Capturing the Moment: Carbon Capture in the American Jobs Plan

In this note, we unpack the carbon capture relevant components of the American Jobs Plan and, where possible, we quantify the potential impact on emissions and jobs.

President Biden’s $2.25 trillion-plus American Jobs Plan (AJP) contains various incentives and investments to deploy carbon capture technology in the US. Carbon capture is one of many key technologies that need to be deployed at scale to decarbonize the US economy. Significant investments this decade have the potential to catapult the carbon management industry into the mainstream. In this note, we unpack the carbon capture relevant components of the AJP and, where possible, we quantify the potential impact on emissions and jobs. We find that enhancements to the section 45Q carbon capture tax credit can result in the deployment of as much as 110 million metric tons of additional industrial carbon capture capacity, yielding up to 76 million tons of emission reductions in 2035. The $12-15 billion in total investment in these facilities through 2035 translates into 60,700-78,600 additional job-years in that time period. Carbon capture retrofits at typical coal and gas plants yield 3,400-5,400 project job-years per plant, and we estimate 3,400 new job-years associated with a new million-ton direct air capture (DAC) plant.

Finally, it’s infrastructure week

With a COVID-19 relief package enacted and implementation underway, President Biden has put forward the American Jobs Plan to stimulate economic recovery and rebuild American infrastructure. The AJP intends to do more than get the economy back on track. The $2.25 trillion-plus in proposed spending addresses a variety of policy priorities, from affordable housing to retooling American manufacturing, road, bridge, and transit improvements and accelerating the decarbonization of the economy.

A key theme of the AJP is to make investments that reduce greenhouse gas (GHG) emissions, create jobs, and make the US a global leader in manufacturing clean technologies. Carbon capture and its sister technology, direct air capture (DAC), have the potential to deliver on all three fronts. Carbon capture is a process that collects CO2 at an emissions source such as a factory or power plant. The CO2 can then be used as a feedstock for products or stored securely underground, preventing emissions from entering the atmosphere and contributing to climate change. Factories and power plants can be built from scratch incorporating carbon capture technologies, or existing facilities can be retrofitted to capture CO2. DAC works similarly but removes CO2 from the ambient air. When coupled with secure geologic storage, DAC leads to a net removal of CO2 emissions from the atmosphere so long as it is powered with zero-emitting energy. Several deep decarbonization studies find that the US and the world will likely need both technologies, along with many others, to get to net-zero GHG emissions.[1]

