Pathways to Build Back Better: Investing in 100% Clean Electricity

As part of its Build Back Better plan, the Biden administration has a goal to get to 100% clean electricity in 2035. We explore ways in which congressional clean energy infrastructure investments can accelerate decarbonization.

The electric power sector accounts for 28% of the United States’ net greenhouse gas emissions and is the second highest emitting sector after transportation. While reducing emissions from the electric power sector is only part of what’s needed to decarbonize the US economy, the power sector is where the fastest and cheapest emission reduction opportunities reside. Over the past 15 years, carbon emissions from the electric power sector in the US have dropped by 40%—more than any other US sector. As part of its Build Back Better plan, the Biden administration has a goal to get to 100% clean electricity in 2035—effectively getting the electric power sector all the way to zero emissions within the next 15 years. At the same time, the Biden administration is expected to step up regulation of fossil fuel-fired electric plants in order to cut pollution that endangers public health.

With the $1.9 trillion COVID-19 relief bill enacted, the Biden administration and congressional leaders are now turning their attention to a major infrastructure investment package, which may include new infrastructure investment in clean energy. In this note, we explore ways in which congressional clean energy investments in the electric power sector can help accelerate decarbonization and put the sector on a path to zero emissions. We then consider how these investments can complement new power plant regulations that could be put in place in President Biden’s first term.

We find that a combination of investment and regulations can achieve CO2 emission reductions of 69-76% below 2005 levels in 2031, accelerating progress towards the 2035 goal. This can be done without imposing new costs on households while also cutting conventional pollutants by up to 84% in just the next five years. To achieve this, Congress will need to enact long-term incentives for new and existing clean generation and inducements to retire carbon-intensive generation. All of these investments can complement other decarbonization policy efforts such as a clean electricity standard or a carbon price.

