Relay Race, not Arms Race: Clean Energy Manufacturing Implications of the IRA for the US and EU

The passage of the Inflation Reduction Act in the US has elicited mixed reactions from policymakers in Europe. In new analysis, we unpack the clean energy manufacturing incentives in the legislation and what it means for European industry.

The passage of the Inflation Reduction Act (IRA) in the US has elicited two competing reactions from policymakers in Europe. European officials are relieved that with the passage of the IRA, the US has a credible pathway to meet its 2030 emission reduction target under the Paris Agreement, provided it is paired with federal climate regulations and additional state-level climate action. At the same time, many in Europe are concerned that incentives for US clean energy manufacturing investment in the IRA could harm European industrial competitiveness. In response, the European Commission has proposed a Green Deal Industrial Plan to further support clean energy manufacturing on the continent. This has generated headlines warning of a “subsidies arms race” between allies.

In this note, we unpack the IRA and what it means for European industry. We find that while the IRA includes meaningful new incentives for the US clean energy industry, the share of IRA spending that supports US manufacturing directly at the expense of European industry is considerably lower than recent reporting on the transatlantic clean energy rift might suggest. The primary driver from the IRA shaping the clean energy manufacturing landscape is likely to be the overall accelerated pace of clean energy deployment in the US. This will expand clean energy manufacturing in the US, but will also create opportunities for European companies and lower the cost of clean energy on both sides of the Atlantic.

Understanding the role of domestic content requirements in the IRA

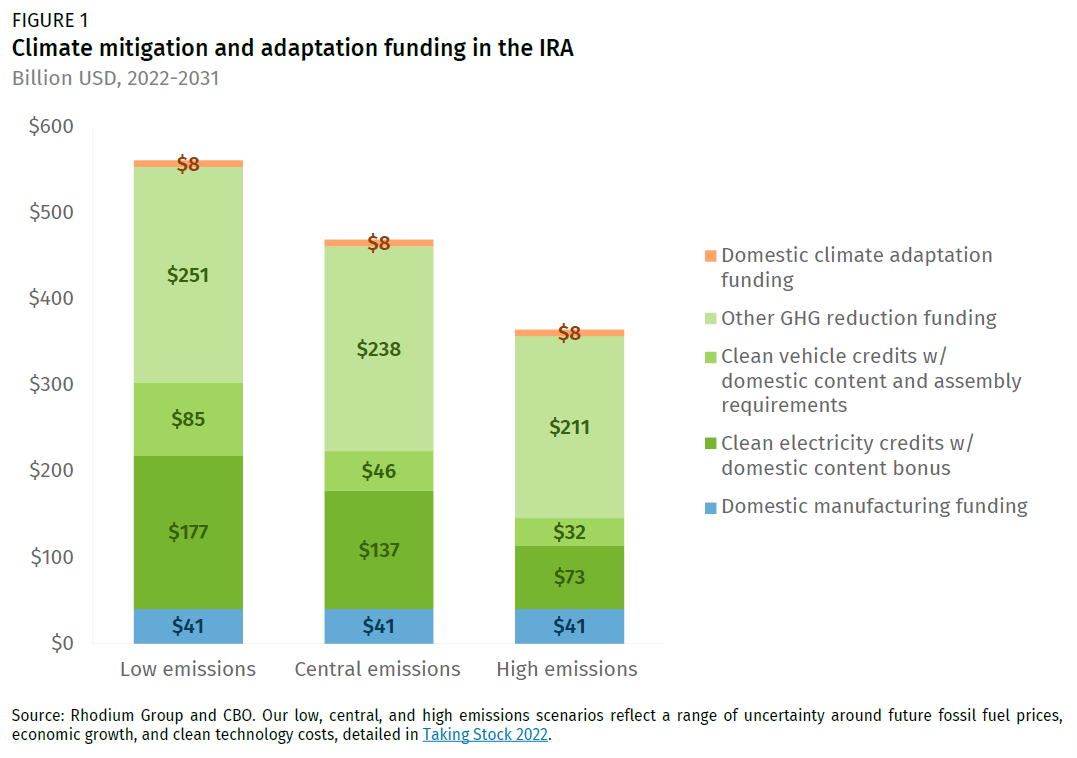

Press reports generally describe the IRA as containing $369 billion of spending on climate mitigation and adaptation over ten years. This number is drawn from the Congressional Budget Office (CBO)’s “score” of the legislation. Some of the IRA’s investments come in the form of direct spending, like grants and agency appropriations, where the dollar amount is outlined in the legislative text. Other investments come in the form of tax credits, where the ultimate amount of federal investment depends on how much demand there is for the credits. Rhodium Group estimates that the ultimate amount of climate-related investment in the IRA will be somewhere between $355 and $552 billion between 2022 and 2031, based on a combination of CBO estimates and Rhodium Group energy system modeling. In this section, we break down where these investments are allocated and which programs have domestic content requirements attached.

