International trade and environmental issues have long been intertwined policy areas, often considered at odds with each other. As countries rachet up climate policies to keep the Paris Agreement goals within reach, the role of trade instruments in decarbonization strategies has been brought back into the limelight. Governments around the world are now embracing trade measures, from tariffs to border carbon adjustments, as key tools to leverage climate and industrial policy objectives. The roll-out in 2023 of the EU’s Carbon Border Adjustment Mechanism (CBAM) has transformed the instrument of a border carbon adjustment (BCA) from a controversial and mainly theoretical tool into a political reality. Policymakers in other regions are now actively considering BCAs, and how to respond as they are subject to other countries’ BCAs. In this note, we focus on the main objectives of BCAs and their role within the industrial decarbonization policy toolkit. We provide insights into whether and how BCAs can contribute to reducing global greenhouse gas emissions from the industrial sector.

Climate policy ambition in a competitive world

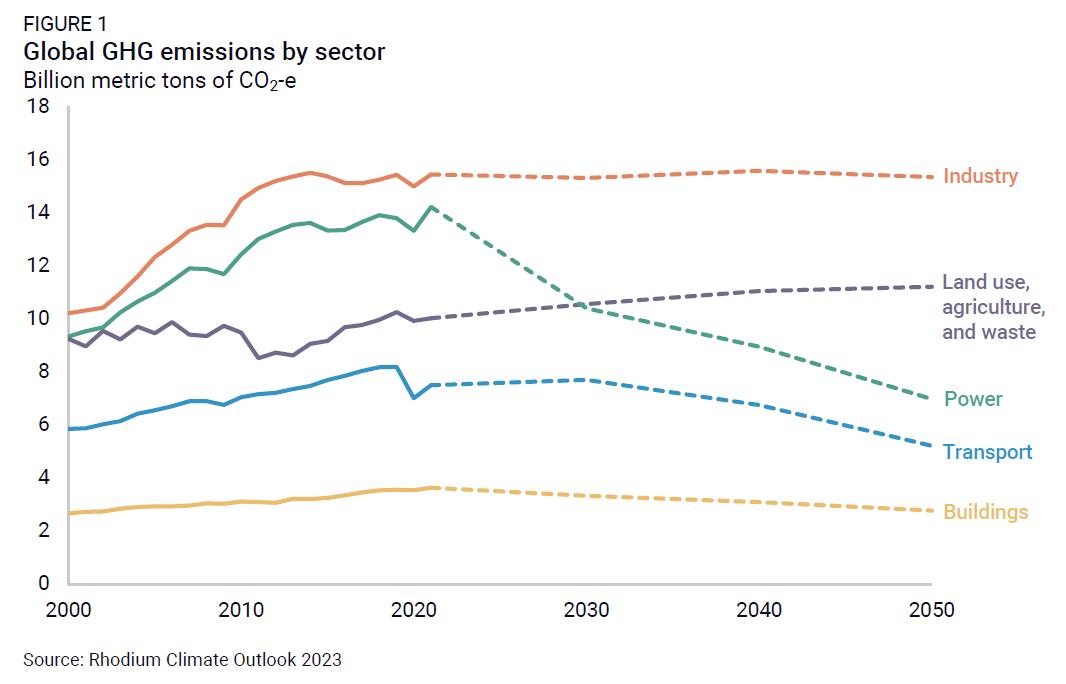

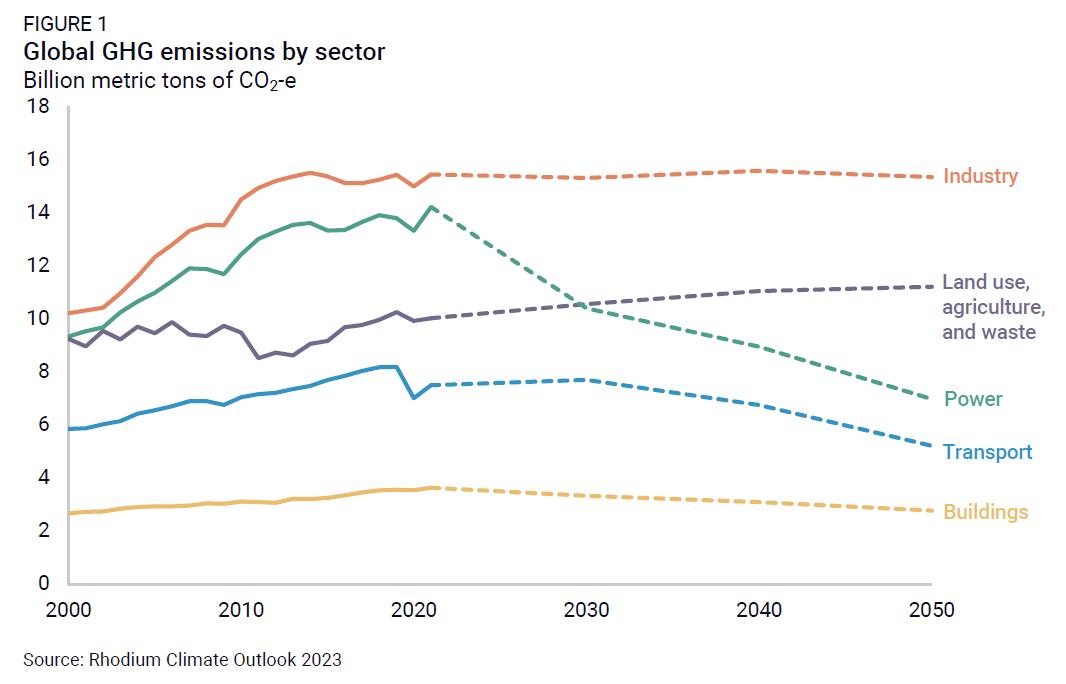

The first Global Stocktake leading to COP28 highlighted the urgent need to increase efforts to meet the goals of the Paris Agreement. The 2023 Rhodium Climate Outlook suggests that while global emissions from the electric power and transport sectors will likely peak by 2030 thanks to decades of policy and innovation, emissions from the industrial sector—generated from manufacturing products and materials like iron, steel, cement, and chemicals—will likely remain stubbornly high without a significant acceleration of policy (Figure 1). If the world is to meet the Paris Agreement goals, countries will need to increase decarbonization strategies for reducing emissions from industry. In this context, industrial decarbonization policies aimed at spurring the development and deployment of low-carbon solutions will increasingly rely on a mix of supply-push and demand-pull instruments, from subsidies for new technologies (see, for example, the recent $6bn funding from the US Department of Energy for low carbon manufacturing) to more stringent emissions standards or targets (e.g., the 2023 reform of the EU ETS to tighten the cap on industrial and power emissions by 2030). As this happens, governments will increasingly be concerned about the competitiveness of their industries on global markets, looking for trade measures to both defend domestic firms from competitors in less climate-ambitious jurisdictions (avoiding so-called carbon leakage) and to champion innovators to achieve a carbon competitive advantage.

