Note

Fueling a Transition Away from Fossil: The Outlook for Global Fossil Fuel Demand

New insights into the evolution of global fossil fuel demand over the coming decades provide a signpost for where additional action is needed.

Achieving the global climate goals of the Paris Agreement will depend on the successful acceleration of policy and innovation to support the wide-scale deployment of low-carbon cement technologies in the regions that matter the most.

Cement is a cornerstone of infrastructure the world over, utilized in everything from bridges to buildings to roads. The process by which modern cement is manufactured is also emissions-intensive, responsible for 6% of global greenhouse gas (GHG) emissions today. Although cement usage in many developed regions has likely peaked, the industry is expected to undergo massive growth in many developing regions as demand for infrastructure explodes. As we project in the Rhodium Climate Outlook, depending on the pace of economic growth, global cement emissions outside of OECD countries and China are likely (67% probability) to remain persistently high and even double through the end of the century. As a result, between now and 2050, the cumulative emissions from cement will exceed those of all cars on the road today. Unlike road transport however, where deployment of electric vehicles has increased significantly in recent years, there are not yet any mature and cost-competitive solutions for cement decarbonization. Several options are currently under development, however, including carbon capture, hydrogen and electrical kilns, and alternative electrochemical processes. Achieving the global climate goals of the Paris Agreement will depend on the successful acceleration of policy and innovation to support the wide-scale deployment of these low-carbon cement technologies in the regions that matter the most.

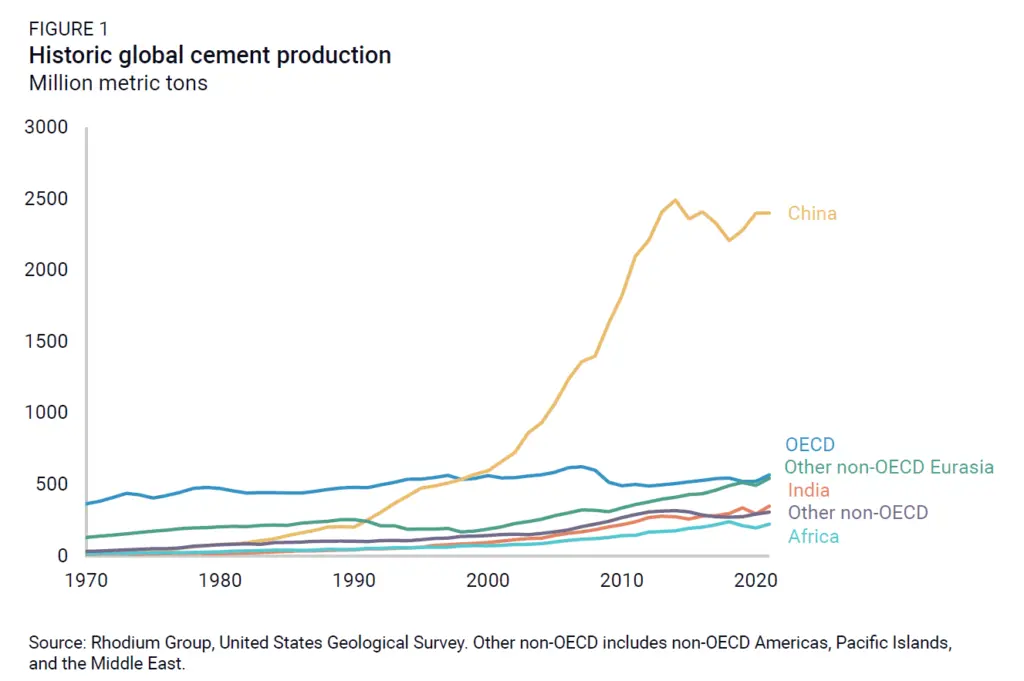

Cement is the most widely used material on the planet after water. Over the past several decades, global cement production has grown exponentially, driven by an over 100-fold increase in China from 1970 to 2020 during a period of rapid growth and urbanization. Over the same period, cement production in the rest of the world grew by about 3.2 times. While OECD countries accounted for the majority of global cement production in 1970 (64%), by 2000 the share fell to 34%, and by 2020 the share was 12% as production there was eclipsed by the growth in cement production in China (Figure 1).

