Sustainable Aviation Fuels: The Key to Decarbonizing Aviation

Sustainable aviation fuels are a promising avenue for decarbonizing aviation, but unlocking this potential will require significant new investment and long-term policy frameworks to jump-start the infant industry.

Aviation is currently the third largest source of greenhouse gas emissions from the transportation sector in the US, and emissions are expected to continue to grow. It’s also one of the most challenging industries to decarbonize, due to the long lifespan of airplanes and the limited number of viable pathways for reducing emissions. The avenue that holds the most promise is sustainable aviation fuels (SAF), which can easily substitute as a drop-in replacement for conventional jet fuel. However the industry and SAF technologies are still nascent, and face significant economic and technological hurdles to scaling up.

Recognizing this challenge, the Biden administration has set a “SAF Grand Challenge,” with a goal of scaling US SAF production to 3 billion gallons per year in 2030 and 35 billion in 2050—a considerable ramping up from the current level of 4.5 million gallons per year. At scale, SAF could not only play a major role in fully decarbonizing aviation, but also offers other benefits including reduced local air pollution and considerable employment opportunities. Unlocking this potential will require significant new investment and long-term policy frameworks to jump-start the infant industry. In this report, we provide an overview of the current state of the industry and SAF technologies, followed by our estimates for the employment and economic benefits from scaling up SAF. We then discuss the challenges to scaling up SAF, as well as potential ways to help accelerate it.

The US is committed to decarbonizing the aviation sector

Just over a year ago, the Biden administration set an ambitious target of reducing economy-wide greenhouse gas (GHG) emissions to net-zero by 2050. The administration developed a long-term climate strategy to help achieve these goals, which includes shifting away from fossil fuels towards clean electricity and clean fuels to power the US economy. The combination of clean electricity and widespread electrification of end-uses is typically viewed as the most efficient and economical way to reduce emissions in sectors such as power, transportation, and buildings. However, this strategy is not always accessible or possible for hard-to-abate sectors like industry and heavy-duty transportation.

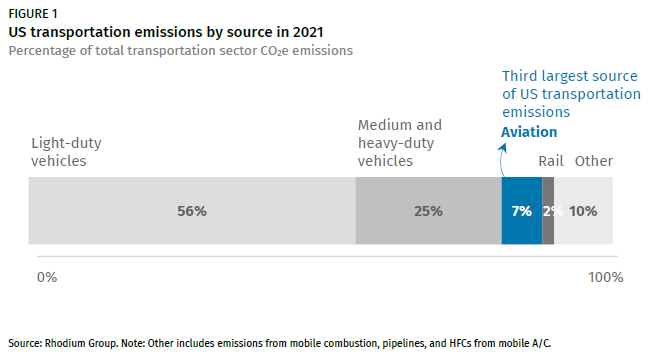

Of the hard-to-abate sectors, aviation is viewed as one of the most challenging to decarbonize, due to the long lifespan of airplanes and the limited number of pathways for emissions reductions over the next few decades. The aviation sector is the third largest source of US transportation emissions, accounting for roughly 7% of total sector emissions (Figure 1). Emissions from the sector are anticipated to continue growing, given the projected growth in US passenger air travel and freight. Recognizing this challenge, the Biden administration has set a decarbonization target for the aviation sector specifically—to achieve net-zero GHG emissions by 2050.

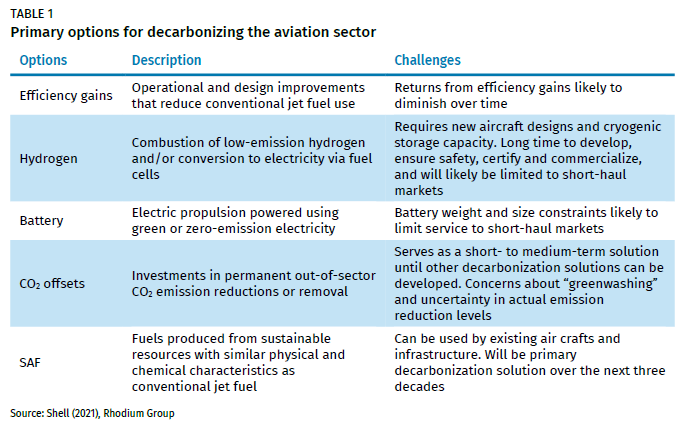

Aviation industry stakeholders have identified five primary options (Table 1) for reducing aviation emissions by 2050, and broadly agree that replacing conventional jet fuel with sustainable aviation fuels (SAF) is the most promising option for yielding significant CO2 emission reductions over the next 30 years.

