Note

Clean Investment Monitor: Q3 2023 Update

Investment in clean technologies is continuing at record levels in the U, as demonstrated by new data from the Clean Investment Monitor.

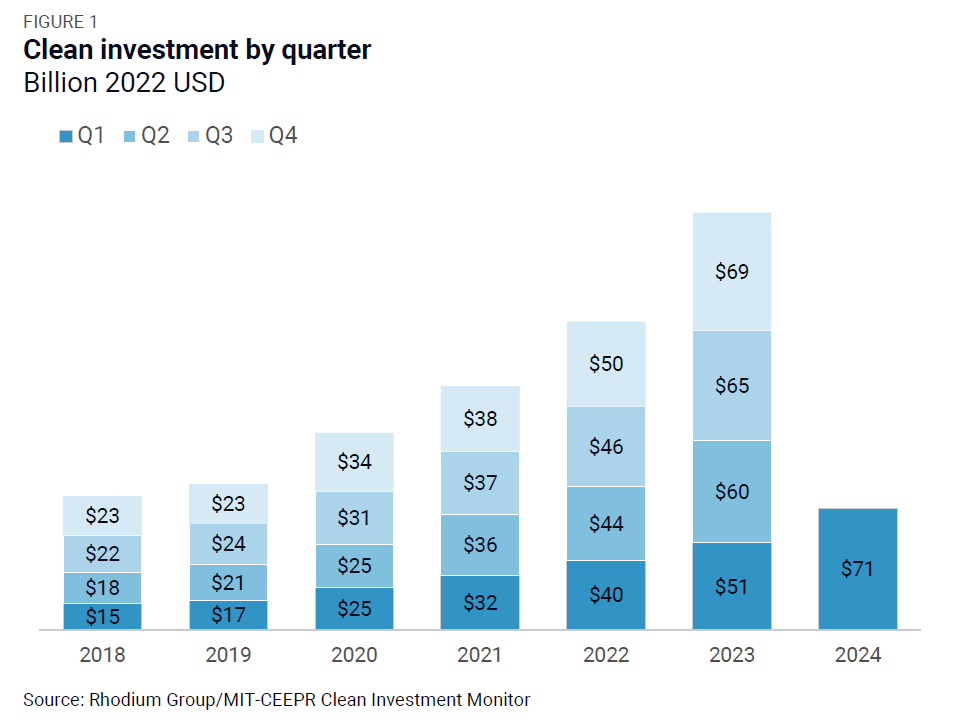

Clean energy and transportation investment in the United States continued its record-setting growth in Q1 of 2024, reaching a new high of $71 billion.