Domestic manufacturing funding ($40.6 billion)

The IRA provides direct fiscal support for domestic clean energy manufacturing primarily through two provisions. The first is an extension and expansion of the existing section 48C tax credit that provides up to $10 billion over ten years to cover up to 30% of the cost of investing in new or retrofitted facilities to manufacture qualifying clean energy equipment. The CBO estimates that $6.3 billion of this amount will be utilized over the course of a decade. The second provision is a new production tax credit for manufacturing facilities that produce qualified clean energy equipment (section 45X). The CBO estimates that this provision will result in $30.6 billion in federal investment over the course of a decade. There is an additional $3.7 billion in domestic manufacturing support in other parts of the IRA.

Clean vehicle tax credits with content/assembly requirements ($32-85 billion)

The IRA provision that has arguably elicited the most concern among US allies, including those in Europe, is the extension and modification of the federal tax credit for consumer purchase of electric vehicles and other qualifying clean vehicles (section 30D). To qualify for this credit when purchasing a new car, buyers must have an income below $150,000 (or below $300,000 for joint filers), and the vehicle they are purchasing must meet the following criteria:

- Have an MSRP below $55,000 (or below $80,000 for a van, truck, or SUV)

- Final assembly must have occurred in North America

- At least 40% of the critical minerals (by value) used in the car (growing to 80% by 2027) must come from North America or a country with which the US has a free trade agreement, and none can come from a country deemed by the US government to be a “foreign entity of concern.” If these conditions are met, the consumer can claim a $3,750 credit.

- At least 50% of the battery components (by value) used in the car (growing to 100% by 2029) must be manufactured and assembled in North America, and none can come from a “foreign entity of concern.” If these conditions are met, the consumer can claim a $3,750 credit.

If all requirements are met, the credit for each vehicle is $7,500. Rhodium estimates that the 30D consumer clean vehicle tax credit will result in between $32 billion and $85 billion in federal investment between 2022 and 2031.

Clean electricity tax credits with domestic content bonus ($73-177 billion)

The IRA extends and modifies the existing production tax credit (PTC) and investment tax credit (ITC) for wind, solar and other clean electricity generation in the United States. In Rhodium’s modeling, between now and 2030 these credits do more to reduce US greenhouse gas (GHG) emissions than anything else in the IRA. The ITC covers 30% of the cost of investing in new clean electricity production and the PTC provides a $26/MWh credit for all clean electricity production from new facilities. Project developers choose which credit they would like to receive.

Under the IRA, the ITC credits increase by 10 percentage points and PTC credits increase by 10% if the project satisfies two requirements:

- All iron and steel used as construction materials in the project were produced in the United States.

- At least 40% of the manufactured components of the project (growing to 55% in 2026) are mined, produced, or manufactured in the United States.

Rhodium Group estimates that the extended and modified ITC and PTC will result in between $73 and $177 billion in federal investment in clean electricity generation between 2022 and 2031.

Other GHG reduction funding ($211-251 billion)

Beyond the clean vehicles and clean electricity tax credits discussed above, the IRA includes another $211 to $251 billion in federal investment in GHG reduction activities in the US. None of this funding has domestic content or manufacturing requirements attached to it within the IRA (though existing Buy America provisions may apply to some programs).

Domestic climate adaptation funding ($7.6 billion)

The IRA also includes $7.6 billion in funding for domestic climate adaptation between 2022 and 2031. These programs do not include any domestic content or manufacturing requirements (though existing Buy America provisions may apply to some programs).

Key factors in gauging the impact on European industry

In assessing the impact of the IRA on the competitiveness of European clean energy, there are several factors worth keeping in mind:

