Global Emerging Climate Technology Diffusion and the Inflation Reduction Act

The IRA includes significant incentives for emerging climate technologies. Using a new modeling framework, we assess the long-term global emissions impact of these incentives.

The Inflation Reduction Act represents a turning point in US climate policy and a suite of recent analyses estimate it will significantly accelerate the pace of US greenhouse gas emissions reductions. Most analyses of the emissions impact of the Inflation Reduction Act (IRA) have focused on the extent to which the legislation accelerates deployment of relatively mature technologies, like wind, solar and electric vehicles within the United States. The IRA also includes significant incentives for the development and deployment of earlier-stage emerging climate technologies (ECT), like clean hydrogen, sustainable aviation fuel, and direct air capture. Much of the potential emissions benefits of these incentives will likely occur after 2030 and outside the US, as IRA-driven cost declines accelerate deployment globally, yet currently there are limited analytical tools to quantify these emissions reductions.

In this note, we introduce a new framework designed precisely for this purpose and apply it to key ECT provisions in the IRA. This preliminary analysis of some of the ECT incentives in the IRA finds that for every ton of CO2 reduced within the US, an additional 2.4-2.9 tons of CO2 emissions reductions are achieved outside the US, thanks to IRA-driven cost reductions in the “green premium” of ECTs globally.

The IRA’s role in emerging climate technology deployment

Building on the bipartisan infrastructure bill passed in 2021, the IRA is the backbone of the Biden administration’s plan to reach the United States’ climate target under the global Paris Agreement of a 50-52% reduction in GHG emissions below 2005 levels by 2030. As such, most analyses of the emissions impact of the legislation, including those by Rhodium Group, have focused on the period between now and 2030 (or 2035), and limited their scope to GHG emissions reductions in the territorial US. In these analyses, the vast majority of the GHG emissions impact from the legislation comes from accelerated deployment of relatively mature technologies like wind, solar, electric vehicles, oil and gas methane control systems, retention of existing zero-carbon nuclear generation, and carbon capture and sequestration (CCS) employed in lower cost applications like ethanol production. In Rhodium’s analysis, for example, the IRA delivers as much as 660 million metric tons of annual abatement in 2030, of which 90% or more is attributable to deployment of these relatively mature technologies.

Looking beyond 2030 and beyond the United States, other provisions of the IRA could have comparable emissions reduction benefits. The legislation includes significant incentives for a number of emerging climate technologies (ECTs) that are currently too early in their development to deploy at scale by 2030, but which will likely play a critical role in a net-zero emissions future, both within the US and around the world. These include the enhanced 45Q tax credit for direct air capture (DAC), the 45V tax credit for clean hydrogen, and a tier of the new clean fuel production credit (section 45Z) for sustainable aviation fuel (SAF).

These incentives have the potential to drive cost declines that accelerate long-term adoption, not just in the United States, but around the world, similar to what German feed-in tariffs (FiT) did for solar power in the early 2000s. From 2004 to 2012, Germany’s renewable energy law, including over €200 billion in subsidies, propelled the adoption of over 30 gigawatts of PV in Germany. The new demand this sparked in Germany helped transform the global PV market, catalyzing global learning and opportunities for massive economies of scale. Recent studies have found that market-stimulating policies like Germany’s FiT played a significant role in encouraging innovation and driving down costs globally, contributing as much as 75% of solar PV cost reductions between 2001 and 2012.

Introducing the Emerging Climate Technology Framework (ECTF)

While the global GHG reduction potential of the ECT provisions of the IRA is potentially large, there is a dearth of modeling tools capable of quantifying the emissions impact of early-stage technology incentives and deployment on reducing technology costs. To help fill this gap, Rhodium Group and Breakthrough Energy have developed the Emerging Climate Technology Framework (ECTF). The ECTF is a new conceptual framework, and supporting model, intended to help quantify the long-term global emissions impact of near-term ECT investments. Developed initially by Rhodium Group and Breakthrough Energy to quantify the impact of investments made through BE’s Catalyst program, the ECTF can also be used in other contexts, including quantifying the impact of policy incentives for ECTs. For more information on the ECTF, see the technical appendix to this note.