Industrial emissions, carbon leakage, and border adjustments

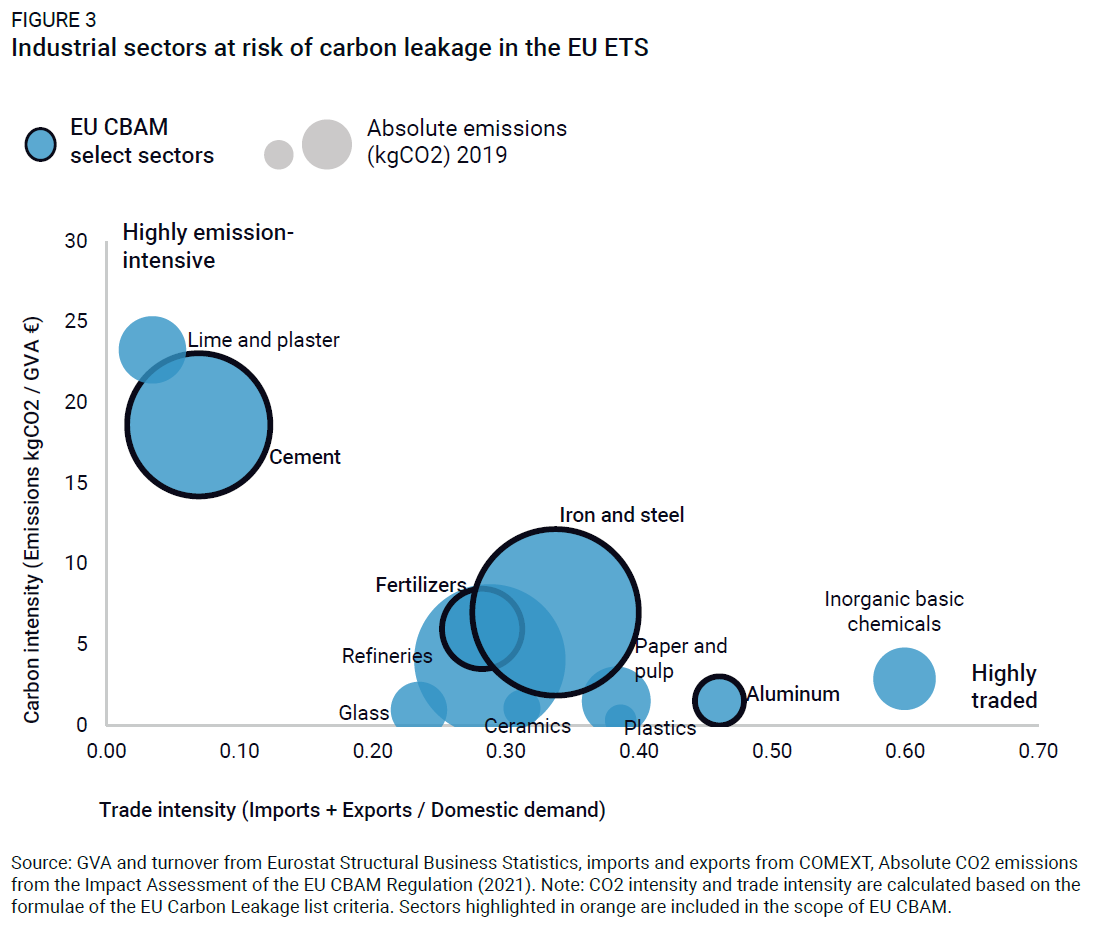

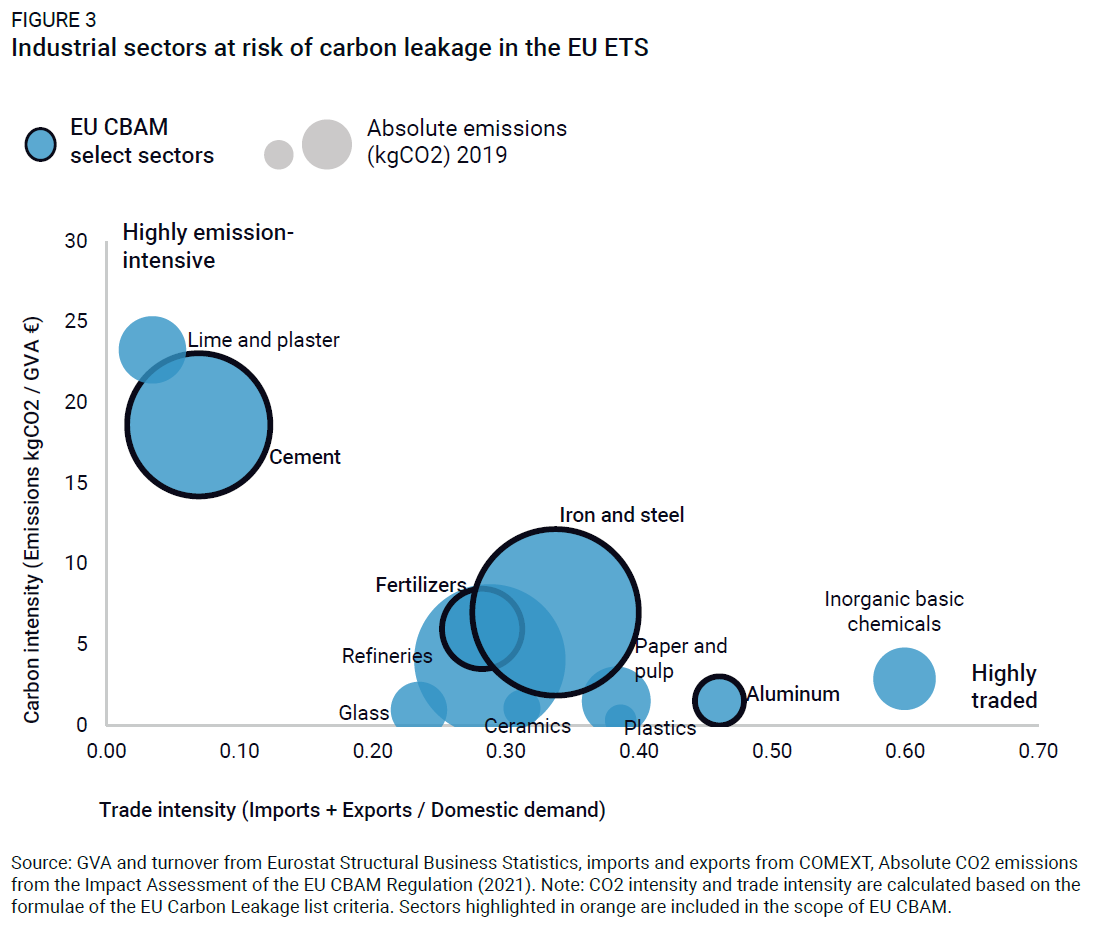

Carbon leakage occurs when, as a result of climate policy in one country, production—and thus emissions—relocates to another country with less stringent policy. If this happens, the benefits of the domestic action are dampened, if not canceled out, from a global GHG emissions perspective. The risk of carbon leakage is highest for goods that are both carbon-intensive to manufacture and internationally traded. Therefore, measures to address it are considered mostly relevant in so-called energy-intensive industries (EIIs), such as metals (e.g., iron and steel, aluminum, copper), minerals (e.g., cement, lime, glass), and chemicals.

While measures to address carbon leakage have been included in carbon pricing policies in the past, these have mainly focused on domestic exemptions for sectors at risk and have stayed well clear of carbon emissions embodied in imports. But as climate ambition continues to diverge, border carbon adjustments (BCAs) have resurfaced as useful tools to combat carbon leakage.

Renewed interest in border carbon adjustments

In simple terms, BCAs consist of putting an equivalent carbon price on imports to what’s faced by domestic producers, intending to level the playing field. Long confined to academic circles and technical policy discussions, BCAs have now entered the political sphere and international trade negotiations, as the European Union (EU) launched the first instrument of this kind last year.

The EU approach: Leveling the playing field

Launched in a transitional phase in October 2023, the EU Carbon Border Adjustment Mechanism (CBAM) is designed to work in tandem with its flagship climate policy tool, the EU Emissions Trading System (EU ETS). The CBAM is a BCA for a selected subset of energy-intensive sectors, namely iron and steel, cement, aluminum, hydrogen, and fertilizers (in its current scope)[1]. Deemed to be exposed to a significant risk of carbon leakage, these sectors have been under the scope of the EU ETS since its inception in 2005 but have been mostly shielded from paying the full carbon price through a system of free allocations of allowances. Imagined as a transitional mechanism while other countries ramp up climate ambition, free allocation to industry was always designed to be a temporary measure, to be phased down over time to incentivize industrial decarbonization in the EU.

