Unpacking the Technology and Policy Landscape for Transportation Decarbonization

Decarbonization in the transportation sector faces three key barriers: cost, namely a “green premium,” a slow pace of stock turnover, and limits on the availability of feedstocks and fuels.

Transport has been the largest-emitting sector in the US economy since the mid-2010s and is responsible for around a third of annual greenhouse gas (GHG) emissions. Any credible pathway to deep decarbonization for the US involves reducing the sector’s emissions to or near zero. The transport sector is diverse, including passenger vehicles, freight trucks, aircraft, ships, trains, and a range of other sources of emissions. Similarly diverse are the potential technological solutions to decarbonizing the sector: electrification, low-carbon fuels, increased efficiency, and reductions in service demand. Despite these promising options and early evidence of success in driving decarbonization in key parts of the sector, three key barriers remain: cost, namely a “green premium,” a slow pace of stock turnover, and limits on the availability of feedstocks and fuels.

Overcoming these barriers requires a well-designed, comprehensive policy approach. Federal tax credits and regulations have a history of driving the uptake of clean transportation technologies and must be sustained, but looking beyond the current toolkit will also be required. Policies like a national low-carbon fuel standard can provide a long-term market signal for deep decarbonization to market actors while building in compliance flexibilities to ease the transition. Strategies to secure the availability of critical minerals can also serve as useful complements to help drive emission reductions in parts of the sector largely overlooked today.

Decarbonizing transportation is key to a net-zero economy

Every year, Rhodium Group estimates a range of future emissions outcomes for the US based on expectations for macroeconomic growth, the price of fossil fuels, cost and performance trends for clean technologies, and current federal and state policies on the books. In our most recent edition, Taking Stock 2024, we found that the US could be on track to cut emissions by 32-43% below 2005 levels in 2030—a meaningful reduction but not enough to achieve the country’s Paris Agreement climate commitment of a 50-52% reduction below 2005 by 2030. The outlook for climate policy at the federal level has changed since we published that report back in July: A second Trump presidency and unified Republican control of both houses of Congress will likely yield backtracking on at least some of the policies implemented during the last four years.

Despite this uncertainty, it’s still useful to consider where the US might be on the pathway to decarbonization by the end of this decade. The power sector leads with the biggest cuts in emissions in 2030 as commercial technologies quickly push fossil fuels out of the fuel mix, which could slash emissions by 26-43% over 2023 levels over this decade (Figure 1). We’ve seen a surge in deployment of clean technologies on the grid over the past few years, with wind, solar, and battery installations breaking new capacity records in the early 2020s.

In contrast, the transport sector—already the largest source of emissions in the US since the middle of the last decade—lags. In 2030, emissions from transportation are only projected to drop by 12-21% over 2023 levels. The transport sector remains the highest-emitting sector, increasing from 33% of all emissions in 2023 to 36-39% in 2030.

It will be impossible for the US to meet midcentury net-zero aspirations without getting transportation-related emissions down to or near zero over the next 25 years. In this note, we begin to outline how to get there. First, we identify remaining transportation emissions in 2030 under current policy, helping to target where additional policy and technology interventions will be needed. We then explore the types of decarbonization solutions available to address these remaining emissions and the challenges they face. Deploying these decarbonization solutions at scale and overcoming those barriers will require the enactment of robust policy support, which we consider in the final part of this note.

Where will transport emissions come from in 2030?

The US transport sector contains a diverse range of sources of GHG emissions, including light-duty vehicles (LDVs), freight trucks, aircraft, ships, boats, rail, buses, and oil and gas pipelines. LDVs—personal cars and light trucks weighing less than 8,500 pounds—currently comprise the largest source of sector emissions, responsible for 54% of total emissions (Figure 2). Despite meaningful growth in the number of electric vehicles (EVs) on the road by 2030 and a reduction in absolute emissions levels, we expect LDVs to remain the largest source of emissions in the transport sector in 2030.

