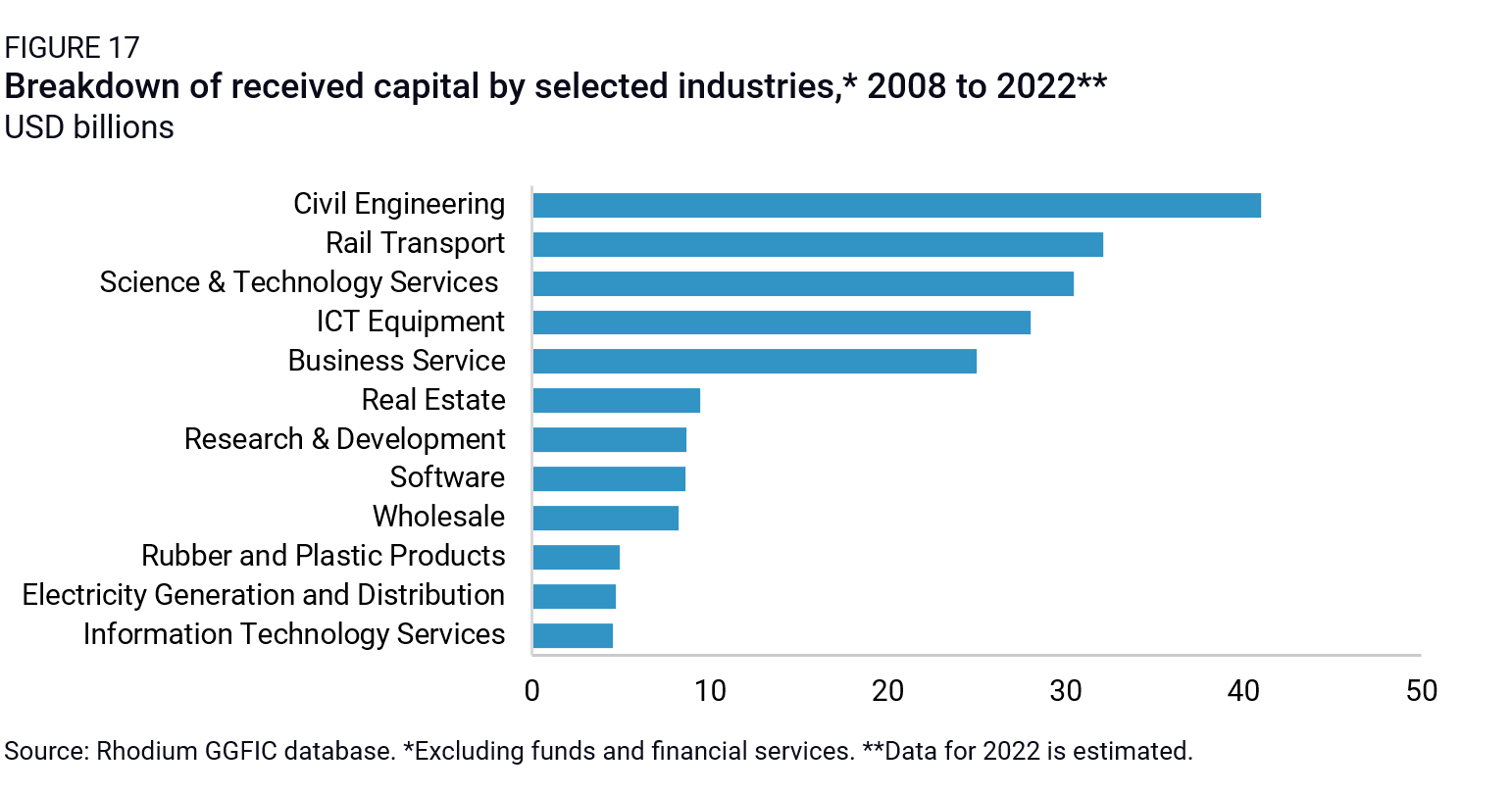

GGFs were intended to focus on strategic sectors, and their investment was concentrated in a handful of companies, mostly state-owned. Throughout the 2008–2022 period, although 37,000 entities received GGF money, 50 percent went to only 150 companies, 20 of which were private, while the rest were central and local SOEs. In addition, sectors typically supported by local governments to power local economic growth, such as the infrastructure and transportation sectors, received the largest share of GGF investment over the past 15 years (Figure 17).

Countervailability: In theory, below-market equity can be included in CVD investigations—and has been in a few rare cases. For example, in its CVD case on hot-rolled flat products of iron, nonalloy, or other alloy steel from China in 2023, the EU Commission concluded that debt for equity swaps constituted a financial contribution in the form of equity infusion or loan.

However, in practice, below-market equity is even harder to classify as a subsidy under WTO rules than below-market borrowing. It faces all the same challenges as below-market loans, but with an added complication: it can only be identified after the fact, by examining the returns generated in the years after the government injects capital. The WTO’s SCM Agreement, however, only considers the initial equity injection itself—not the long-term financial impact—making it difficult to prove as a subsidy in trade investigations.10

Nonetheless, politically-driven provision of equity may be countervailable even if it is not possible to prove a difference with an estimated market price. The SCM states that “government provision of equity capital shall not be considered as conferring a benefit unless the investment decision can be regarded as inconsistent with the usual investment practice (including for the provision of risk capital) of private investors in the territory of that Member.” In other words, if a government invests in a way that a private investor operating under normal market conditions wouldn’t, it could be classified as a subsidy. This would be the case, for example, if GGF investment concentrates more heavily on sectors and companies prioritized by state priorities than a non-state-linked fund would have. The EU Commission’s July 2024 implementing regulation on imposing a provisional countervailing duty on imports of new battery electric vehicles cites government guidance funds investment as a subsidy, pointing to the industrial objectives pursued with these transactions and arguing that it did not follow a purely market logic and did not reflect the actual market risks associated with the transactions investigated.

Provision of goods and services at below-market cost

Governments sometimes supply resources to businesses at lower prices than they could get in the open market. This constitutes a form of subsidy, as it provides an economic advantage to the recipients, enabling them to reduce their production costs and enhance their competitive position both domestically and internationally. These can include lower rates for raw materials, energy, or transportation.

Land

Definition: Below-market land provision happens when governments use their ownership of the land to grant preferential and cheaper access to land use rights to certain companies they want to support. This can happen either through the rental or purchase of land rights.

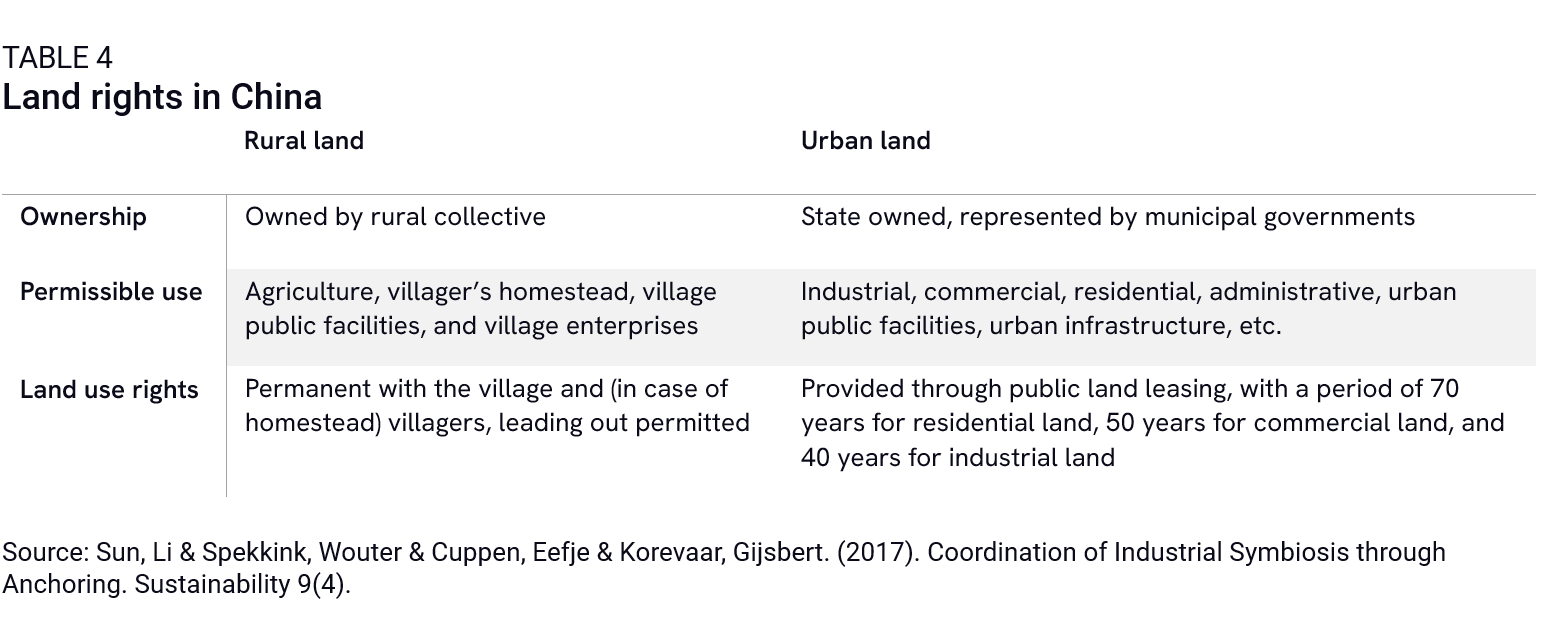

International comparison: Below-market land prices are not entirely unique to China. Some European countries, for example, provide cheap land for social and affordable housing. OECD research uncovered instances of below-market land provision in Gulf countries, for example, leases free of rent for petroleum companies in Bahrain. But the unique structure of China’s land ownership (Table 4) creates much greater opportunities for shaping the price of land according to industrial policy objectives.