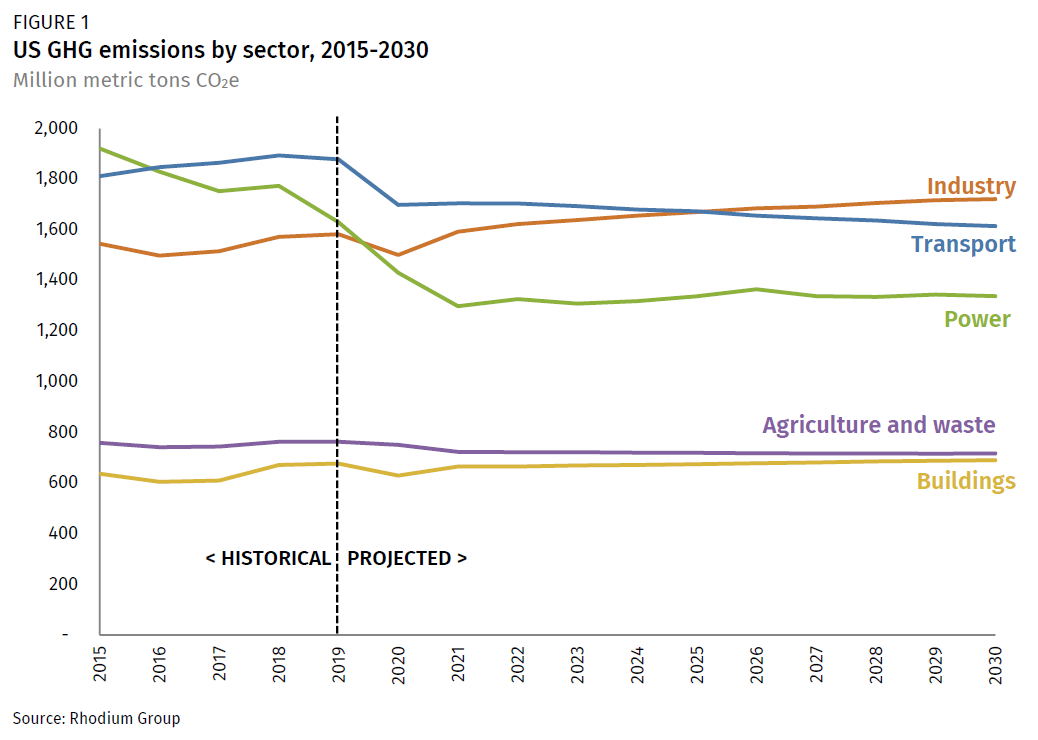

Carbon capture is especially critical to decarbonizing the industrial sector, where electrification isn’t always practical and sustainable renewable fuels are currently in short supply. Currently, the industrial sector is the largest emitting sector globally. Without policy action, the sector is on track to surpass transportation as the largest emitting sector in the US by mid-decade (Figure 1). New investments can change this trajectory.

Carbon capture in the AJP

The AJP contains two general strategies to accelerate carbon capture deployment. First, it proposes a series of enhancements to existing tax incentives to provide increased support and more certainty for carbon capture and DAC deployment. The second strategy is for the government to directly invest in large-scale carbon capture demonstration projects in tough-to-decarbonize sectors such as steel, cement, and chemicals and clean hydrogen production for use across the industrial sector. Almost all hydrogen produced in the US today comes from natural gas, and its production emits large amounts of CO2. Adding carbon capture to these facilities can dramatically cut emissions. Clean electricity-powered electrolysis and conventional hydrogen production with carbon capture represent the most promising ways to produce low-carbon hydrogen at scale. Clean hydrogen will be an important energy source for industrial high-temperature heat applications and a feedstock for clean fuels and chemicals.

The AJP has the potential to take industrial carbon capture to the next level

Assuming a legislative package includes the carbon capture components of the AJP, and that package ultimately is enacted, what can we expect for carbon capture? While many of the details are still under development, we know enough to provide an initial set of estimates.

The AJP proposes to enhance the popular and bipartisan section 45Q carbon capture tax credit by building on the year-end energy tax package that extended the eligibility deadline from the end of 2023 to the end of 2025. Under current policy, starting in 2026, eligible projects can receive $50 for every ton they capture and sequester in secure geologic storage or $35 for captured carbon used as a feedstock or for enhanced oil recovery. The credit payout lasts for 12 years. Carbon capture retrofit projects are large, site-specific, complex, and can take multiple years to design, finance, and build. A bipartisan group of senators has proposed extending the commence construction deadline to the end of 2030. A long eligibility runway will give the capture industry the certainty it needs to scale up supply chains and install multiple megatons of capture capacity annually.

