The Global Economic Disruptions from a Taiwan Conflict

Recent tensions in the Taiwan Strait have stoked fears of a conflict between China and Taiwan and raised questions about the implications of such a scenario for the global economy.

Recent tensions in the Taiwan Strait have stoked fears of a conflict between China and Taiwan, and raised questions about the implications of such a scenario for the global economy. How a conflict would unfold is impossible to predict, complicating any assessment of its economic and commercial consequences. Yet the risks of a crisis around Taiwan have risen, making these questions more important than ever for policymakers and business leaders.

Over the course of 2022, as the war in Ukraine shone a spotlight on geopolitical risks, Rhodium Group examined the potential global economic disruptions resulting from a hypothetical conflict between China and Taiwan. Our work builds on research dating back to 2004 that examined Taiwan’s global economic relationships.1 Unsurprisingly, we find that the scale of economic activity at risk of disruption from a conflict in the Taiwan Strait is immense: well over two trillion dollars in a blockade scenario, even before factoring in international responses or second-order effects. The disruptions would be felt immediately and would be difficult to reverse. They would impact trade and investment on a global scale, leaving few countries untouched. Such disruptions could occur even if the conflict does not become kinetic.

The challenge of estimating disruptions from a conflict between China and Taiwan

Estimating the economic consequences of a Taiwan-centered conflict is challenging. Such a conflict could take many forms, varying in duration, scale, and in terms of the parties involved. Crucial data, particularly on semiconductor supply chain activity, is not publicly available. Important aspects of disruption scenarios are not easily quantified and often left out of trade shock models, including impacts on cross-border flows of people and ideas.2 The ripple effects from trade and supply chain disruptions are also very difficult to estimate.

With these challenges in mind, our analysis adopts a necessarily simplified and partial approach to estimating the range and nature of economic activities at risk of disruption in a Taiwan-China conflict. We define conflict—for the purposes of our hypothetical assessment—as a blockade of Taiwan by China that halts all trade between Taiwan and the rest of the world. Based on these parameters, we identify the main channels of economic disruption, and where possible, provide an estimate of the minimum scope of economic activity at risk. We do so by using conservative assumptions throughout our analysis and by focusing our attention on the most serious areas of economic disruption.

We do not purport to estimate GDP losses or other measures of foregone economic welfare. Instead, we provide a snapshot of activity at risk at the beginning of a blockade, were it to happen today, making no predictions or assumptions about how such a crisis might evolve. Where we provide estimates of economic flows at risk, they are annualized figures. We discuss potential longer-term risks in qualitative terms throughout this note, but our quantitative estimates do not factor in second-order effects. Importantly, our analysis does not attempt to estimate the costs associated with additional disruptions from a military escalation or the imposition of international sanctions.3 As such, our analysis should be considered a conservative and partial estimate of potential economic activity at risk.

Immense global disruptions, even under conservative assumptions

In a blockade scenario, the most significant disruption to global economic activity would come from a halt to Taiwan’s trade with the world, particularly in semiconductors. Associated disruptions to global supply chains—especially in major chip-consuming sectors such as electronics, automotive, and computing—would have grave repercussions for the world economy. Global trade with China would also decline due to a contraction in global trade financing, shocking the global economy and potentially triggering debt crises among China’s more fragile trade partners.

Disruptions from lost trade with Taiwan

Taiwan is the world’s 16th largest trading economy, having imported and exported $922 billion in goods and services in 2021. Almost all of this trade would be severely disrupted in the event of a blockade. Setting aside the value of imports that end up being re-exported and ICT-related trade that we cover below, approximately $565 billion in Taiwanese value-added trade would be at high risk of disruption from a blockade.4

While absolute trade values at stake are high, the most serious economic impact would come from disruptions to semiconductor supply chains and related downstream industries. Taiwan produces 92% of the world’s most advanced logic chips (at node sizes less than 10 nanometers in size), as well as a third to half of the global output for less sophisticated but nonetheless critical chips.5 By some estimates, Taiwan’s leading chip foundry TSMC produces 35% of the world’s automotive microcontrollers and 70% of the world’s smartphone chipsets. It also dominates in the production of chips for high-end graphics processing units in PCs and servers. A rough, conservative estimate of dependence on Taiwanese chips suggests that companies in these industries could be forced to forego as much as $1.6 trillion in revenue annually in the event of a blockade.6

