Pathways to Net-Zero: US Emissions Beyond 2030

There’s a long way to go to get on track for US net-zero emissions by 2050. We assess the key sources of remaining emissions in 2030.

Over the last two years, the US has made historic investments in climate progress, and federal regulations and state policies have helped bend the projected greenhouse gas emissions curve further down. Additional policies could help put the US’s target under the Paris Agreement within reach, to cut emissions by 50-52% below 2005 levels by 2030. However, there’s a long way to go to get on track for achieving net-zero emissions by 2050. The emissions that remain in 2030, assuming the US reaches its Paris target, will almost certainly be more difficult to eliminate than the emissions abated through 2030. Much of the remaining emissions will come from sectors that have been less of a focus to date.

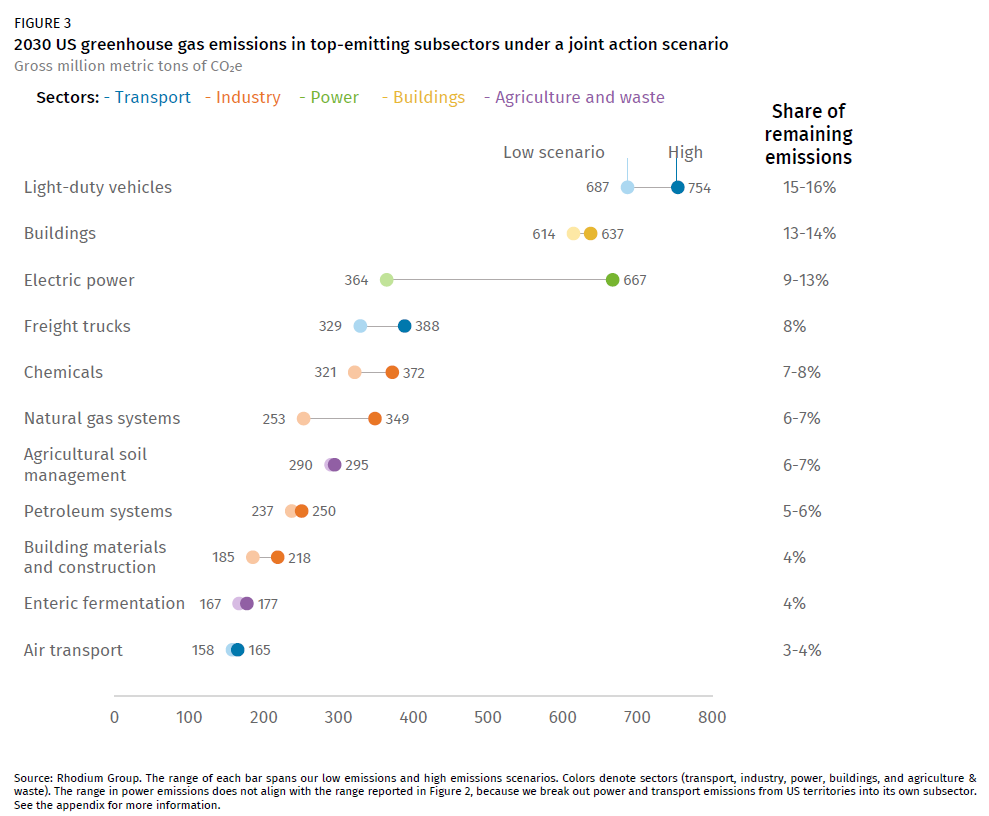

In this note, we revisit our 2023 updated Pathways to Paris scenarios, in which the Infrastructure Investment and Jobs Act plus the Inflation Reduction Act, as well as additional ambitious federal and state policies, reduce emissions to 41-52% below 2005 levels in 2030, and explore the sources of remaining emissions at the end of this decade. We identify the key emitting subsectors and the specific underlying emissions drivers within each, and we provide high-level decarbonization solutions that could address these drivers. Light-duty vehicles, the power sector, and residential and commercial buildings remain the top emitting sectors in 2030, despite some decarbonization gains, while other sources like freight trucks, chemical production, and natural gas systems increase their overall share of emissions contributions.

