When Multinationals Start De-risking, How Will Beijing Know?

When foreign companies and investors start “de-risking” and reducing exposure to China’s economy, Beijing will probably be unable to detect the magnitude of the change in behavior.

When foreign companies and investors start “de-risking” and reducing exposure to China’s economy amidst an economic slowdown and rising operational challenges, Beijing will probably be unable to detect the magnitude of the change in behavior. There is no single economic data series that can effectively capture companies’ decisions to intentionally reduce their real economic exposure to China. Beijing’s official foreign direct investment (FDI) data increasingly measure purely financial transactions, including those by Chinese state-owned companies, rather than foreign corporate decisions. Alternative data series point to sharper declines in both inbound and outbound FDI during the pandemic years.

As a result, China’s decision-makers may not know when they need to adjust policies more aggressively to attempt to restore business confidence. Amidst a broader structural slowdown in China’s economy, the delayed reactions could contribute to further losses in productivity and economic growth.

The Illusion of Inevitability

China’s economy is reopening after three years of pandemic-related restrictions, but optimism among global corporates has been quashed by sudden raids and investigations into foreign firms, including Mintz Group and Bain and Company, alongside more rigorous applications of restrictions on cross-border data flows and counter-espionage rules. Beijing’s retaliation against Micron Technology raises further concerns that geopolitical tensions outside of companies’ control will impact business conditions in China, causing multinational firms to think twice about new investments. The May joint communique of the G7 leadership publicly endorsed the objective of “de-risking and diversifying” away from China’s economy in for the purpose of maintaining “economic resilience.” Recently released surveys of European businesses indicate growing numbers are considering actively reducing their operations in China.

Throughout the past decade, Beijing has expressed few public worries about the attitudes of foreign investors toward the business climate. The reasons for this complacency remain unclear. China’s leaders may hold views that the size and growth of China’s market render foreign firms and investors ultimately incapable of abandoning their China operations—public or private statements from Chinese officials to this effect emerge from time to time. They may also believe that foreign investment is no longer as important for China’s economy, or may pose new security concerns that overwhelm the economic benefits of new investment. If foreign investment in China is simply an inevitable trend, or disconnected from the economy’s performance or Beijing’s increasingly confrontational external behavior, then Beijing is likely to simply maintain its present course.

The more interesting possibility is that Beijing may not even know when foreign enterprises and investors are truly souring on China’s economic prospects and business climate. The most commonly cited data series for monitoring foreign long-term engagement with China’s economy concern foreign direct investment (FDI), with two series published by the Ministry of Commerce (MOFCOM) and the State Administration of Foreign Exchange (SAFE). But these series are more likely to detect changes in purely financial transactions among both foreign firms and large Chinese firms, who often set up offshore entities in order to take advantage of preferential local policies toward foreign investment.

Trade flows will respond much more slowly to changes in foreign engagement with China’s economy, and meaningful shifts will be difficult to detect. Visiting foreign executives are often loath to directly criticize Beijing’s policies in public or private, and typically focus their remarks on the importance of the China market. Local officials in China will primarily report their successes in attracting FDI, not any losses from disinvestment by foreign firms. Beijing may have their own internal data series tracking “real” new greenfield and merger and acquisition activity by foreign firms in China separate from the official data, but frankly, we doubt there is a second set of books.

If Beijing does eventually see the need for a shift in its approach, it may occur long after most de-risking decisions by foreign firms have already taken place, and long after such decisions might have actually impacted Beijing’s economic and political trajectory. Consequently, the case for building better data series to monitor these trends within the public domain is strong.