Following a dramatic increase in carbon prices (from an average of EUR 5.8/ ton in 2017 to EUR 80.18 in 2022), and few trade partners implementing robust carbon pricing policies, the EU decided to gradually phase out free allocations and gradually phase in a BCA instead. The CBAM entered into force in a transitional phase, during which time importers of goods have to report direct emissions (and indirect emissions from electricity use, for cement and fertilizers only) embodied in products entering the EU. From 2026, full implementation will start, and importers will be required to purchase certificates for each ton of emissions imported.

Trade leveling or trade barrier?

Being the first instrument of its kind, the EU took great care in designing the CBAM to be compatible with World Trade Organization (WTO) rules, for example by opting for an adjustment closely related to the EU ETS auction price (weekly), the simultaneous phase-out of free allocation for EU industry, the universal treatment of all trade partners, and by allowing CBAM reductions only on carbon prices effectively paid in exporting countries. Notwithstanding, some trade partners have been highly critical of the EU CBAM, led by BRICS countries, who deem it discriminatory. India, mainly exposed through its iron and steel exports, has announced its plan to raise these concerns with the WTO. African nations have also expressed concerns over the development impacts of the EU CBAM (for example, Mozambique, Cameroon, and Ghana send roughly 95% of their aluminum exports to the EU). Ahead of COP28, African Union leaders called for “trade-related environmental tariffs and non-tariff barriers” to “not be unilateral, arbitrary or discriminatory measures.” Other countries, less dependent on the EU market (and generally less carbon-intensive, in aggregate terms, due to the maturity of their industrial sector), have had more muted reactions to the EU CBAM. Some have announced plans to consider their own border adjustments, including the UK, Australia, and Canada. In the US, the past few years have seen a renewed interest in carbon border measures across the entire political spectrum, with several proposals introduced in the Senate, ranging from carbon data tracking (namely the bi-partisan PROVE IT Act) to a fully-fledged BCA linked to domestic emission performance standards (the Clean Competition Act), and carbon tariffs on imports without additional domestic policy (the Foreign Pollution Fee Act).