A case for higher credit for some

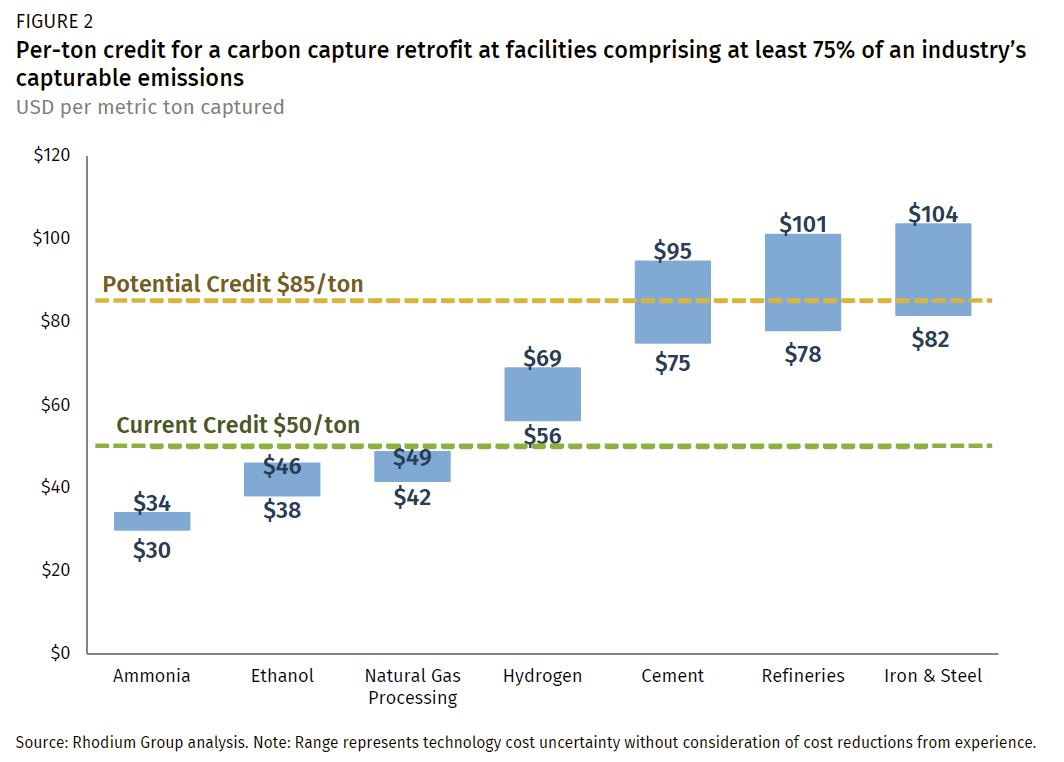

The AJP aims to make the 45Q tax credit easier to use for tough-to-decarbonize industrial sectors. We interpret this to mean that sectors that are more expensive to retrofit relative to low-hanging fruit opportunities such as ethanol, ammonia, and natural gas processing will be eligible for a higher credit value. Why might a higher credit be useful? The current $50/ton credit can drive a lot of deployment at sources with high-purity CO2 streams, but it’s not enough for carbon capture to make sense at facilities with lower CO2 purity.

Using our Industrial Carbon Abatement Platform (RHG-ICAP), a facility-level US industrial carbon capture model developed and maintained by Rhodium Group, we considered different price thresholds for 45Q.[2] We find that the current $50/ton level provides enough economic incentive to install carbon capture technologies at existing facilities that produce at least 75% of emissions in the ammonia, ethanol, and natural gas processing sectors (Figure 2). That credit level is not high enough to achieve the same share of emissions from producing hydrogen, cement, iron and steel, and refineries. However, suppose a higher $85/ton credit is available to those industries. In that case, existing facilities that produce at least 75% emissions from these four additional sectors are in play, assuming low carbon capture technology costs. Differential treatment of emissions sources is a departure from the current 45Q framework but could have a major impact, as we show below.

To assess what the AJP 45Q enhancements can do for industrial capture deployment, we modeled the proposal in Congress to extend the commence construction deadline to the end of 2030, coupled with an assumed higher credit value of $85/ton with secure geologic storage for all sectors except ammonia, ethanol, and gas processing, which continue to get $50/ton.