Foreign Direct Investment: Less Than Meets the Eye

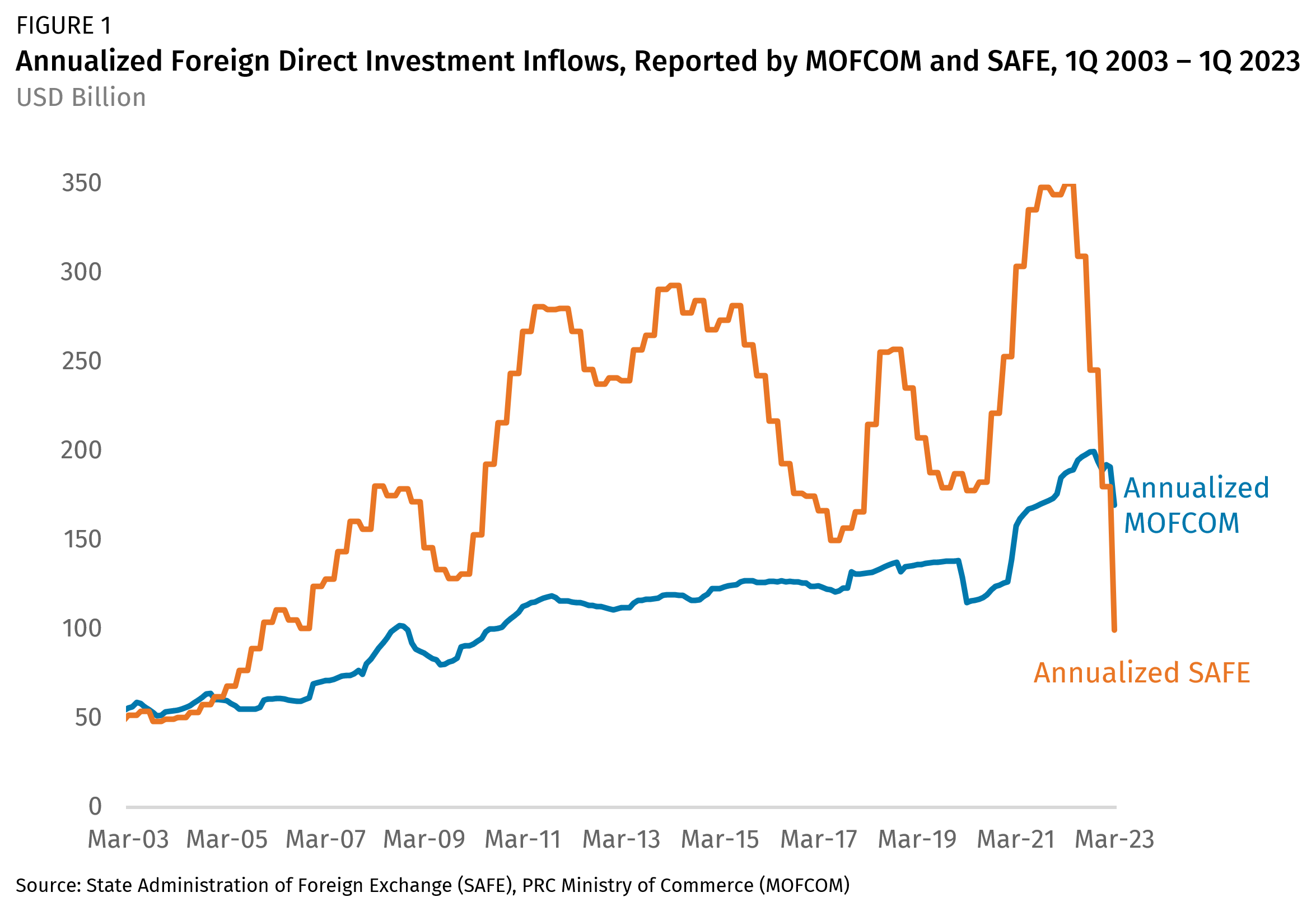

During the COVID-19 pandemic, it was widely anticipated that travel restrictions would limit FDI flows both into and from China, outside of new investment financed by retained earnings from firms’ existing China operations. However, the data revealed no such slowdown, with Ministry of Commerce (MOFCOM) data showing a rise in 2020 inbound investment flows to $144.3 billion, and more significant surges in 2021 and 2022 to $173.5 billion and $189.1 billion, respectively. The idea that foreign direct investment into China would reach record highs despite the sharp economic slowdown in 2022 and prohibitions on travel by foreign executives strains credulity. Similarly, SAFE reported a surge in inbound FDI investment from 2019 levels of $187.2 billion to $253.1 billion in 2020, and $344.1 billion in 2021, before a drop to $180.2 billion in 2022. Looking at the headline FDI data, Beijing did not have a problem attracting foreign direct investment during the pandemic.

The inclusion of purely financial transactions within FDI is not an exclusive problem to China’s FDI data, and extends to these same data series globally. FDI data generally can be subject to distortions because of tax optimization strategies, particularly in tax havens, or “round-tripping” and “trans-shipping” investments through third locations. The issue is slightly larger in China because of a historically closed capital account, particularly to portfolio flows and other short-term flows from banks. As a result, many companies and financial institutions end up using the FDI account to disguise financial flows. This is because China’s system has historically been more open to FDI flows, making it easier to categorize multiple financial investments as FDI.

