Sanctioning China in a Taiwan Crisis: Scenarios and Risks

Exploring the potential economic impacts of sanctions on China in the event of a Taiwan crisis, their spillover effects, and the challenge of coordination.

This report is a joint project of Rhodium Group and the Atlantic Council’s GeoEconomics Center.

In recent months, growing tensions in the Taiwan Strait as well as the rapid and coordinated Group of Seven (G7) economic response to Russia’s invasion of Ukraine have raised questions—in G7 capitals and in Beijing alike—over whether similar measures could be imposed on China in a Taiwan crisis. This report examines the range of plausible economic countermeasures on the table for G7 leaders in the event of a major escalation in the Taiwan Strait short of war. The study explores potential economic impacts of such measures on China, the G7, and other countries around the world, as well as coordination challenges in a crisis.

The key findings of this paper:

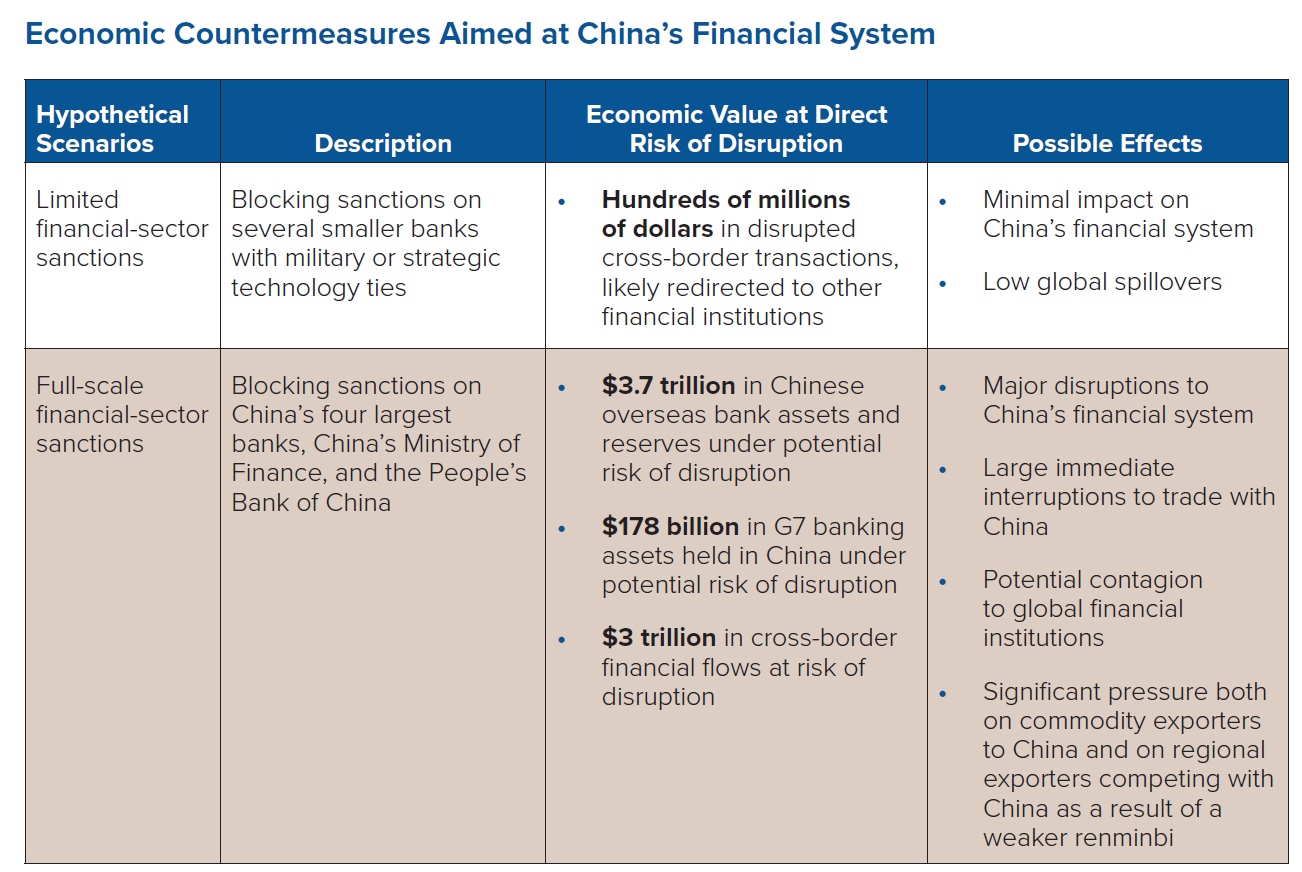

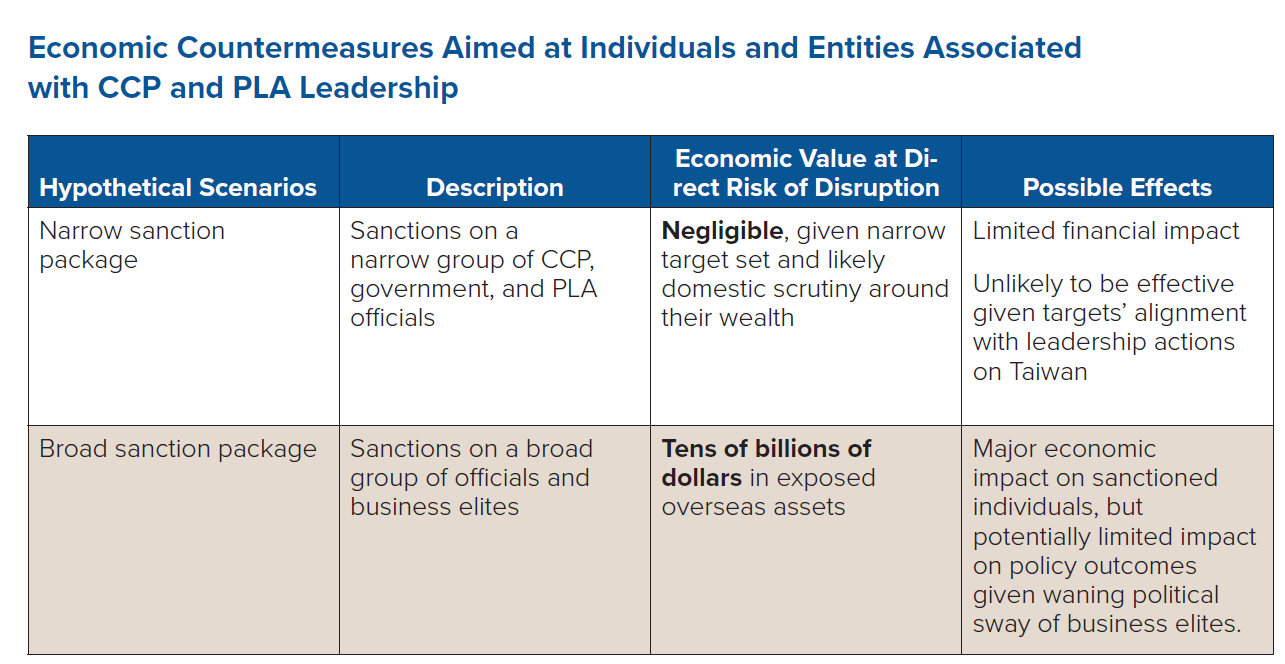

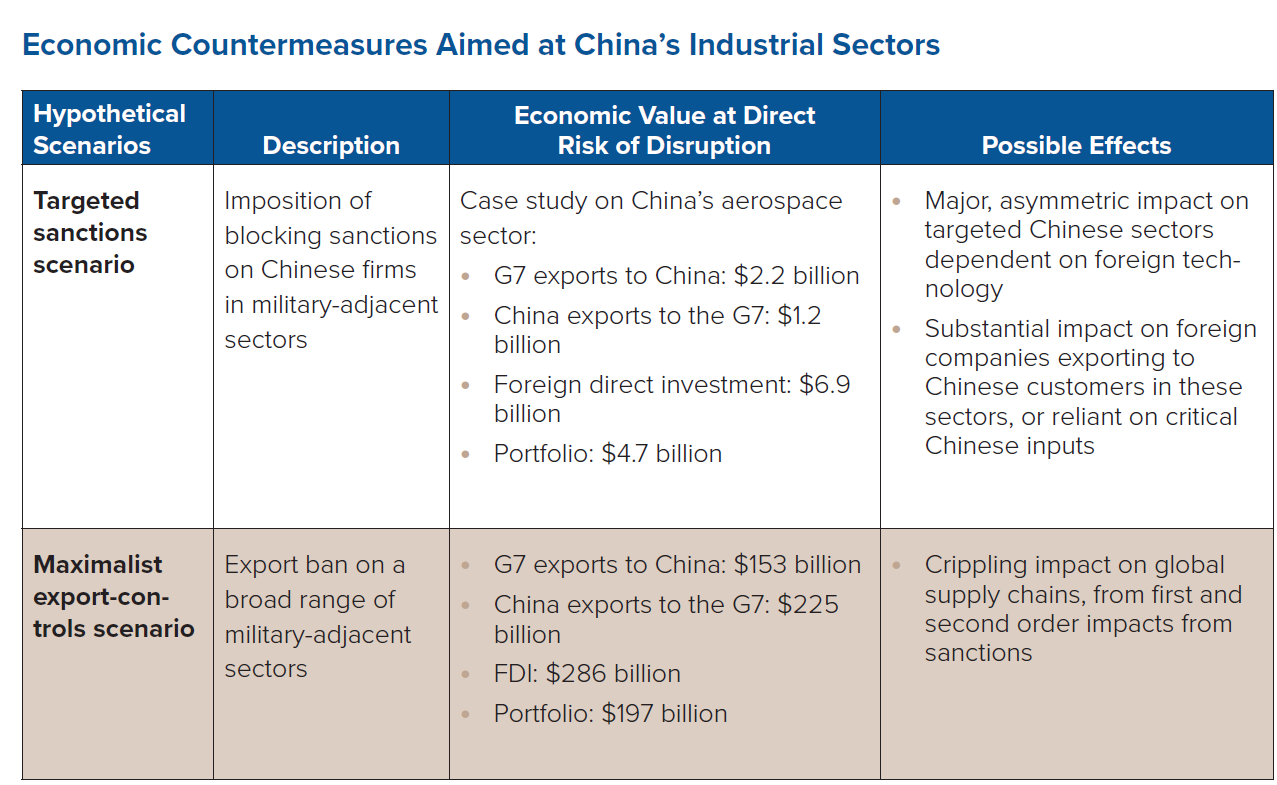

In the case of a major crisis, the G7 would likely implement sanctions and other economic countermeasures targeting China across at least three main channels: China’s financial sector; individuals and entities associated with China’s political and military leadership; and Chinese industrial sectors linked to the military. Past sanctions programs aimed at Russia and other economies revealed a broad toolkit that G7 countries could bring to bear on China in the event of a Taiwan crisis. Some of these tools are already being used to target Chinese officials and industries, though at a very limited scale.

Large-scale sanctions on China would entail massive global costs. As the world’s second-biggest economy—ten times the size of Russia—and the world’s largest trader, China has deep global economic ties that make full-scale sanctions highly costly for all parties. In a maximalist scenario involving sanctions on the largest institutions in China’s banking system, we estimate that at least $3 trillion in trade and financial flows, not including foreign reserve assets, would be put at immediate risk of disruption. This is nearly equivalent to the gross domestic product of the United Kingdom in 2022. Impacts of this scale make them politically difficult outside of an invasion of Taiwan or wartime scenario.