Beyond the immediate effect on corporate revenues from lost semiconductor production, the global economy would face significant second-order impacts that would likely add trillions more in economic impact. Many industries depend on the availability of goods and equipment containing Taiwanese chips. These include e-commerce, logistics, ride-hailing, entertainment, and other industries that collectively employ tens of millions of people. Spare parts and components for critical public infrastructure, such as telecommunications and medical devices, could become scarce. Ultimately, the full social and economic impacts of a chip shortage of that scale are incalculable, but they would likely be catastrophic.

Disruptions to global trade with China

A conflict over Taiwan would affect not only economic activity with Taiwan but with China as well. Even assuming no sanctions or military escalation between the US and China, trade between China and the rest of the world would be severely affected by disruptions to global trade finance.

Every year, banks provide $6.5 to $8 trillion in finance to help importers and exporters facilitate trade while goods are in transit. This short-term finance underpins as much as one-third of trade flows. In the event of a conflict between China and Taiwan, risk-averse global investors would pull back from lending activities, reducing the availability of trade finance and thus impairing international trade. During the global financial crisis, the collapse in trade financing was estimated to be responsible for almost one-fifth of the total drop in global trade.7 In a Taiwan conflict, the effect could be even starker as banks reduce exposure to Chinese counterparties in anticipation of financial sanctions. Between a global liquidity crunch and the threat of sanctions, trade finance with China would likely become at least as scarce as it was in the global financial crisis, with the potential to disrupt more than $270 billion in trade between China and the rest of the world—even before any sanctions were put in place.

