Opening Salvo: The EU’s Electric Vehicle Probe and What Comes Next

The European Commission's new anti-subsidy investigation into Chinese electric vehicles could be just the first of several trade defense measures to protect European industry.

On October 4, 2023, the European Commission launched an anti-subsidy investigation into imports of passenger battery electric vehicles (BEVs) made in China. The investigation underscores mounting concerns in the EU about the impact that a wave of cheap, subsidized BEVs from China could have on Europe’s fledgling industry. While BEVs occupy the spotlight at the moment, the EU is also reportedly considering trade defense measures against Chinese wind turbines and steel. Many more industries are recipients of China’s industrial policy largesse, and could become targets for EU policymakers in the years ahead. In this note, we explain the EU’s concerns about China’s BEV industry, present the likely strengths and weaknesses of the Commission’s case, and explore how trade measures could be expanded, both by the EU and its G7 allies, to encompass a broader set of subsidized industries in China.

EU concerns: Subsidies, over-capacity, and a rise in cheap exports

There are three main concerns informing the EU’s decision to open an investigation into imports of China-made BEVs: substantial Chinese state support to its electric vehicle industry, a rapid increase in cheap exports to Europe, and mounting over-capacity in China that could accelerate those exports. Taken together, these factors could threaten what the Commission views as “an already vulnerable EU industry” that is still years away from breaking even. At the very least, an influx of cheap Chinese BEVs could hinder the investments needed to scale up Europe’s home-grown industry.

By launching a rare ex officio investigation, rather than responding to industry appeals for a case, the Commission is sending a signal that it is prepared to use the tools at its disposal to protect and bolster the competitiveness of European industry—a major theme in Commission President Ursula von der Leyen’s state of the union speech. Importantly, the Commission is taking a preemptive approach by basing the case on the threat of injury, rather than already documented harm, in an effort to avoid a repeat of Europe’s experience with the solar photovoltaic (PV) sector a decade ago, when state-sponsored Chinese players shattered Europe’s domestic industry.