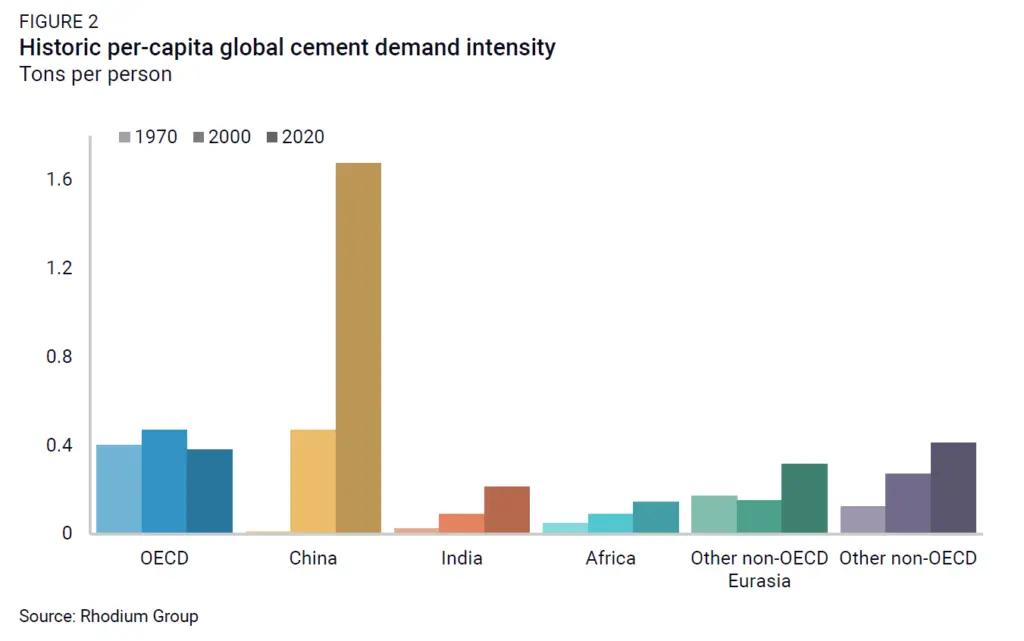

Cement is a core building block for global infrastructure and shelter, and for regions with growing economies and populations, demand is driven by much-needed economic growth. Underpinning both the historical and projected trends in cement demand are shifting regional dynamics in urbanization and economic development. Our analysis of historical data shows that across global economies, cement production per capita initially grows with increasing GDP per capita as a region urbanizes (Figure 2). Following a period of infrastructure expansion and modernization, demand levels off or decreases slowly to levels needed to maintain rather than grow infrastructure, as seen in the relatively steady demand per capita in OECD nations over the past several decades.

Outside of the OECD, per capita demand for cement has been steadily growing over the past 50 years. In China in particular, growth in overall demand was driven by not just an increasing population, but also a large increase in per capita demand to keep up with rapid infrastructure build-out. Despite increasing per capita demand outside of the OECD since 1970, in most of the world per-capita demand remains well under the OECD rate of consumption.

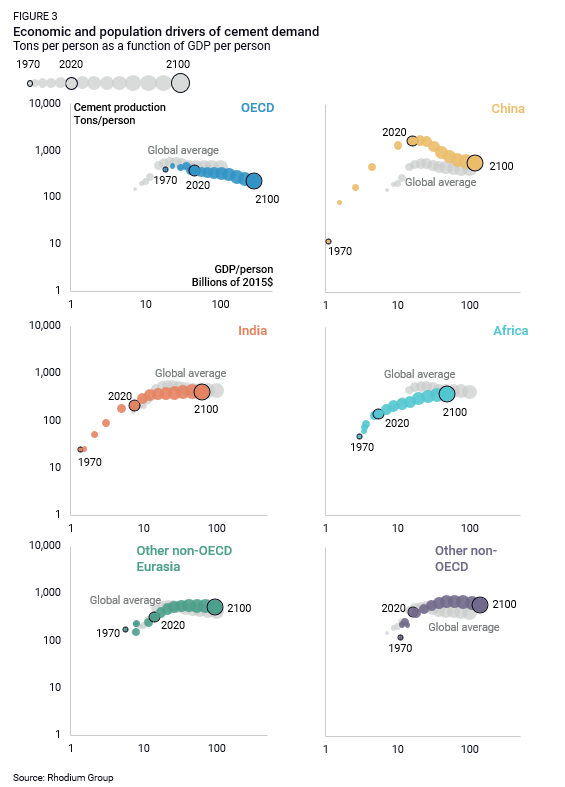

Looking ahead to the coming decades, the upward trend and leveling off of per capita demand is expected to continue. In the Rhodium Climate Outlook—our probabilistic projections of the likely evolution of global energy systems and GHG emissions through the end of the century—we project cement demand under a range of economic growth and population scenarios, resulting in a range of expected demand outcomes and associated emissions. Under the mean population and economic scenario, per capita demand in China, which in 2020 was more than three times the global average, is expected to decline to levels more on par with the rest of the world by the end of the century as urbanization and growth slow. Meanwhile, per capita demand in the OECD declines by nearly 50% and the rest of the world converges towards the global average, as seen in Figure 3.

