How Clean Will US Hydrogen Get? Unpacking Treasury’s Proposed 45V Tax Credit Guidance

Setting clear, attainable, predictable eligibility requirements for the 45V tax credit is the first step in getting clean hydrogen off the ground.

As 2023 was coming to a close, the Internal Revenue Service (IRS) released greatly anticipated proposed guidance on the clean hydrogen production tax credit on December 22. This is the first major step in implementing this new tax credit, also called 45V after its position in the tax code, which is part of a suite of clean energy incentives in the Inflation Reduction Act (IRA). Clean hydrogen is a set of emerging technologies that have the potential to advance US decarbonization by replacing traditional hydrogen in current industrial applications in the near term and substituting for a variety of fuels and feedstocks in the long run. But clean hydrogen will only play a large role in decarbonization if it is widely available, cheap, and has very low greenhouse gas (GHG) emissions. Setting clear, attainable, predictable eligibility requirements for the 45V tax credit is the first step in getting these nascent technologies off the ground.

In this note, we unpack the proposed IRS guidance, building on our previous research and assessing the implications for emissions and clean hydrogen scale-up. The US needs to get experience building and installing electrolyzers for clean hydrogen at an unprecedented scale today to establish a domestic industry, drive down costs, and expand availability. The foundation of a strong clean hydrogen industry starts with policy certainty. The IRS’s guidance, while a bit late, now lays out clear rules for how to achieve the emissions-based credit tiers all the way up to $3/kg for the cleanest producers. We find that key provisions of the proposal can help to prevent adverse emissions outcomes, including a transition to hourly temporal matching in 2028 and incrementality and regionality requirements. We also unpack some open questions in the IRS’s proposal, notably around whether or how existing zero-emitting generators could qualify for the credit.

The core of the proposed guidance

Before the IRA, there was no national deployment policy support for technology-neutral production of clean hydrogen. Clean hydrogen can be used to displace conventional, fossil fuel-derived hydrogen in current industrial uses and can also be used as a fuel on its own or as a feedstock for clean fuels and other products. The 45V tax credit provides increasing levels of tax payment for each kilogram of clean hydrogen produced. The lower the GHG emissions associated with production on a lifecycle basis, the higher the payout—up to $3/kg. Any qualifying facility gets the credit for every kilogram of hydrogen produced for ten years. This fairly generous credit has the potential to kickstart and hypercharge the nascent clean hydrogen market in the US.

If clean hydrogen is going to play a major role in the US energy system, it first needs to be competitive with conventional natural gas-derived hydrogen, which currently costs $1-$1.50/kg, a price that varies largely based on the price of natural gas. The current price of electrolytic, or green, hydrogen is trickier to pin down, because electrolyzer deployment is still in its early days, with only 67 MW of capacity online as of summer 2023. The price is highly dependent on the location of the electrolyzer, the approach to sourcing clean electricity, and assumed utilization rates. Most estimates are generally in the $4-$6/kg range, though some geographies and configurations yield estimates in the sub-$3/kg range. If these projects can qualify for the full $3/kg 45V credit, the post-subsidy cost of this hydrogen could very easily be at or below current fossil hydrogen prices.

Blue hydrogen, or hydrogen produced via steam methane reformation (SMR) with carbon capture integrated into the process, can also reduce GHG emissions from hydrogen production. Unlike green hydrogen, blue hydrogen has existing policy support in the form of the credit for carbon oxide sequestration (45Q), which pays up to $85 per captured ton of CO2, though it could instead opt to claim 45V. The credit can meaningfully reduce the cost of blue hydrogen from its pre-subsidy price of around $1.60/kg to price parity or lower with conventional SMR hydrogen. In the Rhodium Group-MIT Clean Investment Monitor, we are currently tracking announced blue hydrogen projects with more than 4 million metric tons of annual production capacity, most of which are new-build sites—a potential indicator of the ability of a tax credit to drive market change.