Applying the ECTF to the IRA

Using this early version of the ECTF, we quantified the impact of the policy incentives in the Inflation Reduction Act for three key ECTs: clean hydrogen, SAF, and DAC as a stylized demonstration of one potential application of this framework. Much like the German feed-in-tariffs for solar, these incentives are intended to help drive these emerging technologies down the cost curve to the point where they can scale in a broader and more technology-neutral policy environment. Since the shape of that future policy environment is still unknown, we use an economy-wide carbon price set at the current US government social cost of carbon (SCC) as a simplified proxy. In other countries, we assume policy ambition evolves proportional to income and so scale the US SCC by countries’ per capita GDP.[1]

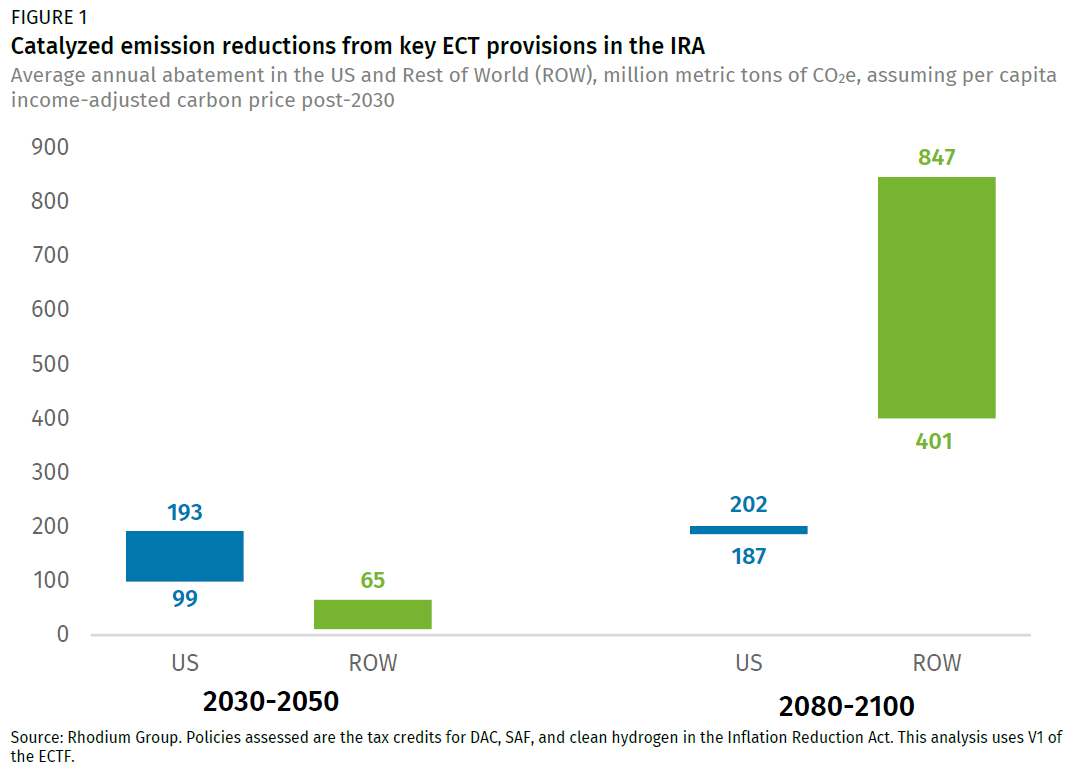

We find that between 2030 and 2050, most of the emission reduction benefits from the IRA’s ECT incentives included in this analysis occur in the United States—between 99 and 193 million metric tons a year depending on future energy prices and technology costs (Figure 1). The reduction in clean hydrogen, DAC, and SAF costs due to deployment in the US begin to accelerate global deployment in the 2030-2050 time-horizon, up to an additional 65 million metric tons per year on average. But the non-US deployment really picks up steam after 2050, as both ECT costs continue to fall and policy ambition in developing countries gets more ambitious. By the end of the century (2080-2100), the ECT incentives in the IRA are driving 401-847 million metric tons of CO2 of abatement each year on average outside the US, relative to a future where those incentives were never adopted. That’s on par with the impact of the legislation as a whole in 2030. On a cumulative basis, the IRA ECT incentives included in this analysis reduce 2.4-2.9 tons of CO2 emissions outside the US for every ton they reduce within the US.

A key limitation of this analysis is the deterministic policy forecast. If post-2030 climate policy is more ambitious than the stylized income-adjusted carbon prices used here, then the post-2030 emission reduction benefits of the ECT incentives in the IRA will grow. The inverse, of course, is also true. A more nuanced “expected policy” trajectory scheduled for incorporation in the ECTF later this year will improve the utility of this framework both for policymakers and ECT investors.[2]

Maximizing US policy impact as domestic emissions decline

While the analysis above is meant to be illustrative only, it highlights a dynamic that will become increasingly important for US policymakers in the years ahead. Rhodium Group estimates that the US share of net global GHG emissions fell to 11% in 2021. If all countries meet their current pledges under the Paris Agreement, the US share of global GHG emissions will fall to 7%. Meeting the US commitment of cutting emissions in half by 2030 and charting a credible course to net-zero emissions by mid-century will be critical for maintaining global momentum. But as the US share of global emissions continues to decline, it will be increasingly important for policymakers to evaluate the impact of domestic policy on the pace of global low-GHG technology diffusion directly—by reducing costs and expanding production scale. Tools to measure this impact, like the ECTF, will be critical to assess the effectiveness of government support for early ECT investments in helping to reach global net-zero goals.

