Scaling Green Hydrogen in a post-IRA World

For green hydrogen to play a role in a decarbonized future, the US needs to get experience building and installing electrolyzers at an unprecedented scale today in order to establish a domestic industry and drive down costs.

Clean hydrogen is a set of early-stage technologies that have the potential to be a “Swiss Army knife” of long-term decarbonization in the US. It can advance US decarbonization by replacing traditional hydrogen in current industrial applications in the near term and substituting for a variety of fuels and feedstocks in the long run, but will require significant policy and investment support to scale up to the levels needed. The clean hydrogen production tax credit included in the recently passed Inflation Reduction Act (IRA) is a meaningful step towards securing a spot for clean hydrogen in the US economy. Now, the Internal Revenue Service (IRS) is grappling with implementing regulations for the credit, trying to decide how to account for greenhouse gas (GHG) emissions from electricity generation used to make electrolytic hydrogen (one type of clean hydrogen, often called green hydrogen).

In this note, we discuss the trade-offs for the decisions the IRS has in front of it. For green hydrogen to play a role in a decarbonized future, the US needs to get experience building and installing electrolyzers at an unprecedented scale today in order to establish a domestic industry and drive down costs. Adhering to restrictive rules to claim the credit in the near term may hamper the ability of this industry to grow, reducing the range of clean hydrogen opportunities down the road. At the same time, policymakers need to provide clarity on a future path that ensures green hydrogen actually reduces long-term GHG emissions. One model that could be useful for the US is the GHG accounting approach for green hydrogen that the European Commission recently set out, which is a phased approach over time to more restrictive rules. In the US, near-term flexibility on these rules is likely to lead to modest increases in overall GHG emissions over the next few years, but standing up a green hydrogen industry that ultimately adheres to strict rules in the future can ensure that green hydrogen can play a meaningful role in deep decarbonization.

Clean hydrogen’s potential in a decarbonized energy system

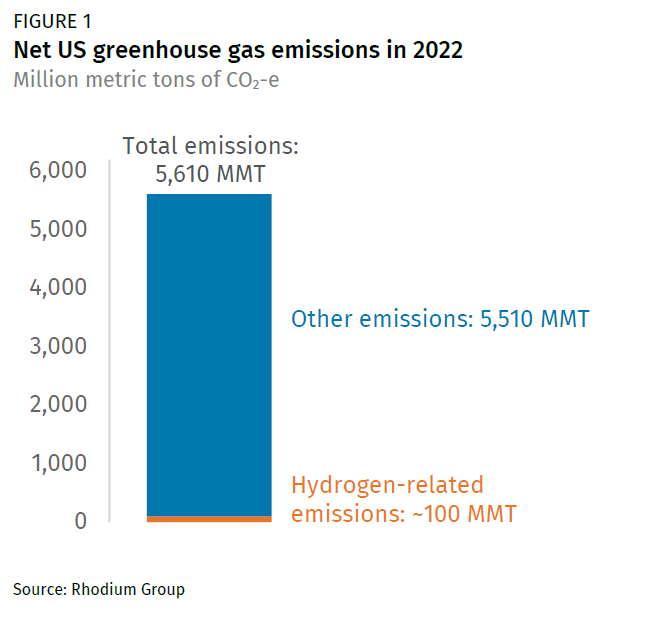

Clean hydrogen has the potential to play an important role in a decarbonized economy as a fuel, feedstock, and energy storage medium across multiple sectors. In previous Rhodium research before the IRA was passed, we assessed the near- and long-term opportunities for effectively scaling up clean hydrogen. The biggest emissions reduction opportunities in the near term come from switching the current roughly 10 MMT of annual US hydrogen demand away from conventional fossil fuel-based production to cleaner production methods. This demand is driven by industrial processes—refineries, ammonia production, and methanol production chief among them. Today, almost all of this hydrogen is produced via the steam methane reformation (SMR) process, which converts natural gas into hydrogen and emits around 100 MMT of CO2e annually or just under 2% of US net GHG emissions (Figure 1). Reducing these emissions by transitioning to clean hydrogen production can make a small but measurable difference in the US decarbonization trajectory.

