Pole Position: Chinese EV Investments Boom Amid Growing Political Backlash

Chinese OFDI along the EV value chain has been booming, fueling anxiety about Chinese companies’ dominance in high-tech industries.

Chinese outbound foreign direct investment (OFDI) along the electric vehicle (EV) value chain has been booming in recent years, fueling anxiety about Chinese companies’ dominance in high-tech industries expanding to overseas markets. This note reviews China’s global EV-related investments in 2023 and discusses the outlook for 2024. We find that:

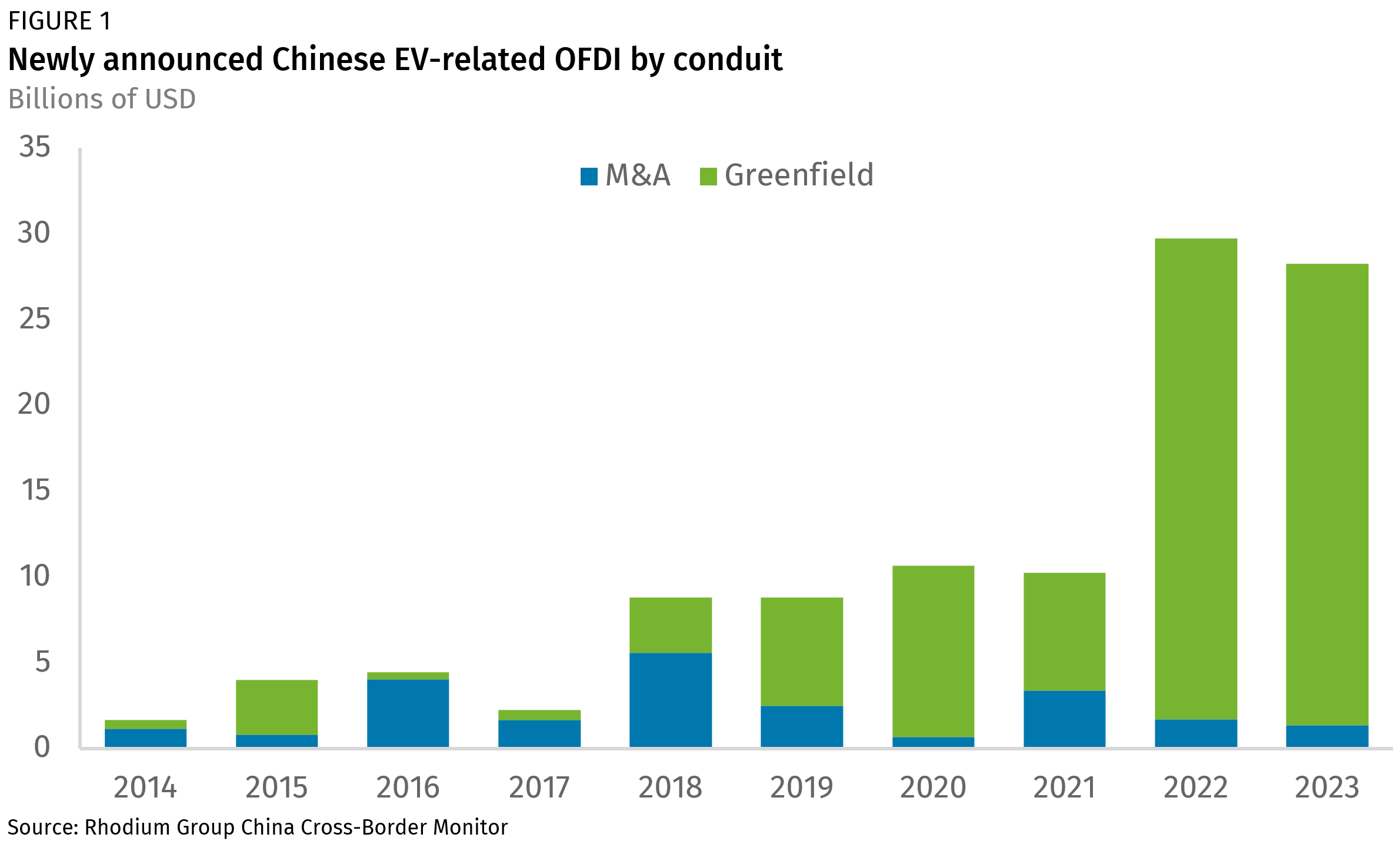

- Chinese OFDI in EV-related industries is likely to have set a new record in 2023. At $28.2 billion, it has not yet matched the $29.7 billion of 2022, but the 2023 figure is a conservative estimate that does not include several big-ticket projects with no known price tag, such as BYD’s Hungary plant.