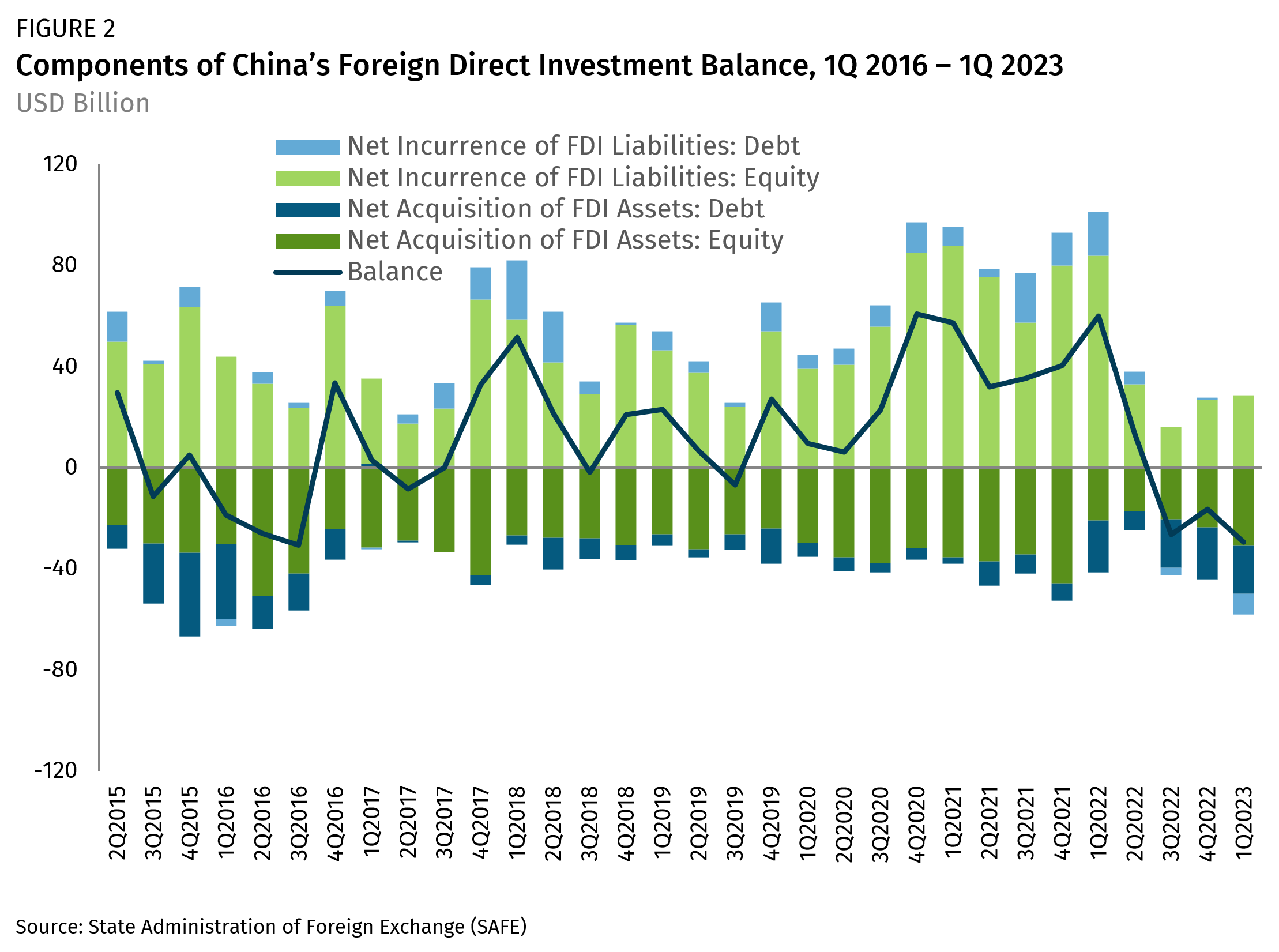

The SAFE data appears to be primarily capturing the financial transactions of both state-owned enterprises with overseas operations (usually conducted via centers in Hong Kong) and foreign companies. FDI inflows dropped sharply in Q2 2022, at the same time that US interest rates rose, while Chinese interest rates fell and China’s currency depreciated. These changes in global financial conditions drove significant adjustments in reported FDI inflows, which were revealed in the SAFE data as changes in intra-company debt flows (the dark blue bars in Figure 2). This can reflect actual divestment decisions by foreign companies, but it can also simply reveal Chinese firms moving funds between their parent companies and overseas affiliates, or vice versa. Most likely the shift in China’s FDI balance from surplus to deficit within the SAFE data over the last year reflects these financial transactions within Chinese firms.

