Full Circle: Mexico’s Resurgence Amid US-China Trade Frictions

Mexico is attracting substantial, long-term de-risking investment—outpacing its closest diversification peer, Vietnam. The country is also attracting Chinese FDI, which is bound to attract scrutiny from Washington as the USMCA review approaches.

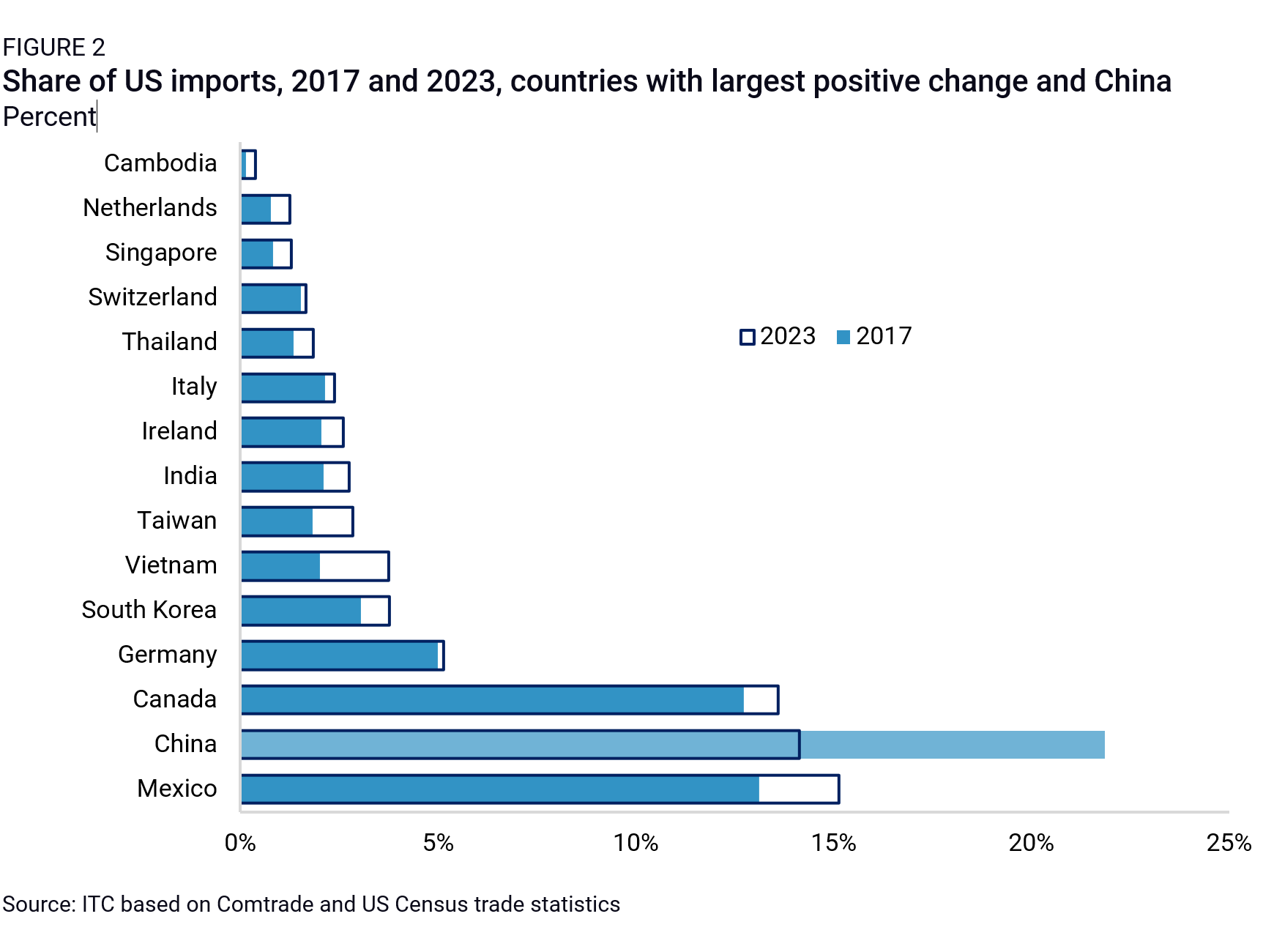

Mexico has emerged as a key diversification partner for the US, increasing its share of US imports by over two percentage points from 2017 to 2023—more than any other country over the same period—and displacing China as the US’s top trade partner for the first time since 2006.

While this may appear on the surface as a major de-risking feat, US policymakers are growing concerned that the trend might be masking a persistent and growing Chinese presence in supply chains running through Mexico, and that some trade may include illegal transshipments meant to circumvent US tariffs.

In this note, we review US-Mexico-China ties and unpack the current role of China in Mexico’s re-emergence as the US’s top trade partner. The reality is nuanced: Mexico is attracting substantial, long-term de-risking investment—outpacing its closest diversification peer, Vietnam. The country is also attracting significant Chinese FDI interest, which is bound to attract more scrutiny from Washington as the six-year review of the United States-Mexico-Canada Agreement (USMCA) approaches.