Technical appendix

There is growing interest among policymakers, companies and financial institutions in investing in the emerging climate technologies (ECTs) that are critical for a net-zero emissions future. Yet until now, there has been no robust analytical framework for assessing the potential climate impact of these investments. The Emerging Climate Technology Framework (ECTF), developed by Rhodium Group and Breakthrough Energy, fills this gap.

Existing energy-emissions modeling can provide some insight into the role different ECTs might play in reaching net-zero emissions globally. For example, the World Energy Outlook (WEO) published annually by the International Energy Agency (IEA) includes a Net Zero Emissions (NZE) scenario where global energy sector CO2 emissions reach net zero by 2050. The NZE scenario in the IEA’s 2022 WEO, for example, includes very specific projections of the scale of ECT deployment needed by 2050, including: SAF accounts for 70% of global jet fuel demand, there is 1,509 billion cubic metres-equivalent of global clean hydrogen production (the equivalent of more than one-third of current global natural gas supply), and 1.4 billion tons of DAC and other forms of carbon dioxide removal (CDR). Policymakers often use these kinds of projections to identify priority technologies for research, development and deployment (RD&D) funding. Investor-focused tools like CRANE use these global net-zero projections to calculate the emission reduction potential of different technologies if they reach full scale.

There are several important limitations with this approach:

- Overreliance on deterministic projections: The IEA’s WEO projections, and most other global net-zero modeling, is meant as an illustrative scenario, not a prediction. For simplicity, the IEA treats economic and population growth, oil and natural gas prices, clean energy technology costs, and consumer adoption of EVs and other low-GHG equipment and appliances deterministically. The result is a single plausible technology pathway to net-zero in 2050, but one that could change dramatically if any of those deterministic assumptions were changed.

- Combination of mutually exclusive technology pathways: Policymakers and clean energy investors often combine technology-specific projections from different models, each with their own, and often conflicting deterministic socioeconomic, policy, energy price and technology cost projections.

- Can’t quantify the impact of individual policies or investments: Most importantly, the existing approaches only provide insight into the potential role of a technology category as a whole in a global net-zero future, not the impact of individual policies or investments aimed at making that future a reality.

The ECTF seeks to address these gaps by quantifying the global emissions impact of individual ECT policies/investments in a methodologically consistent manner, incorporating uncertainty in future policy, socioeconomics, energy prices, technology costs and consumer behavior. The current ECTF model incorporates global baseline projections from Rhodium’s Global Energy Model (RHG-GEM), though other baseline projections can be used. RHG-GEM was built off the Energy Information Administration (EIA)’s World Energy Projection System (WEPS), with significant enhancements made to capture a broader range of clean energy technologies (ECTs in particular), and to handle policy, socioeconomic, energy price, technology cost and behavioral uncertainty. The ECTF Model then quantifies the extent to which an individual ECT investment accelerates baseline deployment projections and the resulting global emission reductions.

The ECTF model produces the following two metrics:

- Green Premium Reduction (GPR): Projected decrease in the price premium at a specific point in time of an ECT relative to a fossil incumbent (or target price, depending on the technology) resulting from a given investment in early-stage ECT deployment.

- Catalyzed Emission Reduction (CatER): Global emission reductions due to accelerated future deployment of the ECT thanks to a given GPR.

For the current version of the ECTF (V1), RHG-GEM is run with deterministic policy and socioeconomic projections, but includes uncertainty in ECT technology costs, energy costs, and consumer behavior. The next version (V2), to be released this fall, will include fully probabilistic policy, socioeconomic, energy price, technology cost and behavioral projections.

It’s important to note that emissions in the RHG-GEM projections underlying the ECTF Model do not achieve net-zero emissions by 2050. This is because they are intended to represent a baseline against which to assess the incremental benefit of a new ECT-focused policy or investment. In a net-zero scenario, such policies/investments have no incremental value because the baseline projections are designed to achieve a net-zero goal, and as such implicitly assume that all necessary ECT-focused policies/investments occur.

[1] In V2 of the ECTF to be released this fall, we will be introducing an econometrically-derived, probabilistic climate policy projection model that includes a wide range of national circumstances beyond per capita income in determining expected future policy ambition and form.

[2] The new probabilistic policy forecasting model Rhodium is introducing in V2 of the ECTF model this fall (along with a number of other model improvements) will address this limitation. See the technical appendix for more detail.