How can BCAs reduce emissions?

With renewed political momentum behind BCAs, it is crucial to understand what they can and can’t do when it comes to reducing emissions, both domestically and globally.

The scale of global industrial emissions

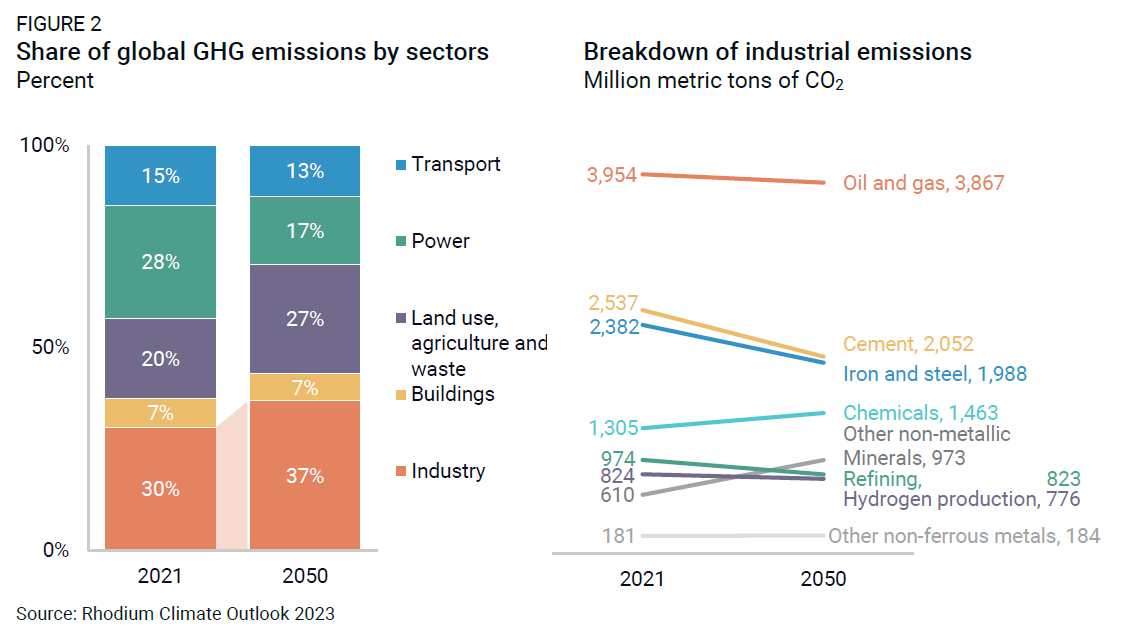

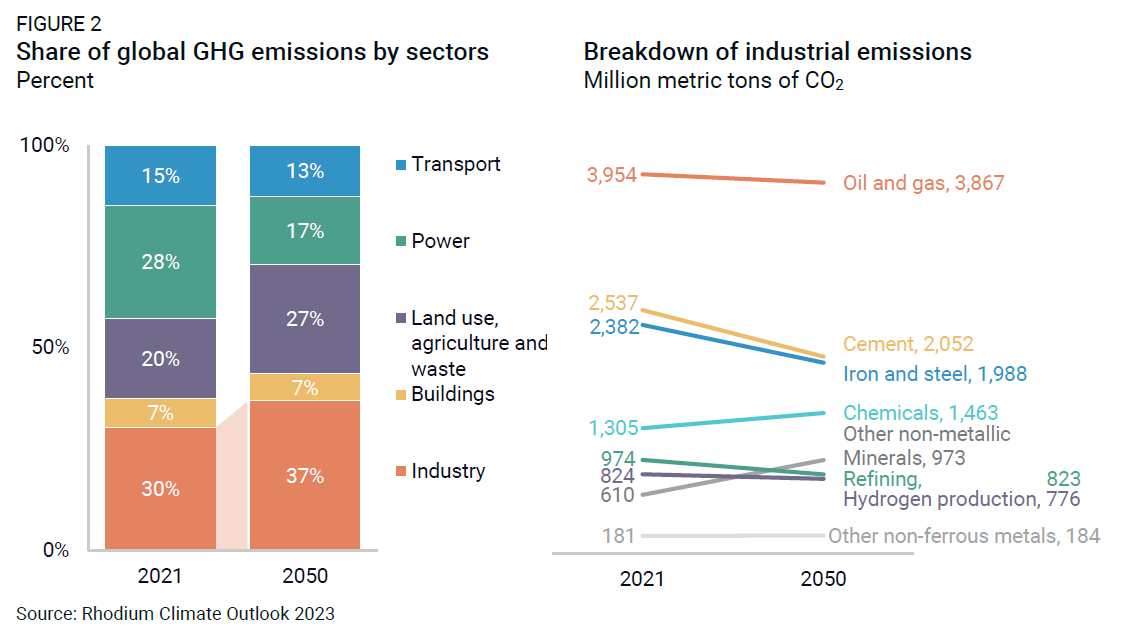

Industry represents over 30% of global GHG emissions today. The 2023 Rhodium Climate Outlook projects this proportion to grow to over 37% of global emissions by 2050. Within industry, emissions are primarily concentrated both in fossil fuel extraction and processing sectors (oil and gas) and in the energy-intensive industry (EII) sectors that manufacture widely used materials such as metal (e.g., steel, aluminum), mineral (cement, glass) and chemical (fertilizers) products (Figure 2). These materials are carbon-intensive since they are produced in energy-intensive processes, mainly relying on fossil fuel inputs, and often releasing process emissions through chemical reactions. Among EIIs, three sectors stand out in particular: cement, iron and steel, and chemicals manufacturing, which currently emit 5%, 4.7%, and 2.6% of global emissions, respectively. The remaining EII emissions are concentrated in the production of non-ferrous metals (such as aluminum and copper), other non-metallic minerals (glass, ceramics), and paper industries, altogether accounting for 1.6% of global GHG emissions. Therefore, a renewed focus today on industrial decarbonization policies can have a significant impact on the global emissions trajectory by 2050.

The broader the scope of policy in terms of which industrial sectors it covers, the more emissions it could help mitigate. However, in the design of BCAs, policymakers must strike a balance between emissions scope and difficulty in implementation and enforceability. In the example of the EU CBAM, policymakers opted to include only a subset of industrial products covered by the EU ETS, accounting for roughly 13% of total EU emissions in 2020. Amongst all sectors considered at risk of carbon leakage (shown in Figure 3), many were excluded from the original proposal, largely based on difficulties in method and data to estimate embedded emissions, despite being highly traded and emissions-intensive (e.g., chemicals, paper, plastics, etc.)