Mexico’s comeback

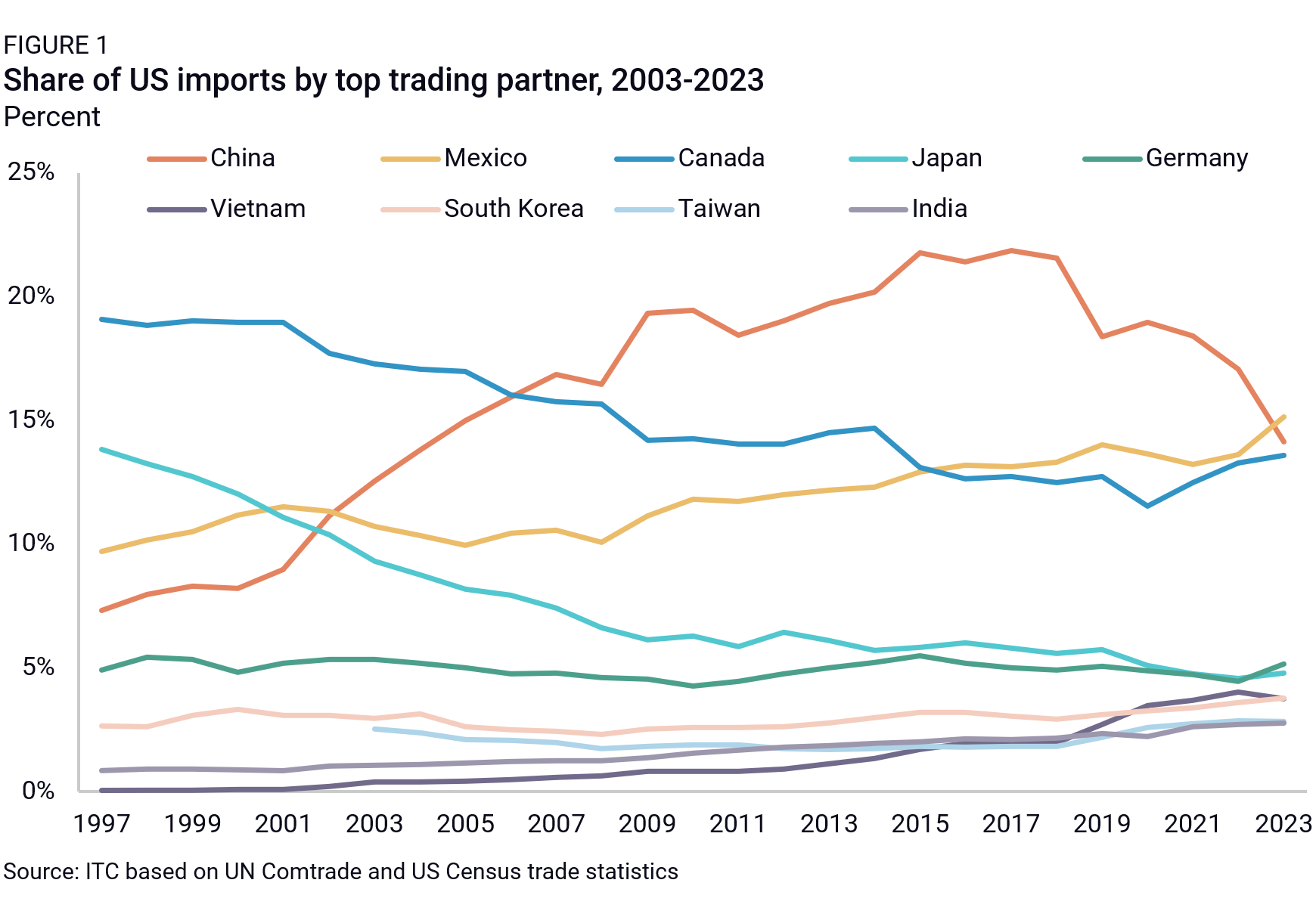

On the back of the US-China trade war, rising geopolitical tensions, and a growing array of US policies compelling firms to de-risk their China value chains, Mexico has emerged as the US’s top diversification partner. In 2023, Mexico reclaimed its place as the largest source of US imports, 21 years after it was overtaken by China (Figure 1). Mexico gained more US import market share in recent years than any other country: 2.02 percentage points (pp) from 2017 to 2023 (Figure 2). Vietnam, in comparison, has gained 1.74pp, and Taiwan, the third-largest beneficiary of deteriorating US-China trade ties and a major player in semiconductor and electronics value chains, has gained a mere 1pp.