In its 45V proposal, the IRS largely embraced the “three pillars” concept—regionality, incrementality, and temporal matching—for defining how to account for the life-cycle emissions of hydrogen production. The IRS generally chose simple and easily demonstrable requirements and avoided overly complicated frameworks. Most of the focus of the guidance is on accounting for emissions associated with the generation of electricity used in green hydrogen production. The IRS proposed that energy attribute certificates (EAC) could be used to track the emissions impacts of that electricity, and that EACs must meet certain requirements. Electrolyzers must be powered with new clean generation placed in service within 36 months of the associated hydrogen facility entering into service. That generation must be delivered into the same region as the clean hydrogen facility claiming the credit and, beginning in 2028, electricity used in hydrogen production must be matched on an hourly basis with electricity from the qualifying generator.

The IRS included these requirements to better account for the actual life-cycle emissions associated with electrolytic hydrogen production. The IRA requires any producer who wants to claim the highest tier credit of $3/kg to show that no more than 0.45 grams of CO2-equivalent is emitted in the production of one kilogram of hydrogen. Currently, there is no region of the US grid where the basic electricity generation mix is clean enough on its own to meet this requirement, so the IRS needed to develop an approach to this life-cycle emissions accounting that was achievable and administratively possible while also keeping the policy focused on reducing emissions. We unpack the emissions impacts of these decisions in the coming sections.

Estimating the emissions impact of the proposal

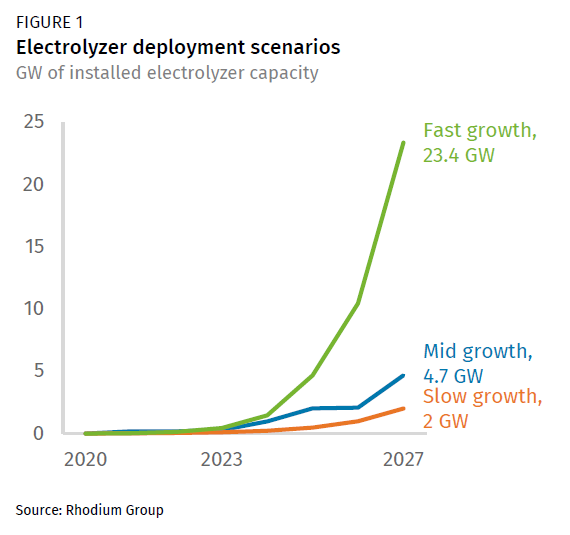

To demonstrate the potential emissions impacts from electrolyzers given 45V as proposed, we developed a representative case study using data from the Rhodium Group-MIT Clean Investment Monitor (CIM). There are currently around 4.7 GW of announced electrolyzer projects tracked in the CIM projected to come online through 2027. In a mid-growth scenario, we assume that these projects come online as scheduled. In a slow growth scenario, we assume a two-year delay in deployment, resulting in 2 GW of electrolyzer deployment in 2027—a 57% reduction in installed capacity that year relative to the mid-growth case. In a fast growth scenario, we assume all announced projects come online two years ahead of schedule and that growth continues at the final year’s rate through 2027 (i.e., a 125% increase each year). Under this pathway, total installed electrolyzer capacity reaches 23.4 GW in 2027. This fast growth scenario represents a massive increase in electrolyzer deployments from today’s levels and should be thought of as an edge case if the industry skyrockets. The IRS guidance may influence which deployment path the US follows, as we mention with blue hydrogen and 45Q above. These scenarios are intended to illustrate the magnitude of multiple potential outcomes.

For each of the three electrolyzer deployment scenarios, we estimate the emissions impacts from hydrogen production cumulatively from 2024 through 2035. We assume that all hydrogen that the electrolyzers produce offsets hydrogen currently produced via uncontrolled fossil fuel based steam methane reformation, which accounts for around 95% of today’s hydrogen.

