Clean Hydrogen Workforce Development: Opportunities by Occupation

The US is positioning itself to be a leader in clean hydrogen production thanks to a wave of policy support. We assess potential job opportunities from building up the clean hydrogen industry.

The United States is positioning itself to be a leader in clean hydrogen production thanks to a wave of public policy support under the Inflation Reduction Act and the Infrastructure Investment and Jobs Act. However, the US will not be able to achieve its goal of significantly scaling up clean hydrogen without a robust and effective workforce. A clean hydrogen economy will require skilled laborers in an array of occupations.

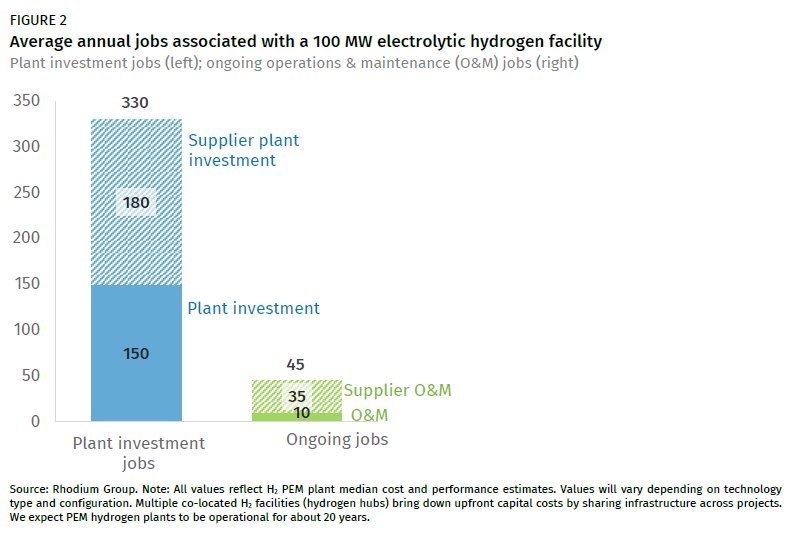

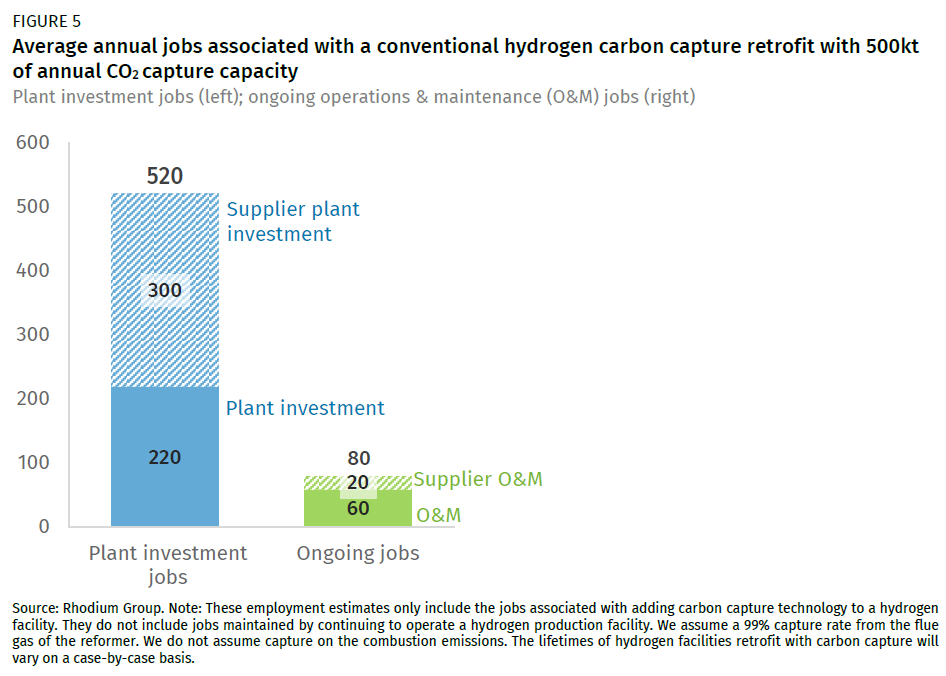

In this note, we explore potential job opportunities from building up the clean hydrogen industry in the US. We assess the total number of jobs associated with example individual commercial-scale facilities, as well as the types of occupations that comprise these employment numbers. Building a commercial-scale electrolytic hydrogen facility is associated with an annual average of 330 plant investment jobs and 45 ongoing jobs. Moreover, retrofitting a traditional hydrogen facility with carbon capture is associated with an annual average of 520 plant investment jobs and 80 ongoing jobs. Many of these occupations will require technical and extensive on-the-job training. To prepare for an expansion of these emerging technologies, occupational training programs will be imperative.