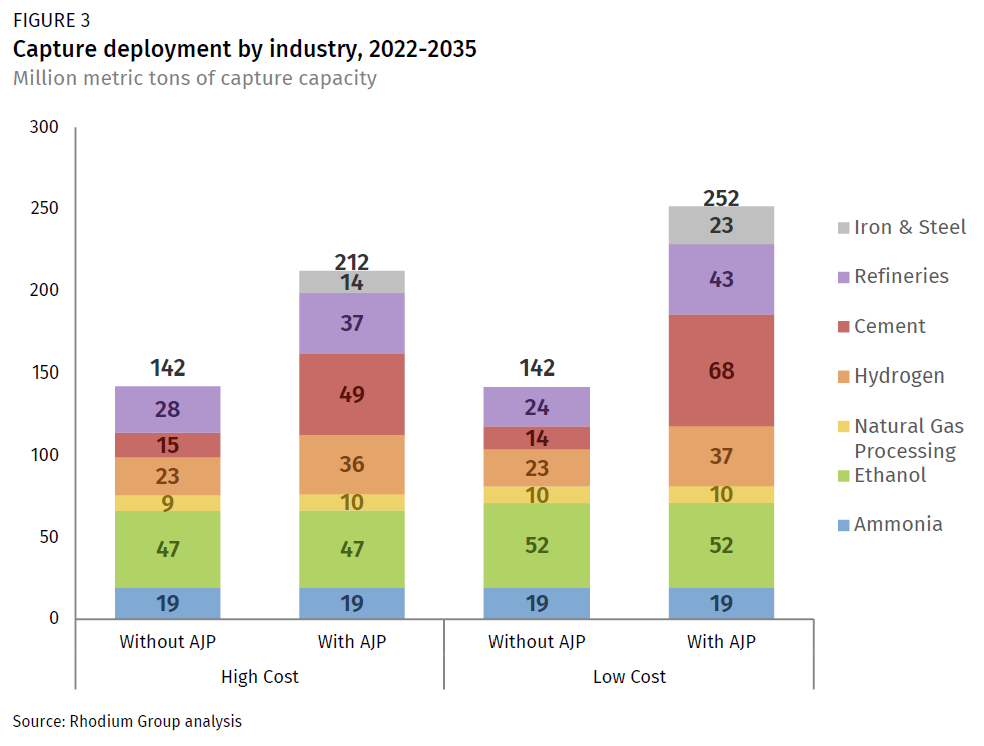

Without the AJP, 45Q, as extended in the year-end energy tax package, will catalyze the deployment of 142 million tons of capture capacity through 2035 (Figure 3). With the AJP, deployment jumps to 212-252 million tons of capacity over the same time frame depending on technology costs—a 50-77% increase. While the AJP doesn’t drive much new capture deployment in relatively easy-to-decarbonize sectors, the higher credit for hard-to-decarbonize sectors works as intended. The AJP leads to increased capture capacity of up to 61% at hydrogen facilities, 79% at refineries, and 386% at cement facilities. Without the AJP, we find no capture deployment at iron and steel facilities. With the AJP, 14-23 million tons of capture capacity is installed in this sector. Deployment in these sectors opens up meaningful opportunities for technology learning and cost reductions that could expand the reach of carbon capture to various other industrial applications over time.

The AJP and new legislation would allow the 45Q tax credit to be available as a direct payment to developers. Direct pay makes it easier to use the tax credit and secure financing and reduces the cost of capital for projects. Without direct pay, developers need to partner with tax equity investors with enough tax appetite to monetize the credits. The tax equity market was able to accommodate the record renewable builds of 2020, but some developers struggled to find tax equity partners. There is no reason to expect that the tax equity market will expand beyond last year’s record to accommodate new investments in capture projects alongside expanded renewable energy deployment. We do not explicitly model direct pay in this analysis; however, direct pay could be a necessary component of a significant investment package to prevent the tax equity market from constraining carbon capture deployment.