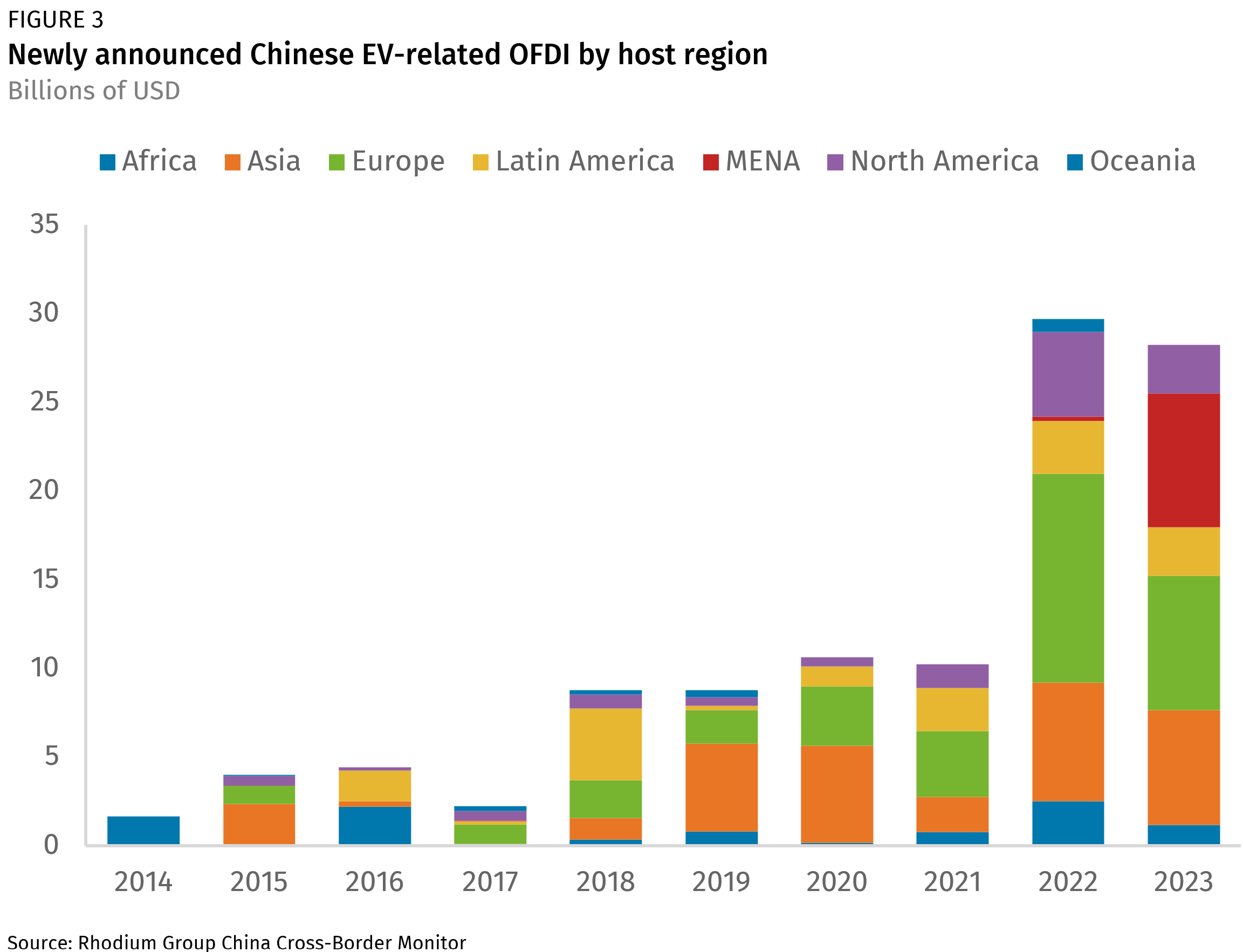

- Chinese EV OFDI shifted away from North America toward Europe, the Middle East, and Asia. Three-quarters of Chinese investment went to Europe, the Middle East and North Africa (MENA), and Asia, with the greatest gains experienced by Morocco, a free trade partner of the EU and the US. OFDI in North America fell to 10 percent of the total as Chinese companies faced regulatory uncertainty and political pushback.