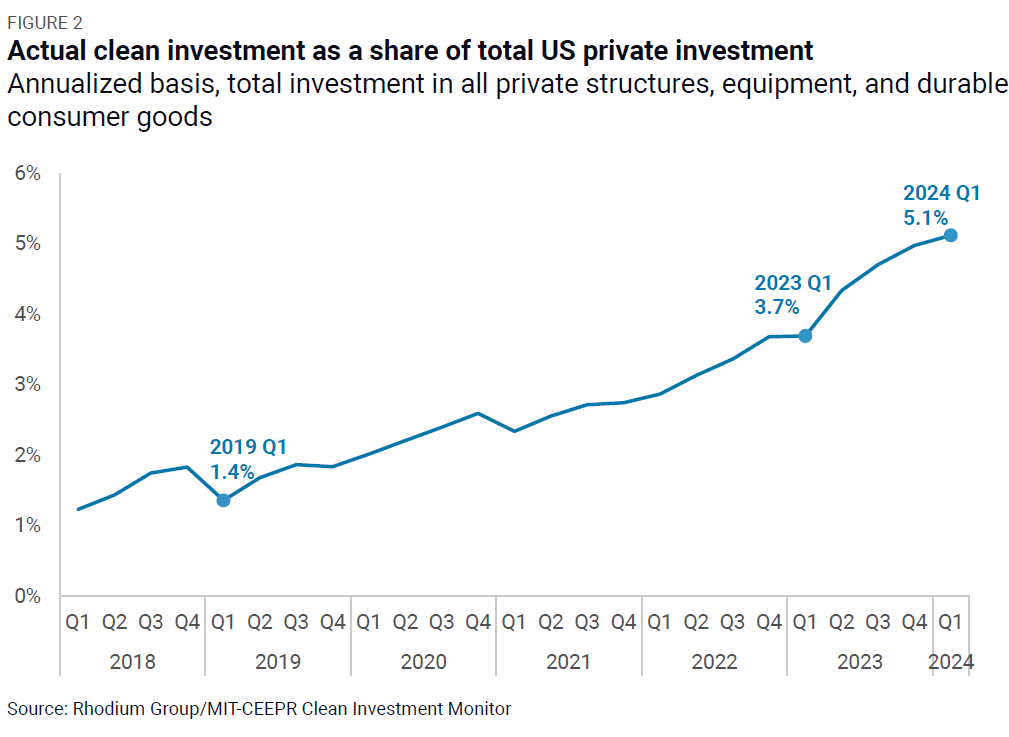

Clean energy and transportation investment in the United States continued its record-setting growth in Q1 of 2024, reaching a new high of $71 billion. This continues a sustained quarter-on-quarter growth trend that began in Q1 2021, with a 40% increase in Q1 of 2024 from the same period in 2023. Clean investment accounted for 5.1% of total US private investment in structures, equipment, and durable consumer goods in the United States, compared to 3.7% in Q1 2023.

Investment in manufacturing clean energy and transportation technology continued to be the main driver of clean investment and growth and increased 28% quarter-on-quarter, again led by the electric vehicle supply chain. Investment in deploying technology to decarbonize energy and industrial production slipped 3% quarter-on-quarter but is still up 51% compared to the same period last year. And investment in the deployment of emerging climate technologies (ECT)—clean hydrogen, carbon management, and sustainable aviation fuels—continued to surge, with a 37% increase relative to Q4 2023 and a five-fold increase relative to Q1 2023. Indeed, actual investment in each individual ECT technology surpassed wind investment this quarter, reflecting continued momentum.

Retail investment declined 3% relative to the previous quarter but increased 12% compared to Q1 2023. The quarterly decline in retail investment was due primarily to a slowdown in zero-emission vehicle (ZEV) sales in Q1. New ZEV registrations (a proxy for sales) declined by 9% in Q1 2024 relative to the previous quarter (though still up 14% compared to Q1 2023). The weakness came entirely from battery electric vehicles (BEV). Plug-in hybrid electric vehicles (PHEV) continued to post strong registration growth. For BEVs, a decline in Tesla Model 3 registrations accounted for nearly two-thirds of the overall drop, though registrations of BEVs made by the Big 3 U.S. automakers (GM, Ford, and Stellantis), European, and Japanese automakers also declined. In contrast, registrations of BEVs produced by Korean automakers continued to post impressive growth. A contributing factor to the weakness in ZEV registrations in Q1 was a slowdown in overall vehicle sales growth in the US.

Actual clean energy and transportation investment in the US continued its record-setting growth in Q1 of 2024, reaching a new high of $71 billion (Figure 1). This continues a sustained quarter-on-quarter growth trend that began in Q1 2021, with a 40% increase from Q1 in 2023. Clean investment represents a growing share of the US economy as well. In Q1, clean investment accounted for 5.1% of total US private investment in structures, equipment, and durable consumer goods nationwide, up from 5% in Q4 2023 and 3.7% in Q1 2023 (Figure 2).