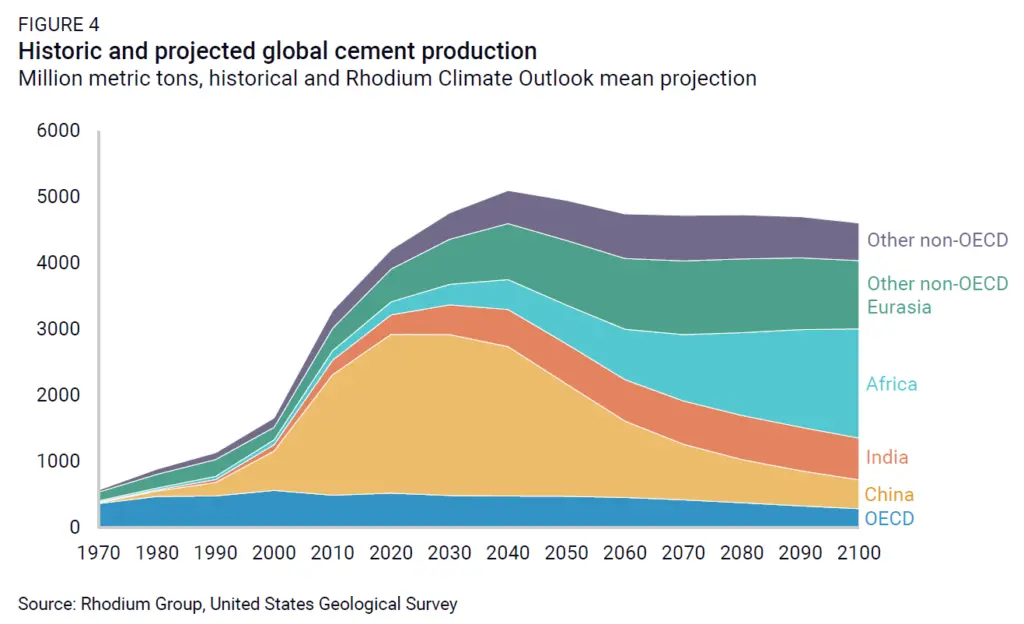

While the magnitude of growth we’ve seen in China remains an anomaly, demand outside China and the OECD is expected to rise from its 30% share of the global total today to reach 56% by 2050 and 84% by 2100. As consumption shifts from today’s industrialized regions to emerging economies, average global demand remains relatively steady through the end of the century, as shown in Figure 4. In African countries in particular, per-capita cement demand never reaches the levels attained in China or the OECD, but by the end of the century the continent becomes the single largest cement producer to keep up with a growing population. In the rest of the world, particularly the Middle East and Asia, rapid urbanization is driving per capita cement demand to levels somewhere between China and OECD countries—and although the projections do not forecast any China-style extreme growth, population growth drives a doubling of overall demand by 2050.