The MOFCOM data series does not really monitor decisions by foreign companies to expand their businesses or initiate new projects in China. Data is sourced from the MOFCOM FDI approval and registration system and therefore only reflects the immediate source location as reported by the companies, as opposed to the ultimate ownership country of the investor. There can be a considerable time lag in MOFCOM’s statistics reporting business registrations that can distort the quality of the data over time—a drop in new FDI may not be revealed for months or years.

In addition, most of these FDI flows within the MOFCOM data appear to be conducted by mainland firms, particularly SOEs, channeling funds round-tripped from their Hong Kong headquarters back to their mainland operations. Often this occurs to take advantage of local incentives to encourage inbound FDI, in the form of lower taxes or costs in land leases. Chinese investors have particularly strong incentives to use offshore holding companies registered in tax havens to engage in both inbound and outbound investment because of existing capital controls, and the lack of adequate financial and legal structures at home.

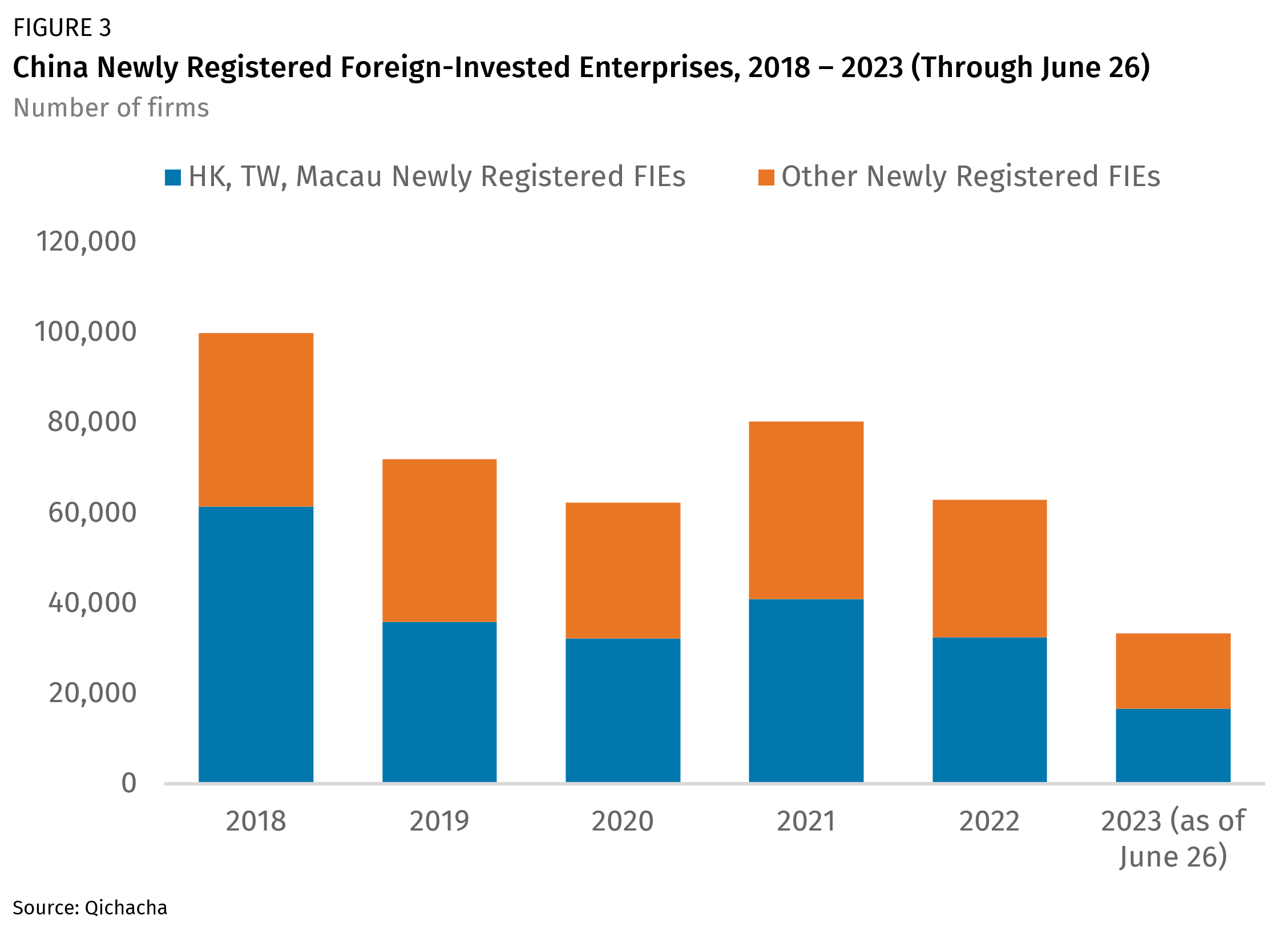

There are other indirect data sources on foreign investment in China available as well, concerning the number of newly registered foreign-invested enterprises by year, reported from corporate information portal Qichacha. Within these data series, firms registered with parent companies in Hong Kong, Taiwan, and Macau are recorded in a separate category. The steady decline since 2018 and relative to the previous decade is clear within Figure 3.

Transaction-Based Investment Data Series

The actual picture of both inbound and outbound FDI, as it concerns decisions for greenfield investment and mergers and acquisitions by foreign companies, reveals a sharper slowdown in activity throughout the pandemic years. A transaction-based approach offers some clear advantages to the headline official data to gain insights into actual investment activity into and out of China. But there are still clear drawbacks in the form of underreporting, poor reporting of transaction values from public sources, and difficulties in accounting for investments in maintenance and upgrading of existing facilities.

Our own data series concerning China’s outbound investment, collected at the transaction level, shows a considerable decline in activity since 2017. At the time, the slowdown was related to Beijing’s deliberate restraints on outbound flows from larger private conglomerates, including HNA, Anbang, and Wanda. At the same time, regulatory scrutiny by foreign governments slowed both Chinese acquisitions and new greenfield investments overseas. The slowdown in outbound investment occurs across all data series but only a transaction-level approach reveals the severity of the downturn, particularly during the years of the COVID pandemic. On average, annual outbound FDI from 2020-2022 was around 22% of 2017 levels and 45% of 2019 levels.

