Rethinking China’s Economic Future

China’s economy is clearly contracting sharply under the weight of “zero COVID” policies, even though Q1 GDP growth beat expectations and April data showed only a modest decline in industrial output.

China’s economy is clearly contracting sharply under the weight of “zero COVID” policies, even though Q1 GDP growth beat expectations and April data showed only a modest decline in industrial output. Consensus expectations have not fully factored in the degree to which China’s economy is weakening this year, or the probability that slower growth will extend into future years. As the gap between this economic reality and rosier expectations closes in the months ahead, we are likely to see significant downgrades to consensus views on global inflation, commodity demand, future carbon emissions, and both direct and portfolio investments in China.

The Direction of Travel is Clear

The events of the past few months in China’s economy have been difficult to comprehend, even for experienced analysts. The years that are supposed to be politically “stable” in China—the Olympic year of 2008, the political transition of 2012, this year—always carry some turbulence, but 2022 represents a watershed in questioning long-held perceptions of China’s technocratic competence and capacity. We are seeing China’s leadership abandon long-term economic and political objectives for transitory, politically motivated gains against an indefatigable foe—the Omicron variant of COVID-19. More than the futility of the exercise, it is the inflexible commitment to sustaining the attempt, despite its dramatic consequences, that is generating a new wave of concerns about China’s economic future, and its position within the global economy. Financial markets have reacted accordingly, selling Chinese assets in large volumes, while corporates reassess the importance of China within their global strategies.

Today, even Premier Li Keqiang was forced to observe that economic “difficulties in some aspects and to a certain extent are greater” than in the epidemic’s first phase in 2020, while urging cadres to keep economic growth in positive territory in Q2. The recent data releases—both official and unofficial—unequivocally point to a contracting economy, possibly by larger margins than in Q1 2020, when GDP contracted by 10.3% q/q within the official data. Goldman Sachs just revised their own expectations of Q2 q/q growth to -7.5% annualized; UBS and JP Morgan made similar adjustments on Tuesday. It goes without saying that China’s 5.5% real GDP growth target this year is impossible to meet—in fact, we doubt we will hear Chinese officials mention the target for the remainder of the year. Our views on China’s growth rate in 2022 are clear—we are headed for very low growth this year, at the most 2% if there is a dramatic rebound in the second half, and a recession or economic contraction for the full year is becoming increasingly probable.