Over time, deeper emission reductions can come from substituting clean hydrogen for incumbent fossil fuels in new use cases, including as an industrial fuel or feedstock and as a transportation fuel for difficult-to-electrify applications like heavy-duty trucking. The biggest emissions benefits from clean hydrogen materialize when its use is expanded to these future applications, compared with a relatively small emissions impact of decarbonizing existing hydrogen consumption today.

Several technological pathways can produce hydrogen with meaningfully lower greenhouse gas (GHG) intensities. Two of the most commonly discussed are retrofitting SMRs with carbon capture and producing hydrogen via electrolysis. In the former, CO2 can be captured at various points in the process of converting natural gas to hydrogen, yielding a production emissions intensity that’s as much as 99% lower than uncontrolled SMR production—though the most economic opportunities for carbon capture at these facilities will likely yield less emissions abatement. Our previous research has indicated that carbon capture on current SMR facilities (also called blue hydrogen) can play a role in near-term decarbonization; however, this note focuses on electrolytic hydrogen produced with low-emissions electricity, commonly referred to as green hydrogen. Green hydrogen uses electricity in the presence of a catalyst to split water into hydrogen and oxygen, emitting no CO2 at the point of production. However, CO2 and other GHGs may be emitted from generating the electricity used in the process.[1]

This future for green hydrogen is far from guaranteed, and it’s not clear how big of a role green hydrogen specifically will play. But we know for sure that it won’t help decarbonize the US energy system unless three things are true:

- Green hydrogen is available

- Green hydrogen is low-emissions

- Green hydrogen is cheap, at least at price parity with SMR production

Policy support for green hydrogen

For green hydrogen to play a role in a future decarbonized energy system, the US needs to start getting experience building and installing electrolyzers quickly. It takes time for new technologies to propagate through the market as developers work to establish supply chains, train labor, and learn to navigate bureaucratic processes. This increase in hydrogen deployment is also necessary to reduce costs and ensure a cheap supply of green hydrogen.

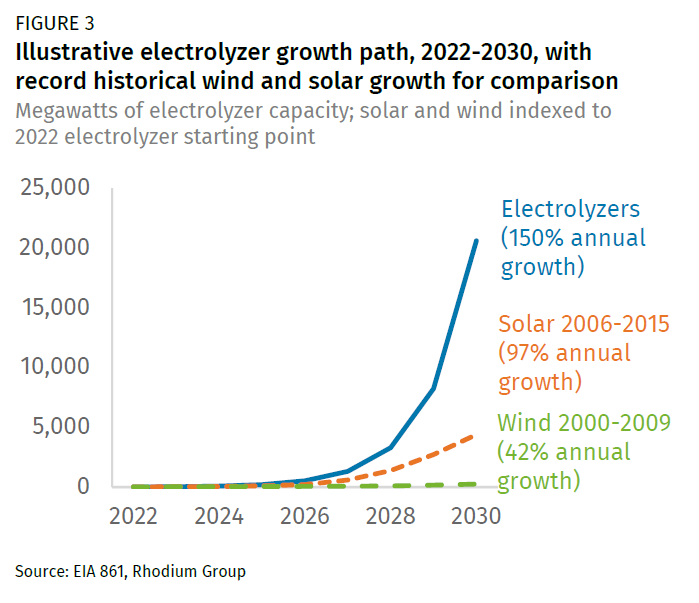

How fast can electrolyzers scale up? One useful example comes from the meteoric rise of wind and solar. During their fastest 10-year periods of scale-up this century, utility-scale wind installations grew by an average of 42% per year, and utility-scale solar installations grew by an average of 97% per year. Even if electrolyzers are on the same path as solar, they’re only on track to provide less than 20% of current hydrogen demand in ten years. Like with wind and solar, aggressive or, in this case, even modest scale-up won’t happen with market forces alone—policy support will be necessary to increase the availability of green hydrogen.