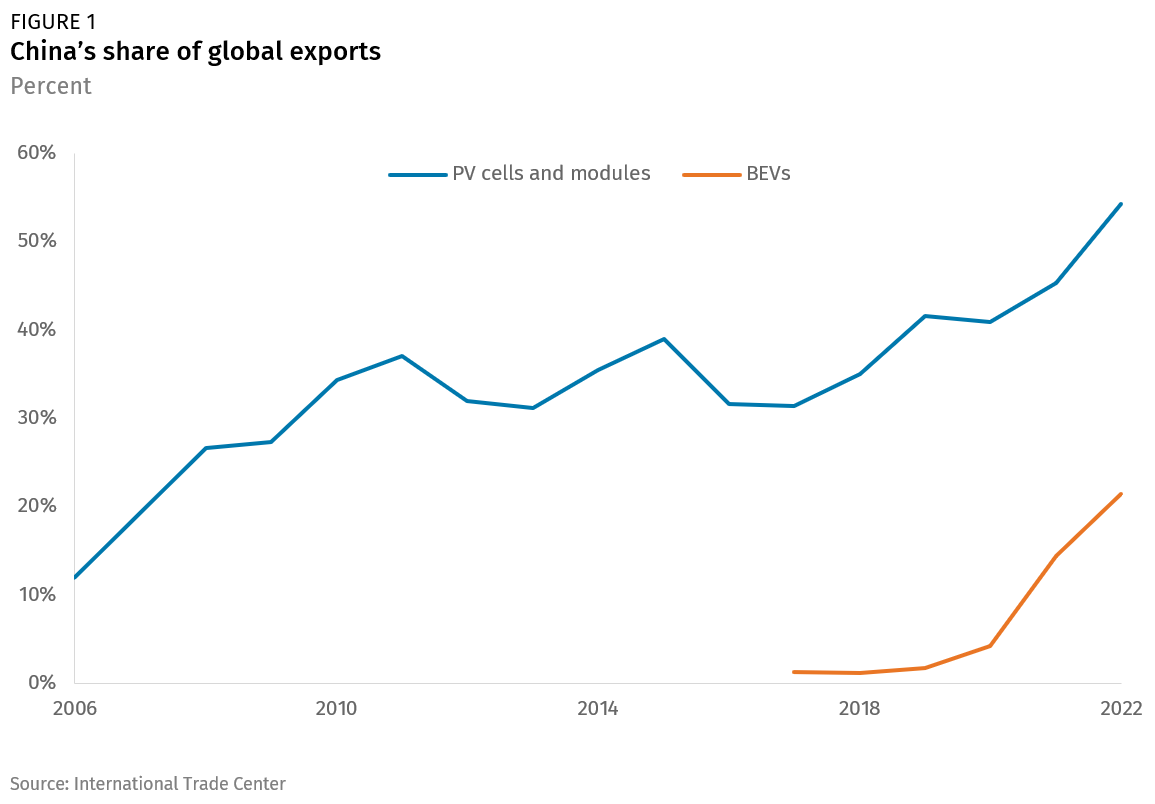

In the late 2000s, Chinese solar PV manufacturers leveraged foreign technology and abundant state financial support to achieve dominance across the PV value chain. China’s share of global PV cell production surged from 14% in 2006 to 60% in 2013. From 2013 to 2018, the European Union, following the United States, imposed anti-dumping and countervailing duties on solar panels, cells, and wafers from China. These moves temporarily halted the growth in China’s share of global exports (Figure 1), but failed to restore the share lost by the EU or US.

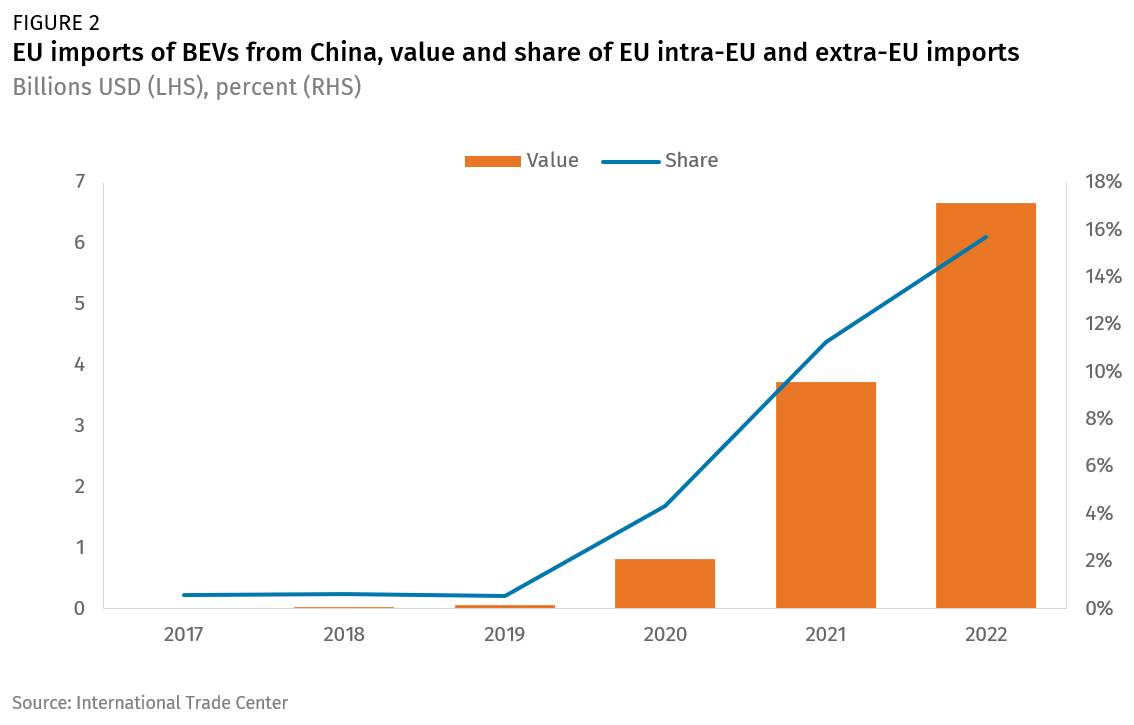

By moving early to impose countervailing duties (CVDs) on BEV imports from China, the European Commission hopes to avoid a similar fate for Europe’s BEV industry. Trade data shows that China’s BEV exports have grown at lightning speed over the past three years (Figure 2). China’s share of global BEV exports grew from just 4% in 2020 to 21% in 2022, and China’s share of EU BEV demand grew from 4% to 16%.1 It is important to note that a majority of BEVs exported from China to the EU are currently foreign brands—chief among them Tesla, but also European brands with joint ventures or contract manufacturing agreements in China, such as Renault and BMW. Renault’s Dacia Spring, produced in Hubei, was the 10th best-selling BEV model in Europe in H1 2022 with more than 19,000 cars sold; and almost 9,000 of BMW’s China-made iX3 models were sold in Europe during the same period. But Chinese brands are growing increasingly competitive. Their share of total EU car sales grew from 0.4% in 2019 to 8% in 2023. According to KPMG, Chinese groups such as BYD and SAIC could capture as much as 15% of new car sales in Europe within the next two years.