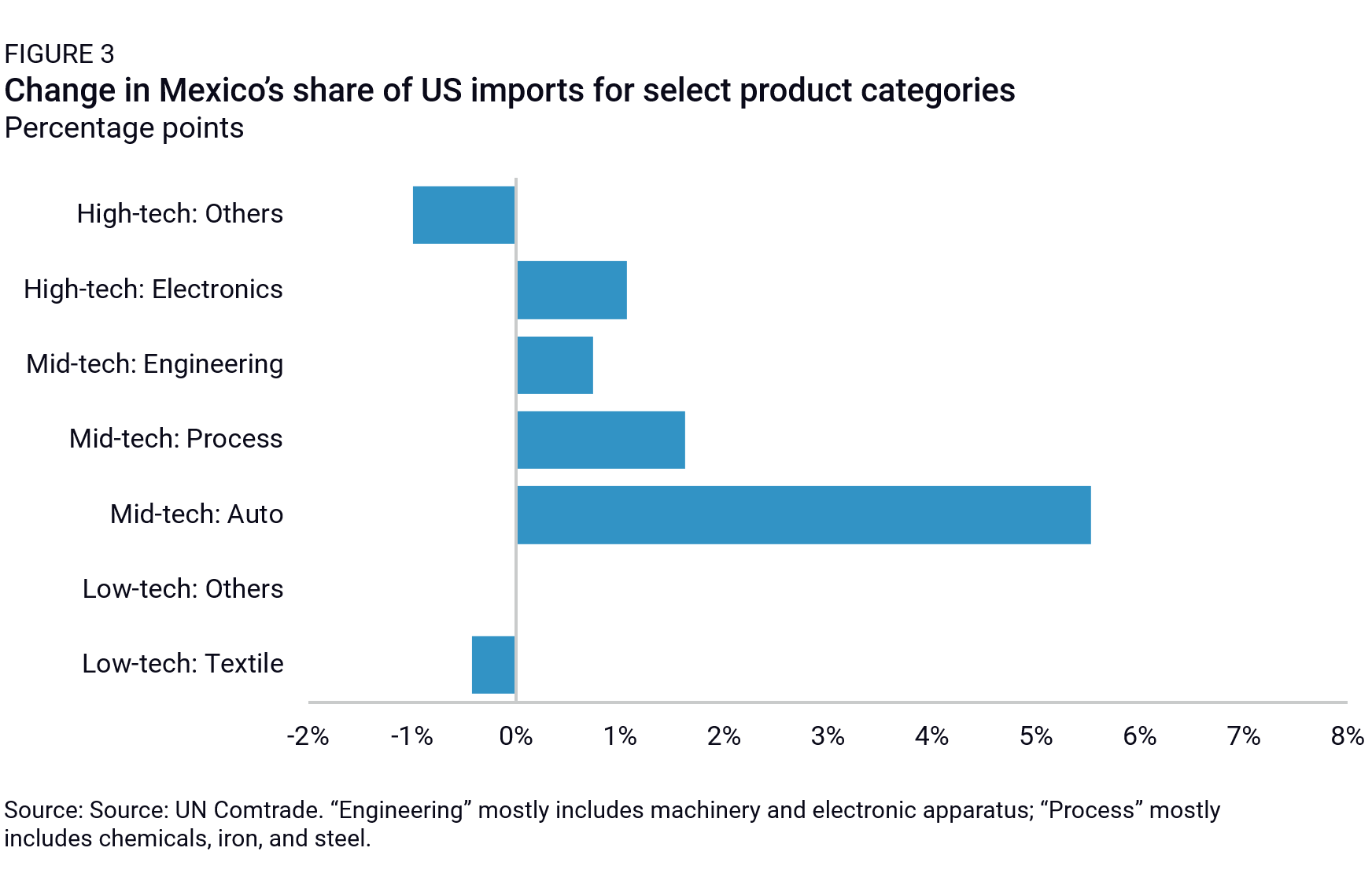

Much of that growth has been driven by automotive trade. Mexico grew its share of US auto imports by 5.5pp over 2017-2022 (Figure 3), and vehicles now make up almost 30% of Mexican exports to the US. USMCA provisions on North American rules of origin and Mexico’s abundant, skilled, and cost-efficient workforce make it extremely attractive to produce autos in Mexico for the US market. Mexico has also grown its share of US imports in a range of other sectors, including consumer electronics, medical devices, and power generating and electrical equipment.

In terms of direct investment, Mexico maintained its share of US manufacturing FDI over 2017-2022. The country received $5.1 billion in US manufacturing FDI in 2022, up more than 40% from the 2014-2019 average of $3.4 billion according to data by the US Bureau of Economic Analysis. This contrasts with a 0.7pp drop in China’s share of US manufacturing FDI over the same period. With near-shoring and China diversification trends gaining traction, US firms have likely been inclined to pick a familiar market close to home and ramp up often pre-existing production capacity in Mexico. In addition to its proximity to the US market, Mexico offers deep trade integration with North American partners through the USMCA, physical transportation linkages with the rest of the continent, and a cost-efficient, skilled, and abundant labor force for manufacturing. Investors must of course weigh these structural advantages against concerns over Mexico’s persistent security and corruption challenges, slumping private sector investment, backtracking on energy reform, and populist policy agenda under a Morena-led government. But US de-risking policies targeting China appear to have nonetheless sustained and increased US FDI inflows to Mexico.

US through Mexico?

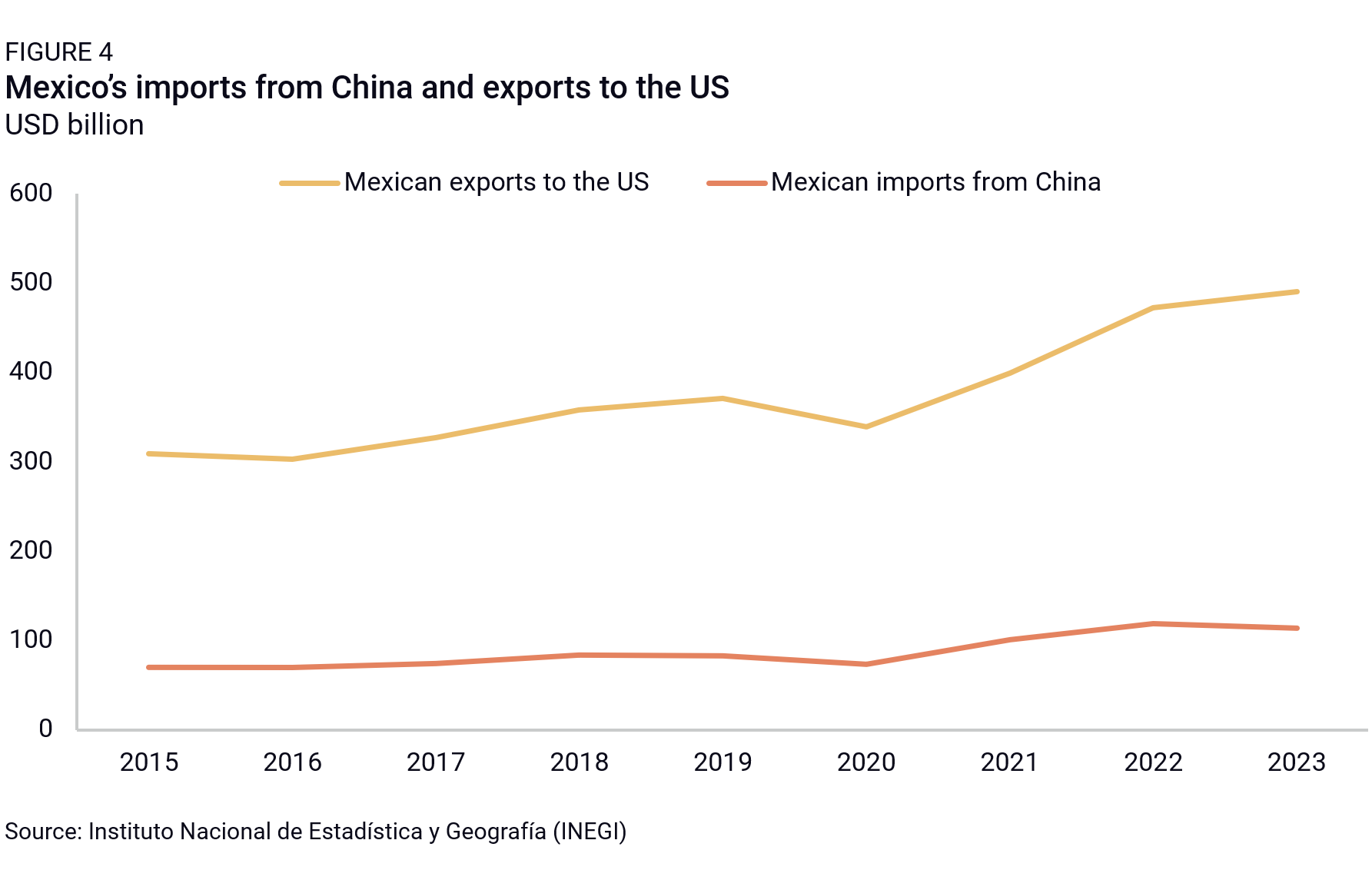

Some US policy circles have eyed Mexico’s resurgent trade status with skepticism, questioning whether it truly represents diversification away from China or if it is simply a reorganization of trade with Mexico-to-US trade flows that remain deeply China-linked. Recent academic papers have pointed out that the increase in Mexican exports to the US have been accompanied by increased Mexican imports from China, suggesting that recent diversification trade patterns could still be shallow, with mostly assembly-type activities returning to Mexico to avoid high US trade barriers.

