Fueling a Transition Away from Fossil: The Outlook for Global Fossil Fuel Demand

New insights into the evolution of global fossil fuel demand over the coming decades provide a signpost for where additional action is needed.

At COP28 in Dubai, countries agreed to transition away from fossil fuels, a critical part of meeting the goals of the Paris Agreement and a formidable challenge given that fossil fuels deliver two-thirds of total global energy demand today. Thanks to the past few decades of policy and technology innovation, we’re on track to dramatically reduce fossil fuel use in power and road transport through mid-century. However, fossil use in industry, aviation, and shipping is slated to remain stubbornly high or grow in the same timeframe. Natural gas demand in particular is on track to increase as much as 50% by 2050. With heightened focus on the potential impact of a continued rise of US LNG exports, it’s more important than ever to understand the drivers of global gas demand in the coming decades. This note provides an outlook for global fossil fuel demand through the end of the century based on the Rhodium Climate Outlook—probabilistic projections of the likely evolution of global energy systems and GHG emissions. These insights into the evolution of global fossil fuel demand provide a signpost for where additional action is needed to accelerate policy ambition and technology innovation sufficient to transition the world away from fossil fuels.

The challenge ahead

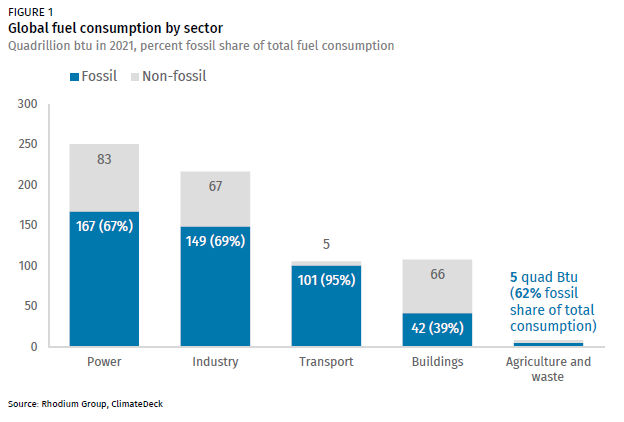

With the adoption of the COP28 UAE Consensus, Parties to the Paris Agreement agreed to a historic effort to “transition away” from fossil fuels. This represents a critical step toward meeting global climate targets, as well as a monumental challenge. Fossil fuels today are pervasive—coal, oil and gas together supply two-thirds of global energy demand. All major sectors of the global economy rely overwhelmingly on fossil fuels for energy, ranging from around 40% in the buildings sector to 95% in transportation (Figure 1).

A transition away from fossil fuels has already begun in certain parts of the energy system. Drawing from the Rhodium Climate Outlook (RCO)—probabilistic projections of the likely evolution of global energy systems and GHG emissions—below we provide an overview of the likely trajectory of fossil fuel demand absent a major acceleration in the pace and scale of climate policy and technology innovation. These findings are not a prediction, but a starting point for assessing where additional action is needed.