Policy support for clean hydrogen continues to grow

In recent years, clean hydrogen has become the focus of increased international attention as a versatile tool for deep decarbonization. In many ways, the United States is positioning itself as a leader in this space. In 2021, the Department of Energy announced its Hydrogen Shot goal to bring the cost of clean hydrogen down to $1/kg H2 in the next ten years. If achieved, this would make clean hydrogen price-competitive with today’s conventional—and emission-intensive—means of hydrogen production via steam methane reformation (SMR), often referred to as gray hydrogen.

In line with this goal, the Biden administration and congressional leaders incorporated support for clean hydrogen into two major clean energy bills—the Inflation Reduction Act (IRA) and the Infrastructure Investment and Jobs Act (IIJA). The IRA includes a clean hydrogen tax credit, 45V, which can bring down the cost of clean hydrogen by up to $3/kg H2 depending on the carbon intensity of the production pathway. Rhodium analysis has found that this incentive can drive down costs and accelerate long-term adoption of clean hydrogen both in the United States and abroad. Additionally, the IRA increased the value of the 45Q tax credit for carbon capture to $85/ton CO2 sequestered. This provides hydrogen from SMR with carbon capture, commonly known as blue hydrogen, with an alternative economic incentive to 45V if a developer prefers to claim it. Moreover, the IIJA includes $8 billion in funding for a clean hydrogen hubs program. This funding will go towards establishing six to ten clean hydrogen facilities across the country to help accelerate adoption in the US energy system. It’s anticipated that these hub locations will be announced towards the end of the year.

Demand growth for clean hydrogen is exponential

While numerous aspirational use cases exist for clean hydrogen in the long-term, the preeminent near-term end use is to replace existing demand for conventional hydrogen in the industrial sector with this low-carbon alternative. This can be done by lowering the carbon intensity of existing facilities by installing carbon capture, and by building new production facilities for electrolytic hydrogen that can potentially displace conventional hydrogen. Electrolytic hydrogen is hydrogen produced from water via electrolysis powered by clean energy, often referred to as green hydrogen.

Under current policies including the IIJA and the IRA, Rhodium estimates up to 16 million metric tons of carbon capture capacity will be installed on existing conventional hydrogen facilities by 2035. We also project between 15.3 to 23.2 GW of electrolytic hydrogen deployment in 2035. The range reflects uncertainty around infrastructure scale-up and technology costs. This is roughly 1,000 to 1,500 times the current electrolyzer capacity in the US and is enough capacity to produce approximately 2 to 3 million metric tons of clean hydrogen. By comparison, the US currently produces roughly 10 million metric tons of conventional hydrogen. Reaching those projections will require an 80% annual average increase in electrolytic hydrogen capacity over the next 12 years. Though that level of scale-up is ambitious, this type of growth is not unprecedented in the clean technology space. For comparison, utility-scale solar grew by an average of 97% per year during its fastest 10-year scale-up.