The Commission argues that rapidly rising Chinese exports of lower-priced BEVs (about 20% below European unit prices), and the sharp rise in China-based production capacity constitute an imminent threat to Europe’s auto industry. In late 2021, capacity utilization rates were only 58.4% for new energy passenger vehicle manufacturing in China. Persistently high levels of investment in the sector (+56% y/y capex growth in H1 2023) could exacerbate overcapacity in the years ahead, especially against a backdrop of slowing Chinese growth. The Commission fears many of these artificially low-priced vehicles will find their way to Europe.

Making the case: Documenting China’s support to the industry

It is noteworthy that the Commission chose to launch an anti-subsidy rather than an anti-dumping investigation into imports of China-made BEVs. In the 2012 case against China-made solar PVs, the Commission launched both simultaneously. There are two plausible explanations for this choice. First, anti-dumping investigations are best applied to basic products like solar panels or raw materials. Because of their complexity, BEVs might not lend themselves as easily to an anti-dumping case. Second, countervailing duties tend to be lower than anti-dumping duties. In bringing an anti-subsidy case, the Commission may be signaling to a reluctant country like Germany that it will remain measured in its response.

In order to impose countervailing duties without running the risk of a major rebuke from national European courts (a more immediate threat than a WTO counter-case, which can take years), the Commission will need to prove three things: 1) that exporters of China-made cars received countervailable subsidies from the Chinese government, 2) that Europe’s industry is under imminent threat of injury, and 3) that there is a causal link between the two.

The existence of state subsidization should not be difficult to show. The BEV industry became a priority for Beijing in the 2010s, as it became clear to China’s leaders that the country’s efforts to achieve competitiveness in internal combustion engines had stalled. Several policy schemes to support BEV makers, including purchase subsidies paid directly to China-based manufacturers, are openly disclosed by the Chinese government. In fact, the EU’s initiation notice points to publicly available evidence of a wide variety of support tools, including direct grants and subsidies but also a range of tax exemptions, low-cost financing, and provision of inputs at below-market prices.