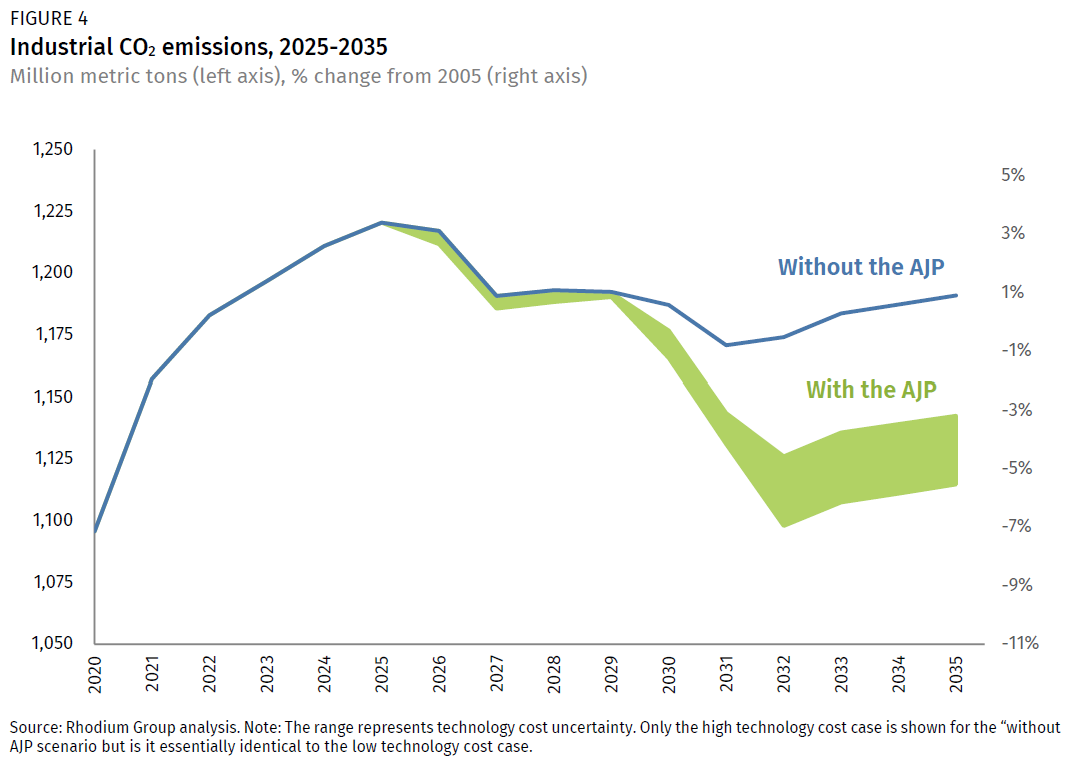

Additional installed capture capacity results in substantial emission reductions through 2035. Without the AJP, we estimate that total industrial CO2 emissions will flatten out by mid-decade, thanks to the year-end extension of 45Q, and will end up near 1.2 billion tons in 2035, 1% above 2005 levels (Figure 4). The industrial carbon capture tax incentives in the AJP push emissions down by nearly 100 million tons in 2035 or 6% below 2005 levels. Other components of the AJP, such as a hydrogen tax credit, may lead to additional emission cuts. Reductions in conventional pollutants may also arise from installing carbon capture at these facilities; however, assessing these benefits is currently beyond the capabilities of RHG-ICAP. Captured CO2 needs to be free of conventional pollutant impurities for the technology to work, so it is likely that there will be other pollution benefits and no net increase in pollution at these facilities.