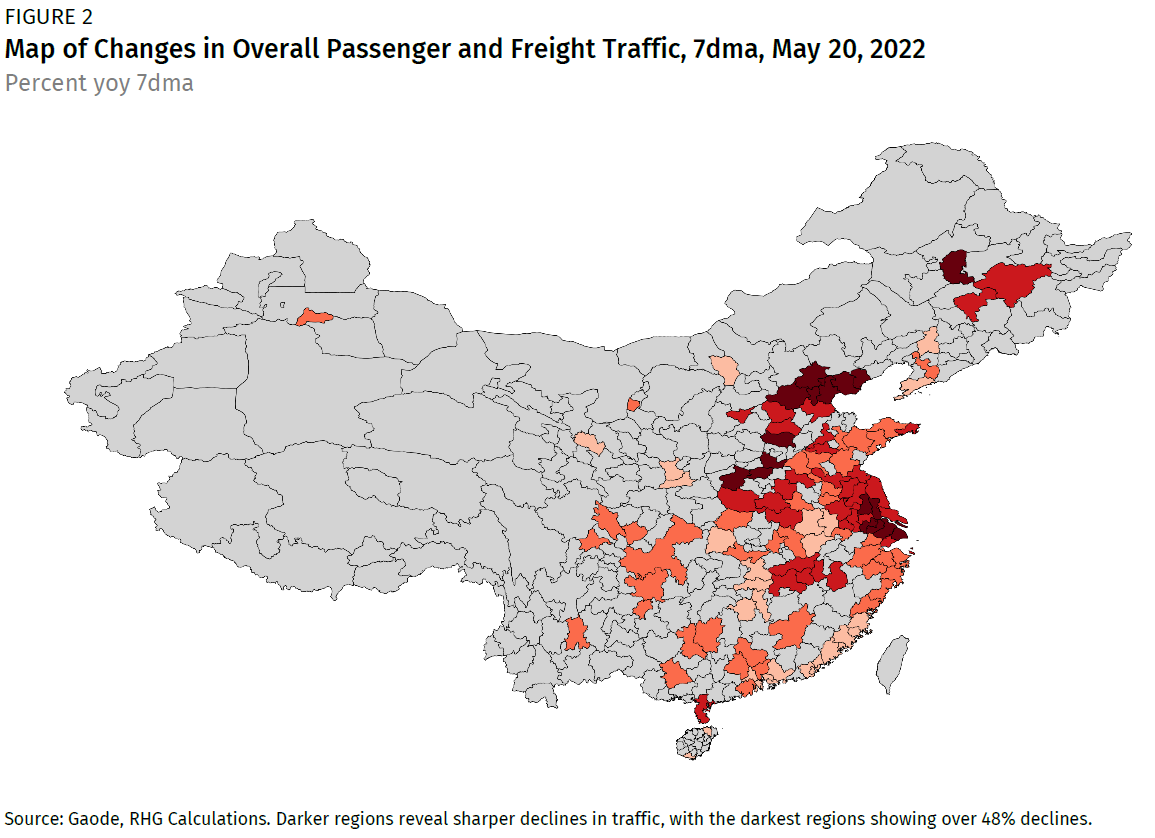

Freight and passenger traffic volumes nationwide have fallen by around 39 percent y/y in China in May as a result of lockdowns and COVID restrictions, based on Gaode data. Official industrial value-added fell by 2.9% in April, and will likely decline by similar margins in May. Property sales officially fell by 39% y/y in April, car sales declined by 47.6%, and excavator sales fell by 61%. Consumption is falling sharply as a result of COVID restrictions, with headline retail sales down 11.1% in April and even online sales from Alibaba’s Taobao and Tmall (undoubtedly hurt by delivery problems) are down 25.6% y/y. These are not small declines—they reflect a massive disruption to the regular operations of China’s economy, and they have continued in May from the declines in April.

Nor is there much evidence that policy support is starting to right the ship. China’s policy support has emphasized infrastructure construction, but this activity is being limited by lockdowns and restrictions just like other sectors. The evidence can be seen in continued drops in production for raw inputs: asphalt output has declined 33.6% so far this year, cement production fell by 18.9% in April, and capacity utilization rates for unsaturated polyester resin (UPR), a key polymer in building materials, are down 42% in April and 65% so far in May.