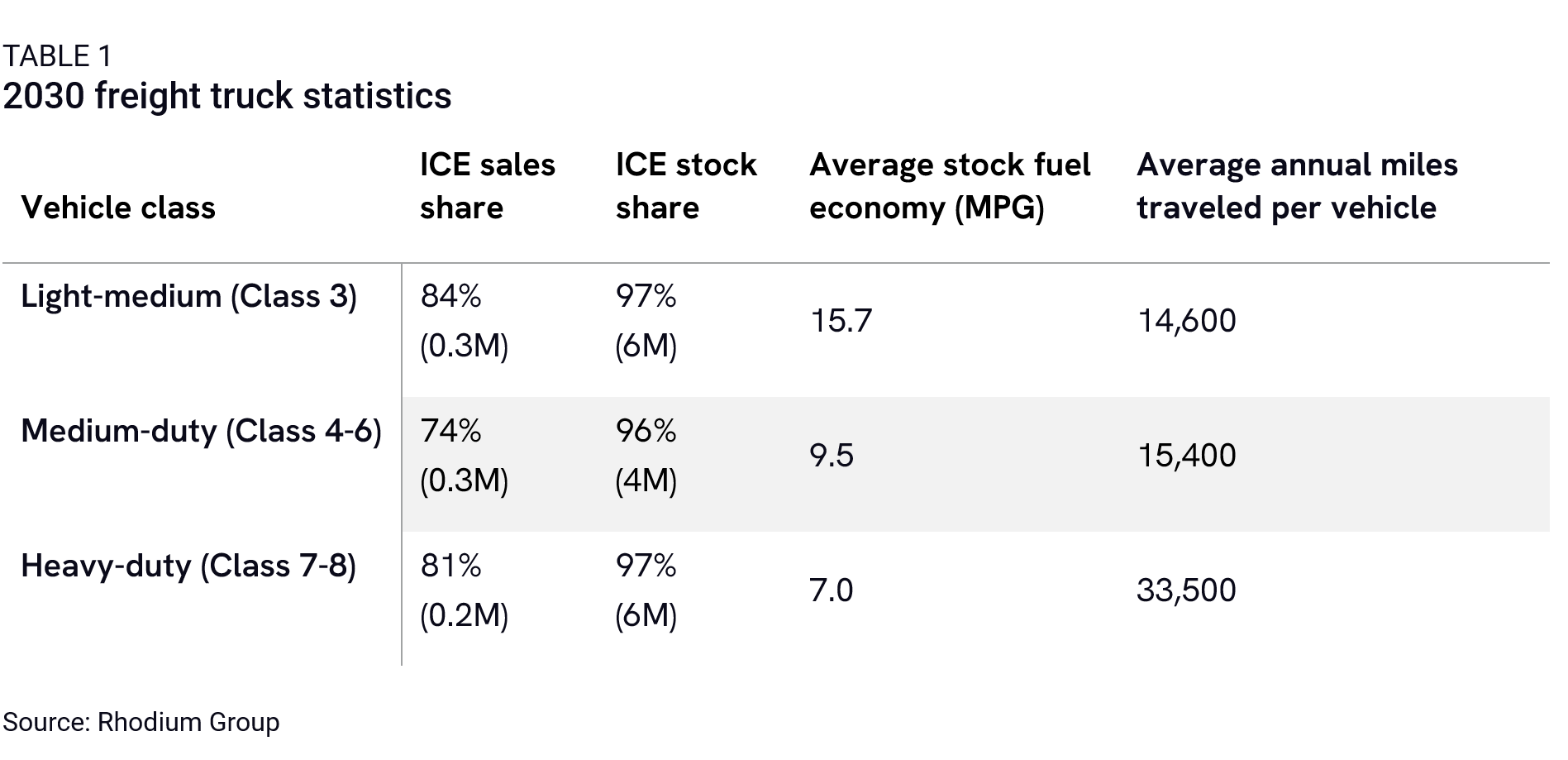

Medium- and heavy-duty vehicles, which we collectively simplify to “freight trucks,” have a gross vehicle weight of more than 10,000 pounds. The freight truck category includes a range of vehicles critical to the economy’s operation—such as box trucks and delivery trucks predominantly powered by internal combustion engines (ICE)—and ranks second in emissions. Freight trucks account for 24% of GHG emissions today despite representing only about 5% of the total vehicles on the road. Heavy-duty vehicles (HDVs) are, on average, driven twice as much as light-medium and medium-duty vehicles (MDVs) because they are primarily used for long-haul transport services (Table 1). Like LDVs, absolute emissions for freight trucks will decline by 2030 but represent a slightly larger share (25-26%) of future transport sector emissions.