Cutting these remaining emissions will be challenging, but we find that a substantial fraction of emissions can be tackled using existing and widely available decarbonization solutions. Common areas of decarbonization focus across subsectors include increasing electrification, the use of low-carbon fuels and other sources of clean heat, improving energy efficiency, and use of point-source carbon capture. Additional policies will certainly be required to reduce these emissions, and future Rhodium Group work will identify sets of policies that can do just that.

Reaching the 2030 climate target

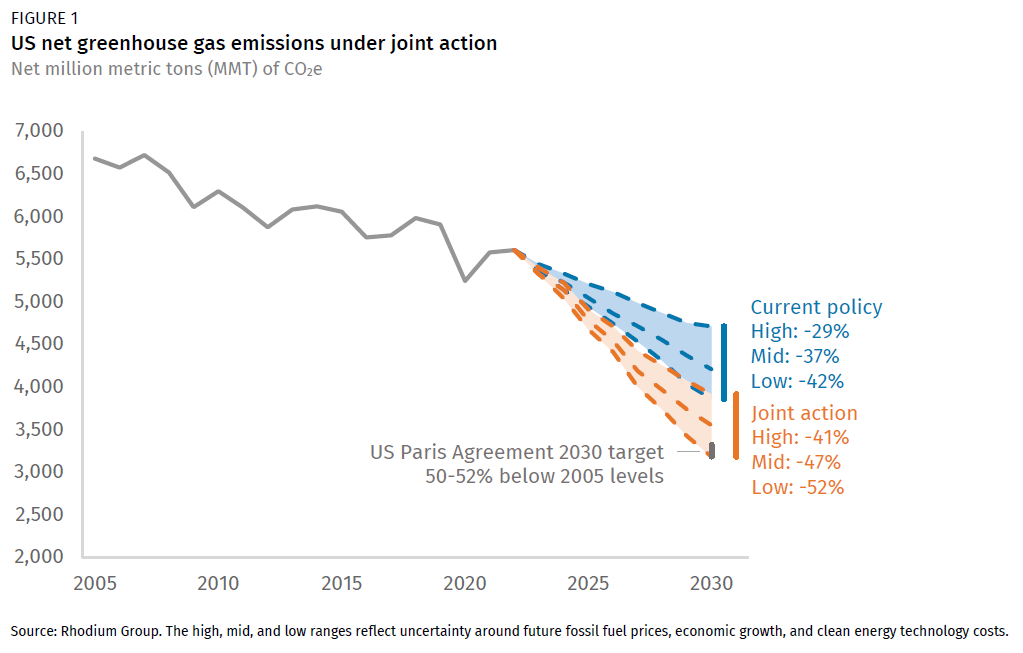

Climate policymaking has made huge strides over the past two years with the passage of the Inflation Reduction Act and the Infrastructure Investment and Jobs Act, progress on federal greenhouse gas (GHG) regulations, and the enactment of more ambitious state climate policies and targets. Under current policy, we estimate the US will reduce emissions to 29-42% below 2005 levels in 2030—a meaningful decline, but still not enough to meet the Paris Agreement target of a 50-52% reduction in 2030 (Figure 1).

As part of our recent Taking Stock 2023 report, we estimated the impacts of a suite of policy actions across all levels of government that could put the 2030 Paris target within reach. We found the policies in this “joint action” scenario could put the US on course to achieve a 41-52% reduction in emissions from 2005 levels in 2030—a further 10-12 percentage point reduction from the emissions trajectory under current policy on the books (Figure 1). The range in emissions outcomes reflects modeling the policies under three emissions cases—high, mid, and low—capturing sensitivities in macroeconomic growth, clean technology cost, and oil and gas price uncertainty.