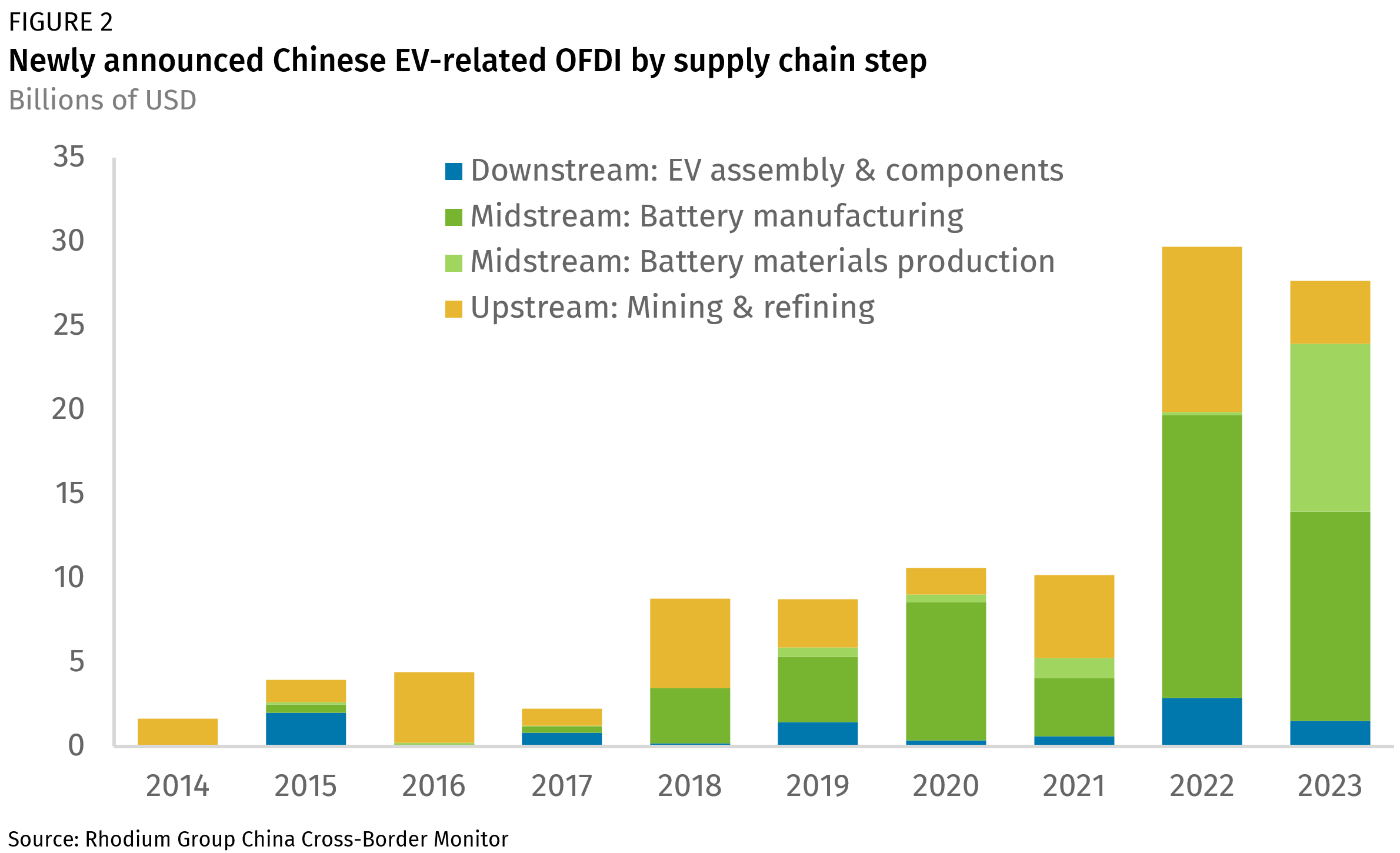

- More localized battery manufacturing is driving investment. Chinese battery investments—driven by greenfield projects—are increasingly diversifying, including inputs like anodes and cathodes. Chinese battery manufacturers are bringing more of the supply chain with them in their overseas expansion, likely in response to growing market demand and re-shoring pressures.

- For 2024, we expect Chinese EV investment abroad to remain strong, but to shift from battery investment to EV manufacturing in Europe, Latin America, and Asia. Key drivers will include China’s slowing home market and host economies’ demands for higher value-added and job-creating investments in return for market access. Investment in North America will remain volatile due to regulatory uncertainty, but Mexico could see an influx of Chinese projects.

- Chinese EV and battery companies are increasingly stuck between a rock and a hard place. Chinese investors are increasingly facing political backlash in host economies, most notably the US, which is trying to limit Chinese influence over its EV supply chains. At the same time, Beijing’s support of the internationalization of its EV and battery companies could eventually hit a limit: Chinese policymakers are increasingly growing concerned over reverse technology transfers and value-added clean tech production shifting abroad at a time when China urgently needs to build up new drivers for economic growth at home.

Disentangling China’s outbound EV FDI

A combination of “pull” factors overseas and “push” factors in the Chinese market is fueling Chinese EV investments abroad. Carmakers in Europe and the US prefer that battery makers operate close to their plants to prevent supply chain disruptions and reduce transportation costs. Chinese battery manufacturers are among the few firms that have the technology and capital needed to fill that role. Meanwhile, China’s slowing and increasingly crowded domestic EV market serves as an additional draw to go overseas. Coupled with a steady uptick in global EV adoption, this incentivizes China’s leading EV companies—including raw material refiners, battery material producers, battery makers, and EV producers—to target overseas markets.

However, China’s overseas EV OFDI is also increasingly shaped by regulatory and political developments in host economies. The US’s stringent Inflation Reduction Act (IRA) subsidy rules have led Chinese producers to increase investment in countries with whom the US has free trade agreements, namely South Korea and Morocco, to get past some IRA barriers (the IRA applies stringent conditions on China-sourced critical minerals and battery components but favors US FTA partners in sourcing requirements and has more lax requirements for leased vehicles). The EU is also on the defensive, with an anti-subsidy investigation underway on Chinese EV imports. These regulatory dynamics have spurred more investment by Chinese producers, who realize that an export-only strategy could create severe political pushback in host economies and cut them out of lucrative markets.

Chinese companies leverage first-mover advantage to invest in new plants overseas

In 2023, China’s new EV OFDI stood at $28.2 billion, down by five percent compared to a record $29.7 billion in 2022 (Figure 1). However, this undervalues China’s actual investments, as deal values for projects like BYD’s Hungary plant and Gotion’s 25 percent stake in Slovakian battery producer Inobat were not disclosed. Taking those deals into account, 2023 likely represented a new record in EV outbound direct investment. Like in 2022, greenfield investments drove overall investment, accounting for 95 percent of the total. This is a significant shift from the 2010s, when Chinese EV-related firms were focused on acquiring mining assets or technology overseas like Wanxiang’s 2012 acquisition of A123 Systems in the US. China’s firms are now looking to expand their market shares globally by setting up new factories to produce batteries or EVs in advanced economies, closer to consumers.

Cathode and anode production investments further concentrate investment in the mid-stream supply chain

Chinese EV OFDI became even more concentrated in mid-stream battery manufacturing in 2023 compared to 2022. A whopping $22.4 billion (81 percent of total OFDI) was comprised of battery manufacturing-related investment. This dynamic is driven partly by the capital-intensive nature of battery plants—often worth at least $1 billion—and Chinese companies’ competitiveness in this field. CATL and BYD alone accounted for 53 percent of the global EV battery market in 2023.

Notably, China’s battery investments have diversified. While Chinese battery producers like CATL and Svolt continued to account for the bulk of Chinese EV OFDI with new gigafactories, a new type of Chinese EV investor has emerged. Battery manufacturers appear to be bringing along their Chinese cathode and anode suppliers. This is driven by several factors: Chinese gigafactories are anchors for upstream investment; foreign battery companies and carmakers are voicing demands for diversification up the value chain away from China; and Chinese anode and cathode producers have been spooked by Chinese export controls on materials like graphite and aim to build more resilient supply chains overseas.

Investment in mining and EV production investment slowed

Investment in mining and refining dropped sharply from $9.8 billion in 2022 to $3.7 billion in 2023 amid an absence of billion-dollar deals, of which there were two in 2022 and none in 2023. Part of this decline can be explained by Chinese investments in the sector nearing a saturation point, but Chinese companies have also faced opposition from host governments. Canada forced Chinese firms to divest from three Canadian lithium explorers in 2022 and Mexico nationalized its lithium industry in 2023, reportedly canceling nine of Ganfeng Lithium’s concessions. Finally, lithium prices fell by 75 percent from Q4 in 2022 to Q4 2023, which discouraged companies from investing in lithium mining and refining. It is crucial to note that our dataset only tracks OFDI and not resource-backed infrastructure loans or licensing deals, which are other avenues for Chinese companies to access overseas raw materials.