A Department of Energy (DOE) technical paper published alongside the 45V proposal characterizes two types of emissions impacts: operational and structural. Operational impacts come from changes to the behavior of existing generators on the grid responding in the short-term to increases in electricity demand, while structural impacts reflect how the grid is expected to evolve over time in response to a long-term increase in electricity demand, including by building more assets like generators and transmission lines. In marginal emissions rate date developed by the National Renewable Energy Lab (NREL), short-term marginal emissions rates are consistently higher than long-term marginal emissions rates on a generation-weighted average annual basis, though the inverse may be true for some hours in the year. Put another way, given time to adjust to increases in demand, the response generally yields lower emissions than simply ramping up existing resources. We report both short-term and long-term emissions impacts from these electrolyzer deployment scenarios using NREL’s marginal emissions rates to bound our estimates, but actual emissions impacts likely fall somewhere between these two points.

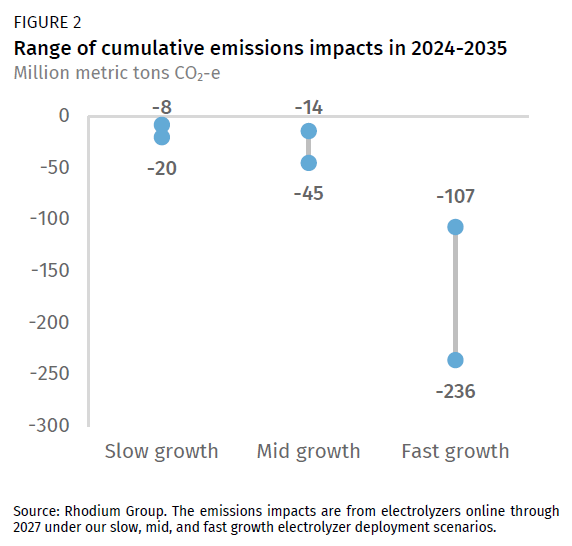

Under the qualification approach proposed by the IRS and described above, the cumulative emissions impact of electrolyzers from 2024 through 2035 in our mid-growth scenario is a 14-45 million metric ton (MMT) reduction in GHG emissions, assuming the hydrogen produced from these facilities is fully offsetting hydrogen that’s currently produced by SMRs (Figure 2).[1] If electrolyzer growth takes off and meets our fast-growth scenario, the cumulative emissions reductions could be as high as 107-236 MMT, and if growth is stymied and our low-growth scenario plays out, the cumulative reductions could be on the order of 8-20 MMT. In all cases, the highest amounts of emissions abatement correspond with structural emissions impacts, while the lower amounts of abatement correspond with operational impacts.

Flexibility in the early days

The proposed 45V guidance provides flexibility in the early years by not requiring hourly matching on day one. Instead, projects will need to temporally match on an annual basis at the get-go, a readily achievable requirement using current markets and tracking. This flexibility lasts until the beginning of 2028, when producers who want to claim or continue claiming the credit will need to transition to hourly matching. Given that hourly tracking systems are not yet widely available across the country, this initial flexibility will allow for a diverse set of projects to get off the ground while tracking systems deploy and markets for hourly credits develop. If the IRS had required hourly matching on day one, it’s likely only electrolyzers directly connected to new clean energy generators would qualify at the outset, likely constraining where electrolytic hydrogen projects would get built and overall deployment. This flexibility comes with an emissions impact. For instance, in the mid-growth case, the cumulative emissions abatement stated above is 23-54 MMT smaller than it otherwise would be due to this initial annual matching flexibility.