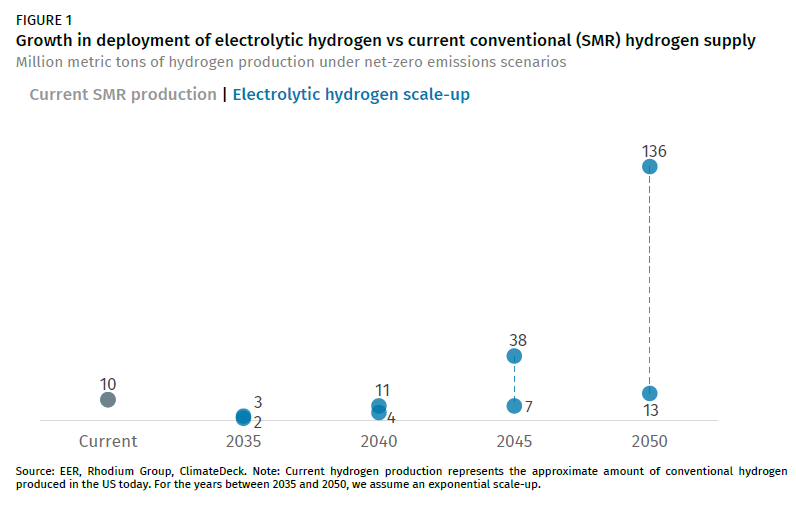

Under an array of scenarios for meeting net-zero emissions by mid-century, Evolved Energy Research finds that the US will need to produce between 25 to 140 million metric tons of clean hydrogen in 2050. Depending on the scenario, they find that 13 to 136 million metric tons of this hydrogen is from electrolysis (Figure 1). To achieve this high level of deployment, further policy support will be required.

Workforce readiness is part of the clean hydrogen scale-up challenge

The US will not be able to achieve the dramatic scale-up of clean hydrogen required to reach net-zero emissions by mid-century without the proper workforce. A clean hydrogen economy will require skilled laborers in discrete occupations. Below we explore the total jobs associated with an initial commercial-scale facility as well as the types of occupations that comprise these employment numbers.

For this analysis, we determined each production method’s capital and operating costs based on expert interviews, literature, and Rhodium analysis. The costs are informed by the size of the facilities and technology maturity. Next, we conducted in-depth research on how the distribution of costs varies by production method and sorted these costs into the appropriate industry codes associated with the input-output model IMPLAN. To estimate employment numbers, we input Rhodium’s cost data into IMPLAN using its national-level tools. We pulled occupational results from IMPLAN and supplemented these outputs with Bureau of Labor Statistics data. Our job numbers capture both the on-site and off-site jobs behind installing and maintaining a clean hydrogen facility, as well as the upstream supply chain jobs. We distinguish job types into two categories: plant investment jobs associated with the construction, engineering, materials, equipment, and supply chains required to build the facility; and operations & maintenance jobs, which are ongoing jobs over the lifetime of the plant.

This analysis accounts for the recent economic shifts, including rising inflation numbers, supply chain constraints, and overall higher capital costs compared to our previous analysis. We also assume larger hydrogen facilities to keep up with the rapidly evolving hydrogen landscape. This section is separated by hydrogen production method since each facility type has a distinct job profile.

Electrolytic hydrogen workforce opportunities

For our analysis, we use an example 100 MW size facility, which is based roughly on an expected initial commercial-scale facility seen in current literature and announced project plans. While a 100 MW size plant is much larger than any existing facility in the US today, it is still relatively small compared to where the industry is heading. Developers and manufacturers hope to eventually increase electrolyzer plants to the GW scale, at least 10 times the size of this sample initial facility. We find that a 100 MW polymer electrolyte membrane (PEM) hydrogen plant is associated with an annual average of 330 plant investment jobs over the 2-year construction period (Figure 2). 150 of these jobs are associated with the construction, engineering, equipment, and materials to build the facility, and 190 come from the supply chain requirements. Additionally, we see 45 ongoing jobs over the lifetime of the plant associated with operating and maintaining the facility and related supplier activities.