So far, Chinese EV producers have focused mostly on exports, which surged in 2022-2023, rather than local production. China’s downstream investment in EV plants actually fell from $2.9 billion to $1.5 billion in 2023, which is linked to the absence of billion-dollar deals while 2022 saw Geely-owned Volvo commit $1.3 billion to an EV plant in Slovakia. Still, BYD and Great Wall Motor invested several million dollars in EV production sites in Brazil and Thailand, respectively. The actual amount of newly announced Chinese downstream EV investment is also obscured because the investment size of BYD’s planned EV plant in Hungary, likely worth several billion dollars, has not yet been revealed.

In addition to shifting closer to final demand for commercial reasons, Chinese carmakers are also enticed by political incentives. BYD announced a new investment in Europe amid the EU’s subsidy probe of China’s EV imports. Producing in Europe would allow BYD to circumvent looming countervailing duties. Chinese EV makers also followed political incentives in Thailand, where foreign EV producers benefit from cuts on import duties, reduced tax rates, and EV purchasing subsidies if they commit to manufacturing EVs locally. While Brazil’s government has yet to throw itself behind widespread EV adoption, newly elected president Lula da Silva has heavily lobbied for BYD to invest in the country and offered an incentive package for the BYD plant.

EV investment in Europe and Asia remains high, but MENA jumps to second place

Geographically, three-quarters of outbound Chinese EV investment was relatively evenly shared among Europe, MENA, and Asia. New investment in Europe decreased by 36 percent from $11.8 billion to $7.6 billion, though this is attributable to the inflated base in 2022 driven by CATL’s $7.3 billion gigafactory in Hungary. Within Europe, 92 percent of OFDI went to Hungary, Finland, and Sweden. In Hungary, Chinese investors announced a handful of medium-sized deals including three investments above $1 billion by Huayou Cobalt, EVE Energy, and Sunwoda. Huayou Cobalt is planning to produce cathodes—likely to supply CATL and others—whereas EVE and Sunwoda are following CATL’s footsteps to produce batteries for local OEMs. In Finland, anode material producer Ningbo Shanshan announced investments in a plant worth $1.35 billion and Beijing Earspring announced an $844 million JV with Finnish Minerals Group to produce cathode active materials. In Sweden, Putailai intends to invest $1.3 billion to manufacture anodes.

In MENA, Chinese investment was entirely focused on Morocco, driven by Gotion High-Tech’s announcement to invest $6.3 billion to build a 100 GWh gigafactory. CNGR announced investments worth $1 billion in a cathode material JV with investment fund Al Mada, owned by the Moroccan royal family. Competitor BTR also plans to invest $500 million in a local cathode plant. The kingdom’s FTAs with the EU and the US are likely to attract further Chinese EV investment.

Chinese EV investment in Asia totaled $6.5 billion and focused on Thailand and South Korea where Chinese companies announced new investments worth $2.1 billion and $1.7 billion, respectively. In South Korea, Chinese firms are setting up JVs with Korean battery firms to supply them with inputs. Major Chinese investments include Huayou’s planned JVs with Posco Future M and LG Chem to produce battery materials as well as Posco’s planned JV with CNGR Advanced Materials on nickel refining and precursor production. In Thailand, Chinese EV investment was driven by downstream EV production including by Great Wall Motor, BYD, and GAC Aion.

Investment in North America decelerated from $4.8 billion to $2.7 billion, driven by regulatory uncertainty and fears over political backlash. CATL adjusted plans to invest in North America to a licensing arrangement with Ford and is still facing political resistance. In early 2023, Reuters reported that BYD is currently avoiding investment in the US due to Washington’s unclear plans toward Chinese firms. The biggest North American investment in 2023 was Gotion’s announcement to invest $2 billion in Illinois. EV producers also expressed interest in investing in Mexico, though deals were still tentative by the end of 2023.

Looking ahead

Five key trends will shape Chinese global EV investment in the coming years.

1. More downstream investment could spark more resistance in the EU.

BYD and Geely-owned Volvo are the first Chinese carmakers to invest in EV production in Europe. But there is a high likelihood that more Chinese EV producers, like SAIC-owned MG and Stellantis partner Leapmotor, will follow in their footsteps. The EV probe has signaled to Chinese EV producers that an export-only strategy is creating enormous political pushback due to the importance of the car industry to Europe’s manufacturing base.