Decarbonization to date and the need to accelerate progress

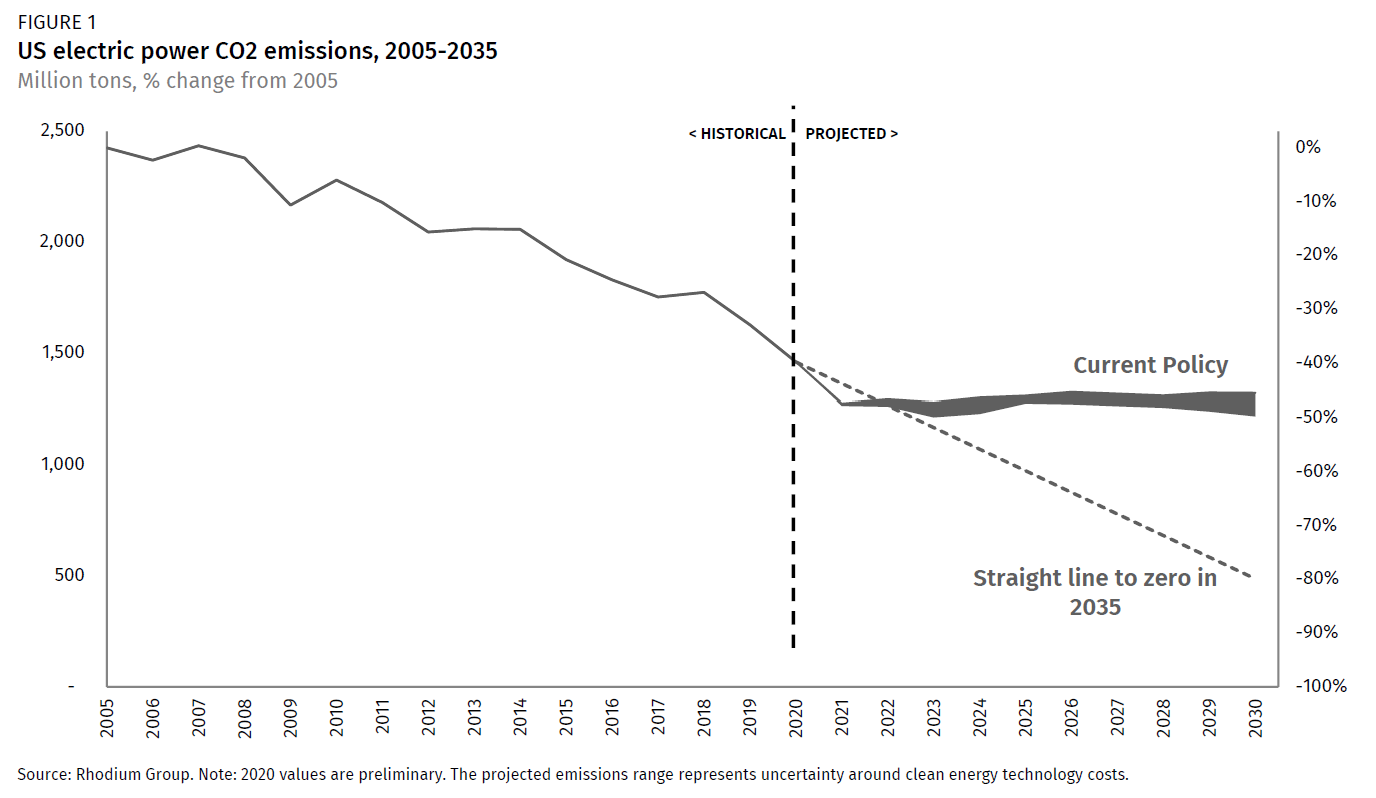

Over the past 15 years, CO2 emissions from the electric power sector have dropped by just under a billion tons, 0r 40% below 2005 levels (Figure 1). In both absolute and relative terms, that’s more than any other major emitting sector in the US. These gains are the result of state and federal policies, rapidly declining costs for renewable generation, and persistently cheap natural gas, which together have undermined the market dominance of carbon-intensive coal plants.

However, this 40% cut does not put the electric power sector on track to zero emissions by 2035. Under current policy, progress on decarbonization will stall out in the next few years (Figure 1).[1] Renewables will continue to grow but continued cheap natural gas will increasingly drive the retirement of zero-emitting nuclear plants, canceling out gains in emission reductions. At best, the electric power sector maintains emissions in the range of 46%-50% below 2005 levels in 2030 without additional action, which is nowhere near a straight-line path towards the goal of zero emissions in 2035.

The Biden administration and congressional leaders have announced plans to pursue a major infrastructure investment package this year. While we don’t know exactly what will be in the legislation, we do know that budget reconciliation is a potential procedural path for the effort. Under reconciliation, all measures must have a direct effect on the federal budget. Taxes, tax credits, and direct spending are all clearly in bounds. New policies such as a clean electricity standard (CES) may also be in play.

While reducing emissions from the electric power sector is only part of what’s needed to decarbonize the US economy, the power sector is where the largest and cheapest emission reduction opportunities reside. In order to help assess potential pathways to decarbonizing the electric power sector, in this note we quantify the extent of emission reductions that are achievable through just federal spending on its own and in combination with pollution regulations that a Biden EPA may pursue.

An investment approach and a CES are not mutually exclusive. If a CES or other decarbonization policy does get enacted, the spending initiatives we consider here can complement those programs. If other policies are not enacted this year but a robust spending package is, investment can buy time and build support for future more ambitious action.

Reintroducing the GREEN Act: the starting point for clean energy investment

The House has already put forward legislation to increase clean electricity investment. H.R. 848, the Growing Renewable Energy and Efficiency Now (GREEN) Act, sponsored by Michael Thompson and co-sponsored by all Democratic members of the Ways and Means Committee, extends and expands existing tax credits in all major energy sectors. Focusing on just the electric sector, the bill contains an array of tax credit extensions and other provisions including:

- Renewable energy production tax credit: Extension through 2026 of the Section 45 production tax credit (PTC) for wind, solar, biomass, municipal solid waste, and certain water power sources. Wind continues to claim the credit at 60% of its statutory level.

- Business energy investment tax credits: Extension through 2028 of the Section 48 investment tax credit (ITC) for solar, offshore wind, fuel cells, and a handful of other clean technologies, plus new ITC eligibility for energy storage and geothermal. Solar and geothermal begin to phase down the size of the ITC in 2026.

- Residential energy efficient property tax credits: Extension through 2028 of the Section 25D residential energy efficient property tax credits for investment in distributed solar, small wind, geothermal heat pumps, and fuel cells, plus new eligibility for battery storage technologies. Like the Section 48 ITC, this credit also begins to phase down in 2026.

- Carbon capture tax credit: Extension through 2026 of the Section 45Q credits for investments in capture and use or storage (CCS) of CO2.

- Public traded partnerships for clean energy: Extends to renewables and carbon capture special tax rules currently available to oil and gas producers and transporters.

- Direct pay in place of tax credits: Allows ITC, PTC, and 45Q eligible projects to take direct payment instead of tax credits at 85% of the value of the applicable credit.

- Workforce development: Provides a bonus credit to projects that meet certain labor requirements such as paying prevailing wages.

To assess the impact of the GREEN Act on emissions and electric power generation, we modeled the GREEN Act in RHG-NEMS. RHG-NEMS is a version of the National Energy Modeling System created by the Energy Information Administration as modified and maintained by Rhodium Group. As our baseline, we used the current policy scenario detailed above, which relies on our Taking Stock 2020 V-shaped macroeconomic recovery scenario, coupled with the latest mid and low technology cost assumptions from National Renewable Energy Laboratory.