A hydrogen production tax credit (PTC) was adopted as part of the Inflation Reduction Act (IRA) in 2022 and is an important policy we identified in our previous note as key to hydrogen scaling up. Alongside a suite of other tax credits, especially the clean electricity production and investment tax credits, the hydrogen PTC (also called the 45V tax credit, after its section in the tax code) can drive down the cost of clean hydrogen to be cost-competitive with SMR-produced hydrogen.

The 45V tax credit is especially important for green hydrogen. If green hydrogen can demonstrate very low lifecycle GHG emissions, it can qualify for up to $3/kg in tax credits. That level of tax credit can drive meaningful deployment of electrolyzers. The key question the IRS is currently trying to address is how to calculate that GHG footprint—which we’ll return to later in this note.

Despite this significant supply-side push, there haven’t been any major demand-side drivers enacted to incent or require the transition to green hydrogen. For green hydrogen to play a meaningful role in long-term decarbonization, it must move beyond just replacing current SMR production. However, creating the green hydrogen market necessary for decarbonization requires sufficient demand-side policy that incentivizes that change. For the green hydrogen market to really scale, these policies will need to exist in the form of sectoral standards or sector-based or economy-wide carbon policies.

Trade-offs in scaling green hydrogen

Delays in installing electrolyzers in the near term will result in a slower overall scale-up of electrolyzer capacity and, therefore, fewer emissions benefits in the long run. When assessing trade-offs of policy implementation, it’s important to understand the balance of considerable long-term emissions reduction benefits vs. short-term impacts. This brings us back to the importance of the IRS decisions around implementing the 45V tax credit.

The statutory language of the hydrogen PTC is straightforward: to qualify for the highest level of tax credit, hydrogen must be produced via a process with a lifecycle GHG emissions rate of less than 0.45 kg of CO2e per kg of hydrogen. Today, electrolytic hydrogen needs the full value of the credit to approach cost competitiveness with SMR hydrogen, so its producers need to demonstrate a very low emissions rate. Electrolysis is a very electricity-intensive process, and emissions from electricity generation are the major contributor to its total lifecycle emissions rate. So the GHGs emitted from generating electricity that flows into the electrolyzer really matter.

Stakeholders and intervenors have proposed several approaches for calculating GHG emissions from relevant electricity generation. The most stringent of these approaches require temporal and regional matching and additionality provisions. In this approach, for electricity to qualify as zero-emitting, every kilowatt-hour (kWh) of electricity going into an electrolyzer must be matched with a kWh of electricity generated from a new, zero-emitting generator sited in the same region as the electrolyzer on an hourly basis. This provides the highest degree of assurance that the electricity demand from the electrolyzer isn’t causing increased GHG emissions in the power sector, thereby yielding the cleanest possible hydrogen. Other approaches vary aspects of this formula, including matching kWhs on an annual basis instead of an hourly basis, not requiring the zero-emitting resource to be new, and not requiring its relative colocation with the electrolyzer.