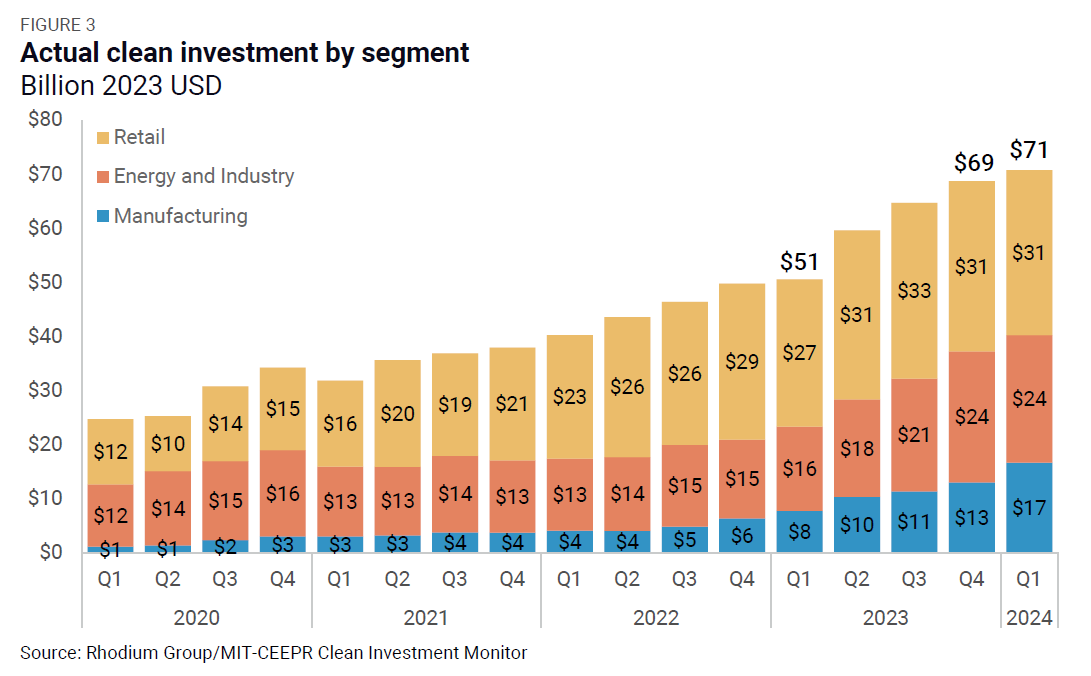

We categorize our clean investment tracking into three segments: investment in the manufacture of GHG emission-reducing technology (“manufacturing”); investment in the deployment of that technology, both to produce clean energy or decarbonize industrial production (“energy & industry”); and through the purchase and installation of that technology by individual households and businesses (“retail”). Each dollar figure in this report is actual investment in Q1 2024, or the real dollars spent within the previous quarter, and we include headline-announced figures to provide context and insight into upcoming actual investment trends.

By segment, retail investment accounted for 43% of total clean investment in Q1 at $31 billion. Like in Q4 2023, actual retail investment declined 3% relative to the previous quarter but was still up 12% relative to Q1 2023. In the energy & industry segment, there was $24 billion in new investment in clean energy production and industrial decarbonization in Q1 2024, slipping 3% quarter-on-quarter but still up 51% compared to the same period last year. Manufacturing continued to be the segment with the most growth in Q1 2024, with $17 billion of new investment, up 28% quarter-on-quarter and 115% year-on-year. Indeed, manufacturing makes up a growing share of overall spending on clean technology, at 24%—up from 18% last quarter and 16% this time last year.