The GREEN Act has a small impact on emissions

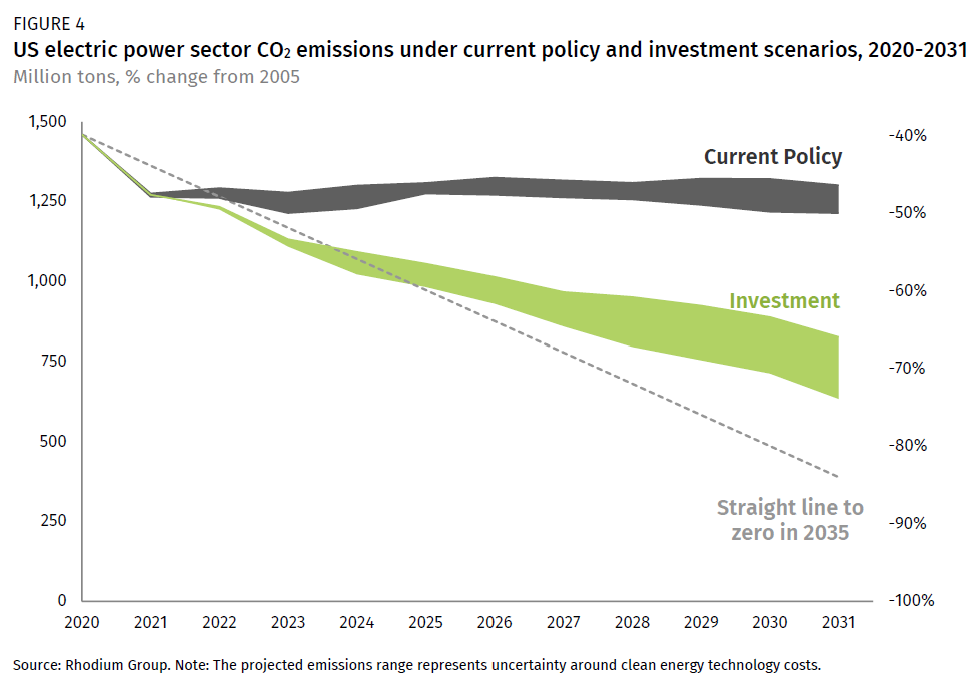

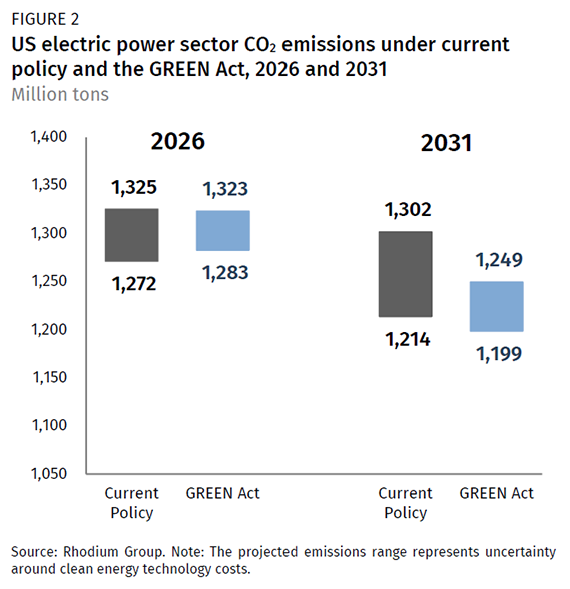

We find that Congress will need to do more than pass the GREEN Act to get the electric power sector on track for zero emissions. Looking out over the next ten years, the GREEN Act increases average annual wind and solar additions to the grid by 5% and total utility-scale storage additions by 28% compared to current policy. This new generation primarily displaces natural gas and nuclear, depending on tech cost assumptions, leading to almost no change in CO2 emissions in 2026 and reductions of 15-53 million tons compared to current policy in 2031 (Figure 2).

The results are far smaller than reduction estimates from our analysis of a previous version of the GREEN Act. Why are we not seeing larger reductions from renewable energy tax credits? There are several reasons. Under current policy, more than half of the current coal fleet retires by 2030 because of low growth in electric power demand, cheap natural gas, and cheap renewables. Remaining coal plants are more competitive and largely not displaced by additional renewables from the GREEN Act. The impact of the additional renewable generation driven by the GREEN Act is smaller than we’ve previously seen with other tax extenders proposals since it is displacing more lower-emission natural gas and zero-emission nuclear instead of coal.

Another reason is the fact that wind and solar are commercially mature technologies. A vast amount of new renewable capacity is already set to come online over the next decade. That’s in part because renewables are cost-effective even if they aren’t deployed at levels needed to decarbonize the grid. Any extension of credits means the federal government will subsidize some projects that will get built anyway. This dynamic has always been in play, but it becomes more significant as technologies get cheaper and more mainstream. One way to counter this is to increase the value and duration of tax credits. The bigger the incentive, the more likely it is that we’ll see more clean energy get built than will happen anyway.