Together, LDVs and freight trucks are responsible for nearly 80% of transportation emissions. Because we project their combined contributions will drop by only three percentage points by 2030, any efforts to cut transport emissions down to or near zero by 2050 must continue to target these sources.

Domestic aviation, including commercial, personal, and military aircraft, is responsible for just 8% of today’s transport sector emissions but expected to increase to 10-11% in 2030. Demand for passenger and freight air travel increases at much higher rates than the projected improvements in average aircraft efficiency, measured in fuel use per mile traveled, between now and 2030 (Figure 3). The GHG impacts of air transport will become increasingly pronounced if travel demand growth continues to outpace efficiency.

The share of emissions from rail, shipping, buses, and pipelines remains consistent through 2030, pointing to a lack of progress on decarbonizing in these parts of the transport sector.

Solutions to address remaining emissions

Given the size and diversity of the transport sector, a range of solutions will be needed to cut fossil fuel consumption and the resulting GHG emissions. This section focuses on three main technological approaches to transportation decarbonization: electrification, low-carbon fuels, and efficiency improvements. We also briefly touch on transportation demand management as a complementary approach to these technological solutions.

In the transport sector, electrification refers to replacing fossil fuels (e.g., gasoline, diesel) with electricity and batteries. If the electricity used to charge the batteries is produced from renewables or other non-CO2-emitting sources, considerable reductions in GHG emissions can be achieved. Consumer demand combined with current state and federal policy has meaningfully increased the share of EVs sold in the US over the last decade. Battery electric or plug-in hybrids went from 0.7% of all light-duty vehicles sold in the US in 2014 to 14.7% in 2024, according to EPA estimates.

Although electrification offers a potential solution for most of the sector, modes like aviation and shipping are not prime candidates for electrification. For example, though electric vertical takeoff and landing shows promise for short-haul flights, battery technologies’ weight and low energy density present major challenges to electrifying long-haul aviation. Low-carbon fuels with higher energy density can directly substitute for incumbent fossil fuels in some of these key applications. These fuels significantly lower GHG emissions on a lifecycle basis compared to conventional fossil fuels and can be produced from a range of sustainable feedstocks, including biomass, biogas, algae, wastes, renewable electricity, and CO2. Fossil fuels, when combined with carbon capture and storage (CCS) technologies, can also produce low-carbon fuels.

Examples of low-carbon fuels include liquid biofuels, electrofuels, low-carbon hydrogen, and low-carbon ammonia. Some of these fuels act as “drop-in” replacements for current transportation fuels—functionally equivalent to diesel or jet fuel—and can either be blended with or completely replace conventional fuels without major changes to associated infrastructure and equipment. Other low-carbon fuels require substantial modifications to a vehicle’s propulsion system, like swapping out fossil fuel-powered engines in shipping for ammonia-powered alternatives.

Today, biofuels account for about 6% of total transport sector energy consumption. Corn-based ethanol dominates, providing 14 billion gallons to the fuel mix in 2023, with biodiesel and renewable diesel adding 2 and 3 billion gallons, respectively. Electrofuels and low-carbon hydrogen and ammonia are not currently widely used in the US transport sector.

Efficiency improvements can also reduce GHG emissions by decreasing the energy required to operate a vehicle while maintaining the same level of travel service (e.g., travel one mile in a car or transport a ton of materials one mile in a plane). Advances in technologies, designs, and materials, such as lightweighting or stop-start functions in engines, can reduce fuel consumption across all forms of transport, thereby reducing emissions. Efficiency improvements can also reduce the demand for electricity or low-carbon fuels, easing the path to the adoption of those technologies. Federal policies including the National Highway Traffic Safety Administration’s (NHTSA) Corporate Average Fuel Economy (CAFE) standards and EPA vehicle emissions standards have driven meaningful improvements in fuel efficiency. Light-duty vehicle average miles per gallon (MPG) has increased by 45% since 2004 to 28 MPG in 2024 and more than doubled since the US began setting standards in the mid-1970s.