Capturing the economic opportunity of industrial decarbonization

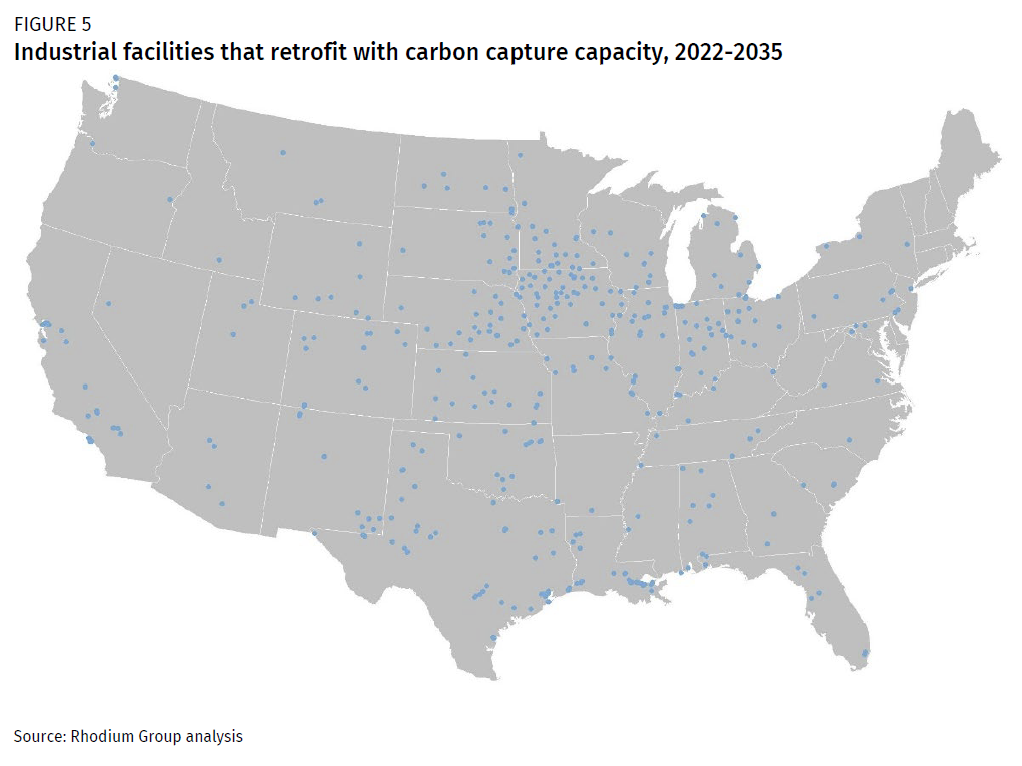

As we’ve noted before, the widespread deployment of carbon capture technology has the potential to drive tens of billions of dollars in new investment across almost every state in the nation. The AJP can help realize this potential. We estimate that the 45Q enhancements in the AJP can drive $10-$12 billion in new capital investment and another $2-$3 billion in operation and maintenance (O&M) spending through 2035. Facilities across the country retrofit with carbon capture capacity due to the 45Q credit, including the AJP enhancements (Figure 5).

Investment driven by the AJP 45Q enhancements also leads to jobs. Carbon capture projects require engineers, construction workers, pipefitters, and other specialized labor. They also require steel, concrete, and other construction materials and equipment. Once built, carbon capture facilities require additional people to operate the machinery and manufacture replacement parts. To examine the economic effects of the AJP, we employ a similar methodology to our previous carbon capture employment analyses. Using the IMPLAN economic model, we translate the investment in project development and operations into job-years.[3]

