Report

Clean Investment Monitor: Q1 2024 Update

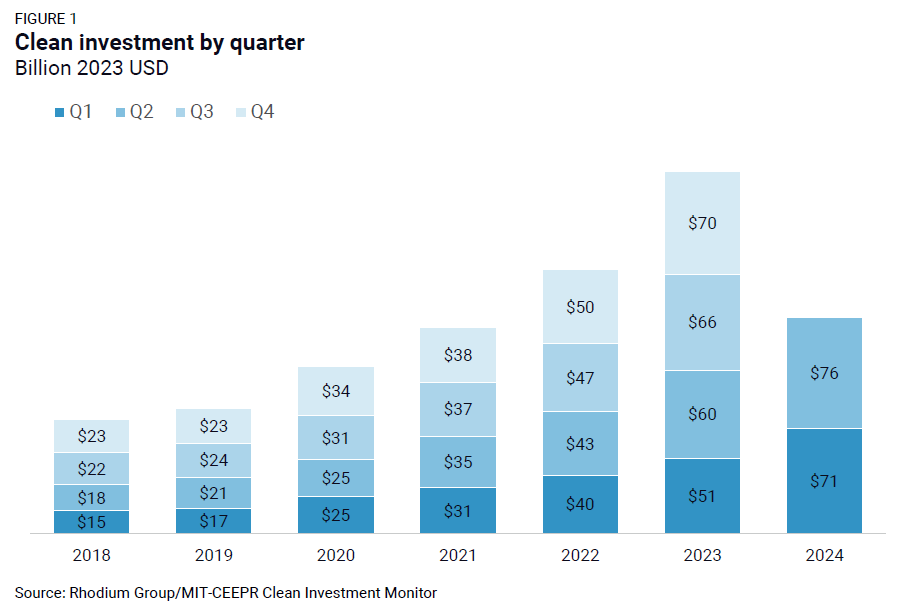

Clean energy and transportation investment in the United States continued its record-setting growth in Q1 of 2024, reaching a new high of $71 billion.

As the United States approaches the two-year anniversary of the Inflation Reduction Act, this report provides a comprehensive analysis of actual investments in clean technologies and infrastructure since its enactment.

As the United States approaches the two-year anniversary of the Inflation Reduction Act (IRA), this report provides a comprehensive analysis of actual investments in clean technologies and infrastructure since its enactment. From the second half of 2022 through the first half of this year, actual business and consumer investment totaled $493 billion, a 71% increase from the two-year period preceding the legislation.

Clean energy and transportation technology is proving to be one of the largest industries in the US economy. The investments in greenhouse gas (GHG) emissions-reducing technologies tracked over the past two years accounted for 4.5% of total US private investment in structures, equipment, and durable consumer goods in the United States, compared to 2.6% from H2 2020 through H1 2022. In Q2 2024 alone, clean investment represented 5.5% of all such investment. Since the IRA’s enactment, clean investment has accounted for more than half of the total US private investment growth. This report includes a detailed state-level breakdown of clean investment in the post-IRA period.

Investment in manufacturing clean energy and transportation technology posted the fastest growth, totaling $89 billion in the post-IRA period—more than quadruple the $22 billion invested in the two years prior to the IRA’s enactment. Over $1 in every $4 of clean investment went to manufacturing in Q2 2024, an increase from $1 in every $10 in Q3 2022. This reflects rapid and sustained quarter-on-quarter growth, with the lion’s share going into the electric vehicle supply chain.

The IRA also injected momentum into investment in clean energy production and industrial decarbonization, reaching $161 billion—a 43% increase relative to the preceding two years. Utility-scale solar and storage investments increased 56% and 130%, respectively, from their pre-IRA levels, while wind investment declined by 52%. The $28 billion invested in deploying the emerging climate technologies (ECT) of carbon management, clean hydrogen, and sustainable aviation fuels in the two years following the IRA exceeded the $21 billion invested in wind over the same period. Post-IRA investment in ECTs was nearly 12 times larger than its near-negligible baseline in the pre-IRA period, highlighting the law’s impact in scaling nascent technologies and building the markets necessary for the clean energy transition.

American businesses and households invested over $242 billion in the two years since the IRA became law in the purchase and installation of zero-emission vehicles (ZEVs), heat pumps, and distributed renewable generation, fuel cells, and storage systems. That’s a 58% increase relative to the previous two-year period. Purchases of ZEVs grew fastest, to $157 billion, nearly double pre-IRA investment. The purchase and installation of residential and commercial rooftop solar systems, other distributed renewables, fuel cells, and battery storage also increased robustly, up 40% in the post-IRA period to $43 billion. Heat pump investment was the outlier, declining 4% relative to the two years preceding the IRA to $42 billion, a market downturn caused by the lagging residential construction sector.

This report summarizes key trends from our Q2 2024 update to the Clean Investment Monitor database, tracking public and private investment in clean technologies in the US. In this report, we also release the first quarterly results of our detailed bottom-up model of actual federal government investment in clean energy and transportation. We estimate a total of $78 billion in federal investment—including tax credits, grants, and loan guarantees—occurred in the post-IRA period. We estimate that private spending in those technologies over the same time period was 5-6 times larger than public investment. We share a breakdown of federal investment by category and state.

Report

Clean energy and transportation investment in the United States continued its record-setting growth in Q1 of 2024, reaching a new high of $71 billion.

Report

Clean energy and transportation investment in the US set another record in Q4 of 2023, reaching $67 billion—a 40% increase from Q4 in 2022.