Beyond adopting technological solutions, strategies to reduce service demand and promote mode shifting can also lower transport sector emissions. Smart urban design, carpooling, and other rideshare programs can reduce the need to drive, resulting in fewer vehicle miles traveled. Likewise, package delivery logistics can be optimized to minimize freight ton-miles. Building transit systems, bike infrastructure, and pedestrian walkways can encourage travelers to opt for the bus, train, or bike instead of driving. Packages and people can shift to lower-emitting travel modes, like rail, instead of flying or truck transport. While technological solutions hold huge promise for reducing transport sector emissions, these other approaches can also play a meaningful role.

Key challenges to large-scale deployment

Large-scale deployment of these decarbonization approaches will encounter challenges, pointing to the need for policy support to help drive technology adoption and ensure the US achieves deep emissions reductions. These challenges generally fall into three categories: cost of cleaner alternatives relative to fossil incumbents or “green premium,” slow stock turnover, and the availability of necessary feedstocks and fuels.

Green premium

A decade ago, effectively all non-fossil transportation technologies carried a significant green premium. However, continued cost reductions and government policy have changed the calculus in some parts of the transport sector. Today, electric light-duty vehicles are generally cheaper to own and operate than ICE vehicles. The per-mile cost of driving is lower, on average, even before accounting for the tax credits provided as part of the Inflation Reduction Act (IRA). This long-term cost parity has increased sales of EVs as part of the LDV fleet. However, the upfront purchase price of EVs is often still higher than ICE vehicles, which presents a barrier to some consumers.

Some smaller commercial EVs and freight trucks are nearing cost parity with gasoline- and diesel-powered counterparts, while larger electric trucks like semis still carry a significant green premium. That cost difference is expected to shrink over time. Clean hydrogen may also play a role as a fuel for larger trucks, but those vehicles have a higher purchase price and hydrogen is a more expensive fuel than diesel on a dollar per gallon equivalent.

Low-carbon fuels and electrofuels currently cost 2-5 times more than diesel and jet fuel products, though this gap will likely narrow. IRA tax credits and expected production cost declines will put some sustainable fuels on track to approach cost parity with fossil equivalents. Very low- to zero-emitting hydrogen and ammonia are similarly more expensive on an unsubsidized basis, with green hydrogen production costs averaging about 3 times higher than gas-derived gray hydrogen and green ammonia costs averaging 2-4 times higher—but tax credits and further technology improvements can reduce this gap.

Slow Stock turnover

The average light-duty vehicle stays on the road for over 16 years, while aircraft and ships last even longer (Table 2). These slow stock turnover rates for existing fleets limit the opportunity to replace dirtier, conventional technologies with cleaner, electric technologies. Consumers, and particularly businesses, are unlikely to replace capital-intensive purchases like vehicles until they reach the end of their useful life, meaning that investment decisions being made today will impact on vehicle stock into the 2040s and 2050s.