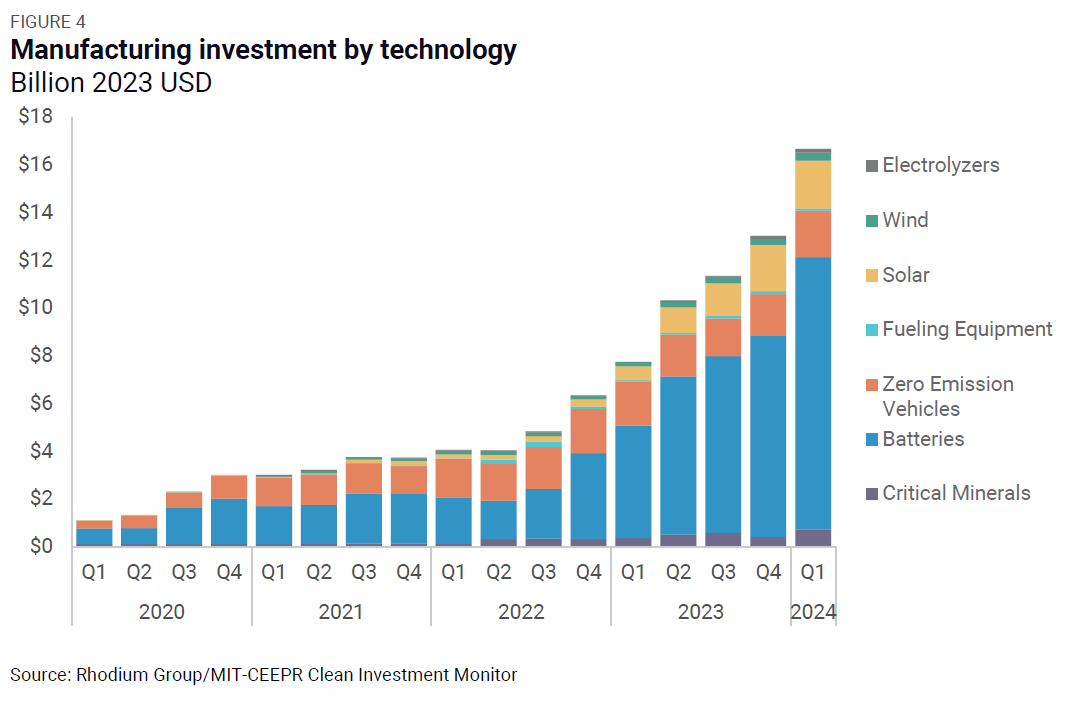

The electric vehicle (EV) supply chain (critical minerals, batteries, vehicle assembly and charging equipment) continued to dominate clean manufacturing investment in Q1, at $14 billion (85%) of the total $17 billion in actual investment (Figure 4). Battery manufacturing investment increased by 36% quarter-on-quarter to $11 billion. Solar manufacturing investment grew by 248% year-on-year to $2 billion. Electrolyzer manufacturing investment also increased by 22% quarter-on-quarter, for a total $157 million. Wind manufacturing investment recovered from a dip in Q4 2023, reaching a record $334 million.

The pipeline of new clean energy and transportation manufacturing investment—measured by new announcements in manufacturing projects—slowed this quarter to $12 billion, a 34% decrease quarter-on-quarter and a 30% decline year-on-year. Most (84%) of the new manufacturing investment announced in Q1 2024 was concentrated on the EV supply chain.

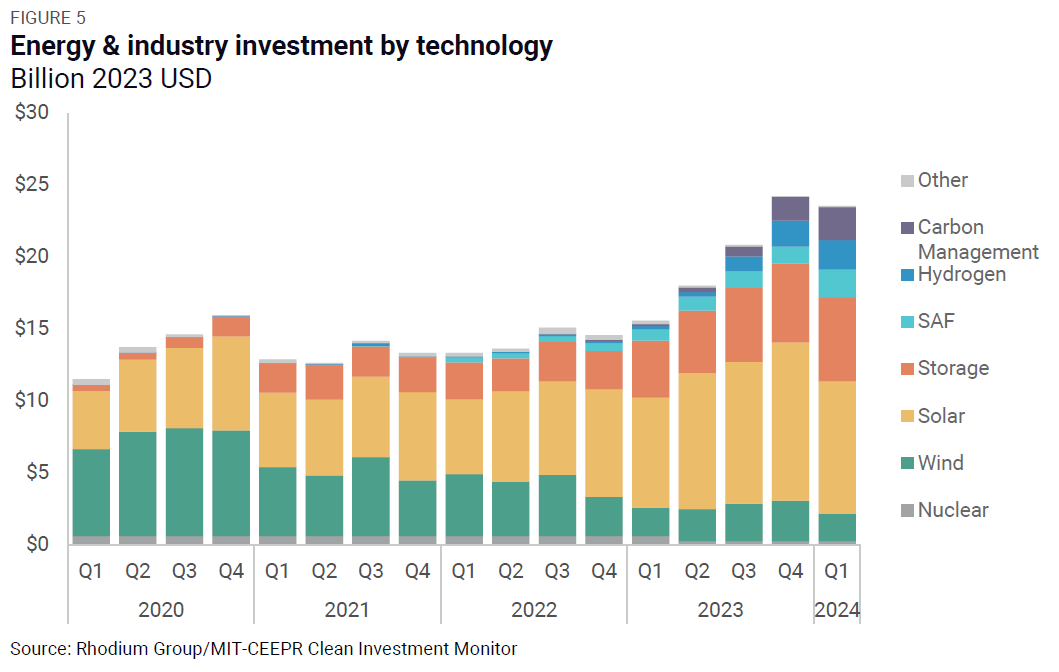

Of the total $24 billion in new actual investment in clean energy production and industrial decarbonization in Q1 2024, utility-scale solar and storage investment accounted for the majority at $15 billion (Figure 5). Grid-scale storage investment increased 7% quarter-on-quarter, and 48% year-on-year to a record $5.8 billion. However, utility-scale solar investment fell by 16% from the record $11 billion invested last quarter. Wind investment decreased 32% quarter-on-quarter to $1.9 billion in Q1. That’s a 5% decline in wind investment compared to the same period in 2023.