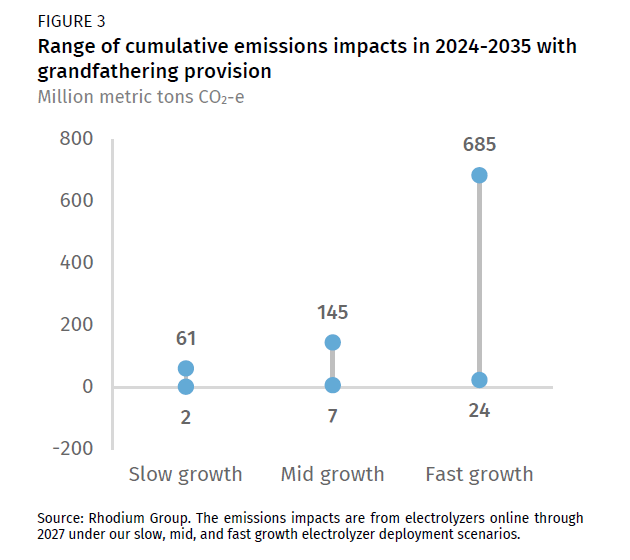

On the other hand, some organizations have advocated that hydrogen production facilities that commence construction before 2029 should not be required to meet hourly matching for the life of the facility, a term called grandfathering. The IRS proposal does not allow grandfathering—all facilities must meet all eligibility measures in 2028. If anything built before 2028 in our deployment scenarios described above were grandfathered, the emissions implications would be substantially different from what we find under the proposal. In all cases, we estimate that such an approach would actually lead to systemwide cumulative emissions increases, counter to the goal of using hydrogen as a decarbonization tool (Figure 3). In fact, these emissions increases could be quite large, depending on how quickly the power sector equilibrates to increases in demand, shifting from operational impacts (the high end of our emission ranges) to structural impacts (the low end of our emission ranges).

Some open questions from the guidance

The IRS is taking comment on all components of the proposal as well as a number of issues where they have laid out multiple options for a path forward. One of the most important open issues from an emissions perspective is how hydrogen projects using electricity from existing zero-emitting resources[2] can qualify, if at all. Nuclear advocates argue that the IRA makes reference to allowing at least some existing nuclear plants to power eligible clean hydrogen projects, while environmental advocates contend that the IRA doesn’t guarantee existing nuclear generation would qualify.

Meanwhile, DOE is using funds from the Infrastructure Investment and Jobs Act to support multiple new hydrogen hubs, at least two involving existing nuclear plants. The economics of these hubs are likely predicated on receipt of the 45V credit and may not pencil unless at least some existing nuclear generation is eligible.

This matters for emissions because existing zero-emitting generation is an important factor in maintaining progress on electric power decarbonization. Currently, when an existing zero-emitting generator, such as a nuclear plant, exits the grid (e.g., through retirement), a mix of generation from dispatchable fossil generators and variable renewable generators fills in the gap. This swap from 100% zero-emitting generation to some portion of generation coming from fossil generators leads to higher total emissions. There’s every reason to expect a similar outcome if existing zero-emitting generation is redirected from supplying the grid to supplying electrolytic hydrogen. The same holds true for any behind-the-meter hydrogen powered with existing, grid-connected clean generation.

The emissions impacts of allowing existing zero-emitting generation to qualify could be huge. We find that net cumulative emissions from shifting all existing nuclear generation to producing hydrogen would increase by 1.3-4.7 billion metric tons from 2024-2035.[3] This is an extreme scenario and would not occur in reality, but it puts into perspective the importance of getting the rules right.

The IRS is taking comments on a few options to allow some portion of the existing zero-emitting generation fleet to qualify for 45V, including:

- Generation from plants where 45V payments would help the plant otherwise avoid retirement

- Generation from zero-emitting plants during periods where modeling indicates zero or minimal grid-induced impacts, like periods of high renewable curtailment or low marginal emissions rates

- Generation from a predetermined percentage of the existing zero-emitting fleet—the proposal includes a 5% target as a starting point