Amounts and evolution: Substantial, but declining amounts are disbursed through this form of state support. According to a 2019 CSIS study, an estimate of 206 billion yuan ($30 billion), or 0.21% of Chinese GDP, was disbursed through below-market land sales in 2019. Earlier IMF estimates found that below-market land provision was more than 1% of GDP from 2010 to 2015, but that land subsidies had declined significantly in GDP terms over time.

Offering land at below-market prices is not limited to specific companies or sectors: It reflects a systematic bias that benefits the entire industrial sector. Local governments in China compete with each other to attract companies through lower pricing of land leaseholds for industrial usage.28 This leads to an extreme price differential between residential and industrial land. A research paper from 2022 showed that in 2019, land zoned for residential use sells at roughly a ten-fold higher price than land zoned for industrial use.29

Energy

Definition: Below-market energy provision refers to governments or other entities supplying energy (electricity, natural gas, oil, etc.) to consumers at prices lower than the market rate or below cost where a market does not exist. This can involve selling energy at a discount or providing subsidies to lower the price consumers pay.

Amounts and evolution: In the early 2000s, the Chinese government used electricity price regulations and quotas under which thermal plants were guaranteed a portion of projected demand, and electricity prices determined by provincial and local authorities. In 2015, China began to allow market pricing of energy and electricity trading on provincial markets. However, although power prices are now allowed to fluctuate within a wider band, the government still allocates quotas to generators.

Energy prices are also subsidized nation-wide through upstream subsidies to energy producers. Coal plants, renewable energy producers, and upstream equipment manufacturers are subsidized, in turn allowing them to provide electricity at cheaper costs. For example, to incentivize the development of data centers, many governments, including the municipal governments of Ganzhou, Gui’an, Karamay, Yangquan, and Zhongwei and the provincial governments of Guizhou, Henan, and Inner Mongolia have provided data centers cheap electricity rates since 2015. The centers get rates at or below 0.35 RMB/kilowatt hours (kWh), significantly lower than the industrial electricity rate in China of 0.6–0.8 RMB/kWh ($0.085-0.11/kWh). Overall, the IEA estimates that China’s electricity subsidies amounted to $242 billion (in 2020 prices) over the period 2010-20, corresponding to an annual average subsidy of $22 billion.

International comparison: Despite large-scale subsidization of energy in China, according to OECD research from 2023, China’s energy subsidies for industrial users are roughly in line with the OECD average and much lower than those practiced in some Middle Eastern countries and Russia. Nonetheless, Chinese energy subsidies in specific sectors or localities can reach much larger amounts and have a more sizable distortive effect (Box 2).

Other inputs

While land and energy are the most obvious subsidized inputs in China like in other countries, all other intermediate inputs can be subject to market distortions. Those distortions are more difficult to prove though, because they often happen informally behind closed doors.

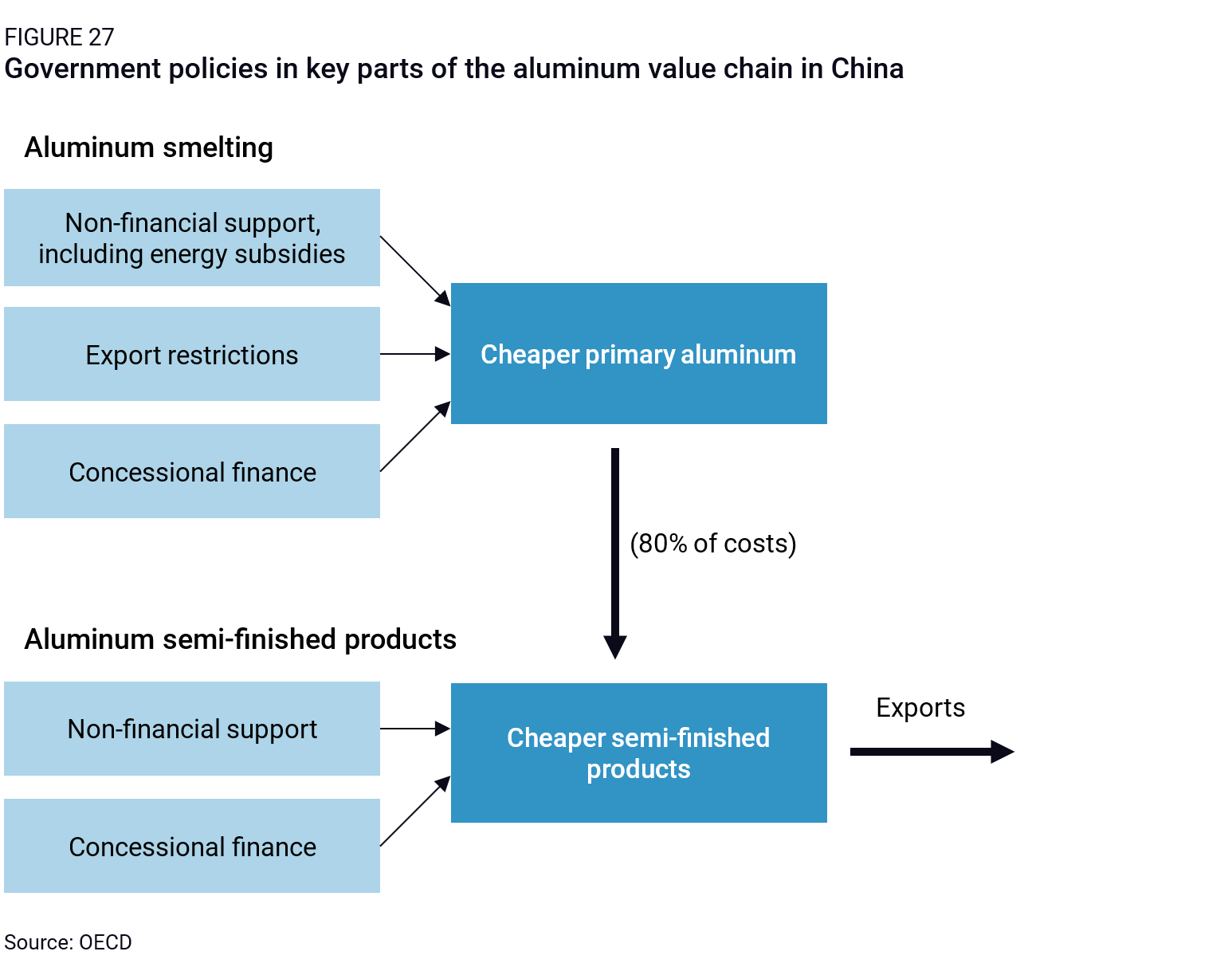

A research paper by Haley and Haley (2013) showed that local governments in China often required SOEs to provide inputs at below-market or even below-cost prices to other SOEs or state-backed producers. More recent OECD research on state support in the aluminum sector showed that cheap inputs have enabled Chinese producers of aluminum semi-finished products (or semis, for short) to compete in global markets at lower costs. It found that a local SOE, Binzhou Gaoxin, provided the privately-owned listed company Hongqiao below-market price inputs. Hongqiao’s own disclosures noted the SOE was responsible for implementing the local government’s development plan by ensuring the stable supply of raw materials for the industry.

The same OECD report also highlighted how China’s incomplete VAT rebates and 15% export tax on primary aluminum kept China’s excess supply domestic, lowering prices for downstream industries. As a result, Chinese producers of aluminum semis and processed articles of aluminum were able to compete in global markets at lower costs and quickly gain global market share.

Countervailability

The provision of inputs at below-market cost has often been used in CVD cases. The previously mentioned Department of Commerce study of 45 CVD orders between 2008 and June 2017 showed that the most common type of Chinese subsidy programs determined to be subjectable to CVDs was providing below-cost goods. Some 80% of the cases involved SOEs providing low-cost raw materials, such as hot-rolled steel, polysilicon, and chemicals. Roughly 70% of cases included government provision of electricity.22 Similarly, in 2024, the EU Commission found Chinese carmakers had benefited from artificially cheap batteries and key inputs for their production, namely lithium iron phosphate.

Applying WTO SCM rules to below-market inputs is a challenge. Providers are often state-owned enterprises, rather than governments, making attribution more difficult in China, where political authority is diffuse, opaque, and not easily traceable. Another obstacle to countervailability is the need for a benchmark to prove the existence of a benefit—something that is difficult to reliably establish in China, where market prices are severely and systemically distorted. Lastly, proving specificity is a challenge. For example, if a cheap, fixed rate of electricity is offered to all industrial users within a specific province or municipality—even if they do all happen to be SOEs—may not be considered specific under the WTO SCM Agreement.