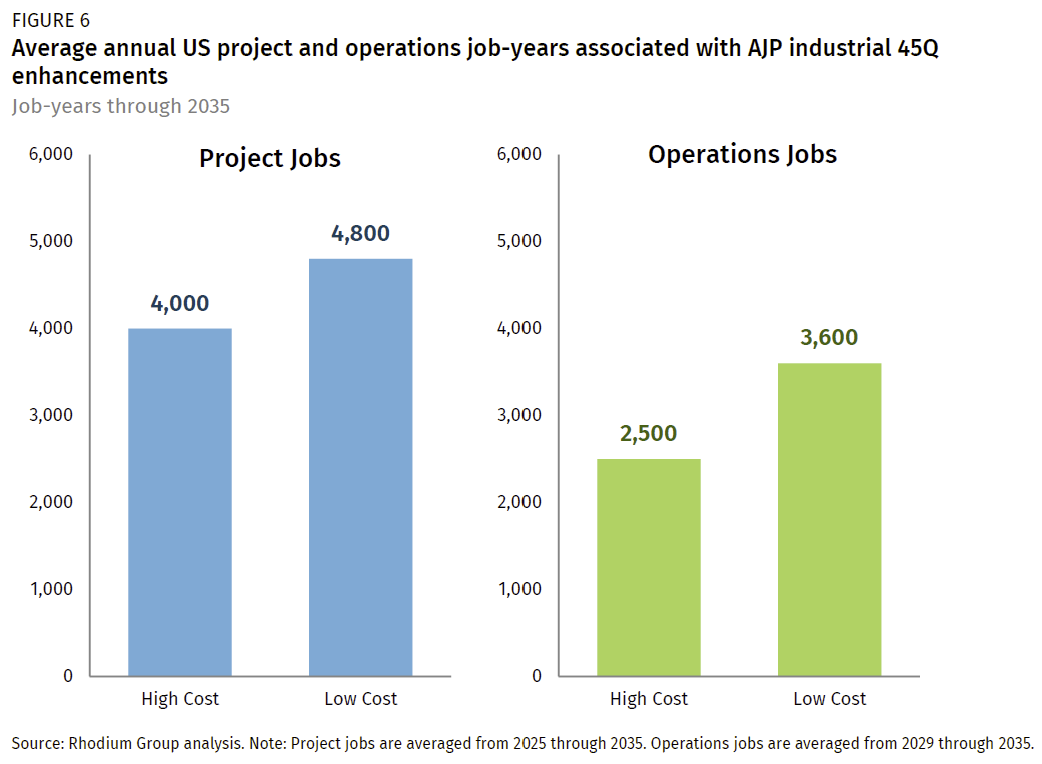

The enhancements to 45Q and the private capital those enhancements leverage yield 60,700-78,600 job-years associated with industrial carbon capture retrofits nationwide in total through 2035. This equals an average of 4,000-4-800 project jobs per year from 2025 (the first year that a facility incented by the 45Q enhancements commences construction) through 2035, and an average of 1,700-2,500 operations jobs per year from 2029 (the first year that a facility incented by the 45Q enhancements comes online) through 2035 (Figure 6). The majority of job-years are associated with project construction. These jobs are in addition to the jobs related to carbon capture deployment already underway, thanks to current policy. This is also in addition to the tens of thousands of jobs currently associated with operating these facilities today that might not be retained in a decarbonizing economy without new investment. We also do not include induced jobs from the economic multiplier associated with project and operation jobs.

Investment in the industries of today and tomorrow

Beyond 45Q in the industrial sector, the AJP contains other enhancements to drive investments in carbon capture retrofits in the electric sector and new DAC facilities. There are also proposals for direct investments in clean hydrogen production and pioneering carbon capture projects.

A potential boost for DAC and electric power carbon capture

The AJP proposes making 45Q easier to use for hard-to-decarbonize industrial sectors; it does the same for DAC and electric power retrofits. The current 45Q credit value is far too low to catalyze DAC deployment even when other revenue sources are considered. Bipartisan legislation recently introduced in Congress proposes to increase the credit value for DAC with secure storage to $120/ton. While this would undoubtedly increase the chances that DAC plants get built, we have found previously that a credit value of $180/ton is probably necessary if the US wants to scale up this critical technology fast enough to reach gigaton scale by 2050. A high enough credit value for DAC will be important to help put the US in a position to reach net-zero alongside decarbonization investments across the economy.

Meanwhile, if the US wants to retain some existing fossil plants on the electric system and still meet the AJP’s goal of 100% clean electricity by 2035, then a credit value above $50/ton for carbon capture retrofits is one policy option. Retrofitting existing plants retains jobs, and economic activity at such facilities reduces the chance of stranded assets and allows plants to provide load balancing and other services as more variable renewables get added to the grid. We have previously found that even if 45Q were made permanent, retrofitting existing plants does not make economic sense at a credit level of $50/ton. Figuring out the appropriate credit level will require more analysis. Unlike the industrial sector, the economics of carbon capture in electric power include covering the cost of capture at a facility and the relative competitiveness of that facility in bulk power markets where other generators may also be receiving incentives (like renewables). While more research is required, it is clear that a credit level higher than $50/ton is necessary.