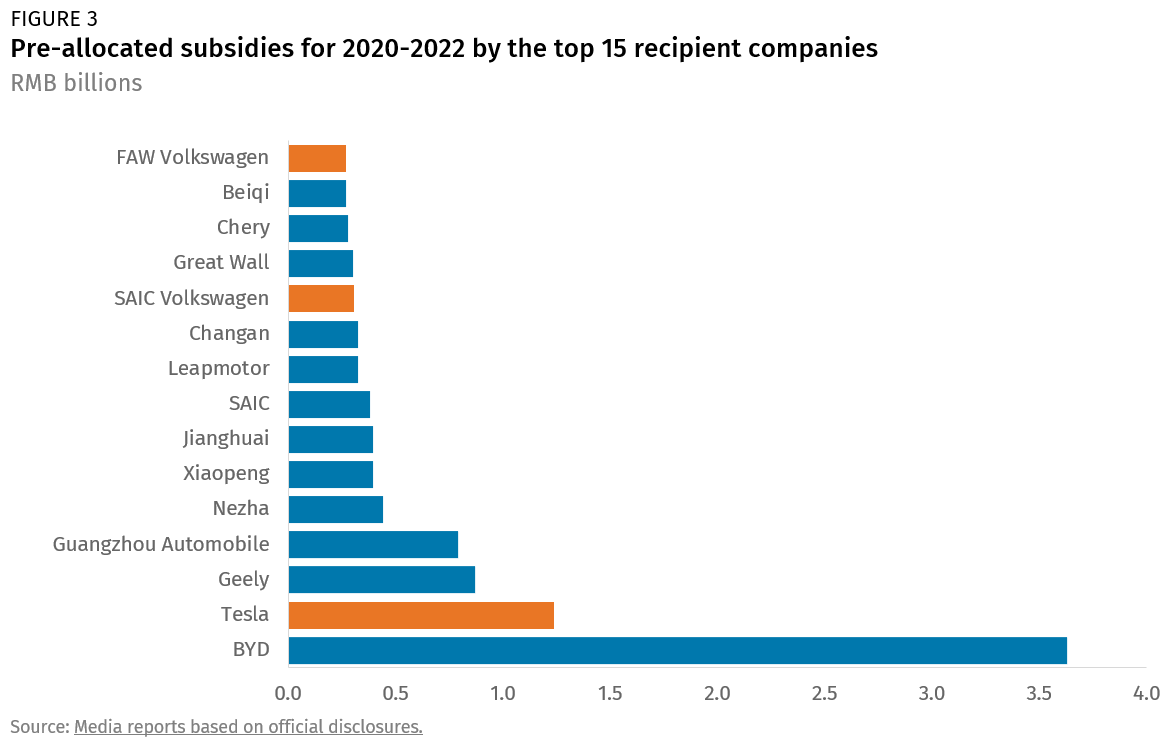

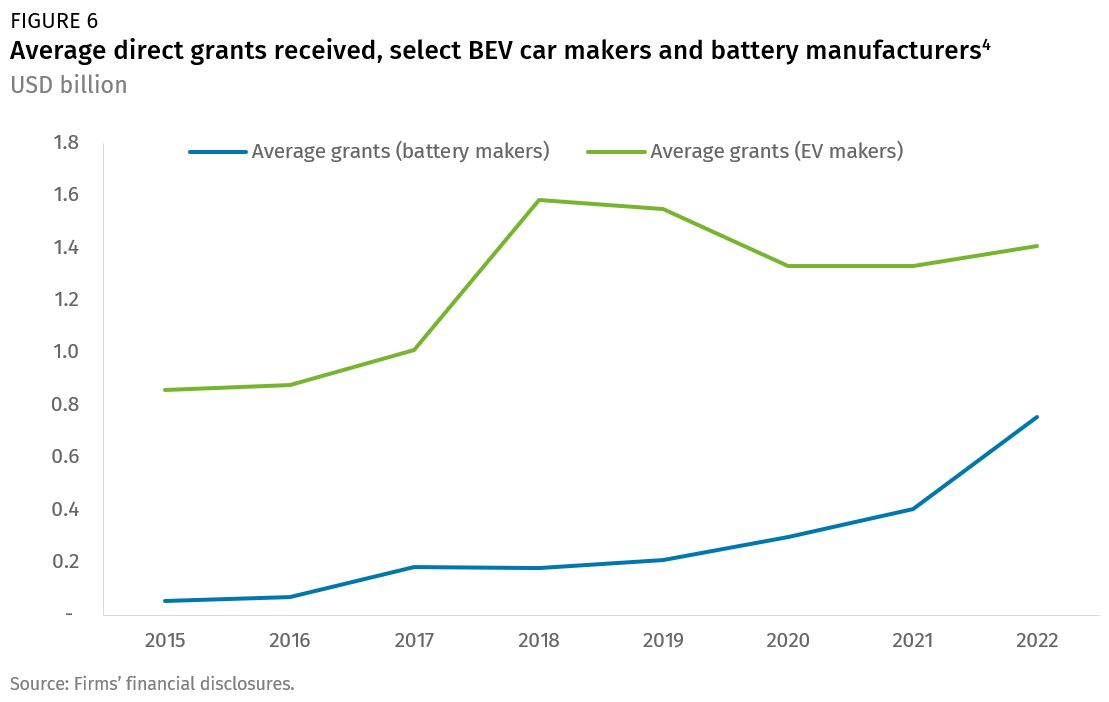

However, measuring the full extent of China’s subsidization to provide sufficient evidence of potential imminent harm might be more difficult. There is abundant quantitative evidence of direct support instruments such as grants and purchase subsidies (Figure 3), which other countries also use to prop up their BEV industries. But most of China’s support to strategic industries tends to take the shape of government-sponsored access to cheap credit and equity, as uncovered by recent OECD work on the aluminum, rolling-stock, and semiconductor sectors. These non-conventional support channels can be much harder to quantify because they require comparing actual costs of capital with theoretically expected costs based on future market conditions.

In its case, the Commission will have to contend with the fact that non-Chinese carmakers (including those based in the US and Europe) have also received significant state support for their China operations, as a means to encourage them to shift production and export capacity from Europe to China. After BYD, Tesla was the second-largest recipient of pre-allocated purchase subsidies in 2020-2022, receiving a total of RMB 1.24 billion (USD 192 million). Volkswagen’s joint ventures with SAIC and FAW, meanwhile, pulled in RMB 0.58 billion (USD 79 million) in such subsidies over the same period.

Because batteries account for around 25-35% of the cost of a BEV, China’s support for this industry will also be important for Brussels to consider. We estimate that Chinese firms BYD and CATL, both of which produce batteries, received approximately USD 4.3 billion and USD 2.5 billion in state support between 2015 and 2020, respectively, more than half of it through below-market equity.2 It is therefore quite likely that the Commission will factor in upstream subsidization (battery manufacturing, and possibly also the processing of critical raw material inputs).