The four Rs of electric power decarbonization

More broadly, the GREEN Act focuses on just two of the four key actions that need to happen to decarbonize electric power generation. We call them the four Rs of decarbonization:

- Redouble the pace of clean capacity additions: Renewable energy deployment reached a record in 2020 of nearly 30 GW. However, recent studies suggest the annual average pace may need to be double that to fully decarbonize the US economy. Down the road, advanced nuclear and advanced fossil plants with near 100% carbon capture may also play a role in decarbonization.

- Retire as much uncontrolled fossil capacity as possible: In 2019, nearly 220 GW of coal was connected to the grid. Under current policy, that number will be cut by more than half by 2030. In order to get to zero emissions, much of the remaining 100 GW of competitive coal plants as well as the hundreds of GW of existing and soon-to-be-built natural gas combined cycle (NGCC) plants will need to retire.

- Retain existing clean capacity: Getting to zero will be easier and happen faster if existing clean generators such as hydro and nuclear plants stay on the grid longer. Last year none of the nuclear plants in the nation’s largest power market made money. Under current policy more than half of the nuclear fleet will retire by 2030, leaving a huge gap. Policies that support retention of plants that have community support and safe operations also help to make sure that new renewables displace fossil capacity, maximizing emission reductions.

- Retrofit the fossil capacity that remains: Persistently cheap natural gas for the foreseeable future means existing and new NGCC plants will continue to play a major role in the electric system without requirements or incentives to install carbon capture technology. There’s no room for a vast fleet of uncontrolled fossil plants in a 100% clean power system.

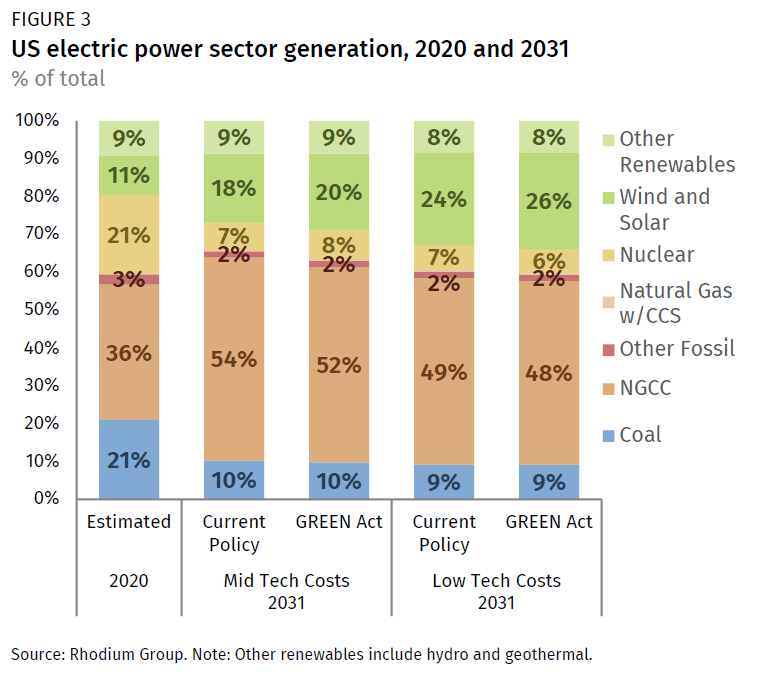

The GREEN Act primarily incentivizes the first R, redoubling new clean capacity but at levels that don’t accelerate additions to the scale that’s needed. It also incentivizes the fourth R, retrofitting fossil capacity through the section 45Q carbon capture tax credit, but again not at levels sufficient to change the system. Meanwhile, existing clean resources are not retained and coal generation is largely unaffected. The result is a 2031 generation mix that is almost the same between the GREEN Act and current policy (Figure 3).

Investing in decarbonization

Can a clean energy investment package make a difference? To answer this question, we constructed a potential investment package scenario that draws from existing and draft policy ideas currently in play in this Congress. The package focuses on programs that push progress on all four Rs and relies on spending mechanisms that can fit within budget reconciliation. The scenario assumes Congress puts in place a 10-year spending package that starts in 2022 and goes through 2031. The scenario is intended to illustrate the potential of spending to decarbonize the electric sector. There are certainly alternative pathways that could be pursued. This specific package is comprised of four key components:

- Tech-neutral tax credits for new clean capacity: An ITC of 30% or a PTC at $25/MWH (67% higher than the current wind PTC) is available for any zero emitting capacity that enters into service before the end of 2031. Fossil capacity with carbon capture, including new retrofits, qualify and get a discounted credit depending on the level of capture. Developers can choose the ITC or PTC, whichever suits them best.

