Terms and Conditions Apply: Regulating Chinese EV Manufacturing Investment in Europe

In this note, we explore the emerging debate in Europe about conditioning Chinese greenfield investment in the EV sector and the tools the EU could use to ensure they reap the benefits from these investments.

European countries have revamped their approaches to vetting foreign investments in recent years to protect sensitive industries and critical infrastructure. But the regulatory changes have focused primarily on the threat of home-grown companies being acquired by competitors from countries like China. They are less well-equipped to address a new trend: greenfield investment from Chinese electric vehicle producers. Going forward, European policymakers will try to ensure that such investments produce jobs for their citizens and lead to a sharing of technological know-how, while limiting any market distortions or security risks that could arise from them. In other words, they may seek to give China, which has imposed strict conditions on foreign investment for decades, a taste of its own medicine. In this note, we explore the emerging debate in Europe about conditioning Chinese greenfield investment in the EV sector and the tools the EU could use to ensure they reap the benefits from these investments.

The benefits of an open door to Chinese EV FDI

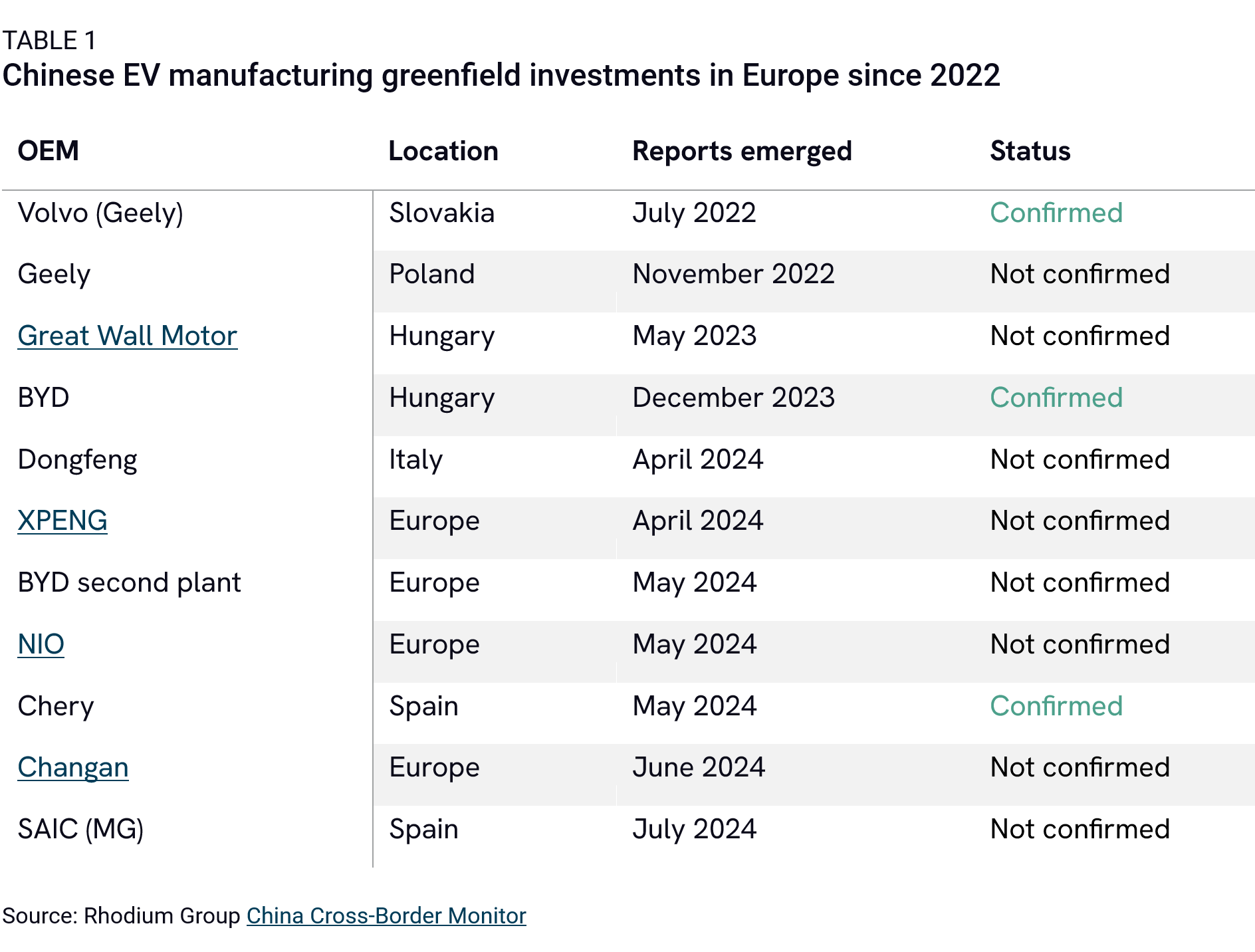

Since the European Commission launched its anti-subsidy investigation into China-made EVs in October 2023, a number of Chinese OEMs have signaled their interest in investing in Europe (Table 1). While trade barriers may not deter all Chinese OEMs from exporting to Europe, given the lower production costs and established ecosystem (see “Ain’t No Duty High Enough,” April 2024) they enjoy in China, they do alter the cost-benefit calculus for Chinese carmakers when they are considering whether to produce in China or set up plants abroad. And so far, European capitals have been eager to attract such investments. Between May and July 2024, Hungary, Poland, and Italy all signed agreements with China that emphasized their openness to Chinese investments in the sector. During Xi Jinping’s visit to Europe in May 2024, the French government made clear that Chinese automakers like BYD were “very welcome in France.”

Many European member states welcome foreign investment as a matter of principle. This approach is even anchored in EU treaties, which explicitly support the free movement of capital between member states and third countries. It is consistent with European values of openness and increases the likelihood that investments by European firms will be welcomed in foreign markets.

Many European member states welcome foreign investment as a matter of principle. This approach is even anchored in EU treaties, which explicitly support the free movement of capital between member states and third countries. It is consistent with European values of openness and increases the likelihood that investments by European firms will be welcomed in foreign markets.