The Commission will also have to show that such practices have contributed to a surge in low-priced exports, which constitute an imminent threat to European industry. It will likely rely on evidence of production overcapacity and signs that this overcapacity is being (or will be) exported to Europe. Although BEVs continue to receive subsidies through tax exemptions and local government programs, the end of the flagship central government purchase subsidies program in January 2023 and slowing domestic demand could increase the temptation to export. The current price war between BEV makers—with Tesla, BYD, and smaller firms like Nio announcing large price cuts in 2023—is a sign that supply and demand are out of whack in the Chinese market, providing companies with a powerful incentive to look for more lucrative markets overseas.

Targets on the horizon: Wind turbines and heat pumps?

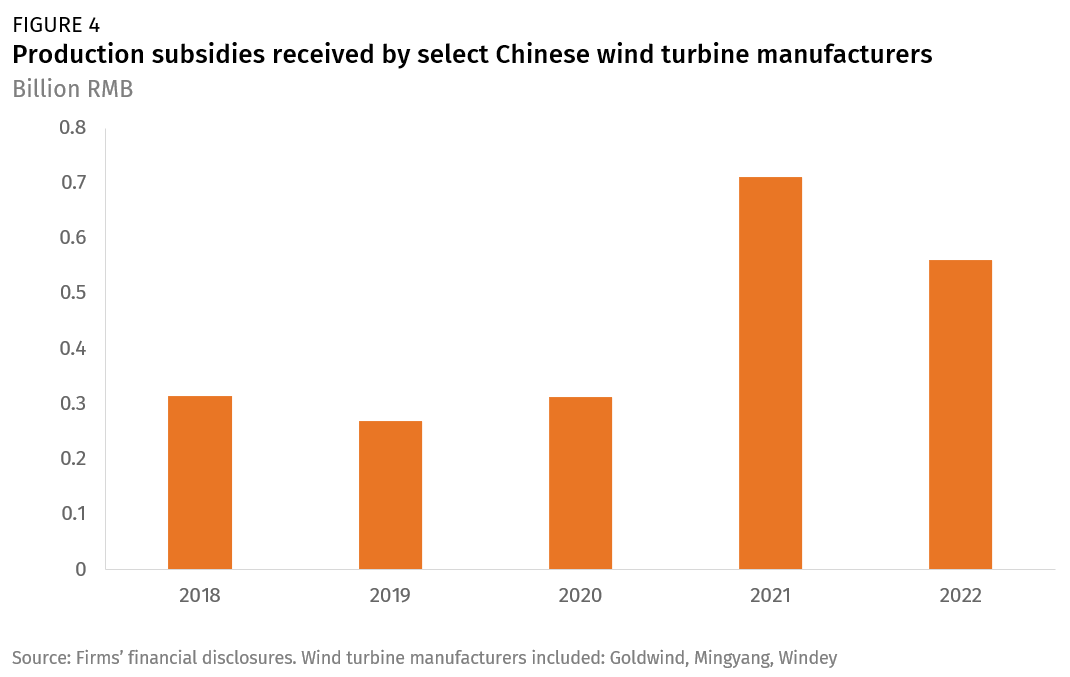

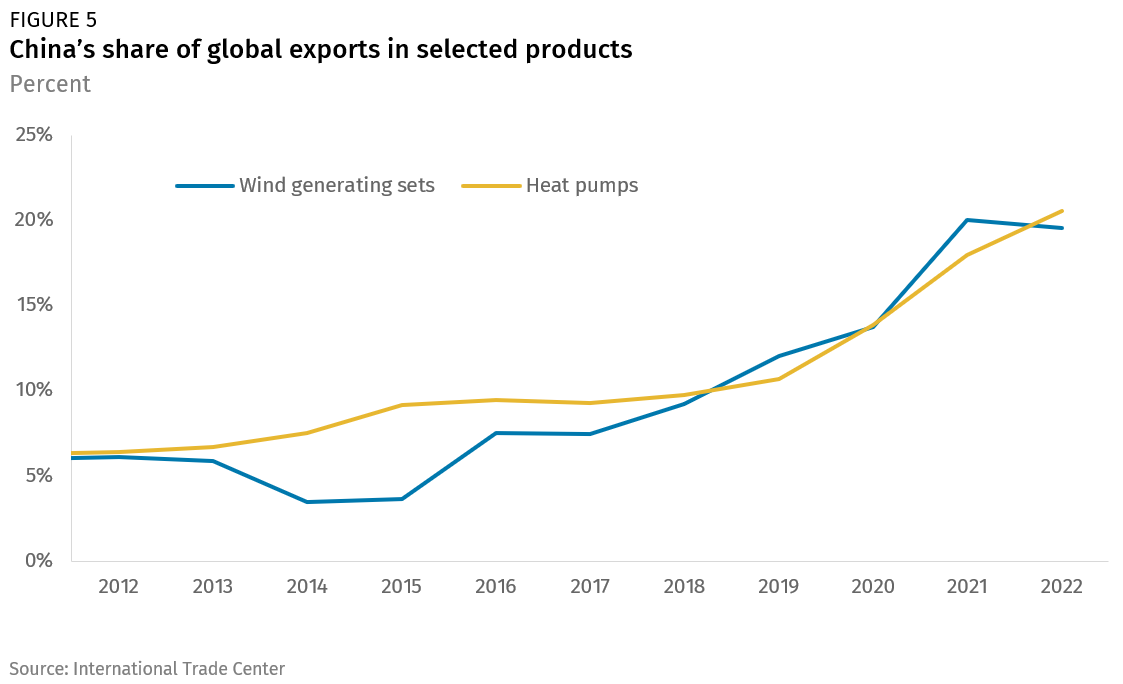

While the Commission is focused on BEVs for now, we expect it to eventually turn to other green tech industries where state support in China is distorting global markets. There is, for example, abundant evidence of state support for China’s domestic wind turbine industry, which benefitted from a combination of demand-side feed-in tariffs and strong local content requirements until 2009.3 After that, China-based wind turbine manufacturers benefitted from abundant production subsidies, with a marked uptick in the last couple of years (Figure 4). Over the same period, China’s share of global exports of wind turbines doubled, from 12% in 2019 to 21% in 2022 (Figure 5). China’s share of EU wind turbine demand grew even faster, from 6% in 2018 to 28% in 2022. China’s increased production capacity contributed to a major drop in the price of wind turbines in China, from USD 700,000 per megawatt in early 2020 to USD 470,000 in late 2021, putting Chinese manufacturers at an advantage compared to foreign—and especially European—manufacturers struggling with rising production costs. It is no surprise, then, that the Commission is reportedly considering an investigation into imports of China-made wind turbines.