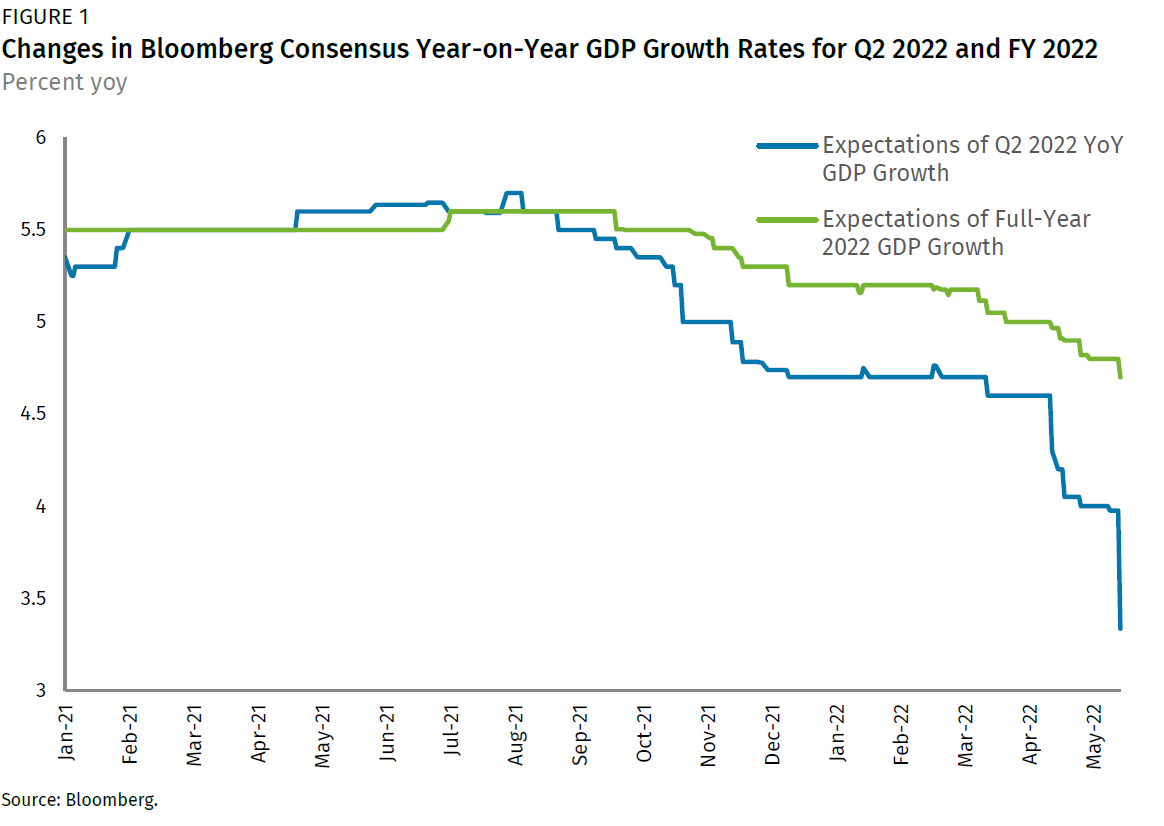

Yet despite this economic carnage, forecasts of China’s growth in 2022, and beyond, have barely adjusted. After the release of Q1 GDP data, which put growth at 4.8% (well above the consensus view of 4.4%), analysts counterintuitively rushed to downgrade their full-year forecasts. The current Bloomberg consensus forecast (Figure 1), even after the release of the April data pointing to an economic contraction and some of the recent downgrades already discussed, is for a 0.2% q/q growth rate in Q2, still in positive territory, and for 4.7% GDP growth for the full year. The forecast for y/y growth in Q2 is 3.3%, only a moderate slowdown from 4.8% growth in Q1.

There are some reasonable arguments why growth might only slow modestly, particularly if China abandons its COVID restrictions altogether and provides significant cuts in interest rates and stimulus to the property sector. But this path seems highly unlikely. Restrictions are more likely to lift gradually and in response to local government subterfuge rather than central government diktat. The property sector is going to remain a significant drag on investment growth this year, and recent zero COVID measures have added to the sector’s woes. It is difficult to understand what sector will actually grow at all this year, given the dramatic disruptions that zero COVID policies have created for the economy.

The direction of travel is clear, even if the magnitude of adjustment is not. Companies, investors, and governments should be thinking about far slower Chinese economic growth, both in 2022 and in the future. Consensus expectations have not yet adjusted meaningfully—in part because of China’s excessively rosy economic data—but they will.

Telling the Truth is Dangerous

We described all of the pressures created by Beijing’s political reliance upon high and stable GDP growth rates in our 2019 note, “China’s GDP: The Costs of Omerta”. The code of silence among most sell-side institutions and global policymakers regarding the quality of China’s GDP data has consistently created false assumptions about China’s growth and the potential for policy mistakes in response to mistaken economic signals. The costs of refusing to engage with economic reality are rising because even onshore market analysts are reluctant to publish any bad news or negative forecasts. The key point is that consensus expectations as we are now seeing them—0.2% q/q growth in Q2, 4.7% full-year growth (according to Bloomberg’s survey)—are still wildly unrealistic, a fact that is acknowledged but unstated publicly by most forecasters. And when those expectations adjust, the scale of the downgrades to China’s expected growth could be large.