- Existing coal retirement incentive: Any coal plant owned by a rural cooperative can have its federal Rural Utility Service loans written off if the plant is retired by the end of 2025 and the energy is replaced with clean generation. We estimate that up to 30 GW of coal could be eligible, which wouldn’t retire under current policy. These plants have an associated outstanding federal debt of roughly $10 billion.

- Existing clean retention incentive: An incentive is available for any existing nuclear capacity to stay online at least through 2031. The incentive can be made available to all generators or scaled based on need, similar to a recent proposal by Senators Whitehouse and Barrasso. We assume the incentive is sufficient to prevent roughly 50 GW of economic nuclear retirements that we see in our current policy scenario.

- Extension of carbon capture incentives: New and retrofitted fossil plants equipped with carbon capture that enter into service by the end of 2031 can claim the section 45Q carbon capture tax credit of $50/ton if coupled with storage and $35/ton if coupled with utilization or EOR. Developers cannot claim both this and the tech neutral credit.

We find that a robust, long-term spending package that focuses on all aspects of decarbonization can make meaningful progress on electric power emission reductions. This investment package gets emissions on a straight-line path to zero at least through 2025, and by 2031 emissions are 66-74% below 2005 levels when accounting for clean energy technology cost uncertainty (Figure 4). That’s a major step forward.

The long-term tax credit for new clean capacity with flexible election of the ITC or PTC in the investment package scenario hypercharges renewable energy deployment. With the tax credit in place, in our mid tech cost case, average annual renewable capacity additions are 33 GW per year through 2031, just over 10% more than the 2020 record. In our low tech cost case, average capacity additions are double that, at 66 GW a year. This new renewable capacity displaces fossil generation, both coal and natural gas, thanks to the nuclear retention incentive. Without the nuclear retention incentive, electric power sector emissions would be 23-28% higher, up to 188 million metric tons more in 2031. Looking at the fossil fleet, we find clean energy and coal retirement incentives combined lead to an additional 34-38 GW of coal retirements in 2031 compared to current policy. Extending the section 45Q carbon capture tax credit does not drive deployment of more plants equipped with carbon capture. The incentive is not high enough for the technology to compete.

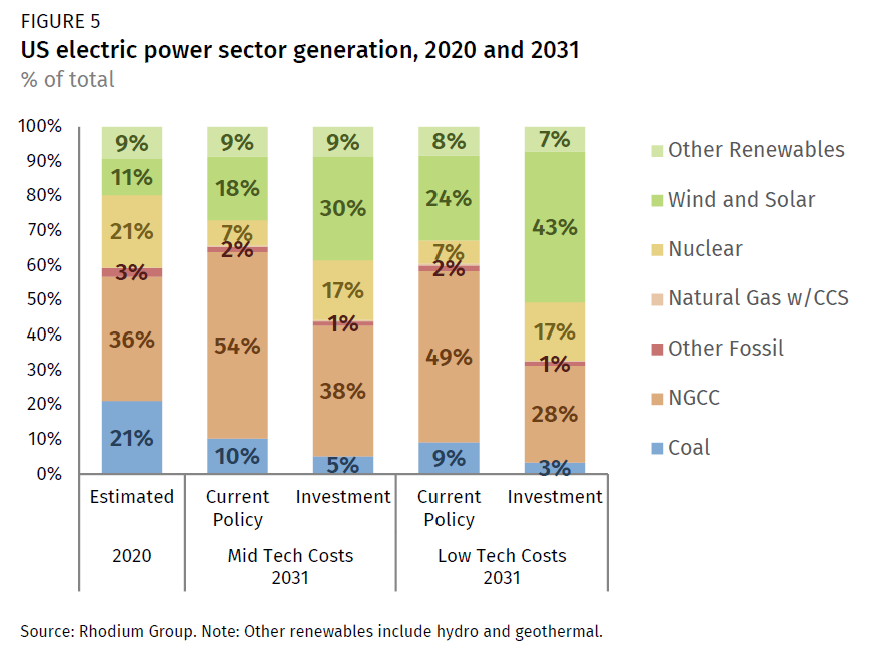

All together, the aggregate impact of the investment package leads to a dramatically different electric power generation mix in 2031 than under current policy. Under the investment package, wind and solar nearly double their contribution to total generation, and nuclear generation more than doubles. The net effect is that total zero emitting generation gets as high as 67% in the low tech cost case. This clean generation plus the coal retirement incentives cut coal generation by one-half to two-thirds compared to current policy and NGCC generation by 30-43% (Figure 5).

Budget implications of investment

The decarbonization and generation shifts in the investment scenario come in at up to double the current $10.5 billion the government spends annually on clean energy tax credits. We estimate that the average net annual budget outlay from 2022-2031 is $14.9-$20.3 billion depending on technology costs. The coal retirement incentive represents 5-7% of total outlays while the nuclear retention incentive makes up 28-38%. More than half of total outlays—55%-67%—are associated with new renewable energy deployment.