There are widely acknowledged benefits to greenfield FDI including knowledge spillovers, job creation, and economic growth. When it comes to Chinese investment in the EV sector, European countries are motivated by a desire to revitalize manufacturing at the national level. The Chinese firm Chery, for example, recently announced that it would retool a factory in Barcelona that had been abandoned by Japan’s Nissan.

Chinese FDI in the EV sector plays into Europe’s twin goals of decarbonizing its economy while responding to distortive Chinese economic policies. Locally produced Chinese EVs may be more expensive than imported models, reflecting higher production costs in Europe. But they can help transform the market for new energy vehicles, offering European consumers greater choice while pushing down carbon emissions. Welcoming Chinese investment can also help ensure a healthy degree of competitive pressure on European manufacturers. Without such competition, domestic firms may have less incentive to innovate and improve efficiencies. As a result, they may produce less attractive models that struggle to compete in third markets, where they will inevitably face Chinese rivals.

Greater proximity to Chinese firms could offer European manufacturers valuable know-how and technological insights. Chery will be running its Spanish plant together with Ebro Motors, a Spanish automotive brand that had been defunct for 36 years. Ebro will benefit from the manufacturing skills and EV technologies that Chery brings to the table. An open door can also alleviate coercion risks. If Chinese carmakers are heavily invested in the European market, it makes it more difficult for Beijing to retaliate against European carmakers operating in China.

The risks of unrestricted greenfield FDI

While greenfield investment was seen in past decades as a win-win proposition, growing geopolitical tensions with China and have led policymakers in Europe, the US, Japan, India and other countries to focus increasingly on the concept of economic security and the risks of an open-door policy.

When it comes to EV production in Europe, the main concern is that manufacturing plants set up by Chinese companies could distort competition in the EU’s single market. The European Commission has highlighted that Chinese EV firms benefit from significant government subsidies which could allow them to lower prices to gain market share, absorb losses when needed, and invest in R&D at levels beyond the reach of their European competitors. State support could also enable them to pursue large-scale foreign investments and subsidize overseas operations and sales. European car manufacturers are already losing market share to Chinese brands in Europe—which captured 11.1% of the European electric car market in June 2024, up from 5.5% in June 2022. Greater Chinese investment in Europe could perpetuate that decline.