The reality of China’s economic distress has been clearly revealed in onshore and offshore equity markets, which have fallen to the lowest levels since the start of the pandemic. Naturally, this has generated considerable risk aversion within China’s financial markets. But actually talking about the woes of the equity market and the state of the economy has caused several mainland investors and commentators to seemingly have their social media access restricted in response, and some may have actually lost their jobs. In this climate, we should not expect significant downgrades of growth expectations from any analyst servicing mainland clients.

Even sell-side firms have been cautious. There is always pressure to remain within consensus, and an awareness that consensus on Chinese growth will remain heavily dependent upon Beijing’s official GDP growth target, unrealistic as it may be. Hence, even those that are downgrading Q2 GDP growth aggressively are seemingly cautious about how that will implicate full-year 2022 GDP growth rates, which may explain the more limited adjustments to full-year forecasts. If one assumes Beijing will continue to publish stable growth rates regardless of how the real economy performs, it makes little sense to go out on a limb with a sharp downgrade of GDP growth forecasts.

The Long-Term Constraints on China’s Growth

More problematic for Beijing is the fact that even after lockdowns ease, the economy is unlikely to spring back to the rates of growth seen before the pandemic. Lockdowns and restrictions on movement of citizens generate immediate economic costs—to production, consumption, services sector activity, employment, incomes, and in other areas as well. But even before the wave of new lockdowns was imposed, China’s economy was suffering considerably from the weakening property industry, a sector that represents around 25% of GDP.

Every cyclical recovery in China’s recent history has been led by either the property sector or local government spending. Beijing is trying to prop up infrastructure investment right now, but these efforts are useless as long as lockdowns and restrictions remain in place, preventing construction projects from launching. Credit growth to drive new investment is slowing, rather than accelerating, driving the PBOC this week to issue yet another set of instructions for banks to boost lending. And even if infrastructure investment picks up, this will only put a floor under activity, as it cannot compensate for the weakness in the property sector.

Over a longer horizon, China’s growth outlook is constrained by demographics, falling productivity, and more significantly, the failed structural reforms of the past decade. Our China Practice head Dan Rosen highlighted these dynamics in much more detail in a recent piece in Foreign Affairs. China’s potential growth rate at present is probably closer to 3% than 5%, and China is currently growing well below that potential rate. With the property market and the financial system in distress, it may take several years to close that output gap, even if policy is more supportive. Yet the current consensus expectations for GDP growth are 5.2% in 2023 and 5.1% in 2024.

There is a reasonable argument that economic conditions will improve due to a boom in pent-up demand in the months ahead, with April and May representing the worst months of lockdown-induced stress. High-frequency indicators of passenger and freight traffic are showing some modest improvements in late May, and the mere fact of passing the worst moment may even be sufficient to drive a rally in China-linked risk assets. But the uncertainty about the future, and the potential for additional lockdowns, are likely to keep a ceiling on any rebound in new investment by foreign firms or Chinese private sector firms. These types of disruptions to supply chains will take months to resolve, and the longer-term impact of lockdowns on employment, incomes, and consumption is likely to persist as well.

The Stakes: Implications of Downgrading China’s Economic Future

Once consensus expectations for China’s medium-term growth adjust meaningfully, this will have significant implications for several important global economic trends.

Commodity demand. One of the obvious transmission channels from slower growth in China into the global economy will be weaker demand—and probably lower long-term prices—for imported commodities, particularly those associated with construction activity, including iron ore, copper, aluminum and other base metals, and some refined petroleum products. The direct impact on China’s crude oil demand will probably only emerge over time, tied to overall trends in China’s energy consumption, since China also re-exports significant volumes of its refined product output. There can be some offsets to weaker demand and changes in development plans for individual commodities, and in some cases, lower commodity prices can actually incentivize lower-cost imports relative to higher-cost domestic production in China. But the probable implication of much slower growth will be a downgrade of China’s commodity imports in the coming years.

Global inflationary pressures. In the short-term, disruptions to China’s supply chains and outbound shipments are inflationary, as scarcities of key components will dominate. After that, in around six to nine months, rising corporate inventories of finished goods may create downward pressure on prices. As companies struggle to sell into flagging domestic markets, they may look to sell overseas, at lower prices (factoring in the recent weakness of China’s currency).