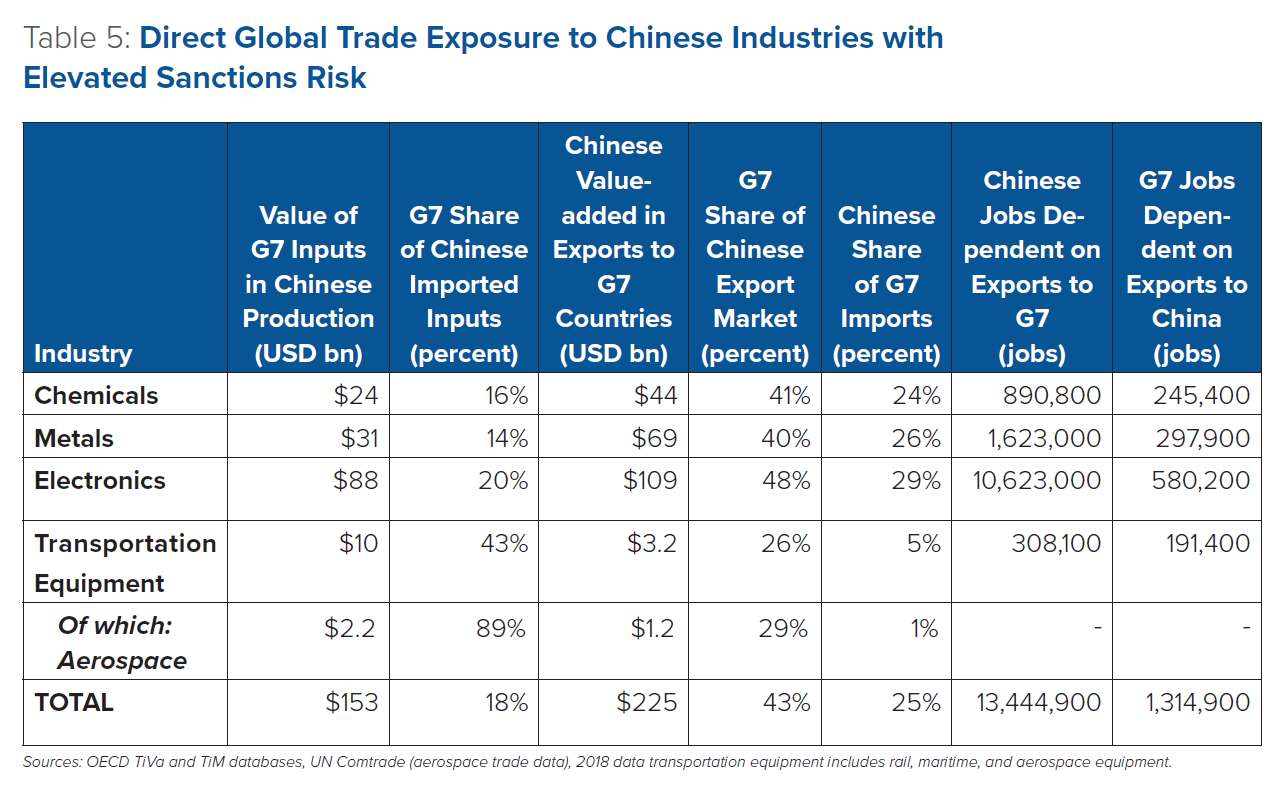

G7 responses would likely seek to reduce the collateral damage of a sanctions package by targeting Chinese industries and entities that rely heavily and asymmetrically on G7 inputs, markets, or technologies. Targeted sanctions would still have substantial impacts on China as well as sanctioning countries, their partners, and financial markets. Our study shows economic countermeasures aimed at China’s aerospace industry, for example, could directly affect at least $2.2 billion in G7 exports to China, and disrupt the supply of inputs to the G7’s own aerospace industries. Should China impose retaliatory measures, another $33 billion in G7 exports of aircraft and parts could be impacted.

Achieving coordination among sanctioning countries in a Taiwan crisis presents a unique challenge. While policymakers have begun discussing the potential for economic countermeasures in a Taiwan crisis, consultations are still in the early stages. Coordination is key to successful sanctions programs, but high costs and uncertainty about Beijing’s ultimate intentions will make stakeholder alignment a challenge. Finding alignment with Taiwan in particular on the use of economic countermeasures will be central to any successful effort. G7 differences on Taiwan’s legal status may also prove a hurdle when seeking rapid alignment on sanctions.

Deterrence through economic statecraft cannot do the job alone. Economic countermeasures are complementary to, rather than a replacement for, military and diplomatic tools to maintain peace and stability in the Taiwan Strait. Overreliance on economic countermeasures or overconfidence in their short-term impact could lead to policy missteps. Such tools also run the risk of becoming gradually less effective over time as China scales up alternative currency and financial settlement systems.