Three Key Outcomes of the “One Big Beautiful Bill Act” on US Manufacturing and Innovation

The budget reconciliation bill passed by the House has important implications for US technology investment, manufacturing, and innovation.

The “One Big Beautiful Bill Act” (OBBBA) budget reconciliation bill passed by the House raises energy costs on consumers and businesses and pushes down on demand for clean energy technologies by effectively repealing a number of energy-related tax credits. There are additional important implications of the House bill for US technology investment, manufacturing, and innovation:

-

Nearly all states face the threat of lost investment from the House bill, which totals $522 billion nationally, with the top 10 states comprising 62% of this investment.

-

Lower demand for clean technologies such as electric vehicles (EVs) and solar paired with the loss of support for clean technology manufacturing could stall growth in the burgeoning clean manufacturing industry in the US, which contributed $14 billion to economic growth in the first quarter of 2025.

-

Emerging clean technologies like advanced nuclear and geothermal face disproportionate risk from the House bill given their long development timelines and challenges in finding affordable capital, with at least 2.2 GW of first-of-a-kind and early commercial deployments facing an uncertain future.

The Senate has returned to Washington after the Memorial Day recess to begin formal consideration of its budget reconciliation instructions. Senate Majority Leader John Thune (R-SD) established an ambitious target of releasing full text of the bill by the end of this week ahead of intended passage before the July 4th recess. Key Senate Republicans have already indicated they want changes to the approach to energy-related tax credits House Republicans took in constructing their “One Big Beautiful Bill Act.” Against this legislative backdrop, we unpack three key implications of the House-passed bill for US manufacturing and innovation—impacts that the Senate may seek to mitigate as they negotiate their response.

1. Clean energy investments are at risk nationally, but some states see larger potential losses than others.

The Clean Investment Monitor, a joint effort between Rhodium Group and MIT’s Center for Energy and Environmental Policy Research (CEEPR), has identified $522 billion worth of clean energy investments that have been announced from mid-2022 through the first quarter of 2025 but that have yet to come online. These facilities represent new and expanded clean electricity generating facilities like solar and geothermal plants, new clean industrial sites like sustainable aviation fuel (SAF) and clean hydrogen production facilities, and new manufacturing plants building clean energy like batteries, zero-emitting vehicles (ZEV), wind turbines, and solar panels. This more than half of a trillion dollars in investment comes on top of the $321 billion that has already been invested since the middle of 2022 in similar facilities.

There is outstanding investment in 49 of 50 states tracked in the Clean Investment Monitor dataset, but the 10 states with the largest outstanding investment levels represent 62% of the national amount. Our modeling of a full repeal of the energy-related tax credits, akin to the approach taken in the House-passed budget reconciliation bill, shows the policy changes reduce new clean power generating additions to the grid by 57-72% and shrinks the number of electric vehicles on the road in 2035 by 16-38% compared to leaving the tax credits alone. These changes directly impact states through lower investment in new clean energy facilities and lower investment in building the manufacturing facilities needed to domestically produce more clean generation technologies here in the US. We unpack this latter risk more fully in the next section. Though we don’t know precisely which facility won’t move forward in response to the changes contained in the OBBBA, states with the highest concentration of proposed investments also very likely face the biggest risks of project cancellations. A state-by-state breakdown of all outstanding investment is available below.

2. Lower US demand for clean technologies threatens continued growth of US manufacturing.

Clean energy and transportation’s share of total private investment has increased by more than 50% since the passage of the Inflation Reduction Act, from 3% in the second quarter of 2022 to 4.7% in the first quarter of 2025. The fastest-growing segment is clean energy manufacturing, where investments have increased by an order of magnitude from $1-3 billion per quarter before passage of the Inflation Reduction Act to $14 billion in the first quarter of 2025. This growth is propelled by a number of factors, but key among them are two drivers contained in the US tax code currently under threat from changes in the OBBBA:

- Direct support for factory output through the advanced manufacturing production tax credit (also called 45X, after its section of the tax code) helps American-produced materials compete with imports. The 45X language spells out a number of categories of equipment that qualify for credits if they are made in America, including critical minerals, batteries, solar, and onshore and offshore wind.