These lower Chinese import prices may not have much of a direct impact on global inflation in the short term, particularly given all of the other inflationary forces and geopolitical factors driving prices higher. But the reassessment of China’s growth and downgrades from this year’s expectations of 4.7% have probably not yet been incorporated into global inflation and growth forecasts. If central banks underestimate the disinflationary pressures coming from a slower-growing China, expectations of the monetary tightening and interest rate hikes that are necessary should moderate.

Similar surprises have happened before. In 2014 and 2015, when China’s economy disappointed due to a flagging property sector while headline GDP growth remained stable at rates above 7%, emerging market central banks suddenly became far more dovish than expected. This was because the Chinese economy produced disinflationary surprises that spilled over into other markets even though headline growth in China was unchanged. The effect was pronounced in commodity prices (Bank Indonesia’s turnabout from hiking rates in November 2014 to cutting them in February 2015 is just one example). As expectations of China’s growth adjust, the same effect is plausible on a global scale, and central banks may look toward less severe tightening paths relative to current expectations.

Carbon emissions. Hundreds of billions of dollars are being invested now for a future of low-carbon energy production, requiring planning for mining of critical metals and raw materials. But all of these investments are likely based on current expectations of China’s own growth in energy demand and carbon emissions, which may simply fail to materialize. A change in the economic trajectory of the world’s largest emitter—at an estimated 14.1 billion tons CO2 equivalent in 2019—is bound to have an impact on global emissions projections. China’s industrial output has been heavily leveraged to property construction, and that sector alone is likely to see construction activity cut in half or more over the next decade.

But China’s own growth targets are set politically, and are likely to be disconnected from actual emissions levels on the ground. This can lead to significant policy mistakes around China’s energy mix as well, as the most important signals to China’s energy bureaucracy this year have been to avoid power disruptions such as those seen in September and October 2021. This has required China to double down on coal output, even though there are likely to be far smaller chances of a power shortage during a year in which China’s economy is slowing so significantly. But overall, slower Chinese GDP growth in the years ahead is almost certain to alter the medium-term trajectory of global carbon emissions as well.