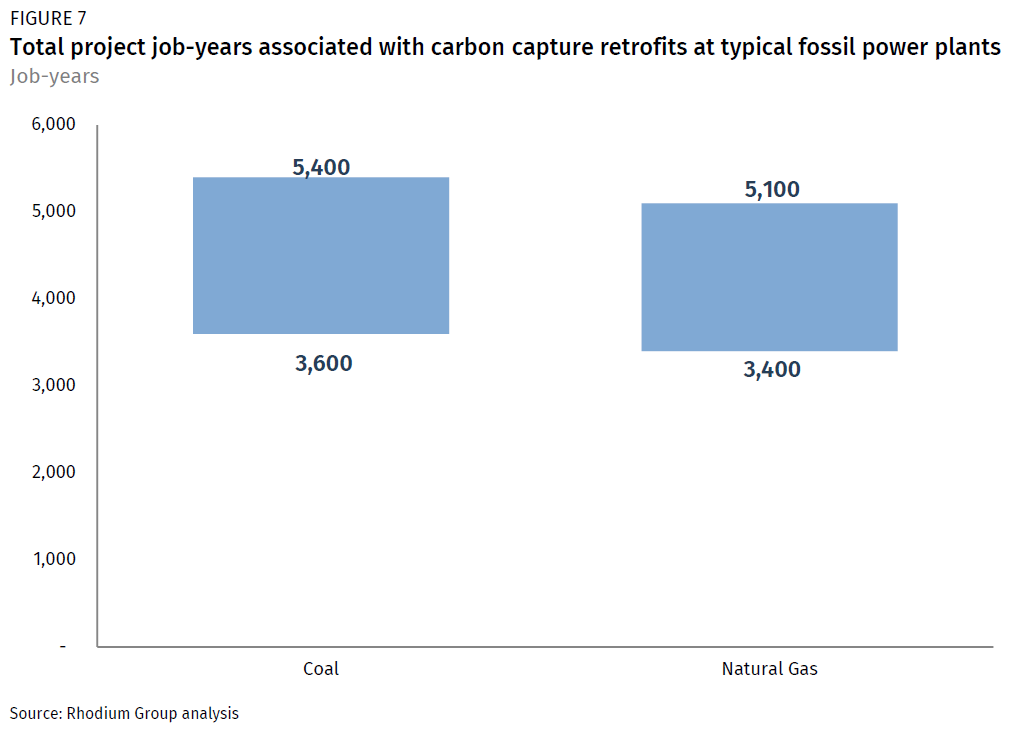

Investing in electric power retrofits and DAC also creates jobs. Individual power plants vary greatly, but as representative examples, we consider the employment effects of retrofitting the National Energy Technology Laboratory baseline supercritical coal and natural gas combined cycle (NGCC) plants with carbon capture technology. We estimate retrofitting a typical coal plant would yield 3,600-5,400 project job-years, while retrofitting a typical NGCC would result in 3,400-5,100 project job-years (Figure 7). An additional 130-280 jobs per year per plant are associated with operating and maintaining the capture equipment. All of these jobs are in addition to existing jobs at such power plants. We also estimate that 3,400 jobs are associated with the construction and operation of a typical 1 million ton capture capacity DAC plant.

Of demonstrations and pioneers

In addition to policies to promote the large-scale deployment of carbon capture technologies, the AJP also contains proposals for new direct federal investments in industrial decarbonization. The plan establishes a target of 15 decarbonized hydrogen demonstration projects, which could be traditional hydrogen facilities paired with CCS or electrolyzers powered by clean electricity. The plan also proposes establishing ten carbon capture demonstration facilities at steel, cement, and chemical facilities—all lower-purity CO2 sources that face a higher per-ton capture cost, as discussed above.

These demonstration projects are critical to ensuring that carbon capture technologies’ full emissions and economic benefits materialize. Demonstration projects play a crucial role in the technology development cycle, transitioning innovations from lab bench scale to commercial scale. Without demonstration projects, technologies may fall into the “commercialization valley of death,” due to a lack of data and confidence. On the other hand, well-designed demonstration programs can help new technologies thrive, providing important technical, financial, and regulatory experience to project developers, funders, and governments. This experience can also help projects achieve lower costs, leading to wider-spread deployment and greater emissions and employment impacts. The demonstration projects themselves can also create jobs at a local level and help plant the seeds for regional clean energy ecosystems.

The road ahead for carbon capture and hydrogen investment

The ball is now in Congress’s court to move the AJP, or some revised version of it, towards enactment. It’s unclear whether any of the plan’s carbon capture and hydrogen components will end up in law. It is promising that most of the plan’s enhancements are also in bipartisan legislative proposals. Some enhancements have yet to get legislative buy-in. For example, higher credit values for certain industrial sources and electric power retrofits are not currently included in any legislative proposals. While hardly a new concept, demonstration programs are not yet contemplated in any bill at the size and scope considered in the AJP. We will continue to monitor developments in Congress as the AJP winds its way through the legislative process.

[1] See for example: Harvey et al 2021, Larson et al. 2020, Haley et al. 2019, Larsen et al. 2019 and IPCC 2018.

[2] For more information on RHG-ICAP see King et al. 2020.

[3] A job-year is the equivalent of one job for the duration of one year.