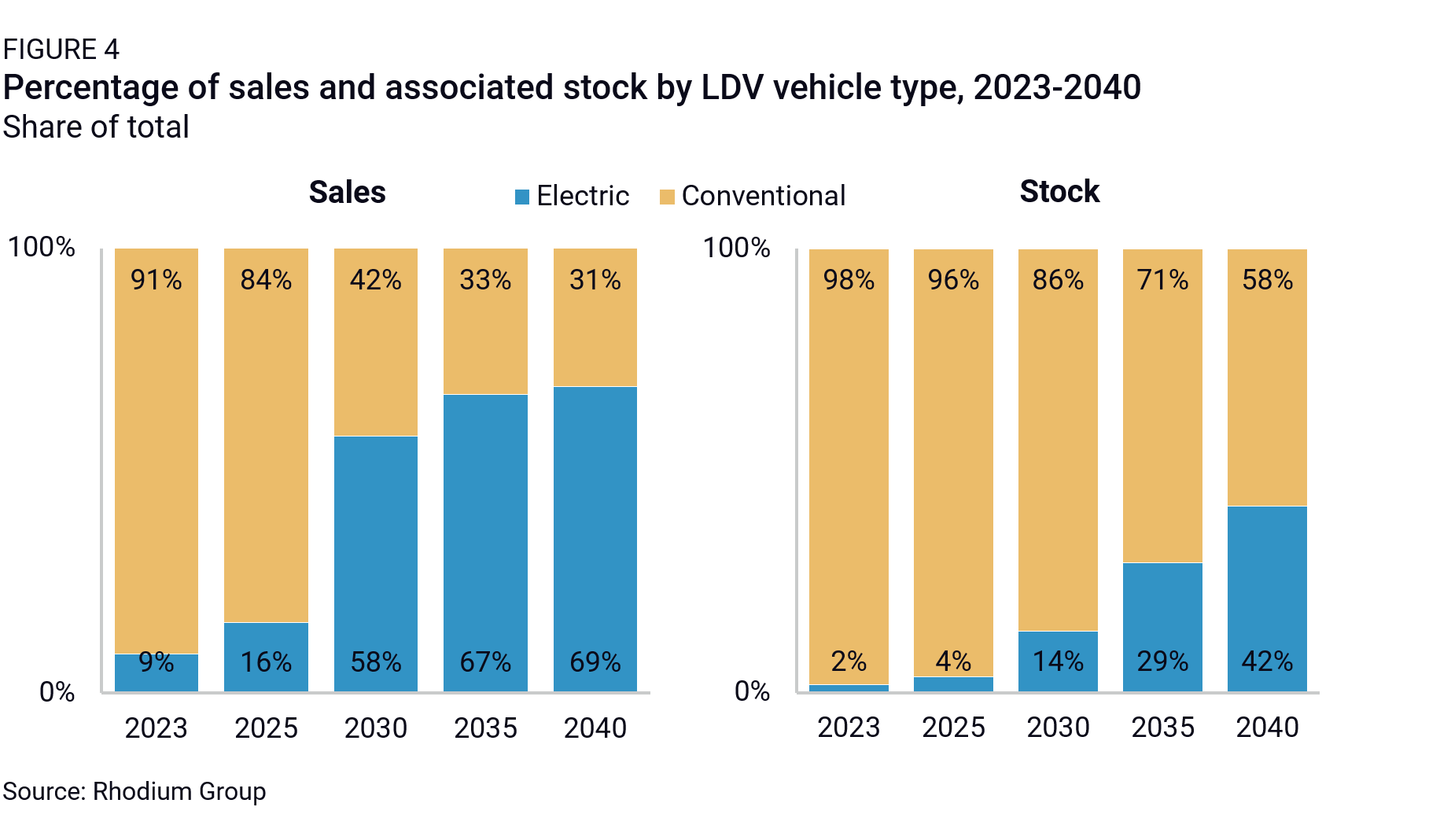

Consider light-duty vehicles (Figure 4). In the mid emissions scenario from our Taking Stock 2024 current policy estimates, EVs could comprise 58% of all LDV sales in 2030 and between 65-70% of sales from 2035 through 2040. Despite these impressive numbers, in 2040, internal combustion engines will still power more than half of LDVs on the road. To put this in context, reducing all remaining LDV emissions to zero in 2030 via electrification would require swapping out roughly 243 million conventional ICE vehicles with EVs.

Similar dynamics exist across trucks, planes, and ships. However, cleaner alternatives cost more, and their fossil-fueled counterparts generally last longer, so the stock transition occurs even more slowly than in the LDV example. These dynamics underscore the importance of driving as many vehicle purchasers as possible to make cleaner choices today and highlights the potential value of policies that accelerate stock turnover.

LIMITS ON FEEDSTOCKS AND FUELS

Oil remains ubiquitous in the American economy—the US has been the world’s largest oil producer since 2018—and replacing that oil with sustainable liquid fuel alternatives will take time and face challenges. As discussed above, low-carbon fuels offer a promising alternative to fossil incumbents like diesel and jet fuel. Biofuels derived from biogenic feedstocks—including crop wastes, forest residues, purpose-grown crops, and waste oils—are a common category. For biofuels to meaningfully reduce emissions relative to fossil fuels, there must be low levels of emissions associated with the production of these feedstocks and little change to the carbon absorptive capacity of the natural and working lands from which the feedstocks are sourced.

