Ways and Means Brings the Hammer Down on Energy Credits

The House Ways and Means Committee's proposed language will raise energy costs for American households by as much as 7% in 2035, stifle energy technology innovation, increase pollution, and could put significant investment at risk.

The House Ways and Means Committee issued its proposed language for inclusion in Congress’s massive budget reconciliation package. It’s the opening attempt to reduce spending in order to partially cover the cost of nearly $5 trillion in proposed extensions and expansions of the tax cuts initially passed in 2017. While we are still analyzing the package, our preliminary analysis shows that the impact of the proposal is likely to be similar to the impact of a full repeal of the energy tax credits initially extended and expanded in 2022. This will raise energy costs for American households by as much as 7% in 2035, stifle energy technology innovation, increase pollution, and could put a meaningful portion of half a trillion dollars of new manufacturing, industrial, and clean electricity investments across the country at risk.

The opening salvo in the budget reconciliation debate

After the House and Senate agreed to a budget framework last month, work commenced on sorting out how exactly to meet the budget targets established in that bill. House Ways and Means released its contribution, which per the resolution cannot add more than $4.5 trillion to the deficit over the next ten years. The Joint Committee on Taxation, the scorekeepers of the federal fiscal impacts of policy, reckons the Committee’s efforts to extend components of the 2017 Tax Cuts and Jobs Act and add new tax cuts, including modified tax rates, no tax on tips or Social Security benefits, changes to deductions and the alternative minimum tax exemption, as well as extending and increasing the state and local tax deduction cap, would increase the deficit by $5.6 trillion. This means Ways and Means needs to find at least $1.1 trillion in savings to meet the budget target. As a result, the Committee has, among other things, chosen to cut most energy-related tax credits way back to make up the difference.

Last year, House Speaker Mike Johnson argued that his members should use “a scalpel and not a sledgehammer” to make changes to energy-related tax credits. In recent months, he’s walked that back to “somewhere between a scalpel and a sledgehammer.” In fact, as a starting point, Ways and Means committee chair Jason Smith (R-MO) and other bill drafters have come down firmly on the sledgehammer end of the spectrum, targeting cuts to a host of provisions, including many that have attracted Republican support in recent weeks and months and historically have enjoyed bipartisan backing.

Major changes in the Ways and Means proposal that will affect energy include:

- Termination of a number of tax credits at the end of 2025, including credits for clean vehicles (with a limited exception for some vehicles in 2026), commercial clean vehicles, previously owned clean vehicles, alternative fuel refueling properties, energy efficiency and clean energy improvements for homes, and clean hydrogen

- Statutory phase-out of the clean electricity production and investment tax credits beginning in 2029 through 2031 on a placed-in-service basis—a shift from the current commence construction deadlines. De facto sunsetting of the credits as early as 2026 (one year after passage of the bill) with imposition of highly restrictive and administratively complex (and potentially unworkable) limits on sourcing of components, subcomponents, and critical materials used at a facility, or 2027 with the phase-out of the ability for clean energy developers to transfer or sell the tax credits they generate to other entities.

- Sunset of the advanced manufacturing production credit after 2031, except for wind components, which sunset after 2027; application of similarly strict sourcing requirements aligned with those proposed for the clean electricity credits; and removal of transferability

- Repeal of transferability, which reduces options for monetizing the credits, and implementation of foreign sourcing limits for a host of other credits

- Phase-out of the zero-emitting nuclear credit beginning in 2029 through 2031; extension of clean fuels credit through 2031 with changes to what fuels could potentially qualify

Beyond the specific policy changes, the proposal will also require a hollowed-out federal bureaucracy to propose and finalize extremely complicated and unprecedented implementation rules before investors and developers will have the certainty they need to make investment decisions. It took the first Trump administration nearly three years to finalize regulations for implementing the 45Q tax credits for carbon capture, rules which pale in comparison to the complexity of what will be required to implement key portions of the Ways and Means proposal.