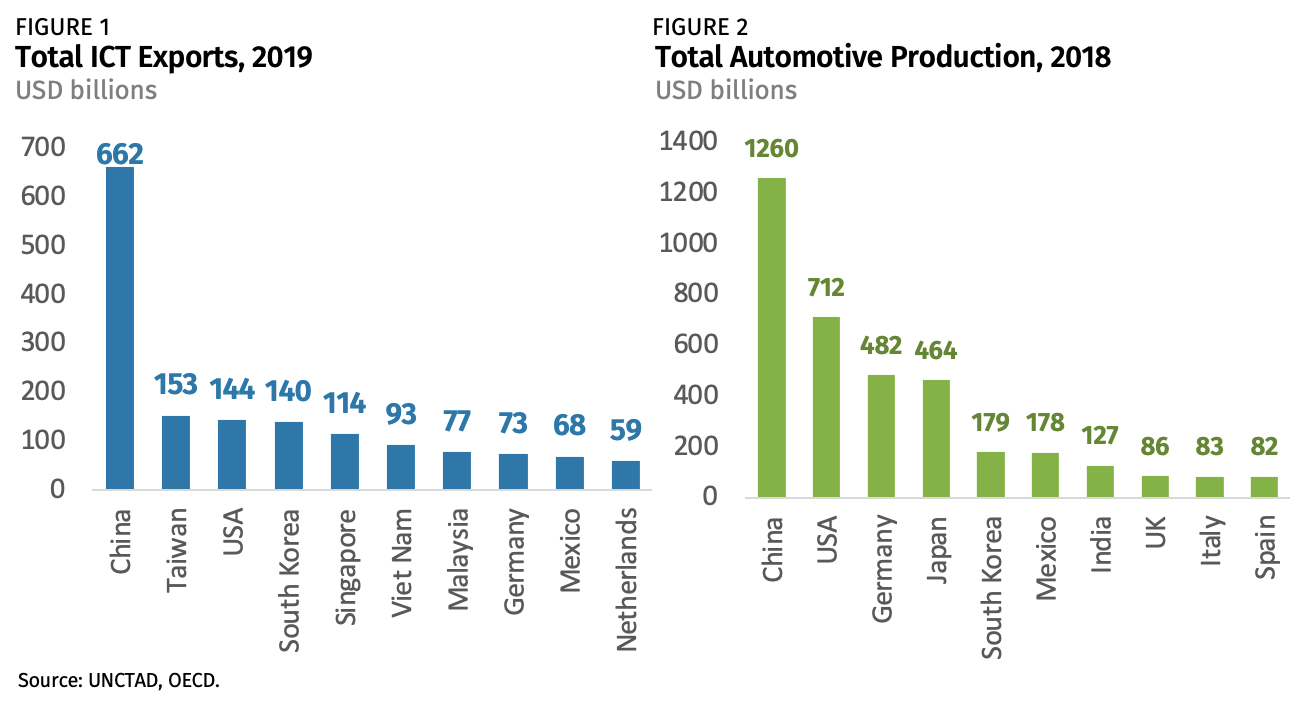

Trade with China would be affected by other forces as well. Domestic economic conditions in China would deteriorate quickly, not least from the disruptions to global semiconductor value chains described above. China is the world’s largest exporter of ICT goods, as well as the number one global production hub for automotive goods (Figures 1 and 2). Losing access to Taiwanese semiconductors would virtually guarantee a major economic shock to China’s manufacturing sector and the overall economy.

In addition, global and domestic investors would almost certainly seek to move money out of China, straining China’s exchange rate to the degree that even China’s strong capital controls and intervention by the PBOC would be unable to fully contain. Against the backdrop of a faltering domestic economy, a weaker RMB would reduce China’s imports from the rest of the world.

Other major disruptions to global economic activity

In a Taiwan conflict scenario, foreign investors are likely to dump their holdings of Chinese securities. As of June 2022, foreign investors held over one trillion dollars in onshore Chinese bonds and equities, and as of September 2022, more than $775 billion in offshore Chinese equities listed in the United States.8 In the event of a conflict, investors would shed Chinese securities to reduce their exposure to possible financial sanctions and broader economic risks. Even prior to the imposition of Western sanctions on Russia, the value of Russian-linked portfolio assets collapsed as war risks began to mount: by February 24th, the day Russia launched its latest invasion of Ukraine, the Russian MOEX stock index had fallen nearly 30% from its October 2021 peak. A conflict could trigger a similar sell-off in Chinese assets, with hundreds of billions of dollars in investor value at stake. The sell-off could, in turn, trigger stronger capital controls from Beijing, preventing foreign investors from moving money offshore.

A conflict is also likely to have a far-reaching impact on Chinese outbound investment and lending activities. Amid a crisis-driven currency crunch, China would likely pause overseas direct investment activities and new lending and aid, putting around $100 billion in annual investment and lending flows at risk. Countries that have relied on rollovers and refinancing of Chinese loans in recent years—such as Sri Lanka, Pakistan, and Laos—would be hurt the most. Beijing could decide to pull out of debt renegotiation talks under the G20 Common Framework as well, putting other countries at risk.

Multinational companies (MNCs) selling into the Chinese market would face immediate revenue risks. The impact would come first and foremost from disrupted global semiconductor trade, given the concentration of foreign investment in China in the auto, manufacturing, and ICT sectors. Beijing could also impose capital controls in response to global capital flight, hindering the ability of multinational companies to repatriate profits. Companies could also face boycotts and protests, both in the Chinese market (due to home country statements of support of Taiwan), and in their home countries if they continued to operate in China during a period of aggression against Taiwan. At the extreme, foreign businesses in China could face risks of nationalization or asset seizure.

A conflict over Taiwan would also affect direct investment to and from Taiwan. Taiwan invests about $18 billion per year overseas, and foreign multinationals repatriated about $22 billion from Taiwan in 2021. A conflict could easily put these flows and foreign assets in Taiwan—including $127 billion in direct investment—at risk.

A truly global impact

Because the channels of disruption from a Taiwan conflict are so far-reaching across trade, investment, and financial channels, even countries that, on the surface, appear only remotely linked to Taiwan would also face risks. A rapid slowdown in Chinese demand for imports would impact commodity export-oriented developing economies that may only have tangential links to Taiwan. Disruptions to ICT and auto value chains would hurt countless economies up and downstream from semiconductors. The world would likely suffer shortages of critical goods ranging from agriculture and mining equipment to medical and telecommunication devices.