- Tax credits that support deployment of these technologies, including the clean electricity production and investment tax credits, clean hydrogen tax credit, and the consumer and commercial clean vehicles tax credits, are also critically important to manufacturing growth. These deployment credits help create a durable, long-term demand signal for clean manufacturing output in the US. Many of these credits also offer bonuses for the use of American-made material or require the use of materials made in the US or by free-trade partners.

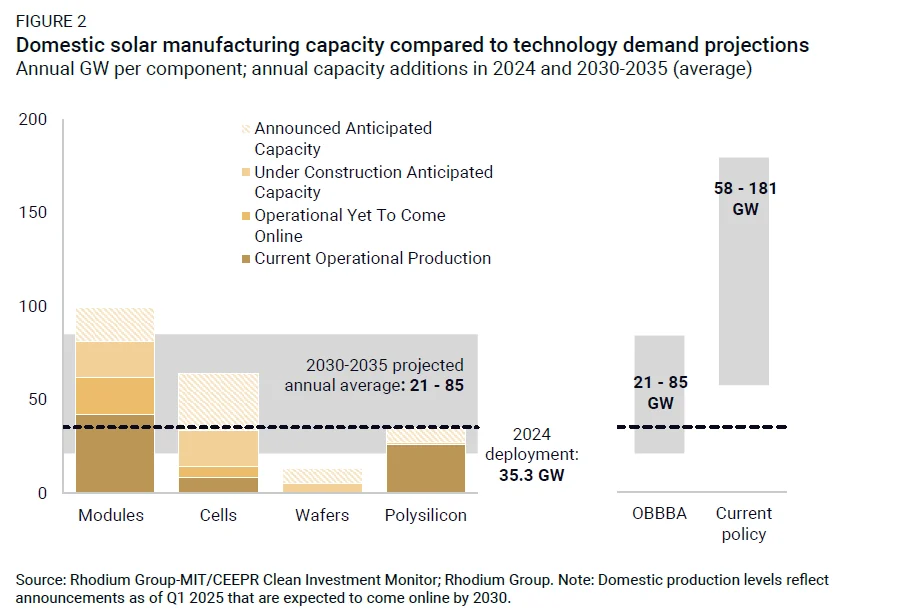

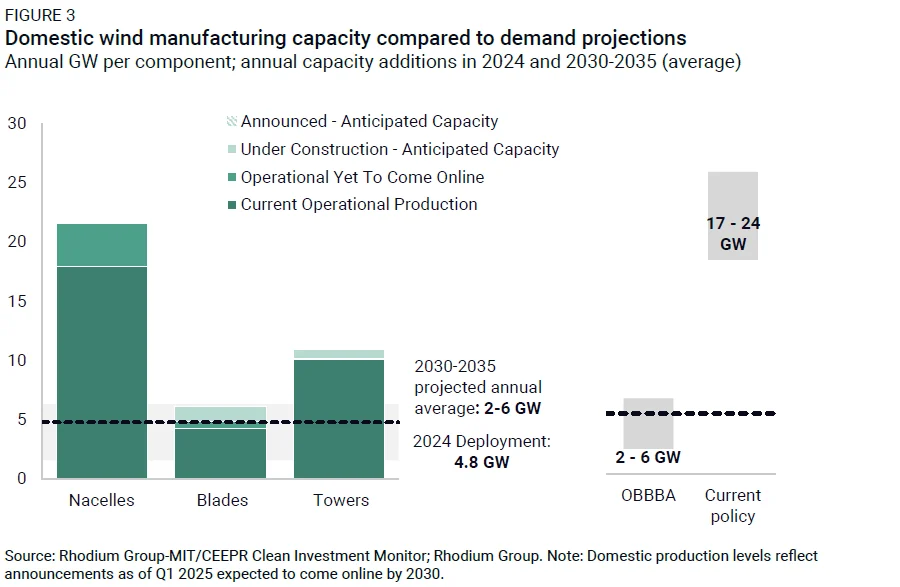

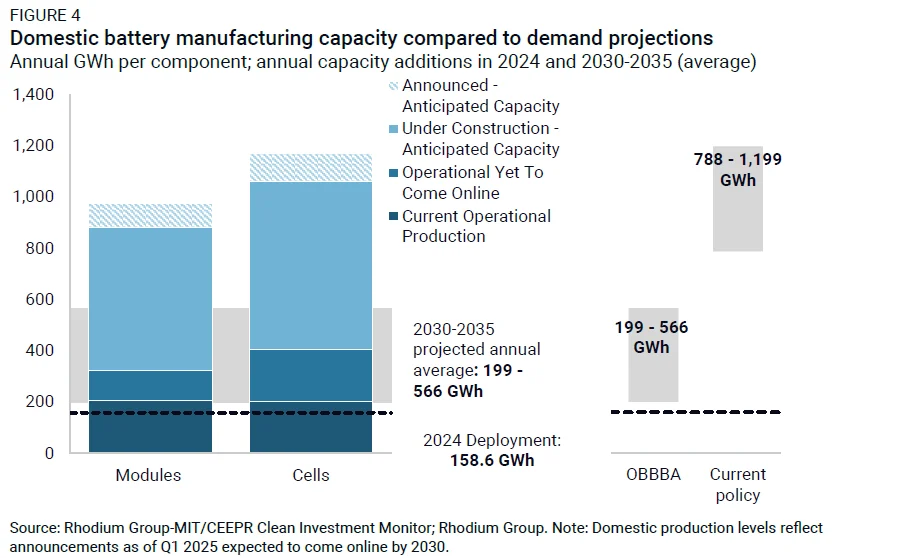

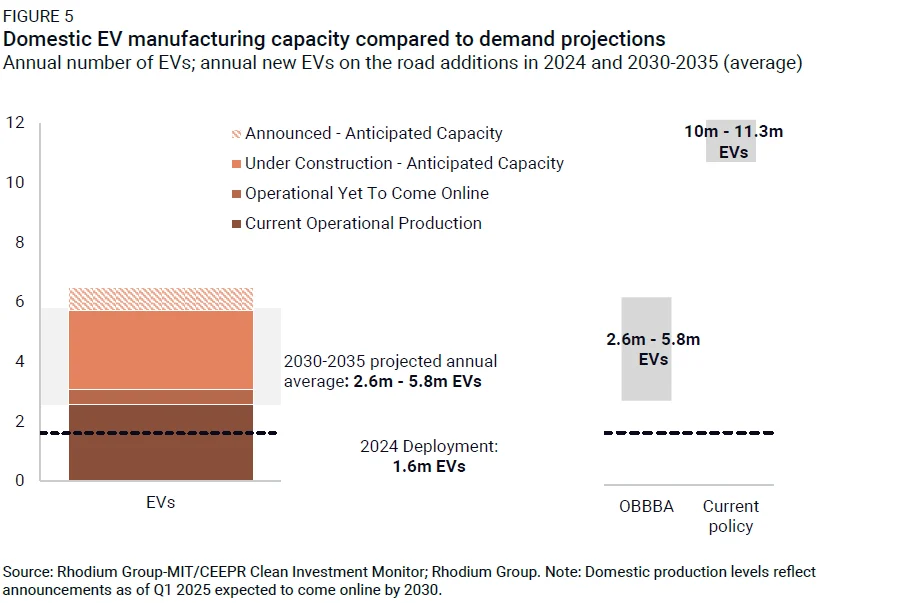

The intersection of the manufacturing and deployment tax credits has helped drive growth in US clean manufacturing over the past few years. The House-passed reconciliation bill shuts down nearly all of these tax credits, in law or in practice, over the next couple of years, threatening this growth. To illustrate the potential impact of these repeals, we draw on an approach from the Clean Investment Monitor, which compares the current and announced domestic production capacity for a number of clean energy components to the projected level of demand for those technologies in the early 2030s under our Taking Stock 2024 current policy baseline.

We adapt this analysis to compare US manufacturing capacity against future demand projections from our modeling of the impacts of the House reconciliation bill. This reflects a future policy environment without tax credit support for manufacturing or deployment as well as rollbacks of major greenhouse gas regulations aligned with recent legislative and executive branch actions. The range in projected annual demand from 2030-2035 represents our low, mid, and high emissions cases from the same modeling.

