An Assessment of the GREEN Act: Implications for Emissions and Clean Energy Deployment

The GREEN Act proposes to extend several tax credits for clean energy deployment and expand several others. We quantify the combined impact of most major provisions of the proposal on both technology deployment and GHG emissions, through 2030.

The Growing Renewable Energy and Efficiency Now (GREEN) Act, a discussion draft distributed to Congress on November 19th, proposes to extend several tax credits for clean energy deployment and expand several others. Given the current political climate and numerous competing priorities facing Congress, a tax credit extension package may possibly be the best chance in this Congress to enact measures that can accelerate clean energy deployment and reduce greenhouse gas (GHG) emissions. This independent analysis quantifies the combined impact of most major provisions of the proposal on both technology deployment and GHG emissions, through 2030.[1] We find that:

The GREEN Act can reduce US net GHG emissions by up to nearly 100 million tons in 2030 compared to no extension of tax credits. The combined impact of the proposal drives deployment of key clean energy technologies across the US energy system, driving US net emissions down to as low as 19% below 2005 levels in 2030. While more action will be required to meet climate goals, the proposal can help the US make tangible progress.

Extending and expanding tax credits can maintain momentum for renewable electricity deployment. The GREEN Act can catalyze deployment of up to nearly 60 gigawatts (GW) of new non-hydro renewable generation by 2030, compared to no extension of tax credits. The market share of these resources can at least double to 19-26% of total generation, up from 10% today.

The GREEN Act can accelerate electric vehicle (EV) sales through increased availability of tax credits. Our analysis finds 3.4 to 5.7 million more electric vehicles sold between today and 2030 in a scenario with extended EV tax credits, compared to current policy. This would accelerate EVs to 38% of all light-duty vehicle sales in 2030, a significant increase from just 3% in 2018.

The House Takes a Step on Climate

The US needs to take quick action to reduce net GHG emissions dramatically by mid-century in order to meet climate goals. Despite substantial reductions in the costs of solar panels, wind turbines, electric vehicle batteries, and many other clean energy technologies, continued policy action is required to accelerate deployment and meet the challenge of deep decarbonization. As Rhodium Group and others have noted, clean energy tax credits have a tried-and-true history of bipartisan support and a demonstrated record of driving higher levels deployment of clean energy technologies. In light of the current political environment, extending and expanding clean energy tax credits may be the only action on decarbonization that Congress and the White House can agree on. If any tax extender package is to become law, it will likely be folded into a broader, must-pass spending bill.

In this context, House Ways and Means Subcommittee on Select Revenue Measures Chairman Michael Thompson released a discussion draft of the Growing Renewable Energy and Efficiency Now (GREEN) Act, which aims to extend several existing or lapsed tax credits, expand tax credit eligibility to more qualifying technologies, and create a handful of new credits. The draft bill targets clean energy technologies in all major energy sectors: electric power, residential and commercial buildings, transportation, and industry. The major provisions of the bill we examine in our analysis include:

- Renewable energy production tax credit: Extension of the Section 45 renewable energy production tax credit (PTC) for wind, solar, biomass, geothermal, municipal solid waste, and certain water power sources.

- Business energy investment tax credits: Extension of the Section 48 business energy investment tax credit (ITC) for solar, wind, fuel cells, and a handful of other clean energy technologies, plus new ITC eligibility for energy storage.

- Residential energy efficient property tax credits: Extension of the Section 25D residential energy efficient property tax credits for investment in solar, small wind, geothermal heat pumps, and fuel cells, plus new eligibility for battery storage technologies.

- Electric vehicle credits: Extension of the Section 30D tax credit for new plug-in electric vehicles, plus new tax credits for used light-duty EVs and heavy-duty zero-emissions vehicles.

- Biofuels: Extension of tax credits for the production of biodiesel and certain other alternative fuels under Sections 40A, 6426, and 6427, and extension of the Section 40 second-generation biofuel tax credit.

- Energy efficiency credits: Revival and extension of the Section 25C residential efficiency tax credit, the Section 45L new energy efficiency home tax credit, and the Section 179D energy efficiency commercial buildings tax credit.

- Additional provisions: Extension of the Section 45Q tax credit for carbon capture, and new eligibility for master limited partnership (MLP) status for a wide array of clean energy technology developers.

