Freeze-in-Place: The Impact of US Tech Controls on China

The Biden administration's new technology controls aimed at China will have far-reaching consequences. We assess the policy objectives behind them, the impact on the semiconductor industry and how China and US allies may respond.

On October 7, the Biden administration unleashed a barrage of new controls on China-bound technologies, with a clear intent to constrain the development of China’s semiconductor industry and keep cutting-edge chips out of China’s hands. As we explained in a note published before the announcement of the controls, the evolving US technology strategy features both narrow and broad elements. The rules are narrowly focused on critical technology domains like high-performance computing, while at the same time far-reaching in their ambition to choke off China’s capacity to develop and scale leading edge semiconductors. This note explains the new controls, discusses the policy objectives behind them, assesses their potential impact—from short-term industry costs to broader spillover effects—and considers possible responses from foreign partners and China.

Below are our key takeaways:

- The new controls are far-reaching and comprehensive. They target key semiconductor chokepoints and are designed to thwart attempts by China to innovate its way around the constraints. Even as Washington grants licenses to mitigate some of the immediate costs to US-based firms and those based in foreign partner countries, the restrictions could be tightened over time to steer firms away from China.

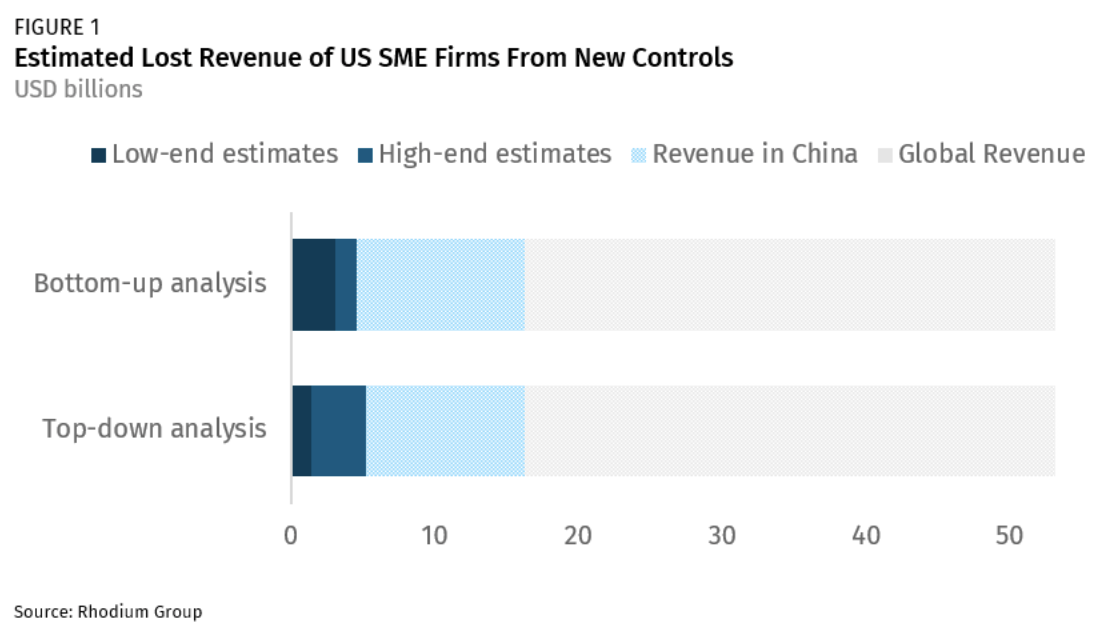

- The immediate costs to US semiconductor manufacturing equipment (SME) firms arising from a narrow implementation of the controls would be fairly limited (between $1.4-$3 billion in annualized sales, according to our estimates). However, if these controls were to be applied more broadly, for example to target foreign fabs in China, costs could rise quickly (to $4.6-$5.2 billion in annualized sales, based on our calculations).

- The memory chip industry could be most affected in the long-term, with the risk of collateral damage to firms based in US partner countries. Restrictions on Chinese memory champion YMTC could rectify market imbalances by keeping a highly subsidized Chinese NAND supplier out of the market. However, foreign chipmakers SK Hynix and Samsung, now at the mercy of US licensing decisions, are likely to face significant costs linked to the restructuring of their supply chains.

- The US administration appears willing to bear the diplomatic and economic costs of imposing unilateral controls. There is a real risk that foreign SME competitors, over time, could remove US inputs from their supply chains. At the same time, the US has signaled that it will not hesitate to pursue extraterritorial measures if partners fail to fall in line with the new tech restrictions.