The joint action scenario assumes both federal regulatory action and state climate policy ambition ramp up dramatically. Federal action includes EPA’s adoption of its recently finalized oil and gas methane regulations and currently proposed power sector and light-duty vehicle (LDV) greenhouse gas pollution regulations, as well as tightened regulations of mercury emissions and medium- and heavy-duty vehicles GHG emissions. On the state side, climate-leading states establish and accelerate 100% clean energy and clean vehicle targets and enact policies to reduce energy consumption through increasing efficiency and reducing carbon intensity. The full list of policies modeled in the joint action scenario is available in the Taking Stock 2023 technical appendix, as well as further explanation of our high, mid, and low emissions cases. Note that, consistent with EPA and IPCC conventions, we report all emissions in this note using 100-year global warming potential (GWP) values for non-CO2 greenhouse gases from the Fifth Assessment Report.

Achieving the 2030 Paris target will require unprecedented levels of policy ambition and historic levels of change to the energy system. And even if the US is able to rise to the 2030 challenge, there is still a yawning gap between emissions levels in 2030 and net-zero emissions in 2050. Policymakers have largely been focused on actions that drive deployment of commercially available clean technologies in the power sector and the light-duty vehicle fleet—and we see meaningful progress in decarbonizing those parts of the economy by 2030. But there remain a host of other, high-emitting sectors that today have fewer and more challenging decarbonization solutions.

In this note, we characterize what emissions remain in 2030 assuming, in the best-case scenario, that the US reaches its 2030 Paris climate target of a 50-52% reduction in emissions below 2005 levels. We also provide short overviews of the kinds of decarbonization solutions available to address these remaining emissions. We don’t assess specific policies that could drive changes in the energy system in this note, but we plan to focus on the policy side of this decarbonization equation in work we’ll publish later this year. That said, the policies that get the US within reach of the 2030 target and the sectors in which the US makes the most progress won’t be the same policies and sectors that can maintain and accelerate this momentum after 2030.