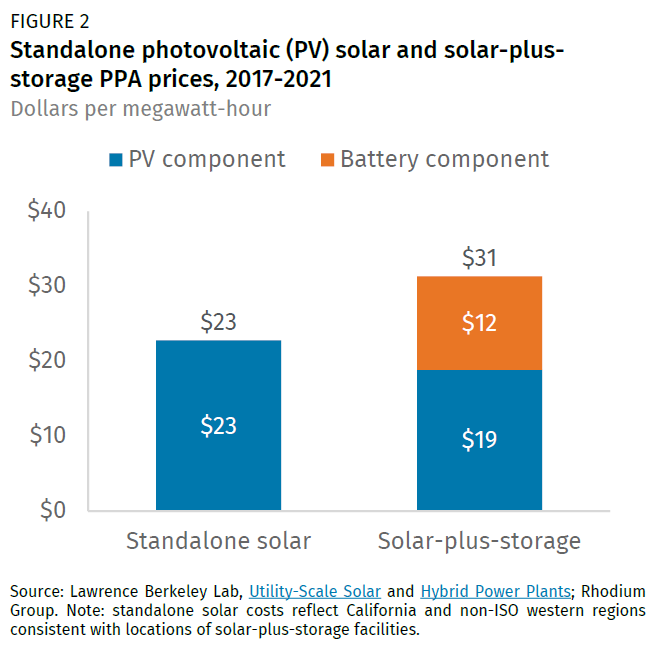

Requiring a high degree of stringency across regional, temporal, and additionality variables on day one comes at a cost. The industrial end uses we’ve highlighted as the current market for green hydrogen need a relatively constant supply of hydrogen. This can be achieved by firming cheap wind or solar power with battery storage or other zero-emitting forms of electricity generation, allowing for steadier production from the electrolyzer. Energy system optimization models project minimal cost impacts over time as the system plans for and equilibrates to this demand. But today, firmed clean electricity contracts come at a cost premium—for example, a 38% increase in price for a solar power purchase agreement (PPA) paired with battery storage compared to a traditional solar PPA (Figure 2).

Since the cost of electricity is the single most significant factor in the cost of producing electrolytic hydrogen, these cost premiums can quickly push the total cost of production above the cost of SMR hydrogen, even with the full $3/kg tax credit in place. The cost increase from switching from a standalone solar PPA to a solar-plus-storage PPA increases the total subsidized cost of hydrogen production from $0.93-$2.98/kg to $1.49-$3.65/kg.[2] SMR hydrogen today is produced at a cost of around $1-$1.50/kg, depending on the price of natural gas, so the additional cost premium makes the economics of green hydrogen tough to pencil even at the low end of our cost ranges.

Firming with a four- or even eight-hour battery also doesn’t improve the regularity of electricity output enough to create a stream of hydrogen useful for industrial applications. Hydrogen producers or consumers can construct large storage facilities to hold hydrogen until needed, but the cost of that storage equipment, which is dependent on the storage type and context of the individual site, scales with their size and again adds to the total cost of hydrogen.

Beyond the hydrogen production cost implications, hourly tracking of the emissions attributes of electricity is still relatively new in the US. There have been promising developments in this regard among major energy attribute certificate (EAC) tracking platforms: the M-RETS platform, which tracks voluntary EACs in several parts of the country, developed hourly tracking tools in 2019, while PJM GATS, used to track compliance EACs in the PJM electricity market region, is expected to release the ability to do so this year. Still, there is currently no nationwide, common platform for tracking hourly EACs in the US. This makes consistent hourly clean electricity matching for early-stage green hydrogen production projects challenging, if not impossible.

Sizing the potential emissions impact

On the other hand, relaxing the hourly matching to an annual requirement will increase emissions from the power sector in the near term. To simplify slightly, if electrolyzers are running at relatively steady capacity factors, that demand is increasing generation from some fossil-fired generators when the renewable resource contracted via a PPA is not generating. As we highlight above, green hydrogen can’t contribute to meaningful decarbonization if it’s not actually low-emitting.

To assess the potential tradeoffs between hourly and annual matching, it can be helpful to consider the scale of emissions that could occur in the less restrictive annual matching scenario. As mentioned above, US electrolyzer capacity is starting from a very low level today. Even with the IRA and Infrastructure Investment and Jobs Act (IIJA), it will take time to scale up. If electrolyzer capacity grows 50% faster than utility-scale solar capacity did in its best 10-year period, installed electrolyzer capacity could reach 21 GW in 2030, producing just under 3 MMT of hydrogen—somewhere around 30% of total hydrogen demand today (Figure 3). The additional electricity used for electrolysis would represent about a 4% increase in total electricity use that year.