- Generation from existing nuclear and hydroelectric facilities that relicense

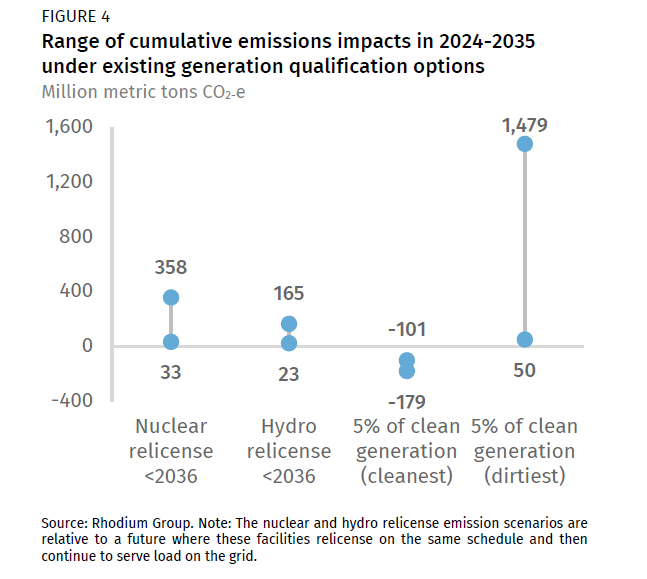

We estimate the emissions impacts of a few of these options. Around 28 GW of existing nuclear plants have licenses that expire through 2035, representing around 30% of today’s fleet. Assuming every reactor relicensed at the end of its current license and subsequently was used only for hydrogen production, we estimate around a 33-360 MMT net increase in emissions from production of this hydrogen cumulatively from 2024-2035, relative to a future where these facilities relicense on the same schedule and then continue to serve load on the grid (Figure 4). A similar calculation for the roughly 13 GW of hydropower facilities due to be relicensed through 2035 yields an emissions increase of 23-165 MMT. As with the nuclear retirements example above, these estimates represent aggressive interpretations of how the IRS might account for incrementality but point to the potential risk of a blanket approval of all relicensed facilities.

Meanwhile, the impacts of a 5% allowance for existing zero-emitting generation depends a lot on when that 5% of generation is used to make hydrogen. If the rules are structured to ensure that generation is diverted to hydrogen production only during periods with very low marginal emissions rates, making that hydrogen could result in a net emissions decrease of 101 to 179 MMT through 2035, again assuming displacement of an equivalent amount of SMR-produced hydrogen. In the first couple of years, the net emissions impact is basically a wash. However, in the future when there’s more variable renewable generation on the grid and more periods of very low marginal emissions rates, the net effects yield meaningful emissions reductions. This is aligned with the IRS’s reasoning behind taking comment on such an approach, as excess renewable generation is on the margin and at risk of curtailment during these periods.

But caution is highly warranted when designing these rules. If instead of diverting generation from existing zero-emitting generators during the cleanest hours on the grid that generation was diverted during the dirtiest hours on the grid, that could cause a huge increase in net systemwide emissions—up to nearly 1.5 billion metric tons of increased emissions cumulatively through 2035. If the IRS decides to embrace the 5% target approach, they should carefully consider how to ensure such an adverse consequence is avoided.

How will the guidance impact the industry?

Perhaps the most important thing the proposed guidance does for the nascent clean hydrogen industry is provide a clear roadmap for how to claim the lucrative 45V tax credit. Certainty is critical for supporting investment and scale-up of projects and equipment manufacturing. While there are still some wrinkles to iron out, the IRS has laid out the rules of the road for clean hydrogen for years to come. Any additional flexibility on hourly matching beyond what the IRS proposes will reduce the emissions benefits of 45V. Meanwhile, how the IRS ends up addressing the role of existing clean generation may also erode emissions benefits.

A robust and dynamic US clean hydrogen industry doesn’t mean every hydrogen company is going to make it or that all players will make mountains of money on day one. It does, however, mean that through competition and innovation, truly clean hydrogen has the potential to become affordable and widely available. This will maximize the chances that clean hydrogen will be able to help accelerate US emissions reductions in the 2030s and beyond.

[1] In the case of electrolyzers, these estimates account for the full impact of electricity consumption, including upstream emissions from fossil fuel production and transportation where relevant. We assume an 80% capacity utilization rate for electrolyzers. The estimated impacts being offset from SMR hydrogen also account for upstream gas emissions. Use of this hydrogen in new end uses (e.g., as a transportation fuel or in the power sector) rather than directly replacing SMR hydrogen (the likeliest near-term use) would result in differing emissions impacts.

[2] The IRS uses, but does not precisely define, the term “minimal-emitting” generators. We use “zero-emitting” to refer to the same concept.

[3] Note that using all nuclear generation would produce more hydrogen than is used in the US today; we only net out the SMR production emissions up to today’s levels.

This nonpartisan, independent research was conducted with support from Breakthrough Energy. The results presented in this report reflect the views of the authors and not necessarily those of the supporting organization.