The decarbonization potential of sustainable aviation fuel

Sustainable aviation fuels (SAF) are low-carbon fuels produced from biological (i.e., plant and animal materials) and non-biological (i.e., municipal solid waste, industrial waste gases) feedstocks, which have similar physical and chemical characteristics as conventional jet fuel but with a lower life-cycle carbon footprint. One of the reasons why SAF is viewed as a leading feasible solution for decarbonizing aviation is because it can easily substitute as a “drop-in” fuel replacement for conventional jet fuel.[1] SAF and conventional jet fuel can be mixed safely, without having to redesign aircraft and aircraft engines to utilize it because the chemical characteristics are very similar. And existing fueling infrastructure can also be used to transport SAF.

SAF has the potential to reduce life-cycle CO2 emissions by up to 99% compared to traditional jet fuel, depending on the technological pathway and feedstocks used to produce the fuel. Other major benefits include local air quality improvements because of lower sulfur content and reductions in soot pollution. Communities responsible for producing and processing SAF feedstocks also stand to reap considerable employment and economic benefits as production scales.

At scale, SAF has the potential to play a major role in fully decarbonizing the aviation sector over the next 30 years. But SAF technologies are currently at various stages of technology readiness, and the scaling of production and deployment faces major technological and economic hurdles. In the rest of this report, we start with an overview of the different SAF technologies currently available or under development. We then provide estimates for the employment and economic benefits from scaling up SAF, followed by some of the challenges the nascent industry faces, as well as potential ways to help accelerate it.

SAF technology pathways

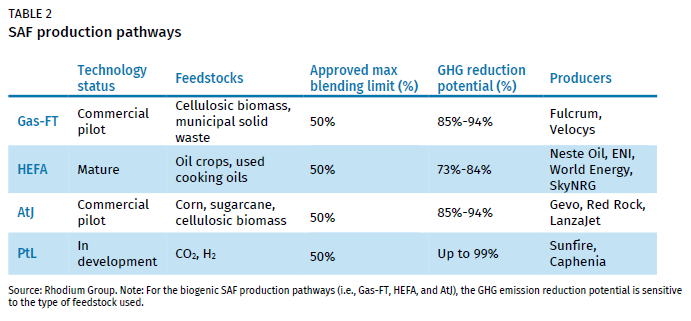

The SAF industry is currently in its infancy. There are several SAF technological pathways that have been developed or are currently under development. However, only seven have been approved by the American Society of Testing and Materials (ASTM) for blending with conventional jet fuel. ASTM is an international standards organization that develops technical standards for various materials, systems, and products. In the case of SAF, it establishes which technologies can be used to produce SAF, as well as the limits for blending SAF fuels with conventional jet fuel. Out of caution, ASTM currently limits most pathways to 50% by volume blending. Doing so helps to ensure that the blended fuel is a true drop-in fuel and will not require additional infrastructure (and costs) to support its use. Industry is currently discussing the need for higher blend limits. Additional testing and evaluations, however, will be needed to ensure that the higher blends remain drop-in compatible.

In this report, we focus on three of the ASTM-approved pathways[2] (Table 2): (1) hydroprocessed esters and fatty acids (HEFA); (2) alcohol-to-jet (AtJ); and (3) synthesis gas Fischer-Tropsch (FT). In the case of FT, we consider two pathways for synthesis gas (syngas) production: feedstock gasification (Gas-FT) and electrolysis of CO2. Production via the second FT route is often referred to as the “power-to-liquid” (PtL) pathway. The first three production routes listed in the table are classified as advanced biofuels. They have a life-cycle emissions-intensity that is at least 50% lower than fossil-based fuels. The PtL fuel is classified as an electrofuel—the term for a drop-in fuel produced from hydrogen obtained from clean electricity together with captured CO or CO2.

Gas-FT was the first SAF pathway to be approved by ASTM, in 2009. The process involves the conversion of a synthesis gas (syngas) into liquid fuel via a Fisher-Tropsch (FT) reaction. FT is a common commercial process for producing liquid fuels from both coal and natural gas. Syngas is produced from the gasification of cellulosic feedstocks or municipal solid waste. The syngas is then converted to a mixture of hydrocarbons (the main chemical component of jet-fuel) in a FT reactor, before being further refined into SAF and other clean fuels.