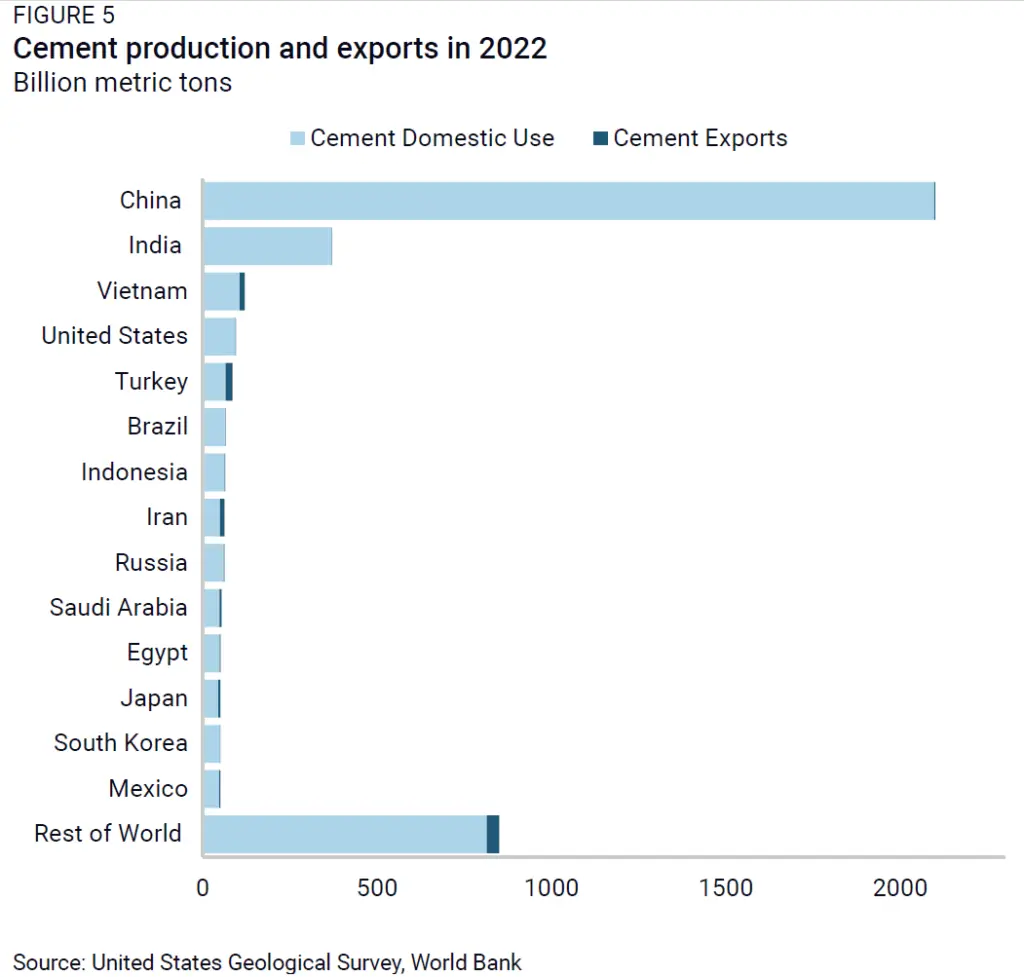

We focus here on demand because nearly all cement production has been used to meet domestic demand and very little cement—only 2.6%—is traded. Three of the world’s top four global cement producers (China, India, and the US) all export less than 1% of total cement production (Figure 5). In 2022, China produced 51% of global cement despite being home to only 17% of the global population, and yet it still exported less than 1% of cement produced domestically. The top cement exporting countries—Turkey and Vietnam—exported only 23% and 12% of total production in 2022, respectively. By comparison, 24% of global steel production was exported in 2021. Given the low export rate of cement, a country’s production is tightly connected to domestic demand, driven by local economic and population growth, reducing the capacity of trade-related measures to drive decarbonization of the sector.