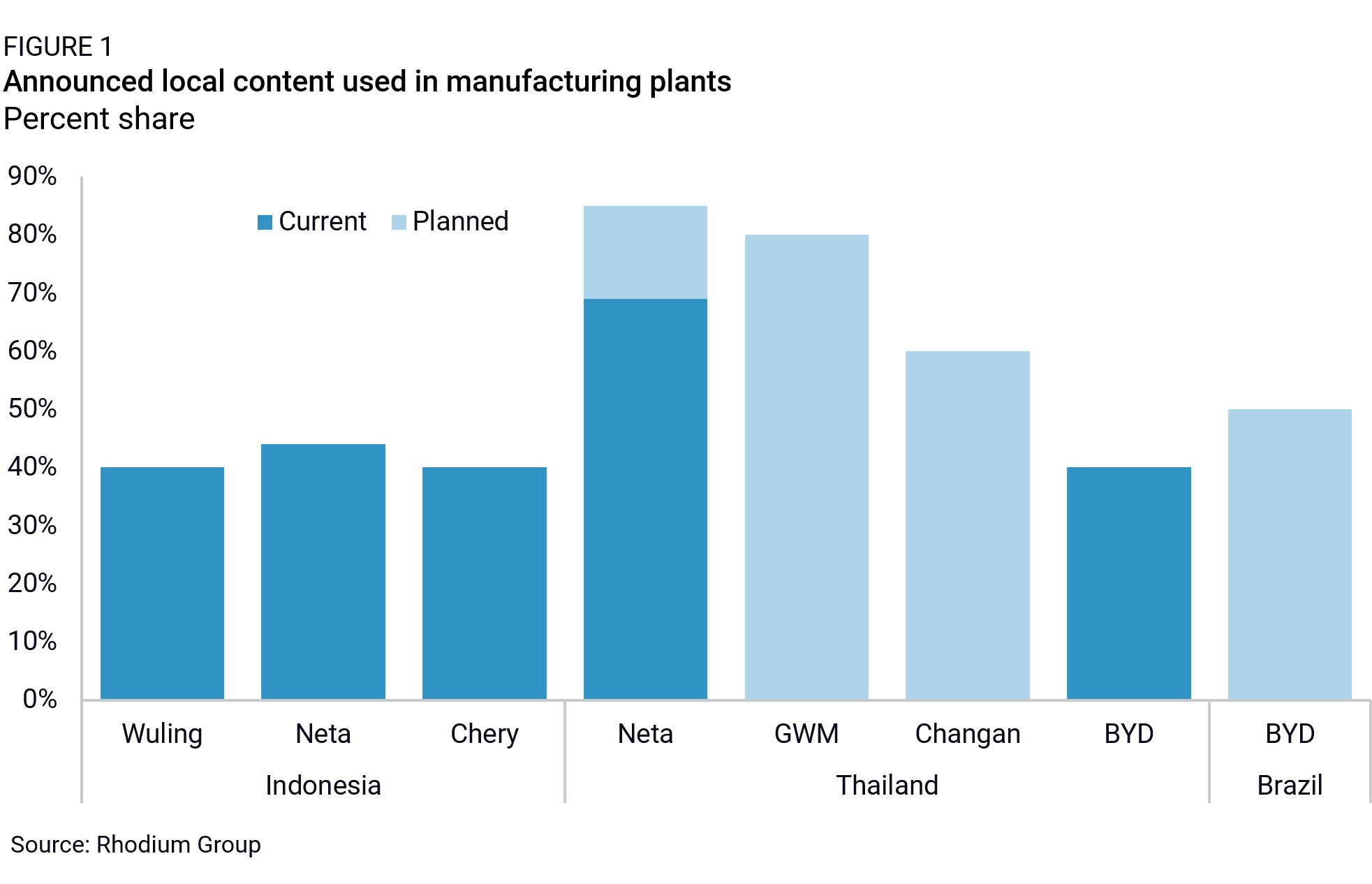

There is also a risk that Chinese OEMs source less from local suppliers than their European peers. Based on their public statements, Chinese EV companies are currently aiming for at least 40% local content at their main overseas plants (Figure 1). However, these commitments are typically happening in countries with local content requirements—which the EU does not have—or are driven by export strategies tied to FTA requirements regarding rules of origin (e.g. exporting tariff-free from Brazil to other Mercosur countries).