Fossil fuel demand by sector

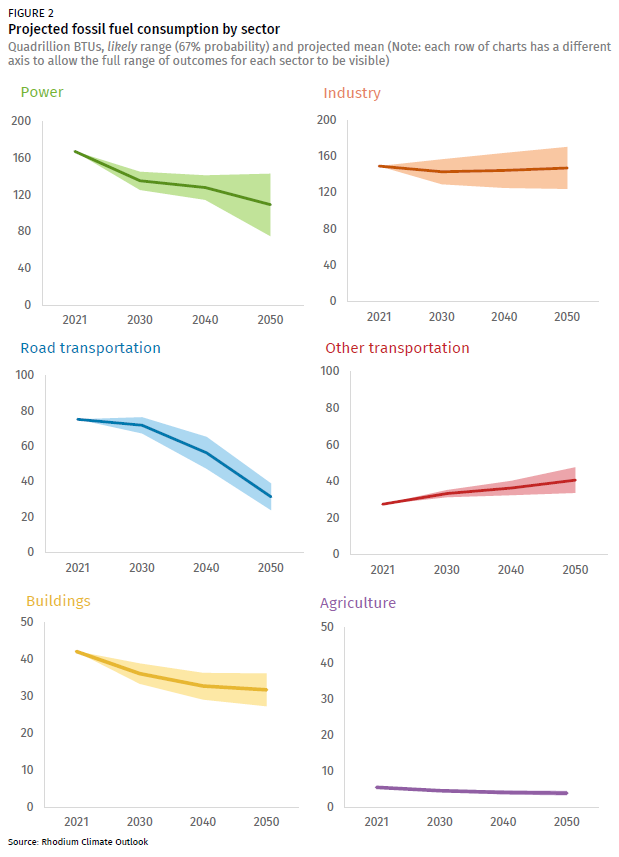

In the last decade, renewable power generation has grown exponentially thanks to a multi-decade legacy of policy action coupled with investment and innovation that led to substantial cost reductions for solar and wind. As a result, we find that, in our likely range (67% probability), the use of fossil fuels in the electric power sector falls by 15 to 55% by 2050 from today’s levels globally (Figure 2). This is largely driven by a reduction in coal-powered generation, which falls by more than half by 2050 from today’s levels in our mean projection. Natural gas power generation, on the other hand, increases by 20% in the same timeframe. Without a step change in policy and technological progress, natural gas continues to play a substantial role in balancing intermittent renewables and meeting bulk electricity demand in fast-growing markets. In 2050, the power sector accounts for 30% of all fossil consumed in our mean projection.

If the world remains on its current trajectory, we find the starkest cuts in future fossil demand will come from on-road transportation. Oil consumption in this sector likely falls by 50% or more by mid-century as electric vehicles displace conventional gasoline and diesel cars and trucks. These gains are partially offset by growing demand for other forms of transportation—air travel and shipping—both areas where policy and technology are further behind. On average, we find that 20% of fossil demand comes from transport by 2050.

While plummeting coal in power and oil in road transport drive overall fossil consumption down in those sectors through mid-century, the current pace of policy and technology innovation is unlikely to drive meaningful reductions in fossil fuel demand in the industrial sector by mid-century. Absent a step change in technology innovation and policy support, we find that industrial demand for coal and oil remains steady while industrial demand for natural gas grows across our likely range. Industrial uses account for 40% of total fossil demand in 2050 in our mean projection.

Within industry, there is a more than 50% chance that fossil demand for cement grows through mid-century. Fossil fuels used for plastic and chemical feedstocks likely stay level or rise. The only sectors where we see fossil fuel demand remain steady or decline across our likely range are iron and steel—where increased availability of scrap drives a switch from coal-fueled blast furnaces to electric arc technology—and petroleum extraction and refining, as electrification of on-road transportation replaces oil.

Fossil fuel use in buildings likely falls through mid-century, driven by efficiency improvements and increasing electrification, as do fossil fuels used for tillage and crop management. These sectors account for 9% and 1% of fossil demand in 2050, respectively.

A rise in non-energy fossil fuel use

While the majority of fossil fuels are combusted to produce power and heat, roughly 13% of global fossil fuel consumption feeds non-energy purposes, primarily in the industrial sector. This includes fuel used as feedstocks for plastics and ammonia production, coal used as a reductant in ironmaking, and non-energy fuels used directly for their physical properties, including waxes, solvents, and lubricants.[1] Tackling emissions from non-energy fossil fuel use has been largely neglected by policymakers, analysts, and advocates due to lack of complete or consistent data and methodologies, and the complexities of the underlying processes. Indeed, the COP28 outcome on the fossil fuel transition seemingly excluded these sources of fossil fuel demand in its call to transition from fossil “in energy systems”. With fewer cost-effective solutions and little policy attention, we expect to see the non-energy share of total fossil consumption increase from 13% today to 19% on average by 2050.