The rise in Mexico’s share of US imports is not particularly surprising, however. As global manufacturers and exporters scrambled to respond to hiked US-China tariffs during the Trump administration, many took partial (and what they probably hoped to be temporary) steps to keep access to the US market with a minimum amount of capital investment. Assembly activities moved first, often to countries that either provided low-tariff access to the US market (Mexico under USMCA) or low tariff barriers on imports of Chinese inputs (Vietnam and much of Southeast Asia under the ASEAN-China Free Trade Agreement). In this context, increased exports from Mexico and Vietnam to the US were naturally accompanied by rising Chinese exports to these locations. Moving assembly activities is costly but easier than recreating China’s extremely diverse networks of suppliers overseas.

This shallow diversification however has raised suspicion, not only because it means that deep indirect ties to China remain despite US de-risking policy, but also because some of these activities could be illegal. Mere transshipments and tariff circumvention, without substantial transformation happening in Mexico, would be in violation of US law.

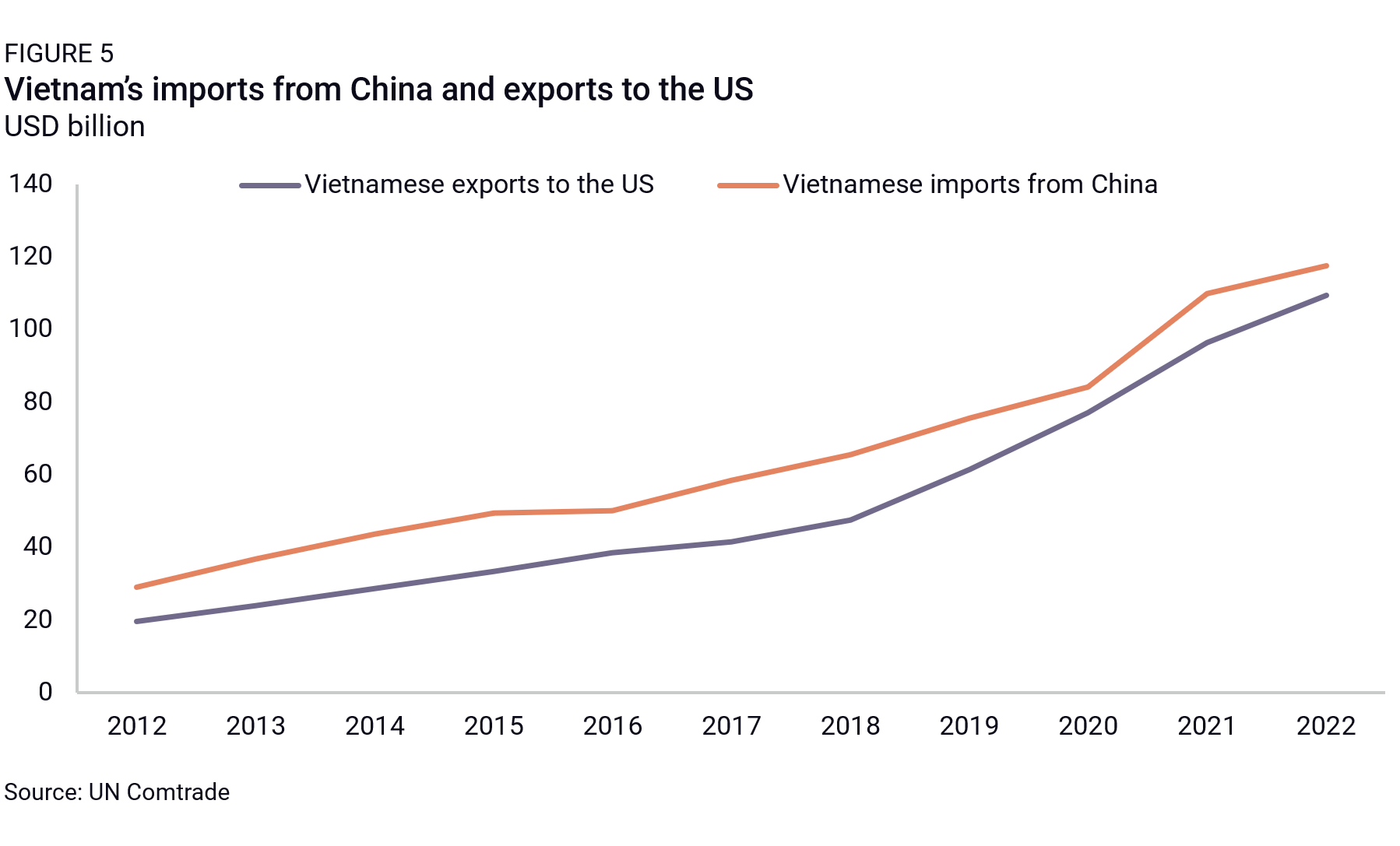

Proving transshipment or circumvention is challenging, particularly in a country like Mexico, which has for decades imported inputs from China for its own export-oriented sectors. Increases in Mexican exports to the US have clearly correlated with increasing Chinese exports to Mexico (Figure 4). But the relationship is not equal, and its correlation is much weaker than with other diversification partners like Vietnam (Figure 5). This suggests that Mexico’s growing exports to the US are not merely Chinese exports rerouted through Mexico.