Workarounds to these challenges exist. As noted above, the US and the EU justify using out-of-country benchmarks in CVD investigations by pointing to significant distortions in the Chinese economy. This approach has been employed in previous cases, such as the EU’s investigation into electric vehicle subsidies, where Taiwanese land prices were used as a benchmark to calculate land subsidies. However, the opaque and implicit nature of these arrangements in China makes the legal bar for proving the existence of a benefit and specificity high and complex.

Non-conventional state support mechanisms

A politically-driven and expansive financial system

China’s state support to its firms differs from many other OECD economies in two key respects: the highly political nature of how financial resources are allocated, and the scale of financing made available—both ultimately stemming from pervasive implicit and explicit state guarantees for state-adjacent and -guaranteed actors. This created a highly supportive environment for firms considered a political priority, with some of the same effects as more conventional subsidies.

Politically-driven allocation of credit

Definition: Despite three decades of reform and growth of market forces in China’s economy, the allocation of credit remains deeply influenced by political considerations. In China’s bank-dominated financial system, all banks are state-owned or state-linked to some degree. Bank lending decisions are still shaped by credit guidance from the government, as well as by a range of implicit and explicit guarantees, which concentrate lending around a set of politically favored actors.

Explicit guarantees are formal state assurances to certain borrowers including large state-owned enterprises and local government financing vehicles (LGFVs). LGFVs are quasi-fiscal entities created by local governments to raise funds for public infrastructure projects and urban development, enabling local authorities to finance investments without directly adding to their official debt levels.

Implicit guarantees are the broad-based belief among lenders and investors in China that certain economic actors—especially state-owned and state-backed firms—are backed by the state and are therefore “risk-free.” In other words, banks expect that state institutions would automatically rescue these borrowers if they risked going bankrupt. State-owned institutions also generally hold more fixed assets as potential collateral relative to private firms, which allows them more opportunities to pledge the collateral when borrowing.

In addition to guarantees, credit allocation in China is shaped by quantity-based targets. These include quotas and loan growth targets to maintain stable credit growth and bolster credit to preferred companies like SOEs and, increasingly, advanced manufacturing firms. According to the IMF, quantity-based policies have risen in China in recent years because the government sees them as “targeted” economic support, rather than the “flood-like” credit stimulus that followed the 2008 crisis.30

These characteristics of China’s financial system make banks more likely to tailor their lending to high-level state objectives than in other countries. It also leads banks to lend more easily and in larger amounts to state-owned or state-linked borrowers. This skewed credit allocation can have some of the same effects as a subsidy, as abundant financial resources create softer budget constraints for state-backed actors. This lets Chinese firms in key sectors lower prices, take greater risks, and invest more without fear of bankruptcy.

The implicit guarantees particularly apply to SOEs. While the IMF estimated in 2021 that Chinese SOEs accounted for some 39% of total industrial corporate assets, they made up 54% of outstanding bank loans in 2016. Official statistics were discontinued after that year, but data at the firm level shows that state-owned firms have retained their share of listed firms’ outstanding bank loans since then, at around 66%.

But SOEs are not the only companies enjoying implicit guarantees and credit guidance. State-directed economic targets encourage lenders to extend substantial financing to specific sectors and actors, based on Beijing’s perceived support. Political targets and national policy plans (such as the Made in China 2025 roadmap) are mentioned in major banks’ reports as key guidance for the allocation of loans. For example, the ICBC’s 2023 annual report stated that “guided by the strategies of building a great power in manufacturing and science & technology, the Bank served the breakthroughs in core technologies of key industrial chains, and actively supported high-quality advanced manufacturing enterprises.”

As a result, sectors flagged as national priorities by the government tend to receive more capital than they would in a more market-driven environment. In the early 2010s, Chinese solar photovoltaic (PV) firms received ample loans at low interest rates, with little regard for firm productivity. This led to an oversupply of PV cells, undermining the competitiveness of non-Chinese firms in the industry (Chen 2015). More recently, between 2018 and 2023, the semiconductor sector saw the largest increase in corporate bank loan amounts within listed manufacturing firms, tripling its credit amount.

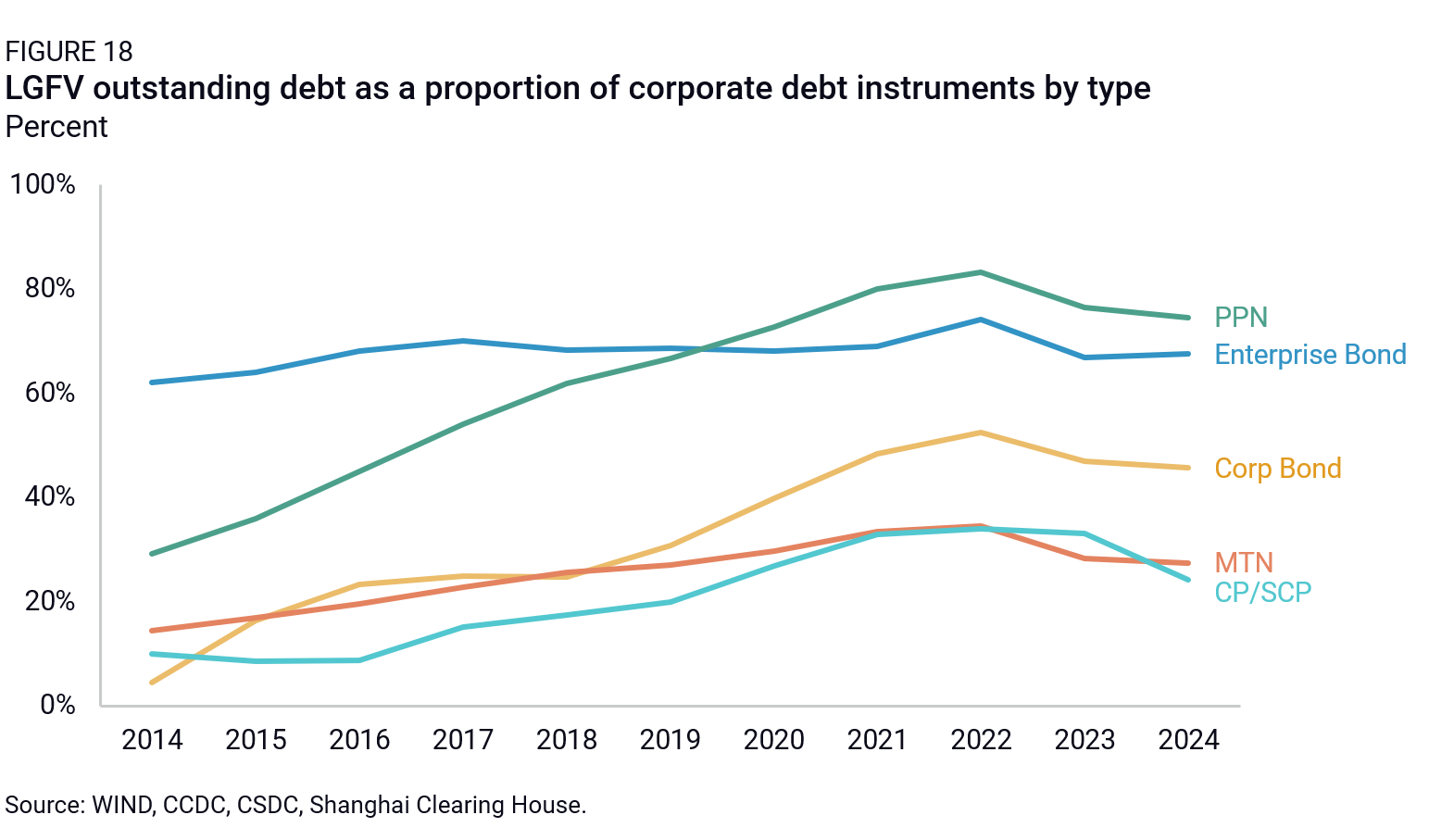

Access to the bond market is also largely skewed toward SOEs and quasi-fiscal LGFVs, which invest in real estate and infrastructure but also in a wide range of industrial sectors.31 By the end of July 2023, LGFVs accounted for 55% of the RMB 10 trillion in CSRC-managed corporate bonds and 86% of all PPNs (Private Placement Notes, which are privately placed but listed in the interbank market). LGFVs were only 19% of publicly issued corporate bonds and around one-third of MTNs (Medium-Term Notes, which are debt instruments typically issued with maturities of 3-5 years) and commercial paper (Figure 18).