It could be harder to build a case against China’s heat pump industry, which benefited from state support, but much of it from demand-side subsidies, which are less likely to trigger countervailing duties. Still, domestic companies often benefitted more from purchase subsidies than foreign firms. For example, most of the heat pump companies (23 out of 26) selected by the government for heat pump water heater purchase subsidies were domestic brands, and no foreign firm was eligible for the highest amounts of subsidies. This support propped up demand and, in turn, boosted the revenues and profitability of domestic manufacturers. China’s share of global heat pump exports expanded in ways similar to BEVs or wind turbines—more than doubling in the past four years (Figure 5). The majority of the export surge has come from Chinese OEMs working with foreign brands, but the exports of local brands are also booming, with Midea’s air source heat pump water heater exports, for example, increasing more than 200% year-on-year in the first half of 2022. The sector, finally, is ripe with overcapacity, which Chinese demand might be incapable of absorbing. This situation could trigger a similar reaction from Brussels.

The case of lithium-ion batteries

As mentioned above, the battery sector has been a major recipient of Chinese state support over the past decade, resulting in rapidly falling prices and substantial overcapacity. In 2022, China’s production of lithium-ion batteries was 1.9 times the cumulative installed volume. Despite this, China’s support to the sector is still growing, with direct support mechanisms such as grants on the rise—even as those to BEV makers have come to plateau (Figure 6).