Potential complements to investment

There are other potential policy ideas not included in our scenario that could complement our results depending on overall policy goals. For example, a tax credit for high voltage transmission could unlock more renewables. A bonus credit for projects that meet fair labor practices can help boost worker wages. Spending programs could be put in place to drive additional renewable investments in low-income and historically disadvantaged communities. All of these programs can change the total budgetary costs as would any other provisions beyond what we’ve considered.

Another key design element we consider is whether developers can receive a direct payment instead of a tax credit as contemplated in the GREEN Act. At the moment, developers often require tax equity financing partners to fully monetize tax credits. The tax equity market was able to accommodate the record renewable builds of 2020, but at times some developers struggled to find tax equity partners. Since we find renewable builds under the investment scenario may far surpass 2020 levels, and since there may be demand for tax equity from other energy tax credits, it may be prudent to provide developers with more financing flexibility through some sort of direct pay or refundability provision. Otherwise, there is a real chance that the tax equity market may become a bottleneck to accelerated decarbonization. It is not at all guaranteed that tax equity can scale at the same pace and as clean energy deployment in our scenarios.

Investment combined with public health regulations can accelerate progress

Just as clean energy investment can complement a federal clean electricity standard, a carbon price or other comprehensive climate policy, spending can support common sense public health regulations on fossil power plants. A combination of investment & regulations can achieve even faster decarbonization as well as bigger and faster conventional pollutant reductions. Investments can also blunt any potential ratepayer impacts from regulations.

While the Biden administration has not outlined its plans for regulating conventional pollutants and CO2 from power plants, we have constructed a scenario based on our experience analyzing Obama-era regulations, which we consider to be a plausible first-term agenda.[2] We couple our investment scenario with a series of regulations modeled on Obama administration rules targeting toxics, NOx, SO2, particulate matter, coal ash, effluent, CO2, and other pollutants primarily at coal plants. We also assume that EPA requires all new coal and NGCC plants to be equipped with carbon capture starting in 2023. These regulations steadily increase coal plants’ operating costs, leading to lower coal generation and more coal plant retirements. NGCCs end up having a reduced role as well. Power plant regulations can drive progress on the retrofit and retire components of the four Rs of decarbonization.

Investment & regulations can cut pollution by more than half compared to 2020 levels

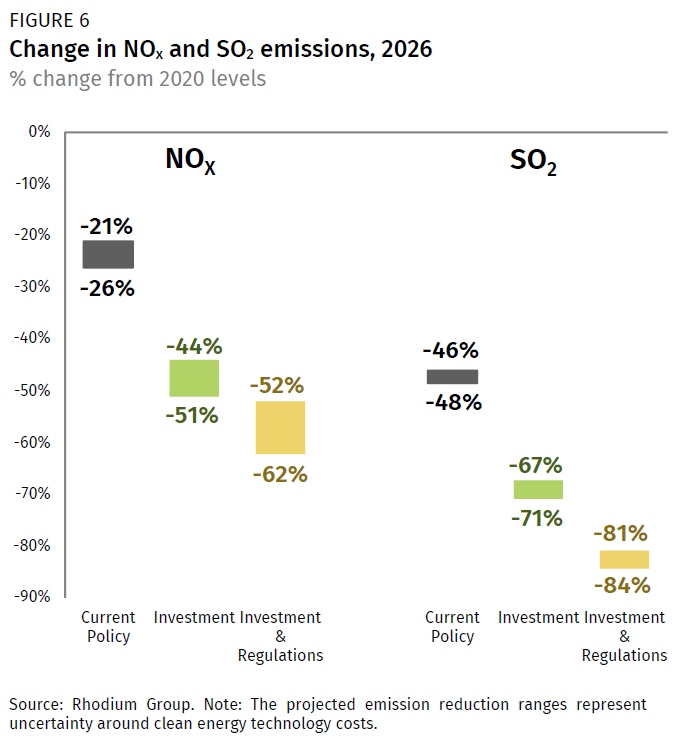

Investment can help regulations achieve even larger conventional pollutant reductions. Here we focus on NOx and SO2, two of the primary pollutants from electric power plants. Both pollutants cause asthma in children, as well as other respiratory diseases and premature death. While EPA regulations under the Clean Air Act have led to huge progress in cutting emissions of these pollutants to date, we find that an investment package coupled with a new round of regulations can catalyze dramatic new gains. We find that five years from now, in 2026, investment & regulations can cut NOx emissions by 52-62% compared to 2020 levels. The same combination can cut SO2 by 81-84% (Figure 6). This is at least 10 percentage points more than what investments can do alone and represents more than double and nearly double the reductions achieved under current policy for NOx and SO2 respectively. While these national level results don’t necessarily reflect the conditions on the ground for all front-line communities, on the whole this progress should provide a wide range of health benefits across the country.