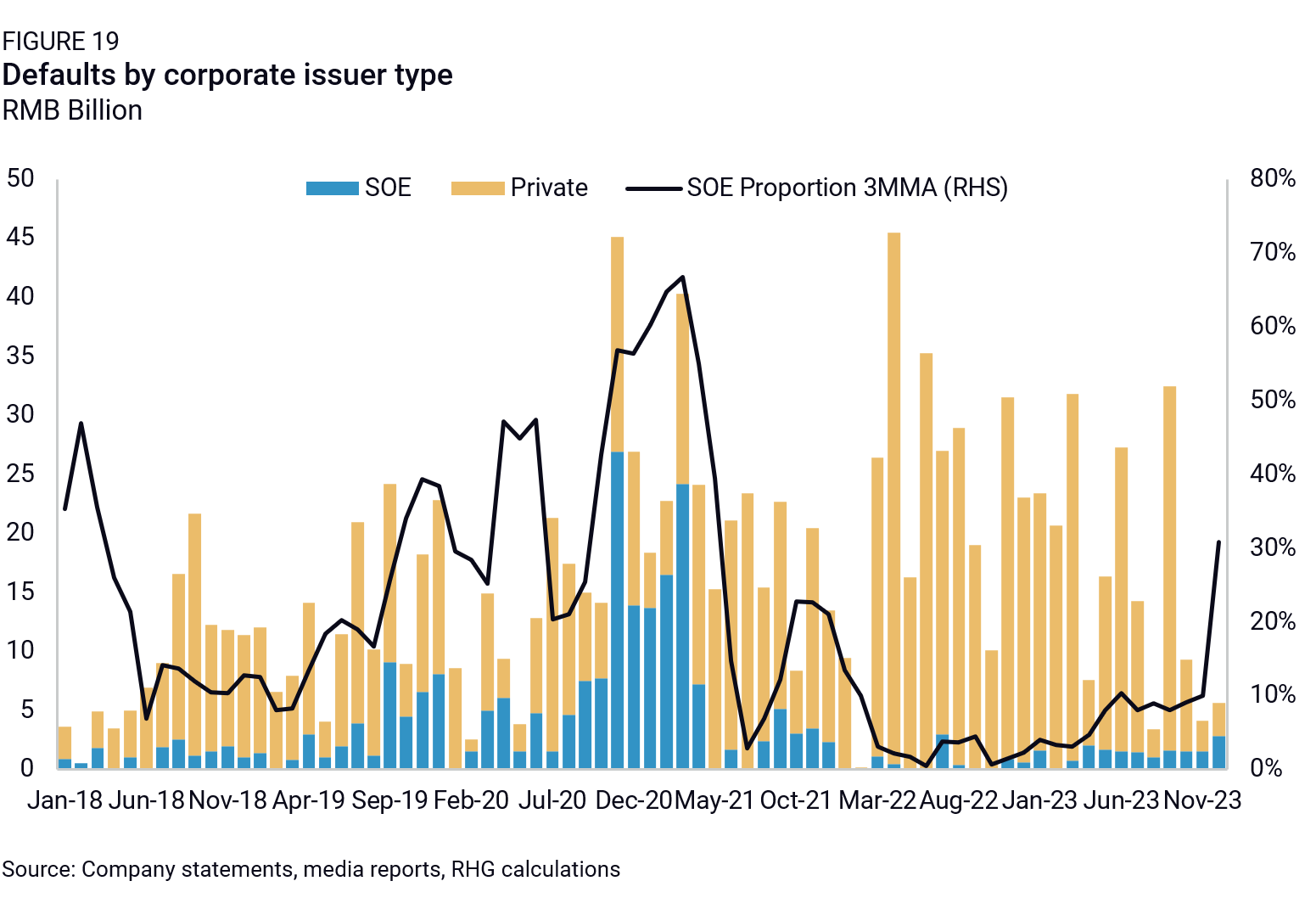

The government’s implicit guarantees explain the discrepancy: Despite only accounting for a small share of corporate bonds and being less likely to make losses than SOEs, private companies account for the majority of onshore bond default amounts (Figure 19).

International comparison: Politically-driven or -influenced credit allocation is not specific to China. In the 1970s and 1980s, state-directed credit policies played a pivotal role in South Korea’s rapid industrialization. Policy loans accounted for around half of the country’s total credit in the 1970s and were mostly directed toward export-oriented firms and heavy and chemical industries, enabling their rapid expansion. Just like in China, the policy led to inefficiencies, rising non-performing loans (NPLs), and moral hazard.

China, however, is an outlier for three reasons. First, the uniquely high share of public ownership in its banking sector and real economy allows for a strong control over credit allocation and widespread implicit guarantees to SOEs. Second, China remains a largely state-driven economy, with the Party maintaining a strong grasp on the economy through party cells in both state-owned and private companies and placing an ongoing emphasis on state planning, like Five-Year Plans. Third and finally, the size of China’s financial system (about 55% of global GDP) and of its economy (the world’s second largest at $17 trillion) makes such distortions much more decisive for domestic actors and much more disruptive to global markets.

Chinese authorities have begun shifting away from implicit guarantees, allowing some local SOEs to default on corporate bonds in recent years. This began with the default of power equipment manufacturer Baoding Tianwei in 2015, an event viewed as a milestone for market discipline in the Chinese corporate bond market. However, the Chinese government remains wary of the widespread propagation of financial risk and continues to prevent larger SOE defaults, maintaining a high level of implicit guarantees. There have been no defaults of LGFVs on their publicly traded bonds, although several have defaulted on loans and corporate acceptances. This dual approach aims to introduce market discipline while avoiding the destabilizing effects of widespread defaults, reflecting a cautious balancing act.

Many of these distortions result from China’s financial system being a tool of its political system. Political incentives add to the distorted economic incentives of borrowers and lenders in skewing market forces. Whereas in most developed economies, companies appeal to banks to grant them loans, in China, the situation is often reversed: Banks will compete with one another to extend loans to state-owned enterprises, national champions, strategic start-ups, or local governments. China’s economic targets are designed for political objectives—a high and stable rate of economic expansion, employment growth, and technological upgrading—rather than financial stability. All banks in China are state-owned or controlled at some level, local governments try to place their own officials in banks and banking regulators, and the central bank explicitly answers to the State Council. The fact that China’s political ambitions have outpaced China’s potential economic growth over several years has forced the financial system to absorb unprecedented losses.

Evergreen credit and tolerance for poor performance

Definition: Because of the political incentives shaping China’s financial system, banks in China tend to extend or roll over debt to poorly performing or loss-making companies. This can have some of the same effects as a subsidy, by removing incentives for companies to stay profitable and isolating them from market forces that would otherwise lead to their restructuring or bankruptcy. It is the substitution of financial risk for political risk. Evergreening of credit, therefore, allows firms to take more risks than they would in a market environment, reducing domestic and global prices to unprofitable levels, and expanding scale faster than in a market-driven environment.

This kind of behavior is not only specific to China. Research showed evidence of credit “evergreening” among Japanese firms in the 1990s, when banks followed a policy of forbearance with their problem borrowers in order to avoid pressure on the banks to increase their own loan loss reserves, which would have further impaired their capital. During the pandemic, many countries deployed large-scale forbearance programs that allowed millions of households and businesses to temporarily stop making payments on certain debt obligations.

But it is particularly prevalent and systemic in the China, beyond temporary responses to the COVID-19 pandemic. Much like in Japan in the 1990s, “troubled (…) banks have an incentive to allocate credit to severely impaired borrowers in order to avoid the realization of losses on their own balance sheets,” and lenders more broadly have an incentive to align with political imperatives to avoid significant job losses.32

Part of the evergreening problem is simply related to the structure of lending for quasi-fiscal infrastructure projects. Because Chinese banks assume that local governments and their financing vehicles will always be guaranteed, they often extend short-term loans to finance long-term projects that are not expected to provide operating cash flows for years. This allows localities to benefit from lower interest rates.