The most rapid growth in energy & industry segment investment in Q1 2024 occurred in emerging climate technologies (ECT)—clean hydrogen, carbon management, and sustainable aviation fuels—on course with sustained growth throughout 2023. In Q1, there was $6.3 billion in investment in deploying these technologies, a 37% increase relative to Q4 2023 and a five-fold increase relative to Q1 2023. Actual investment in each ECT technology surpassed wind investment this quarter, reflecting continued ECT momentum.

In terms of newly announced investments, there were more than twice as many energy and industry projects (by investment value) announced in Q1 2024 compared to Q4 2023, though still less than Q1 2023. All energy and industry categories saw a quarter-on-quarter increase in announcements, with the exception of clean hydrogen production, where announced investment value fell 33% quarter-on-quarter, and 88% relative to Q1 2023. While newly announced wind investments grew in Q1 to $2 billion, that remains considerably below average levels for the past few years, suggesting that interest rate, supply chain, transmission access and siting and permitting issues continue to confront the technology. Outside of clean hydrogen, ECTs continued to exhibit strong momentum, with significant growth in announced investment for both carbon management and sustainable aviation fuel.

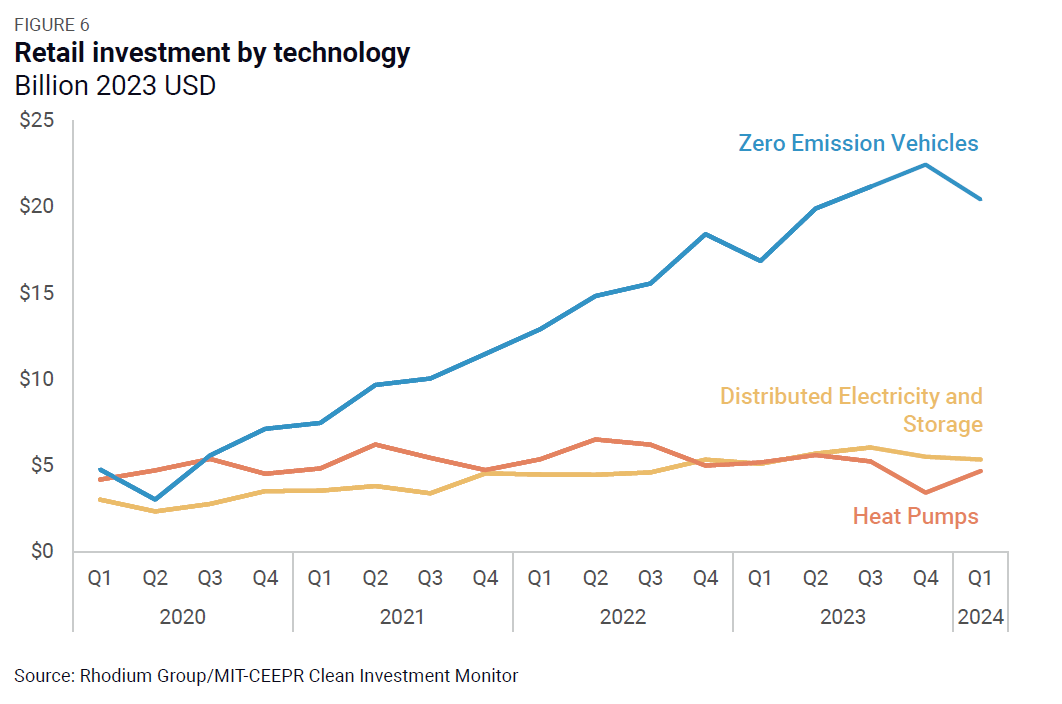

Retail purchases of zero-emission vehicles (ZEVs), distributed renewable electricity and storage, and heat pumps came in at $31 billion in Q1 2024, down 3% from Q4 2023, but still up 12% relative to Q1 2023. Most of the decline was due to a fall in ZEV sales, which we explore in more depth in a separate report. Based on preliminary sales estimates, distributed electricity generation and storage investment also declined by 3% quarter-on-quarter in Q1 (though still up 5% relative to Q1 2023). Partially offsetting this was a recovery in heat pump investment, which grew by 36% quarter-on-quarter to $4.7 billion in Q1, though heat pump investment is still down 9% relative to Q1 2023 as high interest rates continue to weigh on residential construction activity.