Under annual averaging, we estimate that electricity generation to fuel these electrolyzers could increase total greenhouse gas emissions from hydrogen production by 34-58 MMT in 2030 above today’s 100 MMT per year level—a roughly 1% increase in economy-wide GHG emissions—and a cumulative 56-97 MMT increase in emissions from 2023 through 2030.[3] For context on this figure, the Department of Energy finds that if it can scale, clean hydrogen can reduce total US greenhouse gas emissions by 660 MMT in 2050.

These figures are a conservative upper bound on the impact of annual averaging as they rely on high hourly emissions rates and assume no improvement in grid carbon intensity over time. The grid is already on course to be substantially cleaner than it is today—we estimate that the IRA can drive the total share of clean generation from 43% today to 60-81% by 2030.

Though temporal matching is perhaps the most hotly-debated design element, the other elements matter quite a bit as well. Our emissions estimates increase 73 MMT in 2030 if there were no additionality requirement and to 63-100 MMT if the hydrogen was only produced in parts of the country with the highest-emitting power grids. Finally, our estimates assume electrolytic hydrogen serves demand currently supplied by SMR-produced hydrogen. If all of this hydrogen went instead to new end uses and there was no reduction in SMR production, our emissions estimates increase to 60-85 MMT in 2030.[4]

Additional actions that drive grid decarbonization can mitigate some of this near-term tick-up in emissions. Just as a cleaner grid reduces the lifecycle emissions impact of other new electrified technologies like electric vehicles and heat pumps, it will do the same for electrolytic hydrogen production relative to the grid of today, especially to the extent that the cleaner grid includes higher capacity factor, zero-emitting sources of generation. Large-scale deployment of utility-scale batteries and increased transmission can also help make more zero-emitting power available in more parts of the country at more times. Beyond the increases in generation projected to materialize thanks to the IRA, policies including EPA power plant regulations and work to address transmission bottlenecks, siting and permitting issues for renewables, interconnection queue backlogs, and supply chain constraints can help secure progress toward a cleaner grid and drive it further.

How could we maximize deployment and minimize emissions? An example from Europe

The US isn’t the only place wrestling with what constitutes clean hydrogen. The European Commission recently set out its rules for what counts as green hydrogen, proposing a phased approach, and it’s instructive for a couple of reasons. First, the EU is another large energy consumer grappling with how to achieve its climate goals. Second, their requirements apply to any hydrogen imported to the continent as well, meaning US hydrogen producers would have to meet them if they want to consider the EU as an export market.

On the question of temporal matching of clean electricity to hydrogen production, the European model starts with monthly matching, noting that more granular matching “is hampered in the short term by technological barriers to measure hourly matching, the challenging implications for electrolyzer designs, as well as the lack of hydrogen infrastructure enabling storage and transportation of renewable hydrogen to end users in need of constant hydrogen supply.”

Each of these challenges also rings true in the US context, particularly the technological barriers to hourly matching. As we’ve mentioned, there is currently no national hourly generation tracking system, and it’s unclear when one will be in place. Hydrogen projects will likely have difficulty securing financing if developers need to meet an hourly matching requirement with no common framework for compliance.

Given the patchwork nature of US electricity markets, monthly matching is likely even a stretch for the foreseeable future. Notably, the EU has a common power market, while the US market is highly segmented. Europe focuses on achieving hourly matching by 2030, providing a good model for a medium-term transition. Europe’s approach also includes a review clause for the more granular matching in 2028, examining the impacts of the increased stringency on hydrogen production costs.

The EU approach also requires regional matching and that the electricity used for hydrogen production be relatively newly constructed (i.e., in operation within the last three years before the hydrogen production starts) with limited exceptions for regions that already have very clean grids. The rules also include a “transitional phase,” allowing installations in operation before 2028 to get an exemption from the additionality rules through 2037.