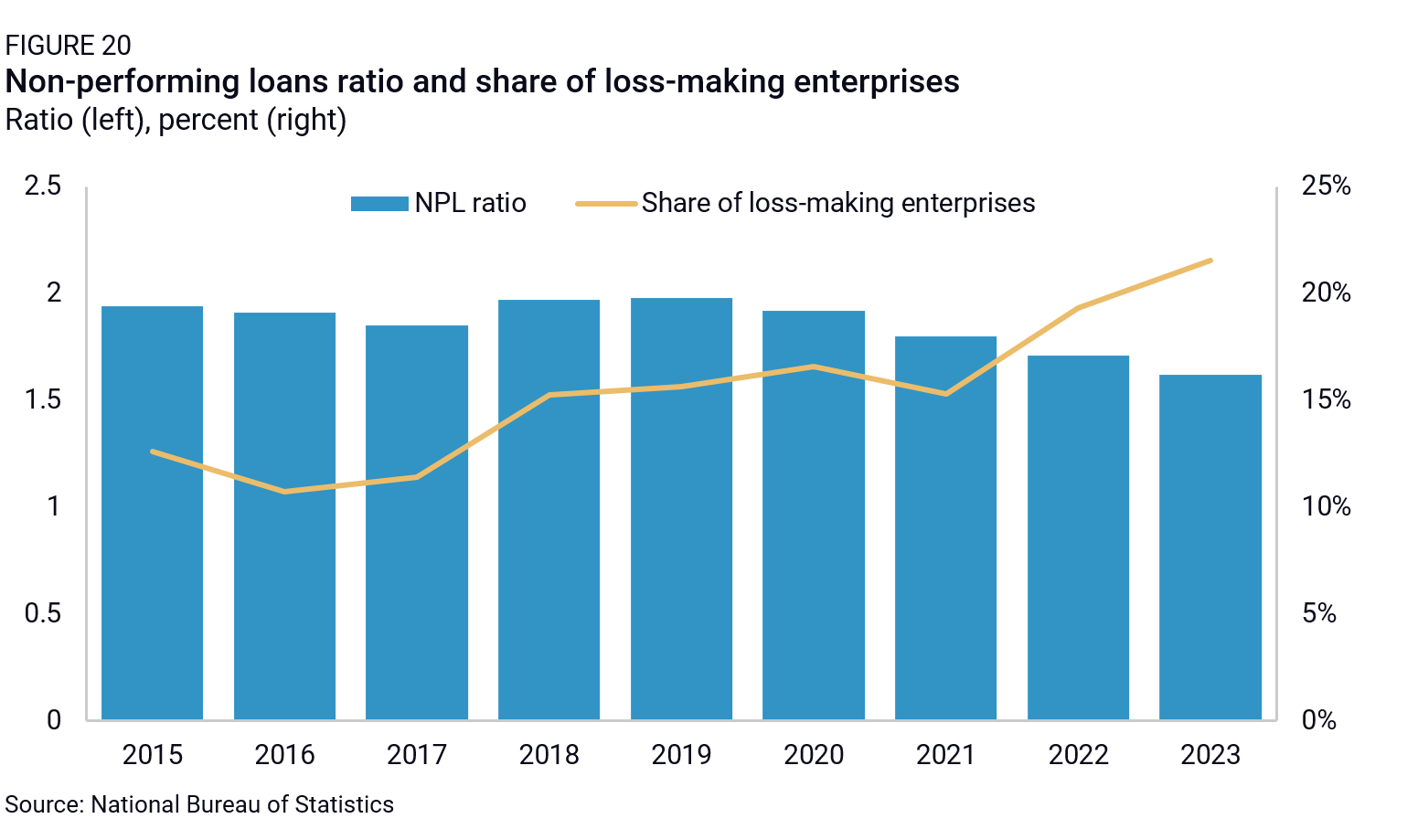

Some concrete data points suggest that China’s evergreening of debt is more widespread than is commonly the case in most market economies. The ratio of banks’ reported non-performing loans has decreased over the past years, while the share of loss-making enterprises increased (Figure 20). This would indicate Chinese banks have been sitting on large volumes of NPLs that have not yet been fully recognized. This is an open secret: The National Audit Office recently claimed in an annual audit report to the NPC that 16 of 43 audited banks last year had NPL levels that were double the officially reported figure. The practice of using bond proceeds to repay existing debt is likewise widespread, as seen recently with China Chengtong Holding Group.

Loan rollovers are a pervasive phenomenon in China. They were especially prominent after 2012, when post-2009 stimulus loans needed to be extended and shadow lenders emerged to help banks hide loans off their balance sheets. As difficulties mounted in the real estate sector, political messages from Beijing encouraged banks to provide loans to sectors and companies in distress. For example, central bank governor Pan Gongsheng stated in August 2023 that the PBOC should provide support for developers’ “reasonable financing demands.”

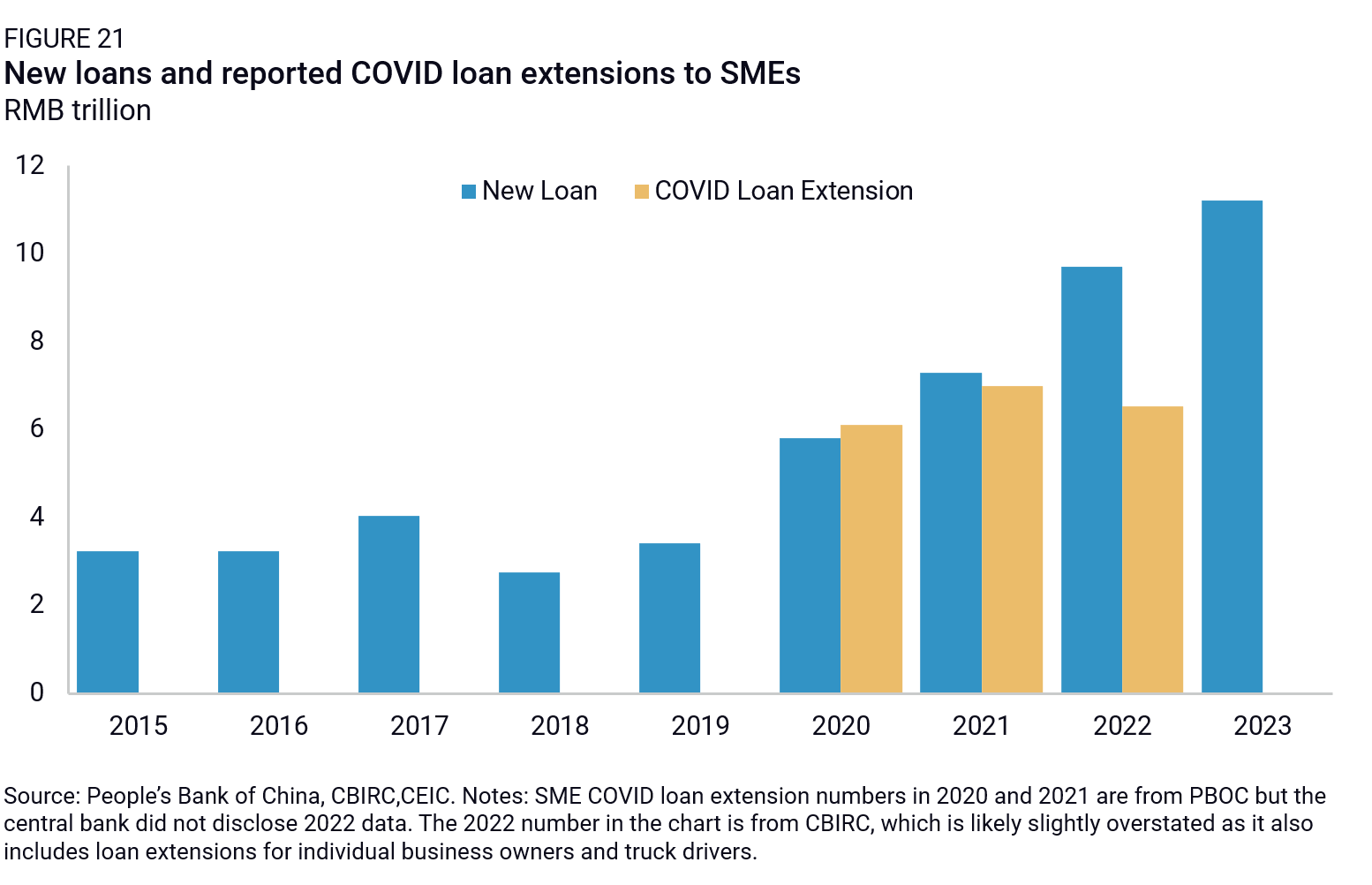

The economic downturn from COVID-19 again worsened the situation by triggering new volumes of loans that are not being repaid and will need to be rolled over again in the future. This was explicit state policy during the pandemic, and banks would publish the volume of loans that they were rolling over to small and medium-sized enterprises. The CBIRC has said that Chinese banks have already postponed repayment of RMB 1.44 trillion in maturing small and medium enterprise loans, out of a total of RMB 13.08 trillion in loans to SMEs (Figure 21). This also includes relatively large companies, as the Chinese government defines SMEs at a larger size than the OECD does. As a result, many companies were kept alive artificially, compounding the problem of “zombie companies” in China, whereby non-viable firms do not file for bankruptcy and continue to produce despite making continued losses.33

In this context, many Chinese firms have been able to keep prices artificially low compared to production costs—despite many running into losses. The potential effects on global markets (downward pressure on prices, quick capture by Chinese firms of global market share, etc.) are similar to more traditional subsidy schemes. In other words, the financial system had served as a shock absorber, channeling resources to enterprises facing losses to maintain output and prevent the defaults and bankruptcies that occurred in market economies.

Politically motivated abundance of credit

Definition: China’s financial system has expanded massively over the past 15 years—faster than might have been expected in a normally functioning market economy. In fact, that growth has been unprecedented in global and historical terms—since 2008, China has added bank assets equivalent to around 41% of global GDP in only 15 years. Although the pace of credit growth has slowed since 2016, it remains well above the pace of economic growth.

This happened for two reasons. From a micro perspective, banks’ state-owned status meant they were perceived as low-risk borrowers, giving them the ability and incentive to grow larger as fast as possible in order to take market share from their competitors. From a macroeconomic perspective, lenders were also incentivized or ordered to increase credit volumes to maintain high levels of economic growth and serve national objectives. The targeted pace of credit expansion was set based on politically motivated economic growth targets, rather than the pace of investment that could be financed sustainably.

This abundance of credit allowed for a swath of redundant firms in strategic or politically encouraged sectors, in the hopes that one of them would grow to become a fierce global competitor. Widely abundant and available credit has also allowed Chinese firms to scale up their activities more easily than would have been the case in advanced economies, capturing market share and building economies of scale faster than their foreign counterparts.