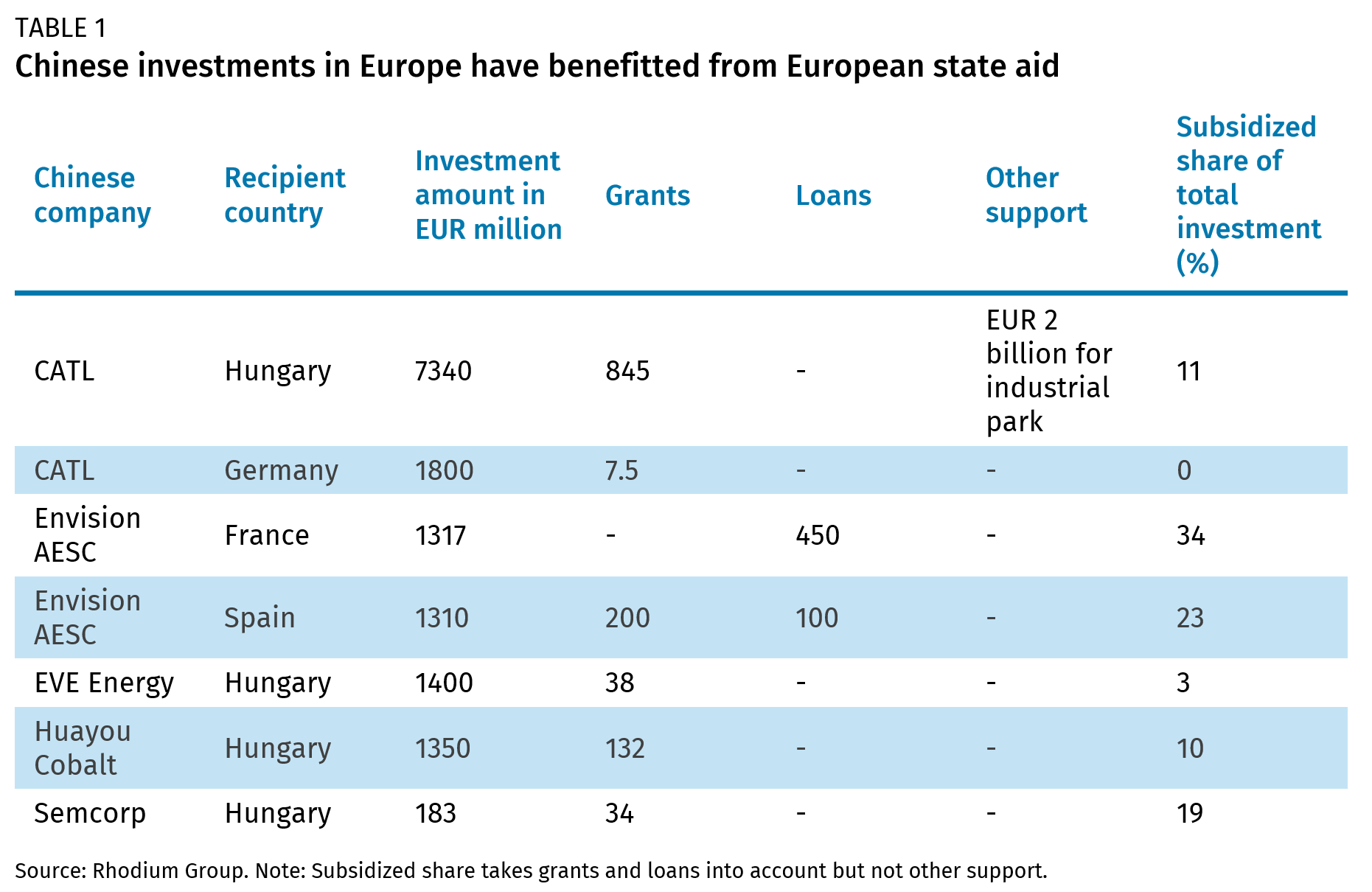

Unlike in the US, where Chinese EV investment has been heavily scrutinized, EU member states have so far been eager to receive Chinese EV investment. In fact, they are competing against each other to offer incentives to Chinese firms. After all, Chinese battery plants bring much needed technology to European carmakers, create jobs, and increase local value added. A desired outcome of the EU’s EV probe was to incentivize Chinese investment in the EU to put Chinese companies on a more level playing field with their European competitors and protect jobs and manufacturing value added in the EU.

However, there is a risk that member states—especially large ones like Germany and France—could increasingly feel that the benefits of Chinese EV investment have passed them by because investment has become so concentrated in Hungary, which received 53 percent of newly announced Chinese EV investment in 2022 and 2023. Tensions with Hungary are heightened by Budapest’s pushback on core EU policy packages and the fact that Hungary’s ability to even hand out grants to Chinese companies is tied to funding it receives from the EU. If China selectively retaliates against the EU’s EV probe, as it already has in the form of duties on French brandy, targeted member states could be more motivated to raise complaints over China’s EV investment in Hungary.

The performance of heavily supported European battery champions, such as Swedish Northvolt or France-based Automotive Cellscould also influence EU decisionmakers. Northvolt has faced difficulties in ramping up production, and in late 2023, truck maker Scania blamed its low order intake for battery-powered trucks on supply shortages from Northvolt. Should these firms fail to make headway, Europe’s dependence on Chinese battery makers could grow. This would increase Chinese firms’ bargaining power, but could also invite more defensive moves by EU member states if Chinese firms are perceived as the cause of failure for their European rivals.

Should Chinese investment continue to be concentrated in Hungary, and if European national champions continue to struggle, the likelihood of EU scrutiny also increases. Specifically, certain member states could push the EU to use the new Foreign Subsidies Regulation (FSR) which enables the Commission to address distortions caused by foreign subsidies, including for greenfield investments. The EU could also increase scrutiny on European state aid handed out to Chinese companies. This could have a negative impact on past and future Chinese EV investments in the region.