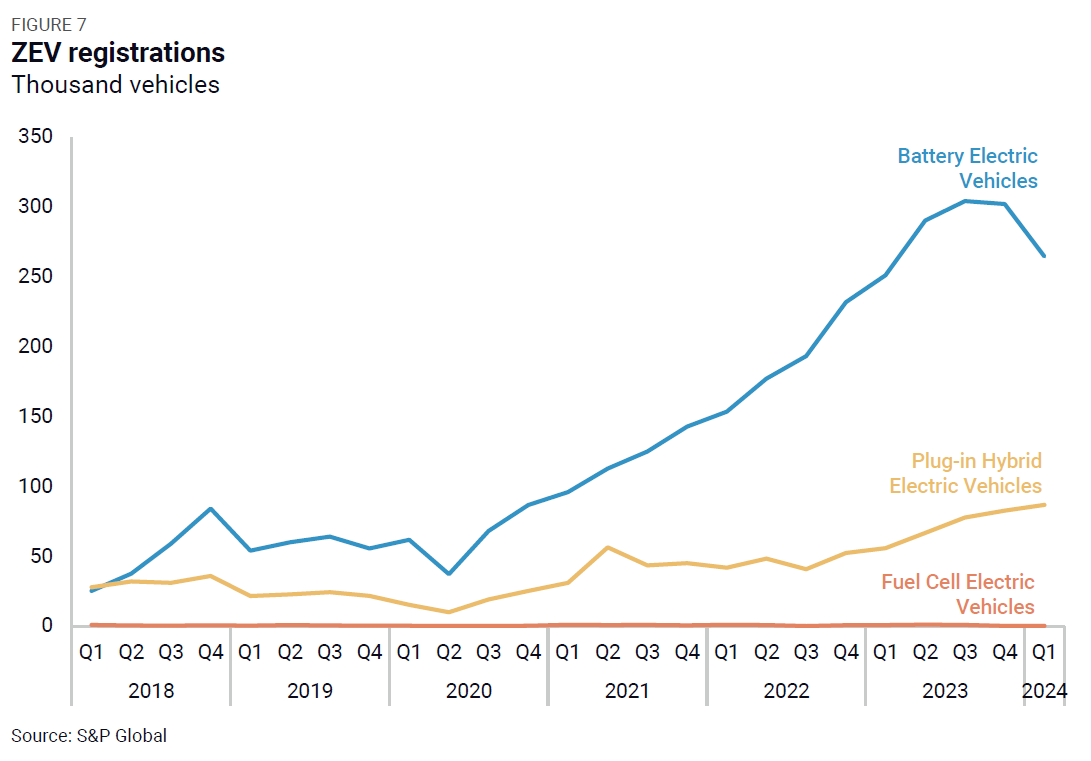

The slowdown in ZEV sales growth generated considerable media attention in the first quarter of the year. This was true for new vehicle registration data as well, which is what the CIM uses because of the higher level of detail available. Overall ZEV registrations fell to 352,000 in Q1 2024, down 9% from the 385,000 ZEVs registered in Q4 2023. This was due to a 12% quarter-on-quarter drop in battery electric vehicle (BEV) registrations, from 302,000 to 265,000 vehicles (Figure 7). Plug-in hybrid electric vehicle (PHEV) registrations continued to grow, up 5% quarter-on-quarter in Q1 to 87,000 vehicles. Fuel cell vehicles (FCV) also grew, but from a much lower basis. While they are helpful from an emissions standpoint, we do not include hybridized internal combustion engine vehicles in our definition of ZEVs. In addition to not receiving incentives under the IRA (our criteria for technology inclusion in the CIM), hybrid systems are best thought of as efficiency-improving technologies for gasoline engines, not a means of fuel switching to electricity which can be completely decarbonized, which BEVs, FCVs and PHEVs all allow.