Fossil fuel demand by fuel type

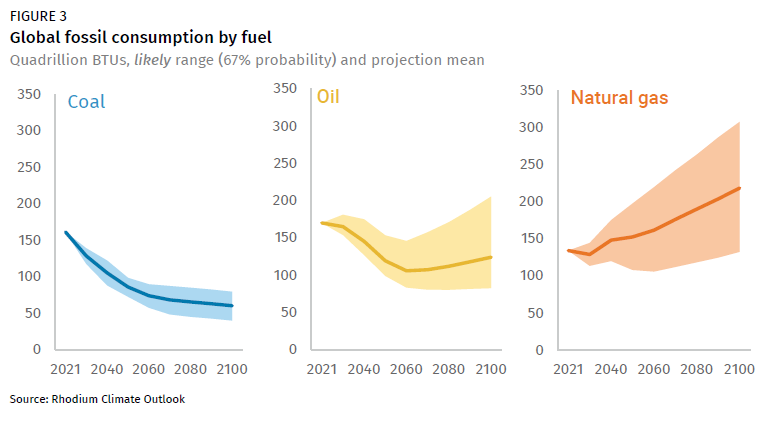

The resulting outlook for global fossil demand shows that progress in transitioning away from fossil fuels is mixed. Thanks to cheap and widely available wind and solar, the world is on track for a rapid decline in coal consumption across the power sector, driving a 40-55% reduction from today’s levels in overall global coal demand by mid-century (Figure 3).

Oil experiences a similar decline (20-40%) through mid-century—driven by electrification of ground transportation—but that trend likely slows or reverses course as transport demand rises, particularly in the aviation and marine sectors where limited policy and fewer technology alternatives maintain oil’s dominance as a transport fuel. Without sufficient policy drivers and fossil alternatives for gas in industry and firm balancing power, gas demand remains strong through the end of the century, likely remaining at today’s levels or rising as much as 47% by 2050 and 126% by 2100.

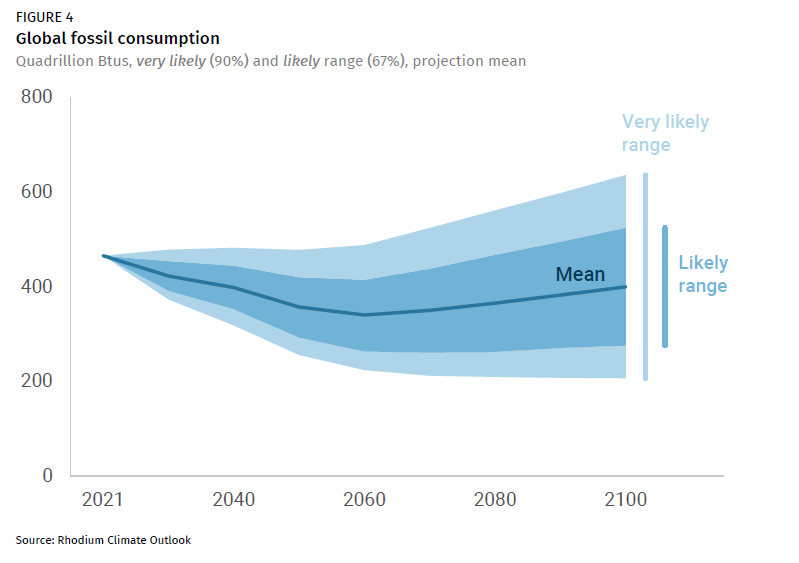

Taken together, economy-wide fossil demand is very likely (90% probability) to flatten or decline through mid-century, before we see those gains level off or reverse (Figure 4).

Accelerating the transition

In the coming decades, global energy demand will likely grow by 16-54% as economies continue to develop and grow. In the absence of additional policy or technology innovation, fossil fuels will continue to supply a substantial share of global energy demand by mid-century—33 to 44% in our likely range—relative to 67% today. Transitioning away from fossil fuels while also providing for the massive growth in overall energy demand will be a significant challenge, requiring a systemic approach to identifying and investing in low-cost, low- or zero-emission alternatives. To do so, we must look at where fossil demand persists over the coming decades for each specific end-use sector. Projections of future fossil demand from the Rhodium Climate Outlook can provide a roadmap of where fossil demand persists and accelerated policy and innovation to reduce fossil fuel demand are required.