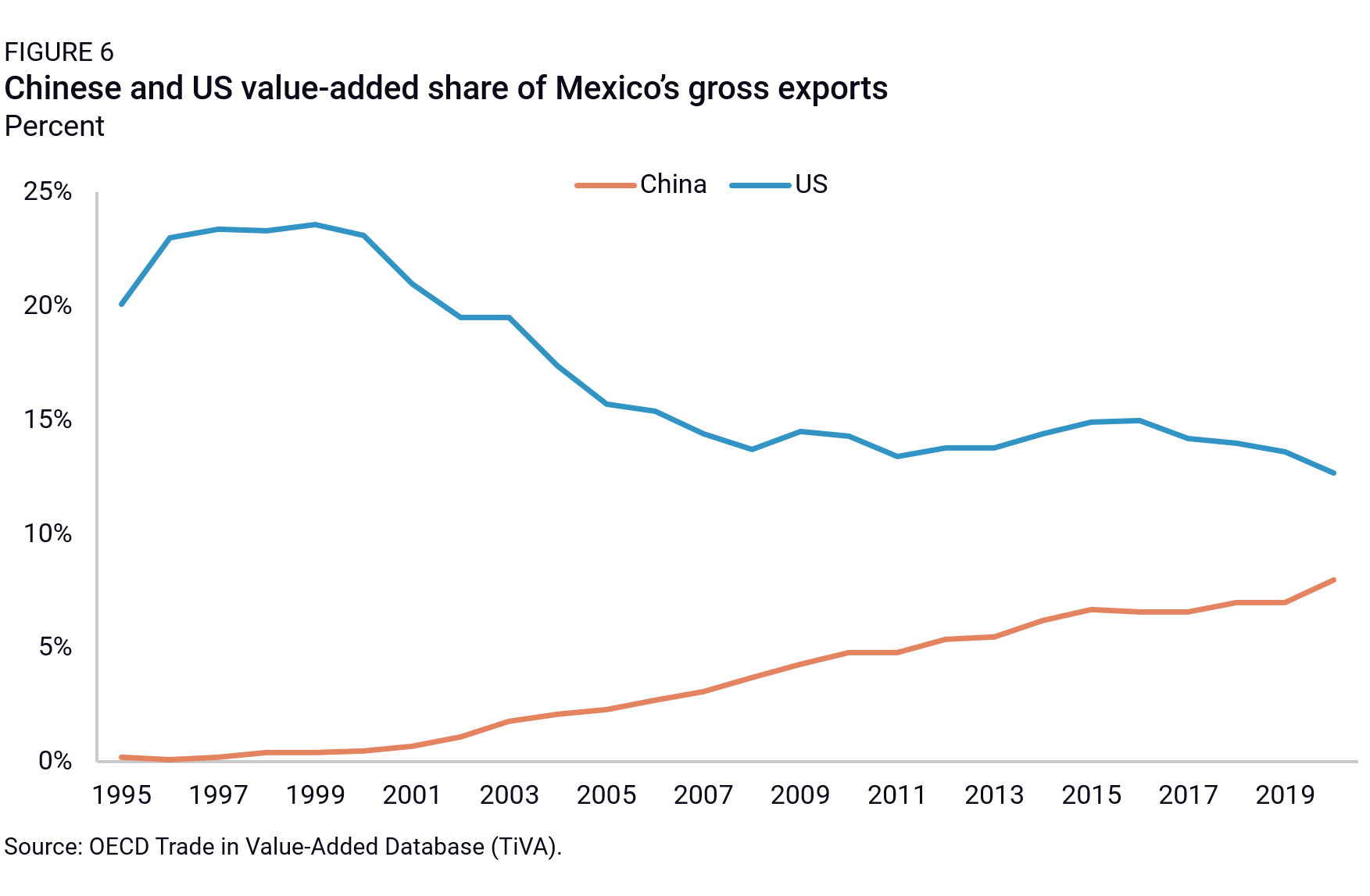

Data on trade in value-added also shows a slow and persistent increase in Chinese value-added as a share of Mexico’s exports, but there was no jump in 2017 amid a rise in US tariffs and global trade relocation (Figure 6). The gradual increase is also in line with China’s overall capture of global manufacturing value-add over the same period.

Chinese firms in the lead?