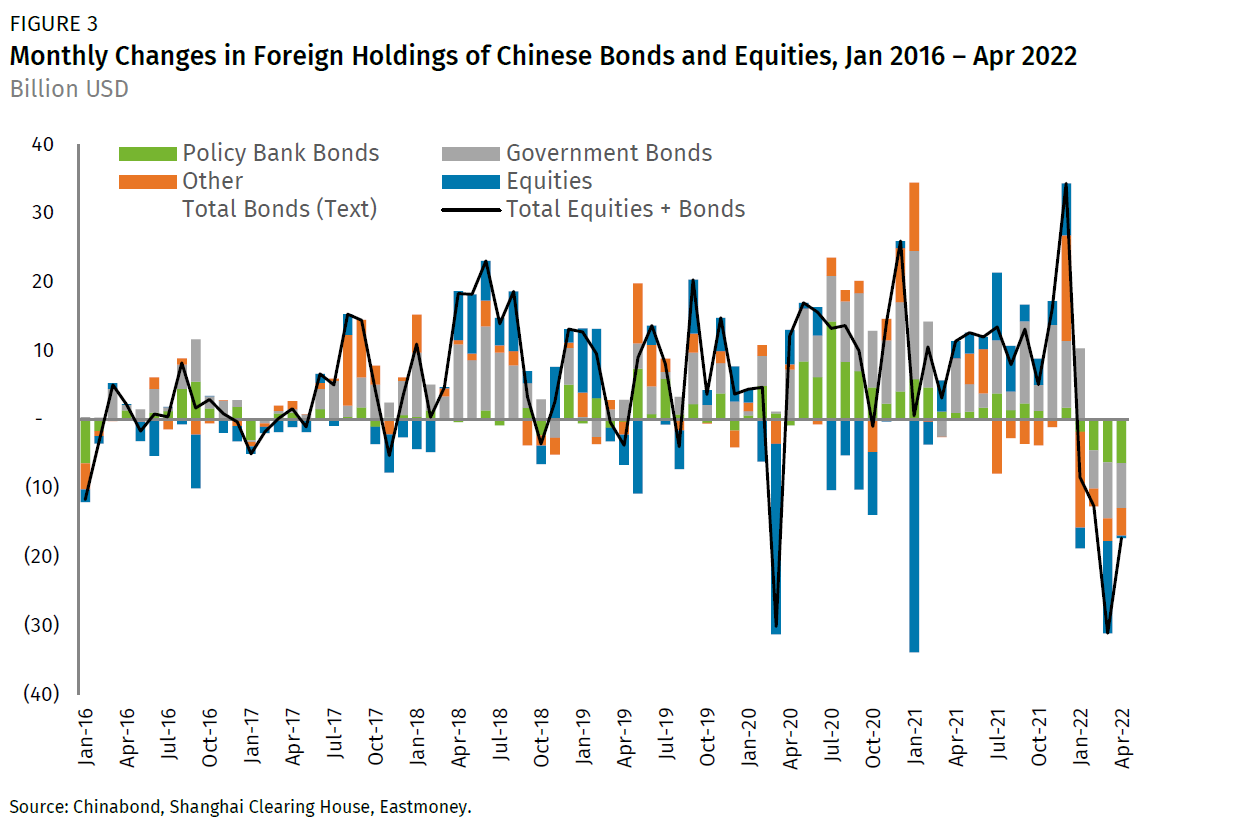

Portfolio investments. Global investment portfolios have been dramatically underweight Chinese equities and bonds for years—and for good reason, because China’s financial markets had not undertaken sufficient reforms to provide confidence that investors could generate returns and reallocate funds out of China when they chose to do so. During the pandemic, portfolio investments into Chinese markets increased dramatically (Figure 3), as China appeared more stable than the rest of the world, investor-friendly reforms continued to advance incrementally, Chinese yields rose far higher than those in developed markets, and more global equity and bond indices started to include Chinese securities, providing investors more confidence in inbound portfolio investments.

The future of China’s position within the global financial system is now far less certain than at any point in the last two decades. Capital outflows have been building throughout the past four months, not only because of weaker Chinese growth, but because of newfound political risks attached to investments in Chinese securities, including China’s political alignment with Russia and Beijing’s zero-COVID crusade. Damage to China’s policy credibility is not easily repaired, and can severely weaken long-term portfolio inflows, along with the prospects of China playing a more important role within the global financial system.

Every time China has faced similar challenges maintaining investors’ attention, there have been concerted efforts from technocrats to reach out to the financial sector and signal some restart of reforms and opening—the 2020 liberalizations on foreign equity restrictions in key financial market segments are just one example. A renewed emphasis on stability in market regulations and relaxations of capital controls may help to stabilize medium-term passive bond market inflows in the coming years, as Chinese yields are likely to decline in the medium-term if growth slows.

Foreign direct investment. US foreign investment in China has averaged about $13 billion over the past decade, while investment from the EU-27 and United Kingdom has averaged roughly $9 billion over the period. Much of this investment was predicated on expectations of long-term growth in Chinese domestic demand. This is now in question. An April survey by the European Chamber of Commerce in China found that 23% of surveyed European companies, the highest share in the past decade, are considering shifting current or planned investments in China to other markets. A significant downgrade of China’s growth expectations could accelerate the debate over diversifying supply chains, particularly as the risk premium in China grows.

There are other consequences to slower Chinese growth which merit discussion. What is clear, however, is that expectations for a 4.7% expansion of China’s economy this year are untenable, and will need to be adjusted soon given the disruptions to the economy caused by the property market downturn and zero COVID policies. The direction of the adjustment is clear—the only questions are how much growth needs to be downgraded and how long the weakness will persist. If the credibility of Chinese data and policy responses suffers in this process, the rerating of growth prospects will become deeper. Beijing will struggle to maintain its narrative of economic stability as these unprecedented pressures grow.