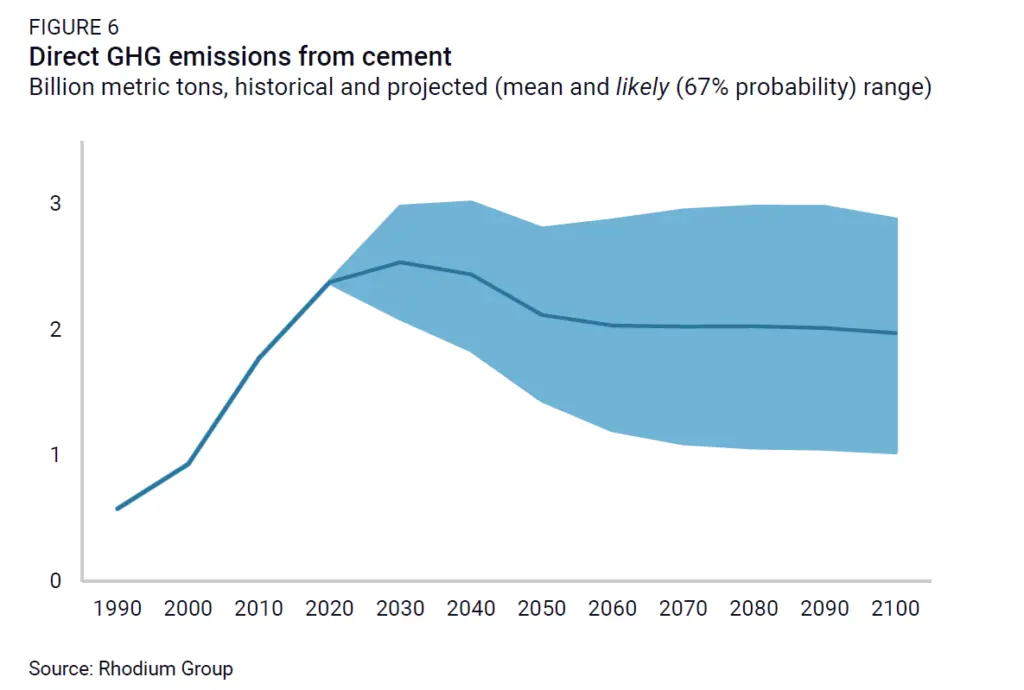

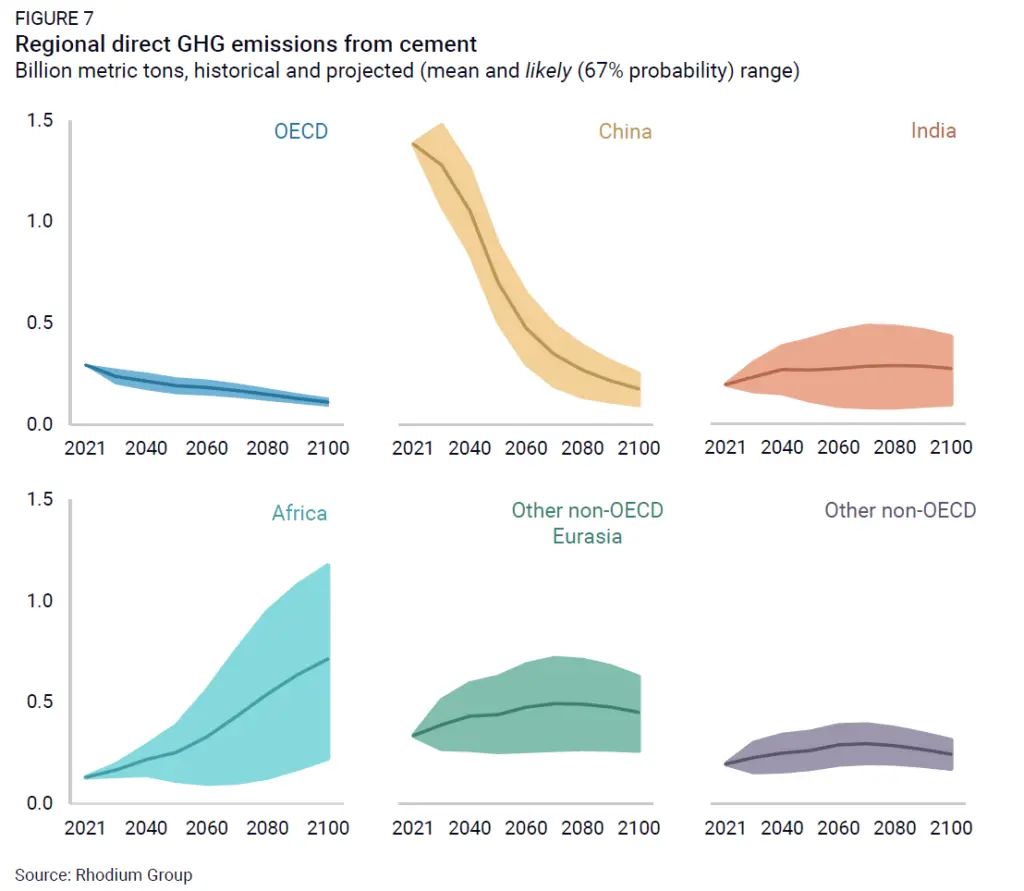

As cement demand has risen exponentially, so has its associated greenhouse gas emissions. Today, cement is responsible for 6% of global GHG emissions. If it were ranked as a country, it would be the world’s fourth-highest emitter, behind only the United States, China, and India. Even without concerted policy and low-cost decarbonization solutions, global cement emissions are on track to peak this decade and then decline somewhat by mid-century as population and economic growth plateaus in China and demand for new infrastructure falls. That is good news, but emissions remain stubbornly high, potentially growing again in the latter half of the century. Based on the Rhodium Climate Outlook, there is considerable uncertainty in the potential range of outcomes for cement production and related emissions over the coming decades. We estimate that direct emissions from cement likely (67% probability) grow up to 17% or decline as much as 39% by 2050 from today’s levels, a wide range given the uncertainty in the outlook for economic growth and population dynamics (Figure 6). In the second half of the century, absent additional investment in innovation and policy for cement decarbonization, we expect cement emissions to remain relatively flat from 2050 levels.

Much of the uncertainty in global cement emissions is driven by economic uncertainty outside of OECD countries and China. Few mature technologies exist to address cement emissions, and as a result while our modeling does capture some modest efficiency gains and clinker substitution across the world, cement emissions are largely driven by changes in demand resulting from economic and population changes.

In OECD nations and China, where a high level of urbanization and development has already occurred and cement demand has peaked, per capita demand looking forward is expected to remain relatively steady, independent of further economic growth. However, in the rest of the world, where cement demand is still well below OECD levels and there is potential for growth with increasing economic output, uncertainty in the exact rate and extent of that growth drives a similar uncertainty in cement emissions.

Cement emissions in Africa in particular are highly uncertain but on an upward trend, likely growing by 1-8 times by the end of the century. This reflects the potential for the continent to either eventually consume like OECD nations, remain largely the same, and anything in between. In the rest of the world, emissions are on track to grow on average, but a similarly wide range of uncertainty encompasses scenarios in which emissions may also remain steady or decline.