A path forward

Electrolyzers are a key technological solution to reducing the emissions of existing industrial processes that use natural gas-based hydrogen. Over time, they can increasingly play a role in other applications as well. To reap the potential benefits of green hydrogen, the US needs to develop an industry to build and install electrolyzers—something unlikely to happen if restrictive regulations constrain near-term electrolyzer deployment.

Global electrolyzer manufacturing capacity is expected to grow substantially over the coming years, and the US risks missing a key clean energy manufacturing opportunity absent supportive policies and robust domestic demand. Electrolyzer costs will reduce as global manufacturing capacity increases, and nothing is forcing US hydrogen developers to buy US-made electrolyzers. Still, domestic deployment can help further drive costs down the learning curve. Achieving steep capital cost reductions requires meaningful electrolyzer deployment above and beyond what is already in the pipeline—and the US can help fill that gap.

Another challenge of restrictive regulations on electrolytic hydrogen production is the risk of lock-in of blue hydrogen as the leading technology producing clean hydrogen. SMRs with carbon capture can already claim the $85/ton section 45Q tax credit, and developers and financiers already have some experience working with that policy. There is no lifecycle accounting requirement under 45Q if the CO2 is permanently stored underground, and the measurement of emissions abatement is more straightforward—a ton of CO2 captured results in a payout, hard stop. Especially if there aren’t policies driving new hydrogen demand, much of the current demand for hydrogen could be saturated with blue hydrogen—useful for near-term emissions reductions but not for decreasing dependence on fossil fuels or hydrogen playing a major role in long-term decarbonization.

Providing a runway for more restrictive limitations on what hydrogen qualifies for 45V, including more granular temporal and regional matching over time similar to what the EU is considering, can point developers in the right direction while giving them important experience installing electrolyzers today and developing a domestic industry.

At the same time, policymakers can’t ignore the long-term emissions risk that can accompany a boom in electrolyzer deployment. To construct emissions guardrails, the IRS can establish target dates for ratcheting up the certainty on key implementation details like a transition to more temporally granular matching. Such phase-in approaches give the hydrogen and power industries the signposts they need to develop the tracking tools, calculation approaches, contract language, and other key elements to assure green hydrogen contributes to decarbonization.

In the meantime, IRS can focus on implementing the (relatively) easy stuff based on existing frameworks and regulations:

- Regional matching of clean electricity generation and hydrogen production, such as by balancing authority reported on form EIA-861, ensuring clean electrons are delivered into the same market as the electrolyzer.

- Annual matching of clean electricity generation and electricity used in hydrogen production using existing tracking systems.

- Simple additionality requirements like establishing an in-service date for new generating facilities to count as additional.

Finding a transition pathway that gets deployment going and minimizes emissions while phasing in a high bar for GHG performance over time represents a compromise and could be the best way forward.

[1] These summaries are not full lifecycle assessments of the greenhouse gas emissions associated with each production pathway.

[2] Cost ranges represent low, central, and high assumptions of the capital cost of electrolyzers. We assume batteries in a solar-plus-storage setting cannot charge from the grid.

[3] The low and high end of the ranges represent securing a PPA with wind and solar facility, respectively. We assume all electricity incremental to what’s available on an hourly basis via these PPAs emits at the eGRID 2021 nonbaseload emissions rate, which likely overstates emissions, as we discuss below.

[4] These outcomes appear relatively unlikely. An additionality requirement is easy to implement, as discussed below, and most regions of the country with existing hydrogen demand have average or cleaner-than-average electricity. As discussed above, a lack of new demand for hydrogen in this period means green hydrogen is largely or entirely substituting for SMR hydrogen. Note that these estimates are for each component individually and aren’t necessarily additive.

This nonpartisan, independent research was conducted with support from Breakthrough Energy. The results presented in this report reflect the views of the authors and not necessarily those of the supporting organization.