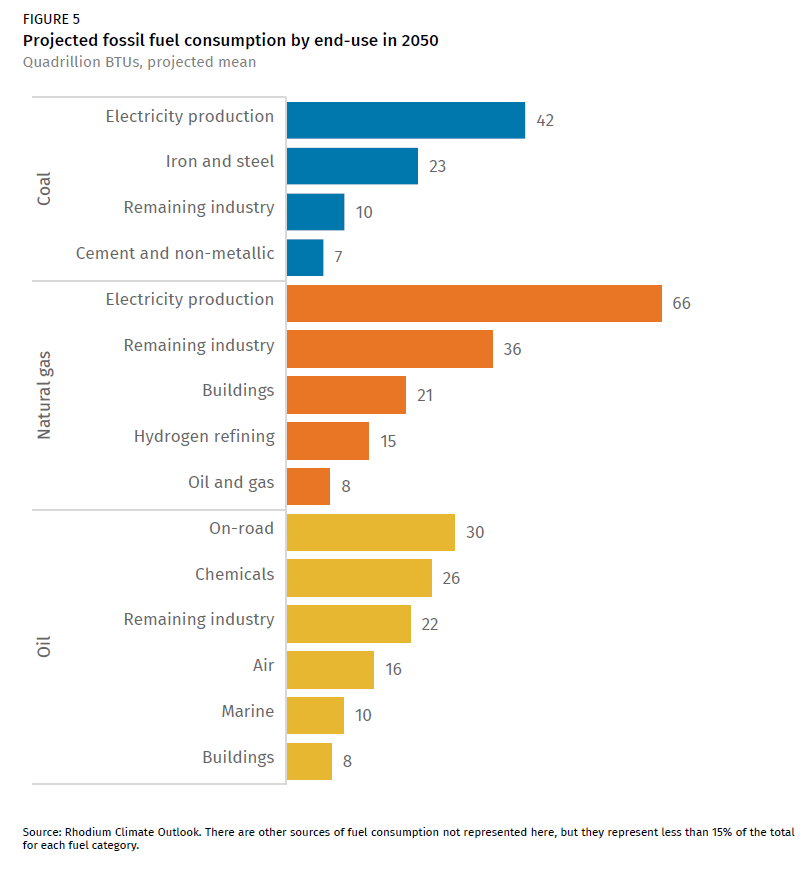

To date, most investment and policy efforts have focused on electric power and ground transportation—and rightfully so as the two largest sources of energy-related emissions globally. But there’s still more to be done, and these two sectors remain the single largest source of demand in each fossil fuel type (Figure 5). In power, eliminating fossil on the grid will require expanded support for wind and solar, complemented by innovation in energy storage and other zero-emitting technologies that can balance intermittent generation. This will help address the remaining 9% of coal and 15% of gas as a share of power sector demand that persists by mid-century in our mean projection.

In transport, we need to leverage the same policy and innovation investments that have driven on-road electrification toward finding alternative fuels and technology solutions for aviation and shipping as well, addressing the 50% of transport demand in 2050 still met by oil on average.

Much of the remaining fossil consumption that persists by mid-century comes from industrial uses (which make up 40% of total fossil demand in 2050 in our mean projection). Carbon capture and low-carbon hydrogen can help drive emissions down in industries like iron and steel and ammonia production, but these technologies don’t guarantee a shift away from fossil, and many industrial processes and feedstocks remain unaddressed. To complete the transition away from fossil fuels, we need a similar level of policy and innovation that we’ve achieved for power and road transport to leverage solutions for each of the subsectors above. Transitioning away from fossil fuels will require credible and cost-effective alternatives to close these gaps for harder-to-abate sectors that rely heavily on fossil fuels today.

[1] Accounting practices for fuels used for non-energy applications differ significantly between countries and sources. Here we include the consumption and associated emissions of fossil fuels sometimes categorized in the Industrial Processes and Product Use sector, including fuel used as reductant in blast furnaces and as feedstock in the production of synthesis gas to produce ammonia, methanol and other chemicals. We exclude fuels used as reductant in other industries due to data limitations.