2. IRA uncertainty could spur more creative arrangements between Chinese EV companies and US FTA partners.

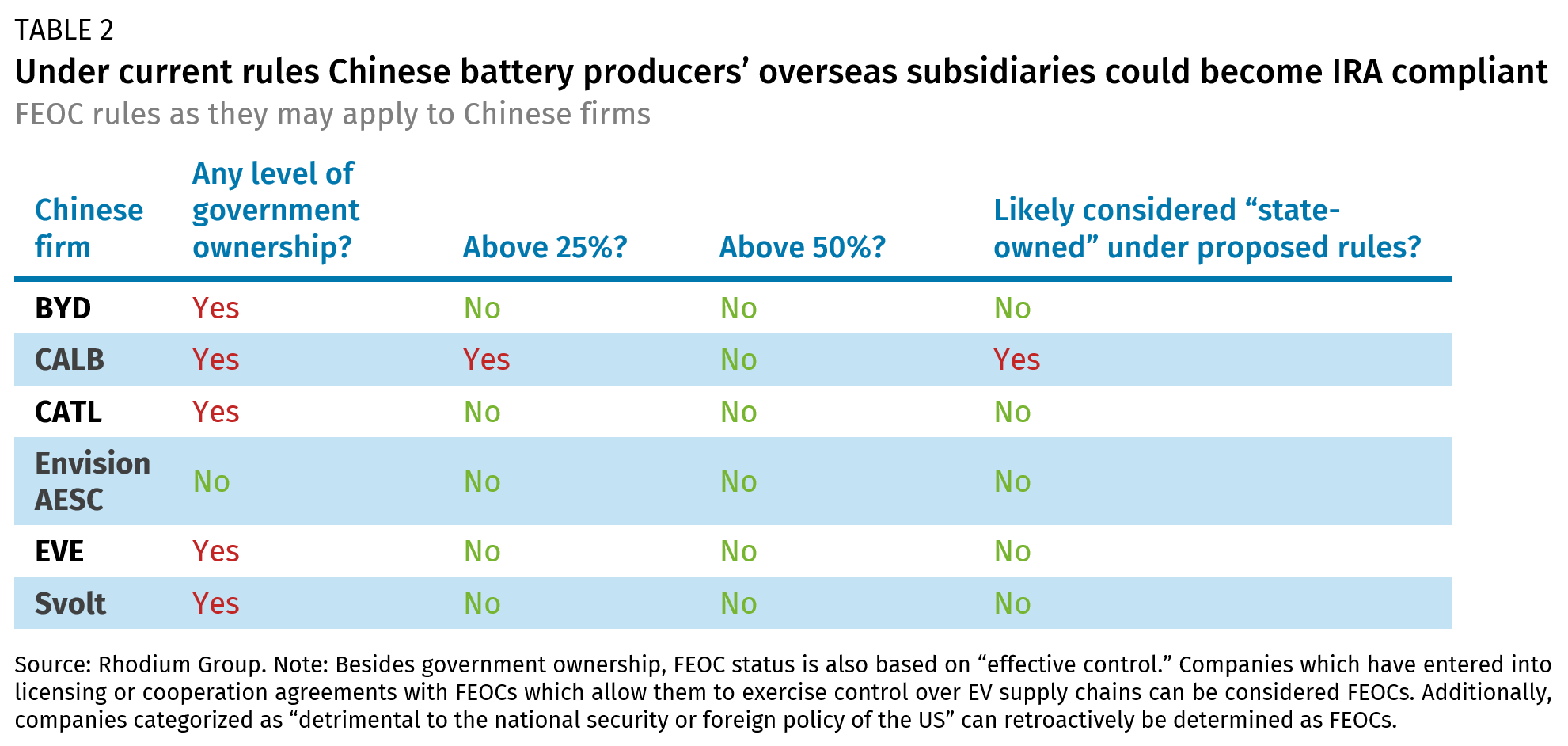

Political pushback from senators and congresspeople and regulatory uncertainty has slowed Chinese EV companies’ investment in the US. The Department of Energy’s definition of a foreign entity of concern (FEOC) remains fuzzy, and investments need to be assessed case-by-case to determine whether overseas subsidiaries of privately owned Chinese EV companies could be IRA-compliant.

While there may be some room for Chinese EV companies to invest in the US according to the current IRA rules, the FEOC determination is subject to further revision and has already been criticized for being too soft on Chinese companies. The current provisions also require screening for whether the entity can impose “effective control” over supply chains in ways that impact US national security and foreign policy. This broad phrasing leaves ample room for regulations to be implemented either loosely or stringently in trying to balance a US political objective of extricating Chinese companies from US EV supply chains or pushing for faster EV adoption.

Still, for Chinese firms, the lure of the huge US market is likely too big to ignore. We will be watching whether creative licensing arrangements can overcome political resistance to enable Chinese investment in the US directly or via US FTA partners.

Chinese companies will likely move cautiously and try to stay under US regulators’ radar, for instance, by watering down their direct ownership ties in battery supply chains. In South Korea, Chinese firms have opted for joint ventures with local counterparts to supply the US market. Being in a joint venture—especially if the Chinese partner owns a minority share—could reduce scrutiny from US policymakers and increase Chinese companies’ bargaining power by turning South Korean partners into advocates for Chinese companies’ continued involvement in US EV supply chains. The same is true for CATL’s licensing arrangement with Ford, which could be IRA-compliant based on the current rules. Ford has pushed for CATL’s continued involvement in the US market despite still-heavy political scrutiny over the deal.

To evade scrutiny, Chinese firms are becoming increasingly creative in their overseas engagements. For example, Geely-owned EV producer Polestar aims to outsource part of its vehicle production to Renault’s South Korean plant in Busan before the vehicles are shipped to the US.

A maze of arrangements is also developing further upstream. China’s leading anode producer, BTR New Materials Group, plans to take a 9.9 percent stake in Australian headquartered Evolution Energy Minerals, which owns a graphite project in Tanzania. Together they plan to set up a joint anode materials plant in the US. Montreal-based SRG Mining, with a graphite project in Guinea, announced a deal worth $17 million to sell a 19.4 percent stake to Chinese anode producer Carbon ONE New Energy Group (C-One), a firm run by former BTR executives. SRG announced plans in 2023 to redomicile outside Canada following Ottawa’s tightened screening of Chinese investment in the country’s mining industry. Finally, SRG and C-One intend to process Guinean graphite into anodes in Morocco, which has an FTA with both the EU and the US. Going forward, we expect to see more transactions involving small Chinese direct ownership ties but large Chinese technological and financial support.

The more downstream and prominent Chinese investments are, the higher the likelihood of US pushback. So far there have been no confirmed investment plans, but EV producers including BYD, Chery and SAIC-owned MG are scouting locations in Mexico. Production in Mexico could enable Chinese firms to not only become IRA-compliant but also make use of cheaper labor and capital costs to supply the US market. Investments in Mexico might also face less local political pushback compared to a site in the US, where Chinese battery projects have received numerous complaints from local lawmakers for being linked to the CCP or creating cyber vulnerabilities in US critical infrastructure. The tentative investment plans and large volume of Mexican car imports from China in 2023, mainly internal combustion engine vehicles, have alarmed DC policymakers. To prevent Mexico becoming a backdoor for Chinese companies, the US Treasury Department negotiated an agreement with Mexico in December 2023 to improve Mexico’s investment screening procedures. We will have to wait to see whether such arrangements end up chilling Chinese EV investment in Mexico.