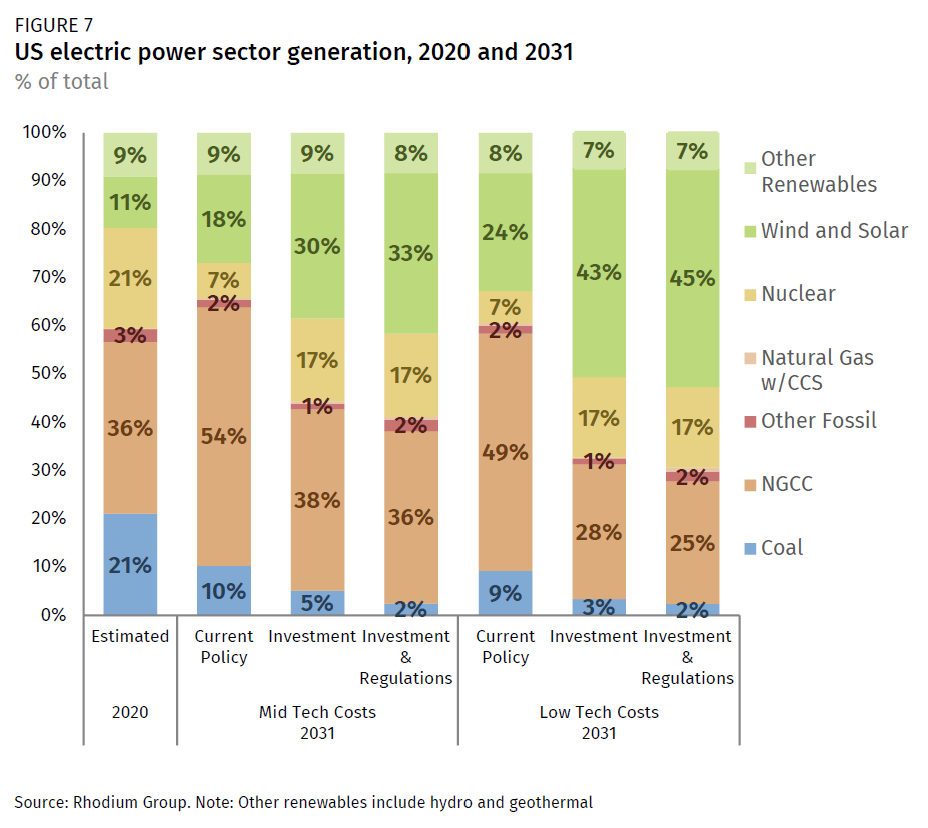

The pollution reductions achieved from investment & regulations are due not just to a surge of renewables but also a reduction in fossil generation. With both regulations and investment, in 2031 renewables contribute 41-52% of all generation depending on technology costs (Figure 7), slightly more than under the investment scenario alone. Meanwhile, coal represents just 2% of total generation, more than a 90% reduction from 2020 levels. NGCCs contribute as little as 25% of generation and, importantly, no new uncontrolled NGCCs are built after 2023 thanks to the EPA regulatory requirements for carbon capture. This is important for limiting stranded assets in the 2030s. Finally, the carbon capture requirements coupled with incentives don’t drive a surge in carbon capture. 3-5 GW of new advanced gas plants with carbon capture are in operation in 2031 in the investment & regulations scenario. This represents 0.2-0.3% of total installed electric power capacity in 2031. The additional clean capacity in this scenario pushes the budgetary costs up slightly relative to the investment only scenario.