Effects on Taiwan-exposed value chains

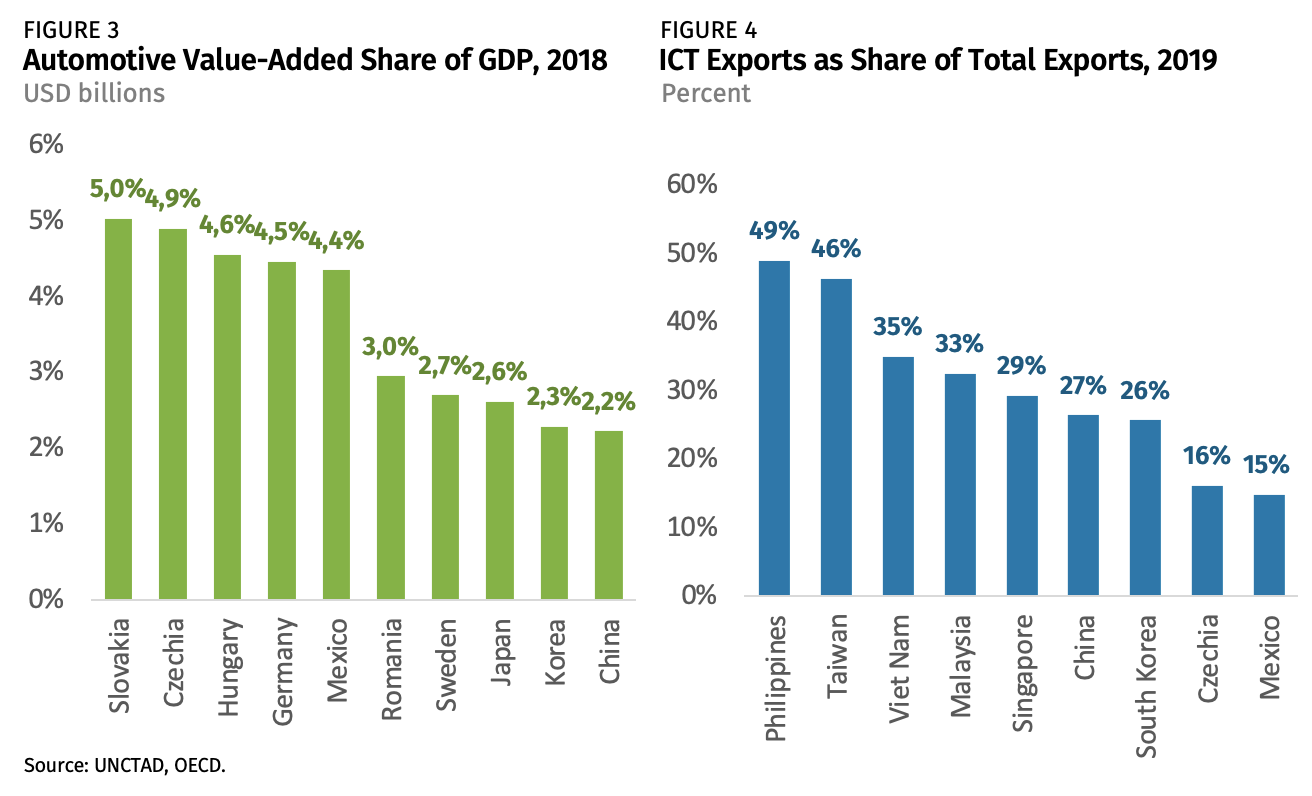

A conflict between China and Taiwan would be highly detrimental to countries exposed to semiconductor-related value chains. These include major global producers of auto components and vehicles such as China, the US, Japan, or Germany, but also economies for which auto production represents an important share of GDP, as is the case with Slovakia, Czechia, and Hungary (see Figure 3 below). During the 2021 semiconductor shortage, average European passenger vehicle production fell around 13%, with German production tumbling nearly 20% and Italian production over 25%. While this shortage was severe, the impacts of a full-blown blockade of Taiwan would be far greater.9

A conflict would also hurt Taiwan’s regional trading partners, who rely heavily on Taiwanese chip inputs for downstream semiconductor assembly and testing operations, as well as electronics assembly. Among them, the Philippines, Vietnam, Malaysia, and Singapore could experience major disruption (Figure 4).