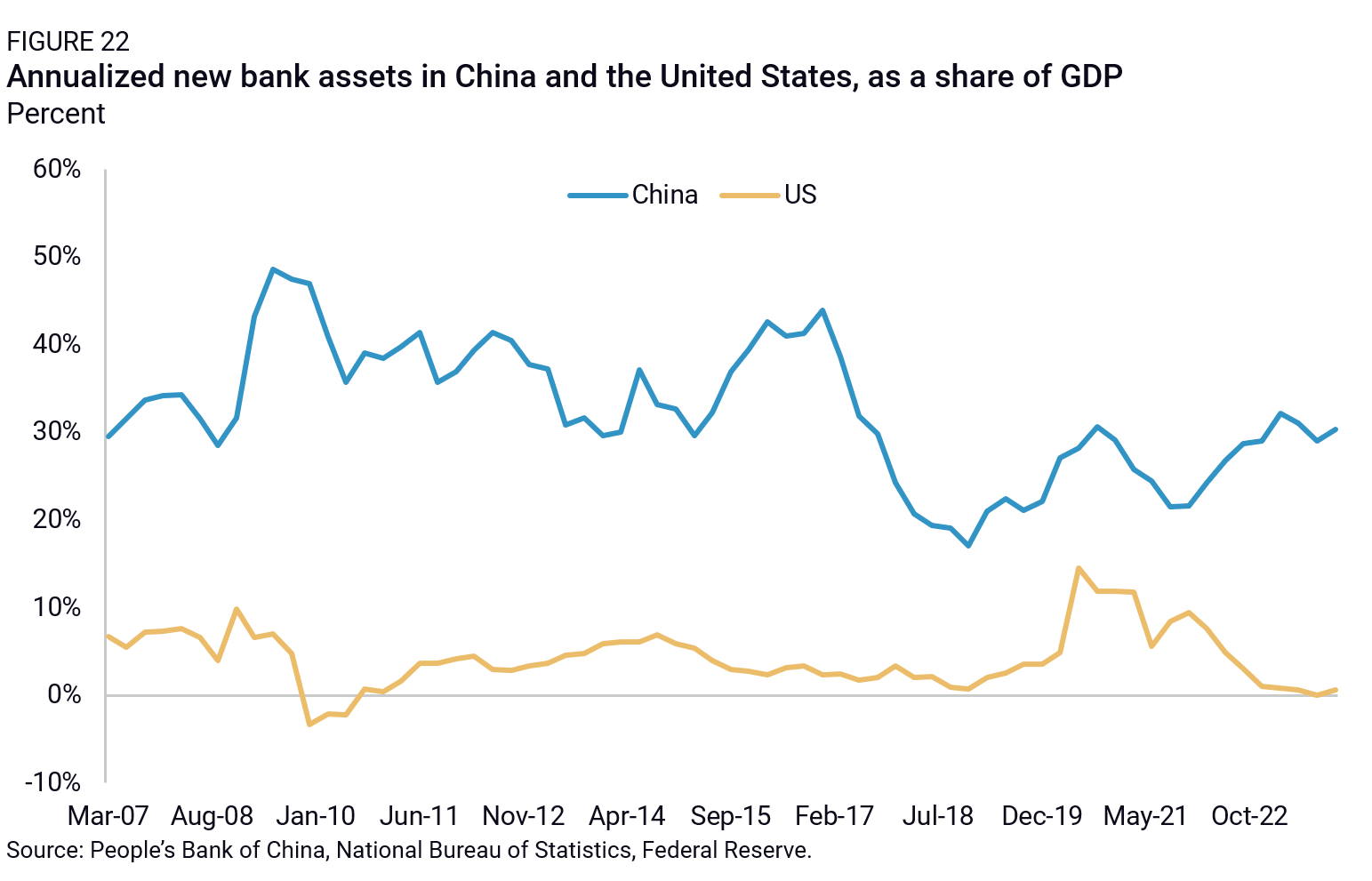

International comparison: In theory, politically-motivated credit expansion is not unique to China. However, historical examples of large-scale, state-driven financial expansion with similar characteristics are difficult to find. For example, while Japan and South Korea implemented ambitious industrial policies during their high-growth periods, their financial systems did not experience the kind of rapid, debt-fueled expansion seen in China. In contrast, China has experienced the single largest credit expansion in global history. Bank assets in China expanded at an average rate of 18% from 2007 to 2016, and even after those growth rates were cut in half from 2017 to 2019, China’s banking system still produced an average of $2.8 trillion in new bank assets per year, roughly the size of the entire economy of France. This compares to around $622 billion in new bank assets per year in the United States, though this is not a direct apples-to-apples comparison as the US has a more diversified financial system and does not depend solely upon bank lending (Figure 22). Consequently, China’s banking system has nearly septupled in size since 2008, reaching $58 trillion in total assets in 2024. And despite being a middle-income economy, China has by now overtaken both the US and Germany in terms of credit to the non-financial sector as a percentage of GDP.

The politicization, inefficiency, and size of China’s financial system are seen as a risk and a challenge by the Chinese government. The deleveraging campaign that started in 2016 was in fact meant to address this systemic risk and slow down the growth of the financial system. But these features of China’s economy still remain, establishing broad-based soft-budget constraint for Chinese firms, who are more able than global competitors to invest, keep prices low, or take risks without having to fear many of the market consequences of such decisions.

These subsidy-like effects could persist in the coming years. Today, despite their efforts to rein in credit growth, Chinese authorities find themselves with limited options. They continue to drive credit expansion and implicit guarantees to sustain economic growth for fear of triggering a financial crisis if they change course. This reliance on credit expansion underscores the difficulty in balancing short-term economic performance with long-term financial stability.

Other non-conventional support schemes

Semi-fiscal expenditures on industrial parks

Local governments in China spend large amounts of public money to develop industrial parks, building factories, roads, and other infrastructure to support businesses. These facilities and land are then offered to companies at below-market prices, effectively giving them a financial advantage. Although not easily countervailable because of this systemic nature, the subsidized building of industrial parks and industrial real estate is a crucial aspect of China’s state support system.

Definition: Over the past two decades, local governments invested substantial resources in high-tech industrial parks to provide companies with the infrastructure and facilities needed to develop and scale up. In 2019, these zones hosted 40% of China’s high-tech companies,34 and provided cheap industrial real estate, including factory premises, office space, warehouses, R&D facilities, and residential buildings for workers.

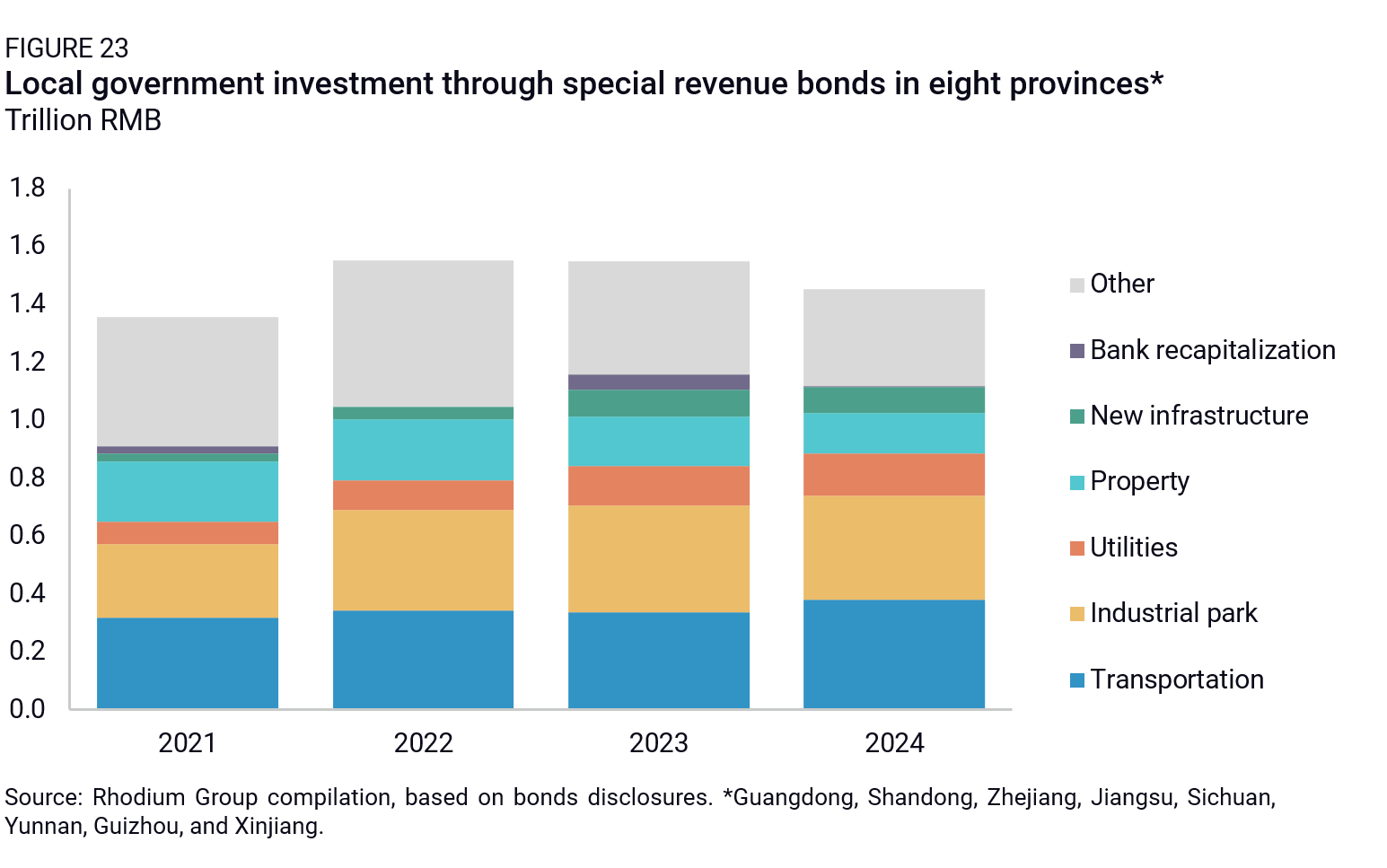

Together with transportation, industrial parks constitute the largest expenditure item in local governments’ off-budget financing (Figure 23). A partial dataset of special revenue bonds (SRBs) in eight provinces (Guangdong, Shandong, Zhejiang, Jiangsu, Sichuan, Yunnan, Guizhou, and Xinjiang) showed that in 2024, spending on industrial parks amounted to RMB 362 billion, up from RMB 255 billion in 2021. The total amount is likely to be much greater because it should also include investment from quasi-fiscal LGFVs, which remain opaque. However, if other provinces dedicate a similar proportion of roughly 25% of SRB revenue to industrial parks, that would put the total at RMB 1 trillion.