Like the methodology in our note from September which examined potential key tax credits, we begin our analysis with our Taking Stock 2019 energy and emissions projections though 2030. This baseline includes all federal and state policies on the books through June 2019. All projections used in this analysis use RHG-NEMS, a version of the Energy Information Administration’s (EIA) National Energy Modeling System modified by Rhodium Group to reflect our own energy market and economic assumptions.

Using RHG-NEMS, we quantify the combined impact on technology deployment and CO2 emissions of most provisions of the tax extenders bill. We consider a range of future energy prices and clean energy technology costs to account for uncertainty in these variables. Interactions between GREEN Act provisions are captured in our analysis. Some provisions of the bill are targeted at technologies that are at a relatively early stage of development, including advanced biofuels and carbon capture. These and a few other GREEN Act components are assessed qualitatively outside of RHG-NEMS.

Renewable Electricity Credits Power Up

The GREEN Act extends commence construction deadlines associated with the renewable energy PTC and the business energy ITC. The PTC currently expires at the end of this year. The GREEN Act makes the credit available to new onshore wind generators and other eligible technologies that commence construction by the end of 2024. Wind energy developers will receive 60% of the original credit value through that time period. The GREEN Act also extends the ITC at its current full credit level (which is 30% of the cost of qualified energy property) through 2024 and steps the credit down to 10% of the cost at the end of 2026. It also changes the PTC for geothermal electric generation to an ITC. Separately, the bill also extends the credit for residential renewable deployment (Section 25D), extending support for technologies like distributed solar and geothermal heat pumps, and aligns phasedown of this provision with the phasedown schedule for the business energy ITC.

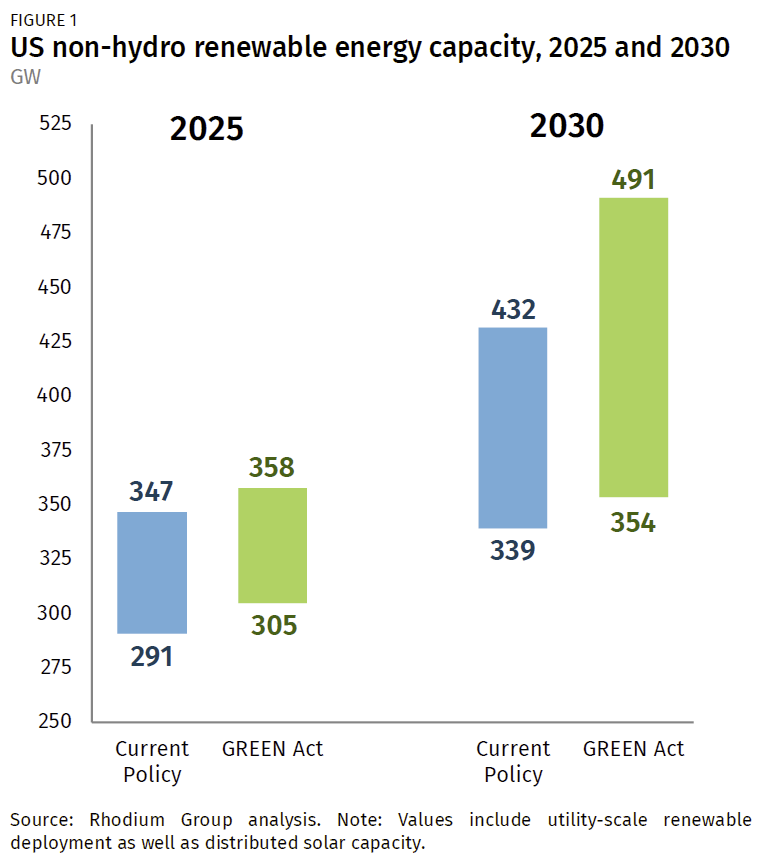

We find that if the GREEN Act is enacted, the momentum behind renewable energy will accelerate. Under current policy with existing tax credits phasing down or expiring, US non-hydro renewable capacity will increase from 161 GW in 2018 to between 291 and 347 GW in 2025. The GREEN Act can increase cumulative capacity by an additional 11-14 GW in the same timeframe (Figure 1). In the latter half of the 2020s, the GREEN Act can catalyze a surge in cumulative capacity additions to 354-491 GW in 2030, an increase of 15-59 GW compared to 339-432 GW under current policy. Though wind and solar make up most of this growth, geothermal generation capacity also nearly doubles to 4.4 GW in 2030. In the same year, 19% to 26% of total US electric power generation comes from non-hydro renewable sources—up from around 10% today.