- Beijing has few retaliatory options. Restrictions on critical inputs like rare earths would only accelerate diversification efforts and hurt exports at a time when China’s economy is already struggling. Still, US firms in China could be targeted as China intensifies its efforts to replace US inputs. Beijing could also use anti-monopoly tools to disrupt cross-border mergers and acquisitions in strategic tech areas.

- More controls are in the pipeline. The White House is advancing plans to create an outbound investment screening regime to prevent US capital from contributing to the development of force-multiplying technologies in China, including advanced semiconductors, high-performance computing, and possibly bio-manufacturing and high-capacity batteries.

Key features of the US export control package

The US Commerce Department’s Bureau of Industry and Security (BIS) published a densely layered package of rules on October 7 targeting China’s indigenous development of critical technologies, with an emphasis on semiconductors. The new controls, detailed in Appendix 1 of this note, are based on the following policy objectives:

- Slow China’s progress in high-performance computing for possible military applications with tight controls targeting high-end computing chips. The rules cover the high-performance chips themselves (i.e., AI accelerators like the Nvidia A100 graphics processing unit (GPU)) as well as the products that contain these chips and associated software and technology. These rules also have a strong extraterritorial component to ensure no such inputs reach China.

- Freeze in place China’s semiconductor industry by targeting chokepoints in semiconductor design software and manufacturing equipment. The rules include end-use controls for any item that could be used to produce or develop advanced semiconductors (defined as logic chips at 16/14nm or below or using non-planar transistor architecture; memory ICs with 128 layers or more for NAND and 18nm half-pitch or less for DRAM). They also reach much further in restricting the activities of US citizens that could contribute to China’s production or development of advanced semiconductors. Bigger questions loom over how pliant BIS will be in issuing licenses for a comprehensive list of controls for semiconductor manufacturing equipment as US-China tech competition escalates.

- Facilitate blacklisting of Chinese entities with an unverified list (UVL) that puts the onus on Chinese entities to demonstrate non-military end-use within 60 days or else get placed on the BIS entity list (or worse). An adaptation of the foreign direct product rule (FDPR), under a new “footnote 4” designation, also enables the US to target a broad set of tech categories that could be linked to weapons of mass destruction (WMD) end-use.

- Compel foreign partners to follow the US lead by expanding the use of FDPR, invoking far-reaching restrictions on the activities of US citizens linked to China’s development of advanced semiconductors, and implicitly threatening to expand extraterritorial measures if US allies fail to implement their own controls.

Narrow costs, broad spillovers

Several recent analyses argue that the costs of the new controls will be limited for the US semiconductor industry. A number of companies, including Dutch SME champion ASML, have said they expect the impact on their business to be manageable. While we agree that the short-term impact from a narrow application of the rules would be limited, we believe these costs could balloon quickly under a tightening of controls (for example to cover non-Chinese leading edge chip manufacturers in China)—a scenario we consider highly plausible. These estimates also do not take into account significant unintended spillovers for US and global players up and down the value chain.

Direct short term costs

The new controls target US SME sales to China for use in leading edge semiconductor development and production. Because one-year licenses have already been granted to the dominant foreign semiconductor producers in China— SK Hynix, Samsung and TSMC —the controls, for now, affect only Chinese fabs producing leading edge chips or planning to upgrade for such production.

Such limited implementation of the controls would result in arguably manageable costs. Using a mix of top-down and bottom-up approaches (see Appendix 2), we find that US SME firms could lose between $1.4 billion and $3 billion in annualized sales as a result of the new controls. The impact is not insignificant, representing between 9% and 19% of US firms’ sales in China, and about 3% to 6% of their global sales—but it would probably not be life-threatening for many of them. In the near term, sales could be redirected to fabs outside of China given that most SME suppliers are currently trying to manage large order backlogs of a year or more.

Although the controls apply to both logic and memory chip production, the impact would be most acute in the memory market. This is because Chinese companies are much more competitive in memory (90% of China’s leading edge capacity) compared to logic chip production (only 10% of China’s leading edge capacity). Nearly all of China’s memory chip capacity build-up would be happening at or below thresholds defined by the BIS as leading edge. Since memory fabs need to upgrade regularly to remain competitive, the US freeze-in-place strategy targeting this SME chokepoint is particularly hard-hitting.