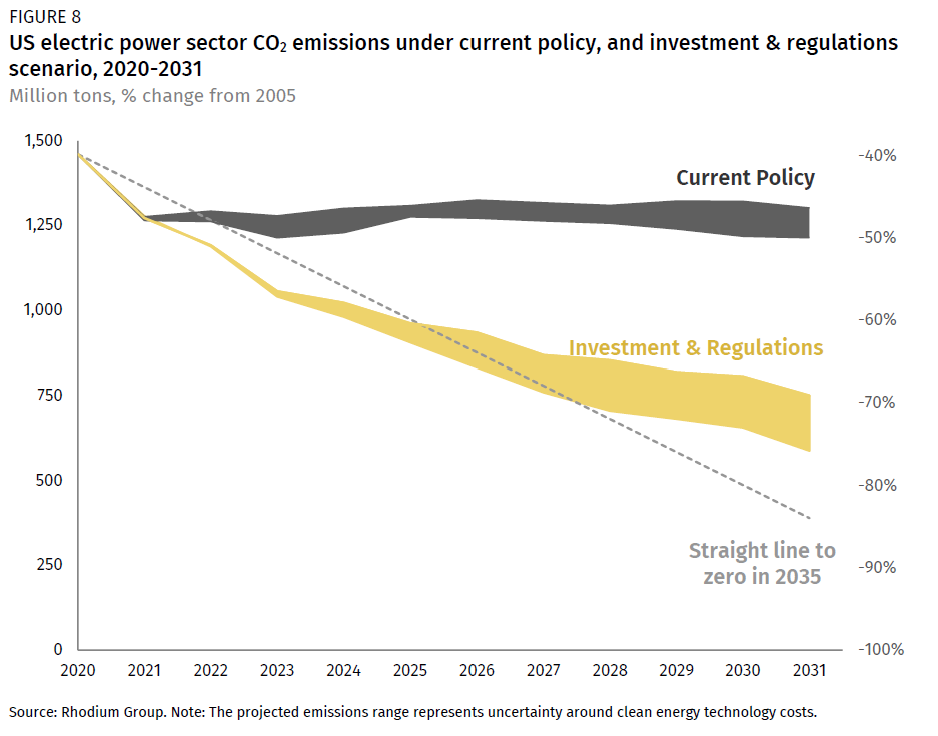

The major shift away from fossil and towards clean generation due to a combination of investment & regulations furthers progress towards decarbonization beyond the investment scenario alone. Emissions can get below a straight-line path to zero in 2035 through the first half of the 2020s and stay within the range of that path as far as 2028 (Figure 8). This results in 2031 emissions that are 69-76% below 2005 levels. If no other policies get through this Congress, a combination of investment & regulations can still achieve progress and build support for more ambitious action down the road.

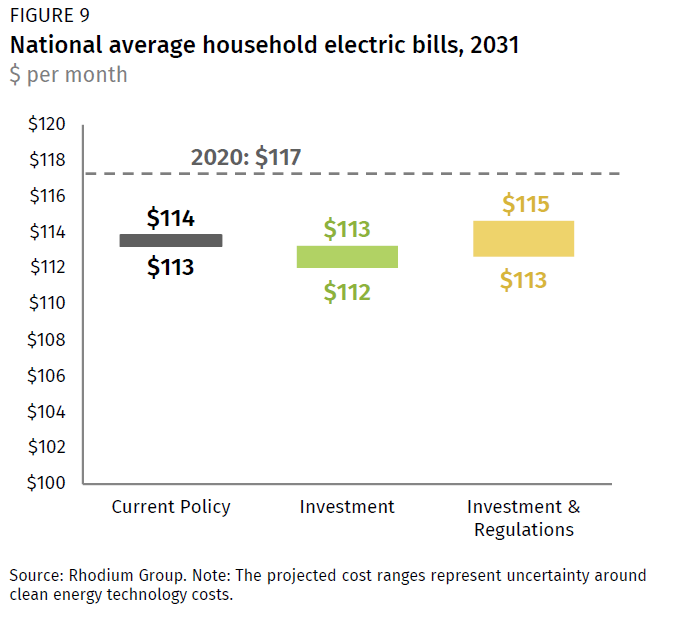

Decarbonization does not have to raise electric bills

One fear often stoked during clean electric policy debates is that ratepayers will have to bear the brunt of the costs of emission reductions through higher bills. We find that this is not the case. In fact, we find that in 2031, national average household electric bills are no more than $1 per month higher under the investment or investment & regulations scenarios than under current policy (Figure 9). Moreover, bills are lower than what households paid in 2020. Renewables have become so cheap (and continue their cost declines through this window), so the impact of accelerated deployment on electric bills is small. In addition, federal investment shifts the cost of decarbonization from ratepayers to the federal government, resulting in negligible changes in bills even when regulations add costs to the electric system. While there will certainly be regional differences in bill impacts, they are unlikely to be large due to these dynamics.

Next step: Congress

It’s clear that federal clean energy spending, especially when coupled with public health regulations, can lead to substantial pollution reductions and major progress towards a 100% clean electric sector. A well-crafted investment package passed by Congress, possibly through budget reconciliation can get the sector on track for long-term deep decarbonization. We plan to monitor developments in Congress to see how the next wave of legislative proposals addresses the four Rs of decarbonization. Watch this space for more on how leading proposals stack up.

[1] Our current policy scenario takes into account all state and federal policies as of May 2020, plus the clean energy tax extenders included in the December 2020 federal tax package. Scenarios considered in this analysis assume all electric power market actors behave rationally and optimize for least cost operations over the long-term.

[2] While we consider this scenario to be plausible, it should not be interpreted as an estimate of the maximum or minimum level of regulation that EPA could pursue. The Biden administration could potentially go far further in regulating electric power sector pollutants than we consider in this analysis.

This nonpartisan, independent research was conducted with support from the ClimateWorks Foundation, the Energy Foundation, the Heising-Simons Foundation, the Linden Trust for Conservation and the William and Flora Hewlett Foundation. The results presented in this report reflect the views of the authors and not necessarily those of supporting organizations.

Related Research: Pathways to Build Back Better: Jobs from Investing in Clean Electricity