The HEFA pathway was formally approved by ASTM in 2011. It involves the refining of vegetable oils, tallow, or waste greases into SAF through the deoyxgenation and hydroprocessing of the feedstocks. It is the most mature of the SAF technologies and the only one currently used today at commercial scale.

AtJ, using isobutanol as a feedstock, was approved in 2016, followed by the approval of ethanol as a feedstock in 2018. This pathway converts alcohol feedstocks (i.e., sugars, starches, hydrolyzed cellulose, industrial waste gases) into SAF and other clean fuels, through several chemical processes.

Electrofuels, also referred to as “power-to-liquids,” are another type of drop-in fuel produced using green hydrogen (H2) and sustainable CO2 via point-source capture or direct air capture (DAC). Like the advanced biofuel pathways, the PtL process can also be used to produce a series of clean fuels. PtL involves the conversion of syngas into SAF via a FT reaction. However, the syngas is produced from either green H2 and captured CO2 via a reverse water-gas-shift reaction or directly via co-electrolysis using solid oxide electrolysis cells and clean electricity.

Announced SAF production volumes

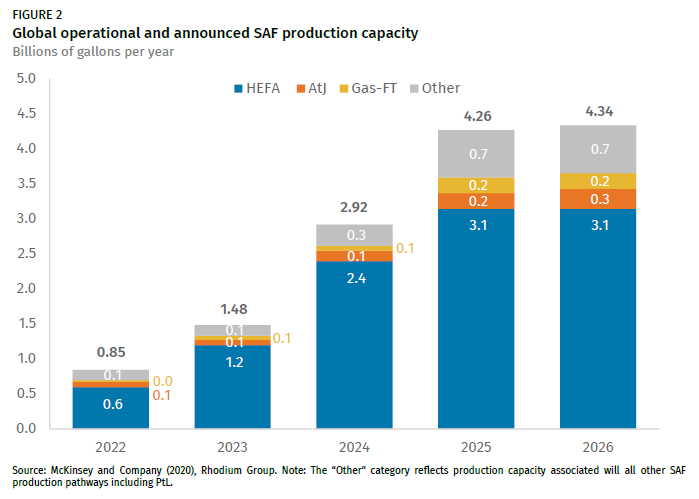

In the last few years, there have been numerous announcements of new SAF projects across the globe. Announced global capacity is on track to total roughly 4.3 billion gallons per year (BGY) by 2026, with HEFA accounting for more than two-thirds (3.1 BGY) of the new capacity (Figure 2). Still this capacity is relatively small compared to the 60 billion gallons consumed globally last year (~4 billion gallons in the US). HEFA production capacity could potentially increase by roughly another 2.5 BGY by 2026 if feedstock supply issues are immediately addressed. Announced capacity additions associated with AtJ, Gas-FT, and other pathways are minor, but are likely to ramp up considerably after 2026 as growing investment and policy support for these technologies help to advance their commercialization.

The economic benefits of scaling up SAF

In addition to being a potentially pivotal tool for decarbonizing aviation, scaling up SAF also offers significant economic and employment opportunities in the US.

We examined the potential employment benefits of SAF production for the four technology pathways described above: HEFA, Gas-FT, AtJ. Each estimate is associated with a typical 50 million gallon/year production facility and includes jobs created from plant investment, operations and maintenance as well as jobs associated with suppliers of equipment, energy, feedstocks and other upstream activities.

According to our analysis, the average total number of jobs associated with the construction and operation of a 50 million gallon per year SAF facility ranges between 1,645 and 7,640 jobs, depending on the technology pathway adopted by the facility. Jobs estimates can vary widely across pathways because of differences in the levels of capital intensity. Generally, the more capital intensive the production pathway is, the more job creation there is. We also note that our analysis focuses solely on total job creation, lacking details on job type and job quality. Forthcoming analysis will delve into these metrics for a better depiction of SAF-related jobs.

A major takeaway from our analysis is that on a plant-by-plant basis, SAF produced via AtJ has the potential to create the greatest number of jobs. However, uncertainties surrounding future deployment levels of each SAF technology make it unclear as to whether we will observe more overall SAF jobs coming from AtJ in the long-run. Our analysis indicated that while HEFA, AtJ, and Gas-FT all have the potential to scale significantly over the next few decades, PtL can scale to the largest quantities, given that it does not face the feedstock limitations that the biogenic alternatives face.