Foreign memory chip makers, Samsung and SK Hynix, will need to consider the reliability of US one-year waivers in assessing whether it still makes sense to continue investing in leading-edge production in China. In contrast, logic foundries, such as Taiwan-based TSMC and UMC, could more easily justify maintaining trailing-edge fabs (TSMC at 16nm and UMC at 22nm) in China.

Costs under ramped-up controls

Our above estimates do not take into account the possibility that controls could be extended to cover non-Chinese chip manufacturers in China. SK Hynix and Samsung were granted one-year licenses within a week of the BIS announcement, but these firms cannot be certain these licenses will be renewed and for how long. If restrictions were expanded to non-Chinese fabs in China, which command most of the market for both logic and memory, then costs could rise quickly. We estimate that these could range from $4.6 billion to $5.2 billion in annualized sales. That said, lost US SME sales to the Chinese market could be compensated if leading memory chipmakers follow through in their plans to expand capacity outside of China.

Under a more assertive GOP-controlled Congress, or should the White House conclude that US allies and partners are moving too slowly in aligning their own export controls, Washington could choose to ratchet up entity listings targeting Chinese semiconductor firms using FDPR designations. We have not modeled out for this possibility, but billions more in global semiconductor and SME revenues would be at risk of disruption.

Co-travelers

Our estimates do not include consideration of “co-travelers,” or semiconductor inputs tightly linked to the sale of SME to China. Should US controls prevent the upgrade or construction of several fabs in China, the effect would also be felt by other players in the semiconductor value chain. This could be the case for semiconductor materials (including chemicals), for which China is the second-largest market globally, representing $11.9 billion in global revenues in 2021.

Psychological effect

Even though the new US controls are aimed only at leading-edge semiconductor development and fabrication, they could lead to an industry over-adjustment. Many SME inputs cannot easily be defined as “specially designed” for the production of leading edge chip at the 14nm threshold. The same tool (for example, deep ultra-violet (DUV) lithography or chemical vapor deposition) could be used in a 14nm process node or a 22nm process node. Given the broad framing of the rules—meant to deter transfer of any item that could be used for the development or production of leading edge chips—SME players could exercise extreme caution in China-related sales, ultimately creating a higher price tag.

Second-order impacts

Our estimates do not take into account second-order impacts on the industry from the recent controls. These include the longer term costs of supply chain reorganization stemming from tightened controls. These also include the possibility of short-run price increases in the industry. For example, the memory market, most affected by the measures, is currently running at overcapacity but industry experts estimate that this surplus may last for only a couple of quarters at most. If China-based memory production were to be severely disrupted by the controls, the memory industry could see significant price hikes within half a year— at least until more capacity is brought online outside of China over at least a couple of years. This would have spillover impact on downstream industries with low profit margins and which rely heavily on semiconductor content in their bill-of-materials—such as smartphones, consumer electronics and information and communications technology. Surging memory chip prices could lead to loss of production in these industries.

Strategic implications

The US administration is consciously taking a long-term, expansive and extraterritorial approach to redefining its technology relationship with China. While most market analysis has tended to focus on the immediate impact of the controls, a longer term perspective may be warranted to fully appreciate this sea change in policy and its possible spillover effects.

Below we lay out key considerations in this context:

With these rules, the US has created a loaded weapon to strangle China’s indigenous technology development. There is ample room to build on the foundation that the new controls have created. Ultimately, the impact of new rules depends on how they are applied. In this case, the tone of the US political debate on China policy, and the risk of rising tensions between the US and China over Taiwan, suggest that we could be headed for a more stringent implementation of the tech controls.

The breadth and depth of controls carry significant hidden costs. BIS put considerable effort into setting technical thresholds when devising the controls, including performance parameters on how many tera operations a chip can compute per second and defining what the US considers “leading edge” for semiconductor development. The controls aim for precision in drawing hard restrictions around priority areas, but also breadth in enabling BIS to track a comprehensive list of inputs for chip manufacturing. This includes mature technologies for both leading- and trailing-edge nodes. BIS’s laborious licensing process is a de facto constraint, but more severe spillover effects are possible if restrictions are applied more broadly.

US attempts to wall off American tech talent may encourage foreign firms to seek alternatives. In recognizing that brainpower lies at the heart of innovation and is the key to creating “as large a lead as possible” over China, the US administration is taking a novel approach to restricting the role that US citizens play in the development of advanced semiconductors in China. In doing so, the US is making a bet that foreign partners will see the costs of replacing US talent and removing US inputs as too high to bear. However, in certain areas of chip toolmaking, these controls could accelerate diversification away from the United States for firms that are keen to keep a foothold in the Chinese market.