Cement is a core building block for global infrastructure and shelter, and for regions with growing economies and populations, growing demand is driven by much-needed economic growth. Scaling new technological solutions beyond OECD countries and China will be crucial for addressing global cement emissions in the decades to come.

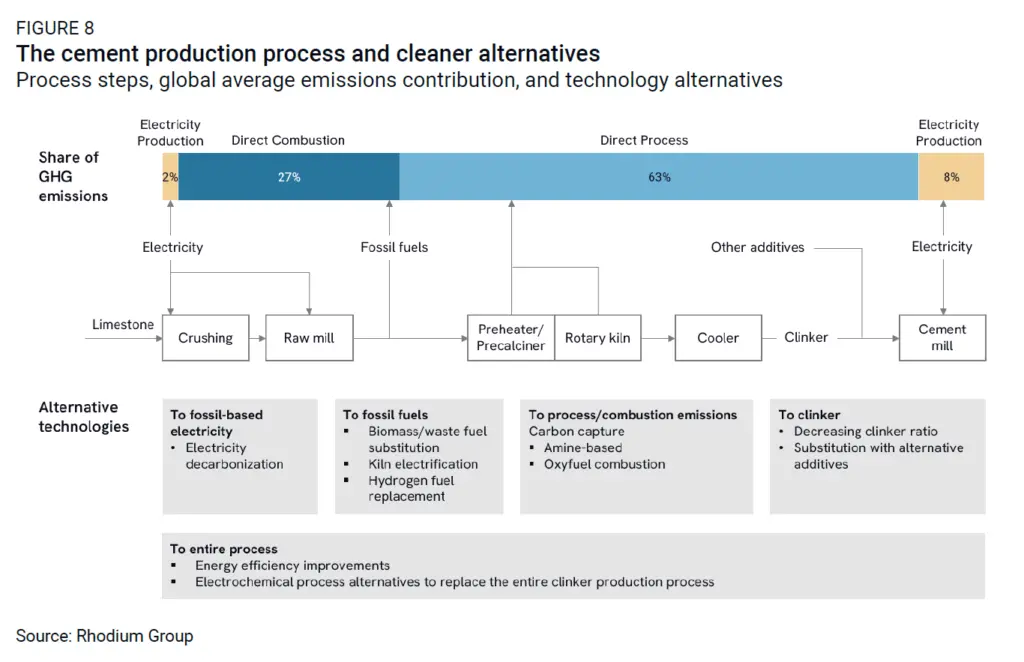

Cement may be one of most widely used substances on Earth, but the formulation and process by which it is made is relatively uniform the world over. Limestone, clay, or other materials containing calcium, silicon, iron and aluminum are quarried, ground up, and fed into a slowly-rotating kiln. Fossil fuels are used to heat the kiln to around 1400°C, and under these conditions calcination occurs, releasing carbon dioxide and converting limestone to lime, which is then free to react with the other compounds in the kiln. The resulting blend of aluminates, silicates and oxides, known as clinker, is then cooled, ground up, and mixed with additional additives.

The exact amount of clinker in a ton of cement varies based on the formulation, but the process by which clinker is produced is key to decarbonization of the industry. Not only does a clinker kiln require large quantities of fossil fuels to combust, but a ton of clinker releases about 520 kg of CO2 from just the calcination process reaction. In addition to these direct process and combustion emissions, cement demand drives indirect emissions from the production of fossil fuels and electricity consumed in the manufacturing process—emissions that are generally outside the purview of individual cement producers and depend on broader decarbonization of the energy system.

To date, most advancements towards decarbonization of cement have involved efficiency gains and tweaks to a process that has remained largely the same for hundreds of years. Globally, about 80% of clinker is produced via a more thermally efficient dry process, as opposed to a wet process in which water is used to mix ground minerals before feeding into the kiln. Some manufacturers swap out traditional fossil fuels for biomass or waste which can combust at equally high temperatures for a smaller emissions footprint.