Impacts of the provisions

Since Ways and Means just released a draft of the bill yesterday, we have yet to fully model the proposal in its current form. In December, we modeled a potential legislative pathway that fully repealed all major energy components of the Inflation Reduction Act beginning on January 1, 2025. For some credits like clean vehicles and residential clean energy, the Ways and Means proposal offers just one more year of credits compared to our repeal scenario. For the technology-neutral clean electricity tax credits, the Ways and Means proposal’s harshest restrictions on material from foreign entities of concern (FEOC) are likely to begin in 2026—so two more years of credit would be available compared to our repeal scenario. Because of the high degree of consistency with the Ways and Means proposal and our previous modeling, our prior work provides useful insights into the expected direction and magnitude of impact of these policy changes. As discussed above, the administrative complexity of implementing these rules also likely puts significant downward pressure on near-term investments, further aligning our previous modeling with this proposal. We plan to refine our modeling after the Ways and Means mark-up to reflect where the committee lands.

We compare modeling outcomes with and without these changes to quantify the impact of the proposal—in both cases holding constant a “rollback” regulatory environment as a baseline where all major Biden-era environmental regulations are removed. The Trump administration and Congress have taken numerous actions to follow through on these rollbacks, the latest of which is the House Energy and Commerce reconciliation bill attempt to repeal EPA tailpipe regulations for light, medium and heavy duty vehicles. Such legislative moves are unprecedented and likely to face scrutiny from the Senate parliamentarian, though Senate Republicans could make another unprecedented move and opt to ignore her ruling.

Whatever comes of these congressional machinations, we expect the rules we identified in our December rollback scenario to be removed from current law in the near future, so we consider the impacts of efforts to change tax policy compared to a baseline where the regulations are rolled back. We report a “baseline” policy case reflecting regulatory changes made by the Trump administration and Congress and then a “repeal” policy case that estimates the incremental impact of revision and removal of energy-related provisions of the IRA beginning in 2025.

As we detail in our December note, rolling back regulations alone will meaningfully impact the energy system, increasing energy bills for consumers and businesses, reducing clean energy deployment, and increasing greenhouse gas emissions. In this note, we focus only on the impacts of changes akin to those proposed by Ways and Means legislation. As part of budget reconciliation, several committees have proposed policy changes that will impact the energy system, including the House Energy and Commerce’s proposed recission of funding for a number of grant programs established as part of the Inflation Reduction Act, new fees on EVs proposed by the Transportation and Infrastructure committee, and the Natural Resource committee’s proposed changes to energy production public lands. We will assess the aggregate impact of the entire reconciliation bill as the complete legislation takes shape.

As in the past, to understand the range of potential impacts, we use the same three main emissions scenarios reported in Taking Stock 2024: a low-emissions scenario that pairs cheap clean energy technologies with more expensive future fossil fuel prices and slightly slower GDP growth; a high-emissions scenario that pairs more expensive clean technologies with cheap fossil fuels and as-anticipated GDP growth; and a mid-emissions scenario that cuts the difference between the two. To model these policy pathways and emissions scenarios, we use RHG-NEMS, our version of the National Energy Modeling System developed by the US Energy Information Administration.