It is worth noting that BCAs alone, by definition, can only target the share of emissions embodied in traded goods, and EII goods are traded in different proportions. In a recent note on global cement decarbonization, we highlight that only 2.6% of global cement production is traded. While that proportion is higher for steel, with international trade representing 20% of global production volumes (13% when considering only extra-regional trade), the majority of these materials are used to meet domestic demand, as historically linked to construction fueled by economic and population growth. Thus, BCAs are likely to be more successful in reducing industrial emissions when implemented in complement with domestic action.

BCAs’ decarbonization channels

Border adjustments can contribute to reducing these industrial GHG emissions in three main ways. First, as carbon leakage tools, they can ensure that domestic industrial emission reductions are not offset (or more) by GHG increases in other countries. In other words, they help ensure the emissions-reducing benefits of domestic climate action. The net GHG emissions impact of an EII decarbonization domestic measure accompanied by a BCA is generally expected to be better from a global GHG emissions perspective than the impacts of a stand-alone domestic measure.

A second decarbonization channel is through leverage: BCAs can aim to leverage emission reductions in other jurisdictions by placing an incentive on exporters to minimize their carbon emissions in order to retain market share. This leverage can be targeted at the firm level, if the adjustment is levied on an individual manufacturer’s carbon intensity (like in the EU CBAM), or at the country-level, if the adjustment is made based on national averages. Country-level leverage relies on a BCA incentivizing other countries to adopt domestic industrial decarbonization policies, which is difficult to achieve in practice.

Finally, BCAs may reduce emissions by incentivizing innovation in cleaner production processes. If allowed to diffuse beyond national borders and scale sufficiently, this innovation channel could be the most significant one in terms of emissions reduction potential.