In Europe, meanwhile, the early signs are mixed. The scale of BYD’s planned investment in Hungary—estimated at several billion euros, with a production capacity of over 150,000 units per year—suggests that it will be more than a mere assembly plant. BYD has secured a local supply agreement with France’s Forvia, with which it is has a joint venture in China and a collaboration in Thailand. The Chinese firm hosted a supplier conference in July to attract Austrian suppliers. However, BYD has also announced that, initially at least, it will import battery cells from China. And even the steel used to build its Hungarian plant has been sourced from China.

For policymakers, battery imports from China could become a major concern. They could undermine the EU’s push to foster European battery champions, and the goal of member states to capture local value added (batteries account for 30-40% of an EV’s value). Chinese battery firms have made significant investments in the EU, but companies like SVOLT and CATL have either canceled or scaled back their investment plans. These investments are, in any case, primarily intended to serve European OEMs. Chinese EV makers like BYD, a fully integrated company that also produces batteries, could continue to import cheap batteries from China, facing only a 1.3% tariff.

Policymakers are also concerned that Chinese firms may hire fewer local staff than European competitors, either to guard their know-how or because they face local skill shortages. Chinese firms have relied on a higher share of Chinese nationals in their foreign plants than companies from other countries operating abroad. In CATL’s German factory, for example, 40% of the staff was reportedly made up of Chinese workers as of 2023.

The concentration of China’s EV FDI in member states that cultivate friendly political ties to China could become another source of concern. In 2023, Hungary received 47 percent of all Chinese EV-related FDI in the EU. This has set off alarm bells in Brussels, given the close relationship between Hungarian Prime Minister Viktor Orbán and Xi Jinping, who signed an “all-weather comprehensive strategic partnership for the new era” during the Chinese president’s visit last May. Hungary’s reliance on Chinese investments could turn it into an ever bigger outlier on China policy within the EU, where some decisions rely on unanimity. Hungary has shown a willingness to accept Chinese investment on Beijing’s terms, while still offering substantial state aid.

Lastly, the localization of Chinese EV production cannot fully assuage concerns about Europe’s overreliance on Chinese companies for a critical green technology good, at a time when policymakers are focused on cybersecurity and data security risks tied to connected vehicles. A permissive policy towards Chinese technology in the car sector could not only leave Europe vulnerable to such risks, but also put it at odds with G7 allies, notably the United States, which is taking a restrictive approach.

In May 2024, the Biden administration raised its tariffs on Chinese EVs to 102.5%, effectively shutting them out of the US market. While the US formally remains open to Chinese EV investment, individual projects like Chinese battery maker Gotion’s plans to establish plants in Michigan and Illinois have been met by a fierce political backlash. Investments that seem less overtly “Chinese,” like a battery plant by AESC and Volvo (Japanese and Swedish firms that are now Chinese-owned) in South Carolina, have encountered less resistance.

The main threat to Chinese EV firms lies in recent US regulatory developments. The foreign entity of concern clause in the IRA may exclude Chinese-owned factories from receiving tax credits, making them much less competitive, and new rules unveiled by the US Commerce Department could lead to effective bans on Chinese vehicles and vehicles made with certain Chinese components, regardless of where they are made. As Chinese EV firms eye investments in Mexico as a way to bypass US restrictions, the Biden administration has pressured its southern neighbor to screen investments and curtail incentives. Washington is also warning allies about the risks tied to connected vehicles, and of the consequences that a different policy approach could have on their access to the US market.

It seems unlikely that the US approach will change substantially after the presidential election. Although Donald Trump has voiced support in the past for Chinese EV investment that creates jobs for US workers, he recently declared himself “100% opposed” to the Gotion project in Michigan and his running mate JD Vance has labeled Chinese investments in the sector a serious security threat.