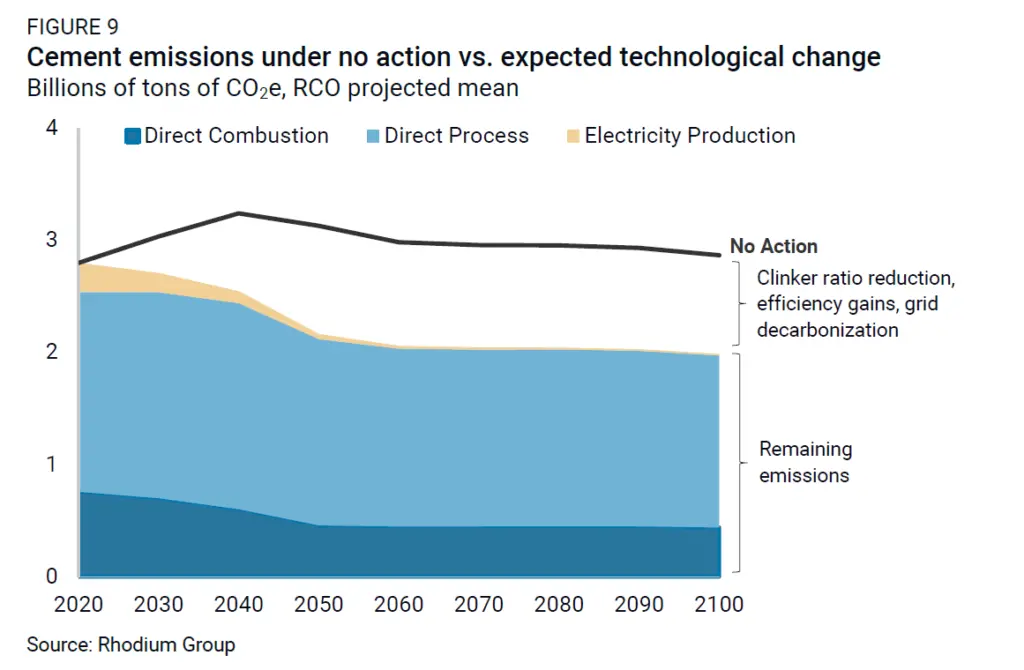

Looking forward, energy efficiency improvements are likely to continue over time, as well as increases in fuel substitution when economic, and when reductions in the ratio of clinker to other less emissions-intensive additives is possible. Widely available materials like calcined clay, fly ash, and natural pozzolans are already part of cement formulation and can be substituted for up to 30-40% of clinker without compromising structural integrity, typically for lower cost. In the Rhodium Climate Outlook, we project the global average clinker ratio is likely to fall from 0.71 today to 0.65 by 2050. These improvements drive a 28% reduction in emissions by 2050 relative to the expected level given no action or change in the industry—in other words, in which energy intensity and clinker fractions remain constant at 2021 levels and no major technological innovations occur (Figure 9).

Closing the remaining emissions gap seen above in Figure 9 will require significant technological innovation and investment, particularly in the clinker production process. A number of options are currently in early research or demonstration stages, but none have yet reached widespread use. The potential benefits and drawbacks of new technologies depend on several factors, among them geographic conditions, availability of alternative fuels, and grid decarbonization.

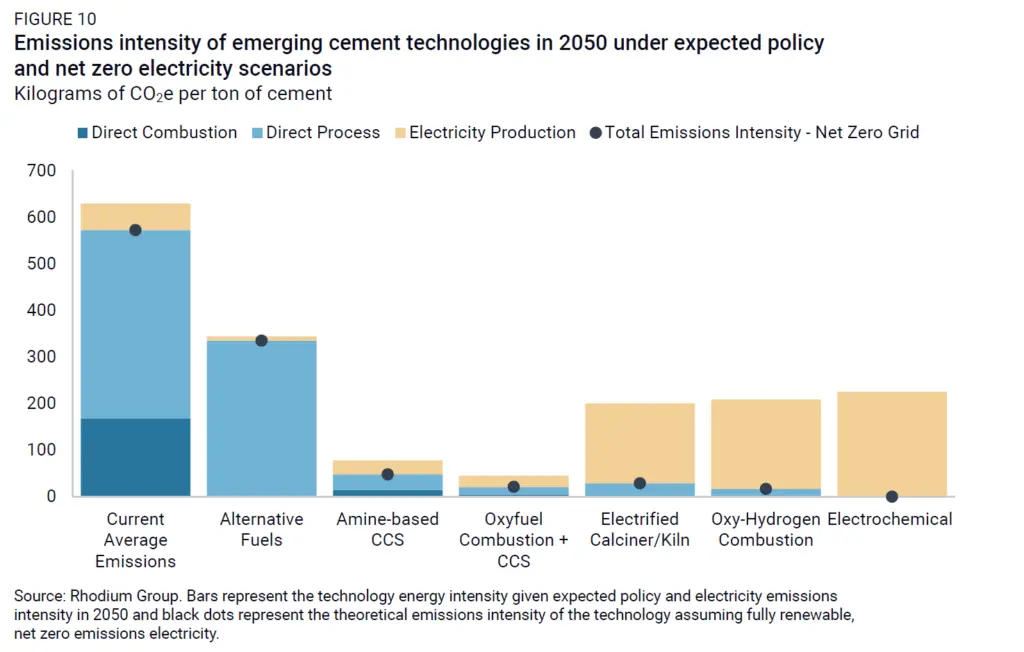

Using energy system outcomes from the Rhodium Climate Outlook and energy intensities reported from technology demonstration projects, we project the global average emissions intensity of emerging cement technologies in 2050 (Figure 10). These intensities reflect expected improvements in clinker ratios and grinding efficiency, as well as projected changes in global sources of cement demand. They also include expected emissions given the likely evolution of policy and power sector decarbonization. The latter is critical for the many solutions that rely on electrification or electrolytic fuels. As we describe in our recent report on a the outlook for global fossil fuel demand, fossil-power electricity continues to play a substantial role in balancing intermittent renewables and providing bulk power through 2100 in our global projections, absent any major shifts in policy or technology innovation.