The provision of abundant and cheap production infrastructure is one of the key ways local leaders support local industry.28 Because they draw much of their resources from land sales and corporate income tax revenues, local governments have an incentive to over-invest in this infrastructure, which leads to an oversupply of industrial parks, driving prices down.10

International comparison: China is not alone in using fiscal resources to build infrastructure that benefits companies. South Korea, for example, established free export zones in the 1960s that provided many advantages for firms operating in the zone and was at least partly financed by the Ministry of Commerce and Industry. Similarly, India’s Industrial Development Corporation has financed the development of many industrial parks. In Ethiopia, industrial parks were financed through public investments often derived from external borrowing.

However, several aspects of China’s spending practices stand out. The first is the strategic targeting of specific sectors through industrial parks. The development of industrial parks follows political priorities. The Shandong 14th Five-Year Plan, for example, earmarks a number of key industrial parks for specific sectors, including automobile manufacturing, high-end chemicals, new energy, and biomedicine—all targeted in China’s high-level industrial policy plans. In practice, this leads to distortive fiscal spending that strategically favors certain industries.

China also stands out for the staggering scale of infrastructure investment for corporate use and the structural bias in public spending toward corporations at the expense of consumers. This emphasis on corporate infrastructure at the expense of household spending effectively reduces operational costs for businesses, particularly large and state-backed domestic enterprises. This support serves as an indirect subsidy, enhancing corporate profitability and competitive advantage of companies (either domestic or foreign) located in the industrial parks without direct financial handouts.

Countervailability: Although the provision of corporate facilities at below-market price is theoretically countervailable, in practice it has not been commonly used in past CVD investigations, partly because of its systemic nature and because of the difficulty of proving the price differential between an estimated market price and the actual price paid by companies.

Selective market access and a biased business environment

Definition: Although it has opened considerably to foreign trade and investment since the 1980s, China remains partially or fully closed to foreign players in many industries through both formal and informal restrictions. The strategic restricting or conditioning of market access and the selective enforcement of regulations, administrative processes, and standards to the benefit of local or state-backed actors are typical market-distorting industrial policy tools. They are not subsidies in the narrow sense of the term because they do not constitute a financial transfer from the state to enterprises. However, they have subsidy-like effects by providing undue advantages to certain (often local and state-backed) firms, helping them to increase scale and compete locally and abroad without concern for the same market constraints that apply to their competitors.

While it displays high trade openness at the aggregate level (see Rhodium Group’s Pathfinder reports), Beijing also formally prohibits or restricts certain imports through negative lists (e.g. the Imported Product List for medical devices), as well as foreign firms’ access to public procurement in a range of sectors. This is the case in the rolling stock sector, where formal restrictions on procurement have favored China’s two state-owned manufacturers, CRRC and CRSC. Foreign firms can only participate in tenders through joint ventures with local companies without a controlling share, and they must have a state-issued license, typically granted only to Chinese-controlled companies.24

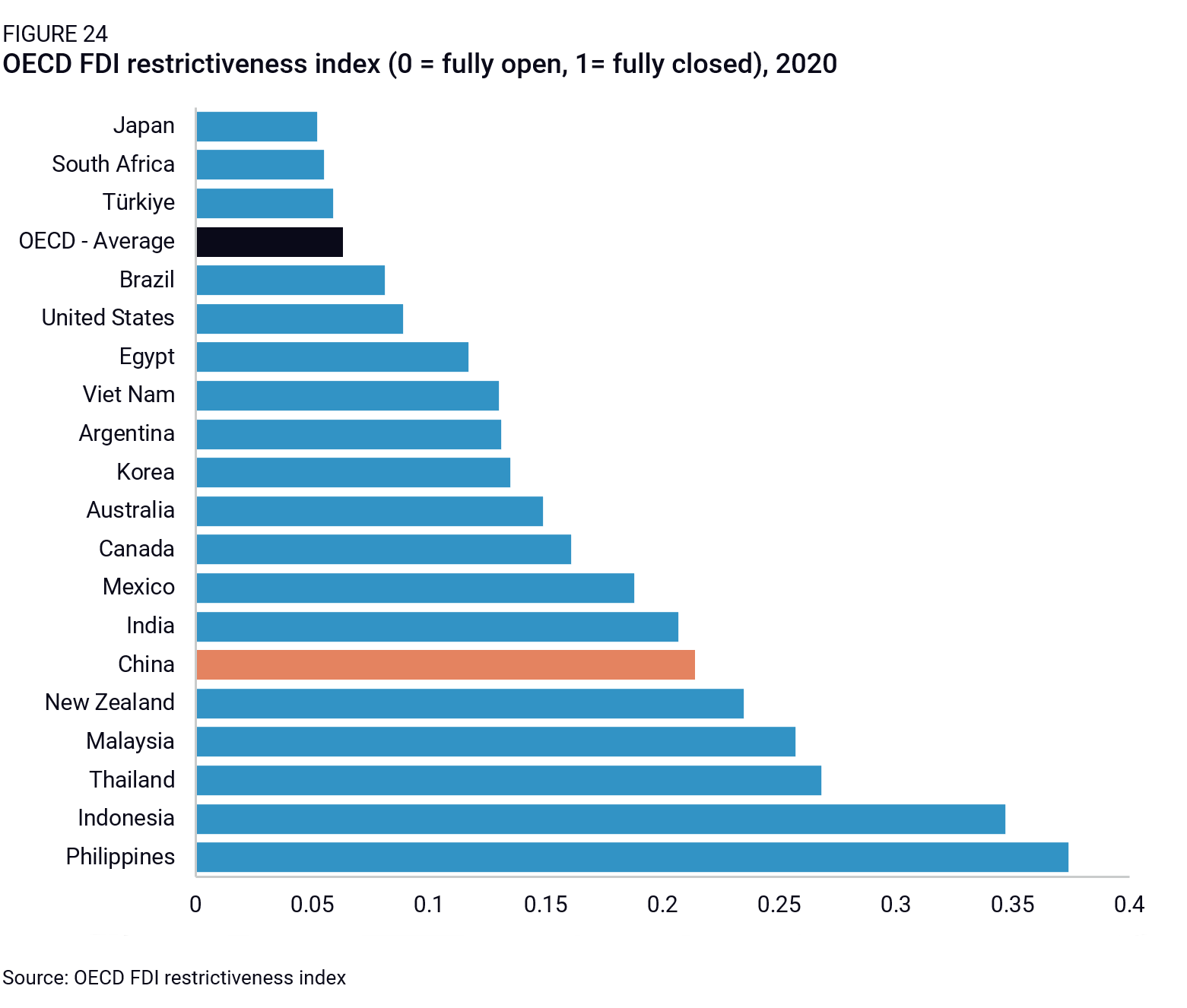

China has also made particularly strong use of FDI restrictions, although it is by no means unique in that regard. It also uses joint venture requirements to condition market access in other industries, such as general aviation and telecommunications services (Figure 24).