Conditioning Chinese EV investment

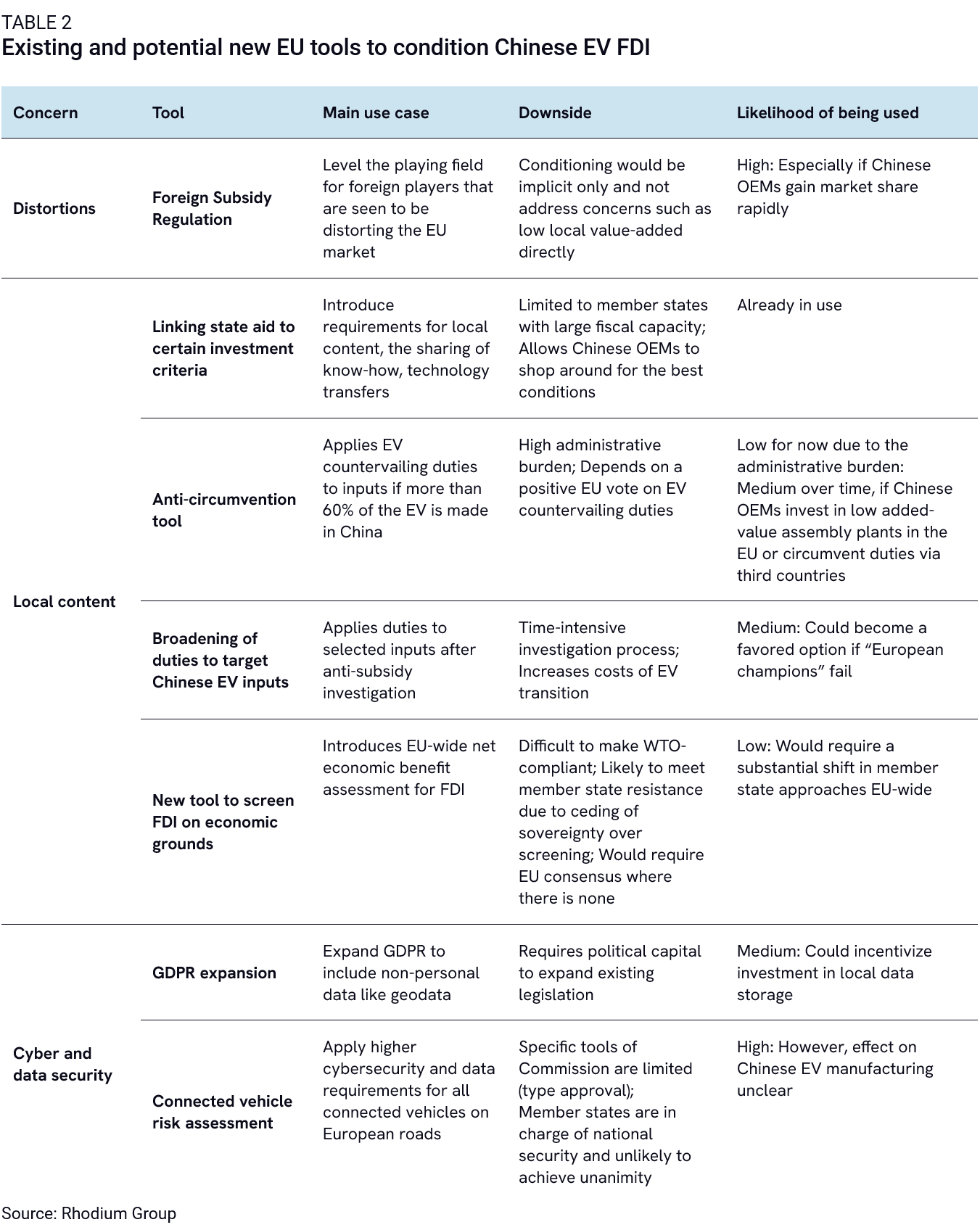

The EU is unlikely to shut the door completely to Chinese cars, whether they are imported or produced in Europe. However, as policymakers in Brussels ponder the risks associated with Chinese FDI in the EV sector, they could turn to a range of existing tools and new rules to ensure investments are not undermining the EU’s economic and strategic interests (Table 2).