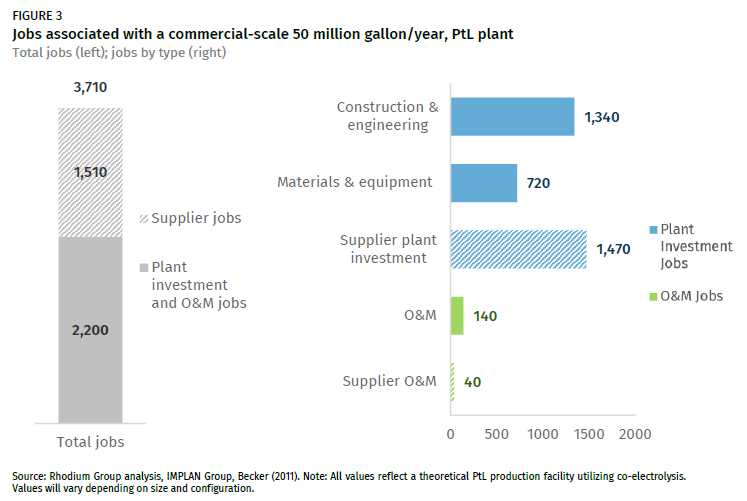

Noting this, we present the job results for a single PtL facility in Figure 3. We find that the construction and operation of a 50 million gallon per year SAF facility utilizing the PtL production process results in an average of 3,710 total jobs being created. Roughly 60% (2,200) of these jobs are directly related to the construction and operation of the physical facility, while all other jobs stem from supporting supply chain activities. Our findings associated with the other three biogenic pathways can be found in the Appendix.

Our analysis shows that the breakdown of job types also varies across the different pathways. In the example above, most of these jobs (3,530 jobs) are related to plant investment, which includes the construction, engineering, materials, and any equipment needed to build the facility. Construction and engineering jobs are those that have to do with the designing and planning of the facility’s construction. For example, this includes architectural services required to design the facility. Materials and equipment jobs capture those linked to the physical construction of the building and its systems. Also included in plant investment are the upstream supply chain activities that support facility construction, materials, and equipment. An average of 180 jobs are associated with ongoing plant operation and maintenance (O&M) activities, with onsite O&M being responsible for the bulk of these jobs. More specifically, it is the operation and maintenance of the electrolyzer system and other major plant components such as the FT reactor.

If the industry scales up enough to produce the majority of aviation fuel, hundreds of thousands of new industry jobs could be created. We have forthcoming analysis that will investigate jobs at scale in detail for the SAF industry.

More investment is needed to jump-start SAF

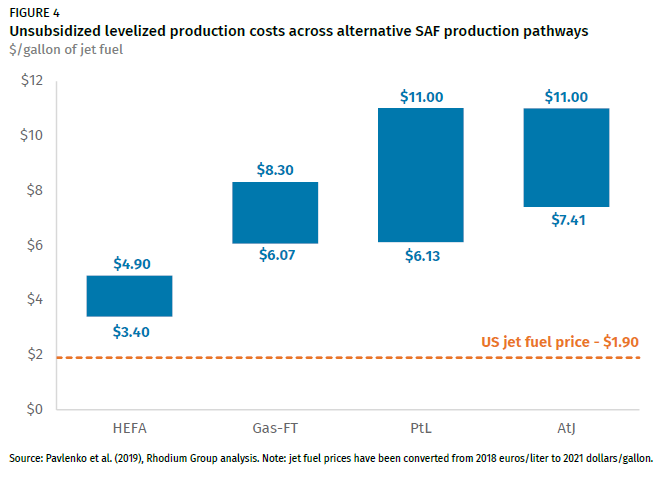

While SAF offers the potential of long-term decarbonization and significant employment benefits, ramping up production to meet these goals will require addressing major economic and technological hurdles first. In the US, current production levels of SAF are approximately 4.5 million gallons per year. A major hurdle to SAF deployment is the considerable cost differential that exists between it and conventional jet fuel. On average, SAF is 3 to 5 times more expensive than conventional jet fuel before considering subsidies and policy incentives (Figure 4). This is due in large part to the nascent production pathways for SAF, which are more expensive than fossil fuels. HEFA fuels are closer to being at price parity with conventional jet fuel than the other pathways primarily because of how long the technology has been around.

In addition to cost, the technological unreadiness of some SAF technologies also serves as a major hurdle on the supply side. To date, the AtJ, Gas-FT, and PtL technologies exist only at lab-scale or pilot-scale demonstration. Shifting to full commercialization will require continued investments in research, development, and demonstration.