3. Chinese firms and OEMs could forego IRA tax credits altogether.

Chinese battery companies and US-based EV producers could consider forgoing IRA EV purchasing subsidies and aim instead to reduce battery costs through competitive supplier relationships and innovation. Germany’s sudden reversal on EV purchasing subsidies—linked to a budget crisis that broke out in late 2023—highlights that subsidies can be politically fragile. In the US, a Trump re-election could lead to a reversal in EV purchasing by de-prioritizing EV adoption, framing such policies as aiding Chinese competition and harming US manufacturing. This would slow overall EV adoption in the US but could aid non-IRA compliant Chinese producers if they are able to beat their IRA-compliant competitors on price.

OEMs aiming to sell in the US market may consider sourcing cheaper non-IRA compliant batteries from US-based Chinese battery plants supplied with inputs from China or batteries from China directly. Chinese manufacturing overcapacity in batteries and China’s technological advantage in cheap lithium-iron-phosphate batteries make this a real possibility. According to Korean analysts’ estimations, US-made and Korean-made LFP batteries could be 40 percent and 17 percent more expensive than China-made equivalents, respectively. The ongoing regulatory uncertainty over FEOC definitions and related costs to ensure that EVs are IRA-compliant could increase the likelihood of OEMs bypassing IRA-subsidies altogether and betting on the cheapest producer instead. Such a strategy could pay off if IRA compliance costs are higher than expected or if the EV purchasing subsidies end earlier than expected.

However, there is likely another catch. Sourcing non-IRA compliant batteries from overseas runs the risk of falling victim to a US tariff hike—already under discussion for EVs and batteries. They could also remain vulnerable to Chinese export restrictions. For now, it appears more likely that Chinese firms will attempt to become IRA-compliant through creative arrangements with US trading partners or maintain a wait-and-see attitude, but we will be watching for signs of Chinese suppliers and OEMs in the US abandoning the IRA altogether.

4. Host countries’ demands for local value added could spur higher levels of Chinese investment.

European Commission President Ursula von der Leyen took aim at China in a thinly veiled comment when addressing an EU-Latin America business roundtable in July 2023. “Europe wants to be your partner of choice. Unlike other foreign investors, we are not only interested in investing in the pure extraction of raw materials. We want to partner with you to build local capacity for processing, for making batteries, and for the final products like electric vehicles.”

But in 2023 it is China, rather than Europe, that is bringing value-added EV activities to Latin America. Notably, BYD is constructing an EV production plant in Brazil, and in Chile, BYD aims to establish a cathode plant, while Tsingshan plans to set up a lithium-iron-phosphate plant. Europe’s only major project in the region is Eramet’s lithium project in Argentina, and even in that project Tsingshan is a JV partner.