Energy prices and costs rise for households and businesses

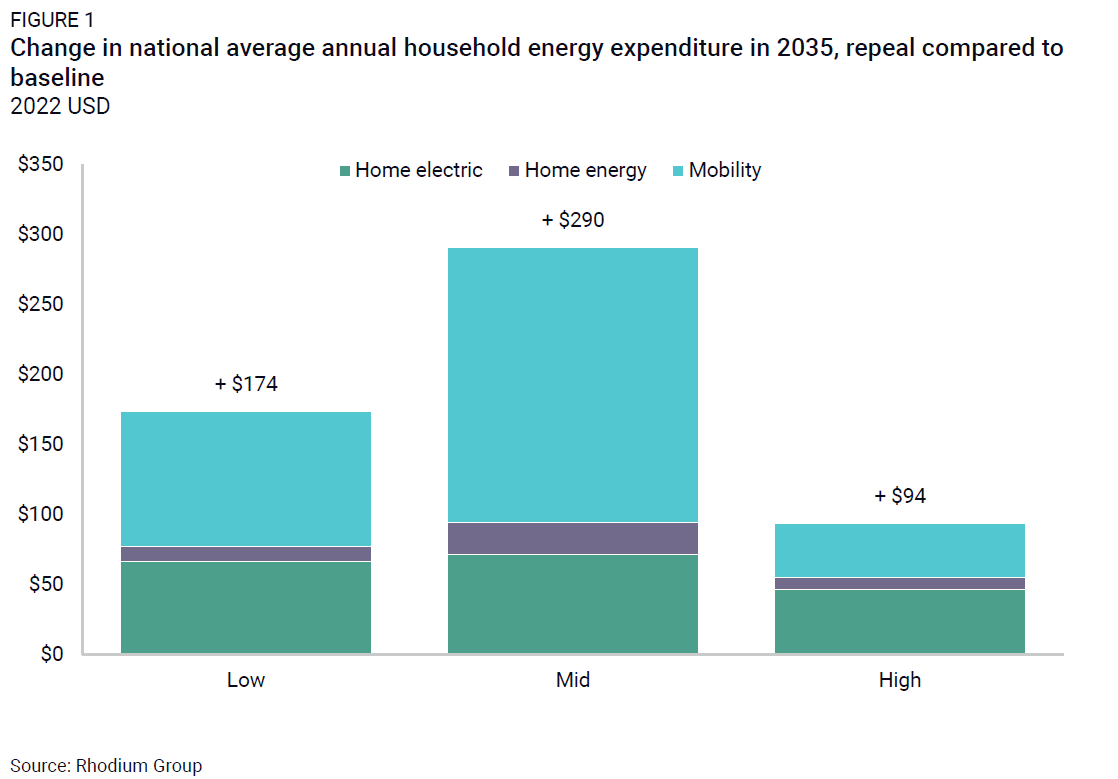

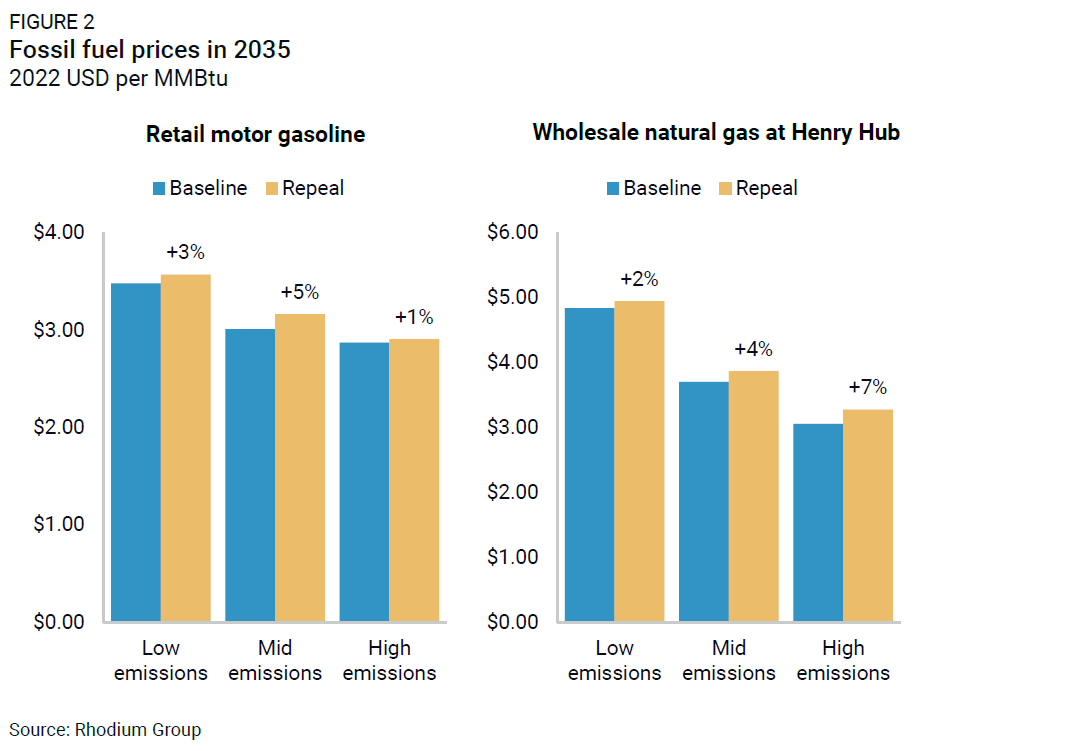

An often-stated goal of these changes is to bring costs down for American households. We find that repealing the energy tax credits has the opposite effect, increasing household energy costs by $95-290 in 2035—a 2-7% increase in costs that year (Figure 1). Repealing tax credits effectively acts as a energy tax increase. Higher spending on mobility energy, including motor gasoline, diesel, and electricity for charging electric vehicles, make up 41-68% of that increase. There are a couple of reasons for this. First, with fewer electric vehicles on the road (discussed further below), consumers will buy more liquid fuels, especially motor gasoline. Relatedly, this increase in demand for gasoline drives up prices at the pump by 1-5% (Figure 2), increasing costs for all drivers. Domestic crude oil production increases very modestly (less than 1%), while crude oil imports increase more meaningfully (5-11%). Electricity bills make up 25-50% of the increase, with households paying $46-72 more each year to power their homes.

Increasing demand for natural gas, particularly driven by more gas demand for power generation, increases wholesale natural gas prices by 2-7% in 2035, despite 6-8% higher gas production (Figure 2). That leads to higher retail prices for all consumers across the economy.