Another major supply-side hurdle to scaling up SAF is investment levels, which have been insufficient to date. Poor investment levels are largely driven by high production costs with the converse also being true, creating a negative feedback loop. Both must be addressed in tandem to see improvements in overall SAF economics. Moving SAF forward to full-on commercialization will require additional investment in new and reconstructed SAF facilities, supply chain development, and other supporting infrastructure. Addressing this investment hurdle requires de-risking of “first-of-a-kind” SAF projects and increasing certainty around future SAF demand.

Limited availability of biogenic feedstocks also presents a hurdle for scaling up the advanced biofuels pathways. A large share of eligible biogenic feedstocks are already being used in other industries and transport applications (e.g., personal transport). Also, feedstocks are widely distributed across the world and difficult to collect. Potential solutions for increasing feedstock availability include increasing biomass production on degraded lands, continuing to make advancements in feedstock collection capabilities, and instituting new incentive structures which shift some biomass supply away from competing industries towards SAF.

On the demand side, one hurdle is uncertainty around sufficient future demand. Numerous airlines have established commitments that could potentially boost SAF demand. For example, Delta Airlines has committed to replacing 10% of their jet fuel with SAF by 2030. Similarly, the United Postal Service (UPS) plans to power 30% of their aircrafts using SAF by 2035. However, even with these types of ambitious SAF consumption targets and offtake agreements, demand continues to be rather scarce, which is stymying deployment.

New coalitions of non-governmental organizations and leading corporations such as the Sustainable Aviation Buyers Alliance (SABA) are working to drive new investment in low-carbon SAF and overcome barriers to procurement and scale-up—much-needed efforts to help jump-start the industry. Increased investment in SAF will be necessary to help make it price competitive with jet fuel and accelerate deployment. However, this on its own is not enough to get the aviation sector on track for decarbonization by 2050. In addition to increased investment, long-term policy frameworks will be needed to address many of the demand- and supply-side hurdles we have identified here.

Policy support for scaling up SAF

Recently, policy developments in the US, EU, and elsewhere internationally have been put in place to support SAF production and create demand for SAF. The most far-reaching of these is the multilateral Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). CORSIA is a three-phase program administered by the International Civil Aviation Organization (ICAO) that aims to stabilize international aviation emissions at 2020 levels by 2035. Several SAF pathways are approved for use in compliance with CORSIA, and airlines can use SAF, approved offsets, and other strategies to meet the target. Compliance with CORSIA is currently voluntary but will be mandatory for all participating countries beginning in 2027, potentially creating new demand for SAF globally.

In the US, the federal government has established a “SAF Grand Challenge” to reduce the cost, enhance the sustainability, and expand the production and use of SAF. The overarching goal of the effort is to scale SAF production to 3 billion gallons per year in 2030 and 35 billion in 2050. This multi-agency initiative includes coordination on research and development investments, demonstrations, and SAF supply chain support. In addition, the federal Renewable Fuels Standard (RFS) and California’s Low Carbon Fuel Standard (LCFS) include provisions allowing jet fuel producers to opt-in to these life-cycle GHG reduction programs with compliance credits acting as a supplemental revenue stream to support production. The US Infrastructure Investment and Jobs Act (IIJA) and Inflation Reduction Act (IRA) both provide support for SAF supply and demand creation. The IRA provides a SAF production tax credit of up to $1.75/gallon for very low life-cycle GHG fuels through 2027. The IRA also includes tax credits for carbon capture, DAC, clean hydrogen, and clean electricity production, all of which indirectly support SAF deployment by decreasing the cost of SAF feedstocks. All these policies have the potential to substantially cut the delivered cost of SAF, and we plan to assess the net cost implications of all these programs in future analysis.