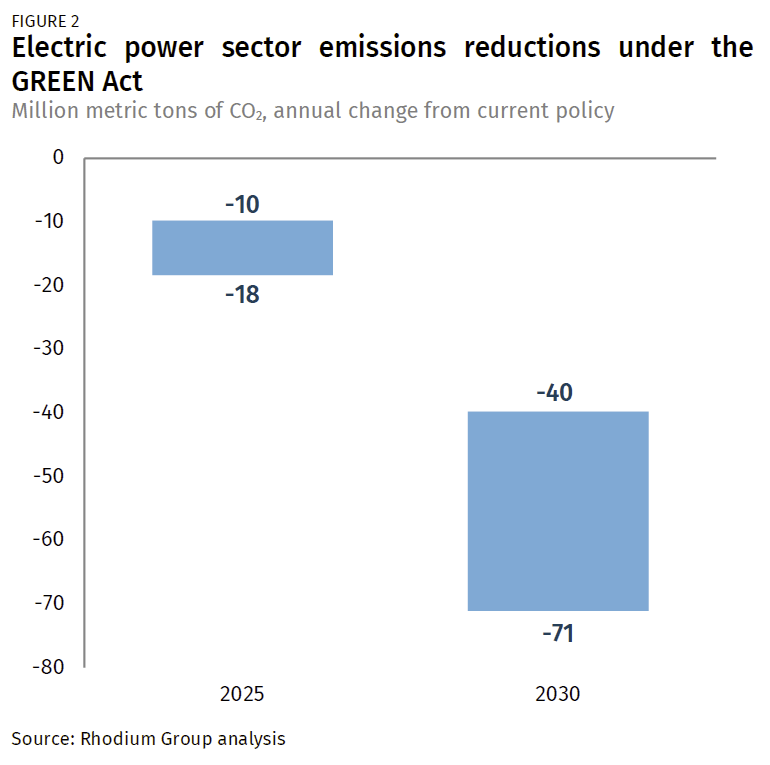

GHG emissions reductions in the power sector track renewables deployment. In 2025, reductions are modest, but in 2030, we find that increased deployment of renewables and building efficiency measures due to the GREEN Act lead to power sector emissions reductions of 40 to 71 million metric tons compared to current policy. By 2030 the GREEN Act could drive electric power sector emissions to as low as 43% below 2005 levels.

One reason that emissions reductions in the electric power sector aren’t larger is that persistently cheap natural gas and the ramp-up in renewables, combined with an aging nuclear power fleet, means nuclear power plant capacity is set to shrink by 65-75% compared to today’s levels over the next decade under current policy. While renewable energy deployment driven by the GREEN Act primarily displaces natural gas generation, it also backfills the lost zero-emitting electricity from nuclear. At best, the zero-emitting generation share of total electric power stays roughly flat through 2030.

Energy storage gets a deployment jolt and offshore wind gets financial stability

The GREEN Act expands the ITC to several new technologies that have not previously qualified for the credit, notably energy storage. Batteries and other storage technologies receive a 30% credit on the basis of the cost of a qualified investment. This credit phases down to 10% by 2026, like other ITC technologies described above.

A significant current driver of energy storage deployment is state energy storage programs. Expanding the ITC to storage technologies reduces the cost of compliance with these programs and provides consistent incentives to drive storage deployment to where it’s most useful on the grid. But the ITC can push storage deployment even further. In our low technology cost case, the GREEN Act leads to the deployment of more than 8 GW of new utility-scale storage—nearly twice the deployment projected under current policy in 2030.