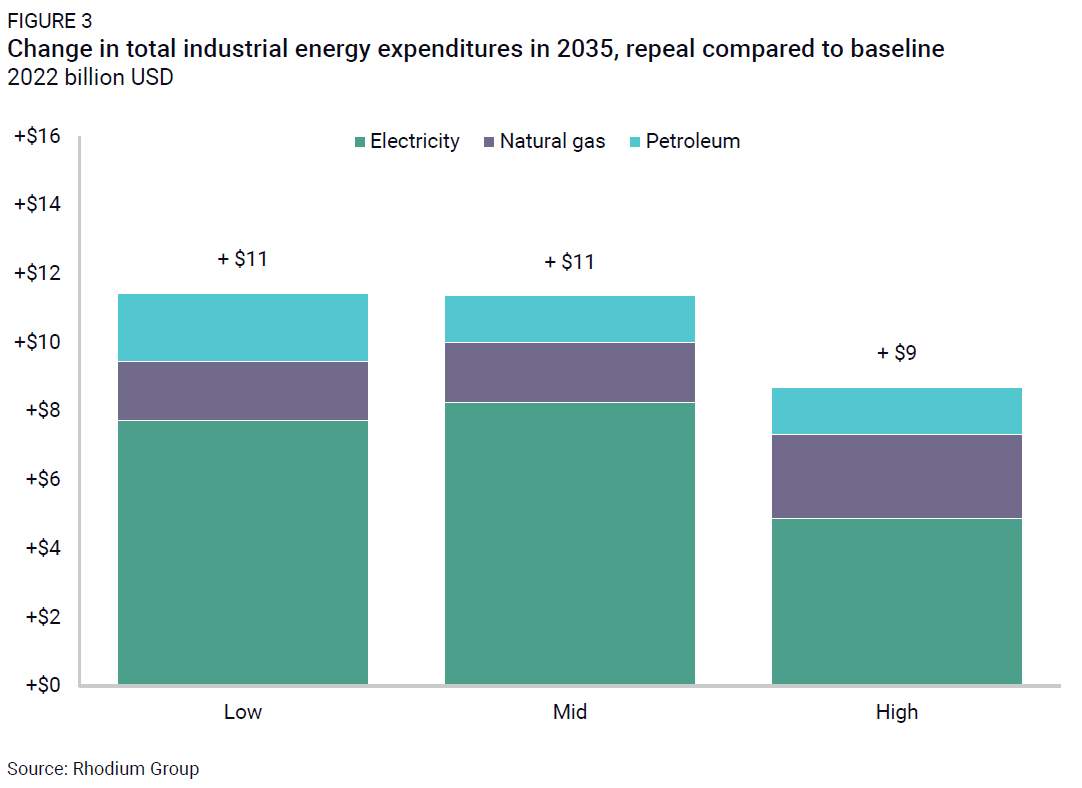

Despite the administration’s stated desire to bolster domestic manufacturing, we find that repealing tax credits places extra burden on industrial producers through higher fuel costs. These higher costs drive up industrial expenditures by $9-11 billion in 2035 (Figure 3). Electricity bills comprise 56-73% of this increase—a consequence of industrial electricity rates rising by 7-12% in 2035. Natural gas expenditures increase by $2 billion on average due to higher wholesale prices. At a time when trade policy turbulence is driving uncertainty around inflation, consumer confidence and the continued economic growth increasing energy costs could add to the turbulence.

Stalled progress on clean energy deployment

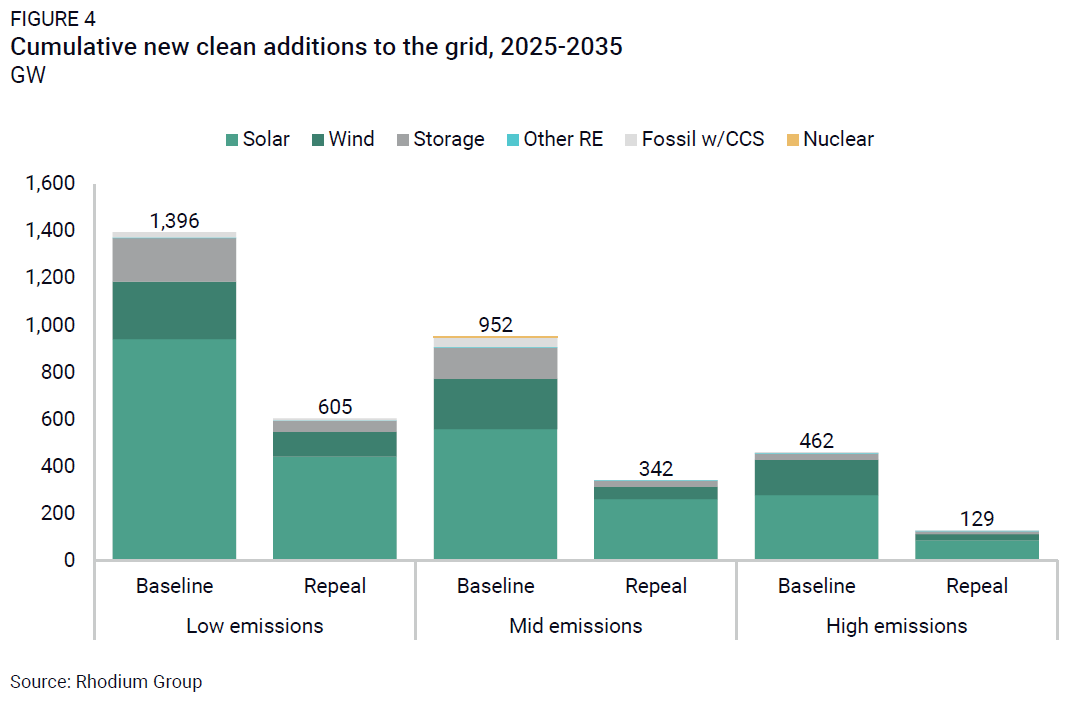

An outright repeal of the energy tax credits similar to the Ways and Means proposal reduces the amount of new clean capacity installed on the grid from 2025 through 2035 by 57-72% (Figure 4). The lion’s share of the decline in capacity comes from lower growth of renewables and storage, and there is no meaningful uptick in non-renewable clean capacity. A part of this decline is made up for by modestly less coal capacity retiring by 2035, though the coal fleet still shrinks by at least half from today’s levels, and no new coal plants are built. Gas capacity expands by as much as 9% in 2035, and both new and existing gas plants run more, compared to the baseline.