Sources of remaining emissions

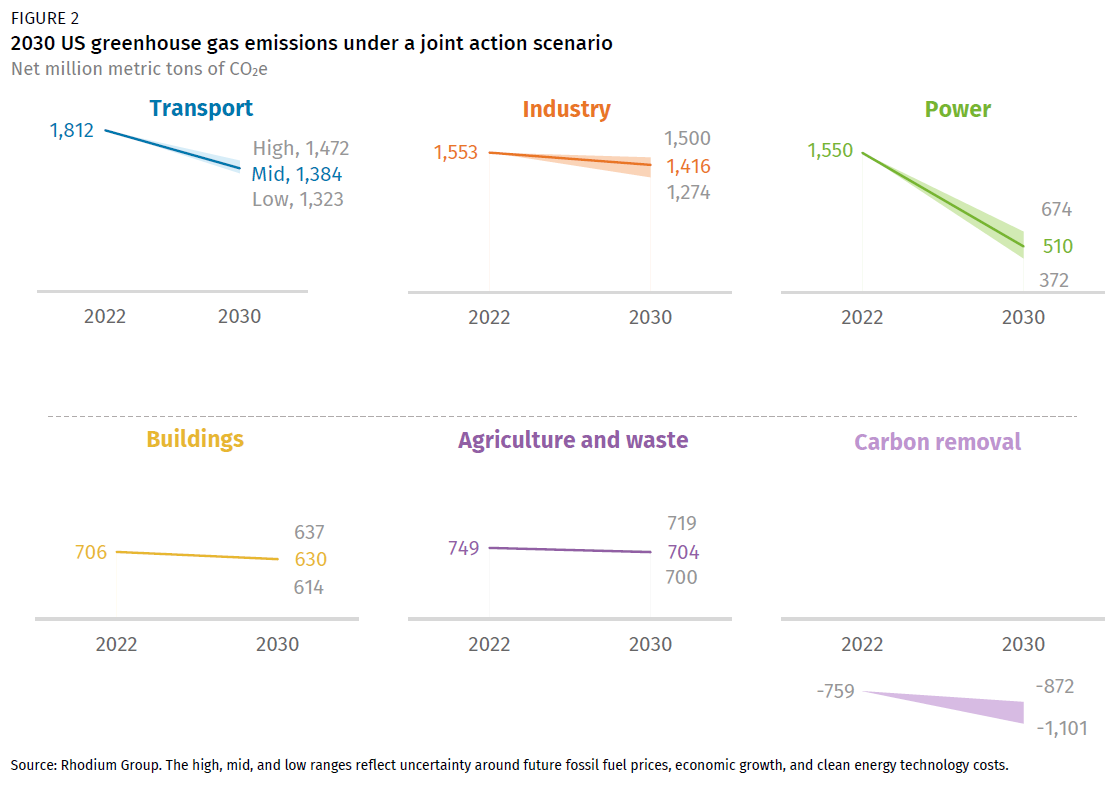

The emissions landscape in 2030 under our joint action scenario looks meaningfully different than it does today (Figure 2). The power sector reduces its emissions by 56-76% below 2022 levels and becomes the least or second-least emitting major sector. The transport sector also declines meaningfully, by 19-27% below 2022 levels, but remains one of the two highest-emitting sectors in all cases. Industrial sector emissions, inclusive of emissions from oil and gas production, decline even less, by 3-18% over 2022 levels in 2030, and industry overtakes transport as the highest-emitting sector in our mid and high emissions scenarios. Emissions from residential and commercial buildings and from agriculture and waste remain largely untouched.

Though a sectoral understanding of emissions is useful, looking one layer deeper can be even more informative. Sectors are diverse, and the same decarbonization solutions that work for petrochemical production or light-duty vehicles may not be as effective when applied to cement production or heavy-duty vehicles.

For the remainder of this note, we group emissions into more granular subsectors, and we find that the top-emitting eleven subsectors are responsible for 84-85% of total remaining gross emissions[1] in 2030 (Figure 3). We provide a breakdown of the remaining 15-16% of emissions in the appendix to this note.

The big three

The three highest-emitting parts of the economy[2] in 2030 are familiar: tailpipe emissions from light-duty vehicles (LDVs), direct emissions from using fossil fuels in buildings, and emissions from fossil-fired power plants (Figure 3). We find that these remain the most important in terms of total emissions to eliminate even after the US achieves its 2030 climate target, emitting about 40% of total remaining emissions in 2030.

One of the reasons that these high emitters remain the top three is the challenge of slow stock turnover—a common theme we’ll return to across much of this note. In short, the equipment that consumers and businesses purchase tends to be long-lived in these sectors. The average light-duty vehicle on the road today is 12 years old, furnaces in buildings are expected to last 15-20 years, and large power plants often have multi-decade lifespans. As such, policymakers have limited chances to influence the purchase of lower-emitting technologies, and it takes a long time for high levels of sales of these technologies to propagate across the entire equipment stock. Put another way, if the US reaches 100% of electric LDV sales in 2030, it won’t be until the early to mid-2040s that the entire LDV fleet is fully electrified.

Continued attention to LDVs, buildings, and power is necessary to achieve high levels of adoption of lower-emitting technologies, and further policy action could help accelerate stock turnover. Fortunately, increasing the share of electric vehicles (EVs) in the light-duty fleet, improving building electrification and appliance efficiency, and deploying zero-emitting power generators in the power sector have recently been core goals for policymakers and environmental NGOs, and the policy environment is favorable for continued increased adoption in these sectors. We unpack these sectors individually in the rest of the note.

[1] Throughout this report, we use gross emissions to refer to total emissions less a modest amount of technological carbon dioxide removal from direct air capture and ethanol facilities with CCS. We also model uptake of point-source carbon capture on key industrial sources and account for that abatement in the appropriate subsector.

[2] Two of these high emitters – buildings and power – are major sectors. We group residential and commercial subsectors together because their emissions come from similar sources and, consequently, they have similar policy implications. Likewise, from a policy perspective, there isn’t a clear and meaningful way to break down the power sector into subsectors.

This nonpartisan, independent research was conducted with support from the Linden Trust for Conservation. The results presented in this report reflect the views of the authors and not necessarily those of the supporting organization.