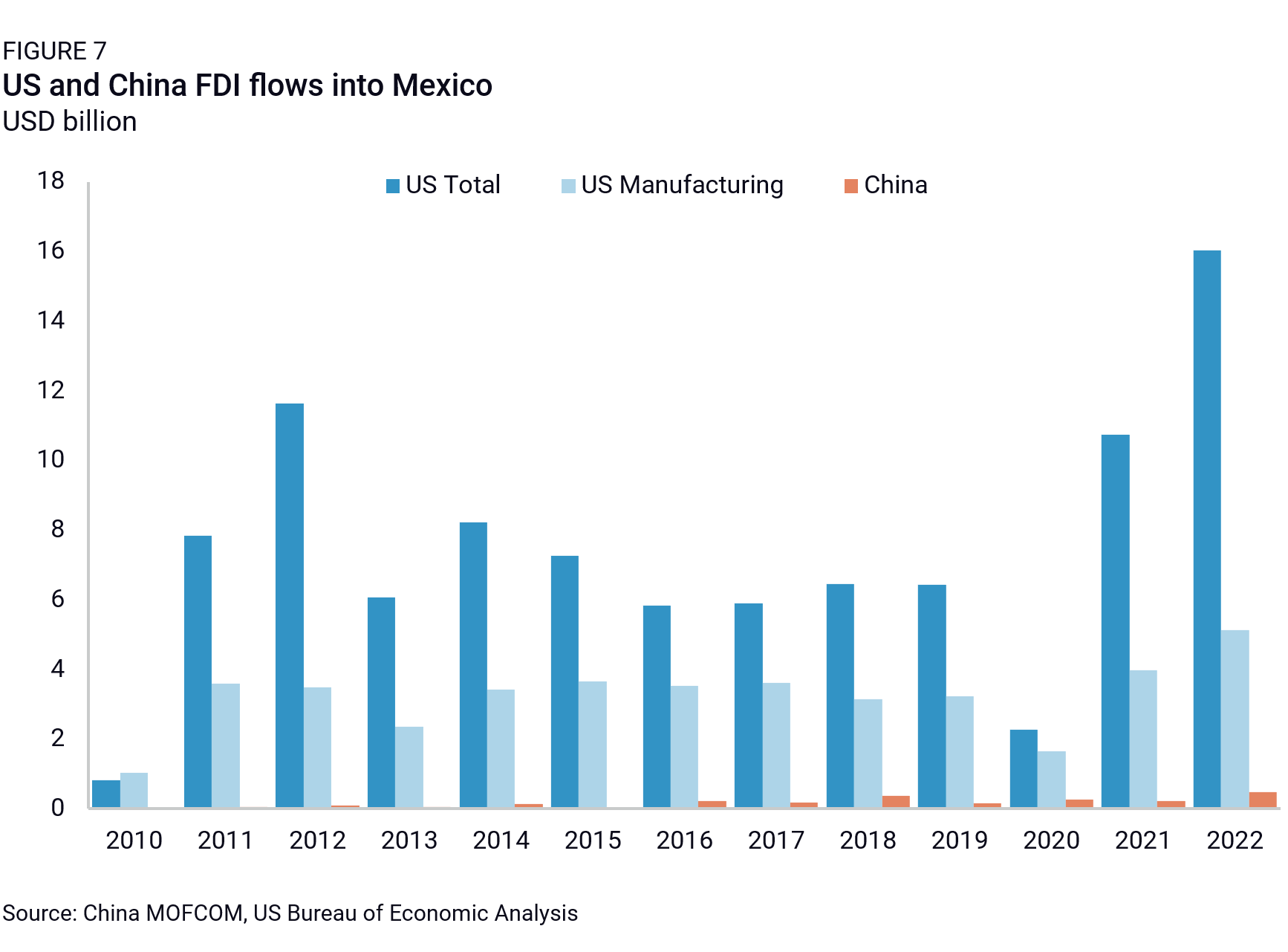

Recent political debates and media reports also suggest that much of the investment underlying increased Mexico-to-US trade is Chinese. A closer look at available datapoints again paints a more nuanced picture. Official data from China’s Ministry of Commerce (MOFCOM) shows low levels of Chinese FDI to Mexico, consistently below half a billion dollars per year (Figure 7). MOFCOM FDI data comes with well-known limitations though, especially in tracking Chinese outbound investment to emerging and developing economies. As a result, the MOFCOM figures likely underestimate Chinese FDI activity in the country.

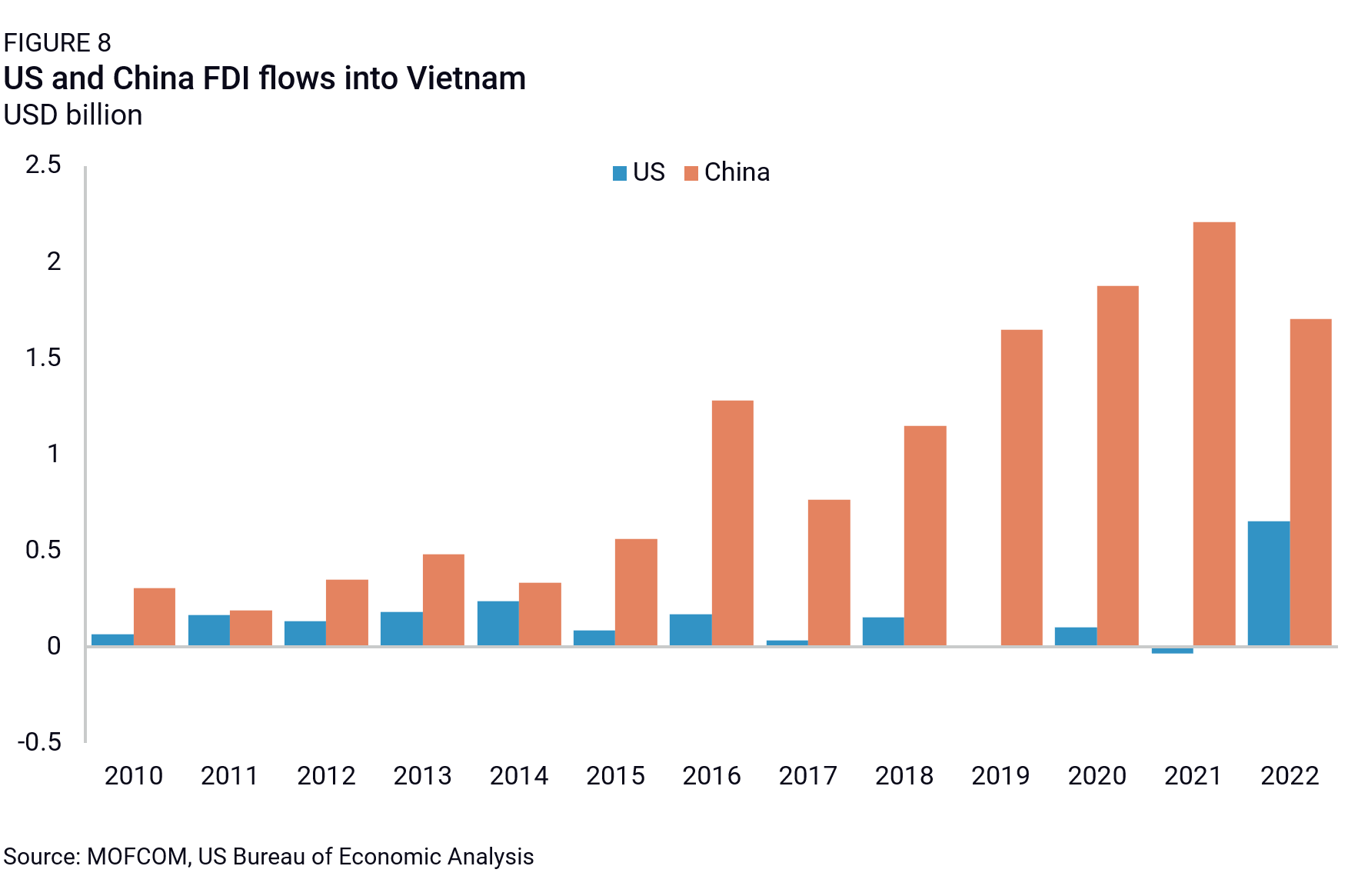

Still, these figures are helpful in showing how, over the past five years, US diversification via Mexico has been much less driven by Chinese firms than US diversification through other countries like Vietnam and other parts of Southeast Asia, where the balance of US and Chinese FDI is largely reversed (Figure 8). In Southeast Asian countries, Chinese firms appear to have moved in quickly and substantially since the start of the trade war to relocate manufacturing, especially in electronics, in light of new geopolitical pressures.