Leveling the playing field through the Foreign Subsidies Regulation

The main purpose of the Foreign Subsidies Regulation (FSR) is to level the playing field within the EU market in instances where foreign firms are judged to have benefitted from subsidies. But it could be used to achieve broader aims, targeting investments that are seen to be creating broader negative spillovers for Europe.

The ongoing trade investigation into EV imports from China has laid the groundwork for the Commission to argue that Chinese EV firms benefit from subsidies. It would not be a big leap to argue that investment by these firms in Europe could distort the market through their investments. The remedies that could be imposed are powerful, from repaying subsidies and suspending production to forced sharing of R&D results.

The EU’s report on state-induced distortions in China suggests that many, if not all, Chinese investments would likely meet the first FSR criterion of benefiting from subsidies, with a risk of also meeting the second one: distorting the EU single market. However, applying the FSR to all Chinese investments is unlikely due to the disruptions it would cause and the high risk of sparking a trade war with China.

Instead, the Commission is more likely to target specific investments. Firms with high sourcing from China could be most at risk of FSR scrutiny. SOEs like SAIC, which have received substantial subsidies, face a higher risk of being targeted. The instrument could also be used ex-post to target firms that gained market share very quickly through foreign state support.

Member states might oppose its use. EU members often welcome and compete for Chinese investment, so invoking the FSR could create tensions between the Commission and those countries benefiting from Chinese greenfield EV FDI. However, the Commission is the ultimate decision-making authority. Decisions taken under the FSR cannot be challenged by member states in the same way as trade defense investigations.

The FSR could be an attractive option for EU policymakers if Chinese firms are seen to be distorting the market and unfairly gaining market share at the expense of local players. However, its use to condition FDI would be implicit at best and the tool is not ideally placed to address specific concerns about local value-added, employment, and knowledge sharing.

Increasing local value-added and technology spillovers

To address these concerns more directly, EU and member state policymakers have several tools at their disposal to encourage greater local value-added from Chinese investments—though all have significant shortcomings.

A straightforward approach would be to introduce local content requirements. Several countries, such as the US under the Inflation Reduction Act (IRA), have adopted such measures. However, these requirements face significant constraints under the World Trade Organization’s (WTO) national treatment rules. Given the EU’s strong adherence to WTO rules, imposing explicit local content requirements is unlikely, as it could lead to legal challenges and trade disputes.

One option is for policymakers to tie local content or other requirements like employment commitments to state aid packages—in short, making access to European subsidies conditional on certain investment criteria. In exchange for several hundred million euros in state aid, Rome is reportedly negotiating with China’s state-owned Dongfeng to ensure that at least 45% of the components in cars produced in Italy are sourced from within the country. According to reports, Rome is also seeking commitments from Dongfeng to manage customer data locally and source critical components like infotainment units from European suppliers. Other member states could follow suit. While potentially effective at the member state level if Chinese firms agree to these conditions, the approach has two main downsides: it depends on individual countries having the fiscal capacity to offer substantial state aid incentives, and it allows Chinese OEMs to shop around, eschewing states that offer subsidies in favor of those that do not impose conditions on investment.

The EU could also extend countervailing duties on imports of EVs from China—if they are imposed—to the components that go into the cars. This is feasible under the EU’s anti-subsidy regulation if over 60% of inputs at Chinese OEM plants in Europe are sourced from China or less than 25% from the EU. However, this approach is complex from an administrative perspective, requiring product-level approvals for European importers. Still, if the EU suspects Chinese OEMs are setting up “screwdriver” plants, or mere final assembly plants, it could go down this path in a push for greater localization.

Another option would be to launch a separate trade defense investigation into EV inputs, such as batteries, to incentivize localization and create a level playing field for European suppliers. This approach would likely slow local EV capacity and adoption due to the higher costs of Europe’s home-grown battery production. But with European battery companies like Northvolt struggling, the EU may be inclined to use this tool to protect local firms.

Alternatively, the EU could introduce an economic impact assessment for FDI—similar to Australia’s Foreign Investment Policy or Canada’s Investment Act—as part of a new EU-wide screening mechanism. This assessment could consider factors such as local content, employment, joint venture requirements, technology transfers, and cooperation with local players. However, this would require a new instrument. Currently, the EU plays only a coordinating role in FDI screening, with member states deciding what investments to vet, and ultimately which ones to allow or block.