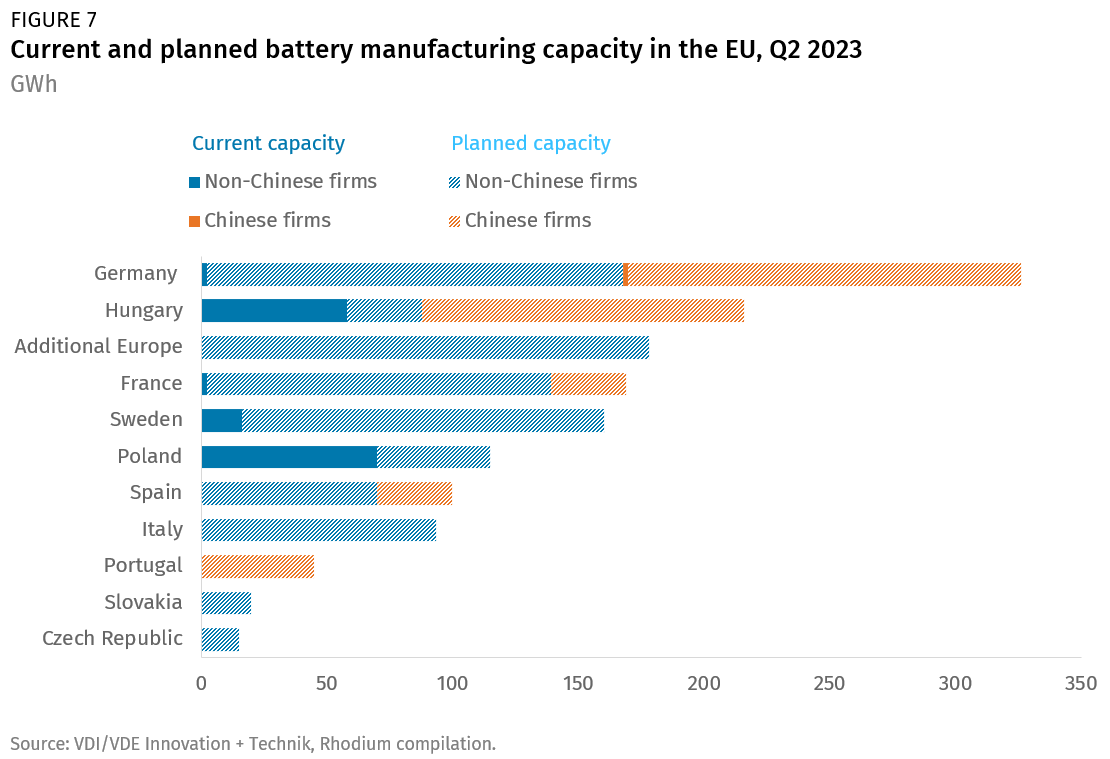

However, there are two important differences between batteries and the other green tech sectors mentioned above, and these have implications for how the EU might respond. First, China’s dominance in the sector means that a trade investigation and resulting duties on China-made batteries could create major short-term inflationary pressures on downstream European industries, as alternative sources of supply are limited and more expensive. China today accounts for nearly half of global battery cell production, in addition to dominating the global market for processed battery components such as anodes, cathodes, electrolytes, and separators. Second, Chinese battery makers have invested heavily in Europe, contributing to local economic activity and leading to an on-shoring of battery capacity—a form of de-risking, even if plants are Chinese-owned. It seems unlikely that the EU will take action against Chinese battery makers in the short- to medium-term, including through its new foreign subsidies instrument, which allows the EU to target subsidized production in Europe.

This could change in the longer term, however. As new battery manufacturing hubs emerge in Europe, the price effect of trade action will subside, while the incentive to preserve these hubs will increase. Poland, Hungary, and the Czech Republic’s combined market share reached 36% of EU battery demand in 2021, up from 7% in 2017, and largely driven by investment from South Korean companies Samsung, SK Innovation, and LG Energy. But that share has stagnated over the past two years, while the share of Chinese batteries in EU imports jumped to 46% in 2022, from 31% in 2021. This was largely due to price differences: in 2022, Chinese batteries were 33% cheaper than those produced in Europe. As Europe strives to create a home-grown battery industry, Chinese-owned mega-factories on the continent—including the likes of CATL’s €8 billion Hungary factory—may be seen to pose a threat to emerging European champions like Northvolt or Verkor, especially if they put depress prices in ways unsustainable for competitors.

European divisions vs. Brussels’ momentum

The Commission has 13 months starting October 4 to make a final decision on the case, and potentially impose permanent countervailing duties on imports of China-made BEVs. While this timeline pushes the final decision to the next Commission, the von der Leyen Commission could impose provisional CVDs within a two-to-nine-month window following the launch of the investigation. An early decision to impose duties might win favor in France, but it would likely rile other member states, chief among them Germany.

Berlin has sent mixed signals about the probe, reflecting divisions within the coalition government. But there is significant concern in Germany that EU duties would trigger retaliation against its carmakers, which are deeply dependent on the Chinese market. France, on the other hand, has strongly supported the investigation, which it views as an opportunity to bring manufacturing jobs back and increase Europe’s resilience in green technologies. Paris has even gone a step further, proposing to introduce national tax credits for electric vehicle purchases based on EV makers’ carbon footprint. France’s methodology for carbon scoring would cover manufacturing and transport (including batteries) and could set a precedent for other member states. Italy is reportedly considering a similar scheme. Nordic states, which are trying to get battery manufacturing off the ground and may be wary of retaliatory moves by China to restrict critical inputs, have not reacted as strongly to the EV probe. Central and Eastern European countries, which are highly integrated with carmakers in Germany, could choose to align with Berlin. But they might also welcome new BEV investments from China, prompted by Europe’s trade measures.