We walk through the different emerging cement technologies below. Our analysis shows that among technology options currently under development, carbon capture (amine-based CCS and oxyfuel combustion + CCS) likely provides the most immediate benefit. However, electrochemical processes can attain the lowest theoretical emissions intensity under a full grid decarbonization scenario (Figure 10).

Amine-based CCS (carbon capture and storage): Amine-based capture is the most mature option and has been in use in the oil and gas and power sectors for decades. The world’s first commercial-scale cement carbon capture project is scheduled to come online as a retrofit on the existing Heidelberg Cement plant in Brevik, Norway in 2024, utilizing amine solvents for post-combustion capture. Trials at the Brevik plant suggest amine solvents can achieve capture rates of around 90%. However, amine capture is very energy intensive and does not eliminate the 10% of residual uncaptured emissions.

Oxyfuel combustion + CCS: Alternatively, oxyfuel CCS, in which combustion occurs in an oxygen-rich environment to produce a flue gas stream with high CO2 purity, can achieve higher capture rates of 90-99% and is less energy intensive. Given expected levels of power sector decarbonization, it achieves the greatest emission reductions of all technologies analyzed. However, it requires greater adaptation of the overall kiln process, has higher electricity requirements and overall costs, and has only gained traction in recent years, having been demonstrated in pilot plants but not yet at commercial scale.

Electrified calciner/kiln: Kiln and calciner electrification is a substitute for the fossil-based process, utilizing resistive heating and plasma. The lack of combustion results in a pure CO2 stream of process-only emissions which can be compressed and stored, simplifying the capture process. With net zero electricity, this process could reduce overall emissions further than carbon capture alone. However, given high energy intensity, electrification would result in overall emissions 2-3 times higher than capture on fossil-based combustion in the absence of additional decarbonization of the power sector.

Oxy-hydrogen combustion: Demonstrations of hydrogen as a substitute for fossils have been achieved at the pilot scale by Heidelberg Cement, and a portion of natural gas can be replaced with hydrogen without any significant plant modifications. Kiln firing solely with hydrogen is theoretically possible, but would require fully decarbonized power and efficient electrolyzers as a hydrogen source in order to achieve significant decarbonization.

Electrochemical processes: Novel electrochemical processes such as those pioneered by Sublime Cement provide a complete alternative to traditional cement-making processes. These are the only options that can eliminate process emissions entirely by moving away from reliance on the traditional calcination reaction, and may use waste or other materials besides limestone as a process input. Further, they are the only technology option that can achieve true net-zero emissions and may be particularly useful in geographies far from carbon storage opportunities. However, the development of these processes is in its early stages and relies on large quantities of electricity, which increases upstream emissions absent significant grid decarbonization.

While clinker substitution and efficiency gains can be economically advantageous and are expected to deploy on their own merits, most emerging cement technologies are very nascent. Without policy support or purposeful private sector investment, there is little incentive for deployment. Carbon capture adds complexity and cost while providing no efficiency or other advantages to the existing process. New processes based on electricity or hydrogen require high capital investments, fuels that are typically significantly more expensive than traditional fossils, and access to cheap and reliable clean power.

Government procurement and private investment and procurement can provide crucial support to early-stage technologies and eventually drive technologies down the cost curve. Policies like the 45Q tax credit in the United States help offset the added cost of carbon capture, and with cheap and widely available clean power, electrified cement processes could eventually become economic on their own. Without additional support for cheap renewables—and zero-emitting dispatchable power to balance them—many potential cement technologies would have limited impact on overall emissions, especially in developing economies where most cement production is expected to occur over the coming decades.

Due to the low-trade nature of cement, there is little potential for trade-related measures in OECD economies to directly force decarbonization of cement in other regions. Instead, policies which promote reductions in the cost of low-carbon cement technologies and make such gains readily available to the entire world—in particular emerging economies experiencing growing urbanization—will be crucial for addressing the major sources of cement emissions in the future.

Note

New insights into the evolution of global fossil fuel demand over the coming decades provide a signpost for where additional action is needed.

Report

We provide probabilistic projections of the likely evolution of global emissions and temperature rise through the end of the century.