An update of the EU’s inbound screening legislation is planned for 2025, but will leave implementation to member states and even if some ended up including greenfield investments and the notion of “economic interest” in a revised law, the diverse approaches of EU member states would leave gaps for Chinese investors to exploit. Ultimately, this approach would only work if it was introduced on an EU-wide basis, and the chances of member states agreeing to this are very slim.

Addressing cybersecurity and data concerns

A tightening of data and cybersecurity standards could drive further localization in the EU. The EU is beginning a cybersecurity risk assessment of connected vehicles under NIS 2 guidelines, with the results expected in the spring of 2025. While it is unclear what sort of recommendations may come out of the assessment, the 5G toolbox presented by the Commission in January 2020 provides a guide for how it could approach the risks tied to connected vehicles. The downside of such a toolbox, as we have seen on the 5G issue, is that each member state is free to decide for itself whether and how to implement recommendations set out by the Commission.

Although vehicle type approval in the EU has traditionally been industry-led and not based on a manufacturer’s country of origin, rising cybersecurity concerns and US pressure could lead to a shift, with market access becoming more dependent on political, economic, and security considerations. Crucially the EU will have to decide whether it wants to use cybersecurity rules as an incentive for Chinese producers to localize or follow into the footsteps of the Biden administration and use cybersecurity rules to ban Chinese vehicles regardless of where they are produced.

Under GDPR, personal data is protected from unauthorized transfer to China, but non-personal data, such as geodata, is not. This could lead the EU to expand GDPR protections to include non-personal data, restricting foreign access through data localization requirements. Chinese OEMs may need to create local data centers within the EU, as XPeng and BYD have hinted at, and rely on local ICT suppliers that are viewed by policymakers as reliable and secure.