Effects on China’s trading partners

The stress on China’s trade and domestic performance from a Taiwan conflict would also have major global ramifications. With a weaker exchange rate, export manufacturing disruptions, and faltering domestic consumption (a common consequence of geopolitical shocks), China’s demand for global inputs would fall.10

Given the composition of China’s imports, it is fair to assume that commodity exporters would suffer from significantly lower demand from China, putting pressure on their own currencies and balance sheets. In a context of already high emerging and developing market debt levels, and financial stress in much of the developing world, the shock from China’s import demand drop could push yet more debt or fiscally stressed emerging and developing economies to the brink.

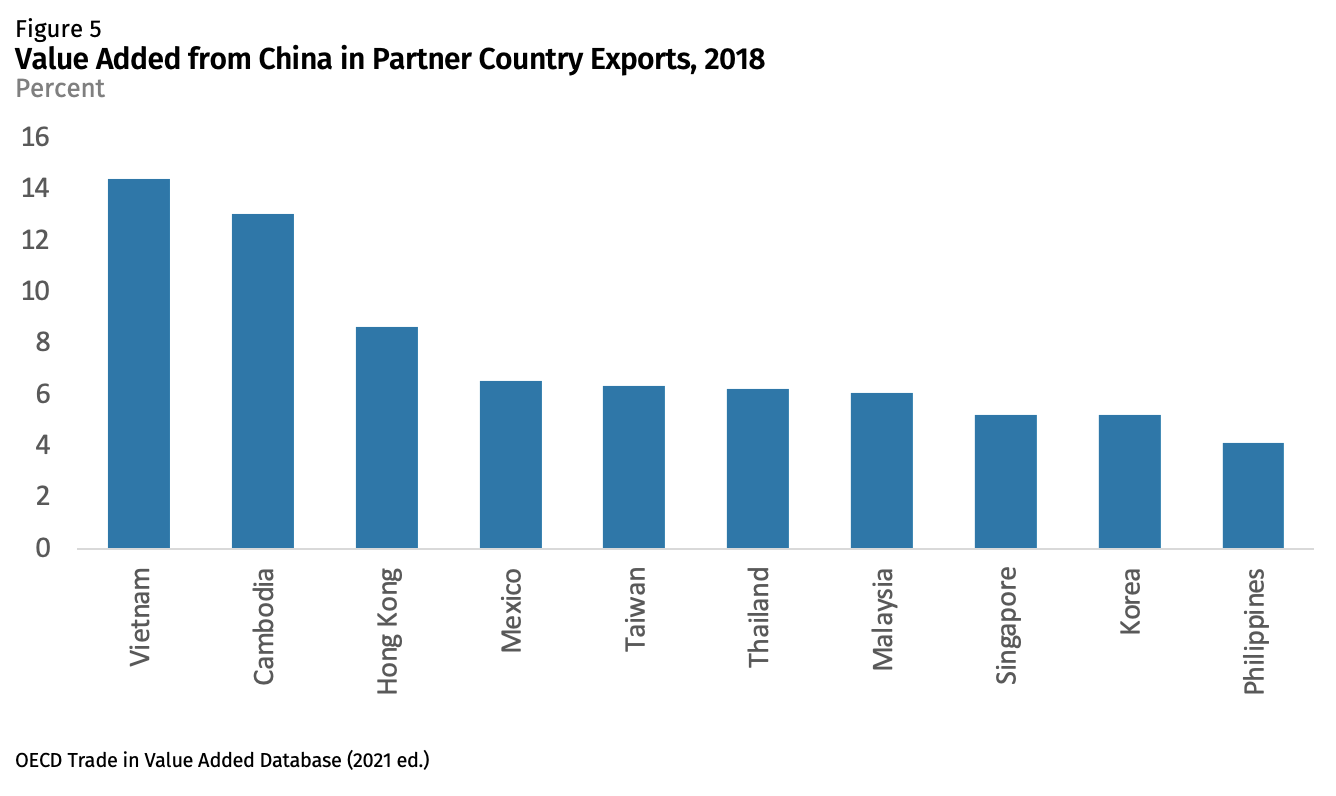

Given China’s crucial role in regional value chains, trade disruptions from a conflict would also directly impact China’s Asia-Pacific trading partners. For example, over 14% of Vietnam’s export value reflects imports of intermediate goods from China (Figure 5). The number is similarly high for Cambodia (13%), Hong Kong (9%), and Mexico (7%). Delays of shipments of key intermediate goods from China could quickly cause production slowdowns and lost revenue.