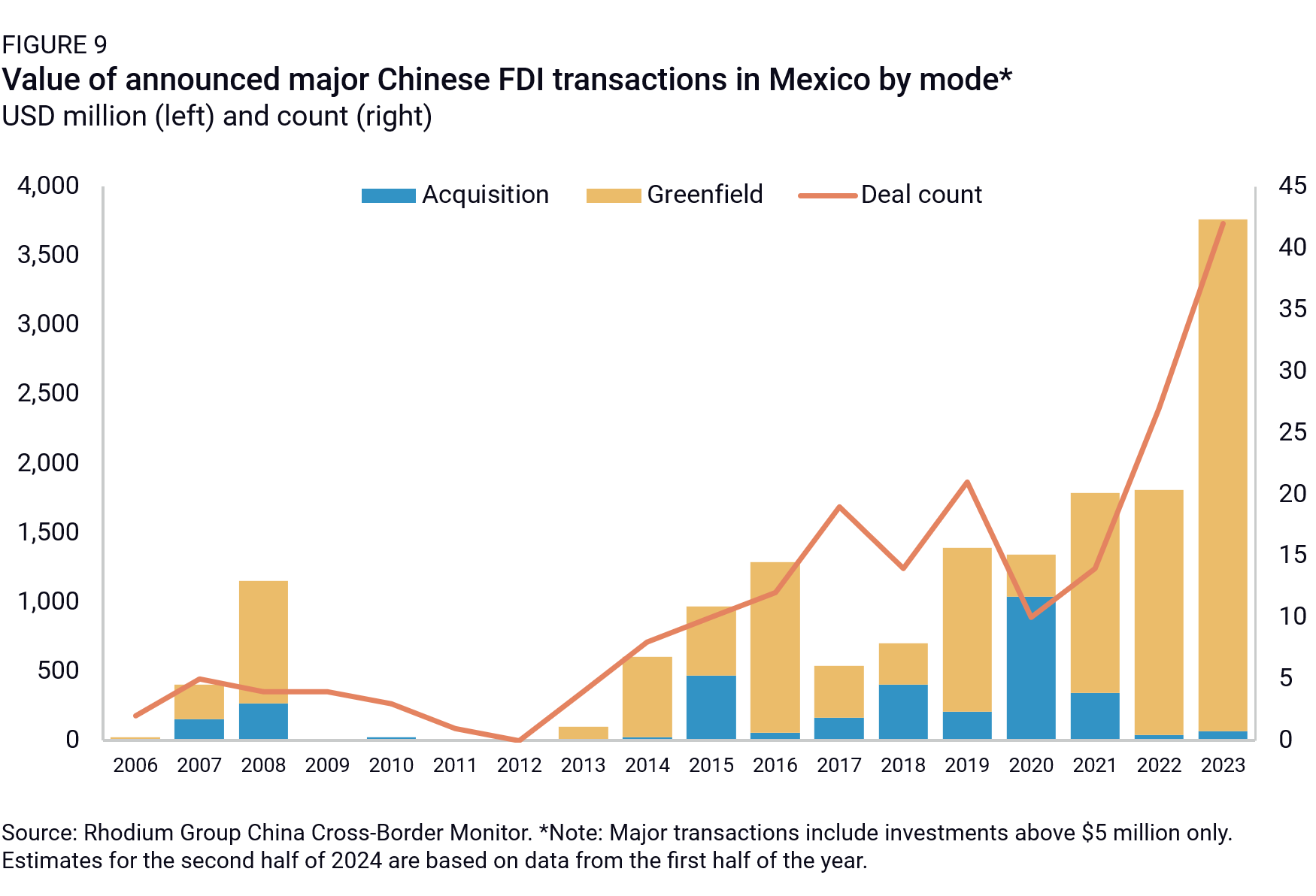

What MOFCOM data fails to capture is the substantial uptick in Chinese FDI into Mexico in 2023. Using a transaction-based approach, preliminary Rhodium Group data shows that announced Chinese FDI transactions in the country more than doubled in 2023, to an estimated $3.7 billion. This stood well above the previous decade’s yearly average of about $1.3 billion (Figure 9). The number of single FDI transactions was also up almost 60% year-on-year in 2023. This puts Chinese investment in Mexico much closer to the US’s $5.1 billion in manufacturing FDI in 2022—though still far below its $16 billion in total FDI into the country the same year, and miles behind US’s FDI stocks in the country, built over decades of close economic ties.

Again, this recent uptick in Chinese FDI to Mexico should come as no surprise. Chinese firms, looking to preserve global market share in a fraught geopolitical environment and worried about growing economic challenges in China, also see Mexico as a diversification destination. And as export-oriented automobile and electronics activity picks up in the country, Chinese component suppliers are likely following the pack in supporting new factories filling local industrial parks.

Our transaction data show that the vast majority of China’s announced FDI in Mexico since 2021 has been greenfield investment, corroborating the idea that Chinese firms are moving in to produce locally—both to serve Mexico’s consumers and to access the US market. Additionally, a significant share of China’s investment over the past few years was in high-end manufacturing industries, including automotives, electronics and electrical equipment, and machinery—following closely areas of US-Mexico trade growth.

Onwards in Mexico

Going forward there are several factors that could drive Chinese firms to further expand their manufacturing footprint in Mexico:

- Intensification of US-China trade tensions. With high tariffs here to stay, Chinese firms will be more incentivized to invest in Mexico—for substantial final assembly at a minimum, and potentially more. Because China’s lifting of zero-COVID restrictions at the end of 2022 is making scouting for alternate manufacturing locations much easier, we would expect yet another strong year of Chinese FDI announcements in 2024.