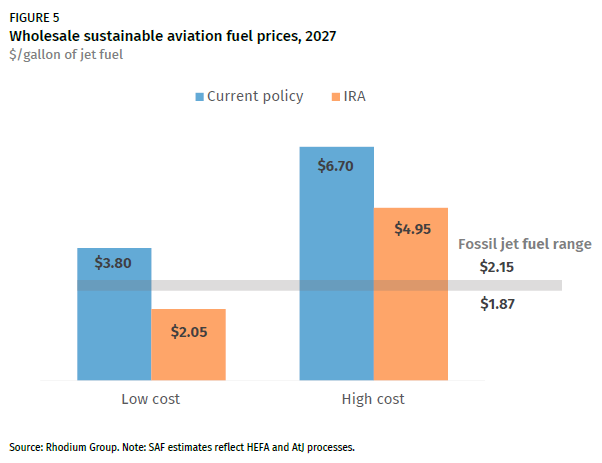

A recent Rhodium Group analysis of the IRA considered how much the new SAF production tax credits improved the cost-competitiveness of low and high cost SAF production pathways eligible for the maximum credit value. We estimated that SAF produced via the low-cost pathway could reach price parity with conventional jet fuel in 2027, the last year the credit is available (Figure 5). Although the IRA can potentially improve the economics of some production pathways, our analysis suggests that additional incentives and/or tax credits will be needed for more of the costlier pathways to be cost-competitive. We have a more in-depth analysis of the impact of tax extenders that is forthcoming.

Getting SAF to scale

SAF has the potential to play a major role in fully decarbonizing aviation. If the industry scales up enough to produce the majority of aviation fuel, hundreds of thousands of new industry jobs will be created. However, varying levels of technology readiness across the different technological pathways and general uncertainty about the future availability and pricing of sustainable feedstocks makes it unclear as to which pathway will emerge as dominant. HEFA is currently the more mature of the pathways. It is also the least expensive to produce and is currently commercially viable. However, because of high feedstock costs and feedstock limitations, it will serve as only a near-term decarbonization solution. Other biogenic pathways like AtJ and Gas-FT will likely serve as medium-term solutions as they eventually reach technical and commercial maturity and increasingly become more cost-competitive. Their deployment and possible viability in the long run will largely depend on future feedstock supply.

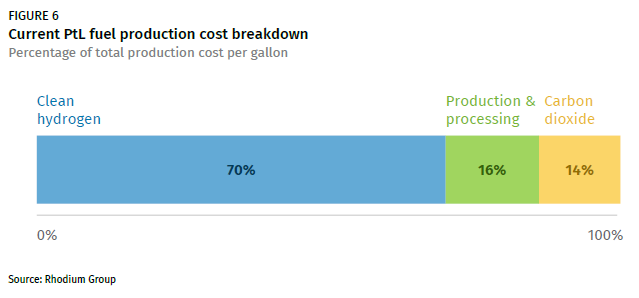

The current costs of PtL likely prevent it from being a near- or medium-term supply source for SAF. Sizeable declines in electrolyzer costs and the costs of CO2 capture, as well as a growing abundance of clean electricity sources—all of which are associated with PtL production (Figure 6)—will be necessary if it is ever to reach some degree of price parity in the future.

Despite the technology development and cost hurdles PtL faces, it is the only SAF technology that has the potential for unbounded production as it does not face the feedstock limitations that the biogenic pathways do. Future Rhodium work will explore ways to bring down these costs and technology deployment hurdles. More specifically, we will investigate how policies like the IRA improve PtL economics.

Our observations of growing investment in domestic first-of-a-kind SAF facilities along with mounting policy support (i.e., IRA, expansion of RFS and LCFS) suggest that industry stakeholders and policymakers alike understand the vital role SAF could play in decarbonizing US aviation. However, these efforts alone are not enough. More must be done to overcome the existing supply-side and demand-side hurdles, which greatly inhibit the scaling of SAF. The US government could push for more public-private partnerships for SAF production. And long-term policy frameworks are critical for getting SAF to scale. Possible avenues include continued government support (at both the federal and state levels) in the form of additional policy incentives, consumption mandates for airlines, further backing for SAF R&D and demonstration plants, and implementing policies that de-risk SAF plant investments.

[1] It is worth noting that SAFs are a subset of clean fuels which are drop-in fuels used anywhere in the economy that generate fewer life-cycle GHG emissions than their conventional counterparts. Many of the SAF processes are like those that produce clean fuels used elsewhere in the economy. If the US does succeed at widespread economy-wide decarbonization, it is likely that clean fuel facilities will produce multiple types of fuels including SAF. We focus on SAF specifically in this note because clean fuels are most needed in the aviation sector.

[2] The other four pathways include: (1) Fischer-Tropsch synthesized kerosene with aromatics (FT-SPK); (2) Synthesized iso-parafinns (SIP); (3) Catalytic hydrothermolysis jet (CHJ) fuel; and (4) Hydroprocessed hydrocarbons – synthesized isoparaffinic kerosene (HC-HEFA).