Effects on other global economies

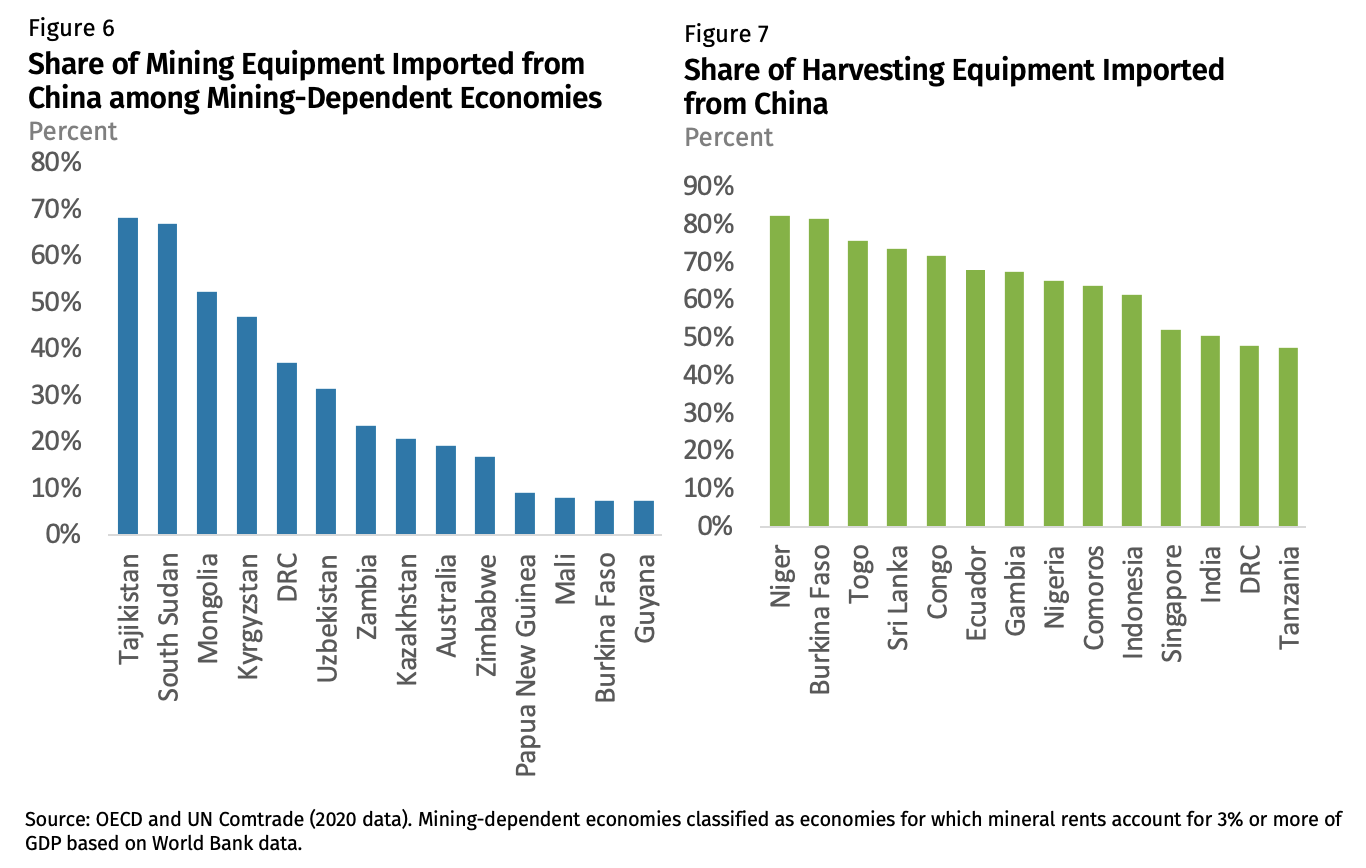

Finally, due to major trade and global manufacturing disruptions, countries around the world would face the risk of spiking inflation and shortages in key industries. This would range from critical infrastructure inputs, such as medical and telecommunication equipment, to less strategic yet equally vital equipment goods for harvesting or mining, with the potential to disrupt business as usual in countless economies (see Figures 6 and 7). All these forces could, combined, increase the risks of a global economic recession, sustained inflation, widespread sovereign defaults, rising unemployment, and potential social unrest.