- An “agglomeration effect” pulling in more steps of the supply chain into Mexico. Assembly activity relocation was a natural first step in addressing increased trade barriers. With more final assemblers now operating in Mexico, the incentives will be much higher, and the risks lower, for upstream suppliers—many of which are Chinese—to follow in their footsteps.

- The electrification of the US auto sector and the pervasiveness of Chinese firms in EV supply chains. More Chinese suppliers will be intertwined in Mexico’s auto supply chains, as some will decide to move closer to the end market. The 2023 announcement of Tesla’s $10 billion investment for a gigafactory in Monterrey is already attracting a network of suppliers that will invest to be part of the Tesla ecosystem. Chinese auto OEMs are also gradually building market share in Mexico, as consumers are drawn to affordable premium ICE models offered by Chery, MG, and JAC. According to MarkLines data, Chinese automakers grew their local market share in Mexico from 6.5% in 2022 to 9.4% in 2023. As these companies test the Mexican market with new showrooms, they may choose to move production as well.

- Vietnam under increased scrutiny from the US administration over issues of transshipment, and from Congress over its human and labor rights track record. Chinese firms may see the need to diversify beyond Vietnam, with an eye toward Mexico as a safer bet. That said, scrutiny over transshipment and labor rights could just as easily follow Chinese firms to Mexico, which is held to higher USMCA standards and will be under scrutiny in 2026 when the trade agreement is up for joint review by all parties.

The path for Chinese investors in Mexico is anything but smooth. Several emerging obstacles lie ahead:

- Eligibility for US subsidies. Depending on how the US’s final IRA implementation language shakes out, Chinese firms will need to navigate foreign entity of concern (FEOC) definitions to assess whether there is room for Chinese stakes in foreign-owned subsidiaries below a 25% threshold. The IRA’s tax credit for leased vehicles, however, is for now not subject to FEOC restrictions, creating an opportunity for Chinese EV suppliers eyeing an expanding US market for leased vehicles. Highly cost-competitive Chinese firms could also decide to forego IRA tax credits altogether.

- Cybersecurity controls. While the US has been busy debating how high tariffs should go to keep Chinese-made EVs out of the US market, cybersecurity measures may be a shortcut to the same political end. The US Commerce Department has launched an investigation into ICT risks tied to connected vehicles with a particular focus on how Chinese-made inputs can lead to nefarious cyber activity, from espionage to sabotage. If Chinese cars and Chinese-made ICT inputs for EVs are effectively barred from the US through these restrictions, then Chinese firms may need to reconsider their plans to supply the US market from Mexico. BYD’s pending investment in Mexico will be the biggest signpost to watch on how a leading Chinese firm is assessing US political risk.

- New AD/CVD regulations. The US recently expanded scope and authority to pursue anti-dumping and countervailing duties with a new Commerce final rule on improving and strengthening the enforcement of trade remedies. The rule would allow Commerce to pursue cases over a country’s lack of protections for IP, human and labor rights, and the environment. It would also allow the US to argue threat of injury to US industry over transnational Under the new rules, the US could start investigating Mexico-made inputs or products by Chinese firms if those firms receive subsidies back in China.

- USMCA under review. USMCA comes under a joint review by all parties on July 1st, 2026. The review mechanism was introduced during the Trump administration as a way to maintain leverage over its North American trading partners and compel resolution of outstanding trade disputes. If one party chooses not to approve a 16-year USMCA extension during the six-month review, then there will be a joint review period every subsequent year up until the agreement’s sunset in 2036. A second Trump administration would likely drive a hard bargain during this review period and impose demands that Mexico block Chinese investment and US-bound trade in strategic industries, including ICT, automotives, and medical equipment. Even a second Biden administration may see an opportunity to impose supply chain resilience requirements that, for example, impose a quota on Chinese imports entering the US via Mexico for sensitive industries, with a phase-out for stickier Chinese dependencies.

Beyond the question of Chinese investment, there are deeper structural factors that will shape to what degree Mexico will benefit from US nearshoring trends:

- Talent availability. Mexico may hit a limit in terms of skills availability for sectors in high US demand, such as the manufacturing of semiconductors, advanced electronics, biotech, and other strategic areas where Mexico still needs to build up a talent pipeline, specialized infrastructure, and general know-how to displace China-based manufacturing. Labor costs will also grow quickly on the back of pent-up demand. Foreign investors may be constrained by Mexico’s 10% foreign labor cap in trying to build out more self-sufficient factories. This is a particular challenge for Chinese firms in Mexico struggling to overcome language barriers and source local managers to effectively coordinate with counterparts back in China.

- Water scarcity. In semi-arid northern Mexico, where most FDI is concentrated, water availability can quickly turn into a political flashpoint if locals, already under tight water restrictions, perceive the influx of big manufacturing plants as exacerbating water shortages. Mexican president Andrés Manuel López Obrador already signaled to Tesla in February 2023 that its investment in Nuevo León would be blocked if there are not sufficient guarantees on water supply. The Mexican president urged Tesla to instead build its gigafactory in the south—where water supply is more stable, labor is cheaper, and, conveniently, López Obrador and his Morena party derive much of their political support—though the investment in Nuevo León did eventually proceed.

- Mexico’s economic policies. Mexico’s backsliding on energy reform and statist approach to managing the energy sector under Morena’s leadership has stifled private investment. The north of the country has access to cheap and plentiful US natural gas, but Mexico has also fallen behind in building out the country’s critical energy infrastructure. López Obrador is making a big bet that investment will follow the buildout of the Interoceanic Corridor megaproject, which is designed to rival the Panama Canal in connecting the Pacific and Atlantic Oceans with a corridor of industrial parks and upgraded rail and highways running through Oaxaca and Veracruz in the south. Mexico’s ability to spread foreign investment to the south will depend on whether companies will be willing to bear higher transport and energy costs and whether they will find sufficient skilled labor to compete with the ease of operating in Mexico’s northern borderland with the United States.