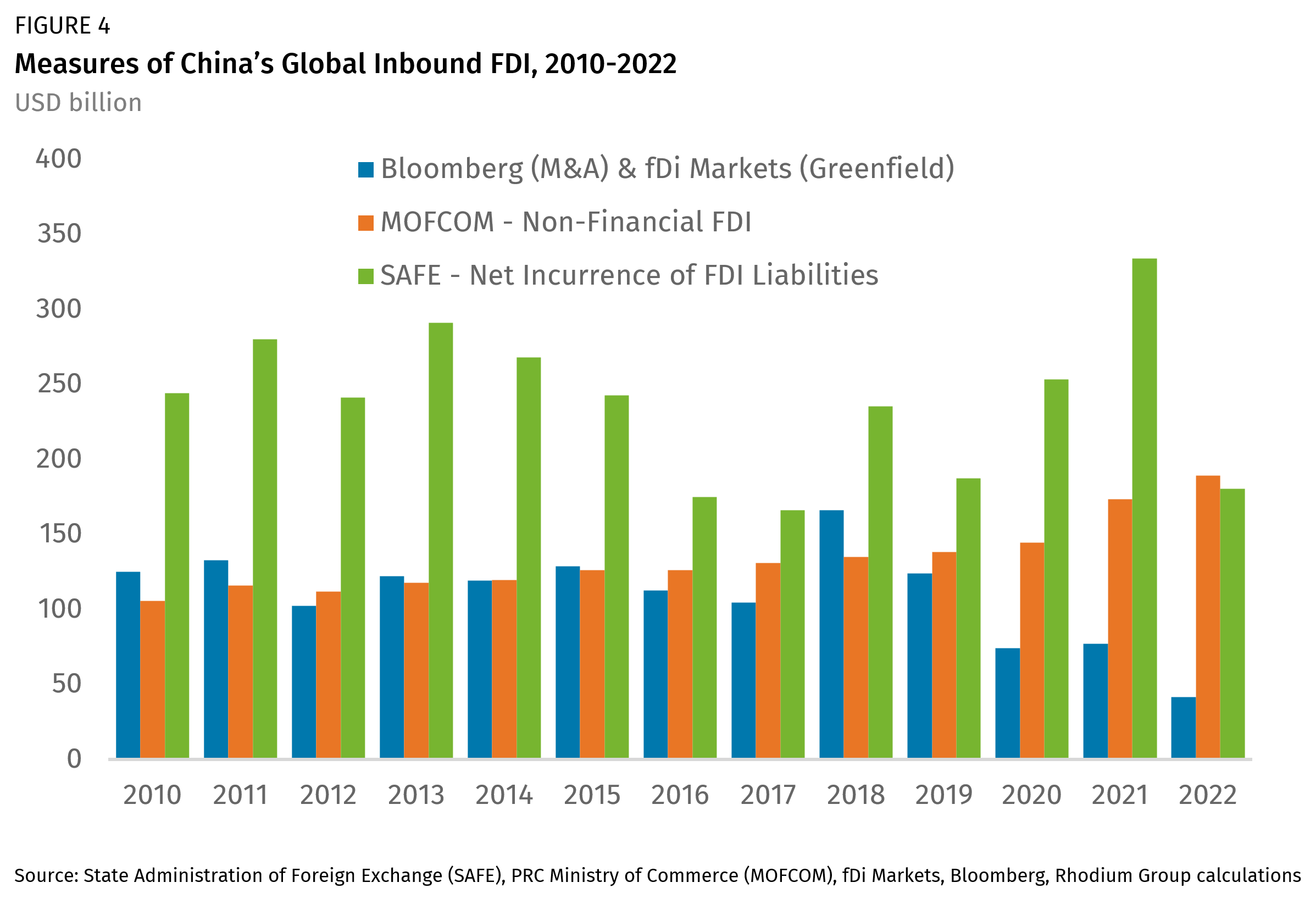

Similarly, transaction-based measures of inbound FDI into China available from commercial data providers also reveal a sharp slowdown during the pandemic years, in contrast to the MOFCOM and SAFE data. Data compiled from Bloomberg and fDi Markets shows that in 2020, announced foreign investment in China dropped by around 40%, from $120 billion to $74 billion. This downward trend persisted into 2022, with foreign investment further declining to a low of $41 billion (Figure 4).

The significance of these shifts in investment is that multinational companies’ real economic engagement in China may already be declining significantly, well before more active efforts from these firms to reduce their exposure.

How Can We See De-risking or Diversification in Progress?

The problems with the FDI data series raise a broader question of how to monitor diversification or de-risking of Western firms from China’s economy. Most MNCs—either surveyed by business associations or as stated within their annual reports—are making clear they are actively considering diversification away from China—for sourcing, manufacturing, or R&D purposes. However, actually tracking changes in firms’ China exposure can be tricky. MNCs typically do not publicize actions taken to de-risk, diversify supply chains, or set up shop in other destinations (beyond the aforementioned statements of intentions). Many firms are both diversifying global activities and insulating China operations through a strategy of localization that involves significant capital expenditures within China. The latter could be misconstrued as increased appetite for the China market, when it instead reflects a more defensive strategy at play. Alternative datasets might also miss part of the picture: they rely on companies to self-disclose China investment plans and can only draw correlations between declining FDI in China with potential upticks in FDI elsewhere.

Trade data can be misleading as well. Moves by Western firms to diversify away from China could produce no material changes in Chinese exports to the rest of the world, as increasingly competitive Chinese firms pick up market share from MNCs. This trend has already emerged over the past decade. Chinese firms are also contributing to the diversification push, through outbound investments chasing lower manufacturing costs outside of China. Diversification of supply chains to Vietnam or India, among possible destinations, could ironically increase trade between China and the world in the medium term, as new plants in these countries are fed China-made inputs and intermediate goods. As of 2021, China accounts for 31% of global manufacturing value-added—so replacing even part of it will take years if not decades. Finally, trade data might be conflating active de-risking decisions with inventory cycles, tariff avoidance or trade diversion to third countries.

The only way to map out de-risking in this context to understand the complex trends underway is to cross-reference multiple existing series for trade and investment data, both official and alternative, and both at the aggregate and sectoral or country level. We will be releasing more research on corporate de-risking from China using this approach in the months ahead.