Lower clean technology demand threatens manufacturing buildout

The differences between the previous analysis reflecting current policy with tax credits in place and this update reflecting the OBBBA approach to tax credit repeal are notable. Under current policy, future domestic demand levels are higher than announced manufacturing capacity for most key clean energy components, pointing to a strong economic and policy case for continuing—and even amping up—clean energy manufacturing growth. Under OBBBA, total announced clean energy manufacturing capacity generally exceeds domestic demand, putting future manufacturing growth at risk. In some cases, the OBBBA causes demand for clean energy components to drop below the production capacity of facilities that are online today, threatening the future of already-built manufacturing plants—a particularly destabilizing possibility given that already-built facilities currently claiming 45X tax credits won’t continue to get the tax credit unless they meet the onerous foreign sourcing requirements put in place by the House bill.

Announced domestic solar module and cell manufacturing capacity are on track to just meet the low end of our current policy demand projection ranges and only 19-61% of polysilicon demand and 7-23% of wafer demand. With the OBBBA changes to tax credits, the US runs the risk of overcapacity of solar module production in all scenarios and overcapacity of cell and polysilicon production in at least some of the scenarios if all announced manufacturing capacity comes online (Figure 2). This puts new solar manufacturing projects at real risk of cancellation or closure due to a drop in demand.

Similarly, only domestic wind nacelle production could meet domestic demand under current policy. Under the OBBBA, all three major wind components (nacelles, blades, and towers) are at risk of overcapacity relative to domestic demand, pointing to a risk of cancellations for wind manufacturing projects (Figure 3).

More than two-thirds of all manufacturing investment since mid-2022 is in facilities producing grid batteries and electric vehicles, so the US is well-positioned to meet its domestic demand for both battery cells and modules before considering the impacts of the OBBBA. If the OBBBA becomes law and all announced manufacturing facilities come online, the US would have 2-7 times the amount of battery cell manufacturing capacity and 2-6 times the amount of battery module manufacturing capacity (Figure 4). In some scenarios, demand for grid storage and electric vehicles drops below production levels of facilities that are already operating, putting factories that are online today at risk of closure.

Finally, currently announced US zero-emission vehicle (ZEV) manufacturing capacity can only meet 58-65% of projected domestic demand for these vehicles under current policy, despite rapid growth in the sector. If the OBBBA is enacted—rolling back key tax credits and weakening EPA and Corporate Average Fuel Economy (CAFE) standards—domestic demand for electric vehicles across light-, medium-, and heavy-duty fleets would decline so that domestic capacity from all announced facilities would exceed domestic demand (Figure 5). This suggests that at least some of those factories might never be built. This finding is consistent with analysis from Princeton University’s REPEAT Project, which similarly found that the viability of this growth in ZEV manufacturing could be threatened by weakening of policy supports.

This comparison of domestic production capacity and domestic demand is instructive, but it misses a few important points. Though we project continued demand for clean energy technologies, the proposed OBBBA policy changes would specifically reduce demand for domestically manufactured clean energy technologies. Under the House-passed bill, there’s little reason for a US energy developer to choose American-made components. Eliminating the 45X tax credits would raise the costs of US-manufactured clean technologies, making them more expensive than foreign (often cheaper) imports, and undermining the competitiveness of US production. Removing tax policies that explicitly reward or require US-produced components puts even more downward pressure on demand for US-produced goods.

The relative price effects of removing 45X could be somewhat muted by tariffs on imported clean energy components, as has been aggressively pursued by the Trump administration (as well as the Biden and Obama administrations previously). But such actions serve to increase the overall price of these clean energy components, resulting in lower overall deployment.

3. Technologies that drive American energy innovation face additional headwinds.

Beyond widely available clean technologies like batteries, solar, and wind, the changes proposed in the House-passed bill also create a very difficult policy environment for the next generation of clean technologies, threatening the potential for US leadership in emerging areas like next-generation geothermal, advanced and small modular nuclear power, and fusion. Technology developers and investors rely on long-term policy certainty for confidence that their projects will pencil out economically when they come online. The first few commercial-scale facilities of novel technology types also generally take longer to build as developers work through the process of deploying their technologies at scale—a process that helps reduce costs for these technologies over time.