Today, we use around 340 million metric tons (MMT) of biomass annually, mostly corn and soy, to produce transportation biofuels. Estimates for how much total biomass could be used to produce fuels vary based on assumptions around what types of biomass would qualify as low-carbon and in what quantities (Figure 5). However, even at the highest estimates, it’s clear that low-carbon biofuels alone cannot power the entire transport sector.

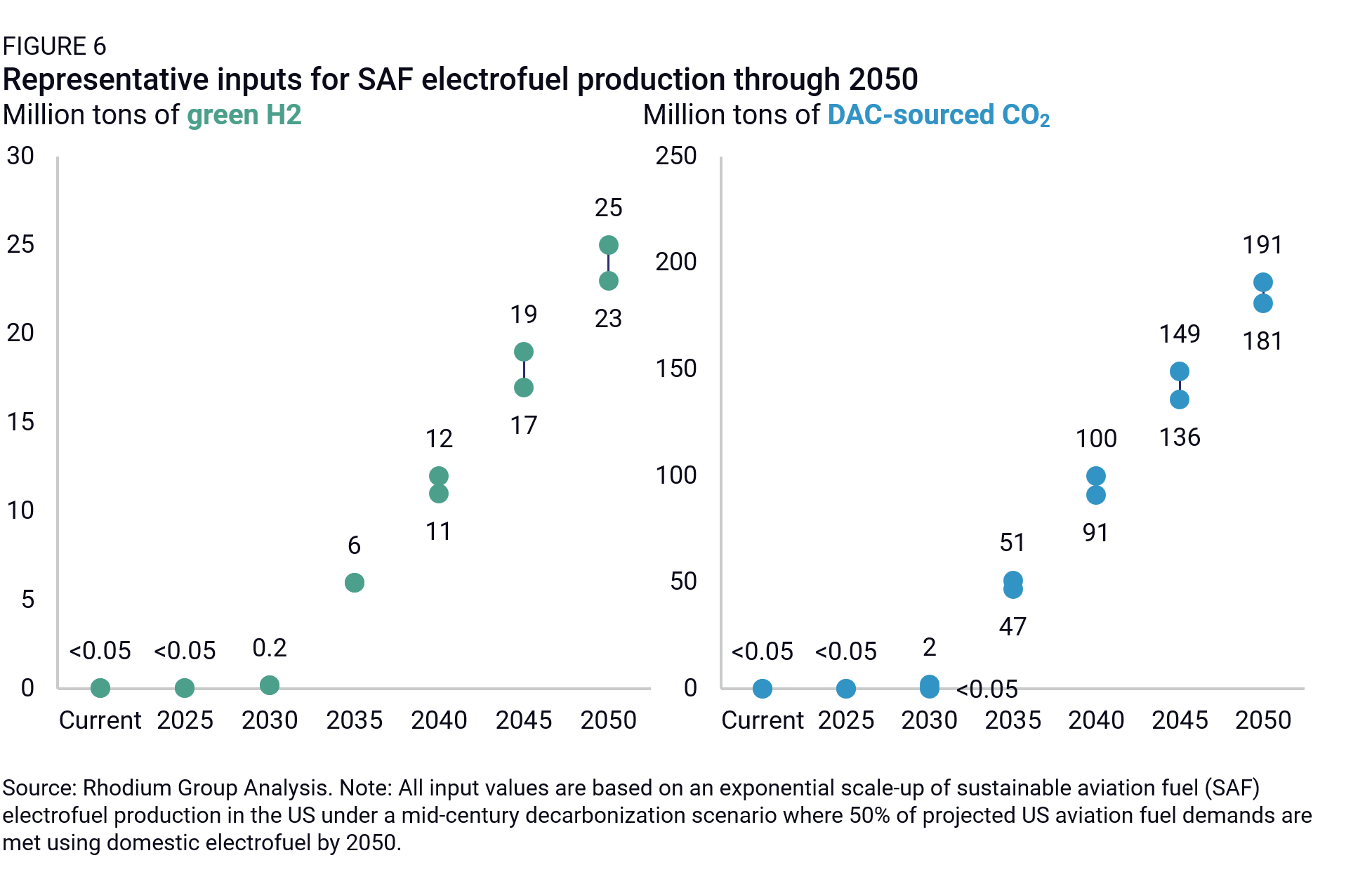

Electrofuels, created by combining hydrogen and CO2, provide drop-in replacements for fossil fuels. As with biofuels, their ability potential to reduce emissions depends heavily on the GHG intensity of the hydrogen and CO2 used in production. Achieving zero-emitting electrofuels requires hydrogen produced without emissions using renewable-powered electrolyzers as well as CO2 produced or harvested without increasing emissions through processes like renewable-powered direct air capture (DAC). Today, there is effectively no zero-carbon hydrogen or DAC-produced CO2. The role of electrofuels in a decarbonized transport sector depends on the rapid deployment of electrolyzers and DAC. As an illustrative example, replacing 50% of jet fuel demand with electrofuels in 2050 would require 23-25 MMT of green hydrogen—more than double today’s total hydrogen production—plus 180-190 MMT of DAC-captured CO2 (Figure 6).

Electrification is also not immune from feedstock and fuel challenges. Growing electricity demand in the US is a hot topic, with much discussion centered around unanticipated load growth from data centers driven by AI. However, in Taking Stock 2024, we found that by 2035, more than three-quarters of load growth will come from what we term “structural electrification”—increased demand from EVs, heat pumps, and electrified industrial end uses. Nearly half of this growth is from the transport sector alone. While easier to plan for and thoughtfully integrate than immediate demands for interconnection from data centers, the scale of demand growth from “structural electrification” is still tough to overstate.

By 2050, electricity demand from electric LDVs could add 1,500-2,000 terawatt-hours (TWh) of demand to the grid (Figure 7). To put that in perspective, the US consumed around 4,000 TWh of electricity in 2023, meaning the growth from LDVs alone—before accounting for electrified freight or other sources—could increase grid demand by 40-50% from today’s levels.