Our previous modeling is best suited to estimate the impact of policy change on commercially available technologies, but there are important impacts beyond commercial technologies as well. The near full repeal of energy tax credits in the Ways and Means language have an outsized effect on innovative emerging clean technologies like enhanced geothermal, advanced nuclear, long duration storage, and fusion. Developers of these technologies are counting on the long-term availability of the tax credits in current law to support initial projects that are unlikely to be placed in service before 2028. The FEOC constraints on clean electric credits and manufacturing tax credits will make it harder to develop and scale supply chains to accelerate technology deployment and drive down costs. The Ways and Means proposal will stifle innovation at a time when the US needs all the power it can get to meet surging electric demand.

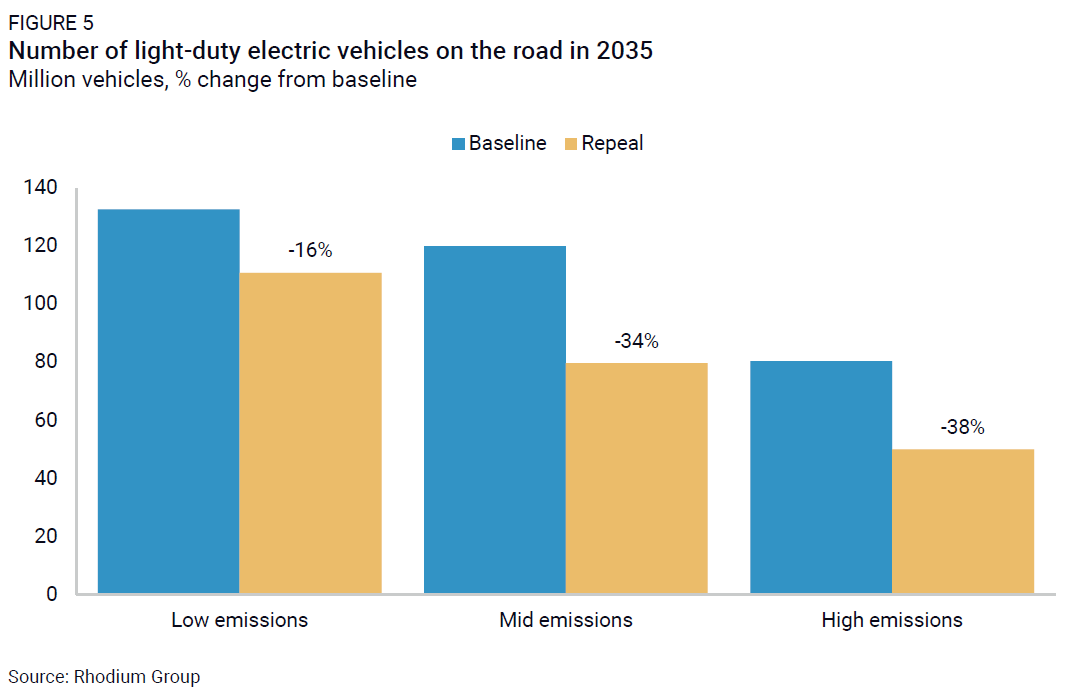

In our baseline, electric vehicle sales already slow meaningfully from removal of EPA tailpipe regulations and the revocation of waivers that prevent California from pursuing more stringent standards. Repealing the clean vehicle tax credits reduces EV sales by another 16-38% in 2035 compared to baseline (Figure 5).

Manufacturing growth threatened

Taking a major step back on domestic deployment of clean energy technologies will likely impact the future of announced manufacturing facilities that produce these technologies. As reported in the Clean Investment Monitor’s Q1 2025 update, six manufacturing facilities totaling nearly $7 billion in investments were cancelled last quarter. In The State of US Clean Energy Supply Chains in 2025 released last month, the Clean Investment Monitor found that domestic manufacturing of key clean technology components including solar modules, battery modules and cells, and zero-emitting vehicles are scaling up above current levels of demand for these technologies and toward deployment levels we see in our modeling of current policy through 2035.