Job breakdown by occupation

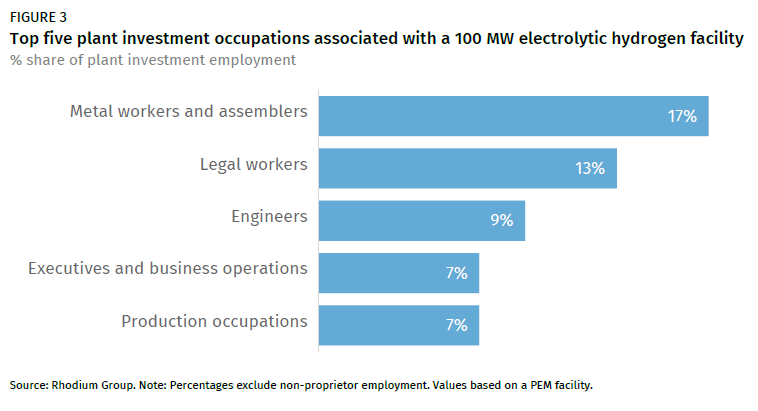

To gain a better understanding of the skilled labor needed to fill these positions, we analyzed the underlying occupations that make up the plant investment and O&M jobs. Supplier jobs are not considered in our occupational analysis. The top five occupations associated with building a new electrolytic hydrogen facility are, in order: (1) metal workers and assemblers, (2) legal workers, (3) engineers, (4) executive and business operations, and (5) production occupations (Figure 3). The top category—metal workers and assemblers—primarily consists of skilled workers including welders and machinists. Electrical, industrial, and mechanical engineers are the largest subcategory of engineers required to build a PEM facility. Production occupations include jobs such as inspectors, testers, processing technicians, and chemical equipment operators and tenders.

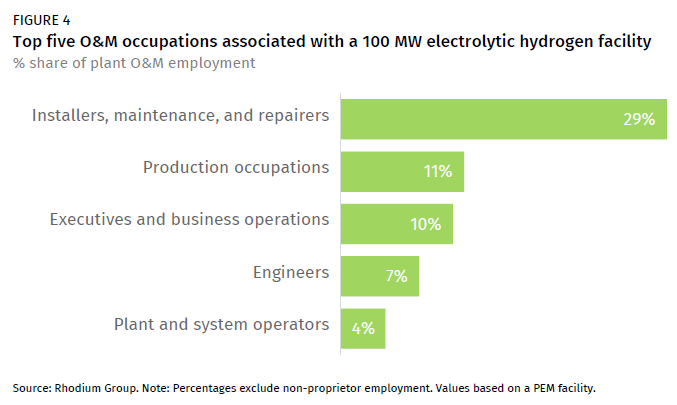

The top five occupations for ongoing O&M jobs are (1) installers, maintenance, and repairers, (2) production occupations (3) executive and business operations, (4) engineers, and (5) plant system operators (Figure 4). The top job category—installers, maintenance, and repairers—includes jobs maintaining and repairing the necessary electrical systems and machinery.

Hydrogen with carbon capture workforce opportunities

As more carbon capture projects break ground, we have noticed a trend towards companies reporting higher costs for carbon capture than previous literature had estimated. These changes are reflected here in our employment analysis. To estimate the jobs associated with a carbon capture retrofit of a conventional hydrogen production facility, we use a facility with 500 kilotons of annual CO2 capture capacity as representative of cost and employment trends for the broader industry. We estimate an average of 520 jobs per year are associated with adding carbon capture to an SMR facility of this size over the 4-year construction period (Figure 5). 220 of these jobs are associated with the construction and engineering of a retrofit project and the remaining 300 jobs are associated with materials and equipment used in the project via the supply chain. Moreover, we estimate 80 ongoing jobs over the lifetime of the facility to operate and maintain the carbon capture equipment. These estimates do not include ongoing jobs retained at the hydrogen production facility prior to the installation of carbon capture.

Carbon capture retrofits will happen where there are existing SMR facilities. Thus, much of this workforce opportunity is expected in the Gulf Coast, Midwest, and California.

Job breakdown by occupation

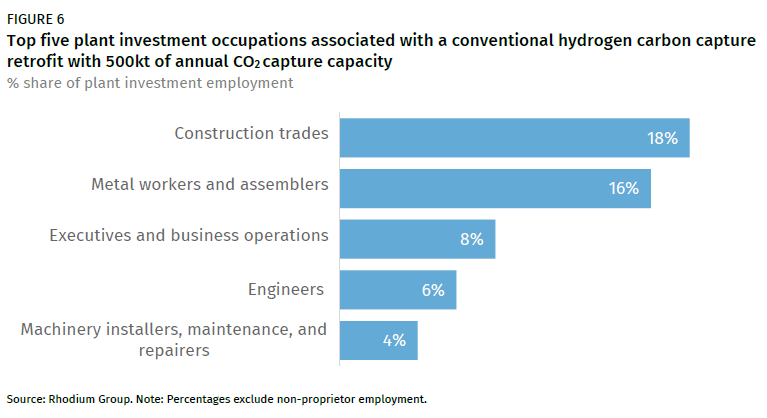

We also analyzed the underlying occupations that make up the plant investment and O&M jobs for hydrogen with carbon capture. Supplier jobs are not considered in our occupational analysis. The top five occupations associated with retrofitting a hydrogen facility with carbon capture are: (1) construction trades, (2) metal workers and assemblers, (3) executive and business operations, (4) engineers, and (5) machinery installers, maintenance, and repairers (Figure 6).