Most of the decline in BEV registrations was due to weak demand for Tesla vehicles, particularly the Model 3. Model 3 registrations were down 50% quarter-on-quarter in Q1 and accounted for 64% of the total decline in BEV registrations across all companies in Q1. Tesla’s popular Model Y saw 8% registration growth. Overall Tesla registrations were down 11% quarter-on-quarter and 9% compared to Q1 2023.

BEV weakness this quarter was not confined to the Tesla Model 3, however. BEVs from the US Big 3 saw a 10% quarter-on-quarter decline, while European and Japanese brands posted a 24% decline collectively. Unlike Tesla, however, registrations of vehicles made by the Big 3, European and Japanese brands were still up in Q1 relative to a year prior.

The most notable success in the BEV space continued to come from the Korean brands (Hyundai, Kia and Genesis) which collectively posted an 18% increase in registrations in Q1 2024 relative to Q3 2023, and an 80% increase relative to the year prior. This helped keep overall BEV growth positive on an annual basis in Q1 2024, up 5% relative to Q1 2023. For ZEVs overall, registrations were up 14% in Q1 2024 relative to Q1 the year prior.

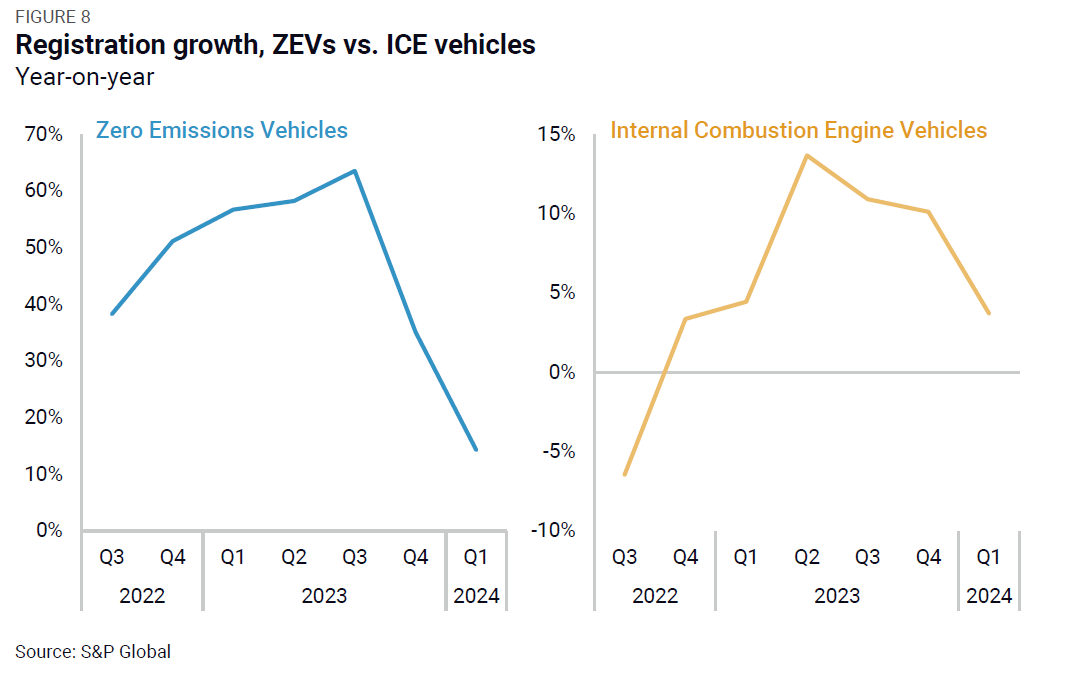

Part of the weakness in ZEV sales in Q1 was likely the result of overall weakness in the auto market that quarter. While year-on-year registration growth for ZEVs slowed in Q1, it also slowed for internal combustion engine (ICE) vehicles (though not as quickly). ZEV share of total vehicle registrations declined from 9.8% in Q4 2023 to 9% in Q1 2024. But that was still higher than the 8.3% market share ZEVs had in Q1 2023.

Note

Investment in clean technologies is continuing at record levels in the U, as demonstrated by new data from the Clean Investment Monitor.

Note

New analysis from the Clean Investment Monitor compares on-the-ground clean investment progress with projections of the Inflation Reduction Act.