While a BCA designed to prevent carbon leakage has the most direct impact on emissions, it is also the most narrow in scope when BCAs are unilateral measures. In essence, it maintains the integrity of a country’s own emissions reduction goal, and covered emissions are those embodied in imported products to that region. The larger the imports of the market in question, the more emissions can be reduced through the scheme. The leverage and innovation channels can have more wide-ranging impacts if they successfully reduce the aggregate-level emissions intensity of products manufactured abroad, but they are also more speculative. The extent to which they succeed depends on their design and the wider climate diplomacy context.

Resource shuffling risks & limits of climate diplomacy

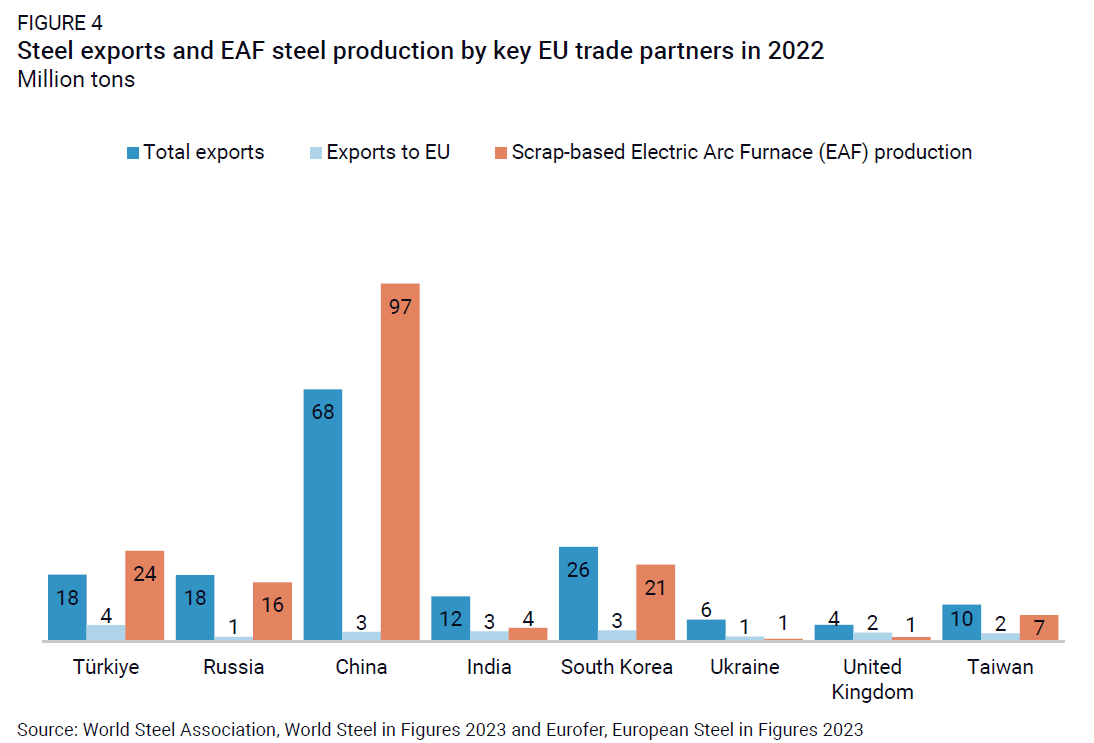

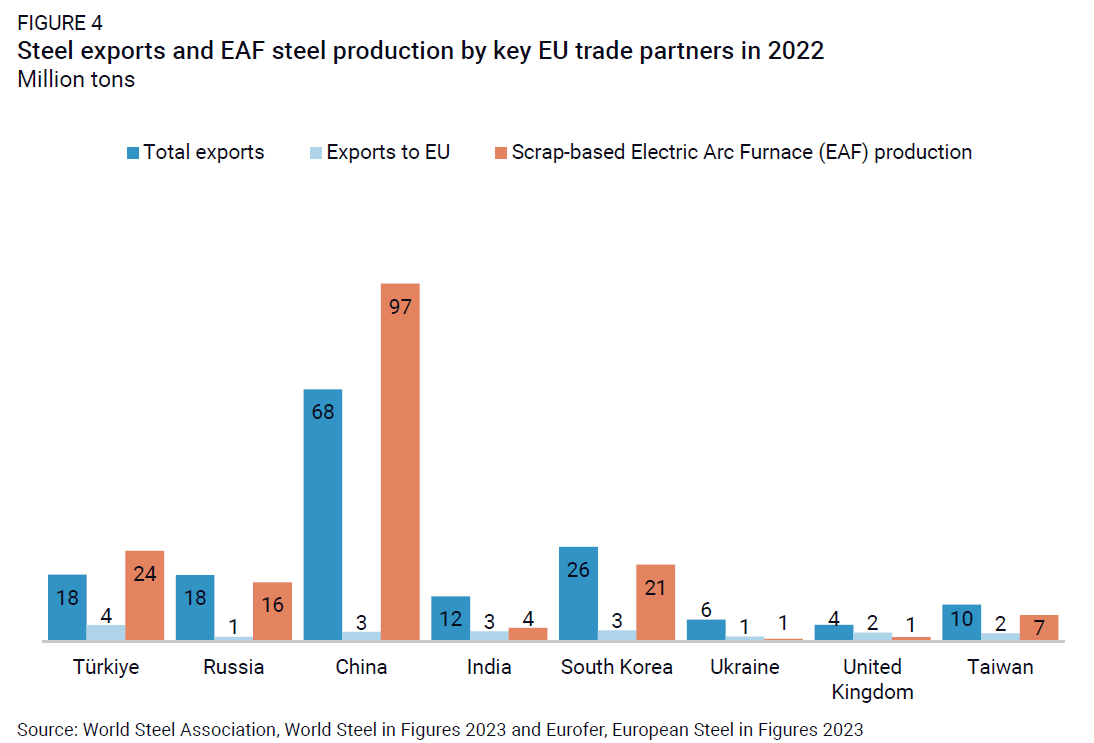

The effectiveness of BCAs in achieving emission reductions can be severely limited if the BCA is not designed to address potential resource shuffling. Resource shuffling occurs when less carbon-intensive products from one country are redirected towards the destination with the highest carbon costs. As a result, no new emissions abatement activity takes place, despite full compliance with the BCA. In the EU CBAM example, exporters to the EU could choose to send the least carbon-intensive products to Europe, while continuing to export the rest to other trade partners. In that case, the net impact of the BCA on global emissions could be null. In the case of steel and the EU CBAM, partner economies could have sufficient electricity-based production capacity to cover their exports to the EU (Figure 4). Within countries, resource shuffling can be mitigated by levying the adjustment based on national average emissions intensity, but that would also blunt firm-level incentives to reduce emissions. Widening the demand pool for clean products with more countries (through several BCAs, clean product standards, climate clubs, or even a multi-national carbon price) would reduce the risk of resource shuffling by simultaneously reducing global demand for “dirtier” products.

