Running Out of Road: China Pathfinder Annual Scorecard

As the structural nature of China's slowdown becomes undeniable, we track Beijing’s reform efforts by comparing China’s economic system to those of market economies.

With hopes of a rapid recovery following the dissolution of China’s zero-COVID policy dashed, structural threats to the country’s economic stability have never been greater. Although draconian lockdowns certainly soured the mood of businesses and consumers in China, the economic malaise that policymakers in Beijing are staring down now is not caused by cyclical factors like COVID, but by a failure to reform the country’s economic system. Chinese leadership is aware it needs to undertake significant reforms to shake off the shackles of the current structural slowdown, but previous efforts have fallen far short of the big bang changes that the moment demands.

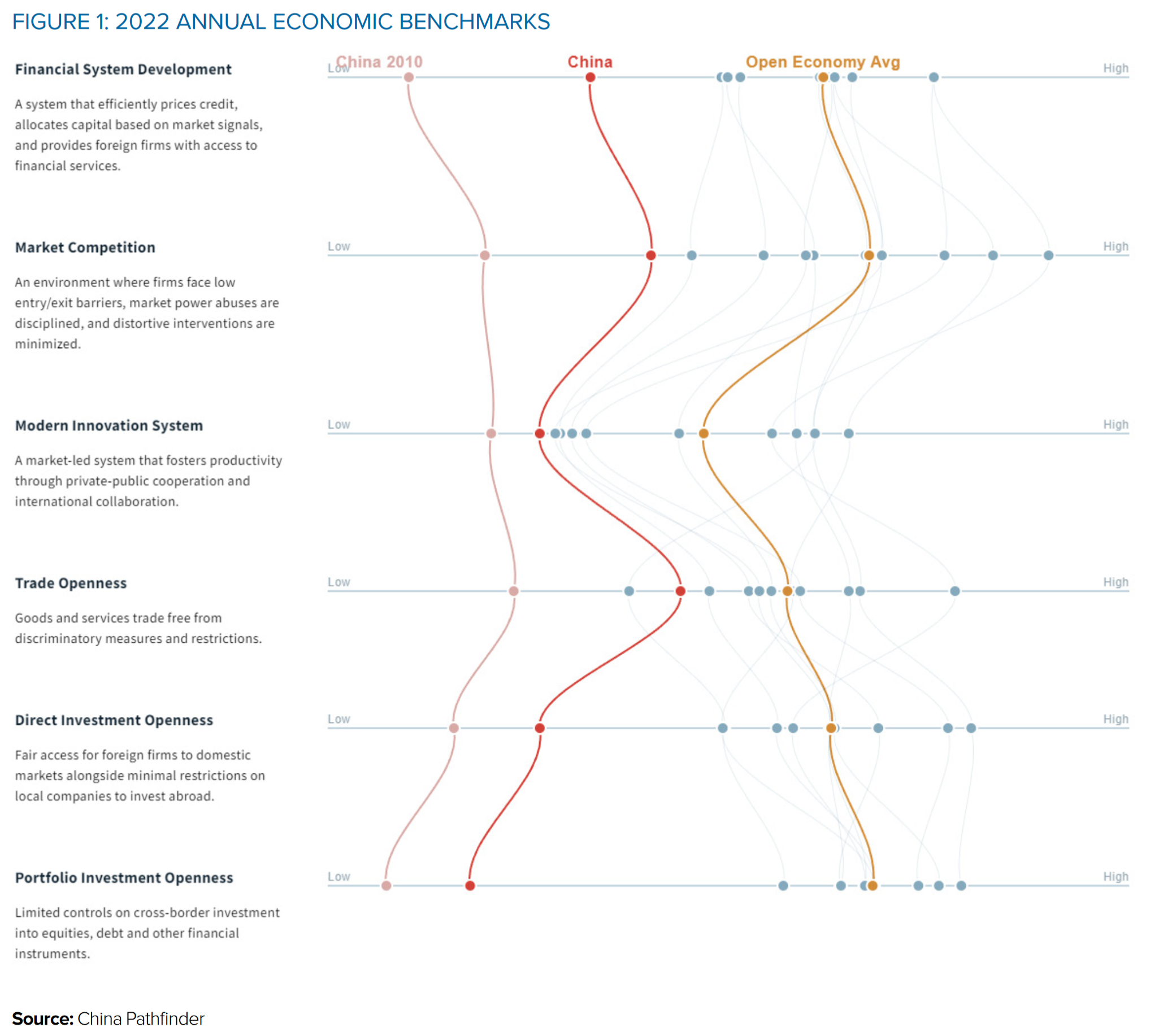

To track Beijing’s reform efforts, China Pathfinder—a joint project of Rhodium Group and the Atlantic Council’s GeoEconomics Center—compares China’s economic system to those of market economies. Using six components of the market model—financial system development, market competition, modern innovation system, trade openness, direct investment openness, and portfolio investment openness—we establish a quantitative framework for understanding China’s progress or regression on reform. China’s outsize role in the global economy and the necessity of reform in maintaining the country’s growth make this work a key to understanding China’s future trajectory.

Key findings

- The economic effects of the pandemic obscured the underlying problems, but developments in 2022 underscored the structural nature of China’s slowdown. Although political expediency led Chinese policymakers to blame the effects of COVID for economic malaise, the implosion of the property sector, cratering market confidence, and rising tensions with G7 countries forced an admission of a downturn.

- China has made some reform progress, with trade openness a standout improvement. China’s trade openness is within the range of market norms, and its goods trade practices are likely to remain a point of progress. Despite still being well behind OECD norms, China has also made progress over the past decade in the openness of its financial system, with the score for pricing of credit entering the range of market norms for the first time.

- In the past year, China strayed further from market norms in the areas of market competition and its innovation system. Amid widening global competition over high-tech industries, Beijing has seen a sizeable increase in the presence of state-owned firms in its top companies, tightening of cross-border data rules, and the staying power of industrial policy as a key tool. China’s restriction of academic database access and crackdown on how companies use algorithms have made its innovation system less open.

- Open market economies in some cases moved away from market norms in 2022 due to the state of the global economy. OECD economies saw movement away from market norms in financial system development and portfolio investment, mostly as a result of a decline in market capitalization and falling non-financial corporate debt compared to GDP. These drifts say more about structural changes in the global economy than they do about particular regulatory changes.

- In its current trajectory, China’s economic growth will continue to grind ever slower. This slowdown will impact Beijing’s ambitions for indigenous high-tech development, exacerbate local fiscal crunches, and have spillover effects for other countries who depend on China as an export or import market. The slowdown will also begin to diminish perceptions of China’s state-led economic system, with implications for the competition between Beijing and market economies.

- If Beijing is going to dig its way out of its current economic hole, it needs to allow robust debate and enact concrete reforms. To make positive changes, China should retire its GDP target, rebalance the fiscal burdens that are unequally shared by local and central governments, privatize some of its state-owned assets, and reform its pension system.

This report was produced by Rhodium Group’s China team in collaboration with the Atlantic Council’s GeoEconomics Center. The principal contributors on Rhodium’s team were Daniel H. Rosen, Nargiza Salidjanova, and Rachel Lietzow. The principal contributors from the Atlantic Council’s GeoEconomics Center were Josh Lipsky, Jeremy Mark, and Niels Graham.

The authors also wish to acknowledge the members of the China Pathfinder Advisory Council: Steven Denning, Gary Rieschel, and Jack Wadsworth, whose partnership has made this project possible.