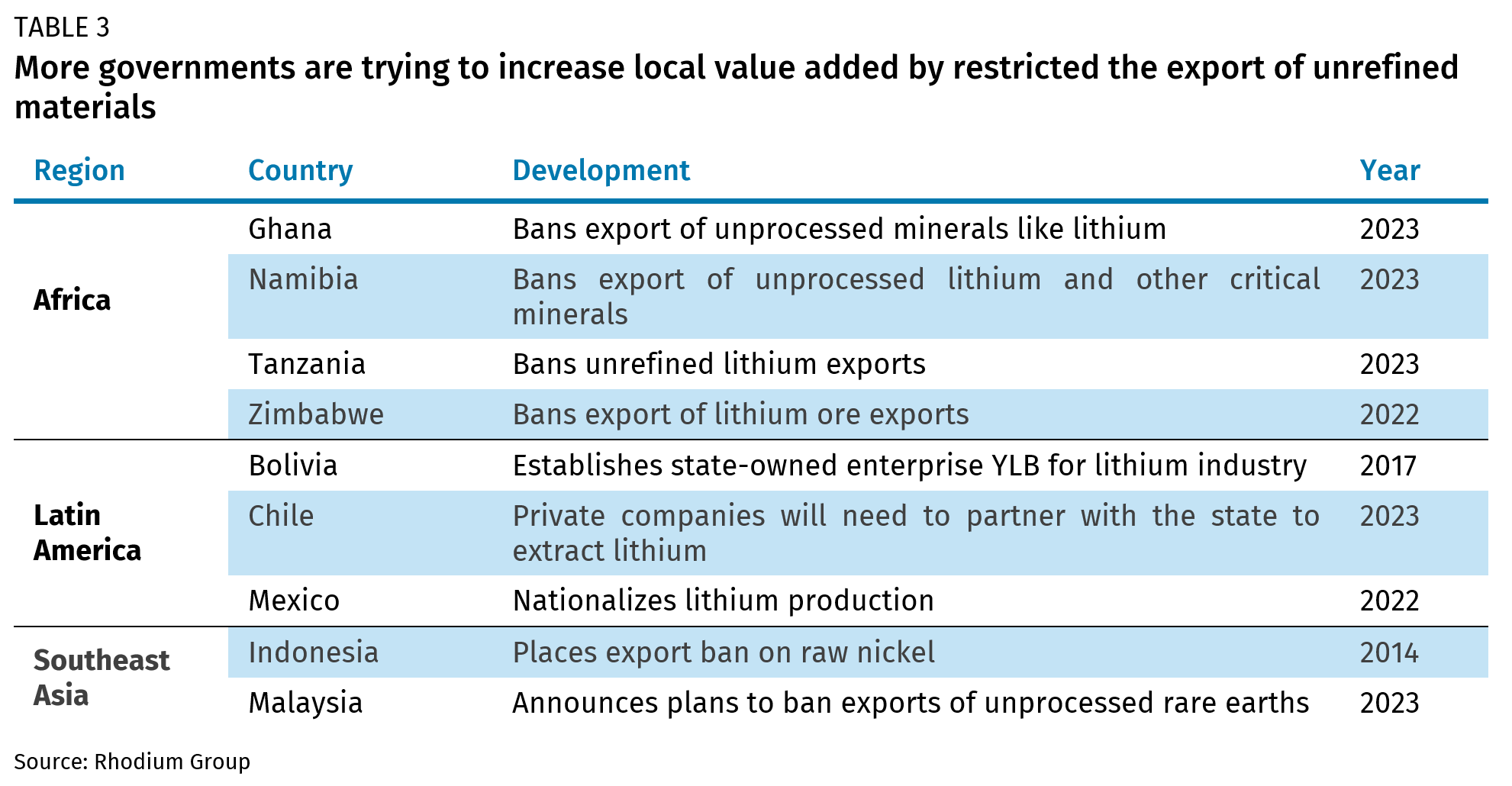

Chinese firms are also active in Latin America’s raw materials production, with CATL announcing several investments in Bolivia to extract lithium. But host governments in emerging economies have started to restrict exports of unrefined minerals in hopes of emulating the perceived success of Indonesia’s nickel export restrictions which attracted more OFDI in local processing. Zimbabwe announced that it would not grant new lithium mining licenses without plans to refine lithium domestically and issued a March 2024 deadline for miners currently in Zimbabwe to submit plans for local production of battery-grade lithium.

So far it appears that Chinese companies could emerge as the main beneficiaries of the bans and nationalization plans. In comparison to global rivals, these firms often have closer ties to downstream customers and financial resources to invest in local refining. By increasing entry barriers, the new regulations could further cement Chinese firms’ global dominance. However, in some jurisdictions, Chinese ownership could become an issue in and of itself. In 2023, Ganfeng announced that Mexico’s General Directorate of Mines canceled nine lithium mining concessions held by the company. The Chinese firm has appealed the decision but signaled openness to collaborate with government authorities to mine the mineral. In Argentina, too, Chinese companies could run into difficulties. Argentina’s new president Javier Milei campaigned on cutting ties with China and announced that Tesla’s CEO Elon Musk expressed an interest in the country’s lithium deposits.

5. Beijing’s steadfast support for overseas EV OFDI could waver.

So far, Beijing has been very supportive of its EV companies’ global expansion, which is a stated goal in high-level policy documents like China’s NEV Industry Development Plan (2021-2035). Indeed, almost all outbound investments, especially billion-dollar ones like battery factories, must receive political approvals from several Chinese agencies. The fact that such a large swath of outbound EV investments is taking place signals Beijing’s approval of the internationalization of its companies.

But Beijing is also in a delicate balancing act. On the one hand, remaining supportive of outbound investment risks eroding China’s own manufacturing base and allowing overseas competitors to benefit from “reverse tech transfer.” On the one hand, were China to tighten outbound investment scrutiny, it would risk losing access to overseas markets, which are increasingly opposed to Chinese imports. If China were to restrict its firms from investing overseas, it would enable global competition to develop, potentially undermining China’s EV tech advantage.

With China’s economy in a structural slowdown, policymakers in Beijing could grow concerned that overseas investment is increasingly in competition with EVs and batteries produced in China. China’s leadership is relying on domestic investment and production of the so-called “new three” industries of solar power, batteries, and EVs to compensate at least in part for loss in growth from China’s real estate downturn. The EV sector will be a litmus test for Chinese policymakers, as it marks the first time that Chinese firms are attempting to produce high-tech, high-value goods overseas rather than export them from China, like for smartphones or high-speed rolling stock.

Just like in other advanced economies, we could begin to witness a divergence between firm and government interests in China, as companies aim to grow their revenue and profits through overseas investment while the government tries to preserve investment at home. In March 2023, Xi Jinping expressed “joy and worry” at the fact that CATL’s global market share in EV batteries had reached 37 percent. The company had to shelve its plan to raise $5 billion in Swiss global depository receipts to fund its expansion in Hungary as Beijing raised concerns over the large scale of the offering. This indicates that policymakers in Beijing are worried about an overly ambitious global expansion as well as international political backlash.

Next to economic concerns, policymakers could also fear that Chinese firms risk losing their technological edge through overseas investment or by falling victim to technology transfer. This could also dampen China’s ability to leverage its lead in battery technology as an instrument of deterrence and coercion.

In 2023, China’s Ministry of Commerce released an updated Catalogue for Prohibited and Restricted Export Technologies, only three years after the previous catalogue was released. While battery technology was not included, technologies related to rare earth extraction and processing and lidar were included. The draft version, released a year prior, spurred rumors among Chinese battery firms that the government could block or restrict the export of lithium-ion battery technology. So far, Beijing has not elevated restrictions to cover battery technologies more directly, but the inclusion of technologies like lidar in the catalogue—where Chinese firms have become global leaders—indicates that Beijing’s worry about reverse technology transfer trumps commercial considerations.

Indeed, the future role of overseas battery and EV investments is already heavily debated in Beijing. In November 2023, Xiao Xinjian, a director at the NDRC-affiliated Xi Jinping Economic Thought Research Center, wrote that Chinese EV investment in Europe and the US can help prevent political backlash generated by EV exports. However, he also pointed out that large overseas investments and R&D projects could harm China’s EV industry. Xiao recommended that certain Chinese companies should be legally restrained from helping to fill foreign countries technological bottlenecks. This is likely a veiled hint at the CATL-Ford tie up in the US which has been scrutinized by China for fears of technology leakage. Xiao also noted the risk that overseas investment could be expropriated by foreign governments.

Chinese EV and battery investors face a more uncertain and challenging investment environment

Overall, China looks set to retain its pole position in EVs in 2024. But political uncertainties abound in Washington, Brussels, and Beijing as G7 nations turn to trade defense toolkits to fend off Chinese EV imports and as Chinese firms scout host governments still willing to incentivize new investments amid growing trade frictions. We expect this dynamic will lead to a concentration of Chinese EV investments in Europe, Asia, and Latin America, while North America remains clouded in regulatory uncertainty as the US heads into a high-stakes election. If Beijing uses its leverage in EV and battery technologies to push back against growing trade barriers, it could end up invigorating stronger political resistance to Chinese firms.