However, while international organizations like the IMF have long advocated for alignment on carbon mitigation policies (e.g., a global carbon price), any such discussions have proven impossible in the past. Germany’s proposal for a G7-led climate club is taking shape more as a discussion forum for international partnerships on green steel than an exclusive group of leading climate jurisdictions. The lack of successful outcomes in the US-EU negotiations on the Global Arrangement on Sustainable Steel and Aluminum provides another striking example of how divergent priorities and policy tools between countries can limit the outcome of such international discussions. Without significant momentum behind multilateral approaches to BCAs, these instruments are, therefore, unlikely to deliver significant emission reductions beyond a country’s own border.

Trade policy for global industrial decarbonization

Global industrial emissions are expected to continue to rise, given he current pace of policy developments. The 2023 Rhodium Climate Outlook also shows that the geographical distribution of industrial emissions is likely to shift quite drastically over the next few decades. Whereas OECD countries and China accounted for 59% of global industrial emissions in 2021, this share is expected to drop to 39% by 2050 (Figure 5).

The majority of industrial emissions growth is expected in Africa, Asia, Latin America and the Middle East, and largely reflects economic development for billions of people in today’s emerging economies. Industrial output, and in particular energy-intensive products like cement and steel, are the foundations of a country’s development journey, as necessary materials for the build-out of infrastructure and urbanization. Research, innovation, and deployment of technologies to reduce emissions in industry can therefore not be solely focused on OECD and China, but should also be encouraged and supported in regions experiencing the fastest economic and industrial growth if the world is to achieve the Paris Agreement goals.

While unilateral BCAs can only go so far in incentivizing industrial emission reductions abroad, trade policy, in a wider sense, can still play a crucial role. Trade of clean products has the potential to accelerate innovation and deployment of decarbonization solutions by increasing the size of the market and creating economies of scale. More work is needed, both at the strategic and sectoral levels, to identify how trade and climate policies can work in tandem to accelerate industrial decarbonization while fostering strong economic growth and ensuring widespread societal support for further climate action.

[1] Electricity generation is also in scope, but not in focus for this note on industrial decarbonization.