Outlook

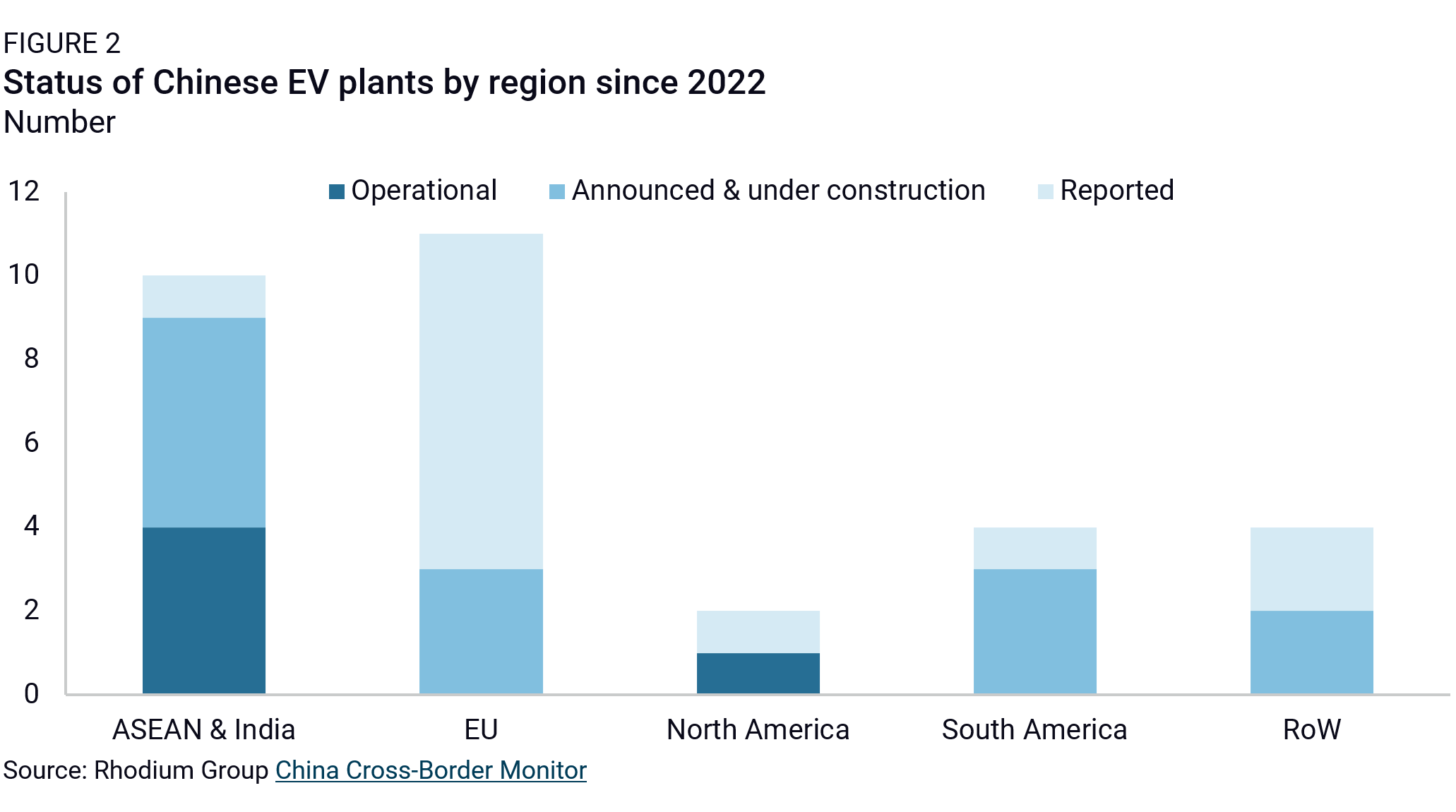

The regulatory uncertainty surrounding the EU’s approach to Chinese investments in the EV sector is already influencing FDI decisions. Some Chinese carmakers have delayed their plans to invest in the EU as they await clearer political signals. A recent report by China’s Chamber of Commerce to the EU (CCCEU) noted that “Chinese investors face more uncertainties and are becoming more cautious,” with an 82% drop in short-term confidence among surveyed companies. The survey also showed, however, that 64% of respondents still planned to invest in local factories within the next five years. Weaker-than-expected EV sales in Europe have also contributed to the uncertainty. Chinese EV exports to the EU have declined since peaking in 2022, and the share of EVs in total EU automotive sales has stagnated over the past two years.

Chinese EV companies are also under pressure from Beijing. While Chinese policymakers acknowledge the importance of overseas investment to bolster their national champions, they are also wary of reverse technology transfers and the potential loss of jobs and value creation in China. In a July meeting, China’s Ministry of Commerce advised automakers to keep their most advanced technologies within the country and focus their overseas operations on assembly. Battery maker CATL is reportedly struggling to secure regulatory approval to move capital abroad for its international expansion.

Caught between a rock and a hard place, Chinese EV producers are holding back with their EU investment plans. In the first nine months of 2024, only Chery confirmed plans to invest, through its joint venture with EV Motors in Spain. Some Chinese automakers have chosen to invest in countries bordering the EU, which may be seen as less politically risky. For instance, BYD has announced plans to invest $1 billion in a plant in Turkey that would have a capacity of 150,000 vehicles, and both Chery and SAIC are in talks with the Turkish government to establish manufacturing facilities. Meanwhile, investments in other regions where there is less scrutiny of Chinese EV investments, like Brazil and Thailand, have also surged. In Europe, there have been numerous reports of planned investments, but to date, very few of them have been confirmed.

Europe and China are not the only factors in this equation. Duties and investment restrictions in third countries will also shape the investment plans of Chinese OEMs. For example, if the US under a future Trump administration were to shift its stance and open up to Chinese EV FDI, this could reduce political pressure in the EU to condition Chinese FDI, while diverting Chinese financial resources away from Europe. Conversely, if the UK were to impose duties on Chinese EVs, Chinese carmakers may decide to increase their local content in the EU to meet rules of origin for EVs and batteries, and export to the UK.

Finally, the financial health of Chinese OEMs and evolving demand in China and abroad will also be critical. The ongoing price war in China, combined with export restrictions, is putting these companies under increasing financial strain. Limited resources may prevent them from meeting localization requirements or pursuing multiple overseas investments, potentially leading them to prioritize politically stable markets over the EU. These investment decisions will have long-lasting effects. Once they are made, suppliers are likely to follow, influencing the global automotive landscape for years to come.