Between investments in these manufacturing facilities as well as investment dollars flowing from installing clean electricity and industrial facilities, $321 billion was invested from mid-2022 through the first quarter of 2025—but a total of $522 billion in investment remained outstanding as of Q1. Steep reductions in clean energy technology deployment plus the proposed material sourcing constraints on clean manufacturing tax credit eligibility could put a meaningful amount of that $522 billion in outstanding investment at risk.

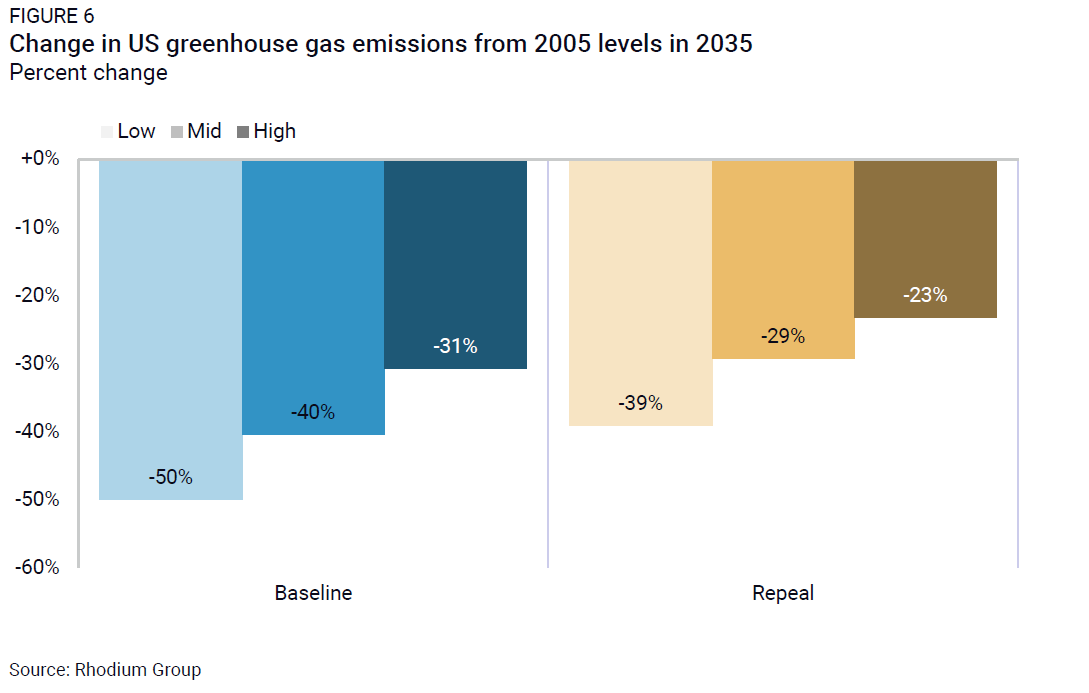

Meaningfully higher greenhouse gas emissions levels

The net result of proposed tax policy changes on the energy system leads to a meaningful reduction in the pace of decarbonization. Repealing the energy tax credits increases emissions by 500-730 million metric tons in 2035 relative to the baseline and more than a gigaton compared to Taking Stock 2024. In the high emissions scenario, repeal leads to emissions that are only 23% lower than 2005 levels in 2035 (Figure 6), or just 4 percentage points lower than annual emissions in 2024—effectively no progress on decarbonization. In the low emissions scenario, emissions are 39% lower than 2005 levels.

What’s next?

The House Ways and Means Committee is considering this proposal today. Whatever moves out of that committee is one step closer to the House floor and a vote of the full House, and we’ll be tracking the bill as it evolves throughout the process. The latest Joint Committee on Taxation revenue effects estimate of the full suite of policy changes in the current Ways and Means proposal is still nearly $800 billion below its spending target, so there’s certainly room for the proposal to evolve in response to ongoing member conversations.

Meanwhile, the Senate Finance Committee (the equivalent tax-writing committee on the Senate side) has a meaningfully different deficit reduction target to achieve and a different set of stakeholders’ interests to balance. How the two chambers will get to passage individually and then in agreement with each other remains a very open question.

This nonpartisan, independent research was conducted with support from Blue Horizons Foundation. The results presented reflect the views of the authors and not necessarily those of the supporting organization.