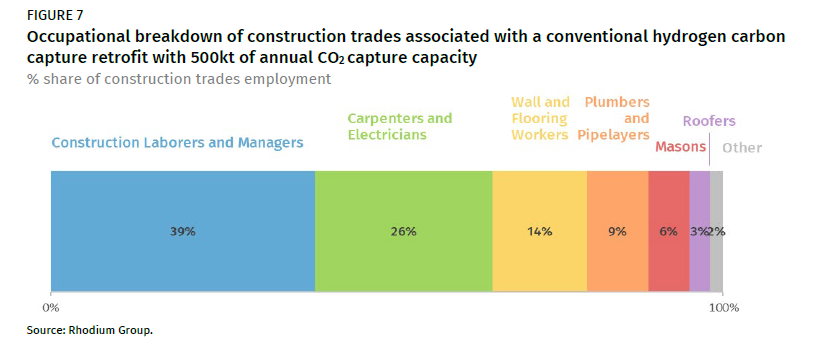

Construction trades include a variety of occupations, including construction laborers and managers, carpenters, electricians, plumbers, and pipelayers (Figure 7). Metal workers and assemblers include occupations such as welding, soldering and electrical equipment assembling. Mechanical, civil and industrial engineers represent the bulk of engineers required to retrofit conventional hydrogen production with carbon capture.

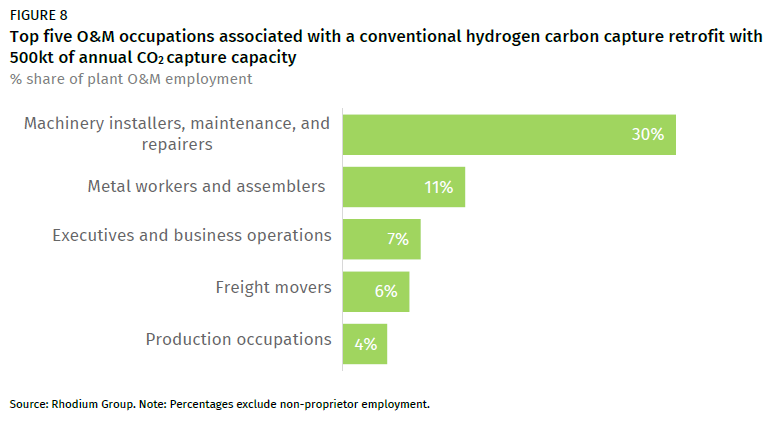

In terms of ongoing jobs, the top five occupations are: (1) machinery installers, maintenance, and repairers, (2) metal workers and assemblers, (3) executives and business operations, (4) freight movers, and (5) production occupations (Figure 8).

Reaching our estimate of up to 16 million metric tons of blue hydrogen capture in 2035 would require 32 facilities of this size—28% of hydrogen facilities reporting to EPA’s facility level data. This translates to over 16,000 annual average plant investment jobs and 2,560 ongoing jobs across the industry.

Across all types of clean hydrogen production, many of these occupations will require technical and extensive on-the-job training. To prepare for a scale-up of these emerging technologies, occupational training programs will be imperative.

Forthcoming analysis

With clean hydrogen being a critical tool of a clean energy future, Rhodium Group will continue to follow this topic closely. We have forthcoming analysis exploring the economic opportunities associated with the Department of Energy’s hydrogen hubs. Additionally, as a continuation of our emerging climate technologies research, Rhodium Group will be releasing employment and occupational analysis for direct air capture and sustainable aviation fuels soon. We will also continue to expand upon our employment analysis to investigate important factors including wages, union labor, and required skills.

This nonpartisan, independent research was conducted with support from Breakthrough Energy. The results presented reflect the views of the authors and not necessarily those of supporting organizations.