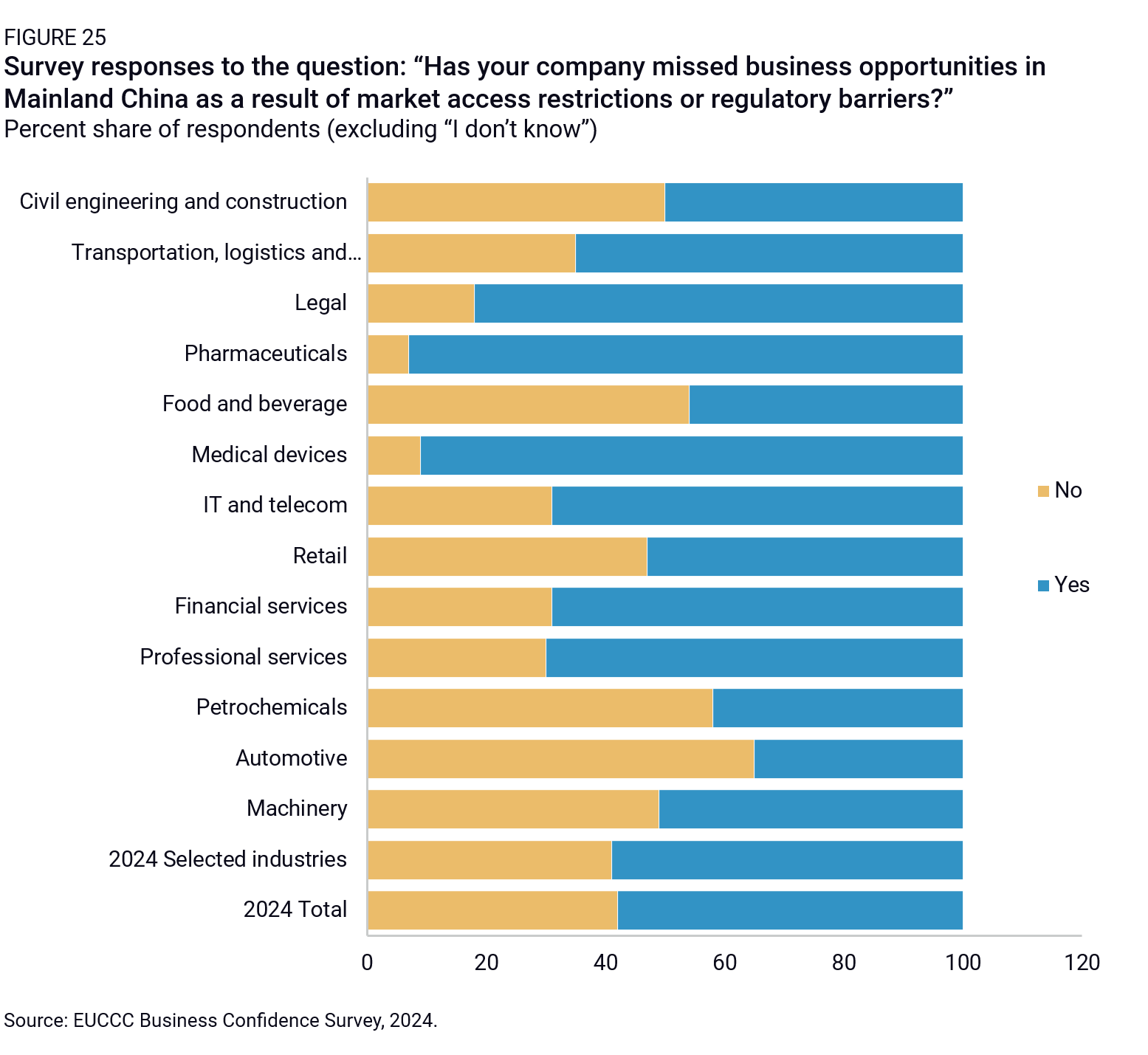

Overall, while the prevalence of market access and regulatory barriers varies by sector, it has overwhelmingly increased in the past few years. 58% of respondents of the European Chamber of Commerce in China’s annual Business Confidence Survey in 2024 reported missing business opportunities because of such barriers, up from 42% in 2022. These barriers result in significant disadvantages for foreign firms: In the same survey, a fifth of respondents who lost business opportunities as a result of market access or regulatory barriers report they would have been worth more than a quarter of their annual revenue. In some sectors such as pharmaceuticals, that proportion was as high as 93% (Figure 25).

China also informally restricts market access for domestic firms and, in some cases, selected foreign firms. Non-public circulars like the 2021 Guidance Standards for Review of Government Procurement Imported Products set detailed and quantified targets for the share of domestic products in goods procured by public institutions like hospitals. The slow or selective delivery of licenses and permits (e.g. medical devices approval) can also restrict or delay market access for foreign firms. This grants local players an artificially high share of the market or timing advantage over foreign peers, providing them with a competitive advantage in domestic and global markets.

Some of these informal restrictions include forced IP transfer as a quid pro quo for market access. This can involve “corporate structure requirements”35 where foreign investors in China have to partner with domestic entities as a condition of making an investment, either by forming a joint venture or affording Chinese investors a controlling equity stake. Forced IP transfers are very difficult to prove because they usually happen behind closed doors and cannot be traced. Companies are also reluctant to disclose their experience for fear of losing market access.36 Yet there is considerable evidence that forced tech transfers have been significantly more common and systemic than other countries. According to a report by the EU Commission in 2022, China is at the origin of 70% of suspected IPR-infringing goods in the single market. These transfers likely helped improve the performance and innovative capacity of domestic producers, producing a subsidy-like effect. The rolling stock industry is one of the most striking examples, where technology transfer contracts signed with CSR Corp. and CNR Corp. allowed Chinese engineers to quickly assimilate high-speed trains’ core technologies.36

Altogether, formal and informal restrictions on foreign activities make China a significantly more restricted market than OECD countries. This is particularly true for high-tech sectors that China’s industrial policy designates as priority areas, in which Chinese firms have established very large market shares in the domestic market at the expense of their foreign competitors.

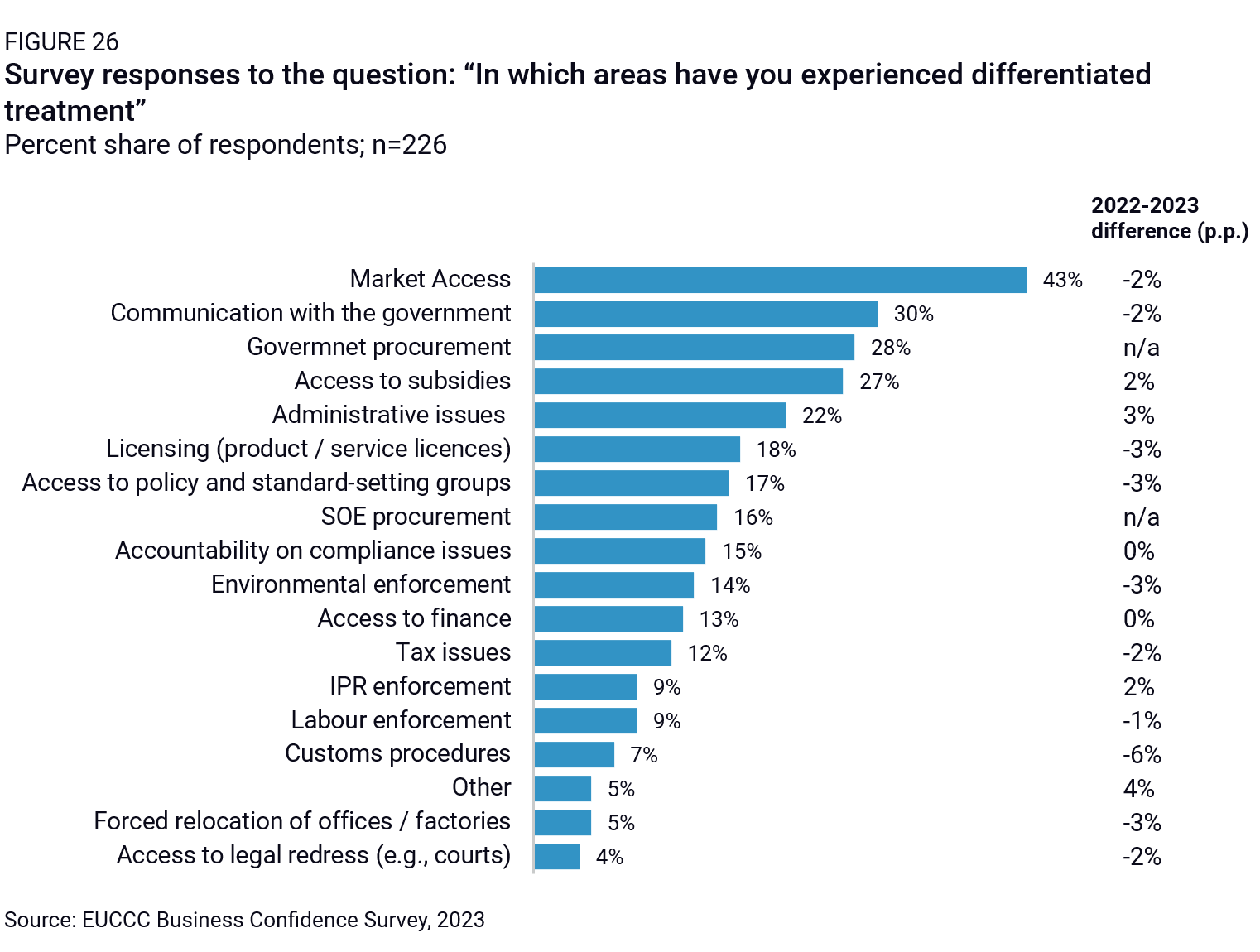

China’s government has also been found to enforce its own regulations and standards selectively to favor domestic enterprises, particularly state-backed and state-owned firms. Foreign firms operating in China have reported discretionary enforcement in a wide variety of fields, from the market access barriers noted above to environmental enforcement, tax, labor, and IPR rules (Figure 26). 24% of respondents of the EUCCC Business Confidence Survey in 2024 reported that these rules were intentionally misinterpreted by officials to disadvantage foreign companies in favor of local champions. Companies reported, for example, a particularly pronounced bias in the enforcement of environmental regulations, where European players typically have higher standards yet are subjected to far more regulatory inspections.