The GREEN Act also allows offshore wind facilities to receive a 30% ITC through 2024, rather than phase down the credit as is done for onshore wind. If 3 GW of capacity is not deployed by the end of 2024, the credit remains available until that target is reached. Offshore wind is at an earlier stage of deployment than onshore wind in the U.S., and the offshore industry will require sustained policy support to develop a domestic supply chain and achieve its full potential. We assess this provision outside of RHG-NEMS and find that the GREEN Act provides financial stability in the face of permitting uncertainty, as we found in our last note. In turn, this foundational support for the industry can help states achieve their offshore wind targets, which currently amount to at least 20 GW of capacity by 2035.

Expanding financing options for clean energy projects

Beyond the extension and expansion of key tax credits, the GREEN Act contains two provisions that can expand the pool of capital available for clean energy. More capital opportunities can lower costs and lead to more technology deployment all-else-equal. First, the GREEN Act allows many of the clean energy developers who qualify for tax credits under various provisions discussed in this note to also be eligible for treatment as a master limited partnership (MLP)—a favorable tax treatment currently unavailable to those developers and mostly used by midstream oil and gas companies. MLP eligibility allows project developers to tap public markets for capital and levels the playing field with oil and gas.

The second provision effectively allows renewable energy project developers to claim 85% of the value of the PTC or ITC as a tax refund. This gives developers the option to forgo pursuit of relatively expensive tax equity capital as well as complex financing structures and instead secure capital from more conventional sources. This has the potential to lower the overall cost of renewable energy projects and lead to greater deployment. Due to the accelerated timeline in undertaking this analysis, we do not include the potential impacts of MLP treatment and credit refundability in our modeling.

Extending Credits to Drive Clean Transportation

The GREEN Act contains several provisions that affect the transportation sector. Most notably, the bill expands the Section 30D plug-in electric vehicle tax credit. Today, only the first 200,000 electric vehicles produced by each manufacturer qualify for a consumer tax credit of up to $7,500. The GREEN Act creates a new transition period and increases the vehicle cap to 600,000 vehicles per manufacturer, during which consumers are eligible to receive up to a $7,000 credit. Tesla and General Motors have both already hit the 200,000-vehicle cap, but their vehicles would qualify for the full transition period (i.e., up to 400,000 additional vehicles). Any vehicles produced by manufacturers that haven’t yet met the pre-transition cap still qualify for the $7,500 maximum credit through the first 200,000 sales.