Conclusion

Collectively, our estimates of global disruption from a Taiwan conflict would put well over two trillion dollars in economic activity at risk, even before factoring in the impact from international sanctions or a military response. This note offers a look at just some of the likely disruption channels in a blockade scenario, and this figure should be regarded as a floor; the full scope of imperiled activity would surely be greater. Importantly, most of these disruptions would materialize almost immediately (particularly the impacts in financial markets) and would be hard to reverse. These impacts would be felt across the global economy, including in countries that may appear to be only tangentially linked to Taiwan.

Some of the impacts of a blockade could be mitigated, if only partially. A share of global trade could be redirected, and smart policy and business decisions in advance of a crisis—such as increasing stockpiles of critical chips—could mitigate the impacts from a short-lived conflict. Yet Taiwan’s centrality in the global semiconductor manufacturing ecosystem means there would be few alternatives in the short-run, and thus disruptions from a blockade would lead to very high, unavoidable costs to the global economy.

Our work sets aside, for now, the economic costs of international policy responses such as financial sanctions against China, but the potential application of these tools needs to be better understood. Additionally, while we have focused on the direct economic activity at risk from a blockade, there are a wide range of economic risks associated with lower-level tensions in the Taiwan Strait that need to be better understood. These might include Chinese economic coercion against foreign companies and countries in response to Taiwan-related statements or actions, rising shipping costs from intensifying military activity in the Taiwan Strait, or the reaction of financial markets to a further escalation between China and Taiwan, possibly involving the US. Preparing for these risks, including through rigorous contingency planning, will be important, whether or not one believes a full-blown conflict is coming.

References

1. Daniel Rosen and Nicholas Lardy, “Prospects for a US-Taiwan Free-Trade Agreement,” December 2004; Daniel Rosen and Zhi Wang, “The Implications of China-Taiwan Economic Liberalization,” January 2011.

2. See Understanding US-China Decoupling (2021), in which we suggest the need for a four-channel stock taking covering trade, finance, people and ideas.

3. Other studies have attempted to estimate the economic costs of a war with China. See Gompert, Cevallos, and Garafola, “War With China: Thinking Through the Unthinkable,” Rand Corporation, 2016.

4. Because gross trade volumes include intermediate inputs to goods that may later be exported, a “trade in value-added” approach is helpful to avoid double-counting the value of trade at risk. Using the OECD’s Trade in Value-Added database (2016), we estimate that $373 billion of value-added exports to Taiwan would be at risk, and $192 billion in Taiwanese value-added exports to the rest of the world would be at risk from a blockade, totaling $565 billion. Note that this excludes value added in computers, electronics, optical equipment, and motor vehicles to avoid double counting the value of trade in ICT supply chains, covered in the following paragraph.

5. Varas et. al, “Strengthening the Global Semiconductor Supply Chain in an Uncertain Era,” Semiconductor Industry Association and Boston Consulting Group, April 2021.

6. This figure is derived by adopting a simplifying assumption that annual industry revenues at risk are directly proportional to the share of chips sourced from TSMC. Industry revenue figures are from Counterpoint Research, Canalsys, and IbisWorld.

7. Bank for International Settlements, “Trade Finance: Developments and Issues,” January 2014.

8. U.S.-China Economic and Security Review Commission, “Chinese Companies Listed on Major U.S. Stock Exchanges, September 2022.

9. Attinasi et. al., “The semiconductor shortage and its implication for euro area trade, production and prices,” European Central Bank, April 2021.

10. Sinem Hacioglu Hoke, “Macroeconomic Effects of Political Risk Shocks,” Bank of England, December 2019.