Regardless of how member states position themselves, the Commission could decide to plow ahead, as it did with solar panels a decade ago. Its biggest battle will be in European national courts, where cases will likely be launched by Chinese and European automakers alike. In this event, the Commission will need to prove not just subsidization but that subsidies have produced a significant price differential between Europe-based and China-based BEV makers, and that this poses an imminent threat to home-grown players. The standard will be high.

If the Commission’s case is successfully challenged in courts, political support for future cases could wane. Beyond the BEV probe, and potential wind turbine and steel investigations, we could envision, in the longer term, the use of various EU instruments to take aim at China’s support to its heat pumps, medical devices, and rolling stock industries. In addition to traditional trade defense tools and the new foreign subsidies regulation (discussed above), the EU also has available its new international procurement instrument (a tool to deny or limit third country firm access to EU public procurement markets where third market public procurement is closed to EU firms). But significant additional action would likely hinge on the success of the BEV case.

How will China respond?

Beijing is clearly alarmed by the momentum in Europe behind the use of defensive trade measures. In response to the EV investigation, Chinese authorities have accused the Commission of “naked protectionism” and signaled a willingness to retaliate. In the near term, while the EU investigation is underway, we believe that Beijing is unlikely to announce formal countermeasures. Instead, it may resort to closed-door threats or informal measures, as it tries to use its leverage with member states like Germany to head off the imposition of EV duties and other EU measures designed to level the economic playing field. As it has in the past, China could impose targeted product bans or encourage consumer boycotts (aimed at French or Italian luxury goods or agricultural products, for example).

While conventional wisdom holds that German carmakers would be first in the firing line, China could, in an initial phase, turn to other targets. Volkswagen, BMW, and Mercedes-Benz have continued to invest heavily in China in recent years, including in technology partnerships with Chinese firms, in a bid to stay competitive in a fast-evolving EV market. At a time when it is struggling to rebuild trust among foreign investors, Beijing may decide that punishing those firms whose trust has never wavered is short-sighted. Still, because they are highly exposed to the Chinese market, the big German carmakers are susceptible to a range of coercive actions, including licensing revocations and crackdowns on data security and cybersecurity grounds.

Beijing has many other factors to consider as it weighs how to respond. China has been developing legislative tools of its own, such as the newly enacted Foreign Relations Law, to send a message about its right to strike back against what it perceives as unfair trade and investment restrictions (see August 17, Codifying Retribution). Its move earlier this year to introduce export controls on germanium and gallium was seen as a warning to Europe and others about China’s willingness to restrict access to critical inputs that it dominates. In an extreme scenario, China could restrict exports of critical materials that the world needs for EV manufacturing (for example, graphite, lithium, cobalt, and copper processing) and EV-related inputs and technologies like neodymium magnets and vehicle-mounted laser detection and ranging systems. Chinese regulators could also become more defensive of battery technologies and restrict outbound licensing deals in an attempt to keep investment in China. Policies like the Inflation Reduction Act, which seeks to reduce Chinese inputs in US EV supply chains, and trade defense moves like the EU’s EV probe, are both likely to steer EV-related investment away from China—a shift Beijing will be keen to counter.

Nevertheless, while retaliation in the EV space may be Beijing’s most powerful weapon, it could also end up turbocharging de-risking policies in Europe. Alienating foreign automakers and suppliers in the EV and autonomous driving space could inhibit China’s prospects of co-developing standards to stay integrated in global EV supply chains. And licensing restrictions on Chinese leading battery makers would hinder their ability to ride friend-shoring waves in auto clusters abroad. Ultimately, from a geopolitical perspective, China will be mindful that an escalating trade conflict with Europe could push capitals like Berlin and Paris closer to Washington. Beijing has economic leverage, particularly in green technologies, but the risks of weaponizing that leverage are high.

1. Share of EU demand is proxied using China’s share of combined intra-EU and extra-EU imports.

2. Drawing on a methodology developed by the Organization for Economic Cooperation and Development (OECD), we gathered micro-level insights into China’s subsidization of the BEV battery sector. We relied on public information about the amounts disbursed to companies for some (though not all) of these conventional and non-conventional policy instruments.

3. We’ve shown in previous work how the combination of a large and closed domestic market can act as a form of state support.

4. Battery makers include Ningbo Shanshan, Zhuhai CosMX Battery, Gotion High-tech, CATL, EVE Energy, and Hunan Corun New Energy. BEV makers include BYD, SAIC Motor Corporation, FAX Jiefang Group, Chongqing Changan Automobile, Beiqi Foton Motor, and Guangzhou Automobile.