EVs sales get kicked into high gear

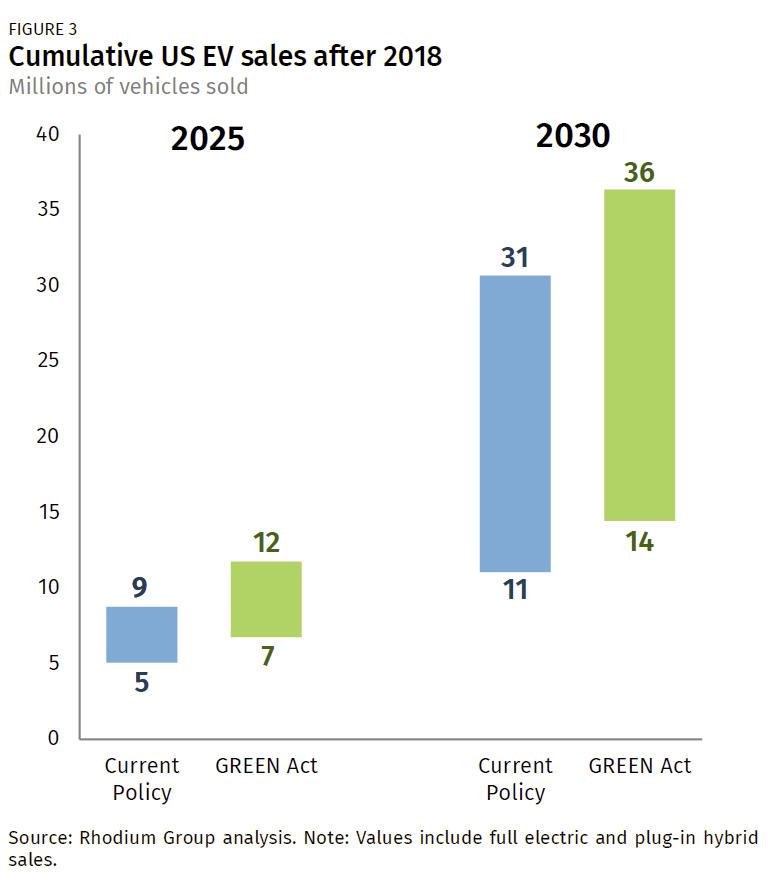

We find that the GREEN Act can accelerate EV deployment beyond what can occur under current policy. Without the GREEN Act, 5-9 million EVs will be sold from 2019 through 2025 in the US, with the range reflecting uncertainty around battery costs. With the GREEN Act, total EV sales range from 7-12 million over the same period, an increase of 34% (Figure 3). Cumulative sales from 2019 through 2030 range from 14-36 million EVs under the GREEN Act, 3-6 million more than without the draft bill. In our highest GREEN Act deployment scenario where battery costs are lowest, EVs comprise more than 38% of total light-duty vehicle sales in 2030, compared with 3% in 2018.

Despite this growth in EV deployment, the GHG emissions impact of this tax credit extension is small compared to what we find in the electric power sector. Turning over vehicle stock takes a long time, and despite record EV sales each year through 2030 under the GREEN Act, EVs still make up no more than 13% of light-duty vehicles on the road in that year. Using EV deployment to achieve emissions reductions also requires rapid decarbonization of the electric power sector, as we’ve noted before. As a result, we find negligible emissions reductions in 2025 attributable to this extension. In 2030, we find that the GREEN Act can achieve up to 20 million metric tons of transportation fossil fuel CO2 reductions at most—about a 1% reduction in sectoral emissions below current policy.

New credits to expand vehicle electrification

The GREEN Act includes two new electric vehicle credits. The first new tax credit is a used EV tax credit for low- and medium-income taxpayers that could help foster a robust secondary market for EVs where one barely exists today. The second new tax credit is a 10% investment tax credit to kick-start deployment of heavy-duty zero emission vehicles. While we do not model these provisions in RHG-NEMS, both have the potential to accelerate electrification and reduce emissions in the transportation sector beyond what we show above.

Relief for low-carbon fuel producers

The GREEN Act extends tax credits for biodiesel and certain other advanced biofuels (Section 40A, 6426, and 6427) through 2021, and phases the credit down until they expire at the end of 2024. The bill also extends the Section 40 second-generation biofuel tax credit through 2024. Biofuel producers have been struggling to compete with low retail fuel prices and ongoing uncertainty surrounding the Federal Renewable Fuel Standard. We do not model these provisions. However, as we’ve said before, extending these credits will provide much needed certainty for this fledgling industry and can potentially serve as a bridge to a more reliable future policy landscape.

Credits for Clean Buildings and Industry

Though decarbonizing electric power generation and the transportation sector typically get the most attention in climate discussions, there are opportunities to reduce GHG emissions in the buildings and industrial sectors as well. The GREEN Act revises and extends several building energy efficiency tax credits. The bill extends the expired Section 25C residential efficiency tax credit through 2024 and increases the percentage of the credit from 10% of the cost to 15% of the cost of qualified efficiency improvements. The bill also extends the expired Section 45L new energy efficiency home tax credit through 2025 and expands the maximum credit from $2,000 to $2,500. Finally, the bill extends the expired Section 179D energy efficiency commercial buildings deduction through 2024 and increases the maximum deduction from $1.80 to $3.00 per square foot.

We model the impact of the residential efficiency tax credit as a reduction in demand for electricity and natural gas in the residential sector. In 2030, this increase in deployment of energy efficiency technologies leads to about 8 million metric tons in reduced fossil fuel combustion GHG emissions, compared to current policy. We find a modest impact on emissions from the commercial buildings credit.

More time for more carbon capture projects

The GREEN Act also extends the commence construction deadline for the credit for sequestration from carbon capture facilities through 2024 (Section 45Q). Carbon capture facilities extract CO2 from power plants, industrial facilities and the atmosphere. The captured CO2 can then be safely stored underground, used in enhanced oil recovery (EOR), or used as a feedstock in products. Carbon capture is important to long-term climate goals because it enables the use of fossil fuels in a decarbonized system, which is particularly vital in applications that are not feasible targets for electrification or low-GHG fuels, such as in the industrial sector.