Those electrons need to come from clean sources for EVs to maximally contribute to decarbonization, highlighting the need to add massive amounts of wind, solar, batteries, and other zero-emitting sources of electricity to the grid. Significant upgrades to the grid’s transmission and distribution components will also be required to handle major charging loads from truck and bus depots and ensure widespread, reliable charging is available for LDVs—critical to reducing consumer range anxiety and accelerating EV uptake.

Critical minerals that are key to today’s battery chemistries, including lithium, cobalt, manganese, and nickel, are also subject to supply chain constraints. The International Energy Agency estimates growing demand for batteries (among other sources of clean technology demand) will increase the need for lithium more than four-fold by 2030 and more than 12x by 2050. Though alternate chemistries like sodium-ion batteries show the potential to gain market share, limited availability and sourcing of these critical minerals could slow EV deployment.

Policy support to achieve deep transportation decarbonization

No single technological approach can reduce transport emissions to or near zero. A diverse mix of technologies and the policies that support them is essential. To pursue this objective, policymakers can look to maintain and enhance what’s currently on the books while enacting the next generation of transportation decarbonization policies.

Maintain and enhance current policy

Federal tax policy has played a major role in accelerating clean tech deployment, from power sector decarbonization to increasing uptake of EVs and hybrids. Current tax credits—up to $7,500 for qualifying consumer purchases of EVs, up to $7,500 for commercial purchases of light and some medium-duty clean vehicles, and up to $40,000 for the purchase of larger medium- and heavy-duty clean vehicles—face considerable uncertainty given unified Republican control of the White House and Congress in 2025.

Beyond credits for vehicle purchases, the tax code also provides a credit for up to $3/kg for clean hydrogen, $1/gallon for many other clean fuels, and up to $1.75/gallon for sustainable aviation fuels. Tax policy also provides support for some of the key feedstocks and fuels needed for transportation decarbonization, including up to $135/ton for CO2 captured via direct air capture and used to produce clean fuels, as well as credits for investment in and production of clean electricity. Maintaining these credits and, in some cases, extending them beyond their current expiration dates—some of which occur as early as the end of 2027—are critical to helping decarbonization approaches compete economically with incumbent fossil technologies. Despite political challenges, providing consumers and businesses with tax credits remains a powerful tool to accelerate the deployment of lower-emitting vehicles and fuels.