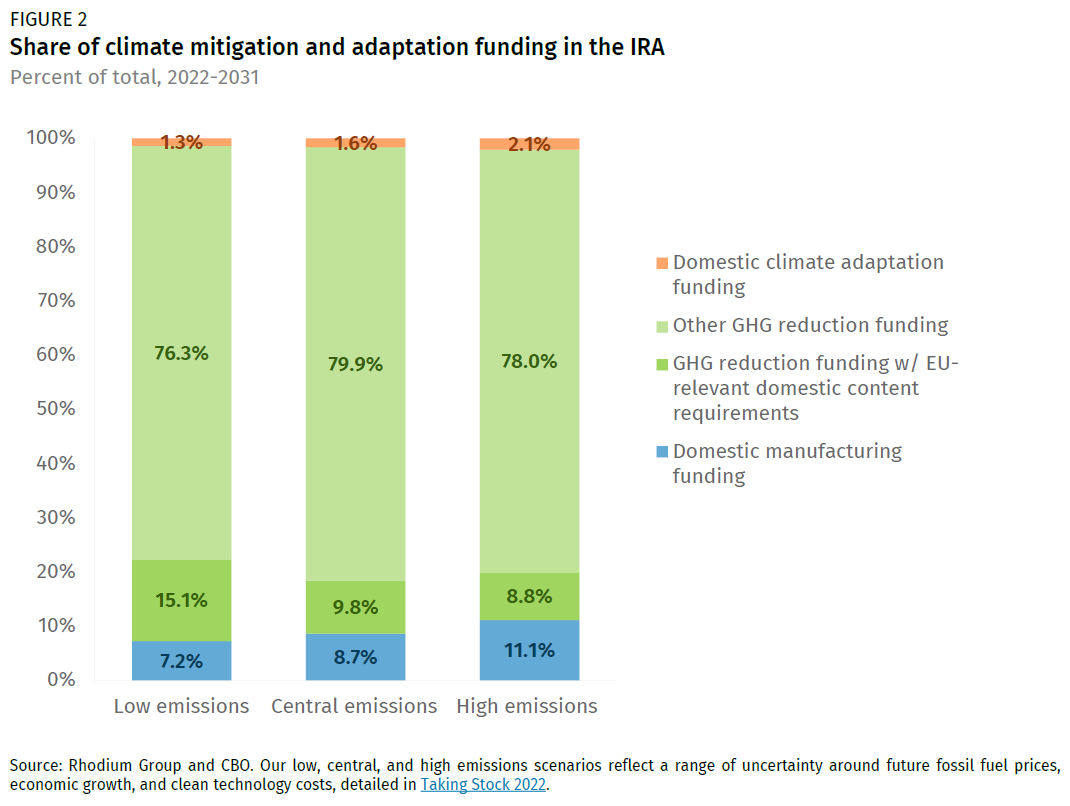

1. Direct subsidies to domestic manufacturing are a small share of the IRA total

Based on Rhodium Group analysis, direct fiscal support to the manufacture of clean energy technology within the United States accounts for only 7-11% of total funding in the IRA. The vast majority of the funding is to accelerate adoption of clean electricity, vehicles, fuels, energy efficiency solutions and carbon capture and removal within the US in order to get the country closer to meeting its 2030 climate target under the Paris Agreement.

2. There are no import restrictions in the IRA and most funding has no content requirements

The IRA does not prevent the importation of clean energy technology from any country. The domestic content requirements (in the case of the clean vehicle tax credit) and bonuses (in the case of the clean electricity tax credits) provide an incentive to purchase domestically manufactured cars and clean electricity technologies over imported vehicles or equipment if the value of the credit or bonus is greater than the cost premium for domestic content. But if it isn’t, then the consumer or project developer can and likely will purchase imported vehicles or equipment. In addition, between 48% and 60% of all funding in the IRA does not include new domestic content requirements.

3. Clean electricity bonus credits likely won’t matter much for Europe

The largest portion of IRA funding with some form of domestic content requirement, the clean electricity credits, likely won’t matter much for Europe. First, using domestic content only raises the value of the tax credit by 10% (and the tax credit itself only covers part of the cost of the project), so there is only a modest incentive to do so. Second, for those project developers that do seek to qualify for the 10% bonus credit, doing so is unlikely to have a significant impact on European equipment suppliers. Wind and solar construction accounts for a small share of overall US steel demand, so using domestically-produced construction steel likely won’t change aggregate US-EU steel trade in any meaningful way.

Most US wind projects likely already meet the requirement that 40% of all manufactured inputs to a wind farm be produced domestically. This requirement is more difficult for solar given a) the relatively high share of total manufactured product costs in a utility-scale solar project attributable to PV modules, and b) the relatively high import share of solar PV modules in the US. But as most US solar PV imports come from Asia, not Europe, to the extent to which the 10% bonus credit changes sourcing decisions, it will impact US-Asian trade more than US-Europe trade.

4. The clean vehicles credit will likely be more distortive, but doesn’t apply to all of the market

Compared to the clean electricity tax credits, the clean vehicles tax credit will likely have a more significant impact on US-EU trade and investment flows. The domestic content requirements are more stringent (100% final assembly in North America, and the EU does not get the free trade agreement exception for battery components) and the $7,500 credit is a larger share of the cost of a new electric vehicle than the clean electricity bonus credit is relative to the cost of a new wind or solar farm. It’s no wonder then that this specific provision of the IRA has attracted the most ire from European policymakers.