Under the credit, carbon capture projects receive up to $50 per ton of carbon captured and directly sequestered, or $35 per ton of carbon captured and used for EOR or products. The US leads the world in carbon capture research and development, and the carbon sequestration tax credit is the most important deployment policy on the books today for this suite of technologies. Extending the credit will provide greater certainty to carbon capture project developers, including first of kind commercial direct air capture facilities. While we do not include Section 45Q in our modeling, we reported previously that up to 74 million tons of industrial emissions annually could be cost-effectively captured under this provision. Extension of the credit increases the chances of maximizing emission reduction opportunities for this key technology.

Putting It All Together

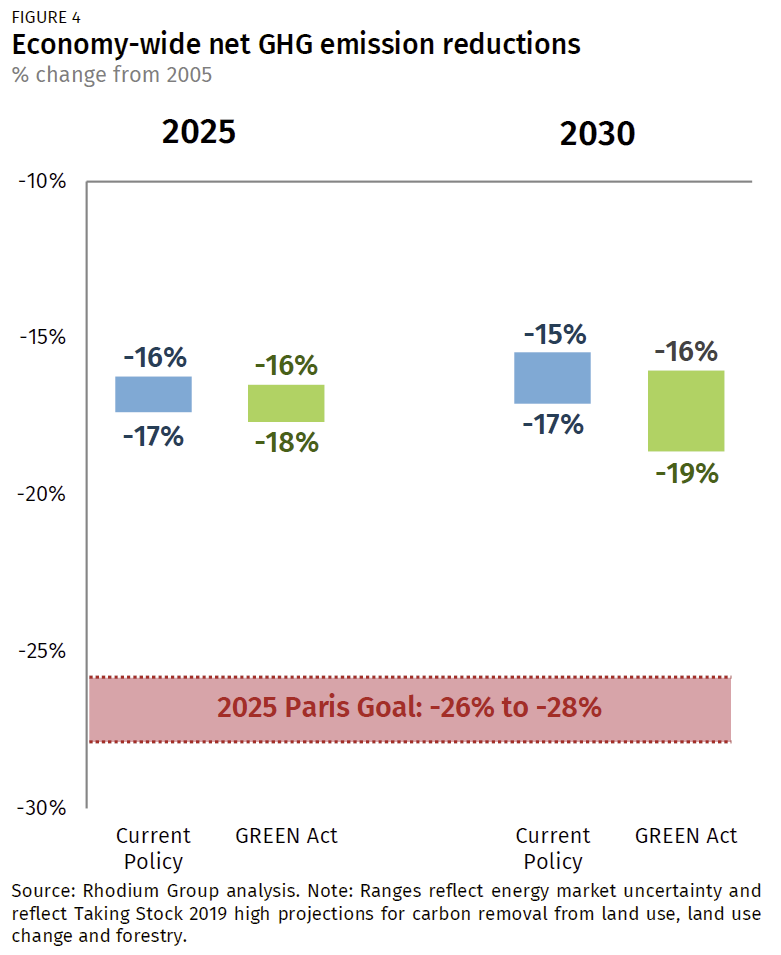

Taken together, our modeling shows that the combined impact of key provisions of the GREEN Act can make progress in cutting US greenhouse gas emissions. If enacted, the GREEN Act would reduce GHG emissions by 17 to 21 million metric tons below current policy in 2025 or 16 to 18% below 2005 levels. In 2030, emissions reductions expand to 37 to 99 million tons below current policy. That’s 16 to 19% below 2005 levels compared with a 15-17% reduction under current policy.

The U.S. is not on track to meet its Paris commitment of a 26% to 28% reduction in GHG emissions in 2025, compared to 2005 levels. We find that passing the GREEN Act will not close the gap, but any progress in reducing emissions is important in the face of the ongoing march of policy rollbacks by the executive branch. While additional policy action in the near-term will be needed to drive deep reductions in US emissions, provisions in the GREEN Act can prime the pump for deployment of an array of technologies that are critical to long-term decarbonization.

[1] This nonpartisan, independent research was conducted with support from the William and Flora Hewlett Foundation and the Heising-Simons Foundation. The results presented in this report reflect the views of the authors and not necessarily those of supporting organizations.