Regulatory standards, such as EPA and NHTSA standards for GHG and fuel economy, are equally vital. Paired with current federal tax supports for consumer EV purchases, these standards can result in the majority of new light-duty vehicle purchases being electric. Similarly, EPA and NHTSA standards for freight trucks, when paired with tax credits, can meaningfully accelerate uptake of zero-emitting vehicles in medium- and heavy-duty fleets. Keeping these regulations in place and continuing to target aggressive levels of emission reductions and fuel economy in future regulations will be an important component of federal transportation decarbonization policy.

Investing in innovation on today’s technologies will create the next generation of transportation decarbonization, yielding substantial long-run benefits. Increasing the scale of congressional appropriations for research, development, demonstration, deployment, and commercialization can unlock breakthroughs. In particular, support for electric and low-carbon fuel vehicle technologies, batteries, and low-carbon fuel production can help the industry realize the potential of this innovation.

The federal government is not alone in enacting policies to drive clean technologies into the transport sector. California leads the way in setting targets for clean vehicle adoption, and 18 states have followed the state in adopting GHG standards and/or ZEV targets for light-duty vehicles, part of their Advanced Clean Cars suite of rules. Ten states have similarly adopted California’s Advanced Clean Trucks rule for freight trucks. These rules rely on EPA waivers that allow California to set its own standards. Keeping that waiver in place is essential to enabling state leadership.

Enact the next generation of policy

Looking beyond policies currently on the books, a federal technology-neutral low-carbon fuel standard (LCFS) offers a transformative opportunity to reduce the carbon intensity of fuels across the sector. Similar standards have been signed into law at the state level in California, Oregon, Washington, and New Mexico. In California, for instance, the LCFS has led to a doubling of low-carbon fuel use on a volumetric basis and significantly spurred the adoption of EVs. However, the limited reach of state-level action creates a patchwork of policies that make compliance challenging for regulated entities that operate in multiple states, potentially missing large portions of the sector’s emissions.

A federal LCFS has several significant advantages. Unlike the Renewable Fuel Standard (RFS), which is constrained to specific biofuel volume targets, an LCFS can take a technology-neutral approach. This expands the range of potential stakeholders in the policy and helps drive technology innovation. A federal LCFS can establish clear long-term targets, providing fuel producers and other obligated entities with ample time to plan for meeting those targets. To ease compliance, an LCFS can be designed to provide compliance flexibilities like compliance credit trading and incorporation of verifiable, durable carbon dioxide removal.

An LCFS complements international agreements in key transport subsectors by addressing remaining emissions as the US light-duty fleet increasingly transitions to EVs. For instance, while the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) sets standards for emissions from international aviation, domestic aviation is not required to meet those requirements. Likewise, the International Maritime Organization’s GHG strategy covers international shipping emissions, but not domestic. A well-designed LCFS can ensure the transport sector achieves deep decarbonization across modes on an intended schedule.

Beyond an LCFS, federal policymakers could contemplate additional policies to bolster cornerstone laws and rules. For instance, efforts to accelerate stock turnover can amplify the impact of tax credits and regulations by aligning more purchase decisions with decarbonization goals. Given the reliance on critical minerals in current and likely future EV batteries, the federal government can enact a strategy to ensure sufficient availability of these minerals domestically and among allied nations. Finally, the federal government is itself a large consumer of transportation fuels. Deciding to shift toward cleaner vehicles and fuels can expand market availability and bring down the green premium for other consumers.

A pivotal moment for transportation decarbonization

The US transport sector is at a pivotal point on the pathway to decarbonization. EVs in the light-duty fleet are pushing beyond early adopters and reaching mainstream consumers. A suite of federal investments aims to improve the economics for low-carbon alternatives. An impressive array of solutions—electrification, low-carbon fuels, and efficiency—are available or rapidly advancing, each with unique advantages and challenges. Robust policies are essential to overcoming these barriers. Existing measures, such as federal tax policies, regulations, and state commitments, provide a strong foundation for a cleaner transport sector. However, some of these policies will face increased political scrutiny given Republican unified control in Washington. Additional actions, like enacting a national LCFS or measures to improve availability of critical minerals, are essential to further sectoral emissions reductions. With the appropriate policy focus, the US transport sector is well-positioned to accelerate emissions declines and contribute to a meaningfully cleaner economy in the future.