One important caveat is that the 30D credit will likely only apply to a portion of clean vehicles sold in the US. The income and MSRP limits mean that many EV buyers won’t qualify for the credit. In addition, the IRA also includes a new tax credit (section 45W) for the purchase of commercial clean vehicles, which does not include any domestic content or assembly requirements. For cars and light trucks, the credit is the lesser of a) $7,500 and b) the incremental cost of the vehicle relative to a gasoline or diesel-powered alternative. In December of last year, the Treasury Department indicated that companies that purchase electric vehicles to lease to consumers would qualify for this credit. About one-fifth of all new cars are leased instead of purchased in the US. It’s unclear how much leasing under 45W will be a substitute for purchasing under 30D, but at the margin it provides a pathway for some EVs manufactured in Europe to receive credits in the US.

5. European companies can qualify for domestic content-tied credits

None of the tax credits in the IRA (with or without domestic content requirements or bonuses) exclude European companies from participating. The accelerated deployment of clean technologies in the US through the IRA may present significant opportunities to invest in, and export to the US. In fact, European companies are already some of the most active wind and solar project developers in the US and can take advantage of clean electricity bonus credits just like US developers if they meet the domestic content requirements. Likewise, customers of European automakers can claim the 30D tax credit if the car they are buying meets the domestic content requirements of that credit. European companies can also qualify for the 48C and 45X tax credits for qualifying clean energy equipment manufacturing facilities they set up in the US (provided either they or a co-investor have US tax liabilities against which they can claim the credits). Rather than a threat to competitiveness, the IRA could be an additional source of innovation and deployment funding for European clean tech manufacturers looking to demonstrate their technology or expand production capacities, complementing the various support instruments already available in Europe (e.g. Innovation Fund, Horizon Europe, and REPowerEU).

6. Accelerated deployment in the US will lower the cost of clean energy in Europe

Much of the press coverage of the US-EU clean energy rift suggests that clean energy investment is a zero-sum game—and that now that the US is a more attractive investment destination post-IRA, that will necessarily come at the expense of investment in Europe. But the much larger competition is investment in clean energy vs. fossil fuels, not just in the US but around the world. IRA-incentivized investments in clean energy deployment in the US will help drive down the green premium for those technologies in a way that makes them more competitive vis-à-vis fossil fuels around the world. When Europe led the way in funding solar deployment in the 1990s and 2000s, the resulting reduction in solar costs led to more solar deployment in the US, not less. We could see the same dynamic occur as a result of US funding for today’s emerging climate technologies like clean hydrogen, sustainable aviation fuels, long-duration storage, and carbon dioxide removal. In addition, the speed at which the tax credits in the IRA are likely to make it to market is shining a spotlight on the relatively bureaucratic nature of some European clean energy funding vehicles and prompting calls for streamlining. This kind of peer competition can accelerate clean energy deployment on both sides of the Atlantic.

Conclusions

Of the $355 to $552 billion in climate mitigation and adaption spending over 10 years included in the IRA, only a fraction of that (7-11%) directly subsidizes domestic clean energy equipment manufacturing (Figure 2). The rest is funding for the deployment of clean energy and adaptation solutions to reduce GHG emissions and make the country more resilient. Some of this comes in the form of tax credits that include bonuses or requirements for domestic content (at levels that vary by provision). In our estimation, only 9-15% of total IRA funding is for the subset of these tax credits where the domestic bonuses or requirements themselves could have a meaningful impact on US-EU clean energy trade and investment.

None of this is to say that the IRA won’t have a significant impact on the global clean energy competitiveness landscape and transatlantic clean energy trade in particular. Accelerating the pace of clean energy deployment in the US along the lines projected to occur under the IRA will necessarily drive the expansion of existing clean energy manufacturing in the US as well as the development of new industries—just as clean energy deployment policy has done in Europe and Asia. This will create new investment and export opportunities for allies in Europe as well as new sources of competition both at home and in third markets, ultimately driving down the costs of technologies crucial to the energy system transition. The direct subsidies for manufacturing and domestic content requirements/bonuses attached to some of the IRA’s tax credits will undoubtedly shape the nature of this competition, but the primary driver will likely be the overall accelerated pace of clean energy deployment in the US resulting from the IRA.

This nonpartisan, independent research was conducted with support from the William and Flora Hewlett Foundation. The results presented in this report reflect the views of the authors and not necessarily those of the supporting organization.