By phasing out tax credits over the next couple of years instead of keeping them in place well into the 2030s, the House bill removes the light at the end of the tunnel for many of these technology developers and makes their commercial viability far less certain. Hydrogen and vehicle tax credits disappear by the end of this year under the House proposal, while most clean electricity tax credits face de facto repeal for facilities coming online in 2026 or 2027. New advanced nuclear facilities were given a longer lead time in the House bill and need to commence construction by the end of 2028, but even that timeframe is exceedingly ambitious given the scale and complexity of many of these projects.

Beyond loss of key tax credits, the House bill also removes other key supports for emerging clean technologies. Chief among these is the rescission of all unobligated funds supporting the section 1703 loan guarantees for clean energy projects and advanced technology vehicle manufacturing loan guarantees that were provided to the Department of Energy Loan Programs Office (LPO) as part of the 2022 Inflation Reduction Act. These government-backed loan guarantees are an important source of low-cost capital to technology innovators who would otherwise have a hard time securing funding for their projects from commercial sources. These funding cuts come on top of a large exodus of expert staff from LPO during the first months of the Trump administration, further complicating access to these important funds. The CIM only tracks new electric generators that report their plans to EIA. Given the longer development timelines for the next generation of clean electricity technologies, some facilities have been announced by their developers but aren’t yet present in the EIA data.

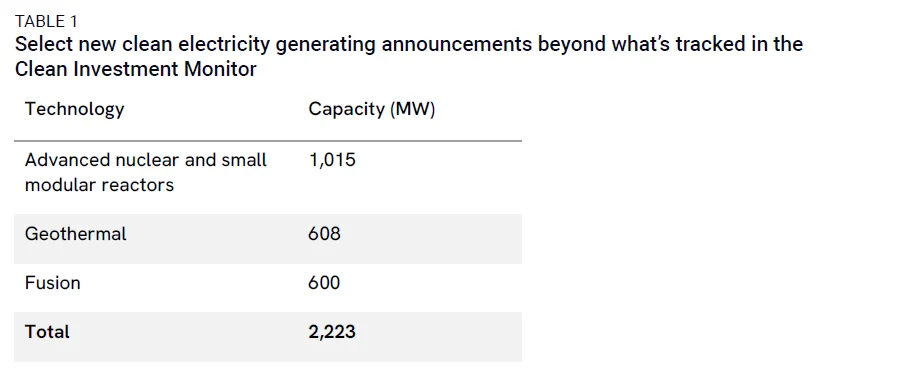

When looking outside of the CIM, we find at least another 2.2 GW of innovative clean electricity technology projects that could be threatened by the loss of tax credits and other policy moves made by the House-passed bill (Table 1). We focused our research on firm or dispatchable clean power generating technologies that can provide high capacity-factor output to the grid. These technologies are an important part of the technology mix to meet generationally high growth in electricity demand and maintain grid reliability. They’re also technologies where the US can be a global leader in manufacturing and deployment expertise.

All eyes on the Senate

As the Senate considers how they want to put their stamp on the budget reconciliation process, there are several key changes to make from the OBBBA framework that could help mitigate risk to US clean investment, manufacturing, and innovation. Major investment decisions turn more like an aircraft carrier than a speedboat, so the more time that developers and investors have to see policy changes on the horizon and respond, the better. An orderly statutory phase-out of tax credits in the medium-term would create far less chaos than immediately lopping off portions of the tax code. As we detail above, more time is particularly important in helping emerging clean technologies like next-generation geothermal and advanced nuclear develop to commercial scale before the tax credits sunset.

In recent comments, Senator Thom Tillis (R-NC) voiced concern about the workability of the material sourcing and prohibited foreign entity provisions inserted by the House. Giving manufacturers and clean energy developers clearer and less administratively complex material sourcing requirements to meet as well as a longer runway to meet them could maintain growth in domestic manufacturing of clean energy components and production of critical minerals. Similarly, maintaining tax credit transferability can provide important additional sources of capital as these technologies seek to scale.

The energy-related tax credits form a portion of the broader tax bill debate that will take place in the Senate in the coming weeks, but the fate of those credits has important implications for continued US clean manufacturing growth, investment, energy innovation, and energy affordability.

This nonpartisan, independent research was conducted with support from Blue Horizons Foundation. The results presented reflect the views of the authors and not necessarily those of the supporting organization.