Building a strategic one-way dependency with China requires restraint. Some US policymakers have argued that their intent is not to destroy US market share in China. On the contrary, if China’s indigenous development remains crippled and thus dependent on the import of US-origin chips for everything from data centers to smartphone devices, then the US can build-up its strategic leverage over China. However, this argumentation only holds so long as the United States avoids excessive application of FDPR. Just as Beijing is trying to steer its most dynamic private tech giants toward hard tech industrial priorities, including semiconductors, sprawling tech conglomerates developing AI chips alongside IoT devices may run a higher risk of getting blacklisted by the US. A proliferation of Huawei-like targets would inhibit the ability of US companies to sell to major Chinese tech consumers and undercut the strategic aim of building one-way dependencies.

Don’t underestimate BIS’s efforts to compensate for obvious resource constraints. BIS is under-resourced, particularly when it comes to the technical expertise needed to regulate the semiconductor industry. The new controls risk creating exponentially more work for the Bureau. Some observers, therefore, are assuming that implementation will be limited. However staffing constraints could be overcome in two ways. First, BIS could take a shortcut to enforcement by making examples of high-profile companies in order to induce broader industry compliance. With CHIPS Act disbursements underway, the US has more leverage than usual over recipient firms. Second, the latest rules respond to China’s opaque military-civil fusion strategy by stepping back from the game of whack-a-mole and shifting the end-use compliance burden to Chinese entities. If the Chinese entitites on the Unverified List fail to establish their bona fides within 60 days, they will be added to the Entity List.

The US is establishing itself as the de facto regulator of the global semiconductor industry, and is willing to apply far-reaching provisions, when it is deemed necessary, to compel foreign partners to fall in line. By including several extraterritorial measures in this package of controls, the administration is signaling to partners that they could be facing more pressure after the 2024 presidential election if they don’t align controls independently or in plurilateral working groups like the US-EU Trade and Technology Council (TTC) and the fledgling Chip 4 Alliance (involving the United States, Japan, Taiwan, and South Korea). Looking forward, it will be important to watch where gaps are created, as partners—who take a traditional country-agnostic, product-specific approach to export controls—shy away from matching the new US restrictions. It is likely to be easier for the US and Japan to align their approaches to semiconductor controls than it will be for the US and EU.

China will be cautious in how it responds, but will look for ways to capitalize on the leverage it does have. China’s continued reliance on US-origin technologies and concerns about doing further damage to its struggling economy are behind Beijing’s decision to comply with far-reaching FDPR sanctions on Russia. These factors have also played a role in the US decision to press ahead with far-reaching tech controls now. China could impose export controls on critical inputs like rare earth elements, but it only has to look at Europe’s accelerated push to wean itself of Russian energy sources to understand the longer term costs of wielding raw material leverage for geopolitical purposes. With electoral politics in the US heating up ahead of the the 2024 presidential campaign, China may be tempted to impose trade restrictions that target the politically-sensitive agriculture sector. China could also use tools like the Anti-Foreign Sanctions Law and blocking statute to push back on US measures. But Beijing has refrained from using these tools for good reason: why force multinational firms to choose between the US and Chinese markets at a time when China still needs foreign investment to move forward in critical technology areas?

China’s response may therefore be incremental. On the global front, China’s State Administrator Market Regulator (SAMR) has shown a willingness to disrupt tech mergers and acquisitions in the past—a particular focus area for Beijing as it works to undercut US-led friendshoring initiatives. Foreign companies operating in China, or heavily reliant on sales in China, could become targets of Chinese authorities. Because Beijing cannot respond to the US in kind, it may rely on nationalistic indigenization campaigns to save face at home. In practice, this could mean US-linked companies getting sidelined and growing state pressure on Chinese private entities to purge US links in the name of national security resilience.

Get ready for more controls. The October 7 BIS release has set a baseline for tech controls on China, but we can expect more regulatory action in the months ahead. The White House is poised to create a new regulatory regime, housed under the Treasury Department, that would allow for the screening—and possible blocking—of outbound investments. The new body is likely to focus on the same force-multiplying technologies that were contained in the BIS package (advanced semiconductors and high-performance AI and quantum computing), but its scope could also be expanded to include areas like bio-manufacturing and high-capacity batteries.

This note has been prepared in cooperation with Jan-Peter Kleinhans and the Stiftung Neue Verantwortung